Few motoring brands evoke prestige, luxury and heritage as effortlessly as Aston Martin. This quintessentially British marque will forever be associated with James Bond, who has remained loyal to Aston ever since Sean Connery first slid behind the wheel of a DB5 in Goldfinger, 56 years ago. But is now a good time to buy Aston Martin shares?

While its cars remain impeccably prestigious, Aston’s turbulent financial performance has failed to impress investors. Currently priced at a 10th of its 2018 IPO valuation, Aston Martin Lagonda’s stock market performance has been so catastrophically bad that some investors may be sensing a revival.

If you’re thinking of invest in Aston Martin, this guide will explain how to buy Aston Martin shares, take a look at the best stockbrokers and consider the company’s prospects going forward.

Where to Buy Aston Martin Shares

If you want to invest in Aston Martin, start by creating an account with one of our recommended online stockbrokers. If you’re outside the United States, eToro is our number one stockbroker. If you’re inside the US or Canada, we advise you go with Stash Invest.

”1.

” image0=”” pros1=”800+ stocks to buy outright or trade as CFDs” pros2=”Beginner-friendly stock trading platform” pros3=”0% commission on stock trading” cons1=”$5,000 account minimum for CopyPortfolios” cons3=”” cta-label=”Visit eToro Now” cta-url=”https://insidebitcoins.com/visit/etoro-stocks” disclaimer-text=”75% of retail investor accounts lose money when trading CFDs with this provider.” paragraphCount=”1″]

Should I Buy Aston Martin Shares? Points to Consider

It’s always best to do your research before you buy Aston Martin shares or other UK assets like Marks & Spencer stock. We always recommend taking a closer look at the company fundamentals and researching historic price movements and forecasts before you invest money.

Aston Martin business model and share price history

June 2020 finds Aston Martin Lagonda arriving at a pivotal moment. Since its IPO in late 2018, AML has endured a disastrous decline in value, steadily plummeting from an initial price of £5.50 to 35p in less than two years. The Coronavirus crisis certainly hasn’t helped, but it’s fair to say that the rot set in far earlier. Ever since its share price dropped 10% on the first day of trading, in fact.

Something had to give, and on May 26 it did, in the shape of chief executive Andy Palmer. Following a COVID-19 ravaged first quarter earnings report, the company ousted Palmer and announced his replacement, Tobias Moers, chief executive of Mercedes subsidiary AMG.

The move ends Palmer’s difficult 6-year tenure and aims to open a new chapter ahead of the long-anticipated release of its DBX SUV (pictured right), a car that could prove instrumental to Aston Martin’s future prospects.

Aston Martin’s current predicament is nothing new. Beneath the veneer of its luxury branding, the company has rarely achieved anything approaching financial stability. The fact that it has gone bankrupt seven times tells its own story. As do losses, before tax, of £118.9m in the last quarter of this year. During the first three months of 2020, Aston Martin sold just 578 vehicles.

Announcing Palmer’s departure, Lawrence Stroll, the billionaire entrepreneur who led a £536 million rescue deal in March, said: “The board has determined that now is the time for new leadership to deliver our plans. On behalf of the board, I would like to thank Andy for his hard work, personal commitment and dedication to Aston Martin Lagonda since 2014.”

The announcement of Moers’ appointment has had a rejuvenating impact of AML’s share price, which instantly shot up from 35 GBX to 49 GBX.

Aston Martin shares dividend information

Aston Martin Lagonda doesn’t currently pay a dividend to shareholders.

Aston Martin shares forecast and prediction

Aston Martin’s median target price based on 12 analyst forecasts is GBX 432.33, with a low target of GBX 199 and a high target of GBX 600. 6 analysts rated AML a Sell stock, 5 rated it Hold and 1 a Buy.

How to Buy Aston Martin Shares on eToro

It’s quick and easy to buy Aston Martin Lagonda shares at our recommended broker, eToro. Once you’ve registered and deposited into your broker account, follow these simple steps to buy AML shares.

