Uber – the world’s favorite ride hailing service and second favorite food delivery service – has become synonymous with the sharing economy. Since its launch in 2012, rapid expansion across new mobility services has proven expensive, but Uber says costs will peak this year. As the company expands into food delivery, electric scooters, e-bikes, and self-driving cars, so too are its competitors. Despite fierce rivalry for drivers and passengers, Uber’s brand identity among on-the-go urbanites is proving hard to unseat.

If you want to invest in the the market leader in the fast growing global mobility market, this guide will explain how to buy Uber stock, evaluate the best Uber stockbrokers, and assess how its expansion into new mobility services will affect the stock value.

On this Page:

Best U.S. Platform to Buy Uber Stocks

We’ve scoured the web to find the best stock broker in the U.S. for investing in UBER and found Stash to the broker to offer the best platform, lowest fees and most appealing bonus. Click the link below and get started with just $5 today.

Best Platform Outside the U.S. to Buy UBER Shares

When it comes to investors outside the U.S., eToro is undeniably the best platform for investing in UBER. Trade stocks, ETFs, CFDs and cryptocurrencies with 0% commissions and competitive spreads. Or, copy the trades and portfolios of top performing traders in one click on the leading global social trading platform. Click the link below to start trading with this trusted, regulated broker.

How to buy Uber stocks in the U.S.

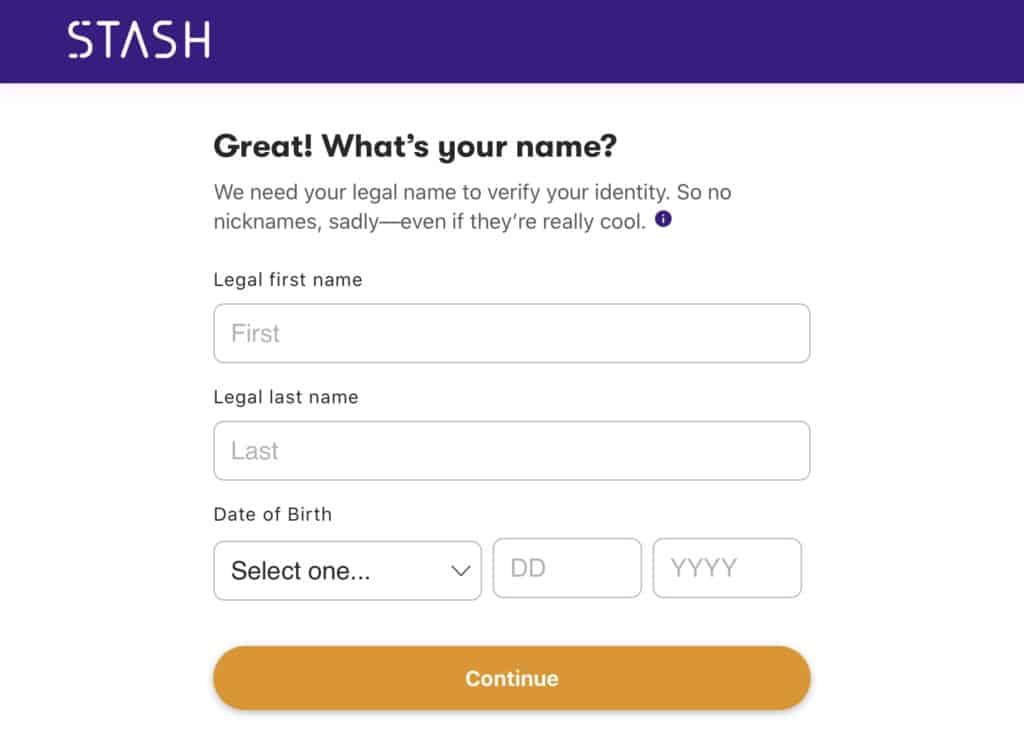

Step 1: Register your account

The first step to invest in UBER in the U.S. is to sign up to our recommended broker Stash. Firstly, click on this link and register your account. Fill in basic personal information and the investor profile. For ID verification, you will only be asked for your social security number.

