AstraZeneca is a British-Swedish multinational pharmaceutical and biotechnology company. The company makes products for major diseases like neuroscience, respiratory, oncology, cardiovascular, gastrointestinal, and inflammation. The AstraZeneca company is known widely as one of the world’s largest pharmaceutical companies.

Furthermore, it’s a maker of the COVID-19 vaccine. With the development of the COVID-19 vaccine, the share price of AstraZeneca has increased rapidly. Thus, it has attracted many investors as they see an opportunity to buy AstraZeneca shares. This guide includes complete and comprehensive step-by-step details to follow to help UK investors with the buying process of AstraZeneca shares online.

On this Page:

Step 1: Find the Best Brokers to Buy AstraZeneca Stocks in 2024

Registering with an online stock broker is the easiest way to buy or sell AstraZeneca shares in the UK.

However, choosing the right stockbroker is a critical decision as it will impact your investment.

To help investors find the right broker in the UK, the following are the two best stock brokers in the country, highly recommended for buying AstraZeneca shares online as they are registered with the Financial Conduct Authority (FCA).

1. eToro –Buy AstraZeneca Stocks Online without Commission

eToro is a 100% commission-free broker based in the United Kingdom. It’s one of the top brokers in the United Kingdom, with more than 800 stocks on offer from around the globe. It was first launched in 2007, and since then, it has expanded its business throughout the UK. With more than 13 million active traders, eToro is a well-known stockbroker in the UK.

eToro offers the shares of companies listed in the London, New York, and Tokyo Stock Exchanges. Furthermore, it does not charge any commission fees to its investors. eToro is licensed by the FCA, ASIC, and CySEC and is partnered with the FSCS. This platform provides a traditional way of buying shares and offers CFDs that provide leveraged trading with low margin requirements.

It means investors do not only enjoy the benefits of commission-free trading, but they can also avoid monthly/annual charges by choosing eToro. The broker provides trading through 17 different stock exchanges with more than 1700 equities, including NASDAQ, which can enable the online buying of Moderna shares in the UK.

Apart from buying with the traditional method, eToro also offers investors the opportunity to trade shares through CFDs. It allows them to leverage up to 5:1. This means investors can trade with volume up to 5 times greater than the actual amount of the account by availing of this method.

Initial Deposit

The minimum investment of $50 means that investors can enjoy the leverage trading facility. In simple words, investors have a chance to own a fraction of a share if they want, and they can also buy shares worth more than the amount deposited through CFD.

Copy trading is also a feature provided by eToro to its customers, which can help beginner traders mirror an experienced investor’s portfolio.

Various Payment Methods

Traders can use various payment methods through credit/debit cards, bank transfers, or e-wallets like PayPal, Skrill, VISA, or Neteller. Another exciting service offered by eToro is that investors can also buy and sell a fraction of stocks. For all newbies, it means traders can buy a fraction of stocks and have no need to buy a single share of a company with their share trading account eToro.

Regulation

eToro is regulated in the United Kingdom (UK) and worldwide, holding licenses from the ASIC, FCA, and CySEC. In addition to this, eToro is a member of the Financial Services Compensation Scheme (FSCS) that protects the first £85,000 of investors’ funds in case of the broker’s bankruptcy.

Buying and selling on eToro can be done online as well as on mobile devices through their application. The opening process of an eToro account is straightforward and takes about a couple of minutes. The payment can be deposited in various ways, including debit/credit cards, e-wallet, bank transfer, and Paypal.

Built-in Social Trading Network

Investors can also generate new trading ideas on a built-in social trading network provided by eToro. The platform also enables investors to have conversations with other investors as well. Traders can also enjoy the copy trading feature that will automatically mimic the trading positions of more experienced traders. This feature is essential, especially for less experienced and new traders.

Pros & Cons of the eToro platform:

- eToro offers copy & social trading.

- ASIC, FCA, and CySEC regulated.

- Offers to buy CFDs along with the shares.

- Commissionless shares trading.

