Citigroup (C) is a diversified financial services holding company that offers an extensive range of financial products and services. It operates across two segments – Citicorp and Citi Holdings – that collectively serve corporate and consumer markets across the globe.

If you’re considering an investment in this US banking titan there’s plenty to weigh up, especially in the aftermath of the Coronavirus pandemic. But, while market conditions may not encourage confidence, Citigroup stock has offered consistent growth in recent years, often exceeding expectations, and many forecasts remain positive.

This guide will explain how to buy Citigroup stock, take a look at the best stockbrokers and consider the banking conglomerate’s prospects going forward.

On this Page:

1. eToro – Market leading broker built on social trading innovation

Recent years have seen eToro ascend to the top of the online trading tree, and it’s not hard to see why. First and foremost, eToro has brought innovation and slick, accessible UX to the world of online trading, delivering fresh, compelling ways to invest and granting novices a route into the markets via social trading and a host of easy-to-master trading tools and courses.

If you’re looking to invest in Citigroup you’ll find a number of ways to do so on eToro. You can opt to buy Citi stock by opening a BUY (long) position and investing in an underlying asset (meaning you actually own the stock you’ve purchased) or trade Citigroup by employing CFDs (Contracts for Difference). This method allows you to take a long or short position without actually buying and owning the stock. It also enables the use of leverage to boost your potential profits and allows you to open a short position and bet on the stock’s price dropping.

eToro’s headline feature is ‘copy trading’, which allows you to duplicate the positions of a more experienced trader and, hopefully, profit from their expertise. Needless to say, this is no guarantee of gains, but it does allow you to tap into a community of expert traders.

eToro’s US userbase is currently limited to crypto but we’re assured that they won’t have to wait long before stock investing is added to the platform.

While eToro’s withdrawal fees aren’t the lowest ($25 plus banking costs) but pricing is otherwise very completive, with zero-commission on stock and ETF trading for European clients and no stamp duty for UK customers how buy stocks.

You can open an account with as little as $200, so dipping your toe in and sampling the eToro experience is relatively affordable. In fact, you can get to grips with the platform for free courtesy of a demo option that gives you $100,000 in practice funds to play with.

eToro is regulated in multiple jurisdictions, with licenses from ASIC, CySEC, and the FCA. If you need assistance with any of the below steps, eToro has a customer support team available 24/7.

- Simple and intuitive web and mobile platform

- An unlimited demo account

- Social trading

- High fees

- $5,000 account minimum for CopyPortfolios

Should I Buy Citigroup Stock? Points to Consider

Weighing up Citigroup stock as a buy or sell? It’s always wise to consider the company fundamentals, along with historic price movements and forecasts.

Citigroup business model and share price history

Citigroup’s long-standing position at the forefront of America’s banking industry is built on a series of innovations that date back to the 1970’s. Most notably, Citigroup introduced the ATM machine and compound interest on savings accounts.

The New York-based conglomerate has since established a consistently held position as one of America’s big four diversified banks, alongside JPMorgan, Bank of America and Wells Fargo, all of which, along with Citigroup, straddle the full breadth of the banking sector by offering commercial, retail and investment banking services.

If you’re looking for characteristics that set Citigroup apart from its aforementioned competitors, consider its overseas presence – Citbank’s international footprint has traditionally been more expansive than the other big US banks. This leaves it more exposed to overseas economic turmoil – particularly in Europe – than rival US banks.

The complexion of its holdings is also distinct from the likes of Bank of America, with far less mortgage exposure meaning the likely post-pandemic uptick in mortgage delinquencies will be less of a concern. However, Citi’s substantial credit card portfolio (which accounts for 9% of its assets) could leave it exposed in the event of a recession.

Citigroup stock dividend information

Citigroup pays an annual dividend of $2.04 per share, with a dividend yield of 4.49%. The last dividend payment ($0.51) was made to shareholders on February 28.

Citigroup’s earnings per share have grown consistently in recent years, ending 2019 at $2.15 for Q4. However, Q1 of this year saw Citi’s EPS drop to. $1.05, a 43.85% decline year-over-year.

As of April 20, 2020, Citigroup’s P/E Ratio is 6.71. For comparison, Bank of America’s ratio is currently 11.03. Typically, large banks have a lower P/E ratio than regional banks because their growth tends to be steady.

