If you want to invest in the company empowering the digital world, this guide will help you evaluate the pros and cons of Microsoft stock, how to buy Microsoft stock, and the best Microsoft stockbrokers.

Should you invest in Microsoft?

Microsoft is known to reward its investors for loyalty. The stock price has been on an upward trend for a decade. Since its Windows operating system and Office suite are cash cows, Microsoft has lots of cash on hand. The software behemoth uses the cash to buyback stock to keep its stock price rising and pay quarterly dividends to investors. Microsoft builds leading business software but it has never achieved the wow effect that makes iPhone users also buy Apple stocks. That’s changing. Revenues of business products are growing in double digits as Microsoft adds new AI and mixed reality capabilities.

Unlike in the video games, Microsoft is not trying to replace humans with AI – at least not yet – but instead it wants to “supercharge” human capabilities. All of Microsoft’s business products are being updated with AI and mixed reality to provide deeper insights and interactions across business data and processes. Companies that are already using AI report 10 percent higher profits.

There is nothing mixed about Microsoft’s results. In 2018, Microsoft’s three business units Productivity and Business Processes, Intelligent Cloud and More PC (Windows, Office, XBox etc.) grew revenues 20, 18 and 8 percent, respectively.

Pros to buying Microsoft stock

AI-powered business productivity tools

Over the last 12 months, the business productivity software used by over 2 billion workers Office 365 has registered average quarterly sales growth of 37.5 while the customer relationship management suite Dynamics 365 has grown 16 percent. If you were required to upgrade to a subscription to get all of your favourite Office apps, then you know well how the switch to subscriptions a few years ago is also bringing in more revenues.

Fast growing cloud business

The cloud business has grown at an average quarterly rate of 96 percent in 2017 and 2018. Sales now equal almost one-third of Microsoft revenues, which surpassed $100 billion in 2018. Nine out of 10 Dynamic 365 customers have signed up for Microsoft cloud. Solutions on the cloud extend to smart homes, smart cities and soon, autonomous cars. The modern factory will have the Azure cloud built into its systems to extend capabilities. For investors, it is hard to find a pure play on the high growth cloud business. The demands of cloud computing from the likes of Microsoft are creating high demand for Nvidia’s powerful chips.

One way to invest in the cloud is to buy Nvidia stock.

Strong hardware sales

HoloLens 2 – available now for $3,500 – will merge the real and virtual worlds in this factory. The Toyota car maker in Tokyo could help design a part in Bangalore through the HoloLens while sharing the design specs and data on the virtual reality screen. This holiday season Surface sales hit a record as more consumers and businesses took home Surface Pro, Surface Laptop and Surface Go. Surface broke into the top five PC vendors in 2018.

In the real gaming world, Microsoft gaming revenues hit record average revenue per user. The company has bought several new gaming studios to create new games for its popular XBox consoles, PCs, and mobiles. Microsoft needs a spin-off or other way to unleash this value for investors. In the fast growing Asian online gaming market, it faces more competition from the leader in online games China’s Tencent. Since 70 percent of Tencent’s revenues come from online games, investors can buy Tencent stock for exposure to the gaming sector.

Cons to buying Microsoft stock

Slowing consumer sales

Revenues of the consumer Office and cloud segment have fallen to low single digits. Windows sales growth has bounced between 5 and -5 for the previous 24 months. As Windows’ share of revenues steadily declines against strong business segment growth, the world’s favourite OS has a smaller impact on profits. Apple is slowly gaining market as its its IPad Pros try to compete as full PCs.

2019 cloud revenue decline

Cloud revenues, though still a very robust 76 percent, have slowed in the last six months. Several other business segments have experienced a slowdown. Amazon stock and Alibaba stock are getting a lift as they invest more resources in their cloud businesses.

Lobby to stop making defense weapons

Microsoft employees are trying to scuttle a $10 billion JEDI cloud defence contract. They contend the company is turning defence into a warfare video game by selling augmented reality systems to the Department of Defense. Microsoft says it will continue to sell to institutions elected by a US democracy.