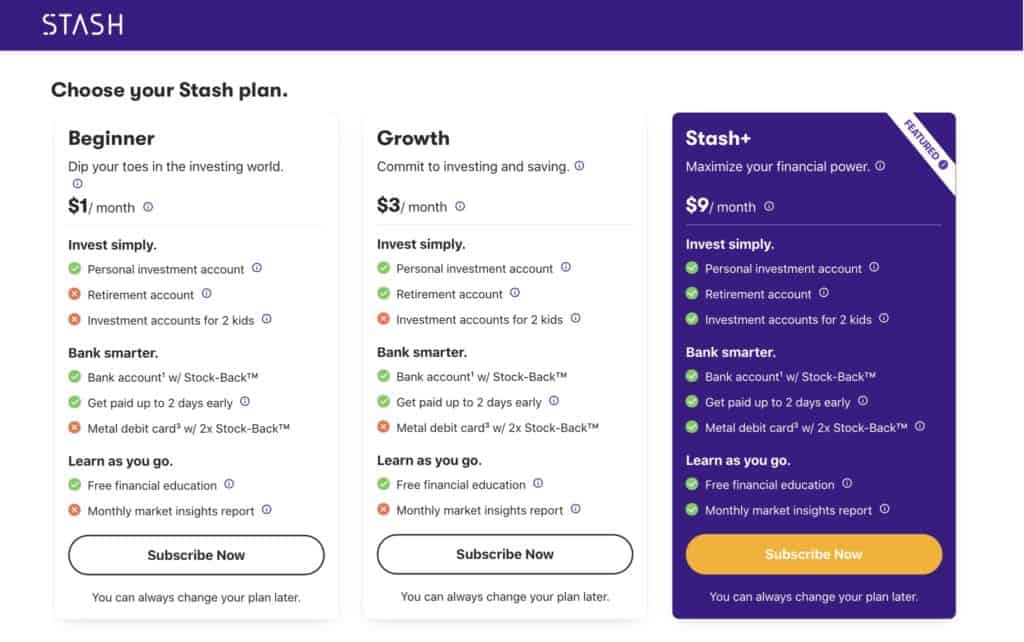

Step 2: Choose a Stash plan

Choose between a Beginner ($1/month), Growth ($3/month), or Stash+ ($9/month) account. All three offer a personal investment account and bank account with Stock-Back™️ rewards and a 2-day early payday. Choose the Growth account to add a Retirement account. Stash+ adds investment accounts for two kids and a debit card with 2x Stock-Back™️. Pay for your monthly subscription via your bank account or debit/credit card.

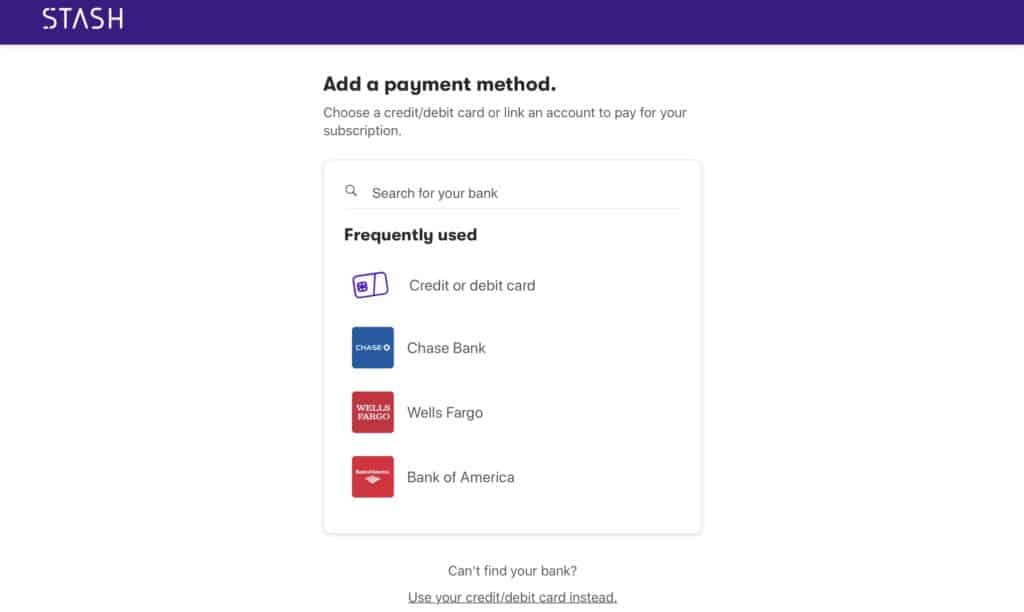

Step 3: Fund your account

Link your bank account and fund your account by wire transfer. Receive $50 to invest when you deposit $300 within 30 days. Optionally, add the Smart-Save feature, which monitors your income and savings patterns and suggests how much to allocate to savings.

