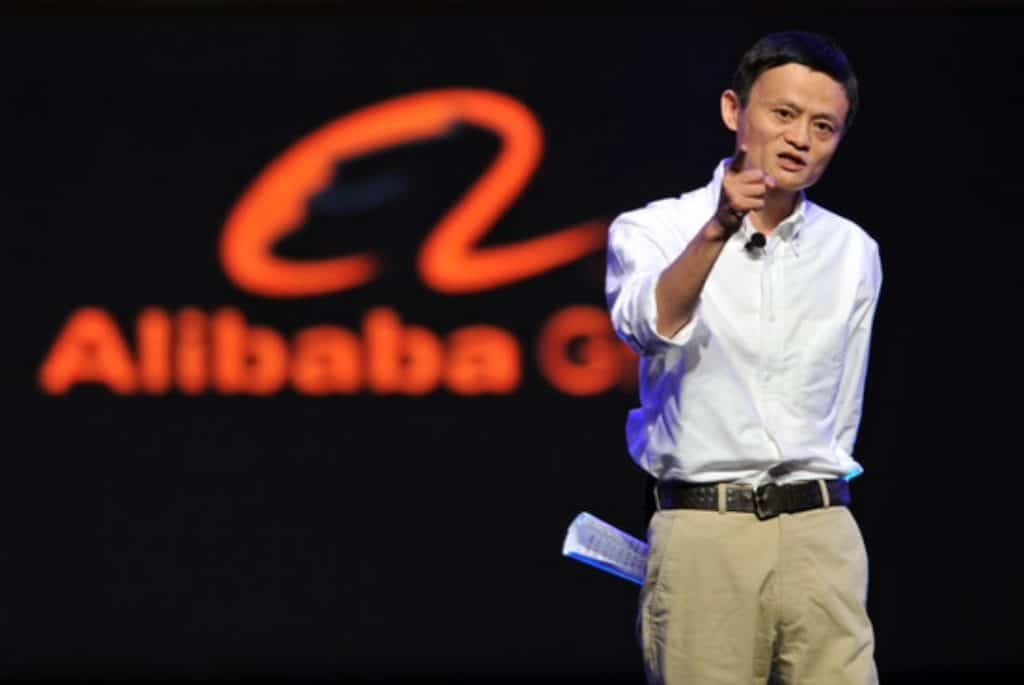

Like Steve Jobs of Apple or Jeff Bezos of Amazon, everyone in China knows Jack Ma, the founder and chairman of Chinese online retailer Alibaba (BABA). Global e-commerce is a land of giants. Among giants, Alibaba is the Goliath. A whopping $700 billion in merchandise was sold in Alibaba online markets in 2018. Under Ma’s leadership, Alibaba has enjoyed revenue growth of 47% over the last five years, double that of the global e-commerce markets. But as the Chinese economy slows, we have to ask, what will happen to the large retail business that Jack built once he retires this year?

If you want to invest in China as its middle class grows and spends more in online shops, this guide will help you evaluate the future growth opportunities of Alibaba stock, how to buy Alibaba stock, and the best Alibaba stock brokers.