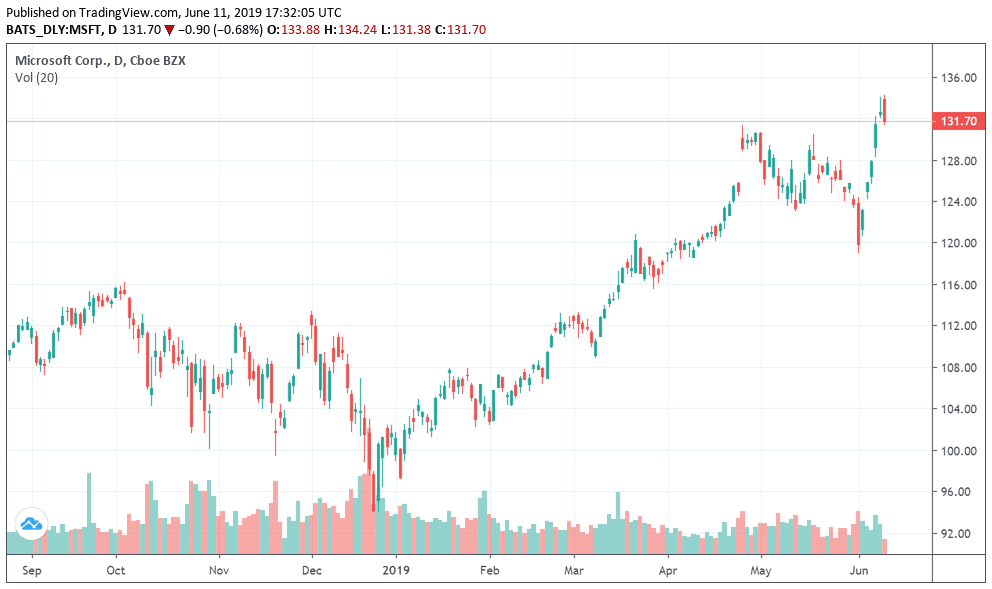

Microsoft Stock: Current Prices and Summary

In 2018 Microsoft regained its perch, lost in the 2000s, as the world’s most valuable stock. In November Microsoft’s stock price reached $850 billion and surpassed Apple. Comparing apples to oranges – these companies no longer get most of their revenues from the top two operating systems (Microsoft’s OS and Apple’s Mac) – is one way to value Microsoft’s diversification strategy. Microsoft gains only one-third of revenues from consumers today and two-thirds from its business products, while Apple is a consumer electronics and software company. If you want to invest in consumer PCs, buy Apple stocks.

Microsoft’s more diversified business makes it a safer stock. Although Apple has been more profitable, profitability alone does not tell you how much investors will pay for the stock. Since Apple is less diversified it is more vulnerable to the current consumer spending decline in China. When comparing the stock price of Microsoft with its peers in the enterprise software business, Microsoft’s price-to-earnings ratio is 26.1, below the industry average of 33.6. Microsoft’s stock is undervalued. Apple stocks, on the other hand, is overvalued at a P/E ratio of 14.3 versus 13.5 for the consumer electronics industry.

Also consider how much you will pay for each dollar of sales of Microsoft. Microsoft has a price-to-sales (P/S) ratio of 7.39 versus 3.29 for Apple. Although Apple sales growth declined in the most recent quarter and decelerated in 2018 over 2017. Microsoft sales growth increased in the most recent quarter and accelerated in 2018 over 2017. Analysts also have a much rosier sales growth outlook for Microsoft over the next two years at 12 percent. When looking behind the numbers at future growth potential, Microsoft is more fairly valued.

MSFT price quote

| Price | $ 170.93 | Daily high | $ 171.44 |

| Volume | 18963658 | Low | $ 169.50 |

| Variation | 12:51 | Opening | $ 169.71 |

| + / -% | 00:30% | Day before | $ 170.42 |

How to Buy Microsoft Stock – Tutorial

How to buy Microsoft stock on eToro

eToro is the most popular social trading platform. The broker has established itself as a reputable and trusted trading platform among traders since it launched in 2007. The leading online broker for copy trading is regulated in several jurisdictions, including by the UK’s Financial Conduct Authority (FCA). Popular features include one-click trade and portfolio copying and social feeds. When deciding whether to buy Microsoft shares on eToro, consider these pros and cons.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Pros

- Fast account opening process

- CopyTrader™ platform

- CopyPortfolios™ across an investment theme

- One-click trade execution

- Low fees

- Low minimum deposit (200 euros)

