Can the world’s oldest telecom compete with younger, more agile competitors? BT is staying competitive by building some of the speediest fixed and mobile networks on the planet, but at a huge cost. A new CEO from the fast-moving fintech world has been brought in to boost BT’s share price. The changing of the guard is taking place as analysts turn bullish on higher speed telecommunications services.

This guide looks at how to assess BT’s future growth opportunities, value BT stock, and find the best BT stock brokers as BT’s 5G and ultrafast fibre networks go live.

Should you invest in BT?

BT Group (LSE: BT.A) could be mistaken for a stodgy telecommunications conglomerate. Revenues are puttering along and modest earnings are being eked out. If you had decided to buy FTSE100 stocks in 2015 when BT bought 4G mobile leader EE, you would have earned a 7 percent return. If you had decided to only buy shares in BT, however, your return would be -9 percent.

But far from behind the times, BT has been nimbler than other telecoms. The telecom is spending $5 billion annually on building high speed fixed and mobile networks to bring you faster streaming videos and gaming. Here’s why BT could be the darling of the FTSE 100 once again.

Pros of buying BT stock

5G networks are live

5G is one of the most anxiously awaited rollouts in mobile history. While most countries wait for delayed networks, BT is one of the first to market with its 5G rollout in 16 cities this year. 5G smartphones and home routers provide an opportunity to gain market share in mobile gear, too. Could the lack of a 5G iPhone be the real reason fewer investors want to invest in Apple stock?.

Fixed networks are leaping from super to ultra fast

Customers are migrating to faster fibre networks. BT reported 680,000 new sign ups in the final months of 2018 – the highest number ever. The enterprise market is turning to more robust broadband networks to handle its rising data analytics, AI and cloud computing demands.

Content convergence has the mobile lifestyle covered

By integrating fixed and mobile networks, BT is creating more value by converging voice, data and content across all devices. One smart number will reach you on your IPad, smart watch or work station. Meanwhile, those other service providers will pay BT more money to access its high speed networks.

Cons of buying BT stock

Soaring sports and entertainment content costs

Britain’s low penetration rate for quad bundles (mobile, phone, TV and broadband) provides a big market opportunity. But should you buy Netflix stock or invest in Disney’s new streaming service or reinvest your BT dividends? All are in content bidding wars. BT has spent over $5 billion on TV sports content since it wrangled some Premier League rights from Sky Sports in 2015. More sports fans are watching BT sports and downloading BP mobile apps.

A lingering Italian accounting scandal

The media is not letting the public forget the $339 million accounting scandal at BT Italia. Dozens of people were involved, including BT executives. BT Group tried to dispose of BT Italia and the scandal with it. With a new CEO, BT has an opportunity to polish its tarnished image.

Rising pension and falling telecom rates

Lower mandated broadband rates are hitting BT’s revenues. The cost of bringing its Openreach rates down to regulatory levels is about $1 billion. Pensions are another rising expense. In Q2 2019, the telecom’s pension deficit grew by $500 million.

BTStock: Current Prices and Summary

Should you buy tech stocks for the convergence play, or is the cost of content too high? In the case of BT, Tencent and Netflix, the rising price of content has hit profit margins. As BT also pays big bucks to upgrade its networks, its earnings fell 30 percent to $1.91 billion in 2017, before increasing 6 percent to $2.03 billion on a weak rebound.

Then BT lowered its dividend for the first time in a decade. A declining dividend is typically a red flag that the company is not making excess profits beyond its operating expenses. If you are a BT investor enjoying the steady dividend income, it’s a reasonable bet the increasing dividend will resume. The networks are starting to be paid off by revenues from subscribers, who will also be spending more on converged services. BT’s current price-to-earnings ratio of $10.55 is below its five-year average of $14.88 but in line with that of telecom services. The stock is in a holding pattern while awaiting the new CEO Philip Jansen to take control this month.