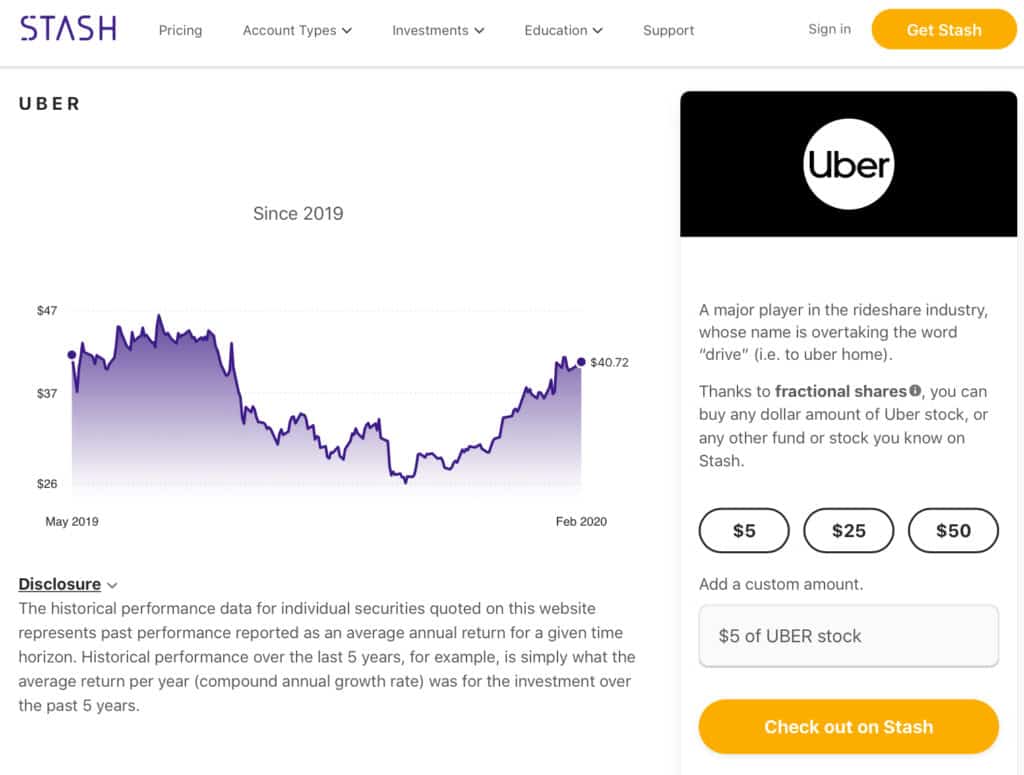

Step 4: Trade Uber stock

Type the UBER ticker in the Search box. Enter the fractional share amount you want to invest: $5, $25, $50, or a custom amount. Press Check Out on Stash to pay for the stock trade from your Stash account.

80.6% of retail CFD accounts lose money

How to buy Uber shares outside the U.S.

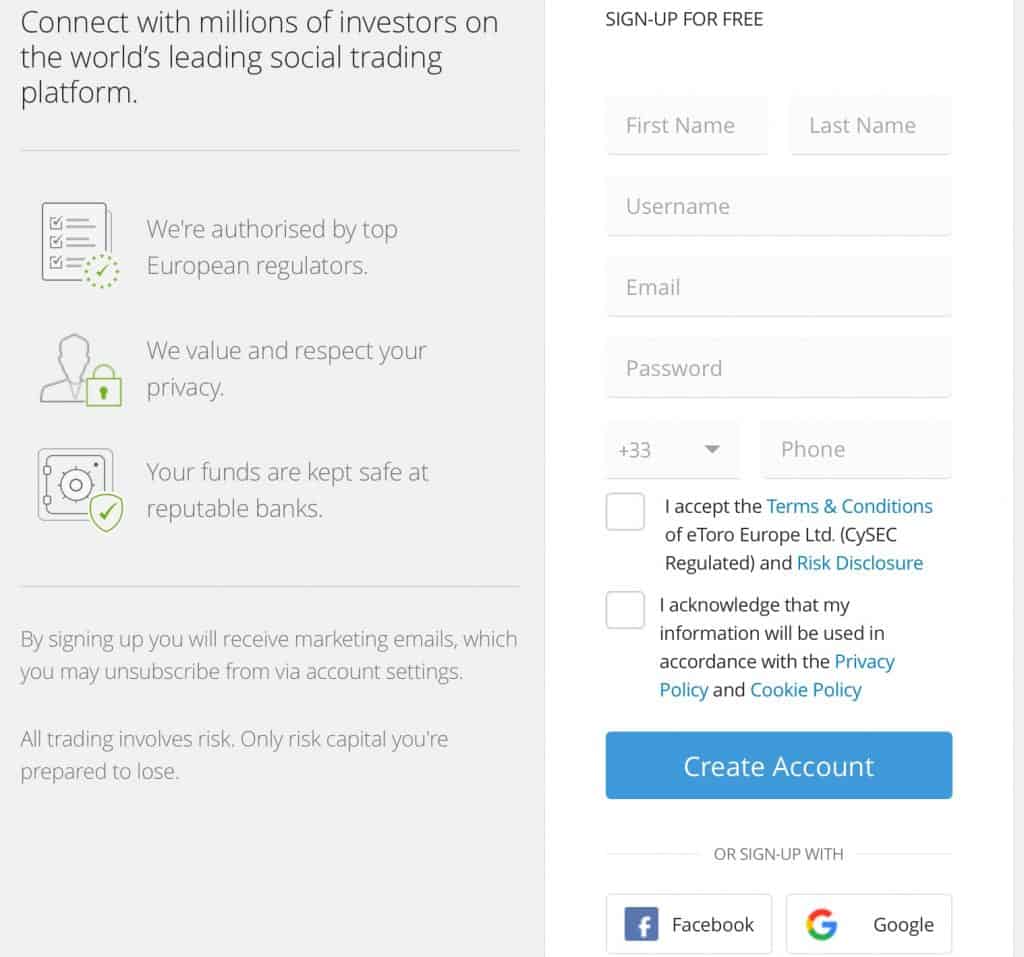

Step 1: Register your account with eToro

The first step to invest in UBER is to sign up to our recommended broker eToro. Firstly, click on this link and register your account. Fill in basic personal information and the investor profile.

