As you’d expect during a period of economic uncertainty, all eyes are on Warren Buffett and his team at Berkshire Hathaway. Given his track record, Buffett’s actions are invariably scrutinised by the wider finance world, so Berkshire Hathaway’s impending AGM – to be held on May 2nd in the form of a pandemic-friendly video stream – will be of particular interest given the uncertain state the Coronavirus-ravaged economy.

Buffett’s famous investment conglomerate hasn’t escaped the impact of COVID-19, with much of its portfolio, most noticeably the decimated airlines American, Delta, United and Southwest, taking a hit.

In theory, bearish market conditions could make it a great time to pursue Warren Buffett’s classic investment strategy and pick up quality stocks at bargain prices. But what about investing in Berkshire Hathaway stock? This guide will explain how to buy Berkshire Hathaway stock, take a look at the best stockbrokers and consider the conglomerate’s prospects going forward.

On this Page:

Where to Buy Berkshire Hathaway Stock

Planning to invest in Berkshire Hathaway? We recommend creating a stock account with one of our recommended brokers. If you’re outside the United States, select eToro. If you’re inside the US or Canada, choose Stash Invest.

1. eToro – Market Leading Broker Built on Social Trading Innovation

eToro made its name as a social trading platform and currently offers over 800 stocks. It's famous for its CopyTrader tool, which allows users to follow and mimic the traders of top investors. This makes eToro an excellent option for beginners as well as more experienced traders.

Given that class A Berkshire Hathaway stock (BRK-A) is currently trading at $281,000, it’s likely you’ll be looking to buy the conglomerate’s class B stock (BRK-B), which is currently priced at a rather more affordable $189.19. eToro offers users a number of ways to invest in BRK-B.

You might favour simply investing in the underlying asset by opening a long (BUY) position, or you may prefer the option of speculating of Berkshire Hathaway with a CFD trade. This allows you to bet on price fluctuations by opening long or short positions, without actually buying the stock. It also introduces the possibility of adding leverage to your trade to increase its value.

A $100,000 demo account that allows you to familiarise yourself with the platform before using real money makes eToro is a great choice if you want to build your knowledge of investing before taking the plunge. The platform is intuitive and easy to use, and the customer support is also responsive and helpful.

Zero-commission and no stamp duty to pay on stock purchases mean eToro is a well-priced platform for stock investing, while ASIC, CySEC, and FCA licenses show that you’re in safe hands. Stock trading on eToro will become available to US users later this year.

- 800+ stocks to buy outright or trade as CFDs

- Beginner-friendly stock trading platform

- 0% commission on stock trading

- $5,000 account minimum for CopyPortfolios

Should I buy Berkshire Hathaway Stock? Points to consider

If you’re thinking of buying Berkshire Hathaway stock, or to buy Amazon stocks, it’s important to do your research. We advise looking at the company fundamentals and considering historic price movements and forecasts before you make an investment. Here are a few points to help you decide whether to invest in Berkshire Hathaway.

Berkshire Hathaway business model and share price history

Headquartered in Omaha, Berkshire Hathaway originally comprised a group of textile milling plants, until Warren Buffett became the controlling shareholder in the mid-60s. Buffett began a project of diverting funds from the core business into other investments before buying National Indemnity in 1967. This was the first of a series of Insurance company buyouts that would help to fuel Buffett’s transformation of Berkshire Hathaway into a powerhouse conglomerate.

Buffett used the ‘float’ (or available reserve) from insurance subsidiaries like National Indemnity and GEICO (Government Employees Insurance Company) to make timely purchases of undervalued companies. Over the years, the ‘Oracle of Omaha’ has exhibited an uncanny knack for picking up struggling businesses, that he regards as having underlying value, and nurturing them back to health.

Buffett also tends to prioritise investment into companies with strong dividend payments, reasoning that this should indicate solid fundamentals. We can see this characteristic in many of the big companies Berkshire Hathaway has significant positions in. Apple and Coca Cola both have healthy, consistently maintained dividend payments, for instance.

Since Buffett took the reins in 1965, Berkshire Hathaway’s results speak for themselves. The conglomerate has outperformed the S&P 500 in 37 out of 55 years (67%), achieving an annualised average return that’s more than double that of the benchmark index.

While many of Berkshire’s subsidiaries are, in theory, recession-proof, because they provide goods and services that people need, the company certainly hasn’t been immune to the Coronavirus crash. Nearly $90 billion was wiped off the company’s $257 billion in invested assets, and there will be plenty of interest in Buffett’s next move. The company has an enormous cash pile of $128 billion and many expect to see it leap into action as it has in previous bear markets.

Berkshire Hathaway stock dividend information

Famously, Berkshire Hathaway doesn’t pay a dividend. Why? Well, in a nutshell, Warren Buffett believes there are more productive ways to use profits. He would rather invest funds – and Berkshire Hathaway has a huge cash pile – into Berkshire’s subsidiary businesses, which, by his reckoning, will ultimately benefit shareholders more than a dividend payment.