- User-friendly GUI (graphical user interface) stockbroker.

- Renowned mobile trading app.

- eToro accepts Skrill, VISA, Neteller, and PayPal.

- Performing advanced technical analysis can be challenging for pro-traders.

- Some account fees

67% of retail CFD accounts lose money when trading with this provider.

2. Webull – Buy AstraZeneca Stocks Online with Low Fees Platform

The best way to maximize your position in AstraZeneca or another UK share is to have an account with the Webull stockbroker. For a margin account with at least $2000 in net account value, Webull offers up to 4 times day-trade buying power and 2 times overnight buying power.

Thus, traders can take a large position in the market and buy shares of a company with relatively little money in their accounts.

This broker offers share trading for more than 500 companies, mostly based in the United Kingdom and the United States. Just like eToro, Webull also has a 100% commission- fee for share trading. The broker does have some account fees and charges very little in spread fees. However, it is considered one of the most cost-effective stockbrokers in the United Kingdom.

The broker provides clients with one of the most popular and user-friendly stock-trading platforms with various unique features. These features include price alerts, risk management tools, an economic calendar, and, most importantly, a built-in charting package.

The risk management is provided with the feature of a stop-loss order that, if added to the trade, protects the investor from maximum loss and manages their risk.

Technical charts are very beneficial for newbie traders, and investors can also access about 100 different technical studies. However, the more customized features are restricted to more experienced traders. The Webull also offers a stock trading app for mobile phones to make trading easier for investors.

Webull is registered with the Securities and Exchange Commission (SEC). It is also a member of the Financial Industry Regulatory Authority (FINRA), Securities Investor Protection Corporation (SIPC), The New York Stock Exchange (NYSE), NASDAQ and Cboe EDGX Exchange, Inc (CBOE EDGX).

Initial Deposit –Webull requires zero minimum deposit, but there is a $2,000 minimum requirement for margin accounts.

Payment Methods – Traders can use a debit card, credit card, PayPal, Skrill, or a UK bank account as a payment method.

Regulation – Like eToro, the SEC regulates the broker. Therefore, one must not have any concerns related to the safety of his funds and regulations.

Pros & Cons of the Webull platform:

- A user-friendly platform for share trading.

- 100% Commissionless share trading

- A great mobile trading app.

- It offers a demo account feature.

- Highly competitive spread fees.

- The Securities and Exchange commission (SEC) regulates it.

- Charts are limited, which isn’t appropriate for advanced stock traders.

72% of retail CFD accounts lose money when trading with this provider.

Step 2: Research about AstraZeneca Shares

AstraZeneca is a well-known pharmaceutical company. Since it has created a successful vaccine for COVID-19, its popularity has spread throughout the world. It is now prompting many investors to buy shares of AstraZeneca, especially UK investors.

To help them with the process, detailed research about the company and its share price is explained in this update. It will help investors decide whether AstraZeneca shares are appealing enough to invest in by giving a background check. Moreover, it will provide hints about the prospects of the company.

A History of AstraZeneca Stock Prices:

AstraZeneca was founded in 1999 through the merger of two companies, Swedish Astra AB and the British Zeneca Group. Before the merger, Astra AB was a Swiss drug manufacturer, and Zeneca was the pharmaceutical division of the UK agrochemical manufacturer ICI. However, it demerged from its parent company in 1993 and merged with Astra AB in 1999. The merger was aimed at improving the combined companies’ ability to deliver long-term growth. The headquarter of AstraZeneca is located in London, United Kingdom, while the R&D headquarters are situated in Sweden, the UK, and the USA.

Since the merger, AstraZeneca has been among the world’s top pharmaceutical companies, and it has also made many acquisitions, including Cambridge Antibody Technology, MedImmune, Spirogen, and Definiens. Furthermore, the company has also spent a lot of money on research and development to create treatments for cancer, infections, respiratory illness, cardiovascular disease, and gastrointestinal problems.