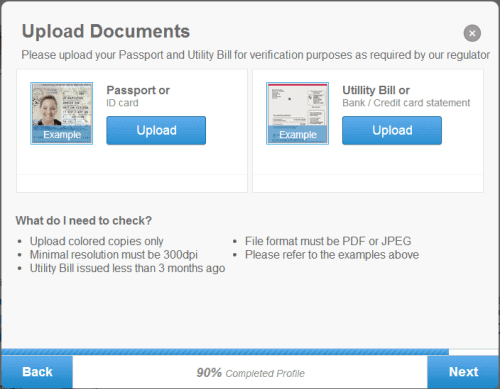

Step 2: Verify your identity

Attach and submit proof of identity for verification.

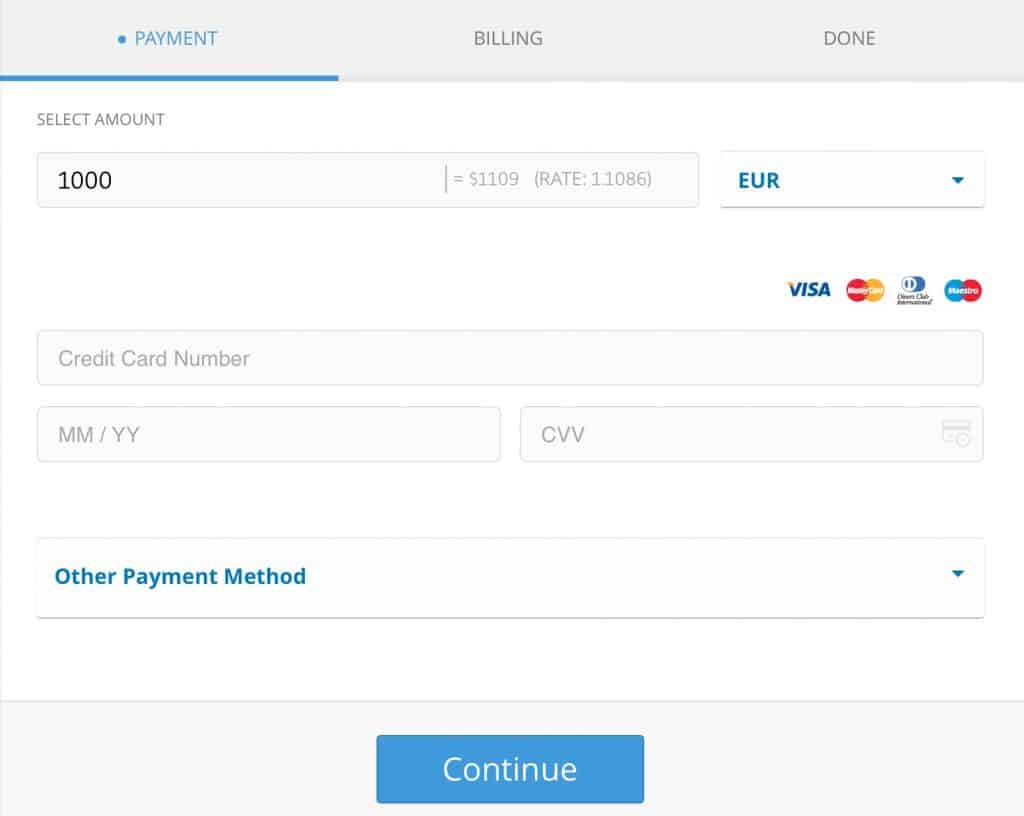

Step 3: Fund your account

eToro provides a wide variety of payment methods. Check to see if your preferred method is available in your country.