- Range of payment methods

- User-friendly interface

- Full BCH trading

Cons

- Withdrawals can be slow

- Mostly CFDs

Start trading Microsoft stock on eToro

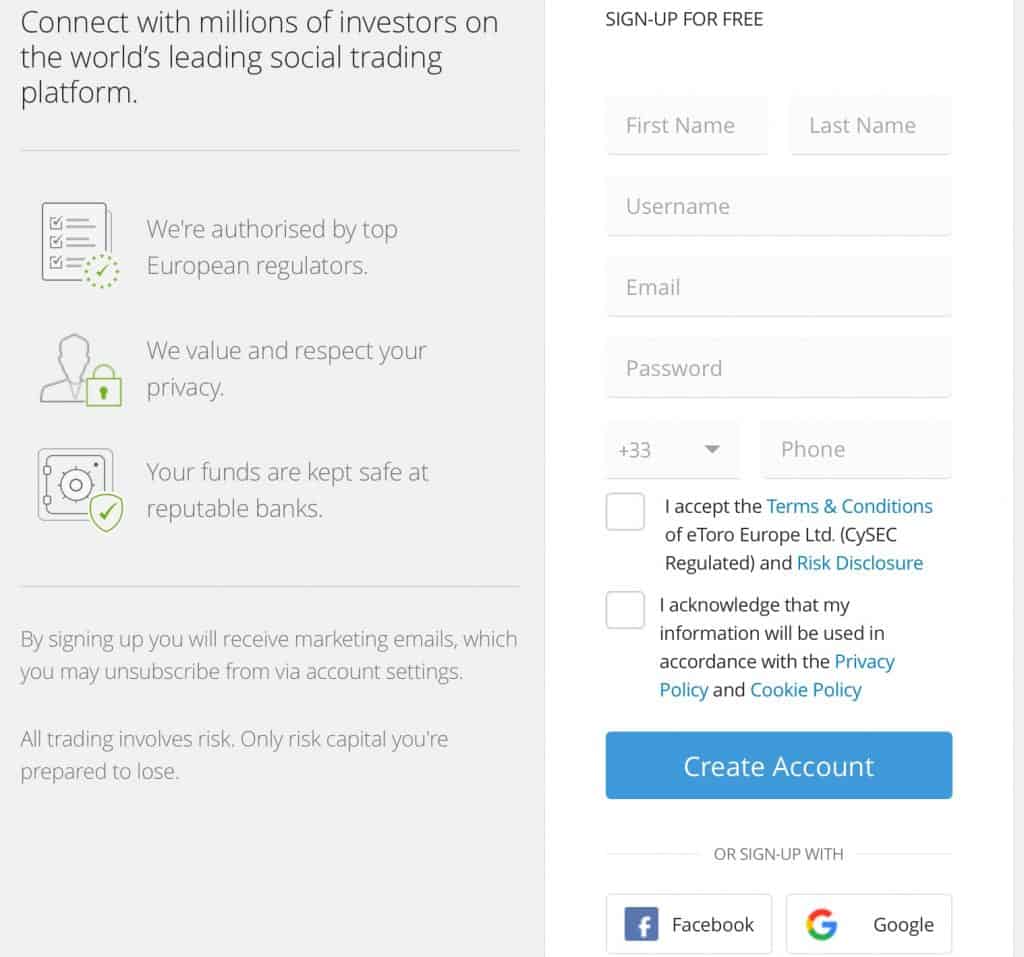

Step 1: Register your account

Fill out your basic profile information. To determine your investor risk profile, you will be asked to answer a few short questions about your investment experience, knowledge and strategy, as well as your risk-return level.

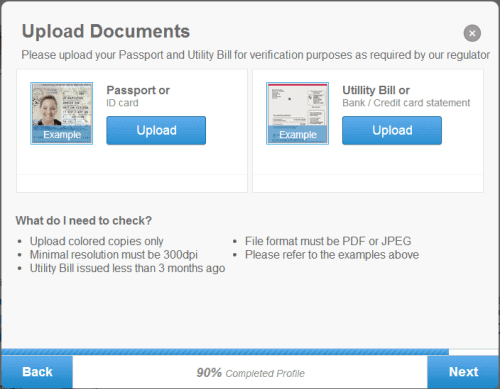

Step 2: Verify your identity

Attach and submit proof of identity for verification. US-based accounts are not accepted.

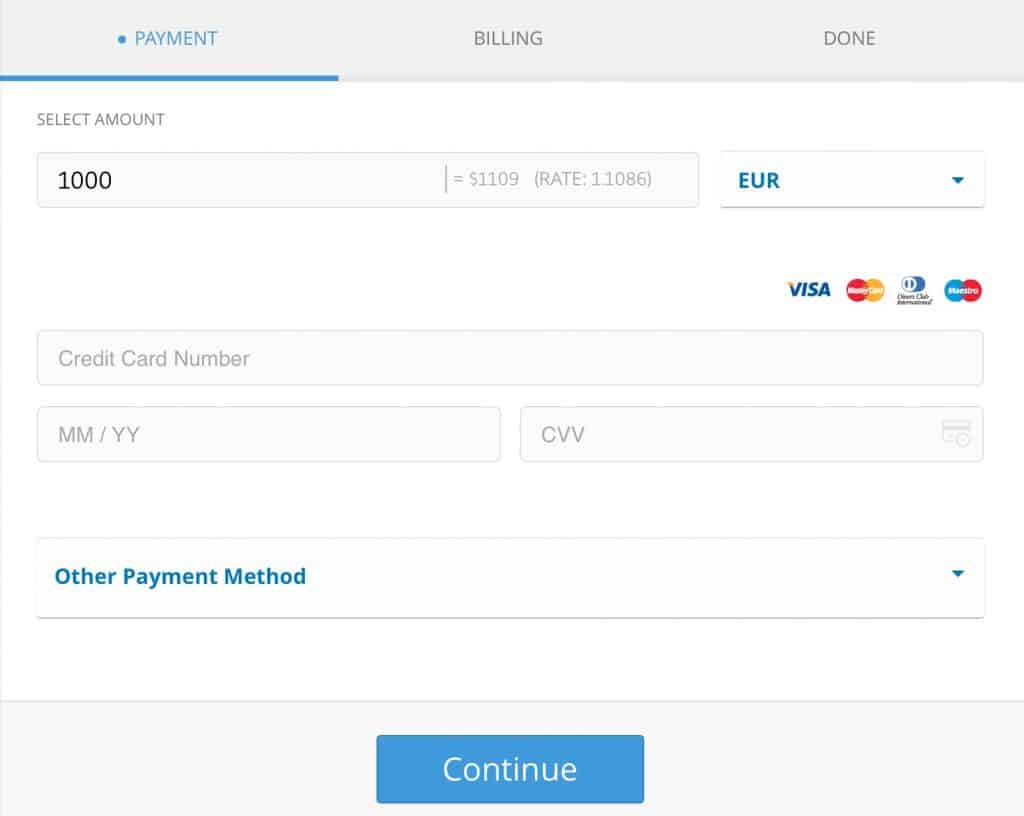

Step 3: Fund your account

eToro provides a wide variety of payment methods. Check to see if your preferred method is available in your country.

Step 4: Trade Microsoft stock

On eToro, you can invest in Microsoft through traditional securities trading and social investing. eToro assigns the portfolio of every trader a risk score based on the volatility – average daily price movement – of the instruments invested in on a scale of 1–6, 6 representing the highest risk. Here are three ways to invest in Microsoft stock on the leading social trading platform.

