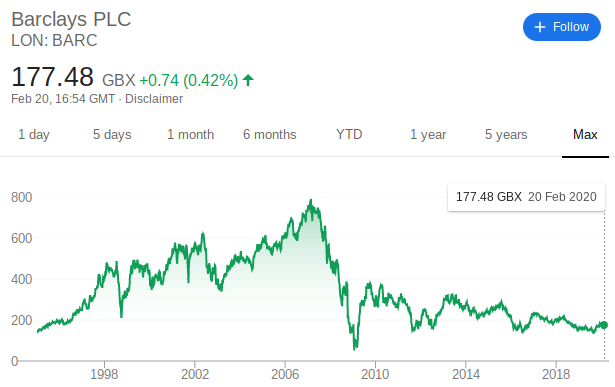

Barclays PLC is a multinational financial institution with its headquarters in London. Listed on the London Stock Exchange under the ticker symbol BARC, shares are currently priced at 181.32p. However, this is just a fraction of what the company was worth before the financial crisis of 2008, when shares were valued at 749p. With that said, if you feel confident in the future direction of Barclays, you can still buy them at a heavily discounted price.

Barclays PLC is a multinational financial institution with its headquarters in London. Listed on the London Stock Exchange under the ticker symbol BARC, shares are currently priced at 181.32p. However, this is just a fraction of what the company was worth before the financial crisis of 2008, when shares were valued at 749p. With that said, if you feel confident in the future direction of Barclays, you can still buy them at a heavily discounted price.

By reading our guide on how to buy Barclays Stocks, we’ll show you how you can make an investment today, as well as the pros and cons of buying BARC shares.

Best U.S. Platform to Buy Barclays Stocks

Interested in buying Barclays stocks today, but based in the US? There are heaps of US-friendly stockbrokers that allow you to buy UK shares at the click of a button. With that said, our top broker pick of 2020 is that of Stash Invest. Through the platform’s stock Trading apps, you can invest from just $5 across thousands of equities.

Best Platform to Buy Barclays Shares outside the U.S

If you’re not based in the US and wish to buy shares in Barclays, we would suggest using Webull. The broker is regulated by the SEC, and it works in many countries. Plus it doesn’t charge any trading fees or commissions.

How to Buy Barclays Stocks in the U.S.

If you’re a newbie and want a step-by-step guide on how to buy stocks today, you’re in luck. We’ve outlined the entire process of opening an account with Stash Invest, depositing funds, and making an investment.

Step 1: Create your Stash Invest account

To get the investment process underway, head over to the Stash Invest website and elect to open an account.

Step 2: Fill out Your Profile

As is the case with all US stockbrokers, you will need to fill out an account registration form. This will initially ask you to enter some personal information, such as your first and last name, home address, nationality, and date of birth. You will also need to enter your social security number, as Stash Invest is only available for US residents.

