Business has, for the most part, suffered enormously during the COVID-19 pandemic. However, the global lockdown has created an opportunity for some companies, especially those with stay-at-home products, like Peloton. Indeed, the home fitness group has just increased its forecasts and reported a two-thirds increase in revenue.

While the gyms are shuttered, Peloton’s “COVID proof” home fitness offering is flourishing, but investors will be asking themselves if the company can maintain its impressive trajectory when the world starts to return to normal.

Thinking of investing in Peloton stock? This guide will explain how to buy Peloton stock, take a look at the best stockbrokers and consider the company’s prospects going forward.

Where to Buy Peloton Stock

If you’re looking to invest in Peloton, we recommend creating an account with one of our recommended online stockbrokers. If you’re outside the United States, select eToro. If you’re inside the US or Canada, Stash Invest is the best platform on which to buy Intel stock.

1. eToro – Market Leading Broker Built on Social Trading Innovation

Having built on its success as an innovative social trading platform, eToro has developed into one of the world’s leading brokers over the years. Combining excellent usability with access to 800+ stocks and an extensive choice of markets, including Stocks, Commodities, Currencies and indices.

If you’re looking to invest in Peloton, eToro offers a variety of options. You can opt to buy the underlying asset by opening a long position on PTON or trade the stock with CFDs, which allows you to speculate on price fluctuations without actually buying any shares. CFD trading also enables you to open a short position if you think Peloton’s price is set to drop and add leverage to your trade to increase its value.

One of the eToro's most famous features is the CopyTader tool. This allows you to copy the trades of other eToro users at the click of a button. With over 12 million investors to choose from, you're sure to find one that matches your preferences.

There are no fees or stamp duty on stock purchases and the minimum deposit is $200. If you’re new to trading, or just new to eToro, it’s a good idea to get to grips with the $100,000 demo account before investing any real money.

- 800+ stocks to buy outright or trade as CFDs

- Beginner-friendly stock trading platform

- 0% commission on stock trading

- $5,000 account minimum for CopyPortfolios

Should I buy Peloton stock? Points to consider

It’s always best to do your research before you buy Peloton stock or other ‘COVID proof’ shares like Zoom stock or Netflix stock. We always recommend taking a closer look at the company fundamentals and researching historic price movements and forecasts before you invest money.

Peloton business model and share price history

Peloton’s IPO last November saw 40 million shares of class A common stock floated at $29 per share. At the time, sceptical voices wondered if the home fitness startup was overvalued. Six months later, Peloton is trading at $43. Of course, this rapid surge in value owes a lot to the COVID-19 pandemic, which has made gyms off-limits and triggered a boom in demand for stay-at-home products.

Peloton’s May 6th earnings report detailed a period of impressive growth. Subscribers to its Connected Fitness product nearly doubled to 886,000 and paid digital subscribers increased by 64% year over year.

Quarterly sales hit $524.6 million, up 66% from the year before, and the company are confident that demand will increase through Q4, raising its guidance for the full year by nearly $200 million. When you consider how many companies are scrapping their earnings guidance in the face of pandemic-induced uncertainty, such confidence is especially striking.

Peloton now expects annual sales of $1.72 billion to $1.74 billion, having previously predicted $1.53 billion to $1.55 billion. Unsurprisingly, PTON stock surged past its previous mid-April high of $36.35, hitting $45.61 the morning after the Q3 report was released.

It’s important to note that Peloton does face some challenges, largely related to shipping logistics and costs. The letter to shareholders explained the issue: “Unfortunately, the unexpected sharp increase in sales has created an imbalance of supply and demand in many geographies, causing elongated order-to-delivery windows for our customers… We do not expect to materially improve order-to-delivery windows before the end of Q4.”

The Q3 report also confirmed that Peloton is still losing money, reporting a net loss of $55.6 million, compared with a loss of $38.6 million in the same period a year earlier.

Peloton stock dividend information

Peloton doesn’t currently pay shareholders a dividend and it isn’t clear if there are plans to do so in the future.

Peloton stock forecast and prediction

PTON has been widely regarded as a Buy stock for months, but a post-earnings report rally means it’s currently outperforming 12-month analyst forecasts.

The median 12-month forecast of 23 analysts, as reported by CNN, is $40.00. This represents an 8.68% decrease on the current price of $43.29 (07/5/2020). The highest estimate was $55.00 while the lowest estimate was $26.00.

How to Buy Peloton Stock on eToro

It’s quick and easy to invest in Peloton stock at our recommended broker, eToro. Assuming you’ve signed up and funded your broker account, follow these simple steps to buy Peloton stock.

