If you had bought 1,000 McDonald’s shares back in 1980 at $1, those 1,000 shares would now be worth a staggering $215,630. This represents a 30-year increase of more than 21,000%. If you think that the company’s fortunes are set to continue in the long-run and want to buy McDonald stocks, read our guide below.

If you had bought 1,000 McDonald’s shares back in 1980 at $1, those 1,000 shares would now be worth a staggering $215,630. This represents a 30-year increase of more than 21,000%. If you think that the company’s fortunes are set to continue in the long-run and want to buy McDonald stocks, read our guide below.

We will cover how you can buy MCD stocks today, the best platforms to do so, and whether or not Mcdonald’s represents a good investment.

Best U.S. Platform to Buy McDonald’s Stocks

Based in the US and wish to buy McDonald’s stocks? If so, we would suggest checking out Stash Invest. Not only is the platform ideal for newbies, but you can get started with an investment in McDonald’s from just $5. Moreover, fees are super-low, and the platform even offers a fully-fledged stock trading app.

Best Platform to Buy McDonald’s Shares outside the U.S

If you’re based outside of the US, we would suggest checking out Webull. The UK broker is heavily regulated and its parent company is listed on the New York Stock Exchange. Crucially, you can invest in McDonald’s without paying any fees or commissions – other than the spread.

How to Buy McDonald’s Stocks in the U.S.

Looking for a step-by-step guide on how to buy stocks today? Although there are heaps of brokers that host MCD stocks, we would suggest going with Stash Invest. Follow the guidelines outlined below to invest in McDonald’s.

Step 1: Create your Stash Invest account

First and foremost, head over to the Stash Invest website and open an account.

Step 2: Fill out your profile

You will now need to enter your personal information. This will include your full name, home address, date of birth, and contact details. You will also need to enter your social security number, so make sure you have this to hand to avoid delays.

