It goes without saying that travel companies like Norwegian Cruise Line are suffering badly during the COVID-19 pandemic. With most of the planet locked down and all forms of tourism prohibited, lost earnings are a best-case scenario. Many travel businesses are facing an existential threat. You may, therefore, be wondering whether now is a good time to buy Norwegian Cruise Line stock.

Despite the current crisis, for those travel companies that can weather the storm, opportunity may just about be visible on the horizon. Norwegian Cruise Line, the third-largest cruise operator in the world, has taken a battering in the first quarter of 2021 but may at least be beginning to envision a route back to profitability.

Thinking of buying Norwegian Cruise Line stock? This guide will explain how to buy Norwegian Cruise Line stock, take a look at the best stockbrokers and consider the company’s prospects going forward.

Where to Buy Norwegian Cruise Line Stock

If you want to buy Norwegian Cruise Line stock, start by creating an account with one of our recommended online stockbrokers. If you’re outside the United States, eToro is the best platform on which to buy NCLH stock. If you’re inside the US or Canada, our top pick is Stash Invest.

1. eToro – Market Leading Broker Built on Social Trading Innovation

eToro offers a safe, affordable and easy way to buy NCLH stock. You can invest in all of eToro's selection of 800 stocks with no commission, and there's also no stamp duty for UK traders, which is mentioned in our eToro review. As well as buying the underlying assets, eToro users can trade stock CFDs with leverage of up to 1:5.

A social trading platform, eToro is famous for its innovative CopyTrader tool, which allows you to mimic the portfolios and future positions of top traders. This means you can buy Tesla stocks and many others without having to research the markets yourself.

If you’re ready to start trading you can begin by depositing $200, or you can trial the platform with a $100,000 demo account. There's a range of payment methods to choose from, including PayPal.

eToro is heavily regulated and is licensed by the FCA, CySEC and ASIC, so it's a secure and reliable platform. This stockbroker is also a great choice if you're a mobile trader, thanks to the eToro app for iOS and Android devices.

- 800+ stocks to buy outright or trade as CFDs

- Beginner-friendly stock trading platform

- 0% commission on stock trading

- $5,000 account minimum for CopyPortfolios

Should I Buy Norwegian Cruise Line stock? Points to Consider

It’s always best to do your research before you buy NCLH stock or other travel assets like Qantas stock. We always recommend taking a closer look at the company fundamentals and researching historic price movements and forecasts before you invest money.

Norwegian Cruise Line business model and share price history

Inspiring any sort of optimism right now requires companies to sell a vision of the post-pandemic future to investors who are probably struggling to see beyond the Coronavirus crisis. Norwegian Cruise Line’s Q1 earnings report seems to have done just this, provoking a modest surge in the travel company’s ailing stock price.

Norwegian Cruise Line’s first quarter results were unsurprisingly poor. The cruise operator lost $1.88 billion, or $8.80 a share, in the three months ending March 31. This compares to a net income of $118.2 million, or 54 cents a share, in the first quarter of last year.

Revenue fell 11.2% to $1.25 billion, missing the analyst consensus of $1.28 billion. Predictably, the NCLH share price plummeted 80.4% during the three-month period. All this despite a relatively strong start to the year.

Q2 won’t offer anything to alleviate the pain according to CEO Frank Del Rio, who was frank in his prognosis: “2021 is a wasted year. At a minimum, the industry is going to go the entire Q2 without a penny of revenue, impossible to overcome.” The company didn’t provide second quarter or full-year guidance.

You may be asking when the optimism kicks in. Well, it seems that investors are impressed by moves the company has made to protect itself by significantly bolstering its financial position.

“In recent weeks, we have taken decisive action to significantly strengthen our financial position in response to the COVID-19 global pandemic, including our highly successful and oversubscribed $2.4 billion gross simultaneous quad-tranche capital raise announced last week,” Del Rio said in a statement to shareholders.

“We believe this capital raise, coupled with other ongoing liquidity-enhancing initiatives, makes us well-positioned to weather an unlikely scenario of over 18 months of suspended voyages.”

Added to this, the cruise operator was able to report demand for cruises in the final quarter of 2021 and early 2021 that is ‘within historical ranges.’

Norwegian Cruise Line stock dividend information

Norwegian Cruise Line doesn’t pay a dividend to shareholders.

Norwegian Cruise Line stock forecast and prediction

Abbott’s median 12-month target price according to CNN – based on 16 analyst forecasts – is $19.00, with a low target of $12.00 and a high target of $70.00. The median target represents a 74.47% increase on the current price of $10.89.