BT price quote

| Price | $ 170.93 | Daily high | $ 171.44 |

| Volume | 18963658 | Low | $ 169.50 |

| Variation | 12:51 | Opening | $ 169.71 |

| + / -% | 00:30% | Day before | $ 170.42 |

Best BT Stock Brokers

|

|

|

|

|

|

|

|

|

|

| Pros: |

|

|

|

|

| Cons: |

|

|

|

|

| Spreads | • Spreads from 2 pips • Flat fee on withdrawal | •Fees are built into spread. • Spread cost : 0.35 • Unregulated broker | • Spreads from 2 pips | •Fees are built into spread. • Spread cost : 2 pips |

| Number of stocks available | 4,000 | 2,500 | 1,500 | N/A |

| Financing rate | 8.9% | 7.9% | 13.9% | N/A |

| Visit broker | |

[button href="https://www.insidebitcoins.com/visit/etoro-stocks" style="emboss" size="medium" color="#329e31" hovercolor="#81d742" target="_blank"]Visit Broker[/button] | [button href="https://www.insidebitcoins.com/visit/etoro-stocks" style="emboss" size="medium" color="#329e31" hovercolor="#81d742" target="_blank"]Visit Broker[/button] | [button href="https://www.insidebitcoins.com/visit/skilling" style="emboss" size="medium" color="#329e31" hovercolor="#81d742" target="_blank"]Visit Broker[/button] |

How to Buy BT Stocks – Tutorial

eToro

eToro has established itself as a reputable and trusted broker among traders since it launched in 2007. The leading online broker for social trading is regulated in several jurisdictions, including by the UK’s Financial Conduct Authority (FCA). Popular features include social feeds, research and One Click Trading. If you are deciding whether to buy BTshares on eToro, review these pros and cons.

Pros

- Fast account opening process

- CopyTrader™ platform

- CopyPortfolios™ across an investment theme

- One-click trade execution

- Low fees

- Low minimum deposit (200 euros)