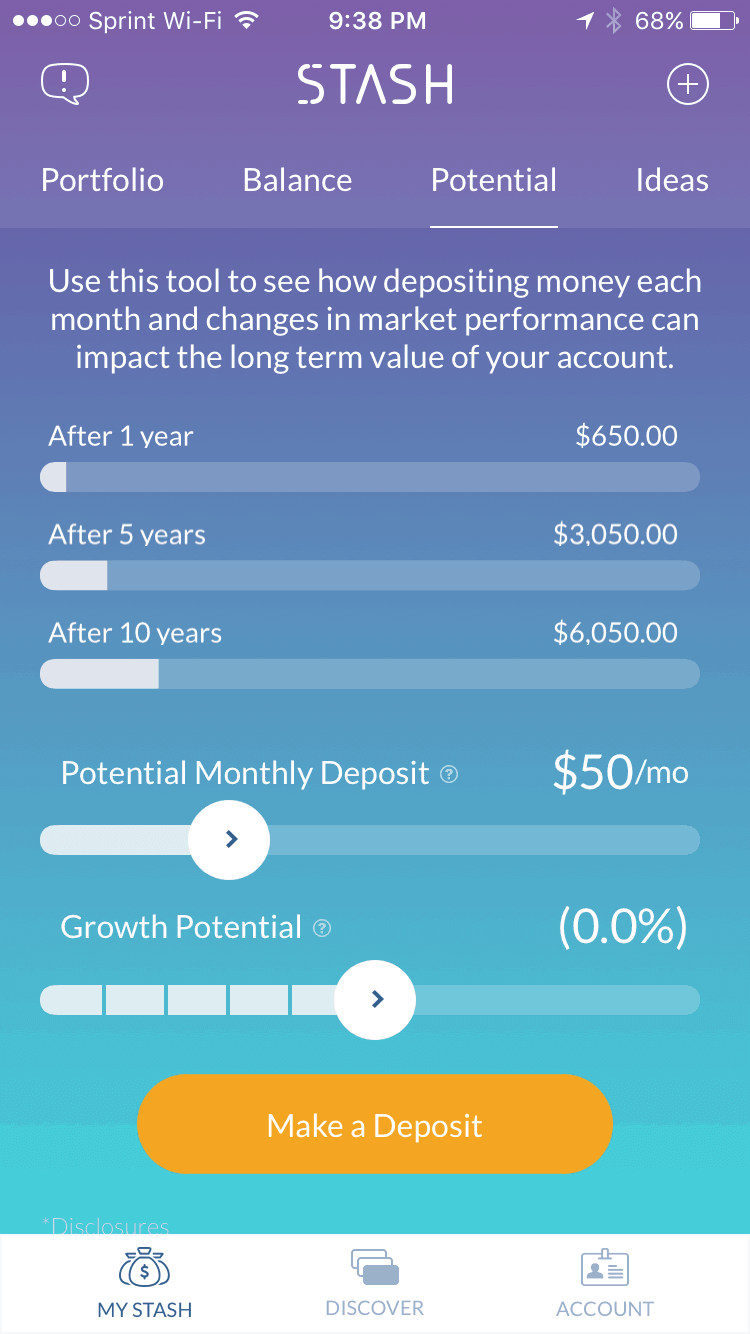

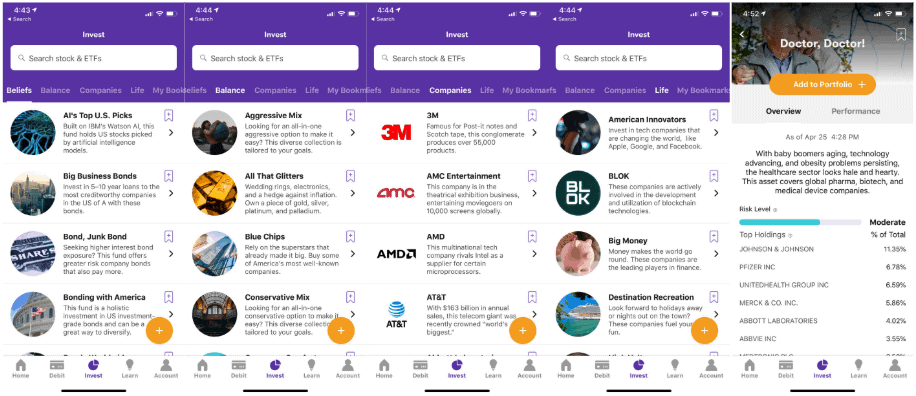

Step 3: Check Your Investment Options

If you’re a newbie trader, have you considered the merits of robo-advisors? In the case of Stash Invest, you can allow the underlying AI algorithm to buy and sell assets on your behalf. If this sounds like something you’re interested in, you need to let Stash know what your trading preferences are. This includes whether you are a conservative, balanced, or high-risk investor.

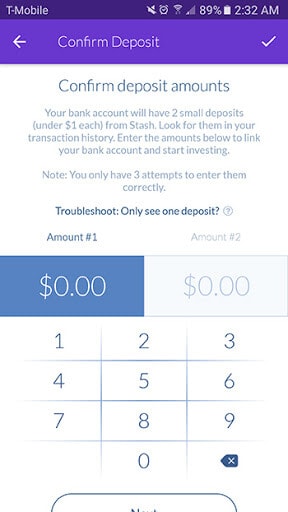

Step 4: Fund Your Account

Once you’ve selected your trading preferences, you will then need to deposit some funds. Stash Invest will ask you to link your US bank account, which then allows you to deposit funds at the click of a button. The platform only asks for a minimum deposit of $5, which is perfect if you want to start off with super-low amounts.

