If you’re keen to explore how you can get your hands on IBM shares today, read our comprehensive guide on how to buy IBM stocks. We’ll show you what you need to do to buy stocks in IBM with our recommended brokers, as well as discuss whether or not we think the company represents a good long-term investment.

Best U.S. Platform to Buy IBM Stocks

Are you based in the US and wish to buy IBM stocks at the click of a button? If so, we would recommend signing up with Stash Invest. Not only do stock trading apps allow you to buy IBM stocks with an investment of just $5, but trading fees are super-low. Moreover, Stash Invest is perfect for trading newbies.

Best Platform to Buy IBM Shares outside the U.S

Not based in the US and wish to get your hands on NYSE-listed IBM? The process is super-easy with broker Webull. The platform lists thousands of US stocks, including that of IBM. There are no trading fees or commissions other than the spread, and it takes just 2 minutes to buy stocks once you’ve funded your account.

How to Buy IBM Stocks in the U.S.

Although the process of signing up with a broker, depositing funds, and buying IBM stocks is super-easy, we’ve outlined a step-by-step guide for those of you that need a bit of help. We’ve opted to show you the process with our recommended US stock trading platform – Stash Invest.

Step 1: Create your Stash Invest account

To get the ball rolling, you will need to head over to the Stash Invest website and open an account. Alternatively, you can download the app from the Google Play or Apple Store and complete the registering process from your mobile phone.

Step 2: Fill out your profile

Once you’ve loaded up the application page, you will be required to fill out some personal information. This will include your full name, home address, date of birth, nationality, residency status, and contact details. You will then be asked to verify your identity, which you can do by uploading a copy of your government-issued ID (passport or driver’s license)