- Range of payment methods

- User-friendly interface

- Full BCH trading

Cons

- Withdrawals can be slow

- Mostly CFDs

How to Buy BT Stocks on eToro

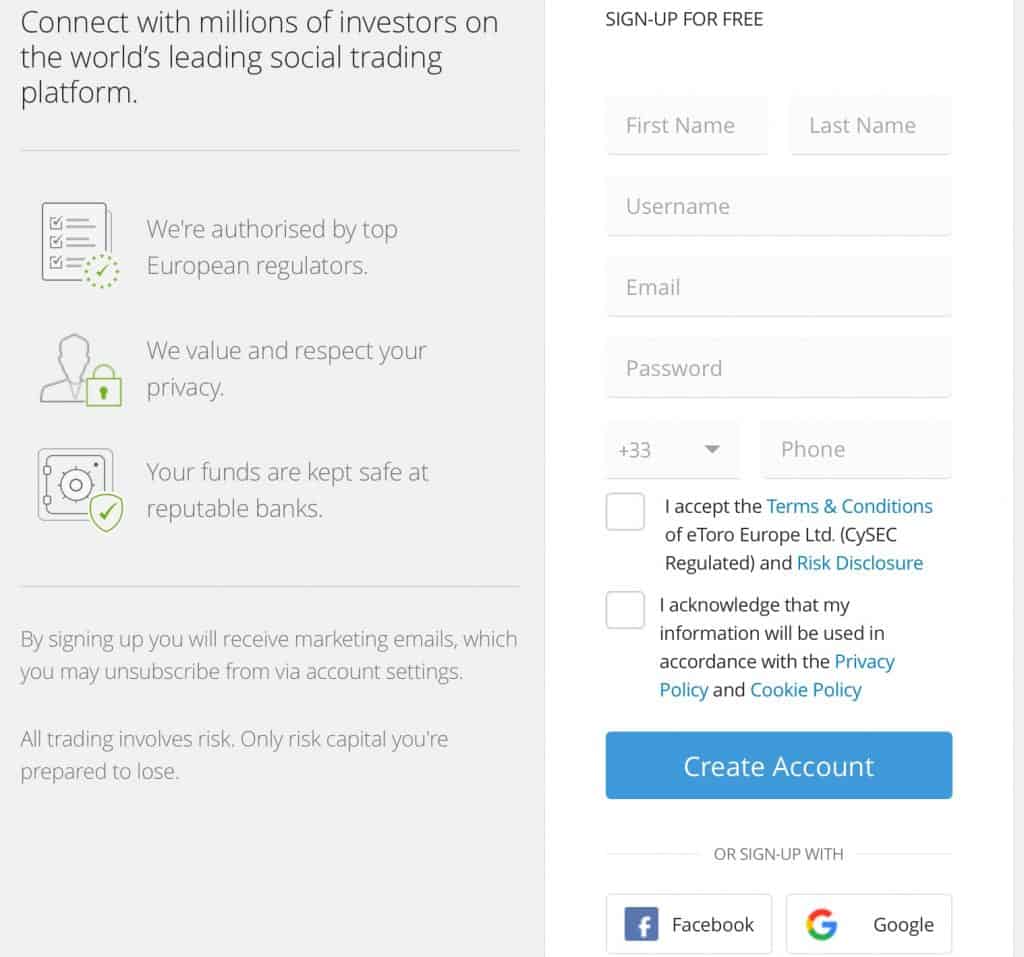

Step 1: Register your account

First, start by opening your eToro account here. Fill out your basic profile information. To determine your investor risk profile, you will be asked to answer a few short questions about your investment experience, knowledge and style, as well as your risk-return tolerance.

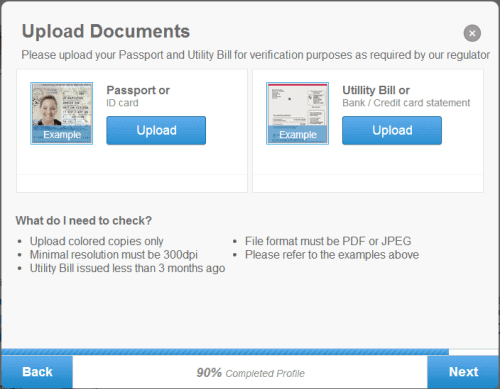

Step 2: Verify your identity

Attach and submit proof of identity for verification. US-based accounts are not accepted.

