The first thing to know about Ladbrokes Coral, the UK-based betting and gambling company, is that it is now a subsidiary of GVC Holdings PLC, one of the world’s largest betting companies and a constituent of the FTSE 250 Index.

GVC’s 2018 acquisition of Ladbrokes Coral, itself a merger of two of the UK’s biggest gambling companies, Ladbrokes and Gala Coral, was reported to be worth up to £4 billion.

With the suspensions of all sporting events during the Coronavirus lockdown, times are undeniably hard for the sports betting industry. Investors are no doubt wondering how the likes of GVC are going to emerge from this challenging period.

This guide will explain how to invest in Ladbrokes Coral by buying or trading GLV stock, take a look at the best stockbrokers and consider the betting company’s prospects going forward.

On this Page:

1. eToro – Invest in Ladbrokes on a well-regulated UK platform

eToro’s mix of accessible, easy to master usability and highly competitive pricing makes it a great choice if you’re looking to buy or trade stocks. Although you cannot invest in Ladbrokes directly on eToro, you can invest in Ladbrokes' holding company (GVC Holdings). eToro's stock platform also offers 800+ strong choice of stocks and there are a variety of ways to invest.

Alongside the option to buy the underlying stock without leverage, eToro also gives you the option trade GVC Holdings shares by taking advantage of CFD (Contracts For Difference) trading. This approach enables you to speculate on the company's price fluctuations without actually buying the stock. It also introduces the possibility of going short or leveraging your trade to bolster its value and to use leverage.

Chief among eToro’s innovative features is it’s CopyTrader function, which allows you to copy another trader’s positions, which can be a great way for novices to get a hang of things.

Prices are generally very competitive, with zero-commission on stock and ETF trading for European clients and no stamp duty for UK customers buying stocks, and the miniumum deposit ($200) is reasonably affordable.

- Simple and intuitive web and mobile platform

- An unlimited demo account

- Social trading

- High fees

- $5,000 account minimum for CopyPortfolios

Should I Buy Ladbrokes Shares? Points to Consider

If you’re interested in investing in Ladbrokes Coral you can do so by buying or trading its holding company, GVC. It’s never a bad idea to take a closer look at the company fundamentals and consider historic price movements and forecasts before you take the plunge.

Ladbrokes business model and share price history

Ladbrokes is one of the longest-established names in UK betting, having been founded by Messrs. Schwind and Pennington in 1886 as commission agents for horses trained at Ladbroke Hall in Warwickshire. It’s modern history as a betting company began in the early 60s, when the government legalised betting shops under the Betting and Gaming Act.

In 1967, Ladbrokes was floated on the London Stock Exchange and enjoyed considerable growth, expanding from less than 50 to 1,135 betting shops in six years.

Over the decades that followed, Ladbrokes diversified via a number of acquisitions, including Texas Homecare (later sold to Sainsbury’s) in 1986 and Hilton International the following year. This acquisition gave Ladbrokes the rights to the Hilton hotel brand outside of the US.

Non-core holdings, like Texaco Homecare, were deemed extraneous in the 90s, as Ladbrokes redoubled its focus on gambling and hotels in the wake of rising debts and losses. This narrowed focus was further honed when the company sold its hotel operations to Hilton Hotels Corporation for £3.5 billion in 2006.

In 2015 a merger with Gala Coral created the UK’s biggest bookmaker, a deal that took some time to push through due to concerns that it might harm local competition.

This newly merged gambling behemoth was then acquired by GVC in 2018, with GVC shareholders owning 53.5% and Ladbrokes Coral 46.5% of the combined company. Alongside, Ladbrokes Coral, GVC’s betting brands include bwin and Sporting Bet as well as gaming labels like partypoker, Cashcade and Foxy.

GVC’s stock has emerged from the Coronavirus crisis in surprisingly good shape having plummeted from £8.07 to £2.92 in March 2020. By April 24, the stock had climbed back up to £7+, largely thanks to the popularity of its online gaming titles – like Foxy Bingo and partypoker – during lockdown.

Ladbrokes Coral stock dividend information

GVC’s impressive emergence from a dramatic Coronavirus crash hasn’t been enough to save its dividend (previously a 5% yield), which has been scrapped.

As of April 24, 2020, GVC’s P/E Ratio is 11.3. To compare this to a direct competitor, Flutter Entertainment’s P/E Ratio is currently at 35.9.

Ladbrokes Coral stock forecast and prediction

On April 24, Berenberg reaffirmed its buy investment rating on GVC Holdings and raised its price target from 850p to 900p, a significant increase on the current price of 700.6p (on 24/04/2020).

How to Buy Ladbrokes Coral Stocks

You can invest in or trade Ladbrokes by buying stocks in its holding company GVC Holdings. For this, you will need a good stock broker. As we explained earlier, our broker of choice for investing in GVC Holdings is eToro. To get started, you will need to sign up to eToro.

