There’s a very good reason why Gilead Sciences is trending right now. It’s called remdesivir. With the planet still reeling from the Coronavirus pandemic, everyone is looking for a way out of a crisis that has sent shockwaves through the global economy. Remdesivir – currently being trialled by Gilead – is touted as a potential treatment for COVID-19 and, as such, offers a glimmer of much-needed hope.

Unfortunately, hopes that the drug might offer a breakthrough in the fight against COVID-19 took a hit on April 23, when news of the trial’s failure and abandonment were accidentally published, causing stocks around the world to fall. Gilead maintains that results are ‘inconclusive’ and that the drug may yet prove useful.

This guide will explain how to buy Gilead Sciences (GILD) stock, take a look at the best stockbrokers and consider the biotech giant’s prospects going forward.

On this Page:

Where to Buy Gilead Stock

Before you buy Gilead stock, you need to find yourself a suitable stockbroker. We’ve reviewed the best stockbrokers on the market and found that the following brokers are the top choices for buying Gilead stock.

1. eToro – Market leading broker built on social trading innovation

eToro burst onto the scene just over a decade ago with a disruptive new vision that sought to make the world of investing more accessible. Their social trading platform offered slick, intuitive UX and innovative features like the CopyTrader function made it easier than ever to get involved.

These days eToro is well-established as a market-leading broker that offers 800+ stocks to invest in or trade. If you’re interested in GILD, you can opt to open a long position and buy the underlying asset or trade Gilead by utilising CFDs (Contracts for Difference). This means you can trade on the price movements of the stock without actually buying it. It also opens up the possibility of opening a short position and using leverage to boost the value of your trade.

A relatively low minimum deposit of $200 means you can get started without stumping up a fortune. You can also trial the experience for free by giving it a spin in demo mode.

The pricing is very reasonable, with zero-commission on stock and ETF trading for European clients and no stamp duty for UK customers on stocks purchases. US users will be able to trade stocks on the platform later this year.

eToro is one of the best trading platforms that are regulated and is licensed from ASIC, CySEC, and the FCA. If you're ever in need assistance, eToro has a customer support team available 24/7.

- 800+ stocks to buy outright or trade as CFDs

- Beginner-friendly stock trading platform

- 0% commission on stock trading

- $5,000 account minimum for CopyPortfolios

Should I buy Gilead Sciences Stock? Points to consider

Considering buying or selling Gilead stock, or similar stocks like Glaxo stock? Whenever you’re interested enough to buy stocks, we recommend taking a closer look at the company fundamentals and consider historic price movements and forecasts to help you decide.

Gilead Sciences business model and share price history

Gilead Sciences was founded in 1987 by Michael L. Riordan, a medical doctor with degrees from Harvard and John Hopkins, and, unusually, experience working with a venture capital firm. Riordan drew on this experience in the early days of Gilead, raising millions of dollars in investments to drive forward his fledgling pharma company. From the beginning, Riordan was focused on researching anti-viral drugs before expanding Gilead’s efforts to include drugs for cancer and cardiovascular disease.

In the early 90s Gilead received funding from Glaxo to develop genetic code-blockers to fight cancer, before completing an initial public offering and raising $86.3 million in 1992.

At this point Gilead had yet to release a product, but that changed in 1996 when Vistide, a compound designed to treat CMV retinis (an eye disease) in AIDS patients, hit the market. It proved to be a great success and revenues soared. Since then Gilead has driven growth by focusing on acquisitions. It has acquired 16 companies over the last two decades, expanding its research and development capabilities into new areas of medicine while gaining existing products like the Hepatitis C treatment Sovaldi, which came with the $11 billion acquisition of Pharmasset in 2011.

Gilead’s all-time high stock closing price was 122.21 on June 23, 2015. The last year has seen an average stock price of 67.11. Hopes that remdesivir might prove to be a successful COVID-19 treatment saw Gilead stock surge towards the mid-80s before news of failed trials sent stocks plummeting.

Gilead Sciences stock dividend information

In February 2021 Gilead announced an 8% increase in first quarter dividend, taking the quarterly payment to $0.68 per share. This was paid to stockholders on March 30.

Gilead’s dividend yield is 3.46% and its payout ratio is 18.48%.

The biotech giant’s earnings per share (EPS) for the fourth quarter of 2019 stood at $1.44, a 9.8% decline on the previous year’s figure.

As of Feb 24, 2021, Gilead’s daily P/E Ratio is 18.48. This figure is higher than 51% of the drug manufacturing industry. Over the last ten years the company has a median P/E ratio of 14.73.

