If you’re wondering which businesses are the biggest Coronavirus winners, names like Netflix, Peloton and Amazon are probably among the first that spring to mind. But arguably, it’s another household name that tops the table of pandemic-proof businesses: Walmart. So, is now a good time to buy Walmart stock?

Walmart’s May 19 Q1 earnings report exceeded expectations, not only confirming that the US retail behemoth had benefitted from the rush to stockpile groceries, but also showing that Walmart is leveraging e-commerce more effectively than many of its rivals.

If you’re thinking of invest in Walmart, this guide will explain how to buy Walmart stock, take a look at the best stockbrokers and consider the company’s prospects going forward.

Where to Buy Walmart Stock

If you want to invest in Walmart, start by creating an account with one of our recommended online stockbrokers. If you’re outside the United States, eToro is our number one stockbroker. If you’re inside the US or Canada, we advise you go with Stash Invest.

1. eToro – Market Leading Broker Built on Social Trading Innovation

eToro is one of the world's leading online stockbrokers and is famous for its social trading platform that allows you to engage with other users. There's also the CopyTrader tool, which allows you to instantly copy the portfolios and future traders of top investors with the click of a button.

You can both buy Walmart stock and trade CFDs on eToro. If you go for the latter option, you can trade stocks with leverage of up to 1:5.

There are more than 800 stocks in total on the platform, and the pricing is also very competitive, with no commission or stamp duty on stock trading. The spreads are also tight, and there's a flat $5 withdrawal fee.

You can get started on eToro with a $200 deposit, or you can trial the platform with the $100,000 demo account. There's a range of payment methods accepted, including PayPal.

eToro is regulated by the FCA, ASIC and CySEC, so it's one of the most secure platforms around. If you want to buy Walmart stock on your mobile, you can download the eToro app for iPhone and Android devices.

- 800+ stocks to buy outright or trade as CFDs

- Beginner-friendly stock trading platform

- 0% commission on stock trading

- $5,000 account minimum for CopyPortfolios

Should I Buy Walmart Stock? Points to Consider

It’s always best to do your research before you buy Walmart stock or other retail assets like Tesco stock. We always recommend taking a closer look at the company fundamentals and researching historic price movements and forecasts before you invest money.

Walmart business model and share price history

While it may seem in poor taste to suggest that Walmart has benefitted from the COVID-19 pandemic, there is certainly a prevailing impression that the world’s biggest bricks-and-mortar retail company has fared well during lockdown due the surge in grocery stockpiling.

Such an impression isn’t inaccurate, but it feels like a simplified explanation of the retail giant’s excellent first-quarter results. Walmart’s success during the pandemic owes a lot to operational building blocks that were put in place long before the Coronavirus struck.

This includes its e-commerce operation, which was up to the task of handling a huge surge of activity. Indeed, the digital sales channel rose 74% in the first quarter as demand for home delivery and in-store pickup exploded.

Overall revenue was up 8.6%, hitting $134.6 billion, a figure that beat expectations and helped to absorb considerable Coronavirus-related costs, including $755 million in cash bonuses as well as sanitation and safety costs.

Operating profit was $5.2 billion, up 5.6% year over year, and adjusted earnings per share rose from $1.13 to $1.18 in the same period.

Walmart stock dividend information

Walmart pays out 43.81% of its earnings out as a dividend, which amounts to an annual dividend of $2.16 per share with a dividend yield of 1.73%. Walmart’s dividend has increased by an average of 1.92% each year.

Walmart stock forecast and prediction

Walmart’s median 12-month target price according to CNN – based on 32 analyst forecasts – is $137.50, with a low target of $100.00 and a high target of $150.00. The median target represents a 10.01% increase on the current price of $124.99.

MarketBeat’s analyst ratings are marginally less optimistic, reporting a median target of $132.09 with a consensus rating of Buy.

How to Buy Walmart Stock on eToro

It’s quick and easy to invest in Walmart stock at our recommended broker, eToro. Once you’ve registered and deposited into your broker account, follow these simple steps to buy WMT stock.

