Everyone has fond memories of growing up with Disney characters. Mickey Mouse is almost a century-old, and he still makes Walt Disney his home. Although the entertainment industry is constantly changing, Disney has always made content king. So as Disney launches its own streaming service Disney+, the Mouse House is spending billions on acquisitions and in-house content development.

As Disney increases its content budget to bring more of its popular movie themes to streaming channels and theme parks near you, this guide explores whether Disney’s plans to win hearts with streaming media will be profitable, how to buy Disney stock, and the best Disney stockbrokers.

Should I invest in Disney?

If you follow the investment advice to invest in stocks you love, then you probably already invest in Disney stock. The 22 percent average stock returns of the last decade, before dividends, would have rewarded you for your loyalty. But Disney, like many media businesses, is experiencing a steady decline in Pay TV subscriptions as subscribers disconnect from cable for cheaper, mobile Netflix streaming. Always in step with entertainment and media trends, Disney is now doing its content magic on its own streaming service, Disney+.

The question for investors is, do you Amazon stock, Google stock, AT&T WarnerMedia stock or Disney stock? All these media giants are entering the streaming video market. Following the launch of ESPN+ in 2018, Disney is ramping up its content for the launch of its Disney+ streaming service this year.

As more subscribers “cut the cord” of their cable service, here is why Disney has a content edge in streaming media.

Pros to buying Disney

Disney’s valuable content collection

Disney’s big rollout in 2019 of its own streaming service includes content from the franchises of some of the greatest box office hits of all time. The entire motion picture library of Disney is moving to Disney+. In addition to Disney’s perennially popular content, Star Wars, Marvel, and Pixar will headline the new service. National Geographic, which Disney picked up in its recent purchase of 21st Century Fox Studios, is also on board.

Getting land in Disney Parks and Experiences

All of the new content produced for streaming will eventually make more money for Disney through its theme parks, consumer products and cable channels as viewers seek “to experience the stories and the characters, the places, that were part of the movies they loved”. Disney theme parks have been able to raise the price of tickets and hotel rooms this year.

High brand value

ABC and ESPN have benefitted from Disney’s high brand value. So while subscriptions are falling, cable and broadcast networks have been able to raise prices for affiliate and advertising fees. ESPN as the top sports network can charge the highest advertising and affiliate fees in the industry.

Cons to buying Disney stock

Higher content costs

Disney’s expenses are rising, and the home of Mickey Mouse says content for the new streaming app is the main cost pressure. Added costs for the streaming play are estimated at $1 billion a year. Expenses rose 8 percent in 2018 to $44.6 billion. As Disney prepares to take on Netflix, it no longer has content licensing revenue from Netflix. Five or six additional movies are being made to provide content for the streaming business. TV series like Star Wars: Rogue One, currently in production, are sure to pay off quickly as loyal fans give Netflix some competition.

Streaming competition

AT&T WarnerMedia is introducing its own streaming service this year, following its $84.5 billion acquisition of Time Warner. Netflix currently makes $100 million an episode on WarnerMedia’s Friends. As the media giant’s stock loses value, the value to buy Netflix stock is rising. The service will include HBO, TBS, TNT, Turner Sports, the Cartoon Network, and the Warner Bros. studio. Discovery and Comcast are other competitors launching a streaming service.

Walt Disney studios revenue decline

Disney recorded record revenue of $59.4 billion in 2018, boosted by the box office hit Black Panther, which won Marvel’s first Academy award. Nevertheless, in 2018 and 2019, studio revenue has been declining following the $1.3 billion Star Wars: The Last Jedi hit in 2017. Long-term investors who hold tight over the rollercoaster revenues of the movie industry have been rewarded by Disney stock.