Best U.S. platform to Buy Alibaba Stocks

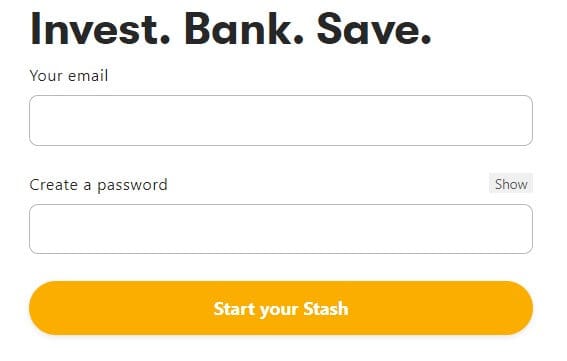

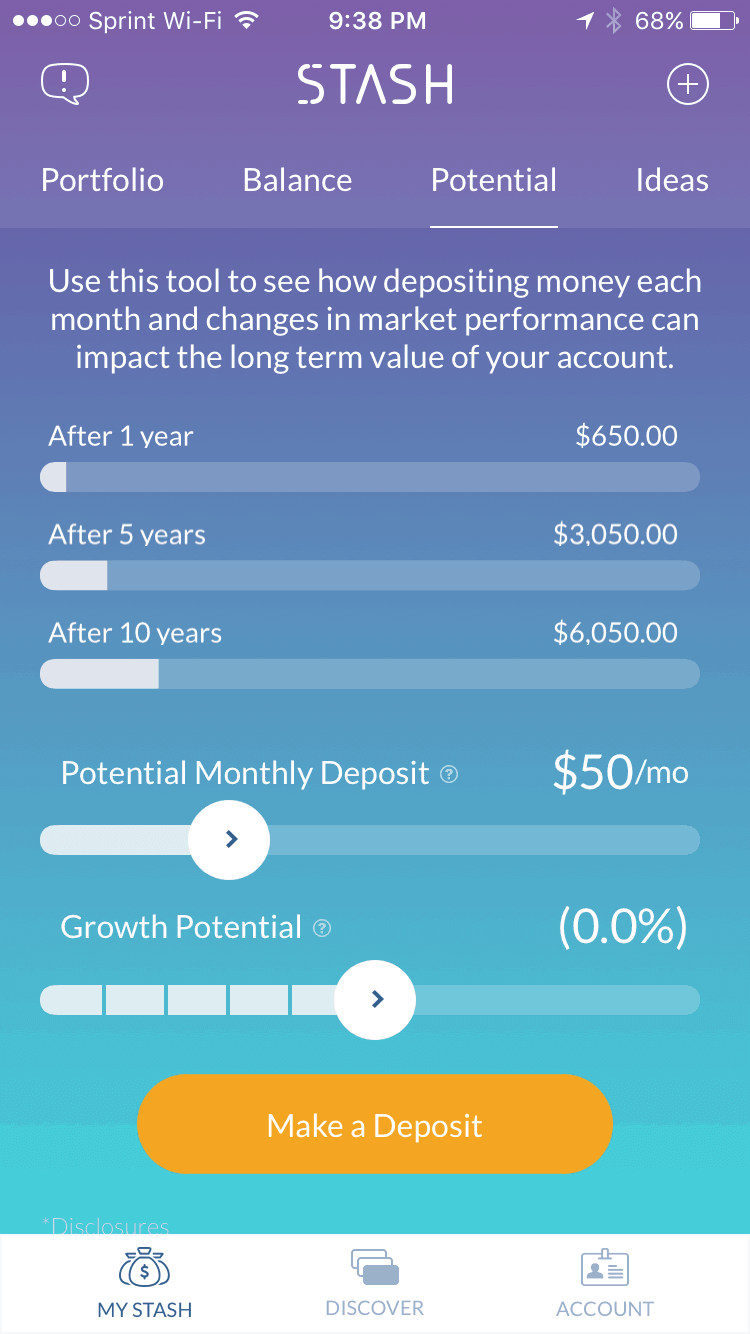

We’ve scoured the web and found Stash to be the best U.S. broker for investing in BABA shares. This smooth stock market app allows users to invest from only $5, and has one of the lowest fees in the market starting at $1 per month.

Best non-U.S. Platform to Buy and Sell Alibaba Shares

If you’re outside of the U.S. and have been interested in buying stocks and shares for some time, you may have come across Webull. It is listed on the NYSE and holds licenses by several financial authorities. Their platform accepts PayPal and offers a range of trading tools, news and technical indicators designed to help you buy and sell over 2,000 different stocks.

How to Buy Alibaba Stocks in the U.S.

If you’re a U.S. resident looking to invest in BABA stocks, we would strongly recommend Stash Invest. This is one of the only apps allowing users to engage in micro-investing, meaning that you can use a small capital starting at $5. Read our tutorial below to get started.

Step 1: Sign up to Stash Invest

Firstly, sign up using the link above, and complete your details. The broker will then redirect you to the App or iOS store where you will be able to download the free app.