Gilead Sciences stock forecast and prediction

According to CNN, 24 analysts offering 12-month price forecasts for Gilead Sciences have a median target of 77.50 with a high estimate of 90.00 and a low estimate of 58.00. This represents a 0.39% decrease on the current price of 77.80 (24/02/2021). Consequently, Gilead is currently given a hold rating by CNN-polled analysts.

How to Buy Gilead Sciences Stock from eToro

Assuming you have a funded account, follow these simple steps to buy Gilead stock.

Step 1: Search for Gilead Sciences (GILD) Stock

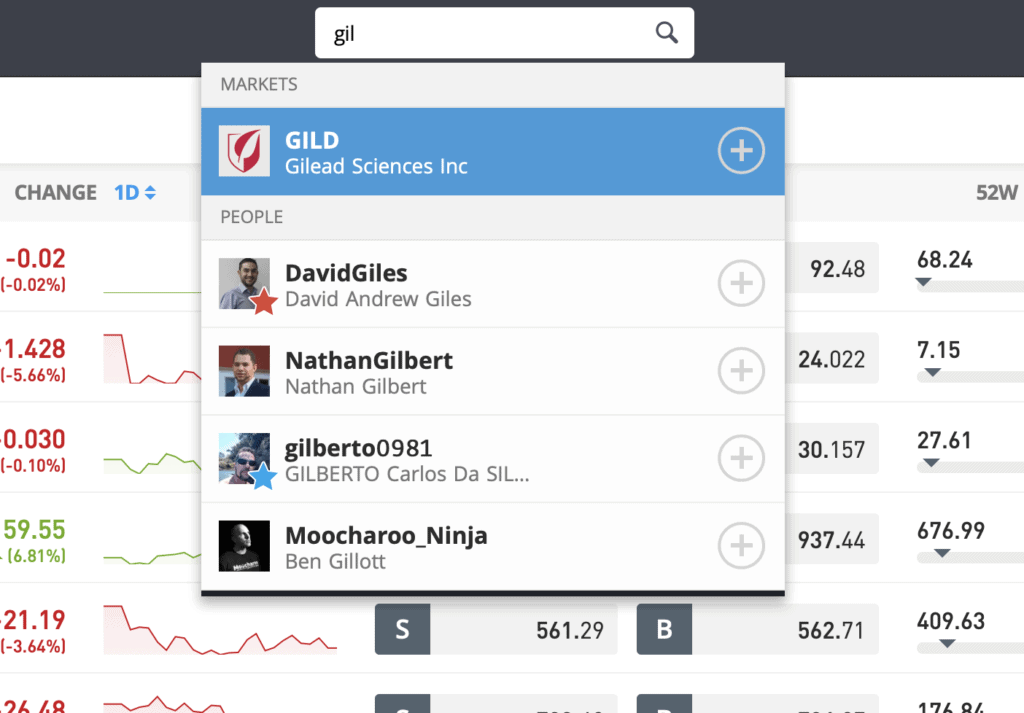

Look up Gilead by typing the ticker symbol GILD into the search box.

Step 2: Click on trade

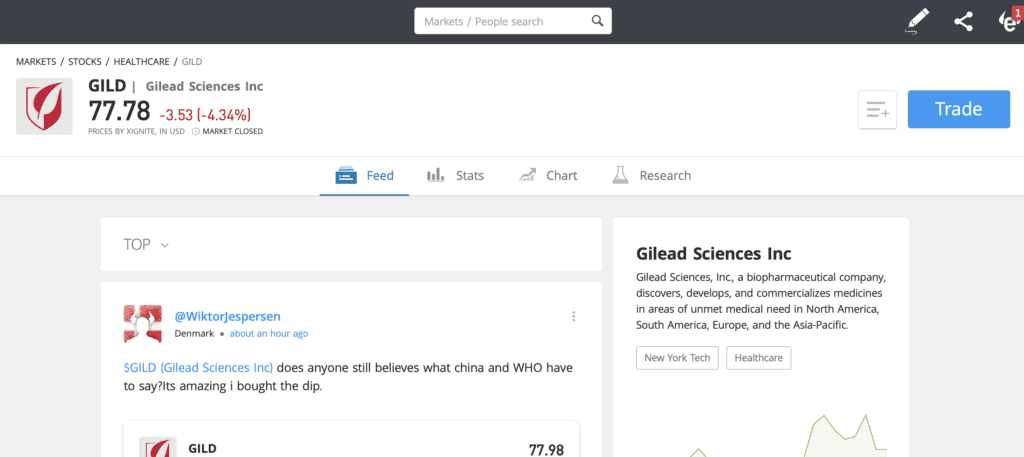

Click Trade in the top right corner of the Gilead Sciences page.