Step 4: Trade Uber stock

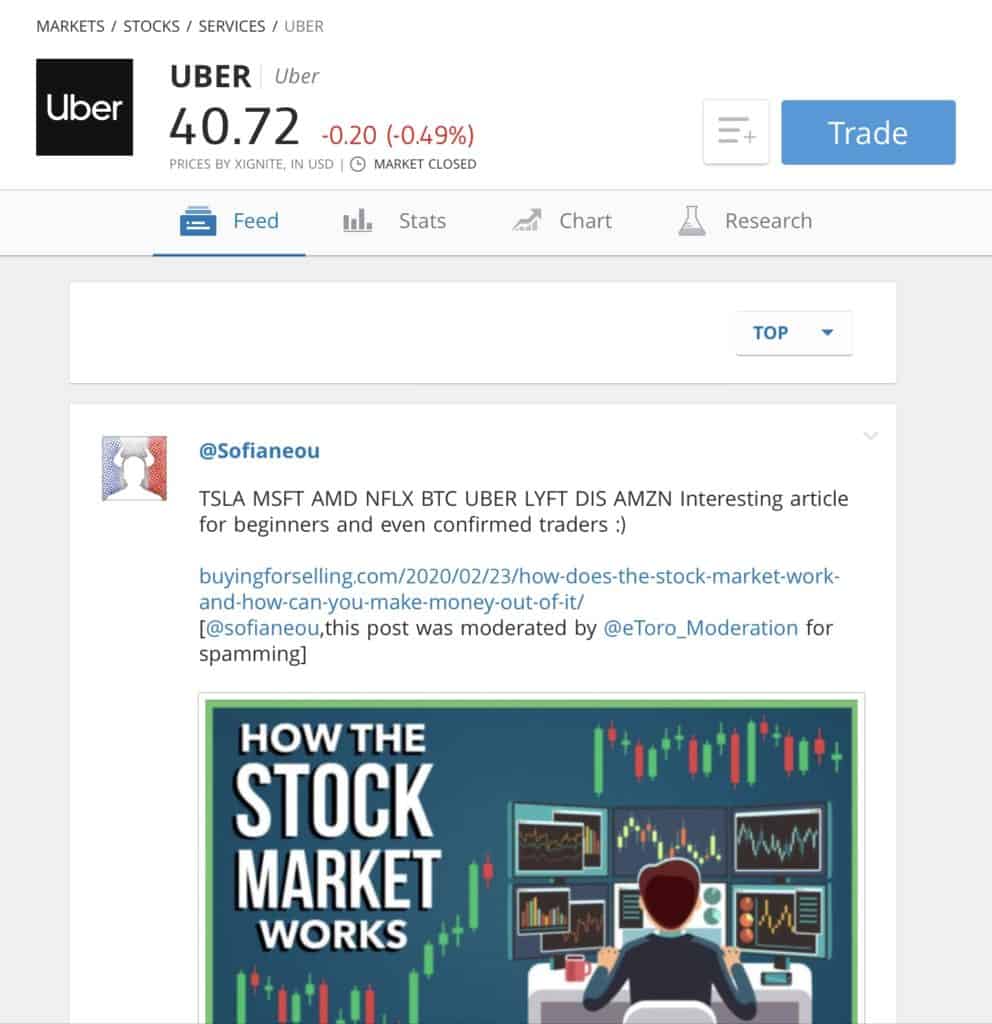

On eToro, you can invest in Uber through direct trading or social investing. Social investors can choose portfolios to copy based on a risk score assigned to every trader portfolio on a scale of 1–6, 6 representing the highest risk. Here are three ways to invest in Uber stock on the leading social trading platform.

Step 4A: Place an Uber stock trade

To buy Stocks in Uber, click on Trade. Select the Market (current price) or other price level you want to enter the market at. Enter the amount you want to trade and leverage (X1, X2, X5). Your Stop Loss and Take Profit levels are preset by you. You can also set up a One Click Trade option and preset the above parameters. The Uber stock profile page provides social feeds, stats, charts and research. Social feeds provide helpful technical analysis tips and updates on how a stock is trading relative to its peers.