Step 2: Complete your trading profile

Secondly, you will be required to fill in a few questions related to your trading preferences. Based on your answers, Stash will create your unique investor profile and recommend relevant products for you.

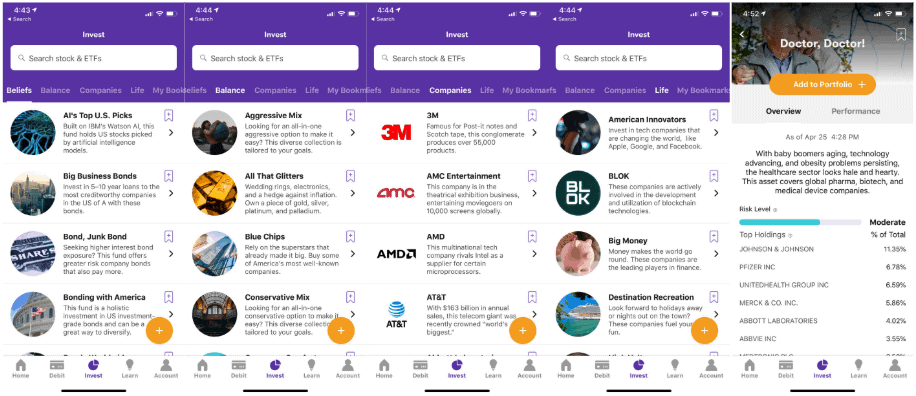

Step 3: Check your investment options

Stash will now recommend different options based on your answers in step 2. Go through the options and select what you are interested in the most.

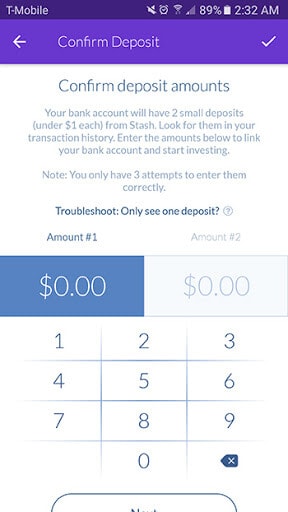

Step 4: Deposit money into your account

Deposit funds into your Stash account using your preferred payment method.