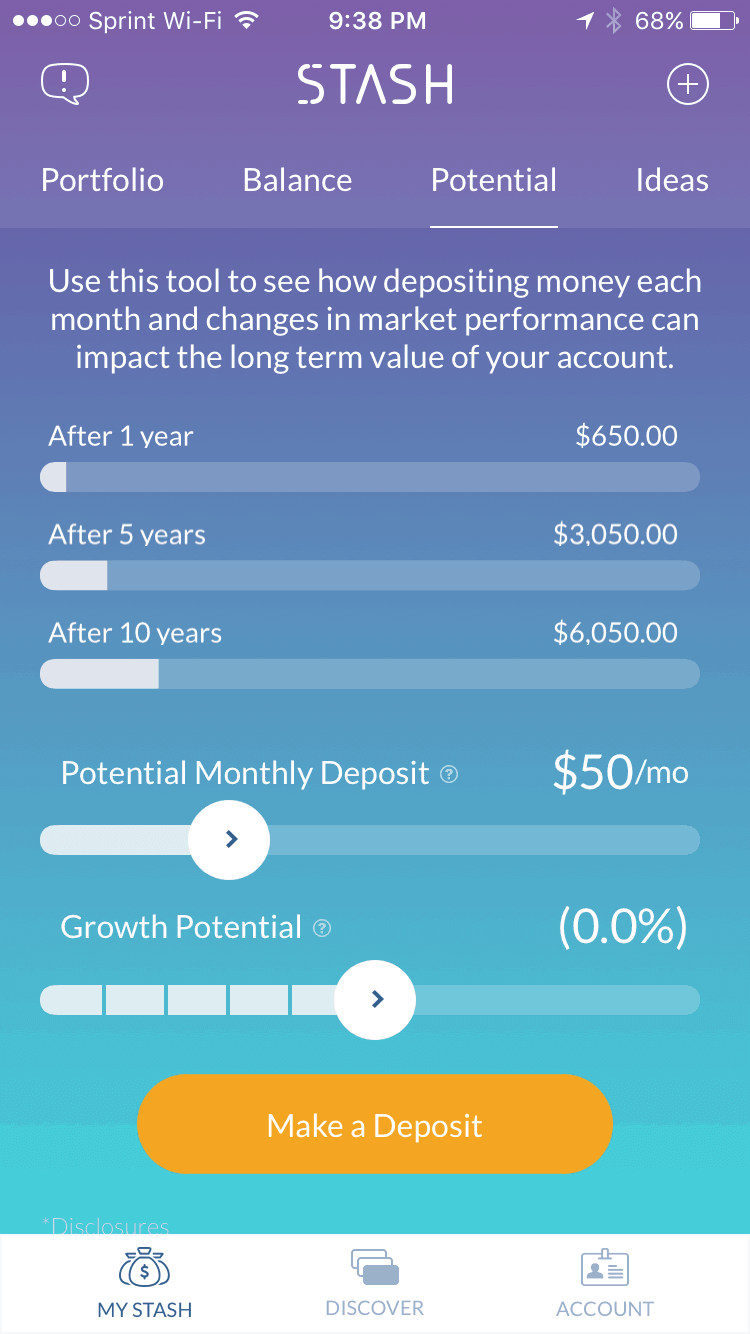

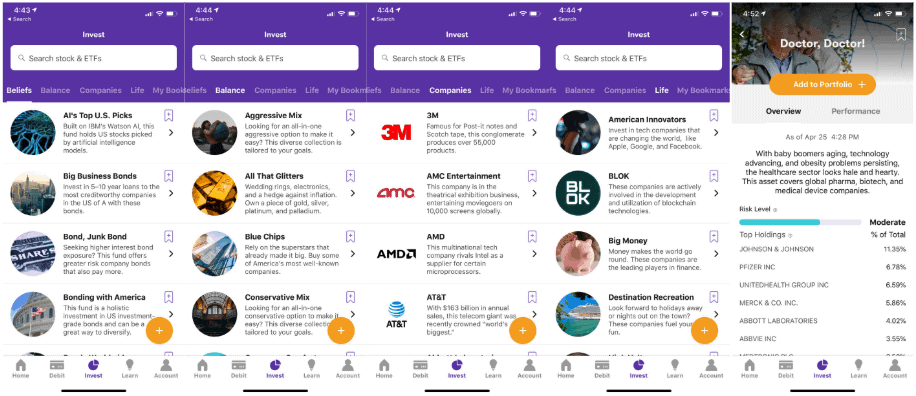

Step 3: Check Your Investment Options

Stash Invest also allows you to engage with its robo-investor services. This means that the platform can buy and sell assets on your behalf. It does so by following a strategy that mirrors your preferred risk levels. As such, choose a plan that best meets your needs.

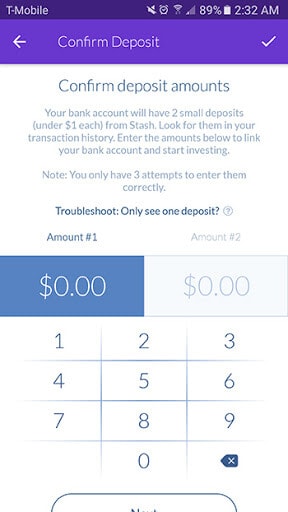

Step 4: Fund your account

You will now be required to fund your Stash Invest account. The platform allows you to link your US checking account, so you easily deposit funds at the click of a button. In most cases, it will take 2-3 days for the funds to arrive in your Stash account.

Step 5: KYC & Verification

You will then need to verify your identity. This requires you to upload a clear copy of your government-issued ID. This can either be a passport, state ID card, or driver’s license.

Step 6: Buy McDonald’s stocks

Now that your account has been verified, you can proceed to buy McDonald’s stocks. Simply search for ‘MCD’ in the search box, and enter the amount that you wish to buy. You will also need to decide whether you want to opt for a ‘limit’ order or a ‘market’ order. The latter will open your trade at the next available price. The former allows you to choose which price you want the order executed at. To complete the process, click on the ‘BUY’ button.

How to Buy McDonald’s Stocks Outside the U.S.

If you’re based outside of the US, we would suggest using Webull to invest in McDonald’s. The broker is regulated by the UK’s FCA, and it supports heaps of payment methods. Moreover, Webull does not charge any trading fees or commissions.

With that said, we’ve outlined the step-by-step process you will need to take with Webull if you want to buy McDonald’s stocks.

Step 1: Open an Account With Webull

You will first need to head over to the Webull and open an account. As is the case with all SEC-regulated brokers, you will need to provide a range of personal information. This will include your first and last name, date of birth, home address, nationality, and contact details.

As Webull offers highly sophisticated financial instruments, you will be required to answer some questions about your prior trading experience. This includes the types of assets you have previously bought and sold, whether you’ve ever engaged with leverage, and how much you typically invest per trade.

Step 2: Verify Your Identity

In order to remain compliant with the SEC, Webull is required to identify all clients that use its platform. Don’t worry, the KYC (Know Your Customer) process is super-easy and rarely takes more than a few minutes. All you need to do is upload a copy of your passport and driver’s license, and the Webull system should be able to verify it automatically.

Depending on where you are based, you might also be asked to upload a proof of address. This will need to be a document like a utility bill or bank statement.

