The Coronavirus crisis has torpedoed most business sectors, and amid such widespread financial devastation, the travel industry has suffered particularly badly.

Global lockdown brought with it stringently observed travel restrictions, meaning almost all commercial flights have been grounded for two months. This total evisceration of bookings is obviously terrible news for the industry and most airline stocks have suffered massively.

Qantas certainly wasn’t immune to this industry-wide devastation, but the Australian airline has rallied impressively and currently stands out as one of the very few major airlines that seems set for a resurgence.

Thinking of investing in Qantas stock? This guide will explain how to buy Qantas stock, take a look at the best stockbrokers and consider the company’s prospects going forward.

Where to Trade Qantas Stock

If you’re looking to trade Qantas, we advise creating an account with one of our recommended online stockbrokers. If you’re outside the United States, select Webull. If you’re inside the US or Canada, Fidelity is the best platform on which to buy Qantas stock.

Should I Buy Qantas Stock? Points to Consider

Before you buy Qantas stock, or invest in similar assets like EasyJet stocks, it’s a good idea to do your research. We always recommend taking a closer look at the company fundamentals, historic price movements and forecasts before you invest any money.

Qantas business model and share price history

“It will be some time before total demand reaches pre-crisis levels,” Qantas CEO Alan Joyce said in the first week of May. “With the possible exception of New Zealand, international travel demand could take years to return to what it was.”

It’s an ominous but realistic assessment of where the Australian airline finds itself two months into the Coronavirus crisis. And yet, Qantas appears to be in a better position to weather the storm than most airlines on the planet. Which isn’t saying much.

Having dumped all his airline stock, Warren Buffett recently observed that ‘the world has changed’ for airlines in the wake of COVID-19, and it’s hard to disagree. The pandemic has obliterated airline revenue and any sort of revival looks a long way away.

At least Qantas seems to have a bit of a head start, having raised enough capital to cover lost business until December 2021, which hopefully represents a worst-case scenario.

Having furloughed the majority of its 30,000-strong workforce in March, Qantas managed to raise A$1.05 billion in March, a move that resulted in a share price resurgence in April. After hitting a rock bottom price of A$2.14 on March 19th, QAN was back up to A$3.72 by mid-April.

Further encouragement came with an announcement, on May 5, that the airline has raised an additional A$550 million, shoring up its chances of riding out this hugely challenging period.

While acknowledging the unprecedented challenges ahead, Alan Joyce was positive about the region’s successful response to Coronavirus and raised the possibility of a “trans-Tasman travel bubble”, which could see the reintroduction of international flights between Australia and New Zealand ahead of further-flung international routes.

Few airlines can match Qantas’ roadmap to revival right now and it’s easy to see why investors might be sniffing an opportunity, in spite of the tough times that undoubtedly lie ahead.

Qantas stock dividend information

Qantas pays an annual dividend of $0.27 per share, with a dividend yield of 7.46%. Payments are made semi-annually and the most recent instalment was paid on April 9, 2020.

Qantas stock forecast and prediction

The Wall Street Journal gives QAN a median target price of $4.16, with a low target of $2.09 and a high target of $5.60. The median target represents an 14.9% increase on the current price of $3.62 (04/05/20).

How to Trade Qantas Stock on Webull

It’s quick and easy to buy Qantas stock at our recommended broker, Webull. Assuming you’ve signed up and funded your broker account, follow these simple steps to invest in Qantas stock.

Step 1: Search for Qantas (QAN) Stock

Look up Qantas by typing the ticker symbol QAN into the search box.

Step 2: Click on the instrument

Select Qantas from the drop-down menu to bring up the Qantas trading screen.