Citigroup stock forecast and prediction

According to CNN, 22 analysts offering 12-month price forecasts for Citigroup Inc. have a median target of 56.25 with a high estimate of 87.00 and a low estimate of 39.40. This represents a +27.84% increase on the current price of 44.00 (20/04/2020). Consequently, Citigroup Is currently given a buy rating by CNN-polled analysts.

How to Buy Citigroup Stock from eToro

Assuming you have a funded account, follow these simple steps to buy Citigroup stock.

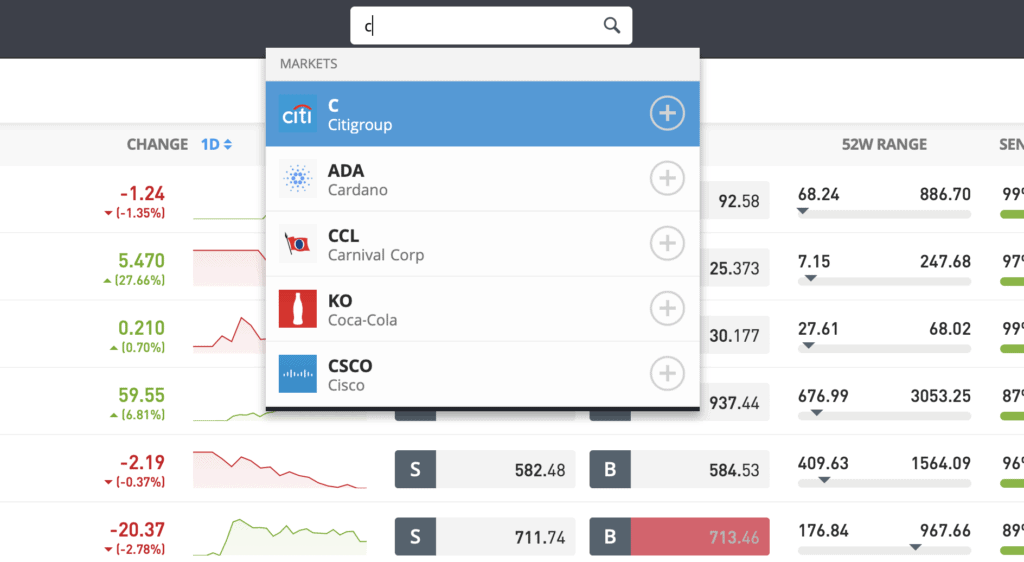

Step 1: Search for Citigroup (C) Stock

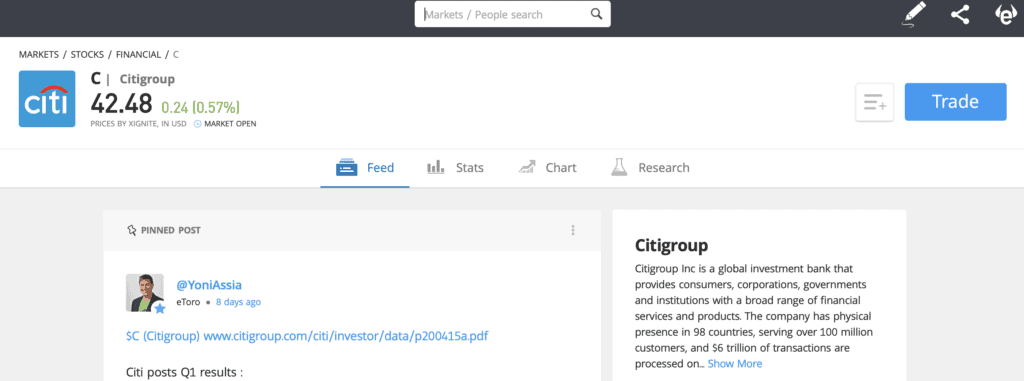

Step 2: Click on trade

Step 3: Specify ‘Buy’