Step 3: Specify ‘Buy’

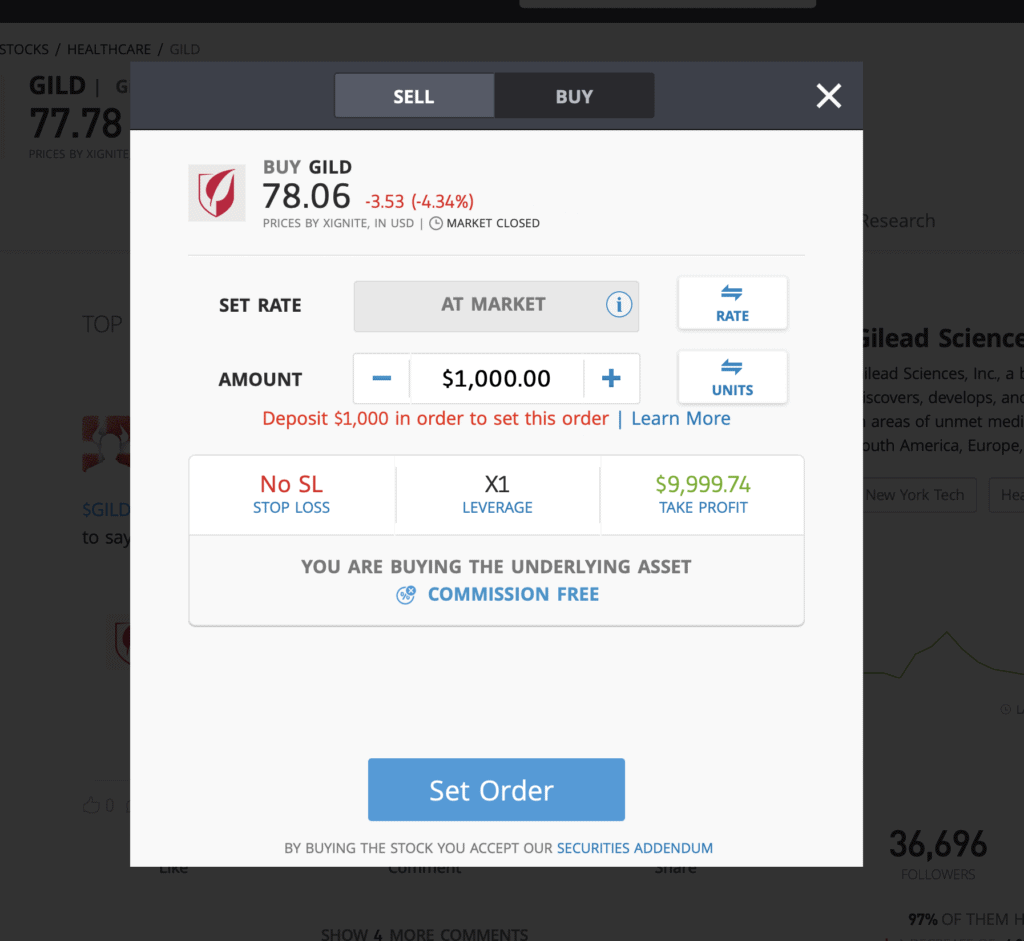

Specify ‘Buy’ on the top tab, change the leverage to X1 to purchase real stock and proceed to set your order. If you want to trade Gilead CFDs, set your leverage amount, Stop loss and Take profit order limits, then click ‘Set Order’.

Investing in Gilead Sciences Shares – Final Thoughts

Excitement around remdesivir’s potential to be the Coronavirus wonder treatment resulted in considerable interest in GILD stock throughout April, but news of failed trials has seemingly put a significant dent in the market’s enthusiasm for Gilead stock. As it stands, analysts are predicting a small decrease in their 12-month forecasts. This could change, however, as Gilead isn’t writing off remdesivir yet and the company’s ongoing success with HIV treatments offers some intriguing prospects, including a potential cure.

Gilead also offers a very solid dividend that shows no sign of shrinking in the foreseeable future.

FAQs

Should I buy Gilead stock or wait?

Most analysists have lowered their expectations for Gilead stock after the remdesivir surge, meaning it’s less of a must-buy than it could have been. This could change, however.

What are the fees when buying Gilead stock?

Our recommended broker, eToro, offers zero-commission stock and ETF trading for European clients. This means that, unlike most brokers, eToro won’t add a dealing charge or any administrative fees when you buy Gilead stock.

Is there a Gilead stock price prediction?

Gilead Sciences has been given a 12-month median target of 77.50 by analysts. This represents a 0.39% decrease from the current price of 77.80.

What does the Gilead stock dividend pay?

Gilead pays an quarterly dividend of $0.68 per share, with a dividend yield of 3.46%.