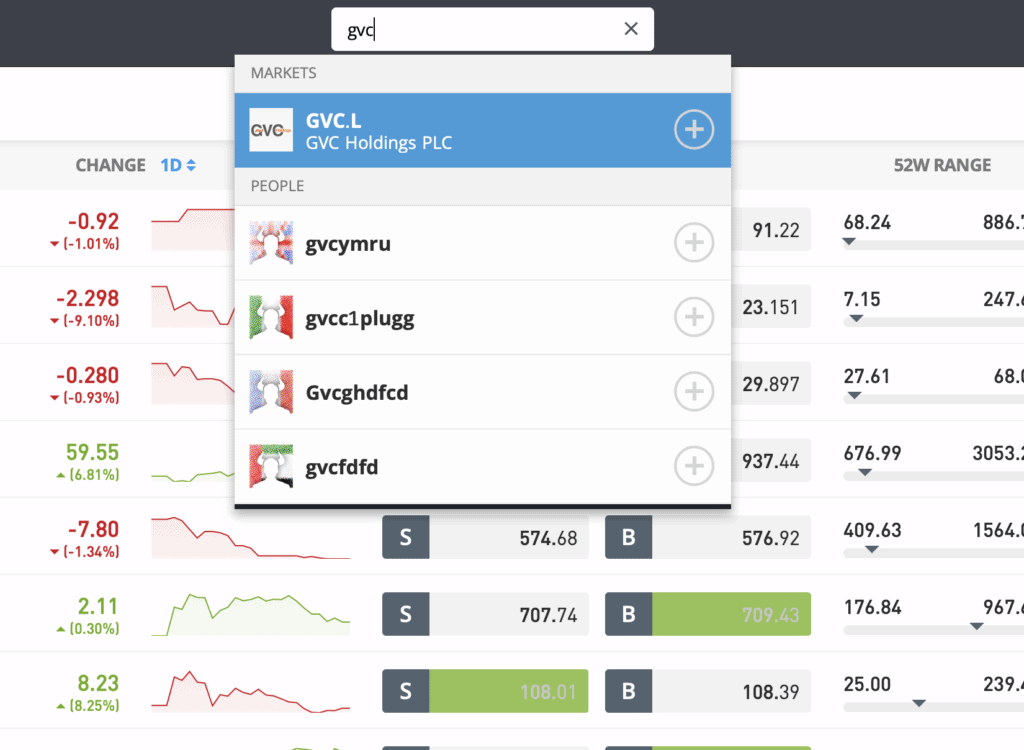

Step 1: Search for GVC Holdings (GVC.L) Stock

Look up GVC by typing the ticker symbol GVC.L into the search box.

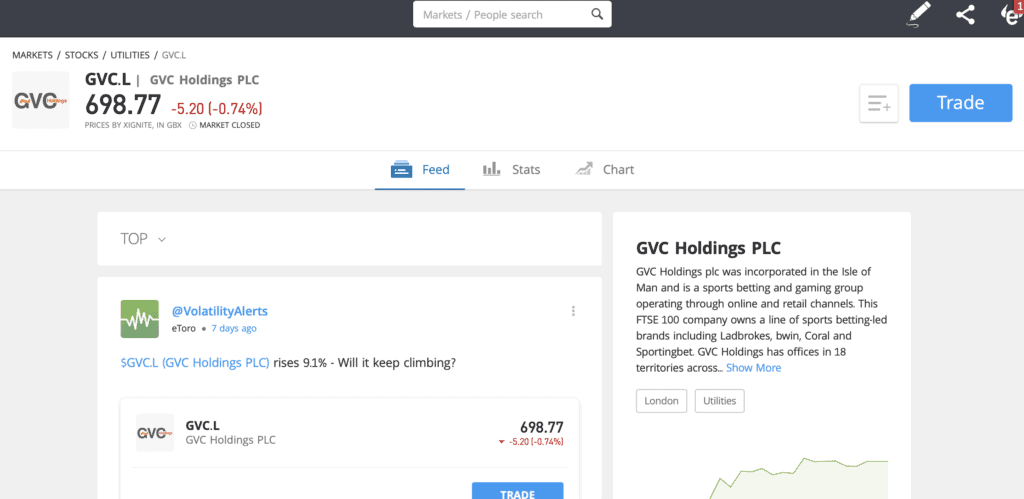

Step 2: Click on trade

Click Trade in the top right corner of the GVC Holdings page.