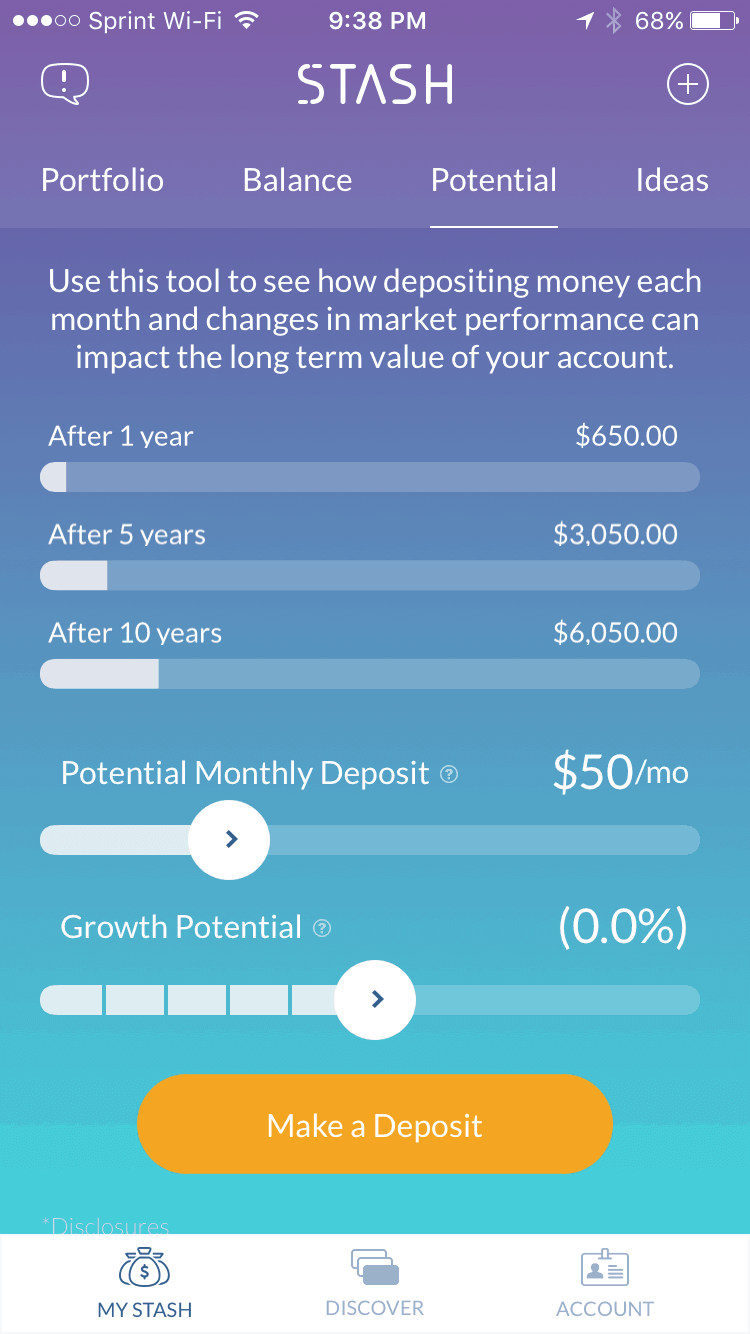

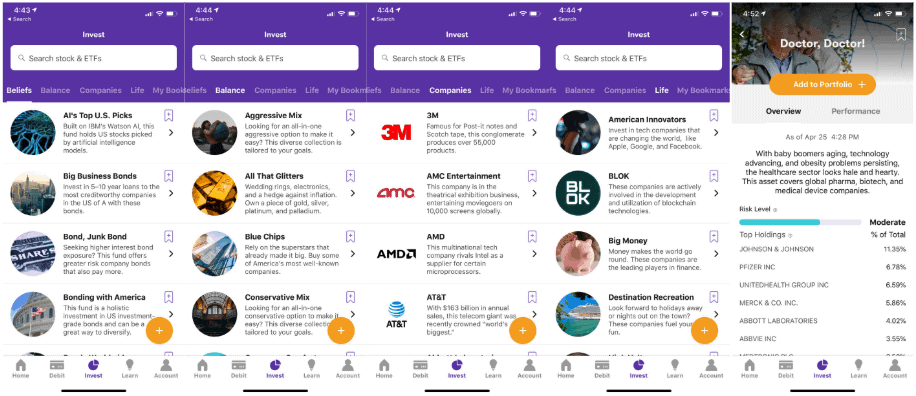

Step 3: Check your investment options

Although you can choose to invest on a DIY basis – meaning that you choose which shares you want to buy and sell, Stash Invest is also known for its automated services. Through the use of AI technology, the app will make investments on your behalf. It does so by mirroring the risk level that you wish to take – for example balanced, conservative, or aggressive.

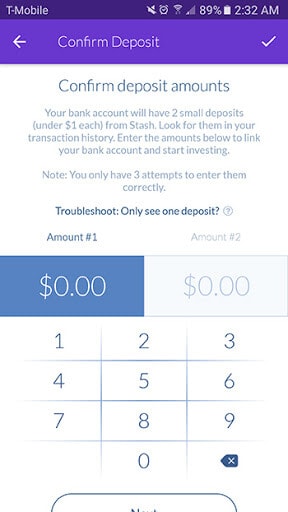

Step 4: Fund your account

Once you’ve verified your identity and chosen your Stash Invest plan, you’ll need to fund your account. You will need to do this by linking your US checking account to Stash, and then transferring the funds over. The minimum deposit amount is just $5, which is ideal if you want to get started with smaller amounts.

Step 5: Buy IBM stocks

Now that you’ve got a fully-funded Stash Invest account, you can proceed to buy IBM stocks. To go straight to the IBM trading screen, simply enter ‘IBM’ in the search box and click on the corresponding result. You will then need to enter the amount that you wish to invest. You don’t need to buy whole IBM shares, so as long as you invest at least $5, you’re good to go.

You will also need to set an entry point. For example, if you just want to take the next available price, go for a ‘market order’. If you instead want to buy IBM stocks at a specific price, go for a ‘limit order’.

How to Buy IBM Stocks Outside the U.S.

If you’re not based in the US, you won’t be able to use Stash Invest. But that’s fine, as broker Webull accepts users from more than 100+ countries. Not only is platform regulated by the FCA, but it doesn’t charge any trading fees or commissions. As such, when you buy IBM stocks through Webull, the only fee that you will pay is via the spread.

Step 1: Open an Account With Webull

Head over to the Webull website and open an account. Much in the same way as Stash Invest, you’ll need to enter some personal details so the broker knows who you are. This covers the basics, such as your first and last name, home address, nationality, tax status, date of birth, and contact details.