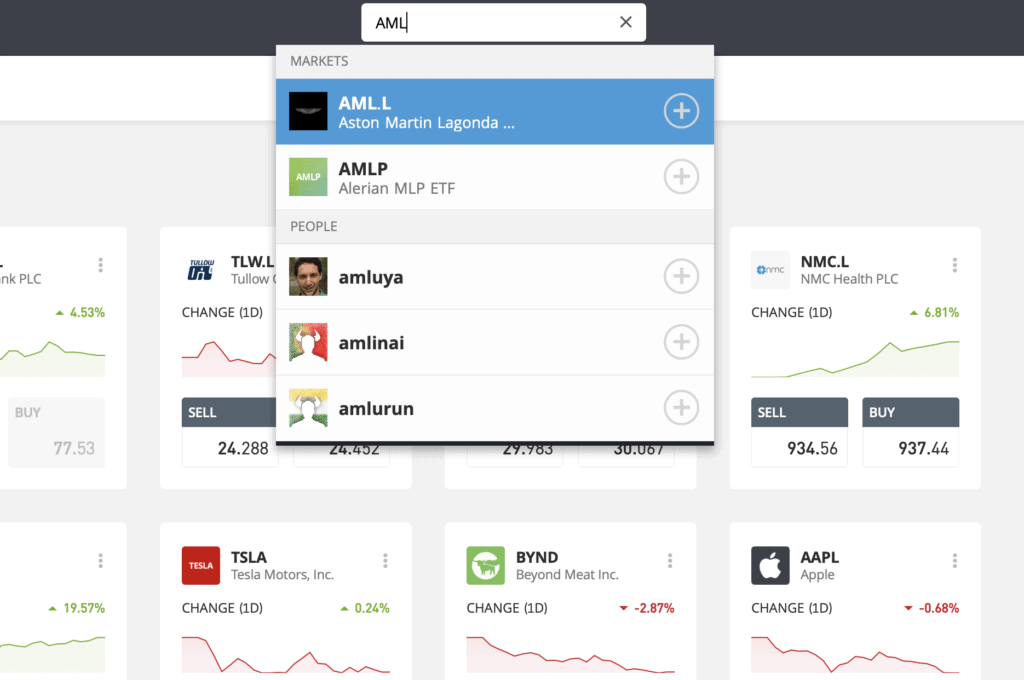

Step 1: Search for Aston Martin Lagonda (AML) Shares

Look up Aston Martin Lagonda by typing the ticker symbol AML into the search box.

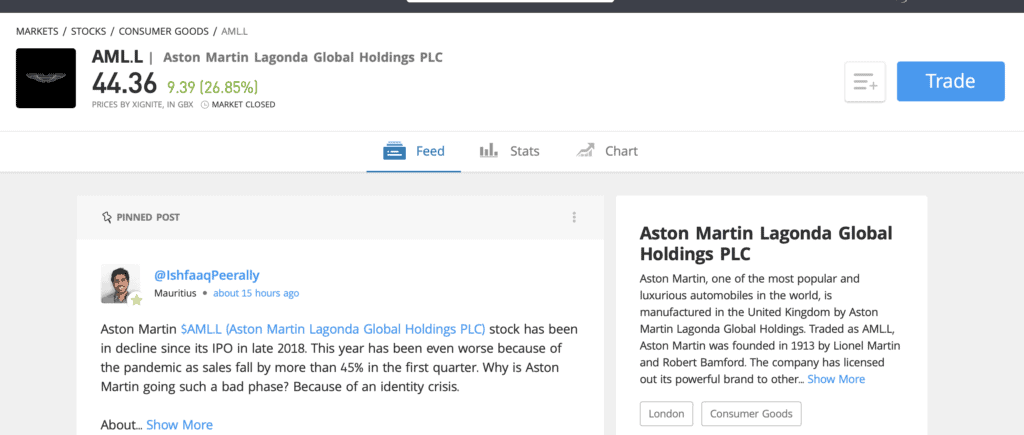

Step 2: Click on trade

Click Trade in the top right corner of the AML page.