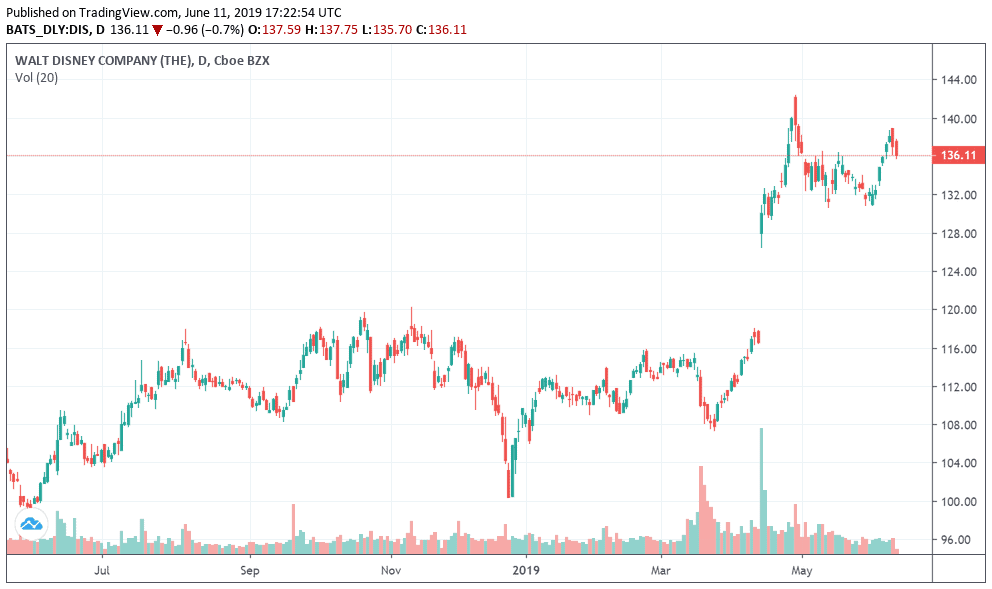

Disney Stock: Current Prices and Summary

The home to the famous Disney characters has been expanding its content library by buying other entertainment companies. The media giant is also the home of Marvel and its superheroes, Pixar, and Lucasfilm and its Star Wars franchise. With its $71 billion acquisition of 21st Century Fox this year, Avatar, X Men, Indiana Jones and the Simpsons have joined the Mouse House. As subscriptions fall across Disney’s media businesses and it transforms into a streaming media company, how should the business be valued? Let’s look at how Disney is valued next to its competitors.

Disney’s price-to-earnings ratio at 15.6 is higher than that of Comcast’s at 15.3 and AT&T WarnerMedia’s at 10.6. But if you buy Netflix stock – a pure streaming media play – you will pay a significantly higher P/E ratio of 135. The market is placing a more than 8x value on the streaming media business. Although Netflix initially struggled with rising content costs because it had to license content, Disney has a full content house. It is producing one-fifth the new content of Netflix for Disney+. Since Disney is making huge acquisitions and investments in content development, the return on invested capital (ROIC) tells us how profitable the company is. Disney’s ROIC at 16.4 reveals it to be creating more value from acquisitions than AT&T WarnerMedia at 15.7 and Comcast at 9.6.

DIS stock summary

| Price | $ 170.93 | Daily high | $ 171.44 |

| Volume | 18963658 | Low | $ 169.50 |

| Variation | 12:51 | Opening | $ 169.71 |

| + / -% | 00:30% | Day before | $ 170.42 |

Best Disney Stock Brokers

|

|

|

|

|

|

|

|

|

|

| Pros: |

|

|

|

|

| Cons: |

|

|

|

|

| Spreads | • Spreads from 2 pips • Flat fee on withdrawal | •Fees are built into spread. • Spread cost : 0.35 • Unregulated broker | • Spreads from 2 pips | •Fees are built into spread. • Spread cost : 2 pips |

| Number of stocks available | 4,000 | 2,500 | 1,500 | N/A |

| Financing rate | 8.9% | 7.9% | 13.9% | N/A |

| Visit broker | |

[button href="https://www.insidebitcoins.com/visit/etoro-stocks" style="emboss" size="medium" color="#329e31" hovercolor="#81d742" target="_blank"]Visit Broker[/button] | [button href="https://www.insidebitcoins.com/visit/etoro-stocks" style="emboss" size="medium" color="#329e31" hovercolor="#81d742" target="_blank"]Visit Broker[/button] | [button href="https://www.insidebitcoins.com/visit/skilling" style="emboss" size="medium" color="#329e31" hovercolor="#81d742" target="_blank"]Visit Broker[/button] |

How to Buy Disney Stock – Tutorial

How to buy Disney stock on Markets.com

The official online broker of the Arsenal Football Club provides all the basic tools and education a retail trader requires. markets.com is owned by Playtech, a public company listed on the London Stock Exchange. Like its PlaytechOne one wallet – one account solution for playing on casino, poker, sports and other gaming sites – markets.com seeks to provide quick and easy access to a good range of investment products. When deciding whether to buy Disney shares on markets.com, consider these pros and cons.