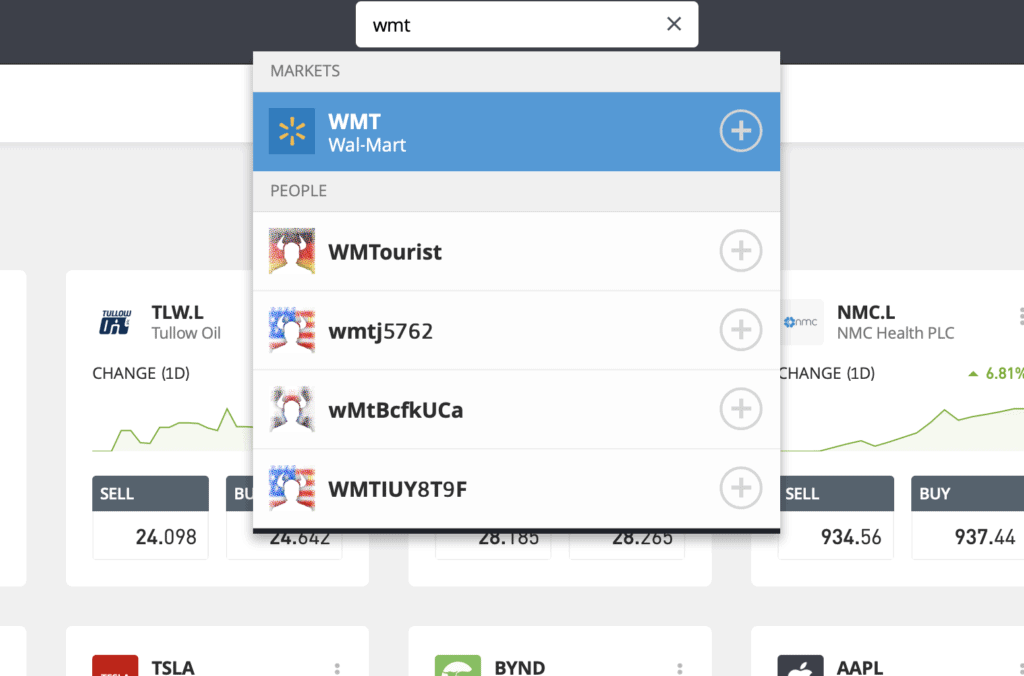

Step 1: Search for Walmart (WMT) Stock

Look up Walmart by typing the ticker symbol WMT into the search box.

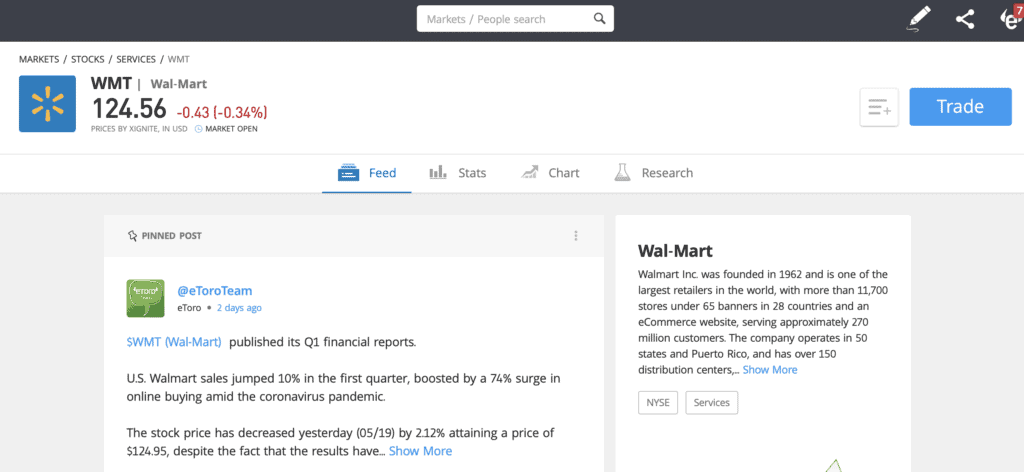

Step 2: Click on trade

Click Trade in the top right corner of the Walmart page.

Step 3: Specify ‘Buy’