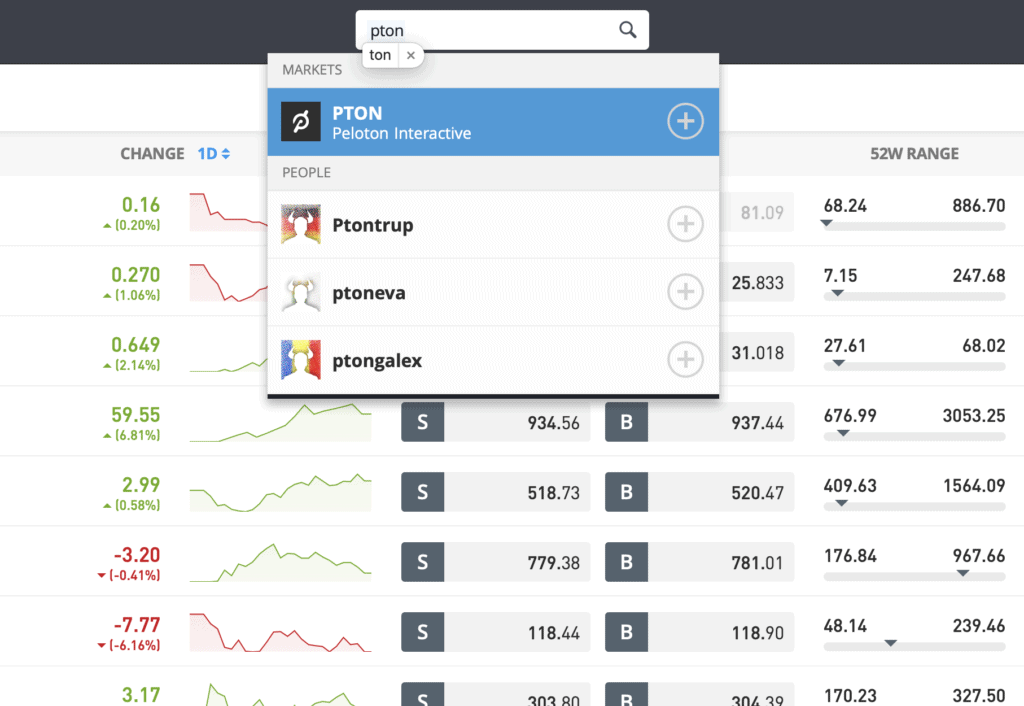

Step 1: Search for Peloton (PTON) Stock

Look up Peloton by typing the ticker symbol PTON into the search box.

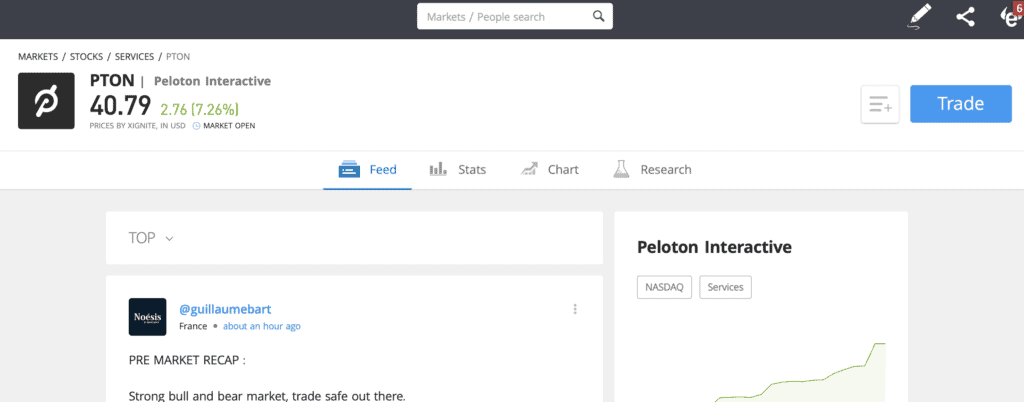

Step 2: Click on trade

Click Trade in the top right corner of the Peloton page.