Step 3: Fund your Webull Account

Once your identity has been verified, you will then need to make a deposit. Webull accepts heaps of payment methods, so choose one that best meets your personal preference. This includes a debit/credit card, PayPal, and a standard bank transfer.

Both PayPal and debit/credit cards are usually credited to your account instantly. Bank transfers can take 3-5 working days.

Step 4: Buy McDonald’s Stocks at Webull

You are now ready to buy McDonald’s stocks at Webull. First, enter ‘MCD’ into the search box at the top of the screen. This will take you to the main stock trading page of McDonald’s stocks. Next, decide whether you want to go long (buy) or short (sell) on the stocks, and how much you wish to invest.

You then need to decide what entry point you want the trade executed at. If you’re happy to take the next available price, go for a market order. If you want to stipulate your entry point, go for a limit order. Finally, click on ‘Buy’ or ‘Sell’ to complete the investment.

About McDonald’s

McDonald’s is one of the largest and most recognized consumer brands globally. Apart from a very small number of nation-states, you’ll be hard-pressed not to find a McDonald’s store within distance. As such, the company is now a multi-billion dollar organization with hundreds of thousands of employed staff members.

Interestingly, the vast majority of McDonald’s stores are actually franchise-owned. This means that store owners are required to pay a significant fee to McDonald’s to open a shop, as well as an annual fee and a share of the profits. This subsequently allows McDonald’s to mitigate the risks of expanding into new regions.

In terms of buying stocks in the company, McDonald’s is listed on the New York Stock Exchange, so it’s super easy to make an investment. Shareholders have been rewarded handsomely since the company went public. For example, had you bought 1,000 shares back in 1980, it would have cost you just $1,000 ($1 per share).

Fast forward to 2020 and those very same 1,000 shares are now worth a staggering $215,630 ($215.63 per share). This represents a 30-year increase of more than 21,000%, which is huge.

Should you Invest in McDonald’s?

It’s difficult not to make a case for McDonald’s. Under the management of CEO Steve Easterbrook, the company has gone from strength-to-strength in recent years. Much of this centres on a long-term plan to get McDonald’s into the age of digitalization. For example, heaps of resources have been dedicated to the company’s growing home delivery service.

This was something that MCD customers have been craving for a long time now, so it’s notable that management are listening to consumer demands. Similarly, the company is also expanding its exposure to artificial intelligence.

This is with the view of understanding customer wants and needs, subsequently allowing the fast food chain to personalize its products. Crucially, McDonald’s is also going through a store revamping project.

As such, restaurants – especially those in the US, are much more appealing to those that are otherwise put off by a fast food environment. This has subsequently transitioned into an MCD stock price that is on an upward trajectory.

As such, investors have been rewarded handsomely in recent years, much of which is down to the effective long-term strategy being implemented by management. However, this isn’t to say that its stock price will continue to go up indefinitely.

On the contrary, you need to have a firm grasp of both the pros and cons of making an investment, which we’ve outlined below.

Pros of Investing in McDonald’s

✔️Strong Dividend History and Yields

Make no mistake about it, McDonald’s is one of the largest and most successful US brands globally. Regardless of where you go, you can be all but certain that you’ll come across an MCD store.

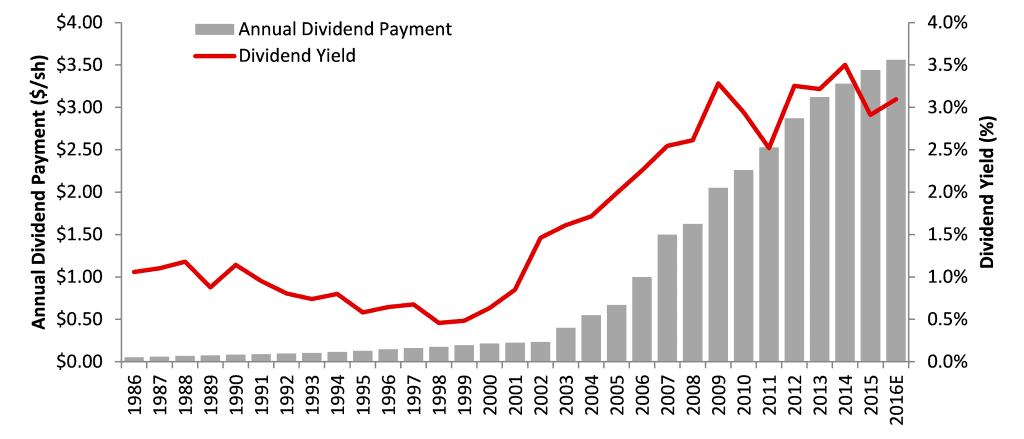

With that said, it comes as no surprise to learn that McDonald’s is a member of the very exclusive Dividend Aristocrats club.