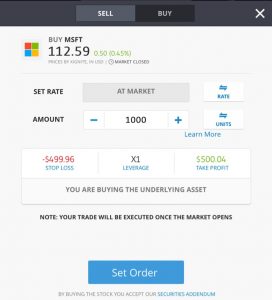

Step 4A: Place a Microsoft stock trade

To buy Microsoft shares, click on Trade. Select the Market (current price) or other price level you want to enter the market at. Enter the amount you want to trade and leverage (X1, X2, X5). Your Stop Loss and Take Profit levels are preset by you. You can also set up a One Click Trade option and preset the above parameters. The Microsoft stock profile page provides social feeds, stats, charts and research. Social feeds often provide helpful technical analysis tips and updates on how a stock is trading relative to its peers.

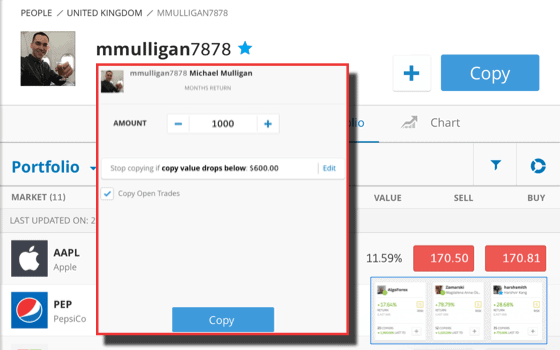

Step 4B: Place a CopyTrader™ trade

Choose from the selection of copy traders by reviewing their risk score, trading performance stats, charts, and portfolio. Check out the traders on the Editor’s Choice list. Click Copy. From the copy trade box, choose the amount you want to trade and the copy trade stop limit. Press Copy.

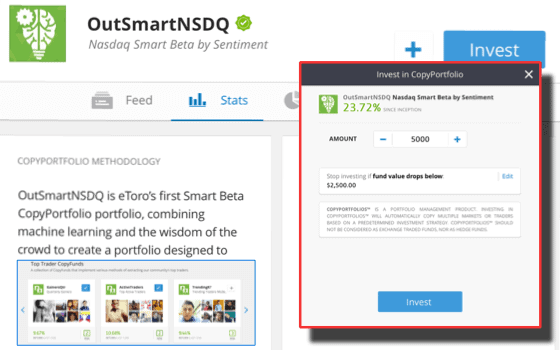

Step 4C: Place a CopyPortfolios™ trade

Choose a portfolio among dozens of investment themes. CopyPortfolios™ copies multiple portfolios and traders following that theme. We chose the NASDAQ100 theme portfolio, which has a high Risk Score of 6, as an example. You will want to choose a portfolio that holds Microsoft stock.

Review the risk profile and portfolio performance. Click on Invest. From the Invest box, choose the amount you want to invest and the stop investing limit.

How to buy Microsoft Stock on Markets.com

The official online broker of the Arsenal Football Club provides all the basic tools and education a retail trader requires. markets.com is owned by Playtech, a public company listed on the London Stock Exchange. Like its PlaytechOne one wallet – one account solution for playing on casino, poker, sports and other gaming sites – for investors, markets.com seeks to provide quick and easy access to a good range of investment products. When deciding whether to buy Microsoft shares on markets.com, consider these pros and cons.

Pros

- Day traders

- Demo account

- Low commissions

- Good quality news flow

- Good set of analytical tools

Cons

- Limited order types

- Not many deposit options

- Customer services not very effective

- Unregulated broker

Start trading Microsoft stock on Markets.com

Step 1: Register your account

You will be prompted to download the markets.com mobile app to register. After filling in basic profile information, a brief questionnaire on investment experience and knowledge, as well as income and assets, will determine your trading level and leverage. 1:30 is the leverage for the average retail investor. So with a $500 deposit, you can trade up to $15,000.

Step 2: Fund your account

If depositing by credit card, you will need to first have it verified. Click on Verify Credit Card on the My Account Page.

Step 3: Verify your identity

Attach and submit proof of identity and a utility bill for verification. Residents of the USA, Canada, Australia, Hong Kong, Japan and some other countries are restricted.

Step 4: Trade Microsoft stock

On Markets.com, you can choose to invest in Microsoft shares, or a wide range of ETFs and indexes with exposure to major technology stocks. Other securities include forex, cryptocurrencies (a handful of majors), bonds, blends, and grey markets in Uber and Lyft ahead of their IPOs. Trending Now displays a list of top moving stocks.

The Microsoft stock profile provides basic stock price charting information and a market sentiment indicator. Place the trade by choosing the Buy or Sell button.

How to Buy/Sell Microsoft CFD Stock on Plus500

Novice retail traders may find this platform lacks the trading interface, research tools and education they depend on for general guidance. The experienced trader with their own tools, stock data and news will be at home with the simple, intuitive interface and over 100 technical indicators. Traders who qualify for a professional account (with a minimum portfolio value of €500k) can raise their leverage levels, for example, from 1:5 to 1:20 for stock trades. When deciding whether to trade Microsoft CFD shares on Plus500, consider these pros and cons.