A Brief History of AstraZeneca’s Share Price:

The shares of AstraZeneca are primarily listed on the London Stock Exchange and are also a constituent of the FTSE 100 Index. The secondary listing of AstraZeneca shares is on Nasdaq OMX Stockholm, Nasdaq New York, the Bombay Stock Exchange, and the National Stock Exchange of India. The market capitalization of AstraZeneca is about $182.27 billion, and it is considered the 68th most valuable company by market cap in the world.

The history of the share price of AstraZeneca shows that the price has shown substantial growth over the past 2 decades. When in 2004, the company was listed for the first time on the London Stock Exchange, the shares were sold for about 2500 pence. However, the share price has reached about 8500 pence.

AstraZeneca share price chart on eToro

In July 2020, the share price hit an all-time high above 10,000 pence, given the increased popularity of AstraZeneca for its development of the coronavirus vaccine. In late April 2020, the company announced a partnership with Oxford University to develop a vaccine candidate against the deadly coronavirus. By July, the vaccine moved into phase-2 and phase-3 trials. It lifted its price to an all-time high above 10,000 pence. In January 2021, the company received approval for its coronavirus vaccine from the European regulators.

The share price of AstraZeneca faced pressure during the early months of 2021, as the EU regulators paused the distribution of the vaccine amid fears of blood clots. However, in March, EU regulators approved the vaccine for distribution after finding no connection between the vaccine and clots.

Meanwhile, the company faced some pressure due to supply shortages and a limited number of manufactured doses. Thus, it drove a bearish correction in the prices of AstraZeneca shares throughout that period. As a result, the share price fell from 10,000 pence back to 7000 pence.

Nevertheless, the company’s share price started gathering strength in March 202. Ever since, it has been rising on the back of increased demand for its vaccine candidate. The accelerated rollout of vaccination has raised the demand for vaccine shots throughout the world. The increased demand means increased sales of vaccines and increased profit, which ultimately pushed the price of AstraZeneca shares higher. The share price has currently reached 8,500 pence.

AstraZeneca (LON: AZN) Shares’ Dividend Information:

The dividend policy of AstraZeneca is very progressive and a favorite among UK dividend investors. The blue-chip stock usually pays out a handsome dividend of 218 pence, equal to a yield of around 2.8%. Though the dividend percentage is not among the list of companies paying higher dividends in the UK, it is relatively high considering the share price appreciation of AstraZeneca.

During the time of the coronavirus pandemic, many companies around the world have reduced their dividend payments. However, AstraZeneca is among the few companies that have pushed forward their dividend percentage during the coronavirus pandemic. It means that investors looking for some dividends can find the shares of AstraZeneca quite attractive for purchase.

Should I Buy AstraZeneca Stocks Online?

There are many good reasons to be positive about buying the shares of AstraZeneca. One of the most important ones is the successful development of an approved COVID-19 vaccine. Apart from vaccine development, the company has also shown substantial growth in its price for over 2 decades, given its solid performance.

Some of the facts about the company are mentioned below to make a better decision about whether to buy AstraZeneca shares or not.

-

COVID-19 Vaccine:

Recently, the main driver of the share price of AstraZeneca has been the production, rollout, and sale of its coronavirus vaccine. The company is struggling to receive approval from the U.S. even though the country has stockpiled millions of vaccine doses. The vaccine is being mistreated after the rumors about blood clots despite receiving approval from the EU regulators.

The share price of AstraZeneca has declined by nearly 15% from its all-time high level. However, there is no need to be pessimistic as much of the optimism is still there for the company, driving the share price higher these days.

The demand for coronavirus vaccines is global, and countries worldwide are seeing an increased demand for vaccine jabs as the vaccination rollout has started in almost every country of the world. AstraZeneca offered its vaccine at a cheaper cost as compared to other brands creating COVID-19 vaccine jabs. The main reason behind a low price of $5 per vaccine was making it available to developing nations. The company has ramped up its production of vaccines so that it could become the leading shot in countries in Africa, South America, and South Asia.