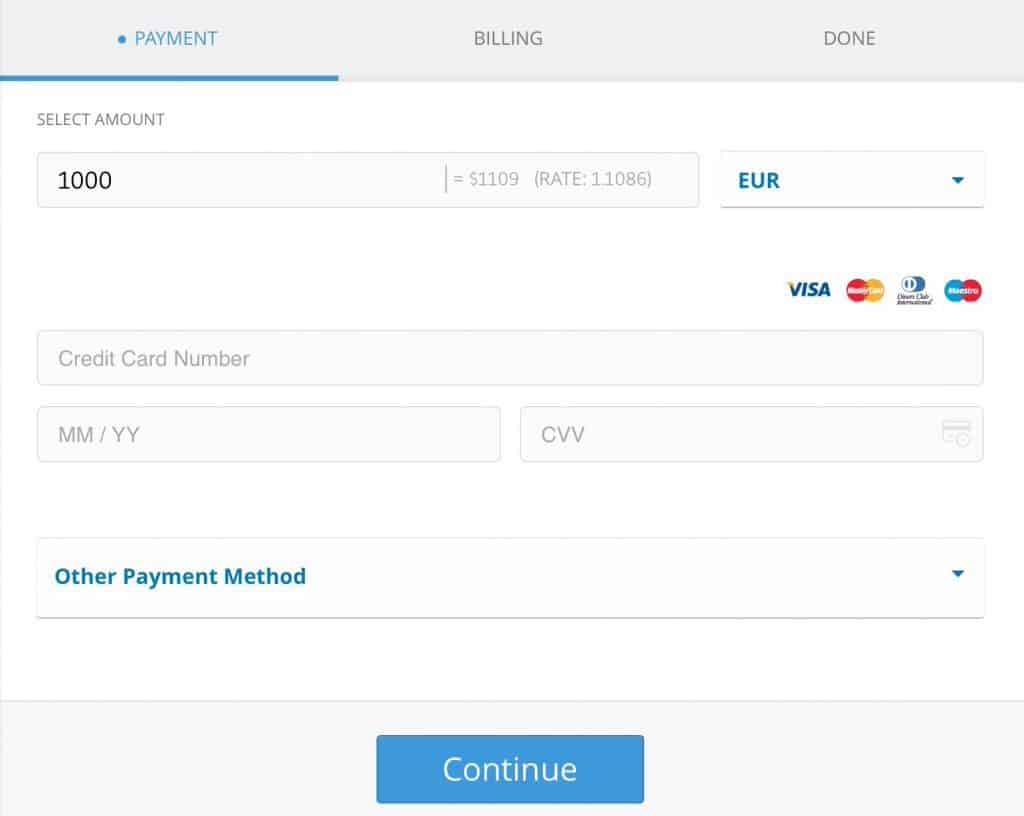

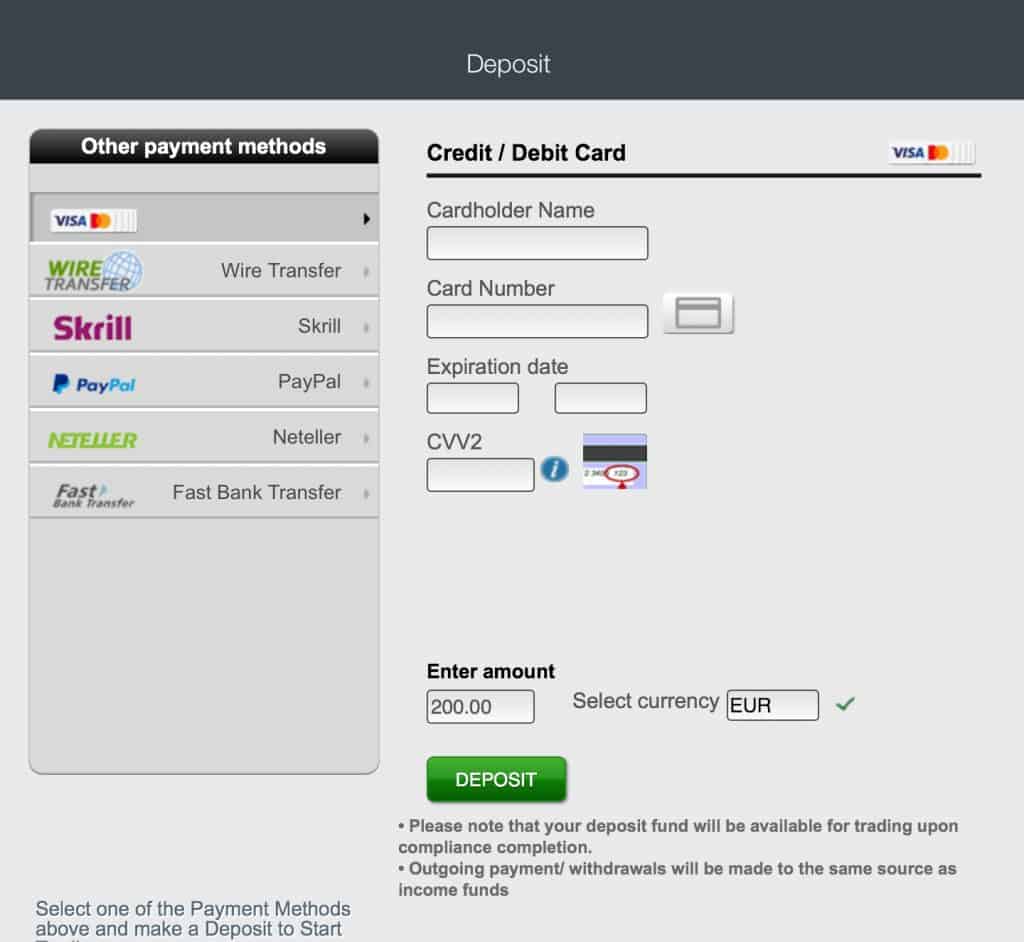

Step 3: Fund your account

eToro provides a wide variety of payment methods. Check our eToro review to see if your preferred method is available in your country.

Step 4: Trade BT stock

On eToro, you can invest in BT through traditional securities trading and social investing. To help you find the best investments for your risk profile, eToro assigns the portfolio of every trader a risk score based on the volatility – average daily price movement – of the instruments invested in on a scale of 1–6, 6 representing the highest risk. Here are three ways to invest in BT shares on the leading social trading platform.