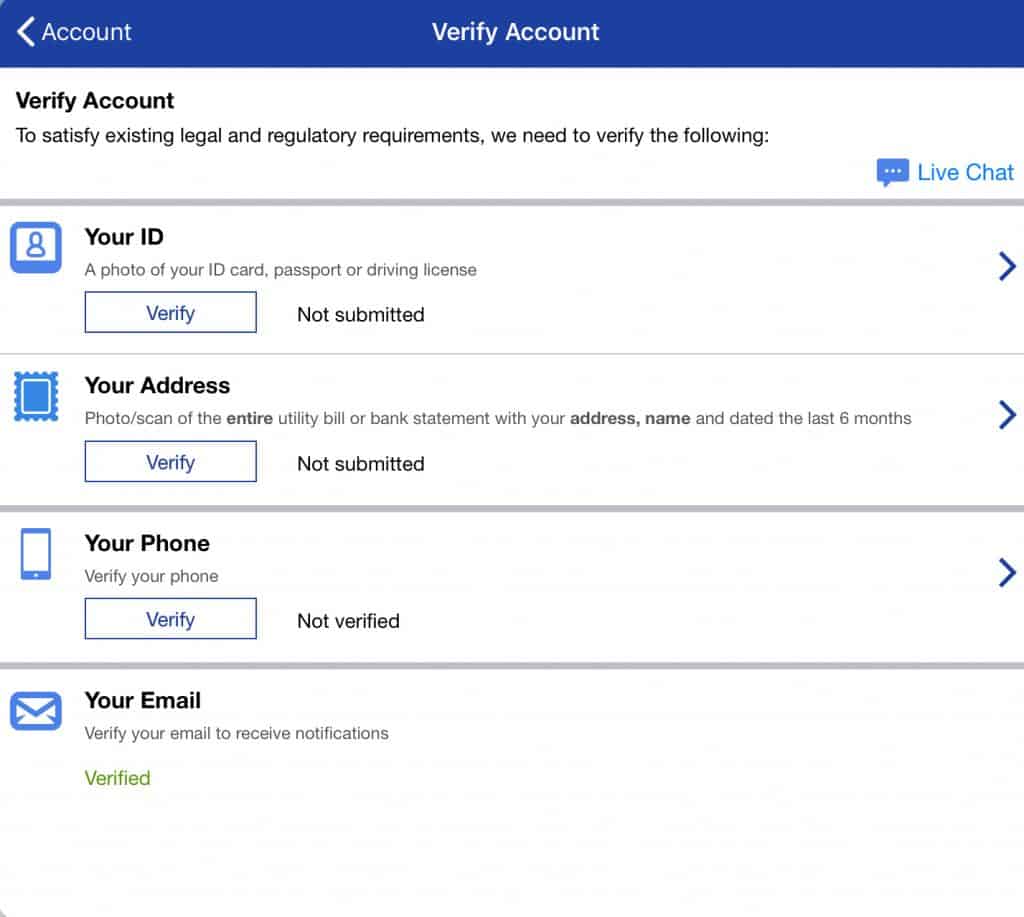

Step 5: KYC & Verification

The app will then ask you to verify your identity by providing the needed documents. This is a compliance procedure which should not take long to complete.

Step 6: Buy Alibaba stocks

Search for “Alibaba” in the search box, enter the amount you want to invest then click the “Buy” button.

How to Buy Alibaba Stocks outside of the U.S.

Step 1: Register your account

Firstly, click here to open your account. You will be prompted to download the Webull.com mobile app to register. Select between a Demo and Real Money account. After filling in basic personal information, you will gain access to an unlimited demo account. Before you can trade Alibaba stock, you will be prompted to answer a few questions to establish your investor risk profile.

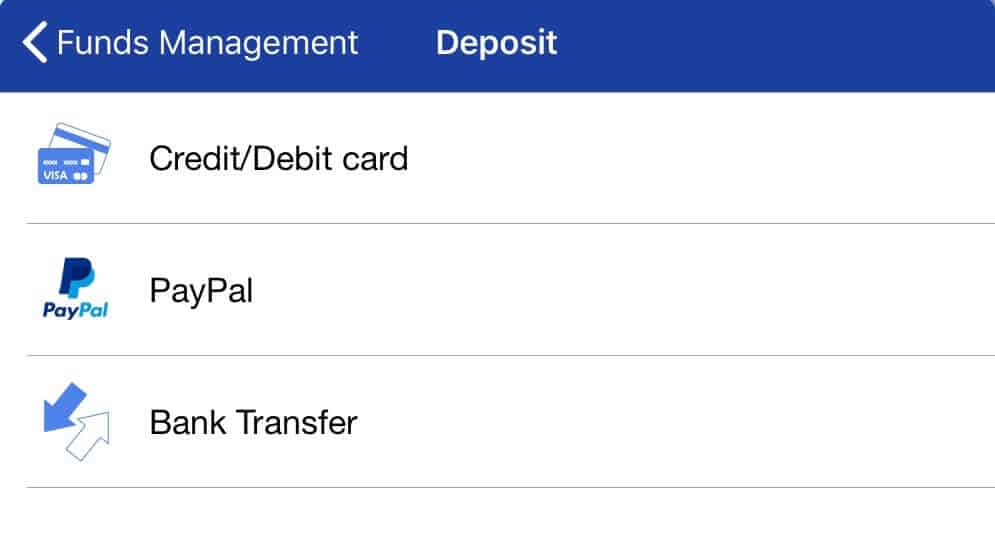

Step 2: Fund your account

When you are ready to trade with real money, fund your account. Three payment options are provided. You may be asked to verify your payment method.

Step 3: Verify your identity

Attach and submit proof of identity for verification.