AstraZeneca has reported about $1.2 billion in sales of vaccine jabs in the first half of 2021. The company has announced that it generated about $894 million during the 2nd quarter of 2021, followed by $275 million during Q1 of 2021. The company has pledged to provide the vaccine created with the collaboration of Oxford University on a not-for-profit basis to developing nations during the pandemic.

The sales figures are improving with time and are expected to grow further during the second half of 2021. By looking at the figures, it can be assumed that AstraZeneca’s share price could move upward with the increased sale of its COVID-19 vaccine in the coming months.

-

Increased Cancer Treatments

Despite the recent popularity gained because of the COVID-19 vaccine, the company AstraZeneca was previously famous for its development of medicines for oncology. The company’s true strength was its cancer treatments, which accounted for about 40% of the total revenue earned during 2019.

The sale of cancer treatments by AstraZeneca is on the rise, and a drug named Tagrisso used to treat lung cancer has been said to bring in more than 770 million pounds last year, with a 58% increase in the revenue generated by the same drug alone.

The rising number of cancer patients and the increased demand for its Tagrisso treatment show that the company AstraZeneca will continue to dominate the cancer treatment market and generate higher revenues for the company, which will be beneficial for the share price of the company in the future.

-

Dividend Growth

With the increased expectations of growth in the coming years, AstraZeneca will likely provide even greater rewards for shareholders. The 2.8% dividend yield followed by the company is below average for the FTSE 100 Index, and the yield is expected to grow in the future as the share price is also appreciating.

-

Many drugs in the pipeline

The increased amount of money that AstraZeneca spends on research and development is not for nothing. In recent years, the company has been pouring higher amounts into its R&D as about 167 projects are in different stages of completion. The likelihood that only a few of those drugs end up making it to market has also held great potential for the company, as it could represent billions in sales each year going forward.

Step 3: Opening an Account and Funds Deposit

The next step after collecting detailed information about AstraZeneca is to open an account with a broker company. As AstraZeneca is listed on the London Stock Exchange, it is crucial to find a broker with access to shares listed on the LSE. Some of the most prominent stockbrokers in the United Kingdom have mentioned above, and the process of opening an account on eToro is mentioned below.

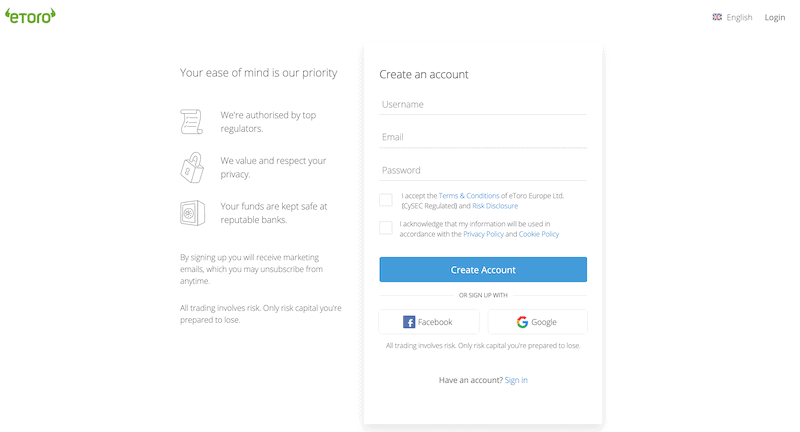

The first step is to open the website of eToro and then register for a trading account by clicking on the “Join Now” button at the center of the screen.

- Full name

- Nationality

- DOB

- Address

- Contact Details

- Username and Password

AstraZeneca share price chart on eToro

eToro will then require you to verify the provided identity with a copy of your driver’s license or passport to comply with government regulations. A copy of the utility bill or bank account statement will also be required to verify the provided address. The verification will then automatically happen once the documents are uploaded.

The minimum requirement for opening an account with eToro is $200, which can be deposited through various methods, including:

- Debit cards

- Credit cards

- Bank transfers

- Skrill

- PayPal

- Neteller

Step 4: Buy AstraZeneca Stocks Online via the eToro Platform.