Pros

- Day traders

- Demo account

- Low commissions

- Good quality news flow

- Good set of analytical tools

Cons

- Limited order types

- Not many deposit options

- Customer services not very effective

- Unregulated broker

Start trading Disney stock on markets.com

Step 1: Register your account

You will be prompted to download the markets.com mobile app to register. After filling in basic profile information, a brief questionnaire on investment experience and knowledge, as well as income and assets, will determine your trading level and leverage. 1:30 is the leverage for the average retail investor. So with a $500 deposit, you can trade up to $15,000.

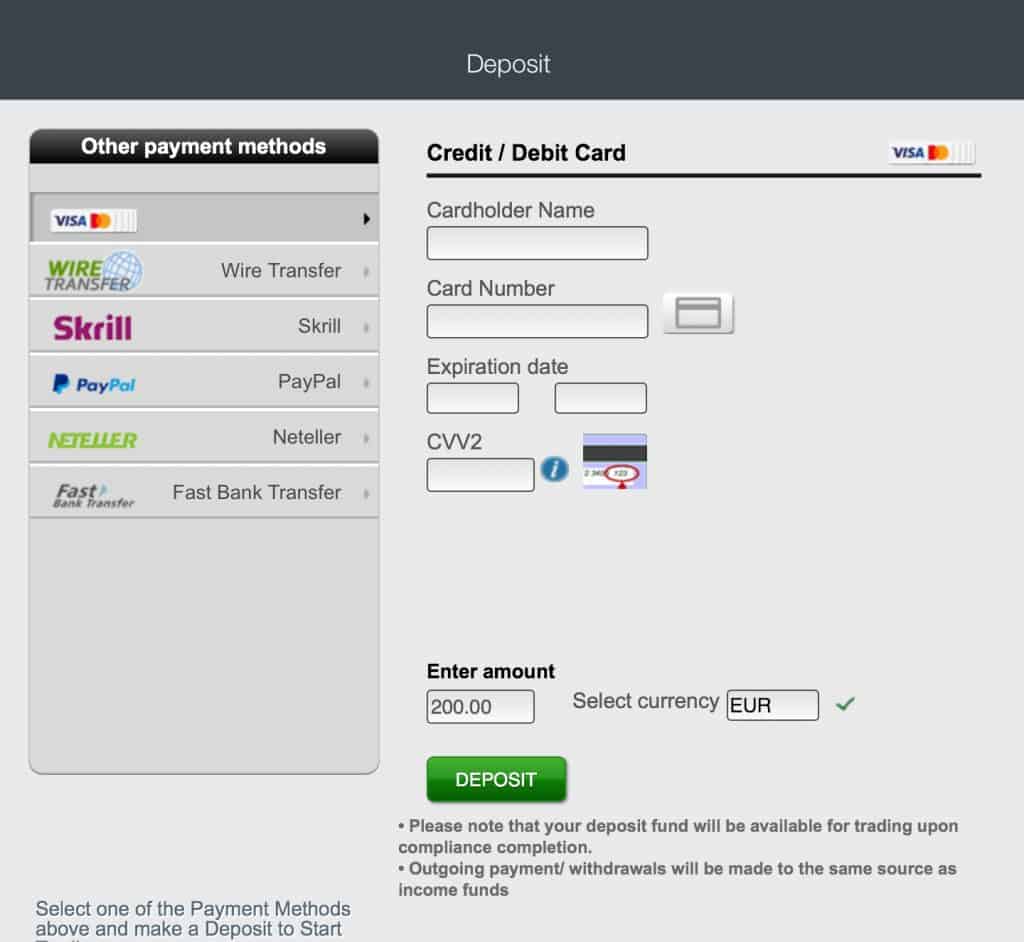

Step 2: Fund your account

If depositing by credit card, you will need to first have it verified. Click on Verify Credit Card on the My Account Page.