Step 4: Trade Alibaba stock

Webull offers a wide variety of investment instruments, including stocks, ETFs, indexes, forex, and cryptocurrencies. Options are also available for advanced investor. Query Alibaba and the price quotes for the stock, as well as put and call options, appear on the screen.

All stock information and the Buy/Sell commands are displayed on the general stock page for the serious trader who wants to execute quickly. The bottom half of the page displays the price chart and provides access to a broad selection of technical analysis indicators.

80.5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the risk of losing your money.

Recommended brokers in this case are eToro or Webull. Or do you seek to make a one-time purchase or long-term investment? In this case, review classic online brokers such as Markets.com

Should you invest in Alibaba?

Alibaba sales hit $250 billion in 2018 – an amount equal to the entire economic output of Hong Kong. If you buy Alibaba stock, or invest in Tencent stock or shares of other Chinese e-commerce plays, you are investing in the tremendous growth in wealth of the Chinese middle class.

Five hundred million Chinese shopped in Alibaba’s Taobao (consumer-to-consumer) and Tmall (business-to-consumer) marketplaces last year. But of greater interest to investors is the number of Chinese who do not shop online. Only 15 percent of 1.4 billion Chinese shop online. The other 85% could be future customers of Alibaba.

With so many new consumers ready to open their wallets, it may not matter that the Chinese economy is not expected to grow at the same fast clip of 13 percent logged over the last decade but a still impressive 9–10 percent.

In 2018, the amount consumers spent on Tmall increased 29 percent. So before you invest in BABA, you need to know if Alibaba can still make money after it processes, packages and ships the products bought from its online shops. Let’s take a closer look at this e-commerce growth story.

Pros to buying Alibaba stock

Digitization is boosting profits

Alibaba has made a smart move by buying the businesses that process and ship the e-commerce purchases on its retail shops. Imagine a lego-world with an Amazon (Alibaba.com) to sell the products, a PayPal (Alipay/Ant Financial)) to pay for the products and a FedEx (Cainiao) to ship the products – this is the Alibaba digital economy.

By automating these businesses, Alibaba is making more money by boosting productivity and reducing operating expenses. Alibaba is also digitizing sales and merchandising at the supermarket chains and shopping clubs it owns.

The Chinese, who still prefer to shop at stores, buy 3 to 5 times more items at Alibaba-owned stores. Amazon, meanwhile, has only recently started buying stores hoping it will boost sales and make more people buy Amazon stock.

A smarter small business ecosystem

Digitization is helping Alibaba fulfill Jack Ma’s original vision of giving small businesses the tools and market power to compete with large companies. Walk into Alibaba’s logistics business Cainiao and you will see smart robots packaging orders and sending them out for delivery. Alibaba owns 47 percent of this business.

Contact a seller and you may have a conversation with a robot. Chatbots are learning how to answer customer questions and solve their problems. Investors who buy Amazon stock were worried about Amazon’s low China market share, not Alibaba on Amazon’s home turf. Alibaba is now wooing US small businesses to join its e-commerce platform and sell to its 1.4 billion users.

Alipay is China’s favourite digital wallet

Most purchases on Alibaba are paid for via Alipay, a separate company spun off from Alibaba with plans to do an IPO. Alipay has 700 million active Chinese users, whose bank accounts are linked to the service.

Apple recently announced it was providing free loans to Chinese consumers to buy iPhones to rebound from a Chinese sales and Apple stock decline. Alipay is the lucky lender chosen to finance those iPhone loans.

China’s growing middle class is spending more

Here are more stats on the tremendous consumer spending power you’ll be investing in when you buy Alibaba stock. By 2030, China’s middle class will grow from 300 million to 850 million.

Over the past decade, the middle class has tripled their retail purchases to $3.1 trillion. Alibaba captures 8 percent of these retail sales. The majority of its 636 million customers are consumers born after 1990 – the wealthiest consumer segment.