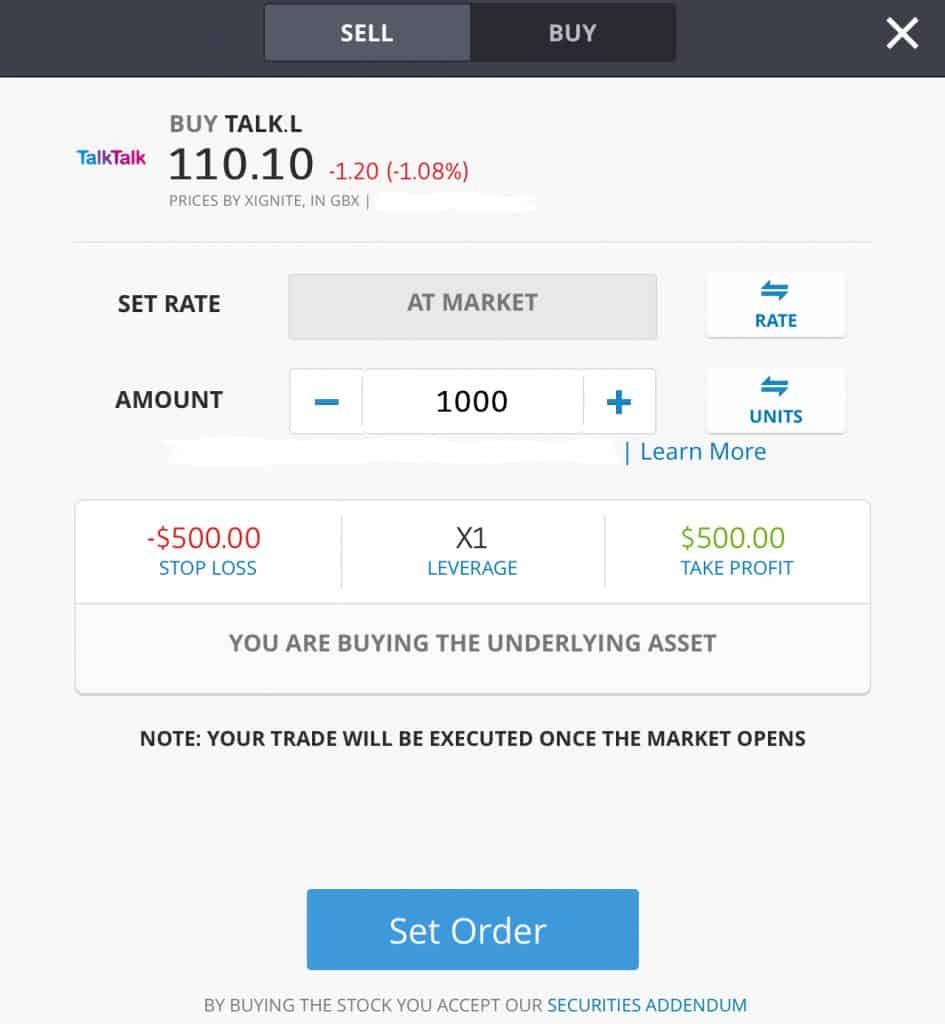

Step 4A: Place a BT stock trade

This sample screen shot is the stock profile for BT competitor TalkTalk. Click on Trade. Select Market (current price) or other price level you want to enter the market at. Enter the amount you want to trade and leverage (X1, X2, X5). Your Stop Loss and Take Profit levels are preset by you. You can also set up a One Click Trade option and preset the above parameters. (The stock profile page provides social feeds, stats, charts and research. Social feeds often provide helpful technical analysis tips and updates on how a stock is trading relative to various benchmarks.)

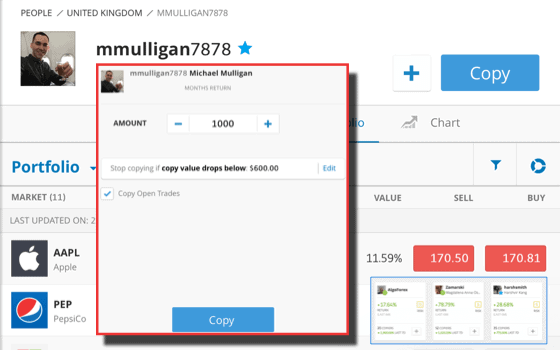

Step 4B: Place a CopyTrader™ trade

Choose from the selection of copy traders by reviewing their risk score, trading performance stats, charts, and portfolio. Also check out the traders on the Editor’s Choice List. Copying a portfolio that holds BT is a way to buy BT stock while diversifying risk. Click Copy. From the copy trade box, choose the amount you want to trade and the copy trade stop limit. Press Copy.