Step 3: Specify ‘Buy’

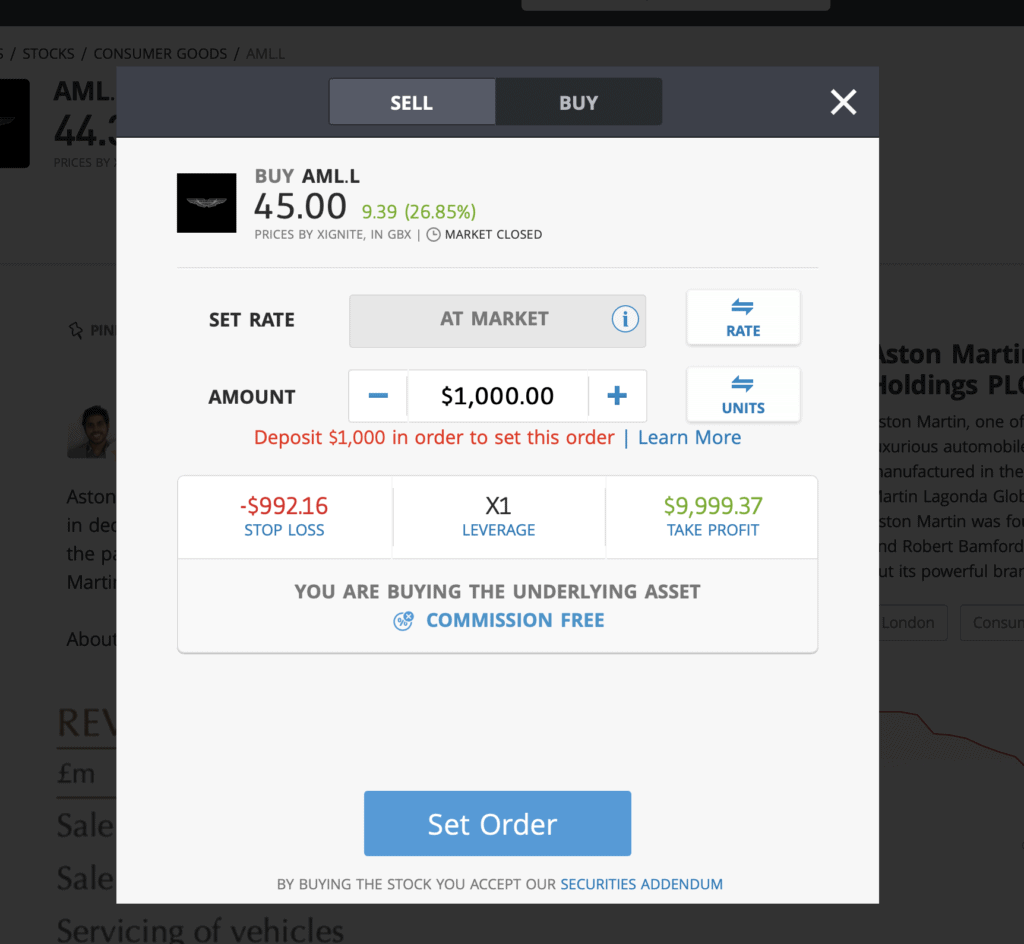

If you want to purchase the underlying asset, specify ‘Buy’ on the top tab, change the leverage to X1 and proceed to set your order. To trade AML CFDs, set your leverage amount, Stop loss and Take profit order limits, then click ‘Set Order’.

Investing in Aston Martin Shares – Final Thoughts

Aston Martin’s disastrous stock market performance has been compounded by the Coronavirus crisis, but its decline predates the pandemic. AML’s share price has been in a state of near-constant descent since its IPO in 2018. The recent chief exec switch-up has inspired an upturn in investor sentiment, however, and there’s definitely some short-term upside given AML’s rock bottom share price. Nonetheless, Aston Martin Lagonda remains a dicey prospect.

If you do want to buy Aston Martin Lagonda shares, there’s no better place to do so than with our recommended stockbrokers. eToro is our top pick for investors outside the US, while we suggest you go with Stash Invest if you live in the States.

FAQs

Should I buy Aston Martin shares or wait?

Despite a recent share price surge following the announcement of a new chief executive, AML remains a troubled stock. We’re inclined to go along with a rating of Hold.

What are the fees when buying Aston Martin shares?

Zero-commission stock and ETF trading is available to European clients who trade on eToro. This means that eToro doesn't add a dealing charge or any administrative fees when you buy AML stock.

Is there an Aston Martin share price prediction?

Aston Martin’s median target price based on 12 analyst forecasts is GBX 432.33.

What does the Aston Martin shares dividend pay?

Aston Martin Lagonda doesn't currently pay a dividend to shareholders.

A-Z of Stocks