These form the core of the Alibaba business operating systems, which are important to the digital transformation of our enterprise customers and allow us to become the leading partner of businesses within China and around the world. Daniel Zhang, CEO, Alibaba

Cons to buying Alibaba stock

Chinese government meddling

The heavy hand of China’s centrally controlled government still meddles in the affairs of businesses and consumers. Some of these actions are good for Alibaba. The government is making it harder for the Chinese to spend money outside of the country. These restrictions are favourable to China’s largest retailer. Alibaba is not so happy with other recent changes.

The Chinese central bank has placed new restrictions on customer funds and mobile payments. These moves reduce the fees retailers can collect. Tencent stock, the world’s largest online games company, was hit even harder when China held up games approval for months to screen for violence.

Founder Jack Ma’s departure

Although the new leadership may come under more scrutiny, it is business as usual at Alibaba. CEO Daniel Zhang, who will replace Ma as chairman, has been running operations for a long time. He is responsible for the successful logistics, offline grocery shopping and Taobao Marketplace businesses.

Retail woes

China’s retail sales hit a 15-year low in 2018. Some blame the US-China trade war, which will eventually have to be resolved for the good of both economies. The Chinese government is giving tax breaks to low income groups and businesses to stimulate consumer and business spending.

Meanwhile, Alibaba has landed on the US counterfeit products blacklist for the second year in a row. In 2017, Alibaba shut down 240,000 shops for making fake products. Alibaba is working with luxury brands to combat counterfeiters through the Alibaba Anti-counterfeiting Alliance (AACA).

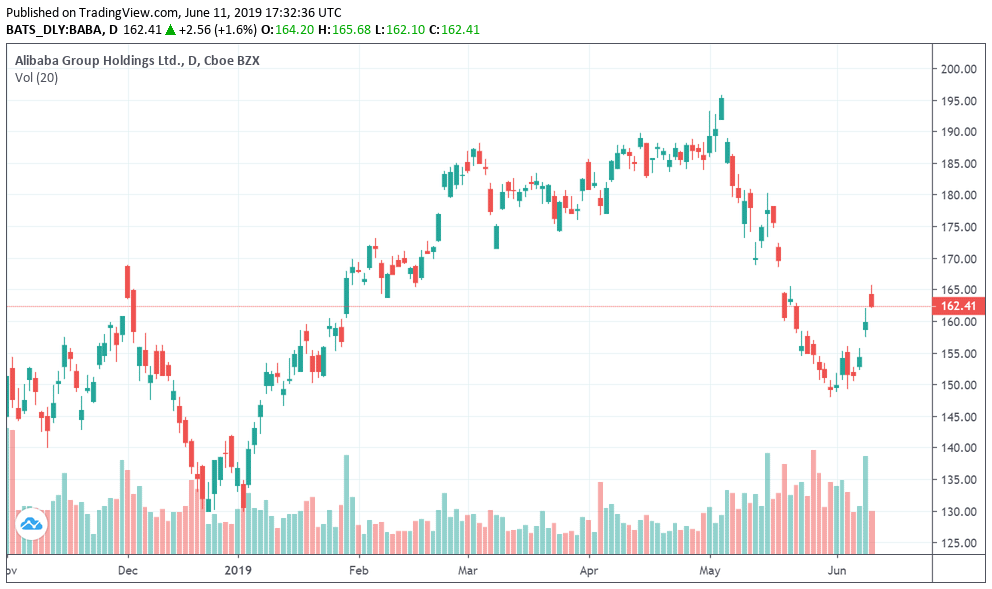

Alibaba Stock: Current Prices and Summary

With a gigantic market cap of almost half a billion dollars, Alibaba stock can influence the e-commerce and wider technology market. Likewise, Alibaba’s stock price is also influenced by the news of other large e-commerce stocks. Alibaba trades as part of a Chinese tech triumvirate called BAT (Baidu (BADU), Alibaba, Tencent (TCEHY)).

In the first two months of 2019, Alibaba and Tencent stock prices were up almost 15 percent while Baidu was down more than 5 percent. So is it a good time to invest in Baidu stock? Before you invest in Alibaba stock, you want to know whether its shares are fairly valued. Before you buy tech stocks, you want to know if they are undervalued or overvalued. Below is the current price you can buy Alibaba stock at, but what about the future value of the stock?