Pros

- FCA regulated

- Listed on the LSE

- Easy to use platform

- Great mobile platform

- High order volume

Cons

- Experienced traders only (no fundamental data)

- Only CFD trading

- High financing rates

- No scalping allowed

Start trading Microsoft CFD stock on Plus500

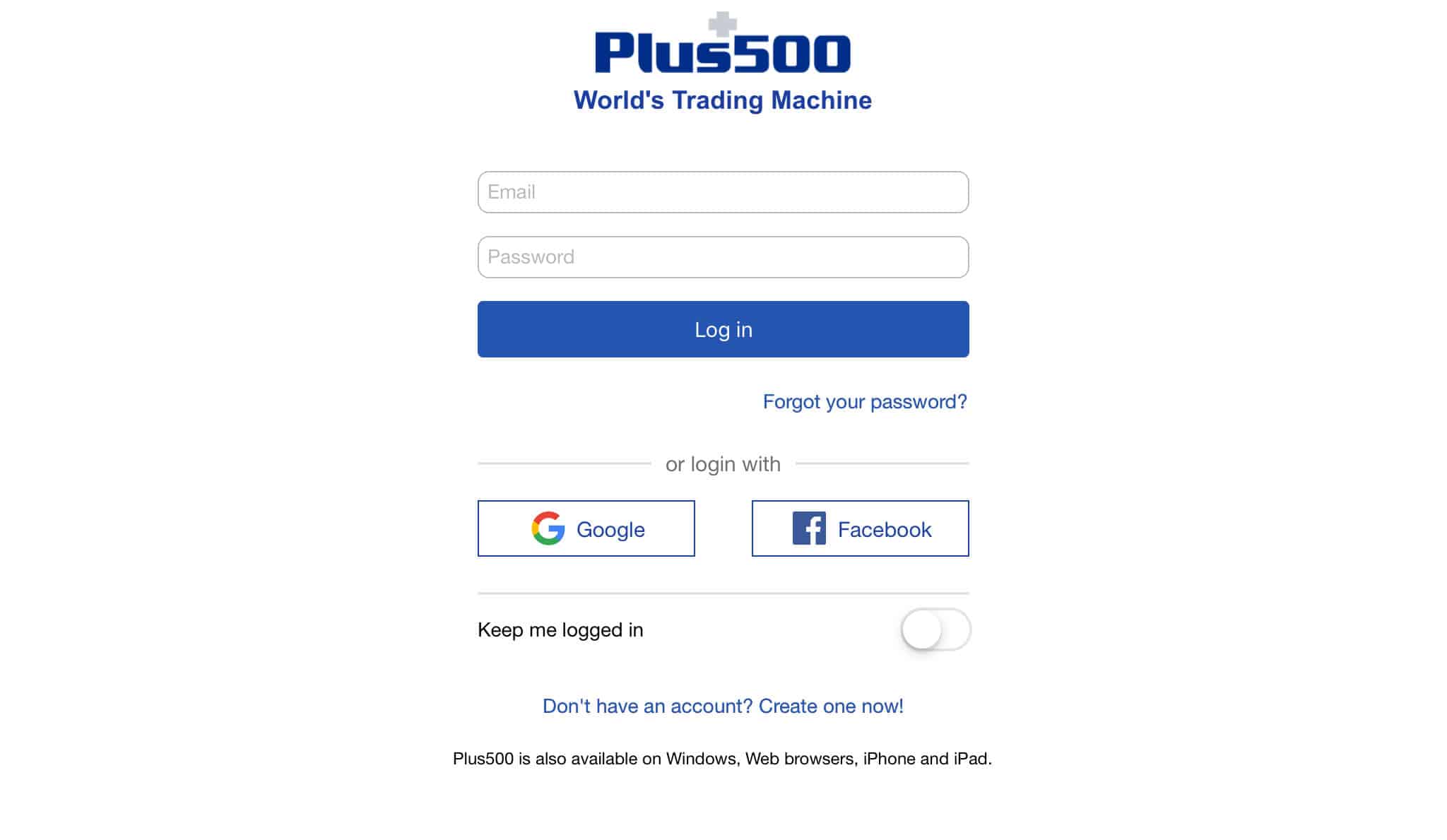

Step 1: Register your account

Firstly, click here to join Plus500. You will be prompted to download the Plus500.com mobile app to register. Select between a Demo and Real Money account. After filling in basic personal information, you will gain access to the unlimited demo account. Before you can trade Microsoft CFD stock, you will be prompted to answer a few questions to establish your investor risk profile.