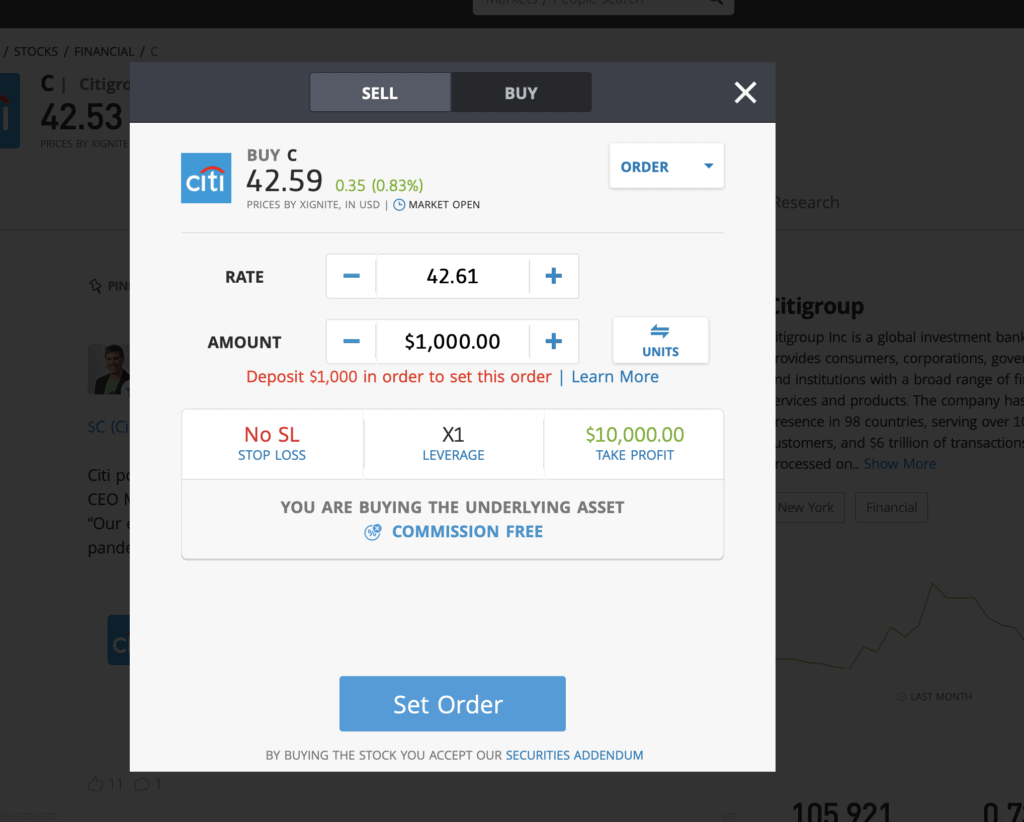

Specify ‘Buy’ on the top tab, change the leverage to X1 to purchase real stock and proceed to set your order.

Investing in Citigroup Shares – Final Thoughts

As you’d expect, Citigroup’s fortunes are very much linked to the Coronavirus crash right now. The economic downturn will result in lower consumer and commercial spending, while loan defaults are almost certain to increase.

All of which is likely to result in a revenue hit for Citigroup, which we expect to show up in July’s Q2 results. Indeed, the economic shockwaves are likely to negatively impact most areas of Citi’s operations, although there is some hope that its sales and trading arm may benefit from extreme volatility in equity and debt markets, which should go some way towards offsetting issues elsewhere in the business – sales and trading generated around 28% of Citigroup’s revenues in 2019.

FAQs

Should I buy Citigroup stock or wait?

While there could be tough times ahead for Citigroup – as you’d expect given the economic shock of the Coronavirus pandemic – we should expect to see a recovery in the latter part of the year and there is a belief that buying at $42 or below should offer long-term value for patient investors.

What are the fees when buying Citigroup stock?

Our recommended broker, eToro, offers zero-commission stock and ETF trading for European clients. This means that, unlike most brokers, eToro won’t add a dealing charge or any administrative fees when you buy Citigroup stock.

Is there a Citigroup stock price prediction?

12-month price forecasts - based on the predictions of 22 analysts - for Citigroup Inc. have a median target of 56.25 with a high estimate of 87.00 and a low estimate of 39.40. This represents a +27.84% increase on the current price of 44.00 (20/04/2020).

What does the Citigroup stock dividend pay?

Citigroup’s dividend payment is currently priced at $0.51. The current annualised dividend of $2.04 is up 6.3% from last year.