Berkshire Hathaway stock forecast and prediction

BRK forecasts have taken a bit of a knock as a consequence of the Coronavirus pandemic, which has had a considerable impact on Berkshire’s portfolio, as it has on most of the economy. UBS analyst Brian Meredith amended his 12-month price target for Berkshire’s A stock price from $393,000 to $358,000, and B stock from $262 to $239. He still considers both BRK stocks to be buys, however.

How to Buy Berkshire Hathaway Stock from eToro

Providing you have a funded broker account, follow these simple steps to buy Berkshire Hathaway stock on our recommended best online stockbroker, eToro.

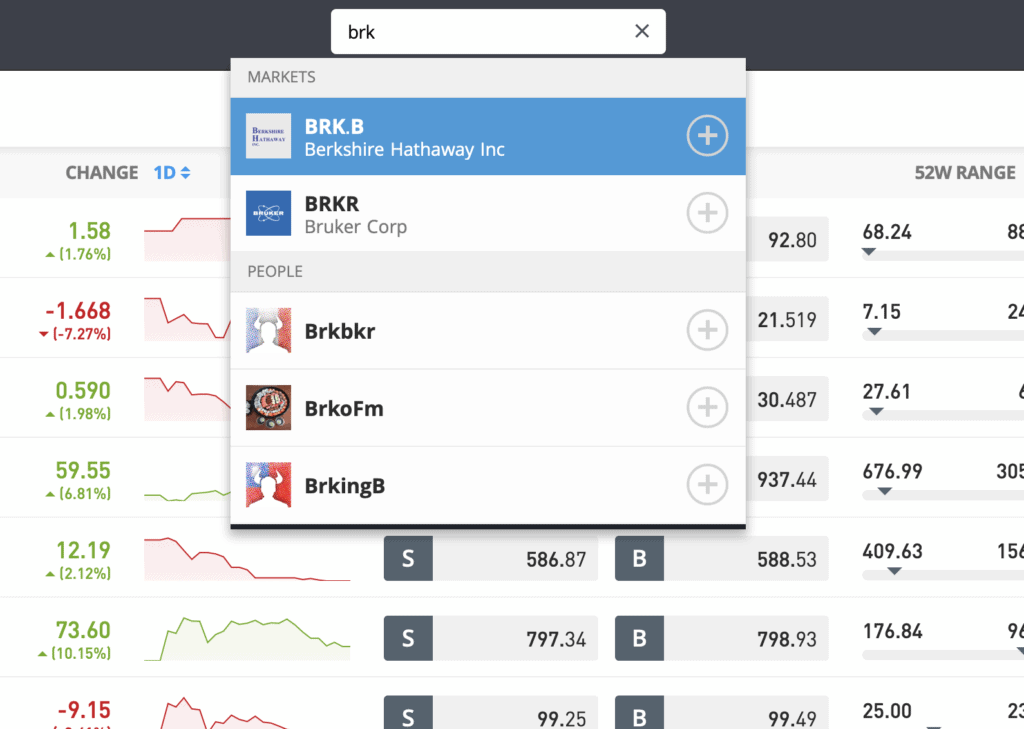

Step 1: Search for Berkshire Hathaway (BRK.B) Stock

Look up Berkshire Hathaway by typing the ticker symbol BRK.B into the search box.

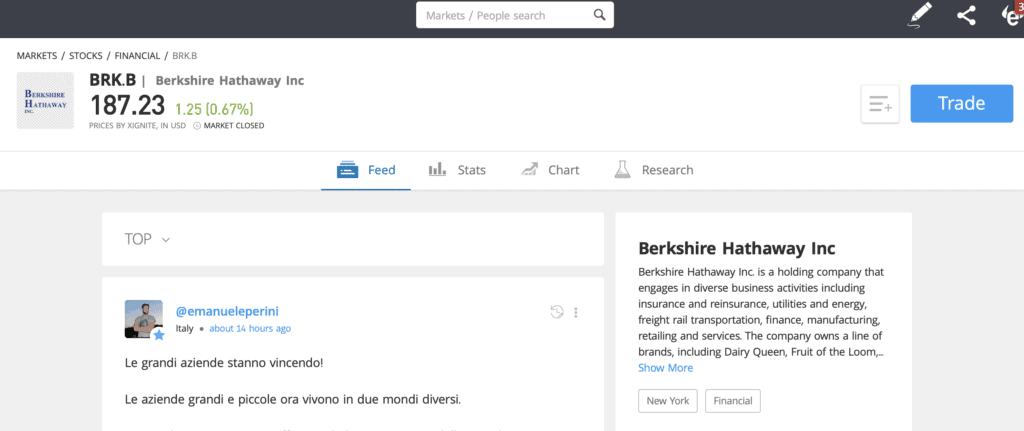

Step 2: Click on trade

Click Trade in the top right corner of the Berkshire Hathaway page.