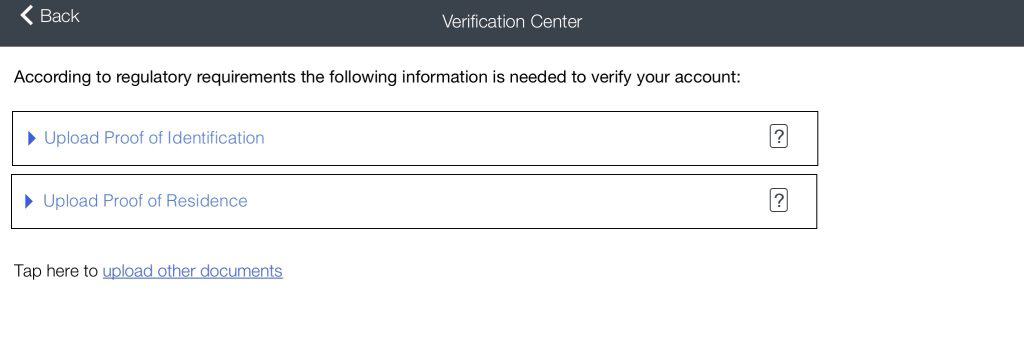

Step 3: Verify your identity

Attach and submit proof of identity and a utility bill for verification. Residents of the USA, Canada, Australia, Hong Kong, Japan and some other countries are restricted.

Step 4: Trade Disney stock

On Markets.com, you can choose to invest in Disney shares, or a wide range of ETFs and indexes with exposure to major technology stocks. Other securities include forex, cryptocurrencies (a handful of majors), bonds, blends, and grey markets in Uber and Lyft ahead of their IPOs. Trending Now displays a list of top moving stocks.

The Disney stock profile provides basic stock price charting information and a market sentiment indicator. Place the trade by choosing the Buy or Sell button.

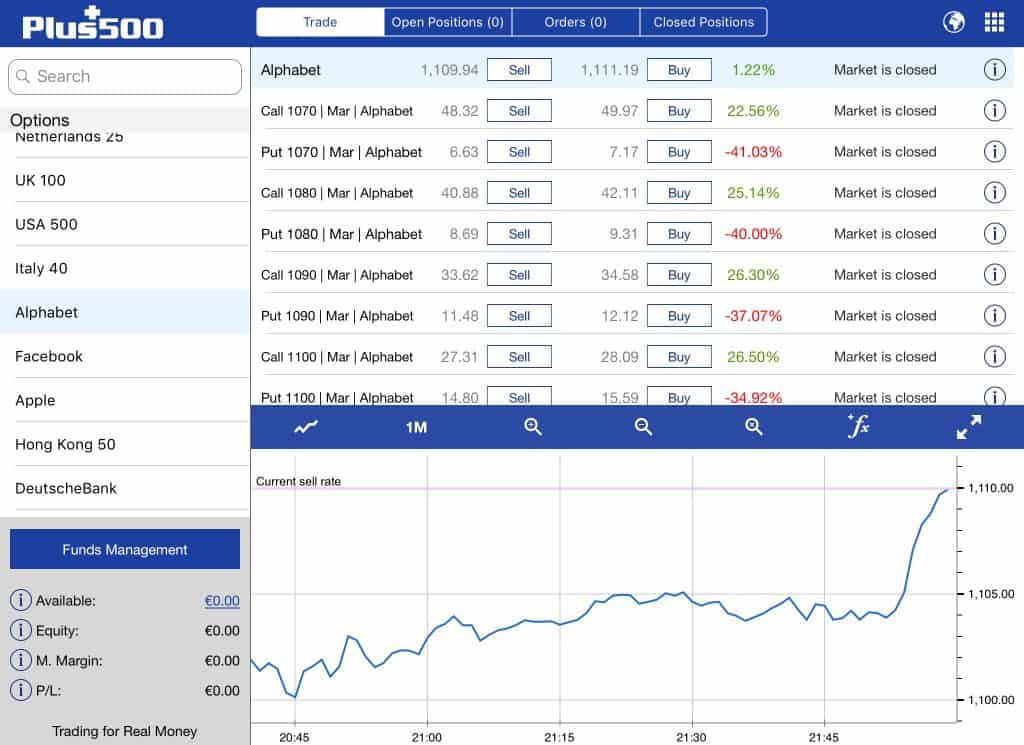

How to Buy/Sell Disney CFD Stock on Plus500?

