Activision Blizzard is an innovative gaming company with a knack for developing immersive titles that captivate gamers. The company’s success is partly built on a knack for monetizing games by upselling must-have in-game items. Formed in 2008 through a merger of Activision, Inc and Vivendi Games, since 2015 it has been one of the stocks on the S&P 500.

Titles like Call of Duty and World of Warcraft have helped millions of gamers to fill the long lockdown days during the Coronavirus pandemic, while highly anticipated franchise sequels Overwatch 2 and Diablo 4 promise blockbuster sales on the horizon. With spending on video game software, hardware, and other accessories hitting $1.6 billion in March (a 35% increase year over year), this could be a great time to invest in the gaming industry.

Interested in buying Activision stock? This guide takes you through everything you need to know, including how to buy Activision Blizzard (ATVI) stock, the best stockbrokers and consider the gaming company’s prospects going forward.

On this Page:

Where to Buy Activision Blizzard Stock

Before you buy Activision stock, you’ll need to find yourself a broker you can trust. We’ve reviewed the best stockbrokers on the market and found that the following brokers are the top choices for buying Activision stock.

1. eToro – Market Leading Broker Built on Social Trading Innovation

Having built on its success as an innovative social trading platform, eToro offers a comprehensive and competitively priced stock market with over 800 stocks as well as cryptocurrencies, forex, ETFs and more.

If you’re contemplating an investment in Activision Blizzard, eToro isn’t short of options. Looking to invest in the underlying asset? You can simply open a long position (BUY) on ATVI. Alternatively, you might opt to speculate on ATVI with a CFD trade. This enables you to bet on the stock’s price movements without actually buying stock and opens up the possibility of utilising leverage to increase the value of your trade or open a short position if you think the stock’s value is set to fall.

The social trading aspect makes eToro a great option if you're a beginner looking to buy Activision Blizzard stock for the first time. The CopyTrader tool allows you to follow and mimic the traders of high performing traders, while you'll also have access to your own personal news feed where you can build up your stock trading knowledge and engage with other community member.

As you’d expect of a platform with ASIC, CySEC, and FCA licenses, eToro feels safe and offers a good level of customer support. Pricing is also competitive, with zero-commission and no stamp duty to pay on stock purchases, although there's a $5 withdrawal fee. Stock trading will become available to US users later this year.

- 800+ stocks to buy outright or trade as CFDs

- Beginner-friendly stock trading platform

- 0% commission on stock trading

- $5,000 account minimum for CopyPortfolios

Should I buy Activision Blizzard Stock? Points to consider

We always recommend taking a closer look at the company fundamentals and researching historic price movements and forecasts before you decide to buy stocks from online stockbrokers. This will help you make an informed decision when buying Activision Blizzard stock or similar stocks like Nintendo stock or Microsoft stock.

Activision Blizzard business model and share price history

Formed by a merger of Activision Inc. and Vivendi Games in 2008, Activision Blizzard has proved itself to be an adept navigator of the gaming sector’s shifting trends over the last decade. Under the stewardship of CEO Bobby Kotick, the company has rewarded investors with consistently impressive returns thanks to stratospheric successes like the Call of Duty franchise and the esports hit Overwatch.

Activision Blizzard operates under five business units: Activision Publishing, Blizzard Entertainment, King, Major League Gaming and Activision Blizzard Studios.

Activision Studios has been home to major titles including Call of Duty, Guitar Hero and Skylanders, Blizzard is responsible for the likes of World of Warcraft, Diablo, Hearthstone and Overwatch, while King, acquired for $5.9 billion in 2016, has produced mobile successes like Candy Crush Saga.

Activision Blizzard Studios that makes original film and television content and Major League Gaming, acquired in 2016, is an esports organisation that Activision intend to leverage as part of its plans to build an esports-focused TV network.

The fact that Activision Blizzard generated 53% of its revenue from purchasable in-game content shows how effective the company has been at monetizing gamers. This is a strategy that significantly extends the revenue-generating potential of top titles, meaning it isn’t reliant on releasing new games as frequently as some competitors, such as Nintendo.

The company reported revenues of $6.49 billion in 2019, with international revenues accounting for 48.5%.

Activision Blizzard stock dividend information

Activision’s current dividend payment is $0.41 per share which is due to be paid on 6 May 2020. This represents a 10.8% increase on the previous quarterly payout of $0.37. Dividend Yield is currently 0.62%. We don’t anticipate the company having any difficulty fulfilling dividend obligations in the foreseeable future.

Activision Blizzard stock forecast and prediction

The general consensus among analysts is that ATVI is a buy stock right now, with most forecasts predicting gains over the next 12 months as the company develops its mobile and esports offerings while benefiting from new console releases like the Microsoft Xbox Series X.

The median 12-month forecast of 32 analysts, as reported by CNN, is $70.00. This represents a 5.09% increase on ATVI’s current price of $66.61 (24/4/2020). The highest estimate was $76.00 while the lowest estimate was $49.00.