Step 5: KYC & Verification

As per anti-money laundering regulations, Stash Invest will need to verify your identity. As a new-age FinTech platform, the verification process at Stash only takes a couple of minutes. Simply upload a copy of your government-issued ID (passport or driver’s license), and the system should validate the document automatically.

Step 6: Buy Barclays stocks

Once your bank account deposit has been credited, you can then head over to the Stash Invest stock trading page. You will see heaps of equities listed, and you can even break shares down by the respective stock exchange. Once you find Barclays, you will need to enter the amount that you wish to invest.

You also need to choose from a ‘market’ or ‘limit’ order. The former means that you will buy Barclays stocks at the next available price, while the latter allows you to choose your entry point. Once you complete the trade, you will own stocks in Barclays!

How to Buy Barclays Stocks Outside the U.S.

If you’re based outside of the US and you want to buy Barclays stocks in the easiest way possible, we would suggest Webull. The broker allows you to buy and sell Barclays stocks without paying any fees or commissions. Moreover, you can deposit funds with a debit/credit card, e-wallet, or bank account, without being charged any funding fees.

Here’s what you need to do to buy Barclays stocks with Webull.

Step 1: Open an Account With Webull

To get the Webull buying process underway, you will need to head over to the platform’s homepage and open an account. You will now be asked to provide some personal information. This includes your full name, home address, date of birth, and contact details. You will also need to enter your local tax number.

Webull also requires you to answer some basic questions about your historical relationship with trading. For example, you’ll need to state the types of assets that you have previously invested in, as well as the average size of your trades. Moreover, you also need to answer some questions about the risks of trading with leverage, as this is something offered by Webull.

Step 2: Verify Your Identity

Before you can deposit funds at Webull you will need to verify your identity. In most cases, you will simply be asked to upload a clear copy of your government-issued ID.

This can be either a passport or a driver’s license. Depending on where you live, Webull might accept your national ID card. You will likely be asked to upload a document that verifies your stated address. This can either be a tax statement, utility bill, or bank statement.

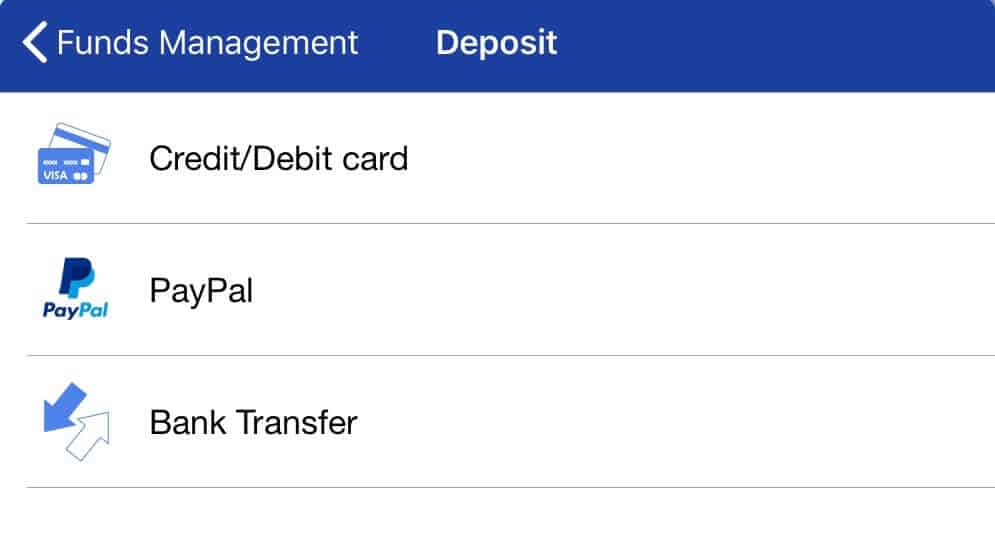

Step 3: Fund your Webull Account

As soon as Webull has verified your identity, you can then proceed to deposit some funds. The platform hosts a number of payment options. This includes debit/credit cards (Visa or MasterCard), PayPal, or a bank transfer. Take note, if you deposit via a bank transfer, it might take a few days for the funds to arrive. Otherwise, deposits at Webull are usually instant.