Step 3: Specify ‘Buy’

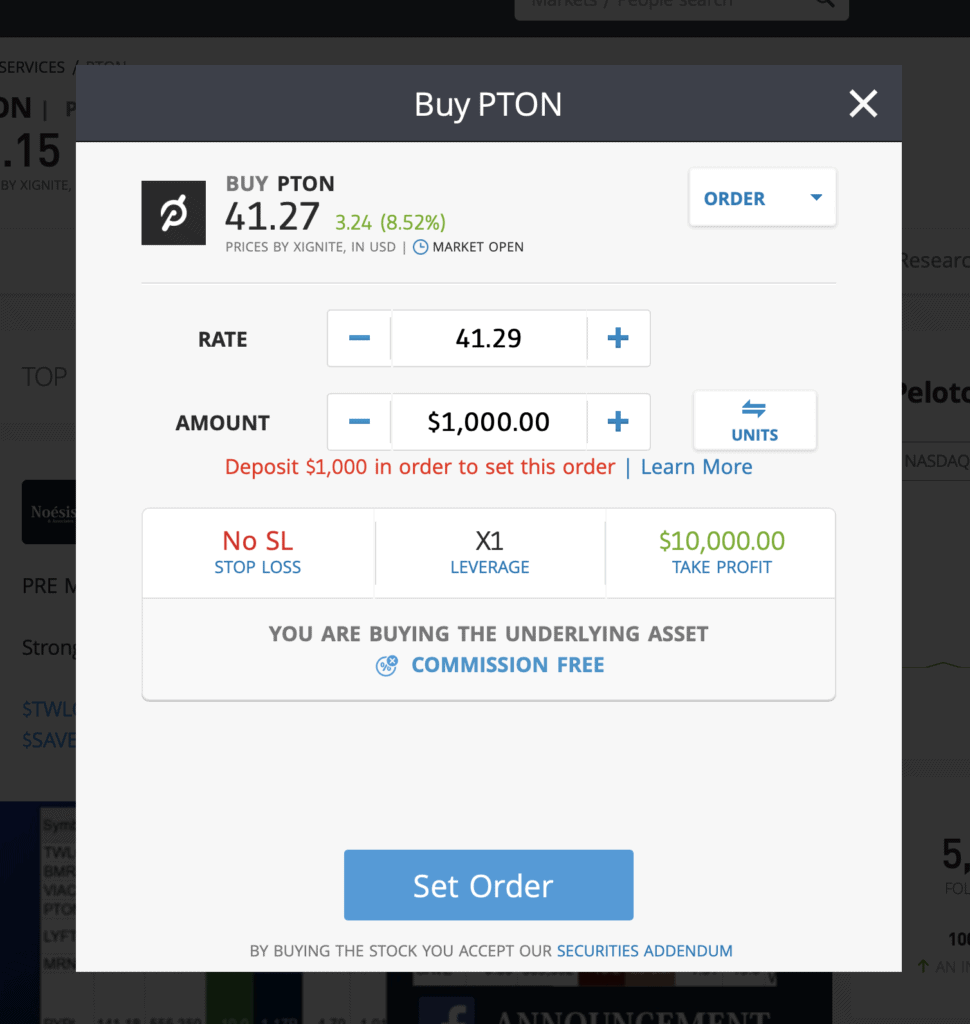

If you want to purchase the underlying asset, specify ‘Buy’ on the top tab, change the leverage to X1 and proceed to set your order. To trade PTON CFDs, set your leverage amount, Stop loss and Take profit order limits, then click ‘Set Order’.

Investing in Peloton Shares – Final Thoughts

Peloton has clearly benefitted from the COVID-19 pandemic driving panic sales of all sorts of stay-at-home products. Its excellent Q3 performance looks like continuing into the next fiscal quarter, but it remains had to predict whether the home fitness boom will continue when gyms reopen and life returns to some semblance of normality.

At this stage, it seems likely that the return to ‘normality’ will be tentative and the public’s enthusiasm for gyms may well be permanently damaged. In which case, Peloton could be the future of fitness.

If you do want to buy Peloton stock, sign up to one of our recommended online brokers. We suggest going with eToro for traders living outside the US, while Stash Invest is the best option if you live in the States.

FAQs

Should I buy Peloton stock or wait?

Peloton stock is currently soaring, but can it maintain its upward trajectory? Positive Q4 forecasts suggest there is plenty of growth potential in the months ahead and it’s not hard to see stock prices continuing to rise.

What are the fees when buying Peloton stock?

Zero-commission stock and ETF trading is available to European clients who trade on eToro. This means that eToro doesn't add a dealing charge or any administrative fees when you buy PTON stock.

Is there a Peloton stock price prediction?

CNN’s 12-month price target, based on the predictions of 22 analysts, is $62.00, a 6.11% increase on the current price.

What does the Peloton stock dividend pay?

Peloton doesn’t currently pay a dividend to shareholders.