Novice retail traders may find this platform lacks the trading interface, research tools and education they depend on for general guidance. The experienced trader with their own tools, stock data and news will be at home with the simple, intuitive interface and over 100 technical indicators. Traders who qualify for a professional account (with a minimum portfolio value of €500k) can raise their leverage levels, for example, from 1:5 to 1:20 for stock trades. When deciding whether to trade Disney CFD shares on Plus500, consider these pros and cons.

Pros

- FCA regulated

- Listed on the LSE

- Easy to use platform

- Great mobile platform

- High order volume

Cons

- Experienced traders only (no fundamental data)

- Only CFD trading

- High financing rates

- No scalping allowed

Start trading Disney CFD stock on Plus500

Step 1: Register your account

Firstly click here to open your account. You will be prompted to download the Plus500.com mobile app to register. Select between a Demo and Real Money account. After filling in basic personal information, you will gain access to the unlimited demo account. Before you can buy Disney CFD stock, you will be prompted to answer a few questions to establish your investor risk profile.

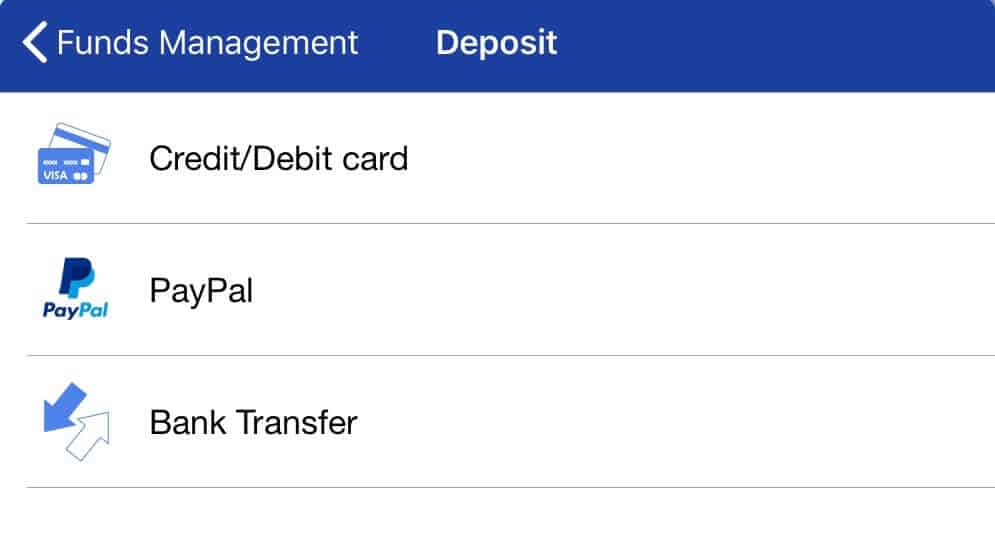

Step 2: Fund your account

When you are ready to trade with real money, fund your account. Three payment options are provided. You may be asked to verify your payment method.