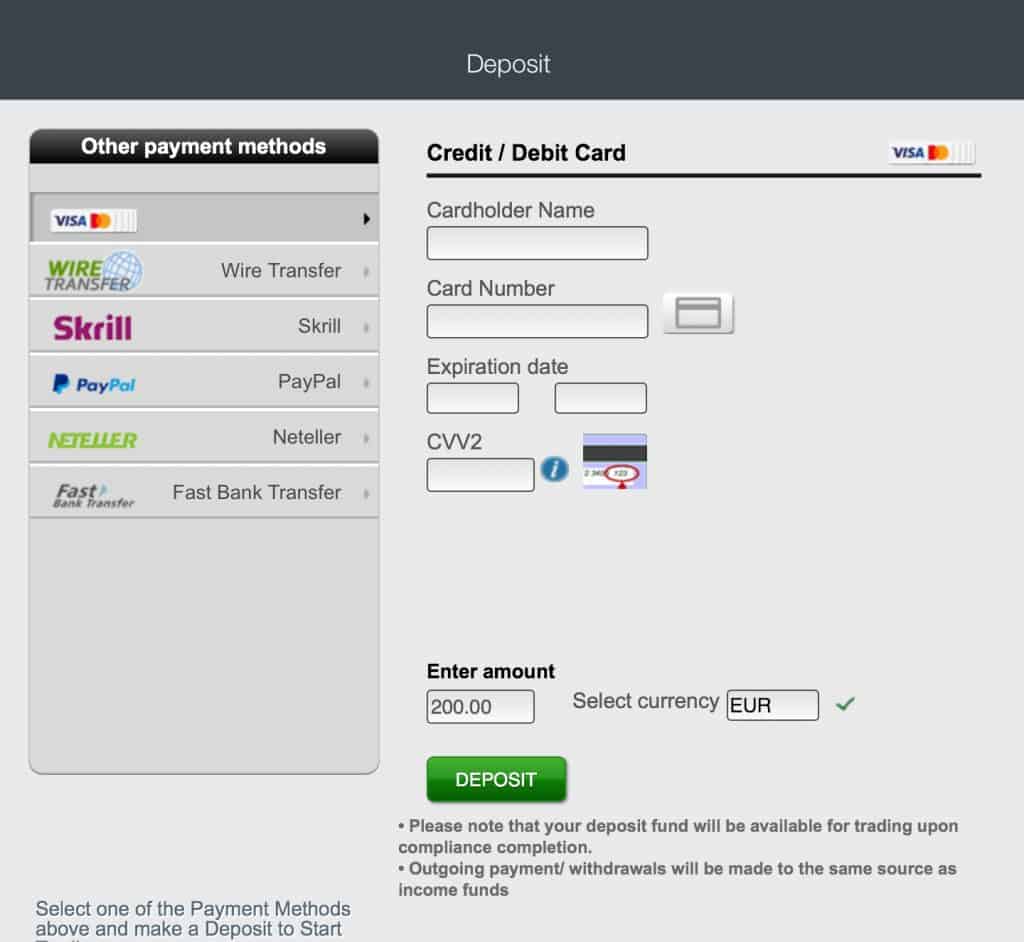

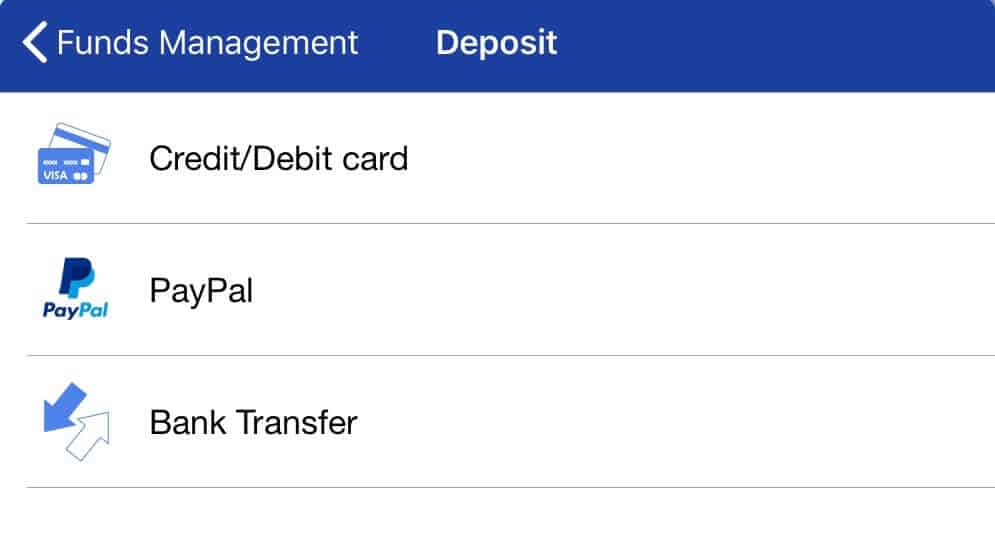

Step 2: Fund your account

When you are ready to trade with real money, fund your account. Three payment options are provided. You may be asked to verify your payment method.