If we compare the current stock price to the forecasted future earnings of the company, we can get a glimpse into the future value of Alibaba. Alibaba has a forward price-to-earnings ratio of 27 versus 32 for Tencent and 17 for Baidu. The forward PE of Amazon, on the other hand, is much higher at 57. When compared to the stock of its peers, Alibaba stock appears to be fairly valued. Whereas a purchase of Tencent stock at current prices could be too expensive.

A Brief Overview of the History of Alibaba

Jack Ma, the founder of the world’s largest internet business, used the internet for the first time in 1995 – the same year Yahoo! was founded. Though some believe Alibaba copied, Amazon was formed around the same time, 1994. In 1999, the former English teacher established Alibaba with 17 other founding partners from his apartment in China.

The mission was to develop an internet portal to support small business. Alibaba.com remains a business-to-business e-commerce site but today not only hosts exporters, manufacturers and entrepreneurs from China but many other countries as well. Tmall the business-to-consumer market was started to provide a way for overseas Chinese to buy from Chinese businesses.

Taobao is the consumer-to-consumer site and a top 10 visited site globally with 617 million active users. Cloud computing, and digital media and entertainment businesses were added. Alibaba continued to grow through. Alibaba owns a 33% stake in Ant Financial.

In 2005, Yahoo paid $1 billion for a 40 percent stake in Alibaba. The company went public in the world’s largest IPO in September 2014 raising $25 billion. Yahoo! made $10 billion in the IPO. In January 2018, Alibaba stock passed the $500 million market cap. Meanwhile, Yahoo!’s search business was sold to Verizon in 2017.

The Alibaba stake was transferred to Altaba (AABA), an investment company controlled by Yahoo! cofounders Jerry Yang and David Filo, which today holds a 16.3 percent stake in Alibaba. In 2017, Alibaba became the official sponsor of the Olympic Games until 2028. In the cloud business, Alibaba competes with Amazon and Microsoft.

In 2020, Jack Ma will no longer be at the helm of Alibaba. The former teacher will be focussing on his education initiatives and most likely relaxing at his wine chateaus in Bordeaux in the south of France. Ma says it will be business as usual as he has left his retail house “built on systems of organizational excellence and a culture of talent development.”

What’s ahead for Alibaba stock during the leadership transition? You would have lost a lot of money if you chose to not buy Apple stock after Steve Jobs or invest in Microsoft without Bill Gates. Since these iconic leaders left, these stocks have tripled and quadrupled, respectively.

2019 – The billionaire-dollar-a-minute business

China retail sales are forecasted to grow at a rate of about 9 percent in 2019 and 2020. Alibaba has revised its 2019 sales forecasts downwards from 60 to 50 percent growth. The Chinese government tax breaks to low income groups and businesses should start stimulating consumer and business spending by the end of 2019.

Alibaba’s recent annual online shopping event revealed the pent up consumer demand behind rising incomes. Chinese consumers spent $1 billion in the first minute. We forgot to mention Alibaba Pictures, which behind the e-commerce scene has has been coproducing movies with the likes of DreamWorks and Paramount Pictures. This year’s Oscar winner GreenBook was co-financed by Alibaba Pictures. It is hitting the box offices now and is sure to be a blockbuster.

Expect other movie hits to follow. If you invest in Disney stock, Alibaba could spin off its film business one day. The average 2019 forecast for BABA stock is $1360, with an estimate of $830 on the low end and $1,900 on the high end. Though some analysts expect Alibaba stock to climb back up to its all time high above 2000 surpassed in June 2018.

2020 – On the cloud

2020 will be the first year without Jack Ma running Alibaba since its founding in 1999. Alibaba expects to turn over $1 trillion in gross merchandise value this year, about double 2017 turnover. The cloud business will become an increasingly stronger contributor to revenues. In 2018, cloud services grew 84 percent to $6.6 billion.