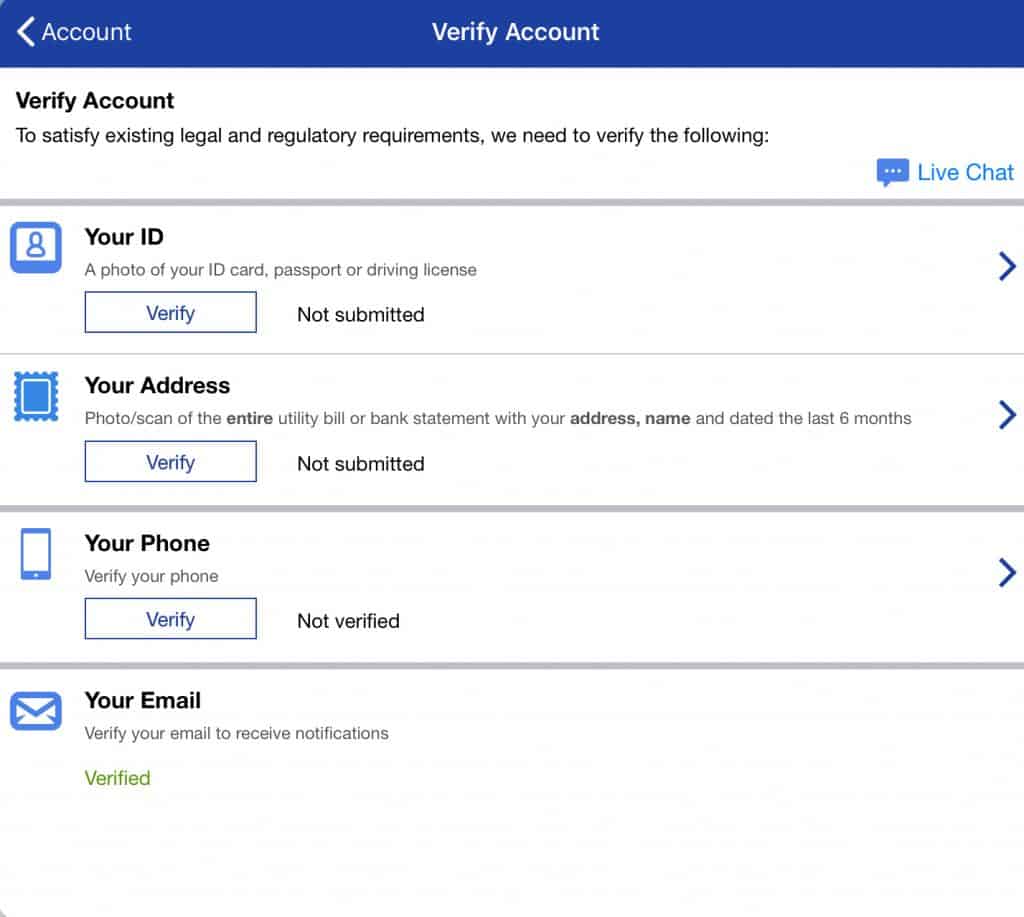

Step 3: Verify your identity

Attach and submit proof of identity for verification.

Step 4: Trade Disney CFD stock

Plus500 offers a wide variety of CFDs on investment instruments, including stocks, ETFs, indexes, forex and cryptocurrencies. Options are also available for the advanced investor. Query Disney and the price quotes for the stock, as well as put and call options, appear on the screen.

All stock information and the Buy/Sell commands are displayed on the general stock page for the serious trader who wants to execute quickly. The bottom half of the page displays the price chart and provides access to a broad selection of technical analysis indicators.

80.5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the risk of losing your money.

A Brief Overview of the History of Disney

In 1923, a cartoonist named Walt Disney and his brother Roy opened The Disney Bros. Cartoon Studio in an uncle’s garage in Los Angeles. Walt’s talent for caricature was recognized early by Universal Studios. But after Disney created the popular Oswald the Lucky Rabbit, they poached his cartoonists. The brothers immediately saw the profit potential in owning and licensing Walt’s creations. In 1928, Disney created Mickey Mouse. The adorable Mouse would become the world’s most famous and enduring cartoon character. Minnie Mouse, Donald the Duck, Pinocchio, Cinderella and dozens of other characters followed.

Disney monetized the popularity of these characters through movies, books, consumer products, and eventually its world famous theme parks. The first Walt Disney theme park resurrected in 1955 cost $17 million to develop. Under Chairman and CEO Robert Iger’s leadership, Disney has acquired Marvel, Pixar, LucasFilm, and 21st Century Fox. These content buys give Disney a very strong content edge when launching its own streaming media service Disney+ in 2019. New theme parks in Southeast Asia, Hong Kong and China provide more commercialization opportunities for this new content. In 1985, Disney entered the broadcast network business by buying ABC, also acquiring ESPN. In 2018, Disney launched its first streaming business, ESPN+.

Disney Shares: Forecast 2019–2023

There will be a big change at the top of Disney over the next few years. Bob Iger, the Chairman and CEO who has increased revenues from $32 billion in 2005 to $59 billion in 2018, is retiring in 2021. He has left the Mouse House in fine form.

2019 – Fox on board

The Fox buy will start adding to top and bottom line growth in the latter half of 2019. In the first quarter of 2019, 21st Century Fox Studios’ operating income jumped 43 percent to $193 million following the success of the movie Bohemian Rhapsody. More promising movies are in the production pipeline. In Disney’s current lineup, the third in the recent Star Wars trilogy Episode IX will hit the box office in 2019 and is expected to outsell Jedi. Low-to-median stock growth is forecast.