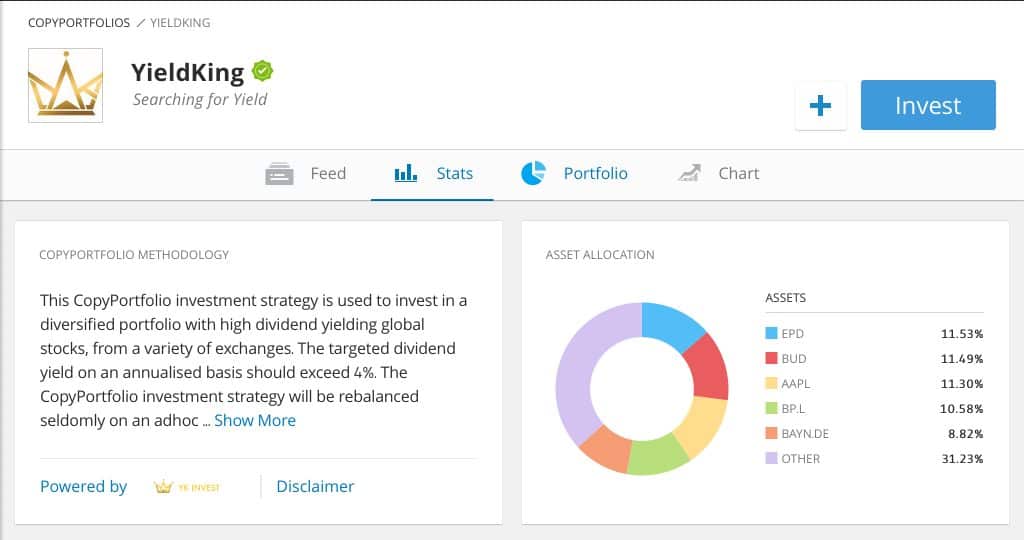

Step 4C: Place a CopyPortfolios™ trade

Choose a portfolio among dozens of investment themes. CopyPortfolios™ copies multiple portfolios and traders following that theme. This sample portfolio YieldKing consists of stocks that like BT pay high yielding dividends.

Review the risk profile and portfolio performance. Click on Invest. From the Invest box, choose the amount you want to invest and the stop investing limit. That’s it! To open your eToro click here.

66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Markets.com

The official online broker of the Arsenal Football Club provides all the basic tools and education a retail trader requires. markets.com is owned by Playtech, a public company listed on the London Stock Exchange. Like its PlaytechOne one wallet – the one account solution for playing on casino, poker, sports and other gaming sites – markets.com seeks to provide quick and easy access to a good range of investment products. If you are deciding whether to buy BT shares on markets.com, review these pros and cons.

Pros

- Day traders

- Demo account

- Low commissions

- Good quality news flow

- Good set of analytical tools

Cons

- Limited order types

- Not many deposit options

- Customer service not very effective

- Unregulated broker

Step 1: Register your account

You will be prompted to download the markets.com mobile app to register. After filling in basic profile information, a brief questionnaire on investment experience and knowledge, as well as income and assets, will determine your trading level and leverage. 1:30 is the leverage for the average retail investor. So with a $500 deposit, you can trade up to $15,000.

Step 2: Fund your account

If depositing by credit card, you will need to first have it verified. Click on Verify Credit Card on the My Account Page.

Step 3: Verify your identity

Attach and submit proof of identity and a utility bill for verification. Residents of the USA, Canada, Australia, Hong Kong, Japan and some other countries are restricted.

Step 4: Trade BT stock

On Markets.com, you can choose to invest in BT stock, or a wide range of ETFs and indexes. Other securities include forex, cryptocurrencies (a handful of majors), bonds, blends, and grey markets in Uber and Lyft ahead of their IPOs. Trending Now displays a list of top moving stocks.

The BT stock profile provides basic stock price charting information and a market sentiment indicator. Place the trade by choosing the Buy or Sell button.

Plus500

Novice retail traders may find this platform lacks the trading interface, research tools and education they depend on for general guidance. The experienced trader with their own tools, stock data and news will be at home with the simple, intuitive interface and over 100 technical indicators. Traders who qualify for a professional account (with a minimum portfolio value of €500k) can raise their leverage levels, for example, from 1:5 to 1:20 on stock trades. If you are deciding whether to trade CFDs on BT shares on Plus500, review these pros and cons.