How to Buy Activision Stock from eToro

Assuming you have a funded account, follow these simple steps to buy Activision stock on our recommended best online stockbroker, eToro.

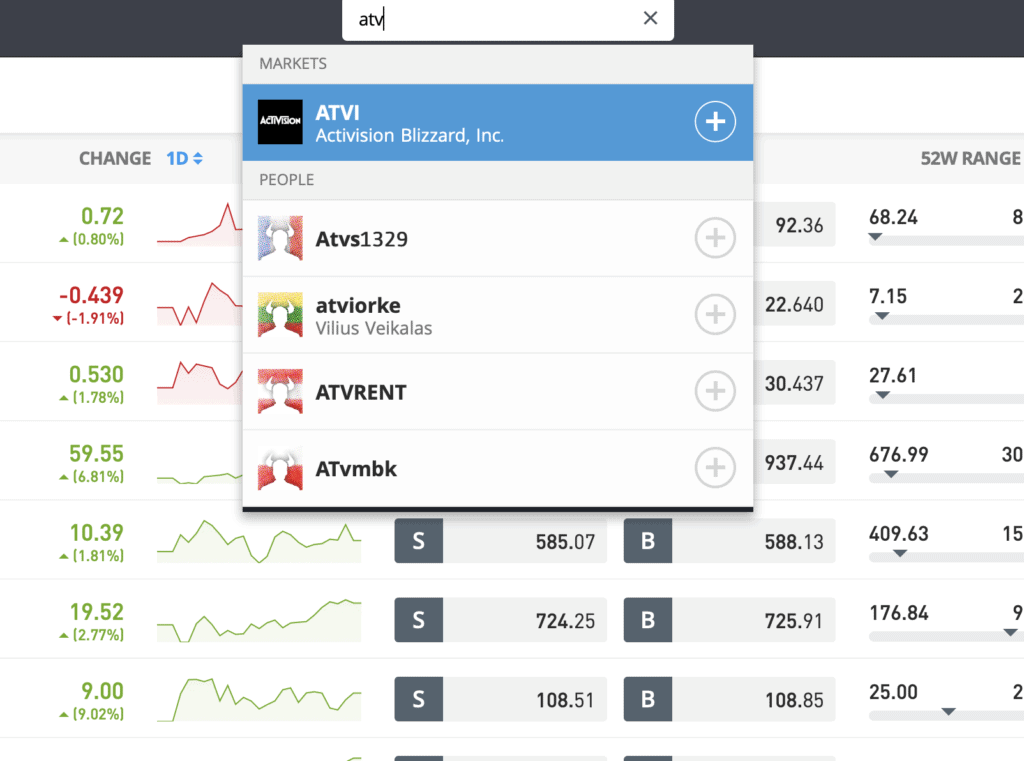

Step 1: Search for Activision Blizzard (ATVI) Stock

Look up Activision by typing the ticker symbol ATVI into the search box.

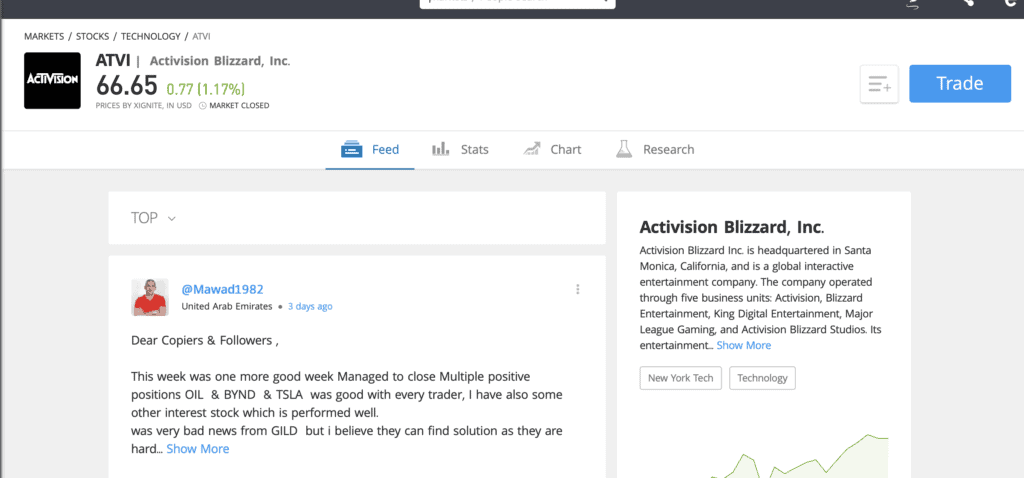

Step 2: Click on trade

Click Trade in the top right corner of the Activision Blizzard page.