2020 – Streaming revenues

Disney+ streaming will introduce a new revenue stream when it comes online in 2019 and by 2020 analysts expect 8 million subscribers to be signed up. Disney stock will be viewed as a streaming media play. Whereas to buy Amazon stock (Amazon is Netflix’s major competitor)is an investment in an e-commerce company.

Low-to-median stock growth is forecast.

2021 – Changing of the guards

Bob Iger is expected to retire in 2021. The king of content will be gone after bringing Pixar, LucasFilm, and Marvel under the Disney roof and rebooting Disney studios. Iger is dedicating two years to the 21st Century Fox integration. New titles from Avatar, Indiana Jones and other properties should be coming to market. Synergies across existing theme park and gaming properties will be leveraged. Yet no one knows who Iger’s replacement will be. The first choice did not work out. Low-to-median stock growth is forecast.

2022 – Marvel and other superheroes

Deeper Star Wars distribution, new Marvel movies and other properties will put studios on a stronger profitability track. Much of this content will now be streaming on Disney+ – a considerably cheaper distribution channel than movie theatres. Netflix competitor Disney+ will be driving higher revenue year after year. Analyst forecasts of subscribers range from 90-160 million by 2030. In 2018, Netflix had 140 million global subscribers. Median-to-high stock growth is forecast.

2023 – Content is king

In five years, investors will have more choice beyond investing in Netflix in the streaming media market. As Disney transforms into a streaming media business, revenue growth could more than double from the current five-year average of 5.70. Netflix’s pure streaming content play has averaged five-year sales growth of 29 percent. Disney is more profitable. Disney’s strong content library will help its profit margins expand from 21 percent to 27 percent by 2023. In contrast, over two years, Netflix’s profit margins have doubled to 7.6 in 2018 as it has focused on producing its own content. Median-to-high stock growth is forecast.

Conclusion

Can Disney meet the growing content appetite of streaming subscribers and keep costs under control? We think Disney is a proven wizard at adapting the delivery model of its high value content as the entertainment industry has evolved over a century.

When you are ready to buy stock, we recommend doing so via a regulated online broker such as Plus500 if you’re a UK customer, and Ally Invest for U.S. customers.

FAQs

In addition to the price-to-equity ratio, a number of metrics are considered when evaluating whether a stock will deliver a reliable return. Here are a few measures of why we would consider Disney a safe stock: Dividend payments - Disney has paid a consistent and mostly increasing dividend for two decades. Though its dividend yield looks more like the Space Mountain rollercoaster. This measure of financial health reveals the proportion of debt versus equity used to finance a company. Debt-to-equity ratio - After peaking at a high in 2017, Disney's debt-to-equity ratio has fallen to .33, well below the media industry ratio of 1.28. Institutional ownership - Disney is the most popular stock among institutional investors. Sixty six percent of Disney shares are held by institutions. Competitive moat - Disney has strong brand equity and is consistently rated one of the world's most valuable brands.

Disney is acquiring 21st Century Fox film and television groups. Sky is being sold to Comcast. Other Fox holdings are being spun off into the new Fox Corporation controlled by the Murdochs. These divisions include Fox Broadcasting Company, Fox Television Stations Group, Fox News Group and Fox Sports Media Group. Surprisingly, Disney will not take ownership of the 20th Century Fox studio lot, but instead lease it from Fox Corporation.

Some of the high profile content assets Disney will acquire include: Avatar, Indiana Jones, X-men, Fantastic Four, National Geographic, The Simpsons.

Disney is paying $71 billion for 21st Century Fox Studios. A bidding war between Disney and Comcast added $21 billion to the purchase price. Comcast, however, agreed to buy Fox's Sky satellite broadcasting business – now owned by Disney. Comcast will pay Disney $15 billion for Sky, helping to offset the $71 billion purchase price. Investors have a choice of a combination of shares and cash.

You can buy Disney shares from online stockbrokers. Markets.com and Plus500 are examples of Disney online brokers providing intuitive trading platforms that make it easy to buy and sell stocks. After signing up online, type in the DIS ticker, place your order and you will become an owner of Disney shares. Is Disney a safe stock?

What is the new Fox Corporation?

What content is Disney acquiring in the Fox deal?

How will Disney pay for 21st Century Fox Studios?

Where and how can I buy Disney stock?