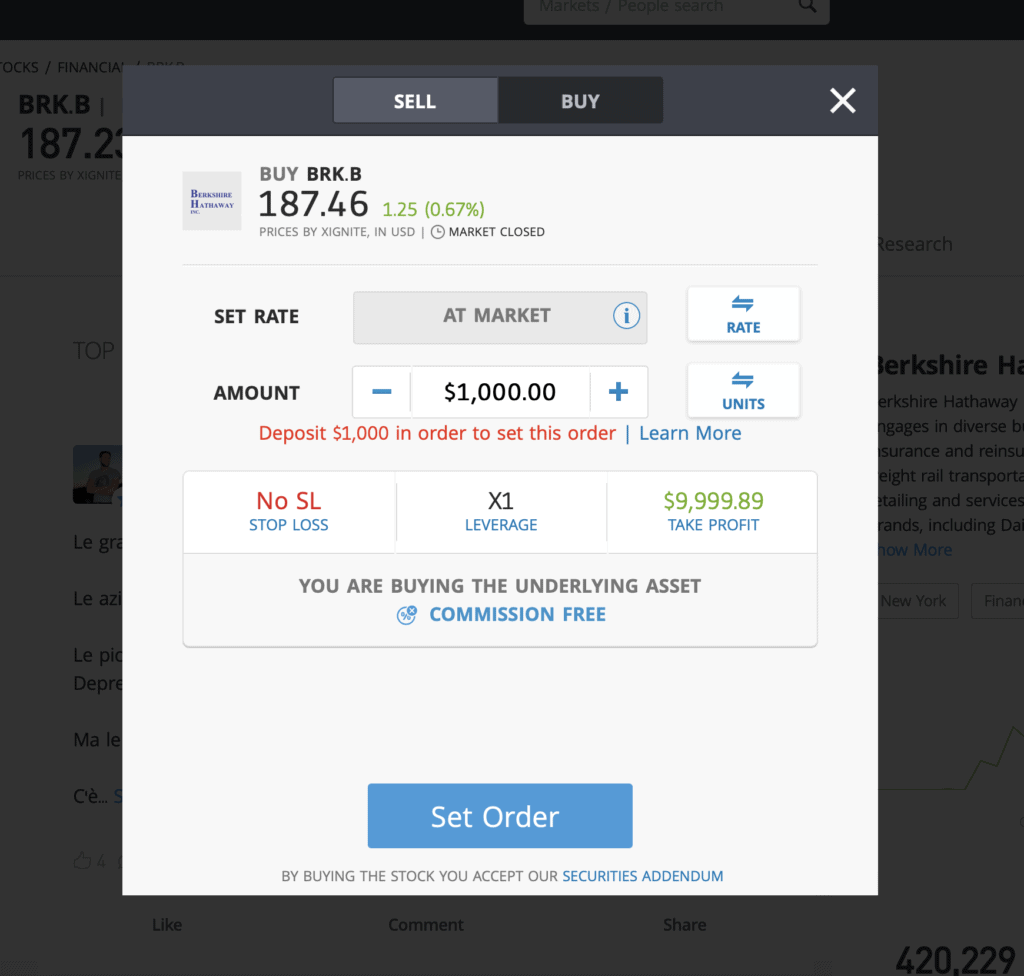

Step 3: Specify ‘Buy’

Specify ‘Buy’ on the top tab, change the leverage to X1 to purchase real stock and proceed to set your order. If you want to trade Berkshire Hathaway CFDs, set your leverage amount, Stop loss and Take profit order limits, then click ‘Set Order’.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Investing in Berkshire Hathaway Shares – Final Thoughts

While Buffett seems to acknowledge the significant challenges posed by the Coronavirus crash, he typically maintains a level head in such situations and, invariably, emerges stronger than ever. There is a sense among analysts that any damage wrought by the pandemic should be manageable and most still regard BRK as a buy stock.

It remains to be seen how Berkshire Hathaway will respond – will it deploy its capital while the market is still reeling, or will it wait to see what happens? Keep your eyes peeled for news emerging in May. With the AGM scheduled for the 2nd May and details of Berkshire’s stock due to be filed shortly after on the 15th, the coming month will give us a clearer picture of Buffett’s strategy.

If you want to buy Berkshire Hathaway stock, simply sign up to one of our recommended online stockbrokers to get started. If you’re not in the US, then we advise going with Toro. For US stock traders, we suggest you choose Stash Invest.

FAQs

Should I buy Berkshire Hathaway stock or wait?

Berkshire Hathaway has been rocked by the Coronavirus crash but it’s a fortress built on significant foundations and could thrive on the opportunities created by a bear market. We think it’s still a buy stock.

What are the fees when buying Berkshire Hathaway stock?

Our recommended broker, eToro, offers zero-commission stock and ETF trading for European clients. This means that, unlike most brokers, eToro won’t add a dealing charge or any administrative fees when you buy BRK stock.

Is there a Berkshire Hathaway stock price prediction?

UBS analyst Brian Meredith gives Berkshire's A stock a 12-month target price of $358,000 (currently $281,264) and its B stock a target price of $239 (currently $187.46).

What does the Berkshire Hathaway stock dividend pay?

Berkshire Hathaway doesn’t pay a dividend to shareholders.