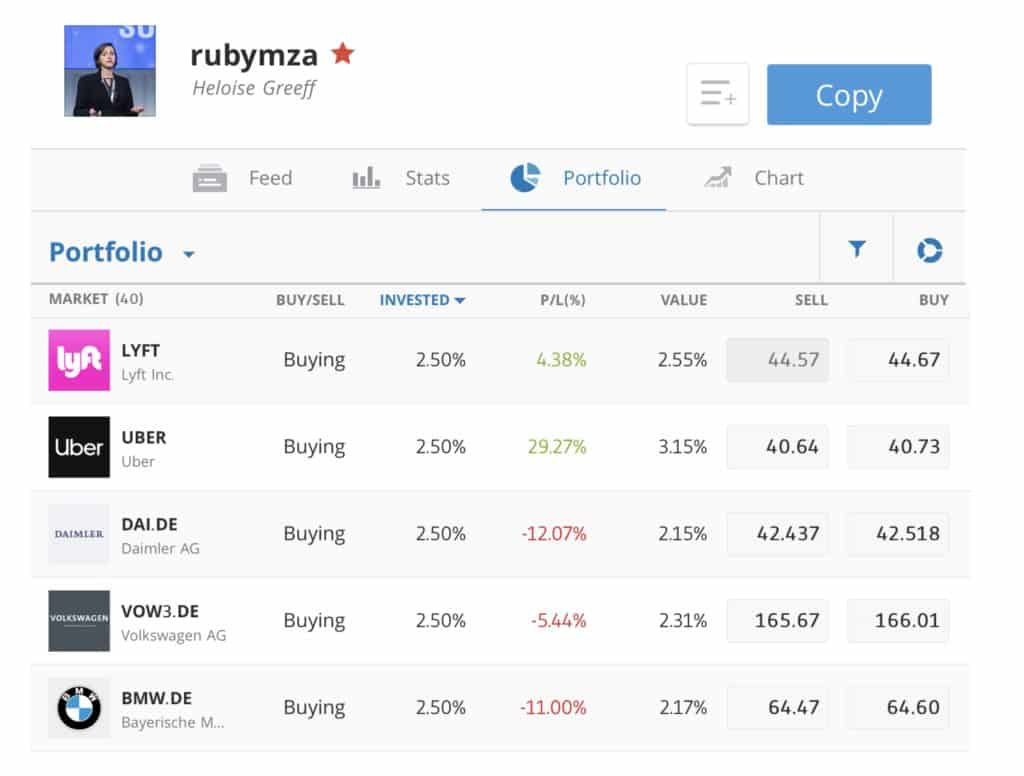

Step 4B: Place a CopyTrader™ trade

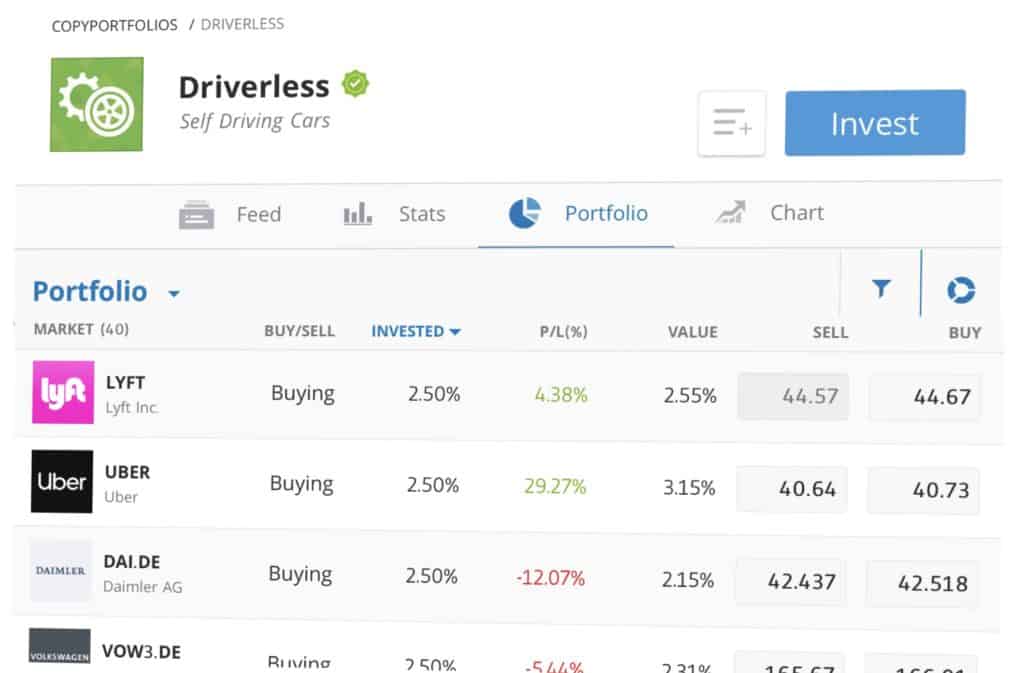

Step 4C: Place a CopyPortfolios™ trade

Choose a portfolio, among dozens of investment themes, that holds Uber stock. CopyPortfolios™ copies multiple portfolios and traders following that theme. We chose the Driverless portfolio.

Review the risk profile and portfolio performance. Click on Invest. From the Invest box, choose the amount you want to invest and the stop investing limit.

75% of retail CFD accounts lose money.

Uber Stock: Current Prices and Summary

Uber stock is trading around $40 a share, $5 below its May 2019 IPO price. The current market cap of $69.9 billion is moving closer to the $100 billion valuation it sought in its public offering. The IPO valued the company at less than one-tenth of this value at $8.1 billion. The ride hailer was punished by investors for large losses.

If Uber meets its operating profit targets in 2020, it is one of a few ride hailing stocks investors can bet on. Uber has many formidable startups as competitors with plans to go public in the next few years: Didi, Yandex, and Grab in ride hailing and DoorDash, Zomato, and Postmates in food delivery.