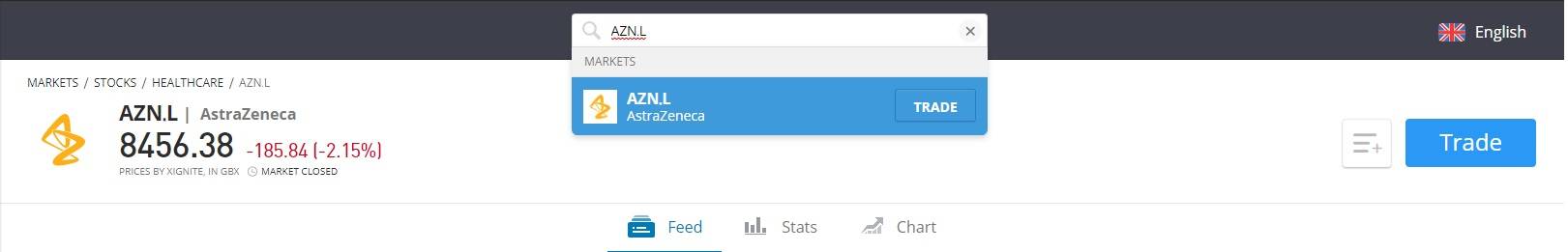

Once the account is funded, the trader is ready to buy AstraZeneca shares. The term ‘AstraZeneca’ is entered into the search box, and the desired result is selected from the account dashboard. The method of buying stocks via eToro is straightforward to follow. Let’s take a look:

- The process starts with logging into the account by entering the username and password.

- Type AstraZeneca or AZN.L in the search box.

- The popped-up search results will bring forward a list, and investors will have to click on the desired stock.

AstraZeneca share price chart on eToro

- A form requiring the investor to submit an order will prompt the investor to tell the position he wants to take, i.e., buy or sell.

- The amount of the transaction, which has a minimum limit of 40 pounds, is entered.

- Stop Loss or Take Profit levels are also selected if needed to minimize the risk. Moreover, we can use the leverage option in the same window.

- After entering all the necessary information, ‘Open Trade’ is clicked to buy AstraZeneca shares.

Should I Buy or Sell AstraZeneca Shares?

One of the crucial decisions to make is whether to buy or sell the stock. If an investor assumes that the share price of AstraZeneca is going to increase in the near future, he goes for the buy option. Alternatively, if he thinks that the share price will decline, he goes for the sell option.

The reasons for an uptick in the share price of AstraZeneca have been listed above. However, anything negative, like the recent struggle AstraZeneca is facing to receive approval from the US FDA, could hurt its reputation and bring down the price of its shares.

Conclusion

AstraZeneca shares have shown significant growth over the past 2 decades. It has been a darling among investors, traders, and analysts. The pharmaceutical giant has plans to develop more medicines. Therefore, it has been adding a sum of money to its R&D, which makes the biotechnological company’s position at a higher stake.

With 167 projects in progress, the company has huge chances of success in the future. Furthermore, the rising demand for its COVID-19 vaccine and the increased sale of cancer treatment also provides a solid picture for its future. The commission-free service of eToro also makes it easier for investors to earn higher profits with AstraZeneca. In this way, investors can earn big profits from their smaller investments.

Click the link below to get started!

FAQs

Is it a good time to buy AstraZeneca stocks?

AstraZeneca shares have shown significant growth over the past 2 decades. It has been a darling among investors, traders, and analysts. The pharmaceutical giant has plans to develop more medicines. Therefore, it has been adding a sum of money to its R&D, which makes the biotechnological company's position at a higher stake. Furthermore, the rising demand for its COVID-19 vaccine and the increased sale of cancer treatment also provides a solid picture for its future.

Where can I safely buy AstraZeneca stocks online

Our top broker recommendation is eToro as they are regulated in multiple countries, the easiest to make a deposit onto and simplest to use for beginner investors and traders.