MarketBeat’s analyst ratings are markedly higher, reporting a median target of $38.73 and a consensus rating of Buy.

How to Buy Norwegian Cruise Line Stock on eToro

It’s quick and easy to invest in Norwegian Cruise Line stock at our recommended broker, eToro. Assuming you’ve signed up and funded your broker account, follow these simple steps to buy NCLH stock.

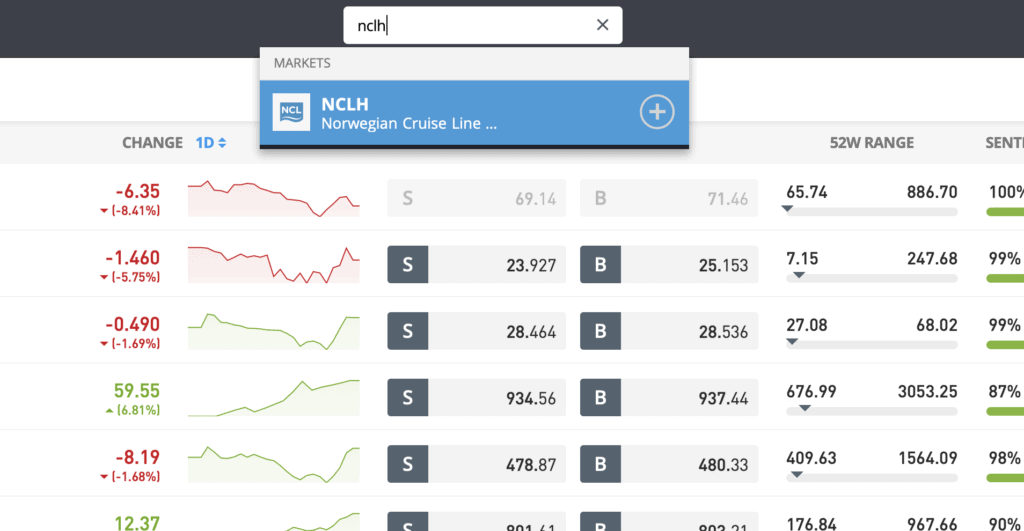

Step 1: Search for Norwegian Cruise Line (NCLH) Stock

Look up Norwegian Cruise Line by typing the ticker symbol NCLH into the search box.

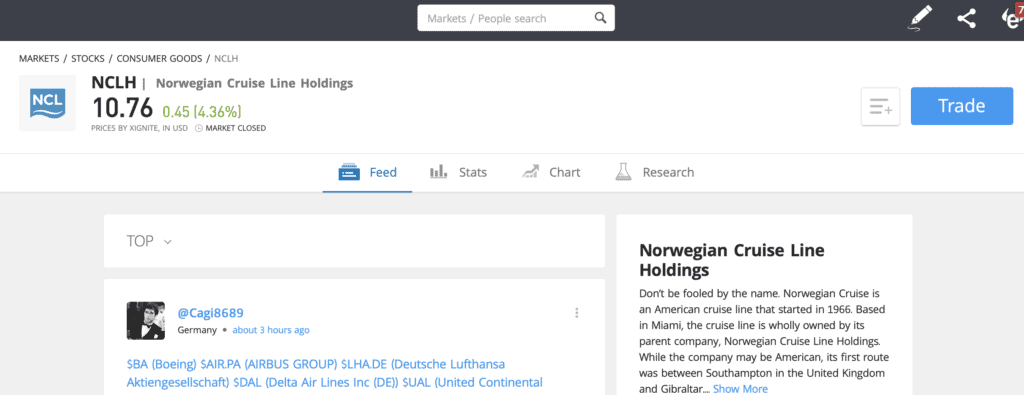

Step 2: Click on trade

Click Trade in the top right corner of the Norwegian Cruise Line page.