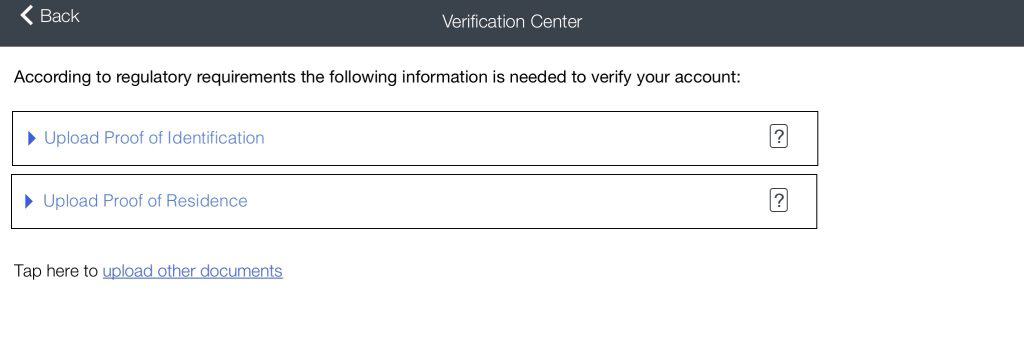

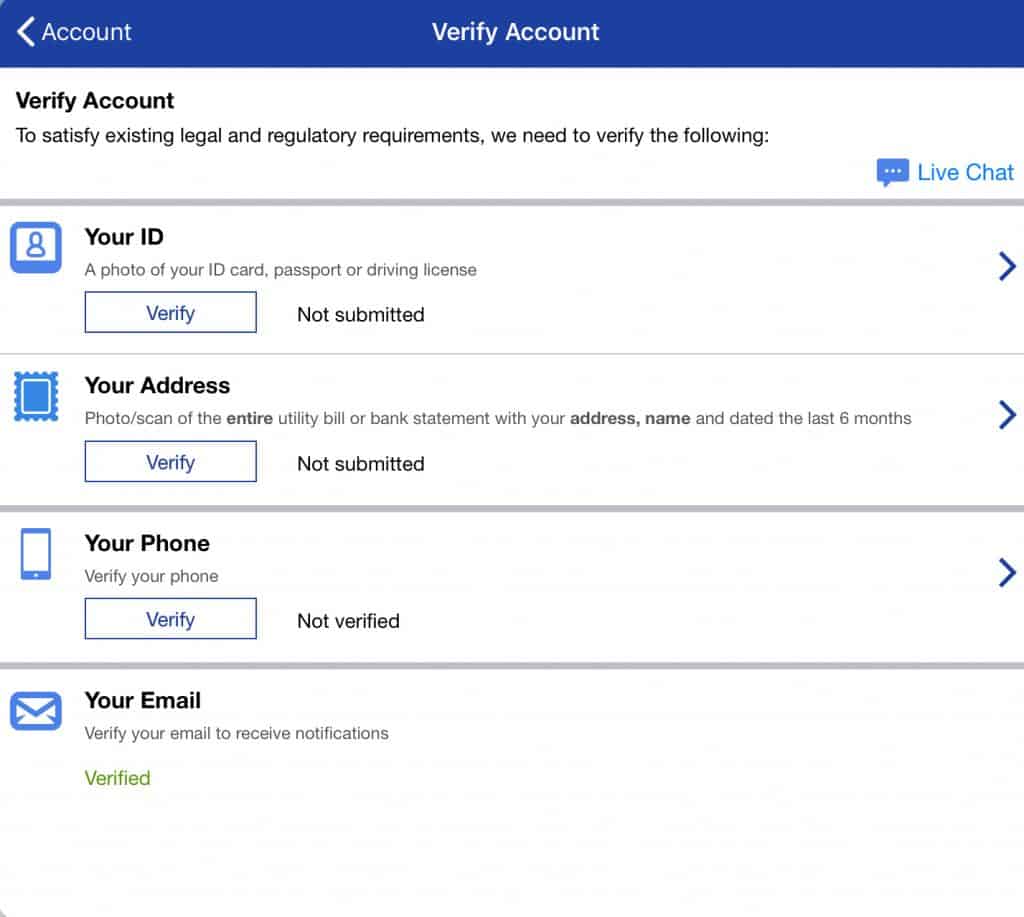

Step 3: Verify your identity

Attach and submit proof of identity for verification.

Step 4: Trade Microsoft CFD stock

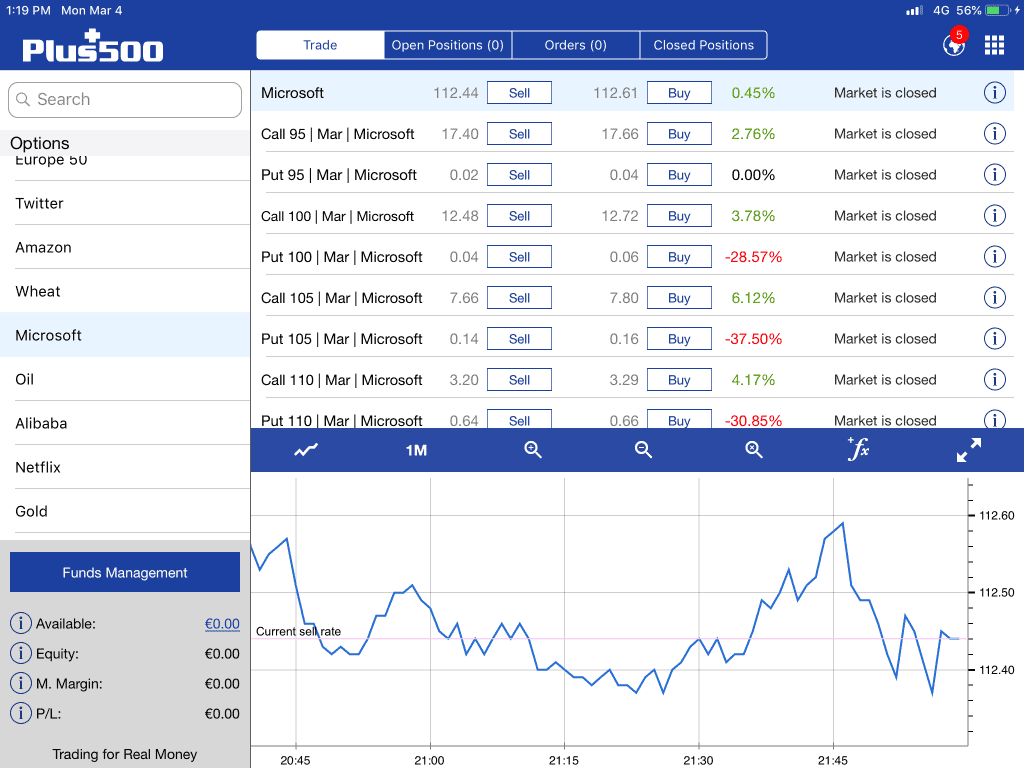

Plus500 offers a wide variety of CFDs on investment instruments, including stocks, ETFs, indexes, forex and cryptocurrencies. Options are also available for the advanced investor. Query Microsoft and the price quotes for the stock, as well as put and call options, appear on the screen.