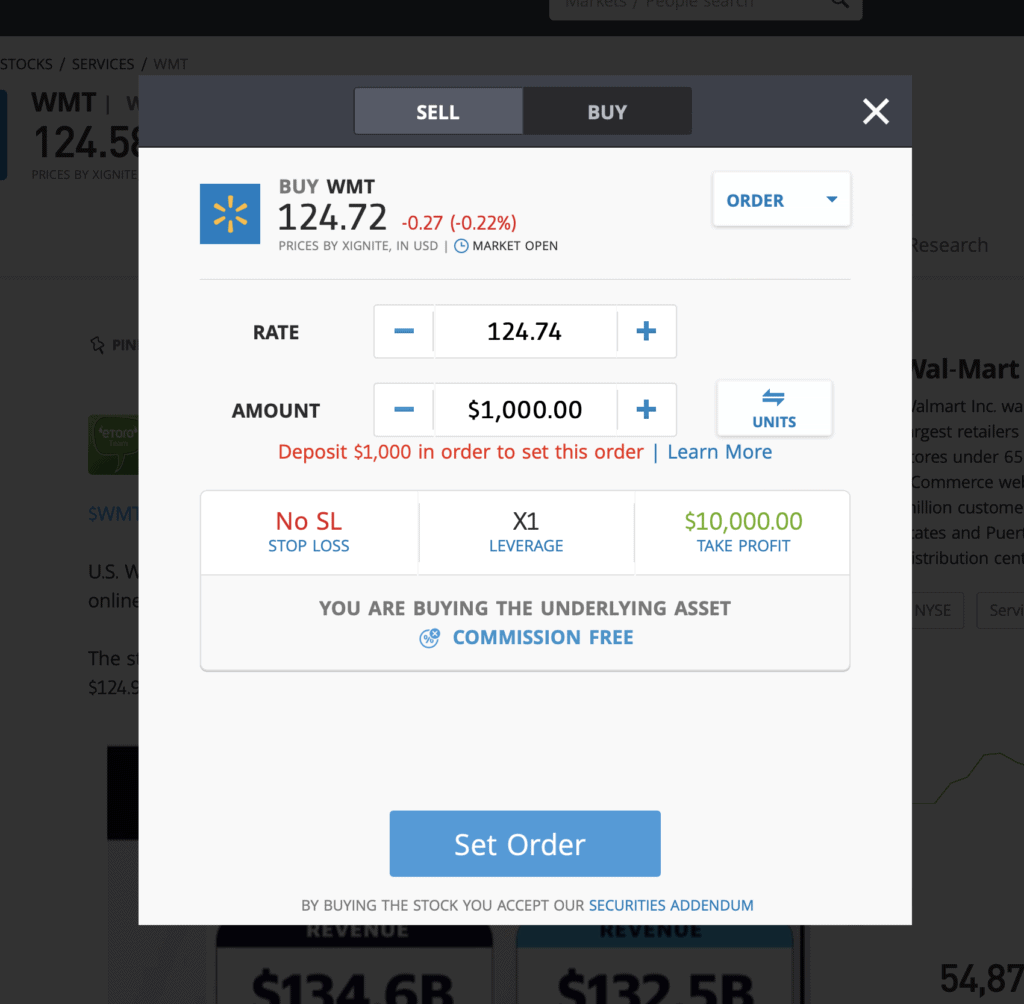

If you want to purchase the underlying asset, specify ‘Buy’ on the top tab, change the leverage to X1 and proceed to set your order. To trade WMT CFDs, set your leverage amount, Stop loss and Take profit order limits, then click ‘Set Order’.

Investing in Walmart Stock – Final Thoughts

Walmart has confirmed itself to be the safest retail stock going in recent months, riding through the pandemic and bolstering its position by absorbing costs more effectively than any of its peers, including Amazon. To an extent, this confirms what we already know – that Walmart does well in recessions – but COVID-19 has thrown up fresh challenges and the retail giant has shown itself to be infrastructurally flexible enough to handle them.

On the face of it, discontinuing Jet.com, the e-commerce site it acquired in 2016 for $3.3 billion, might look like a bad bit of business. But it seems that Walmart effectively leveraged the acquisition to develop its own, once ailing, e-commerce business, to the extent that it’s now second only to Amazon.

If you want to buy Walmart stock today, we recommend registering with one of our recommended stockbrokers. eToro is our pick broker if you’re outside the US, while we recommend US traders sign up to Stash Invest.

FAQs

Should I buy Walmart stock or wait?

Walmart excellent performance during the Coronavirus crisis is reflected in its share price ($124.99 at the time of writing) – investors won’t be getting WMT stock at a bargain price. Nonetheless Walmart looks like such a solid bet right now that most analysts rate it as a sensible buy, especially with a recession looming.

What are the fees when buying Walmart stock?

Zero-commission stock and ETF trading is available to European clients who trade on eToro. This means that eToro doesn't add a dealing charge or any administrative fees when you buy WMT stock.

Is there a Walmart stock price prediction?

Analysts estimate a median 12-month forecast of $137.50, which represents a 10.01% increase on the current price of $124.99.

What does the Walmart stock dividend pay?

Walmart pays an annual dividend of $2.16 per share with a dividend yield of 1.73%