Step 4: Buy Barclays Stocks at Webull

As soon as your Webull account is funded, you can now proceed to buy Barclays stocks. To go straight to Barclays stock trading page, simply enter ‘BARC’ in the search box. You will then be presented with a range of investment options. Firstly, decide whether you think the price of Barclays will go up (buy order) or down (sell order). Next, enter the amount of money that you wish to invest.

By the way, you don’t need to purchase whole shares at Webull, so you can start off with smaller amounts. Finally, you need to choose your entry point. If you just want to take the next available market price, select a ‘market order’. Alternatively, a ‘limit order’ allows you to choose the price that you enter the trade.

About Barclays

Barclays PLC is a UK-based financial institution with its headquarters in London. On top of providing hundreds of high street branches for everyday retail clients, Barclays is involved in a range of other investment sectors. This includes corporate and investment banking, as well as wealth management.

While Barclays has a wide international presence, its two core markets are based in the UK and the US. The company is publically listed on the London Stock Exchange, and it is a long-standing member of the FTSE-100 index.

As is the case with all UK high street banks, Barclays is regulated by the Financial Conduct Authority (FCA). Moreover, its personal accounts – which it offers to retail clients in the UK, are backed by the Financial Services Compensation Scheme (FSCS). This means that were the bank to run into financial problems, bank account deposits would be protected up to the first £85,000.

Finally, it is also important to note that before the multi-billion dollar collapse of the Lehman Brothers in 2008, Barclays PLC attempt to rescue the bank through a $1.75 billion takeover. However, the acquisition was subsequently blocked by then UK Chancellor Alistair Darling, which ultimately paved the way for Lehman’s collapse.

Should you Invest in Barclays?

First and foremost, it is important to remember that you, and only you, should determine whether or not Barclays represents a good investment. Crucially, you should never invest on the back of somebody else’s advice.

Nevertheless, Barclays has had a turbulent time in the stock markets in recent years. Before the financial crisis of 2008, the bank had a share price of 749p. Fast forward to today, and the same shares are worth just 181.32p – amounting to a market capitalization of £30.5 billion.

This means that were you to have entered the market in 2008, and still retain possession of the shares, your overall loss would stand at around 75%. At the other end of the spectrum, you would need the value of Barclays stocks to increase by 313% to get back to its previous all-time high.

Is this likely? Well, it’s not impossible, but it would likely take a number of years before this can happen. As such, an investment into Barclays needs to be a long-term strategy.

With that said, there are both pros and cons to buying Barclay stocks. For example, its most recent earnings report posted a 2% increase in income, which was just ahead of what the markets were expecting. This was mainly a result of good results in its investment banking division. Most importantly, profits at Barclays increased by a staggering 25% to £4.4 billion – as per its most recent report.

This indicates that based on current market prices, Barclays could be a shrewd investment. However, an investment in Barclays also comes with its risks. For example, UK banks are first-in-line with the uncertainties of Brexit, meaning that a downfall in the economy would hit Barclays hard. Moreover, with Bank of England interest rates still at rock bottom levels, this is hindering the ability for Barclays to accelerate growth.

Nevertheless, below we have expanded the key pros and cons of buying Barclays shares.

Pros of Investing in Barclays

✔️Recent Barclays Earnings Report Very Positive

One of the most, if not the most important metrics to look at when assessing the viability of a stock market investment is the financials. By looking at the most recent earnings report released by Barclays, we can see that the outlook is very positive.

For example, the company saw its total income increase to £21.6 billion, representing a 2% rise. More importantly, profits before tax rose by a huge 25%.

This takes profit levels to £4.4 billion. It is also important to note that dividends went up once again, taking the year-on-year increase to 38.5%.