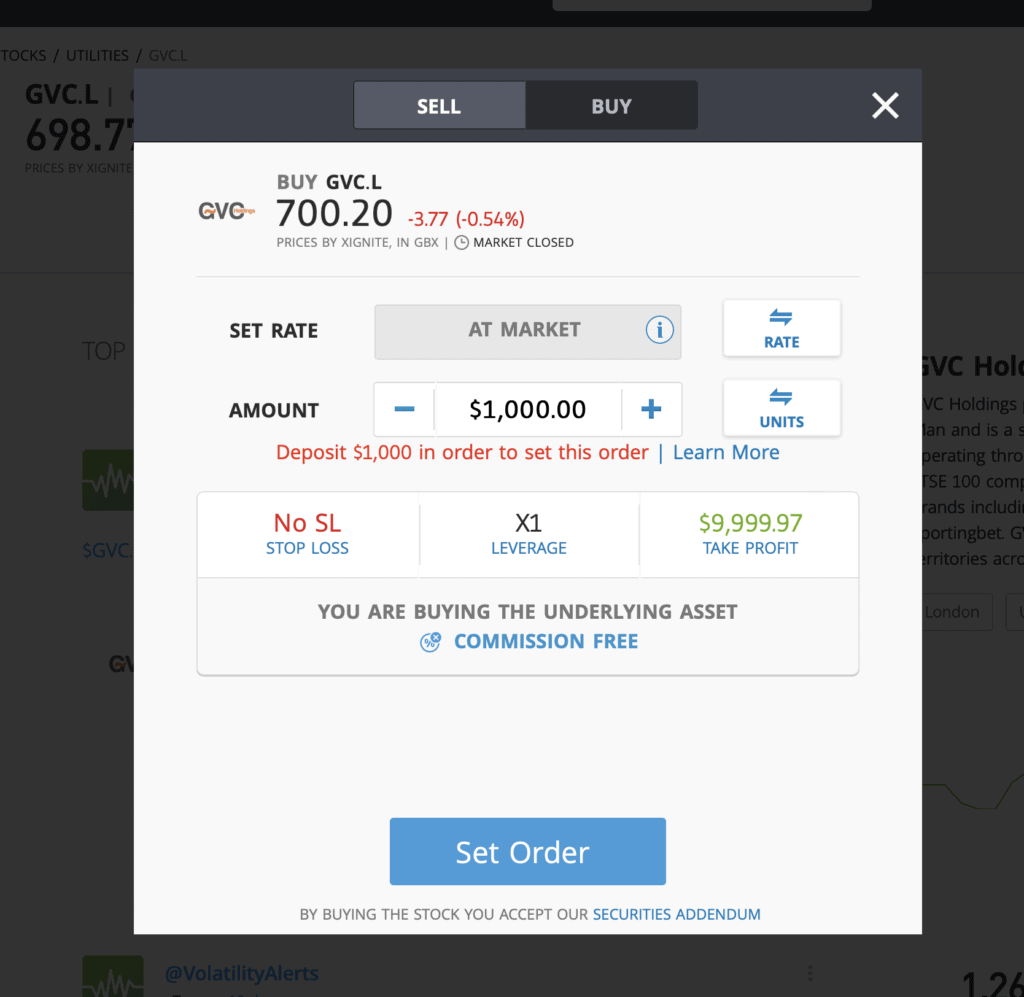

Step 3: Specify ‘Buy’

Specify ‘Buy’ on the top tab, change the leverage to X1 to purchase real stock and proceed to set your order. If you want to trade GVC CFDs, set your leverage amount, Stop loss and Take profit order limits, then click ‘Set Order’.

Investing in Ladbrokes Shares – Final Thoughts

GVC is currently looking well placed to emerge from the Coronavirus crash in reasonably good shape, largely thanks to its gaming brands – Ladbrokes Coral will continue to suffer while betting shops are shut and there’s no sport to bet on.

Because so much uncertainty surrounds the Coronavirus diminished UK economy right now, it’s hard to confident of anything, but buying GVC stock in the aftermath of such a shock could prove to be a smart move – the signs of a strong recovery are already there.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

FAQs

Should I buy Ladbrokes stock or wait?

Buying GVC while the Coronavirus still casts such a shadow over the UK economy is a bit of a risk but analysts seem convinced that a strong recovery is likely, so now could be a smart time to buy.

What are the fees when buying Ladbrokes stock?

Our recommended broker, eToro, offers zero-commission stock and ETF trading for European clients. This means that, unlike most brokers, eToro won’t add a dealing charge or any administrative fees when you buy GVC stock.

Is there a Ladbrokes stock price prediction?

Analysts at Berenberg have raised their target price on GVC Holdings from 850.0p to 900.0p, indicating they believe it to be well positioned to emerge from the Coronovires slump in the next 12-months.

What does the Ladbrokes stock dividend pay?

GVC, Ladbroke Coral’s holding company, has scrapped its dividend in light of significant revenue losses.

A-Z of Stocks