Pros

- FCA regulated

- Listed on the LSE

- Easy to use platform

- Great mobile platform

- High order volume

Cons

- Experienced traders only (no fundamental data)

- Only CFD trading

- High financing rates

- No scalping allowed

How to Trade CFDs on BT Stocks on Plus500

Step 1: Register your account

You will be prompted to download the Plus500.com mobile app to register. Select between a Demo and Real Money account. After filling in basic personal information, you will gain access to the unlimited demo account. Before you can use it, you will be prompted to answer a few questions to establish your investor risk profile.

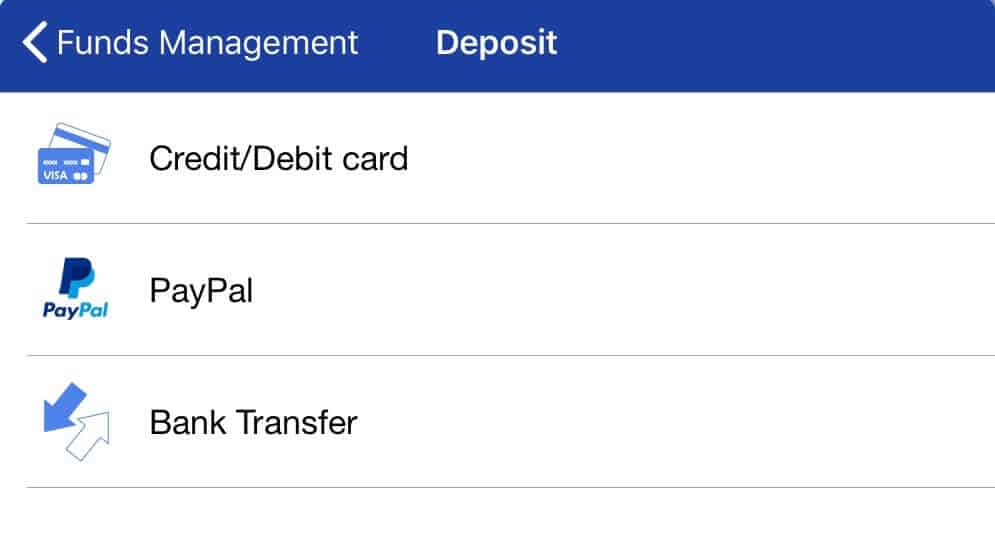

Step 2: Fund your account

When you are ready to trade with real money, fund your account. Three payment options are provided. You may be asked to verify your payment method.

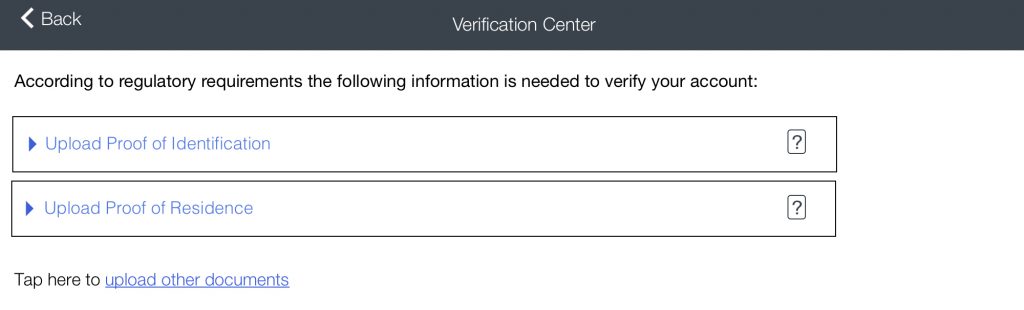

Step 3: Verify your identity

Attach and submit proof of identity for verification.

Step 4: Trade CFDs on BT stocks

Plus500 offers a wide variety of CFDs on investment instruments, including stocks, ETFs, indexes, forex and cryptocurrencies. For the advanced investor, options trading is also available on many stocks. Query BT and the price quotes for the stock appear on the screen.

All stock information and the Buy/Sell commands are displayed on the general stock page for the serious trader who wants to execute quickly. The bottom half of the page displays the price chart and provides access to a broad selection of technical analysis indicators.

80.5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the risk of losing money.

A Brief Overview of the History of BT

Since BT built the first nationwide communications network, the company has been focused on building faster networks to provide higher value communications services. So it is not surprising that BT is one of the first to market with high speed mobile 5G services in 2019. In fixed networks, BT is wooing businesses with the first “unhackable” quantum-secured high-speed fibre network. The former telecoms monopoly has remained competitive since the government privatized BT in 1984. Now called BT Telecommunications plc (LSE: BT.A), the telecom has a 37 percent fixed broadband market share.