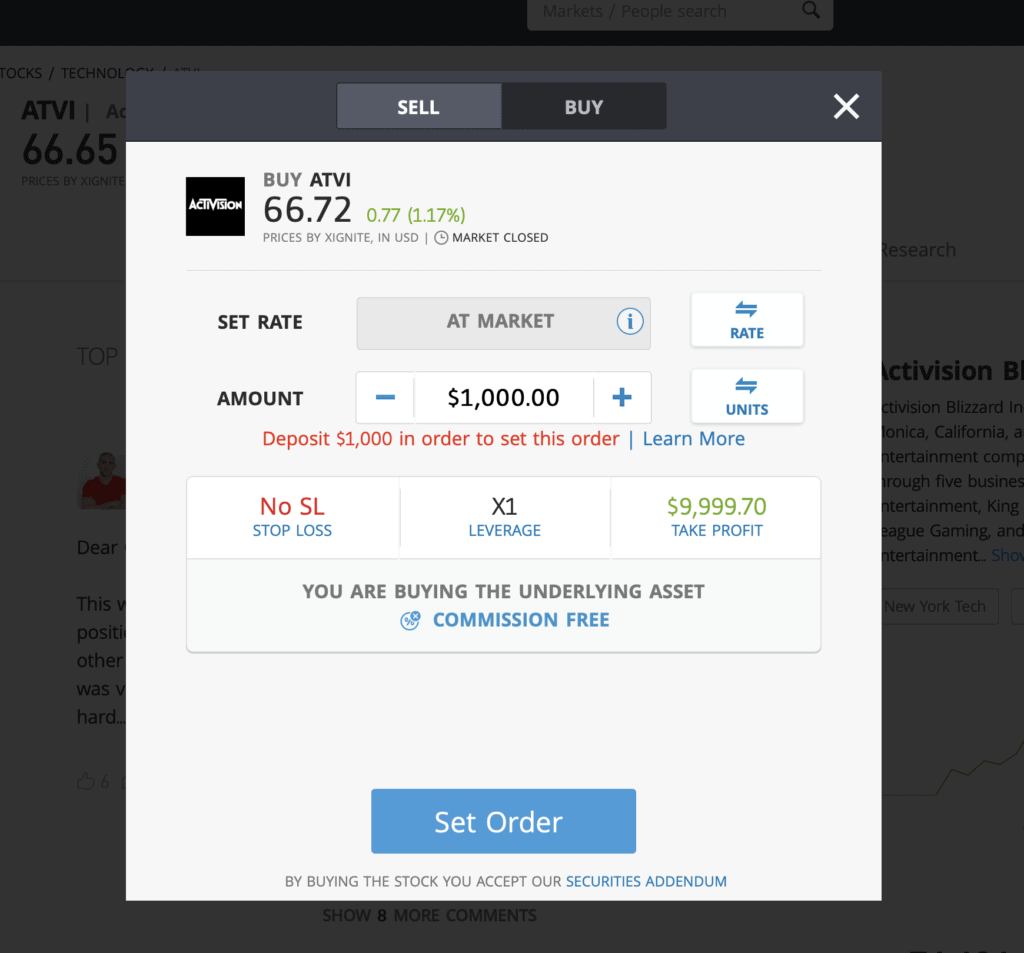

Step 3: Specify ‘Buy’

Specify ‘Buy’ on the top tab, change the leverage to X1 to purchase real stock and proceed to set your order. If you want to trade Activision CFDs, set your leverage amount, Stop loss and Take profit order limits, then click ‘Set Order’.

Investing in Activision Blizzard Shares – Final Thoughts

There’s no doubt that the gaming sector is perfectly positioned to enjoy a boost in these days of social distancing and the early signs suggest that Activision has capitalised on the opportunity, reporting record levels of engagement in March 2020.

The success of Call of Duty Mobile also bodes well for the year ahead. It may be a free-to-play title, but, as we’ve seen, Activision knows how to monetise gamers with in-game add-ons. Given that the game has been downloaded a staggering 100 million times, this looks like a very solid opportunity and reflects Activision’s plans to pivot into mobile gaming. A move that will probably see other key franchises given the mobile treatment just as 5G opens up new possibilities.

Unsurprisingly most analysts consider ATVI a buy stock and we wouldn’t be surprised if it beats top and bottom-line estimates over the next 12 months, as it did in the first quarter.

FAQs

Should I buy Activision stock or wait?

There are plenty of very good reasons to consider ATVI a solid buy stock. Obviously, a spike in gaming stock is likely during the COVID-19 pandemic, but, looking beyond the lockdown, we can see mobile gaming opportunities ahead for Activision, as well as a series of console releases – Xbox Series X and PlayStation 5 – that should boost Activision sales.

What are the fees when buying Activision stock?

Our recommended broker, eToro, offers zero-commission stock and ETF trading for European clients. This means that, unlike most brokers, eToro won’t add a dealing charge or any administrative fees when you buy ATVI stock.

Is there an Activision stock price prediction?

Analysts estimate a median 12-month forecast of $70.00, which represents a 5.09% increase on ATVI’s current price of $66.61.

What does the Activision stock dividend pay?

Currently the dividend payment is $0.41 per share which is due to be paid on 6 May 2020.