Here is how Uber stacks up to other public ride hailing companies on a price-to sales basis. Uber’s price-to-sales ratio is 4.94 versus 3.7 for Lyft (LYFT) – its major U.S. competitor. HyreCar (HYRE) and YayYo (YAYO), startups renting cars to ride hailing and ride sharing drivers, have a P/S ratio of 3.3 and 1.5, respectively. Although rentals to ride hailing drivers of U.S. car rental leader Hertz (HTZ) are less than one percent of its fleet, ride sharing helped boost earnings in 2019. Hertz has a P/S of $0.20.

As a more mobile generation takes Uber rides, robo-taxis, e-bikes, and helicopters, what can we expect for the stock price going forward? Analysts have a median UBER stock price forecast of $50 (high $50, low $36), a 22.8 percent premium on the current stock price.

A Brief Overview of the History of Uber

Since the launching of its mobile app in 2011, Uber has become the flagship company of the sharing economy worldwide. Uber seized on four fast-moving trends capturing the pocket books of generation X and Y – mobile app user growth, digital payments, the sharing economy, and green consumers eschewing car ownership. Over 1.9 billion urbanites in 785 cities around the globe have become active Uber customers.

Uber has rapidly dominated the global ride hailing market by knowing exactly what mobile urbanites want and the marketing tactics to reach them. Its two founders had both launched successful startups aimed at the same young aficionados of social media and sharing. Garrett Camp founded the peer-curated social media information site StumbledUpon and Travis Kalanick founded peer-to-peer file sharing service Red Swoosh.

In addition to ride hailing, Uber offers ride sharing (UberPOOL), car rentals, electric scooter and bike rentals, and is currently testing a helicopter service. In 2017, the transportation tech diversified its business by adding food delivery service Uber Eats and Uber Freight – a matching service of drivers and cargo. Uber has faced stiffer competition in international markets, causing it to exit the Indian and Korean markets and adopt a partnering strategy. In China it partners with DiDi, Russia Yandex, and Southeast Asia Grab.

Meanwhile, Uber has invested heavily in its robo-taxi business. The Advanced Technologies Group (Uber ATG) has been testing self-driving cars since 2016. Although the theft of self-driving car trade secrets from Google when it hired the former self-driving car chief of Waymo (Google’s self-driving car business), Anthony Levandowski, has proven costly. Google and Uber settled in 2018, with Google taking a 1 percent stake in Uber, valued at around $250 million at the time but more payments to Google are expected.

Uber did an initial public offering in May 2019, raising $8.1 billion.

Uber Shares Forecast 2020–2024

Although Uber is juggling several not yet profitable business lines, it plans to turn an operating profit by the end of 2020. The company expects to gain control of high costs and steadily improve earnings from the second quarter and record its first quarter of positive operating earnings in the fourth quarter. Applying conventional earnings metrics, including all expenses, analysts expect Uber to improve profitability each year and record positive earnings in 2023, with a forecasted earnings per share of $0.22 (Yahoo).

Here is how we see Uber’s expansion across the mobility market affecting its stock price going forward.

2020 – Ride hailing

The global rollout of premium services such as Uber Comfort and UB4 will continue to improve operating margins. The ridesharer announced Dial-an-Uber in February, allowing non-smartphone users to dial direct. This option could unlock access to an older generation of taxi users who are not inclined to use apps. The majority of Uber’s riders are mobile phone users under 50. If Uber meets its profitability targets in 2020, investors are sure to reward the stock of the pioneering ride hailer. The outlook for Uber stock is median-to-high.

2021 – Uber International market expansion

Uber will jostle for its market lead with competitors and partners this year. In Asia, Uber will benefit from the strong growth of its partner Didi in China – one of the world’s highest valued companies at $57.8 billion (PitchBook) and Grab in Southeast Asia. Uber has stakes in both these companies. Asia will record the highest ride hailing growth from 2019–2024 (Mordor Intelligence). Competition remains tight, though. Didi has moved into Latin America. At the end of 2019, Uber lost its license to operate in London, as Ola – the competitor that pushed it out of India – entered the UK as part of its European expansion. The outlook for Uber stock is low-to-median.

2022 – Self-driving car speed bump

Uber plans to have self-driving taxis on the road by 2022. The costs, however, are expected to rise due to more Waymo woes. Uber recently said it will need to pay a licensing agreement to Waymo or change its self-driving technology (Reuters). Either way, the costs of putting Uber’s robo-taxi service on the road – full service is targeted for 2024 – will rise. Morgan Stanley recently lowered Waymo’s valuation based on slower growth in self-driving car technology and ride-sharing profitability. By 2030, Morgan Stanley expects Uber to have 6 percent autonomous car market share, behind Tesla (buy Tesla stocks here), Waymo, and General Motors. The outlook for Uber stock is low-to-median.

2023 – Uber Eats

In 2019, Uber Eats was serving 400,000 active restaurants, a 78 percent increase over the year. Uber management says expenses will start to decline in the second quarter of this year, leading to stronger earnings momentum. In the U.S., Uber Eats is steadily stealing market share from top players DoorDash and Grubhub, and now has more than one-third market share. Globally, competition is escalating. Adopting its Rides global strategy, Uber sold to Indian market leader Zomato and took a 10 percent stake. The global online food delivery market is expected to grow at a CGAR of 7.5 percent to $164 million between 2020–2024 (Statista), versus 3.5 percent for traditional food delivery. The outlook for Uber stock is median-to-high.