In 2005, BT acquired Infonet and formed BT Infonet to provide globally managed voice and data services for corporate customers. In 2009, BT announced Openreach would bring fibre to the home (FTTH). By 2013, 86 percent of UK residences had broadband service up to 10 mps. In 2016, BT acquired mobile network EE, bringing its 30 mps network to 60–90 mps capacity. Deutsche Telecom received a 12 percent stake in BT in the deal. Going forward, BT is focused on developing converged services across its mobile and broadband networks.

BT Shares: Forecast 2019–2023

Simultaneously building out high speed fixed and 5G mobile networks is a mammoth task, even for one of the world’s largest telecoms. The financial strain has forced the company to slim down its many large subsidiaries. The more agile BT is converging ultrafast mobile and fixed services to provide consumers and enterprises the best value in digital communications. If you want to invest in BT shares, here is how convergence could boost BT’s stock performance over the next five years.

2019 – On ramp to high speed networks and profitability

BT’s 5G mobile network will be operating this year. Other ways to invest in 5G is to invest in Samsung stock, which has a 5G phone ready for South Korea’s 5G network, or Verizon in the US. Most other countries are lagging on 5G. BT plans to compete by providing differentiated converged services across mobile and BT Plus fast broadband. A record 13,000 customers are signing up for broadband weekly. The median BT stock price forecast is 18, with a low of 13 and high of 24.

2020 – High speed network growth

5G phones will start flying off of the shelves. It could be a bad time to buy Apple stock. But the last mile of 5G ultra fast broadband to the home will be costly. Revenues and earnings are forecast to slide slightly in 2020, but this forecast could change drastically. New CEO Philip Janssen will present his strategy mid-year. Low-to-median growth is forecasted for BT stock.

2021 – Convergence plays

With high speed networks operating on full throttle, convergence will add value with differentiated services across devices. One smart number will enable call receiving on any device, watches to iPads.

Low-to-median growth is forecasted for BT stock.

2022 – Global enterprise market

In the corporate and government markets, BT has teamed up with Cisco to add BT Connect, and Microsoft Azure and Google on the cloud. Though voice lines continue to fall at about 10 percent annually, IP voice is growing at 40 percent plus. The business transformation has the power to improve earnings and offset regulatory rate increases. Median-to-high growth is forecasted for BT stock.

2023 – The last mile

By 2025, BT plans on having 10 million fibre to the premises (FTTP) installations, a 27 percent annual increase over five years. Behind the scenes of the convergence strategy, BT continues with an aggressive cost cutting program. Median-to-high growth is forecasted for BT stock.

Conclusion

Although BT has not been the darling of the FTSE 100 in recent years, convergence of our digital home and work lives across BT’s highly rated mobile and broadband networks could be a reason to invest in BT shares again.

When you are ready to buy stocks, we recommend doing so via a regulated online broker such as eToro if you’re a UK customer, this will allow you to buy Amazon stocks, as well as a number of other stocks.

FAQs

BT listed on the London Stock Exchange as BT in 1984. Half the company was sold to the public in the government privatization in 1984. The rest of the government shares were sold in 1991 and 1993 (Wikipedia).

Yes, BT had paid a consistent and increasing dividend since 2008. Though the current semi-annual dividend is USD 4.62, a slight decline from the 2018 dividend of 4.85. The 2018 dividend yield was 6.8.

Yes, the BT Investment Plan administered by Equiniti Financial Services automatically reinvests dividends in BT stock.

A direct stock purchase plan (DSPP) was not found for BT.

In 2015, BT did its only 2-for-1 stock split. If you had owned 100 BT shares before the stock split, you would have had 200 BT shares post-split. Over the last 10 years, on a split-adjusted basis, BT’s return was about 15% with dividends reinvested.

You can buy BT stock from online stockbrokers. eToro and Plus500 are examples of online broker platforms where traders buy and sell BT stock. After signing up online, type in the BT ticker, place your order and you will become an owner of BT shares. When did BT go public?

Does BT pay a dividend?

Does BT have a dividend reinvestment plan?

Can I buy BT stock directly from BT?

How much has BT’s stock value increased since its 2-for-1 stock split in 2015?

Where and how can I buy BT stock?