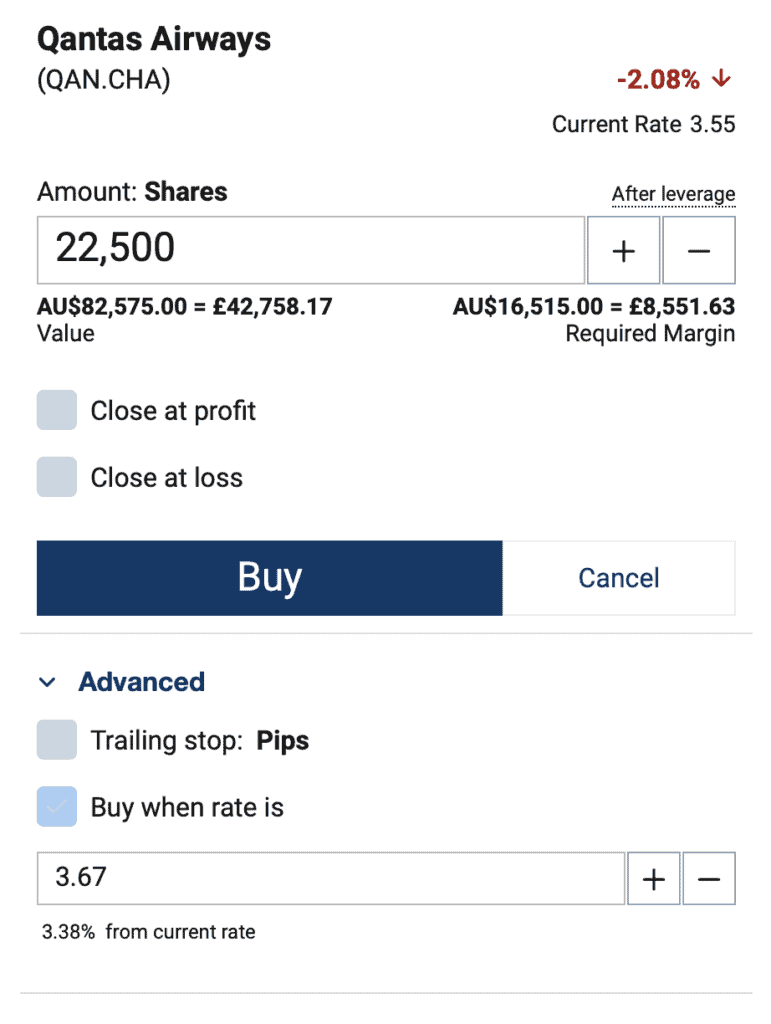

Step 3: Choose Buy or Sell

Choose either ‘Sell’ or ‘Buy’ to open a long or short position on QAN.

Step 4: Configure your trade and hit Buy or Sell

Set your leverage amount, Stop loss and Take profit order limits, then select ‘Buy’ or ‘Sell’.

Investing in Qantas stock – Final Thoughts

Qantas finds itself in an odd position right now. While the Coronavirus crisis has had a devastating impact, effectively halting business for months, the Australian airline appears uniquely well-positioned to weather the storm and, potentially, emerge with a strong competitive advantage.

Qantas has extended the suspension of most of its domestic and trans-Tasman flights until the end of June, so the immediate outlook isn’t great, and anything beyond that is shrouded in uncertainty. However, the Australian airline has the liquidity (reportedly $3.5 billion in short-term liquidity) to survive anything short of the most extreme scenario.

If you do want to buy Qantas stock today, we advise signing up to one of our recommended online stockbrokers. If you live outside the US, we suggest Webull, while Fidelity is our top pick for US traders.

FAQs

Should I buy Qantas stock or wait?

Qantas is well-positioned to emerge from the Coronavirus crisis and do well. Brave investors could see plenty of upside in a year or two.

What are the fees when buying Qantas stock?

Zero-commission trading is available to clients who trade on Webull. This means that Webull doesn't add a dealing charge or any administrative fees when you trade QAN. However, you still have to consider the spread and other charges like overnight fees.

Is there a Qantas stock price prediction?

WSJ's price target is $4.16, a 14.9% increase on the current price.

What does the Qantas stock dividend pay?

Qantas currently pays an annual dividend of $0.27 per share.