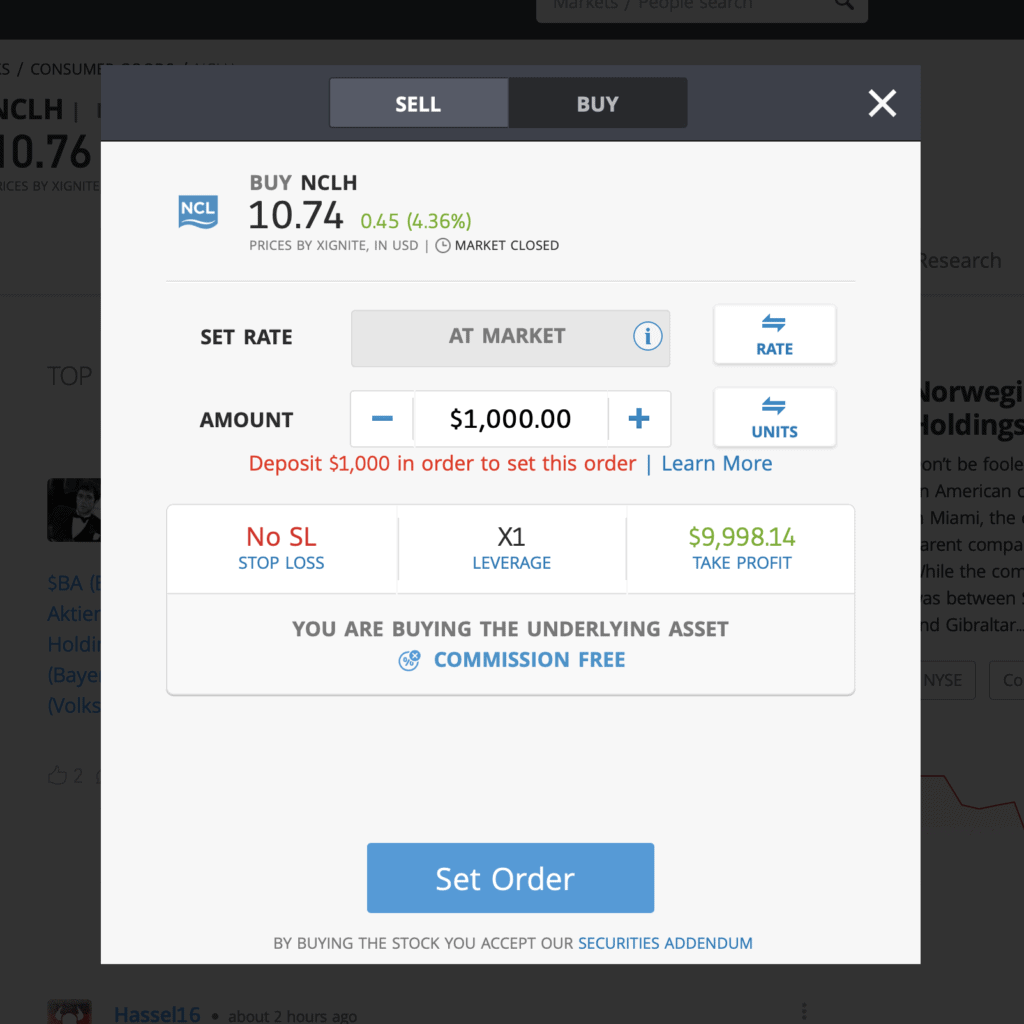

Step 3: Specify ‘Buy’

If you want to purchase the underlying asset, specify ‘Buy’ on the top tab, change the leverage to X1 and proceed to set your order. To trade NCLH CFDs, set your leverage amount, Stop loss and Take profit order limits, then click ‘Set Order’.

Buying Norwegian Cruise Line Stock – Final Thoughts

There’s no denying that the travel industry faces an uncertain future right now. With no concrete news on when we can expect tourism to return, any investment in the sector is a bit of a risk. But, if you’re looking for a longer-term opportunity, Norwegian Cruise Line looks relatively well-placed to survive the pandemic and return to business as usual.

With enough capital to withstand a worst-case scenario and evidence that bookings are set to return to pre-pandemic levels, it’s easy to see why investors detect plenty of long-term upside in NCLH stock.

If you want to buy Norwegian Cruise Line stock today, we recommend registering with one of our recommended stockbrokers. eToro is our number one broker if you’re outside the US, while we suggest US traders go with Stash Invest.

FAQs

Should I buy Norwegian Cruise Line stock or wait?

Norwegian Cruise Line has offered enough evidence that it will emerge from punishing Coronavirus-inflicted losses to suggest rallying share prices aren’t far away. While uncertainty remains, NCLH looks like a Buy to us.

What are the fees when buying Norwegian Cruise Line stock?

Zero-commission stock and ETF trading is available to European clients who trade on eToro. This means that eToro doesn't add a dealing charge or any administrative fees when you buy NCLH stock.

Is there an NCLH stock price prediction?

Analysts estimate a median 12-month forecast of $19.00, which represents an 74.47% increase on the current MYL price of $10 89.

What does the Norwegian Cruise Line stock dividend pay?

Norwegian Cruise Line doesn’t pay a dividend to shareholders.