McDonald’s dividend growth history is very impressive to say the least.

The company has raised its dividend each and every year since paying its first dividend in 1976. Today, McDonald’s dividends are paid on a quarterly basis and are averaging a solid 2.3% yield. This is great for those who wish to invest in a solid income-paying blue-chip stock.

✔️Global Strategy Continues to see Results

McDonald’s recently reported that it had posted its 17th consecutive quarter in which comparable global sales grew. In Layman Term’s, this means that customers are on the rise outside of its core US marketplace.

One of the key reasons for this is that the fast food chain targets both ends of the budget spectrum. For example, it’s popular Dollar Menu is sought-after by those of a tight budget. Those with a slightly more expensive appetite are tailored for via the Signature Menu.

✔️ Home Delivery Rollout is in Full Swing

In a time not so long ago, customers were left somewhat frustrated at not being able to order McDonald’s from the comfort of their home. Fast forward to 2020 this is now a reality. Customers simply need to download and install the MCD Mobile app, and they can have food delivered directly to their home.

Moreover, there is no need to worry about having cash t hand, as customers can pre-pay for their food via a debit/credit card. While the home delivery service is not yet available everywhere, the rollout is working its way through more and more locations.

Cons of Investing in McDonald’s

❌ Recent Profits Were Slightly Below Expectations

Earnings reported by McDonald’s in October 2019 were somewhat below par. Although profits still increased by 0.5% in comparison to the prior quarter, this was still below market expectations. This amounted to $2.11 per share, which was just under its $2.20 target.

Moreover, although revenues increased by 1%, this was once again just below expectations. The good news is that McDonald’s increased its prices by 9% over the prior quarter, subsequently allowing it to retain its same-store growth levels.

❌ McDonald’s is Facing Increased Cost Pressures

A further concern that some Wall Street commentators are pointing towards is that MCD is experiencing increased pressures on its operating costs. At the forefront of this ever-growing currency fluctuations across its global reach. A weak US dollar does not help, either.

Moreover, a dedication to increased wages has also increased the company’s cost pressures. At the same time, McDonald’s is also investing vast resources into its artificial intelligence and store revamp projects, which is proving highly successful.

❌ McDonald’s Faces Stiff Competition From Healthier Alternatives

In a modern world that is seeing people place a much stronger focus on healthier diets, this is having a direct impact on McDonald’s. Although the company has since increased its healthy product range through a number of salads and fresh juices, this doesn’t seem to be doing to trick for health-conscious consumers. Ultimately, as much as the chain strives to rid itself of an unhealthy food option, this is yet to see any success.

Conclusion

In conclusion, you should now have a firm grasp of what you need to do to buy McDonald’s today. Whether you’re based in the US or overseas, the process is super-easy.

In fact, opening an account, depositing funds, and subsequently buying MCD stocks should take you no longer than 10-15 minutes. With that being said, you still need to perform your own research on whether or not you think MCD represents a good long-term investment.

On the one hand, the company has been on an upward trajectory for some time now. It is seeing excellent returns on its investments in-home delivery rollouts, as well as its focus on digitization through artificial intelligence. Moreover, customer numbers are on the increase, partly because of its store revamp efforts, as well as its ever-growing menu to suit all budgets.

However, McDonald’s stocks are not 100% foolproof. For example, the company’s recent earnings report was slightly below-par, especially in the revenue department.

Moreover, the fast-food chain faces increased competition from healthier options. Nevertheless, if you do want to proceed with an investment in McDonald’s today, we would suggest going with regulated platform Stash Invest if you’re located in the US, or SEC-regulated broker Webull if you’re based elsewhere.

FAQs

Most brokers in the online space allow you to deposited funds with a debit or credit card, as well as a bank transfer. Some - such as Webull, allow you to deposit with an e-wallet like PayPal .

Although minimum investments will vary from broker-to-broker, most allow you buy fractional shares. This means that you are not required to buy MCD stocks in whole.

Most metrics indicate that McDonald's represents a good long-term investment. One of the key reasons for this is that the company is a Dividend Aristocrat, meaning it has increased the size of its dividend payments for the past 25 years.

Selling your McDonald's shares works in exactly the same way as when you bought them, albeit, in reverse.

Although CFDs offer a number of benefits - such as low fees and a seamless buying and selling process, you won't be entitled to dividend payments. What payment methods can I use to buy McDonald's stocks?

What is the minimum number of McDonald's shares that I can buy online?

Is McDonald's a good investment?

How do I sell my McDonald's stocks?

Will I get dividends if I buy McDonald's stocks in the form of CFDs?