✔️Barclays Retains 23 Million UK Customers

Although Barclays has had a somewhat turbulent time in the stock markets since 2008, there can be no denying that the financial institution is still a hallmark bank in the UK. Recent earnings indicate that Barclays is capitalizing well on this ever-growing customer base.

Crucially, Barclays is a highly diverse bank with heaps of revenue-generating products. This includes everything from loans, credit cards, mortgages, and of course – personal accounts. It is also important to remember that the bank is growing its presence in its second core marketplace – the United States.

✔️ Barclays Continues to Reduce its Operating Costs

One of the key targets of the Barclays management team over the past few years has been to keep operating costs under control. This became evident in its most recent earnings report, with the bank cutting year-on-year operating costs to £4 billion, representing a decrease of 2%.

This has also allowed the bank to keep a tighter grip on its income ratio, which now stands at 55%. Barclays has achieved its cost-cutting targets in a number of ways. For example, the bank has reduced its branch numbers to sub-1,000. Moreover, Barclays has managed to reduce its exposure to bad loans. This fell by 14% year-on-year in its most recent financial report.

Cons of Investing in Barclays

❌ The Uncertainties of Brexit

On the one hand, the UK officially departed the European Union (EU) on January 31st, paving the way for negotiations for the eventual UK-EU trade deal. At present, it’s pretty much business as usual for financial institutions in the UK. However, it remains to be seen what the outcome of Brexit will be – especially for those involved in the transnational banking scene (such as Barclays).

A worst-case scenario for Barclays would be the UK leaving the EU without a trade deal, As a result, some commentators argue that buying shares in UK banks while the Brexit saga is still ongoing might be unwise. Instead, it might be worth waiting until negotiations have concluded before entering the market.

❌ Interest Rates for Savers are Still Rockbottom

A core pillar of any high street bank is customer deposits. This allows the bank to fund profit-generating streams like mortgages and loans, as well as the investment banking side of operations. However, with Bank of England interest rates still super-low, savers at Barclays are getting virtually no yield on their deposits.

While there isn’t much that the big banks can do about this until the Bank of England increases interest rates, customers at Barclays won’t hang around forever. Instead, they might be forced to look at other investment products on their savings. If they do, this could be highly detrimental for Barclays.

❌ The Rise of Challenger Banks Continues

Although challenger banks such as Revolut, Monzo, and Starling are still minute in comparison to established financial institutions like Barclays, more and more customers are making the transition.

This is because challenger banks offer a 360-degree service that focuses on digitalization, convenience, and speed. As such, unless Barclays joins the digital revolution and does away with slow and cumbersome paper-based processes, it could lose customers.

Conclusion

In summary, you should now have a good idea of whether or not buying Barclays stocks meets your long-term investment goals. As we have noted throughout our guide, there are both pros and cons to Barclays as an investment prospect. For example, recent earnings were better than expected, with a year-on-year profit increase of 25%. However, fears still remain present on the uncertainties of Brexit, so this is a key risk that you need to make considerations for.

With that being said, if you do want to buy Barclays stocks, we’ve shown you what you need to do to make an investment today. If you’re based in the US, we’ve pointed you in the direction of Stash Invest. If you’re a non-US resident, then we would suggest UK broker Webull.

Read more:

FAQs

By using one of the brokers we have recommended on this page, you can deposit funds with an e-wallet, debit/credit card, or bank account. .

Brokers such as Stash Invest now allow you to buy fractional shares, so you can get started with an investment of just $5.

Although Barclays is worth just a fraction of its 2008 all-time high price, its recent earnings report was very positive. As such, it's still possible to buy Barclays stocks at a discount.

If you've lost faith in Barclays, you can sell your shares at the same online broker that you used to buy them.

Yes, Barclays has a long-standing track record of paying dividends. However, if you buy Barclays stocks in the form of CFDs, you won't be entitled to any dividends. What payment methods can I use to buy Barclays stocks?

What is the minimum number of Barclays shares that I can buy online?

Is Barclays a good investment?

How do I sell my Barclays stocks?

Does Barclays pays dividends?