2023 – Freight

The newer business, freight, launched in 2019 is a sleeper ready to disrupt the global logistics industry in the same way Uber disrupted the taxi industry. Uber has the largest virtual fleet in the U.S. and has started its global expansion. Transporters are reporting 15 percent savings when using the Uber app (Goldman Sachs). The outlook for Uber stock is median-to-high.

2024 – Strong global mobility market growth

Led by ride hailing, the global mobility market will be worth $8.5 trillion in 2030. Uber has taken a lead in key mobility growth markets. Ride hailing and sharing is a potentially $5 trillion market. By 2023, global online food delivery will be a $300 billion business and micro-mobility (e-scooters and bikes) a $200 billion market. The $3.8 trillion freight market is another sizeable opportunity for virtual brokers (all figures Goldman Sachs). The outlook for Uber stock is median-to-high.

Should you Invest in Uber?

Uber Rides, a maturing business generating 75 percent of Uber revenues, is on the road to profitability, but it is towing half a dozen mobility startups with mounting losses. The losses have fuelled a debate over whether the ride sharing company’s diversification in 2017 into Uber Eats and Uber Freight was a smart move.

Rides is boosting margins by focusing on premium services. Uber for Business (UB4) and Uber Health (UH) passengers are among those choosing the higher priced Uber COMFORT car with more leg and headroom. These premium sales have driven revenue growth over the last three quarters, which jumped 42 percent to $14.1 billion in 2019.

Losses, however, swooned to $8.5 billion in 2019. But on an operating basis, Uber is becoming profitable. In the last half of the year, Rides generated 1.4 billion in earnings – minus certain expenses. Uber Eats had $777 million in losses and the autonomous car unit $254 million. Put differently, Uber Eats comprised 65 percent and autonomous cars 21 percent of losses.

Uber has proven it can grow its ride hailing customer base and entice its 111 million platform users into also spending more money across Uber Eats, e-scooters and e-bikes, and other services. By the end of 2020, Uber expects these businesses to also improve profitability.

Pros of investing in Uber stock

Following are some of the challenges and opportunities ahead as Uber helps people change the way they get around.

Cons of investing in Uber

Conclusion

Should you buy Uber stock?

Despite the current losses, the debate over the viability of diversification across mobility services is one Uber is on course to win. Although the stock of overly diversified companies tend to underperform the market, customer-focused companies are more successful at diversifying their business. The growth in active riders and monthly usage are a testament of Uber’s ability to provide a superior customer experience, for which it has won many rewards.

If you want to buy stock in Uber, we recommend doing so via a regulated online broker such as Stash Invest if you’re a U.S customer, or eToro for investors outside the U.S.

FAQs

Uber says it will turn a profit in 2020 based on adjusted EBITDA – in other words, it will be profitable on an operating earnings basis. Adjusted EBITDA is not the standard measurement of profitability because it does not deduct finance related expenses, restructuring charges and other expenses that affect the bottom line. However, profitability on an adjusted EBITDA basis is a positive development. It means Uber is gaining control of its operating expenses. On a trailing 12-month basis, operating expenses have increased 41 percent to $22.1 billion.

Uber has significantly diversified its revenue streams since it launched UberEats in 2017. With the purchase of Latin America’s Cornershop, Uber will launch grocery delivery this year. None of these business have yet turned the corner to profitability but losses are expected to decline in 2020.

As a disruptor of the taxi business and a first mover in ride hailing, the transportation network company has faced high market and regulatory risks. In some global cities such as New York and Paris, the taxi industry initially blocked its entry. Currently, Uber is fighting efforts of regulators to treat its drivers as employees, eligible for employment benefits, rather than contractors.

Uber is still slightly cheaper than main U.S. competitor Lyft. A trip from the Los Angeles airport to the hip new Edition Hotel in West Hollywood would cost $29 with Uber and $30 with Lyft, but $60 by taxi. Luxury cars are even cheaper with Uber. The same trip in an Uber Black costs $92 versus $96 for Lyft.

You can buy Uber shares from online stockbrokers. If you are in the US, you can purchase Lyft shares through Stash Invest. Investors outside the U.S. can purchase UBER shares through eToro. Both online stockbrokers provide intuitive trading platforms that make it easy to buy stocks and sell them. After signing up online, type in the UBER ticker, place your order and you will become an owner of Uber shares. Is Uber profitable?

Is Uber’s diversification strategy profitable?

Does Uber face higher regulatory risks than its competitors?

Is the cost of a ride in the U.S. cheaper with Uber or Lyft?

Where and how can you buy Uber stock?