All stock information and the Buy/Sell commands are displayed on the general stock page for the serious trader who wants to execute quickly. The bottom half of the page displays the price chart and provides access to a broad selection of technical analysis indicators.

80.5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the risk of losing your money.

A Brief Overview of the History of Microsoft

In 1975, two former schoolmates and programming enthusiasts Bill Gates and Paul Allen started Microsoft to develop and sell software programming tools. In 1980, Microsoft licensed a software program called 86-DOS to IBM. In 1981, IBM introduced its first PC running a program called MS-DOS licensed from Microsoft. Presciently, Microsoft negotiated a non-exclusive license with IBM. This agreement allowed the software maker to sell the software to other computer makers and spawn the PC clone industry. A very competitive market for the PC pushed prices down, making the PC affordable to every household. So when Microsoft introduced its graphical operating system Windows in 1985, over 100 million personal computers were already running MS-DOS. In 1998, Microsoft began producing Windows for enterprise servers. CSR suite Dynamics 365 followed.

In 2018, Windows still controlled just under 90 percent of the OS market. Microsoft Office introduced in 1998 has become the leading productivity suite on consumer and enterprise computing devices. The Azure cloud computing platform, launched in 2008, is the market leader and makes up almost one-third of revenues. Microsoft is now upgrading its business productivity software with IoT, AI, and mixed reality capabilities. Gates, the man who has continually boosted the world’s productivity, sees virtual reality as a way of doing “far more than would be practical in the real world.” In 2008, Gates resigned as Microsoft CEO and was replaced by Steve Ballmer and in 2013 current CEO Satya Nadella

The outlook for Microsoft’s mixed reality business world over the next five years is bright. Analysts are forecasting revenue growth of around 12 percent and earnings growth of 14 percent.

2019 – A mixed reality for business

The median outlook for Microsoft stock in 2019 is $125 with an estimate of $160 on the high end and $76 on the low end. This year, Microsoft is rolling out a number of AI and mixed reality features for its business applications. Dynamics 365 Product Visualize will provide customers with a 3-D immersive evaluation experience before they buy a product. By April, the Virtual Agent for Customer Service will be available. The $3,500 HoloLens is available by pre-orders. Toyota, Virgin Airlines and Exxon Mobile are among the many early AI adopters already using the technology in manufacturing, customer service, marketing, and many other areas.

2020 – Collaboration on the cloud

Microsoft’s recent purchase of GitHub, the leading collaboration site for developers, should be a big boost to Visual Studio. Among its 31 million accounts, developers for half the Fortune 100 are members. Microsoft has accelerated its stock buyback program to offset any stock price decline owing to the GitHub stock deal. In hardware, the end of the Intel chip shortage behind the increase in Surface costs will improve profits. Median growth is forecasted for MSFT stock.

2021 – More games

The AI infusion in Office Commercial, Dynamics and LinkedIn will boost growth as Microsoft clients start to discover more innovative uses and Microsoft introduces new upgrades. In gaming, two studios purchased in 2018 will be producing new games and increased revenues per users. Tencent stock price is slowly rising as it acquires more of Microsoft’s competitors, but if the game giant does not execute well, Microsoft’s foes could be obliterated or lost in China’s game land. Median-to-high growth is forecasted for MSFT stock.

2022 – People productivity

Human-machine collaboration does not mean machines are taking over the business world. As Microsoft’s $26.2 billion acquisition of LinkedIn in 2016 grows revenues by 30 percent, the social media platform for business is investing more in people-driven processes. Following the $400 million acquisition of Glint in 2018, new talent recruitment, engagement and training tools are being introduced. Median growth is forecasted for MSFT stock.

2023 – More AI growth

Ninety two percent of business leaders recognize the importance of AI and forecast their revenues to grow by 15–30 percent from AI adoption, according to a Microsoft survey. As a leader in business productivity tools, Microsoft’s businesses fully powered by AI can be expected to grow accordingly over this forecast period. Median growth is forecasted for MSFT stock.

Conclusion

So, should you buy stocks in Microsoft? We believe Microsoft is currently introducing its most compelling productivity products to help companies transform into digital businesses. Considering the enthusiastic response of business to Microsoft’s AI-run world, it could be a good time to buy Microsoft shares.

If you’re not sure if you want to get into PC stocks why not try vehicles, check how to buy Tesla Stocks.

When you are ready to buy stock, we recommend doing so via a regulated online broker such as eToro (check out our comprehensive eToro review here) if you’re a UK customer, and Ally Invest for U.S. customers.

FAQs

In 1996, Bill Gates owned a 24 percent stake in Microsoft. Over the years, in addition to an annual donation of 80,000 shares, the Microsoft founder has made $25.7 billion in share donations. By 2017, his ownership in Microsoft was reduced to a 1.3 percent share. Steve Ballmer and CEO Satya Nadella are the top two shareholders. Institutional investors hold a 72% shares in the company.

HoloLens 2 is a headset that creates an immersive 3D mixed reality experience. When integrated with the cloud and AI services, enterprises can gain deeper insights into business solutions. The recent announcement that the Epic Games Unreal Engine 4 game development tools will be supported by the HoloLens was welcome news to gamers.

You can buy Microsoft stock from online stockbrokers. eToro and Plus500 are examples of online broker platforms where traders buy and sell Microsoft shares. After signing up online, type in the MSFT ticker, place your order and you will become an owner of Microsoft shares. Is Bill Gates the largest shareholder in Microsoft?

What is HoloLens 2?

Where and how can you buy Microsoft stock?

Comments are closed.