Also keep an eye out for Alipay’s expected IPO – no date has been announced. Alipay now has one billion active users. The IPO will be a windfall for Alibaba, which has a one-third stake. And who knows, Ali Entertainment may have a few more movie blockbusters in production.

2021 – Borderless business

The economic slowdown forecasted for 2021–2022 will be a good time to buy tech stocks on the cheap. Alibaba will benefit from the rising GDP of the Southeast Asian developing economies where 20 percent of its global active buyers reside. International sales could grow from 8% of revenues to 20% over the next five years. Low-to-median growth is forecasted for BABA stock.

2022 – Digitization

Alibaba says e-commerce is growing at 20-30 percent because of digitization. Over the last five years, revenues have grown 48 percent but jumped 58 percent to $250 billion in 2018. Operating margins, though, were squeezed 2.5 percent.

Alibaba’s plan is to make those robots and other automation tools work harder to boost productivity. CEO Zhang says automation is behind its improved operating leverage. Low-to-median growth is forecasted for BABA stock.

2023 – One trillion shoppers

By 2036, Alibaba expects to have one trillion consumers, double the amount in 2018. Alibaba’s revenues will be more diversified. Over the next five years, the cloud and entertainment and media businesses will be contributing as much as 20 percent to revenues. Median-to-high growth is forecasted for Alibaba stock.

We believe Alibaba has fulfilled its vision of making it easier for small business to do business. Its business friendly e-commerce shop is ready to introduce more American and other global businesses to China.

Conclusion

So, should you buy Alibaba stock? We believe Alibaba is making it easier to do business. Having fulfilled his mission, we understand why Jack Ma is now moving onto his nonprofit projects. Considering the positive future outlook for Alibaba, it could be a good time to buy Alibaba shares.

When you are ready to buy stocks, we recommend doing so via a regulated online broker such as eToro if you’re a UK customer, and Ally Invest for U.S. customers.

FAQs

If you are deciding whether to buy Amazon stock or invest in Alibaba, consider that Alibaba has over 550 million active users, and 80 percent of the Chinese e-commerce market.Amazon has 300 million active users, and 40–50 percent of the US e-commerce market. The e-commerce giants are close in revenues at 250 billion and 232 billion, respectively. In 2018, Alibaba profits were 63 billion about six times that of Amazon’s at 10 billion. The difference in profitability is reflected in operating performance. Alibaba has an operating margin of 28 versus 5 for Amazon.

In February 2018, Alibaba announced it was taking a 33 percent ownership stake in Ant Financial as the company prepares for a future IPO. Alibaba shareholders will now share directly in the profits of the company. Ant previously had an affiliate agreement with Alibaba in which it paid royalty and technology service fees to Alibaba in the form of 37.5 percent of its pretax profit. Ant Financial, which was recently valued at $150 billion (more than double the market cap of Goldman Sachs), operates the leading mobile wallet in China, as well as a one-stop shop for financial services – digital banking, investment products, micro-loans and insurance.

Many people did not realize Alibaba was in the film making business, until its movie GreenBook won an Oscar this year. Alibaba co-produced the film with Dreamworks and Participant Media. Other movies produced by Alibaba include A Dog’s Purpose with Paramount Pictures and soon to be released Ugly Dolls with Huaxia Film Distribution and STX Entertainment. Digital Media and Entertainment is 10 percent of Alibaba revenues.

You can buy Alibaba stock from online stockbrokers. eToro and Webull are examples of online broker platforms where traders buy and sell Alibaba shares, either by buying the underlying assets or trading CFDs. After signing up online, type in the BABA ticker, place your order and you will become an owner of Alibaba shares. Which e-commerce giant is bigger Alibaba or Amazon?

Does Alibaba own and share in the profits of Ant Financial?

What is Alibaba’s relationship with Dreamworks and Paramount Pictures?

Where and how can you buy Alibaba stock?

company. The P/B is calculated by dividing the book value (assets minus liabilities) by the number of shares outstanding.” image-9=”” count=”10″ html=”true” css_class=””]