You will also need to answer some questions about your prior experience in the trading online scene. This is because Webull allows you to trade on leverage, so it wants to ensure that you have a firm grasp of the basics.

Step 2: Verify Your Identity

You will now need to go through a KYC (Know Your Customer) process. This is industry-standard in the online brokerage space, and merely requires you to upload some documents. This will include some ID (passport or driver’s license), and depending on where you live – a proof of address (bank statement or utility bill).

Webull utilizes cutting-edge technologies, so it can usually verify your documents instantly.

Step 3: Fund your Account

You will now need to fund your newly created Webull account. Head over to the deposit page and select your preferred payment method. You’ll be able to choose from a debit/credit card (Visa or MasterCard), PayPal, or a standard bank transfer.

Other than a bank transfer – which usually takes a few days to arrive, deposits at Webull are instant. Moreover, there are no fees to deposit. Also there are no minimum deposits.

Step 4: Buy IBM Stocks

If you have a firm grasp of how stocks work, and you’re happy to proceed, you will need to head over to the IBM trading page. Simply search for ‘IBM’ in the search box to go straight there. You will then be asked whether you want to buy or sell IBM stocks. If you think the price of IBM will go up, you’ll want to buy. Alternatively, you’ll want to sell IBM shares if you think its share price will decline.

Next, you’ll need to enter the amount that you wish to invest. Finally, choose whether you want to place a ‘market’ order or a ‘limit’ order. The former means that you simply take the next available price in the market. The latter means that you get to choose the specific price that you want the trade executed at.

IBM Stock Price

About IBM

The International Business Machines Corporation, or simply ‘IBM’, is a huge multinational company of significant size. In fact, the technological innovator now has operations in over 170 countries. In terms of its presence on the stock markets, IBM is listed on the New York Stock Exchange. To give you an idea of how IBM shareholders have been rewarded over the past few decades, its stock price amounted to just $16.50 in 1980.

At the time of writing, this now stands at a whopping $150.80. However, it is important to note that IBM is still worth less than its all-time high of 2013, where its share price surpassed the $205 mark. With that said, many would argue that IBM stocks can be purchased on the cheap. In terms of the company’s outlook, IBM might not be suitable for those of you that seek capital gains. This is because the company has effectively reached a point of saturation. As such, IBM is perfect for investors that seek regular income in the form of dividends.

Should you Invest in IBM?

Firstly – like most tech-orientated firms listed on the US stock markets, IBM was hit hard when the 2008 financial crisis hit. It’s share price dropped from $124 to $86 in a matter of months. However, IBM stocks then went on an upward trajectory that lasted five years.

In fact, it reached its all-time high in February 2013, at a stock price of $205. Since then, IBM stocks have been going in the opposite direction. Although the stocks saw a period of recovery in 2015, they are now sat at around the $150 mark. The main concern that investors have is that the US economy is the strongest it’s ever been.

Heaps of listed companies are now experiencing all-time highs, so it’s slightly concerning that IBM has not followed the market trend. So this begs the question – can IBM be bought at a heavy discount at current prices, or is it a risky investment?

To help you make that decision on your own accord, we’ve listed some pros and cons of buying IBM stocks.

Pros of Investing in IBM Stocks

✔️ IBM is Focusing on Innovation

IBM is a company that has gone through many cycles since its foundation in 1911. This is smart business, as IBM has time and time again shown that it leads the way in the innovative race.

As of 2020 and beyond, IBM is now focusing heavily on the future of both cognitive software and the cloud. These are two key markets that IBM believes will revolutionize most industry sectors in the near future, so it’s notable that new CEO Satya Nadella is looking to get ahead of the curve.

✔️ Profits Levels are Almost Double That of 2017“

Back in 2017, IBM reported profits of $5.8 billion. Fast forward to its profit report in Q4 2019, and this figure rose to a staggering $9.4 billion – representing an increase of 74%. Interestingly, the company still made declines in three of its five core departments.

Nevertheless, Wall Street analysts forecast an annual profit increase of 7.3% over the course of the next five years, which should please shareholders greatly.

✔️ IBM Stocks can Still be Purchased at a Discount

If IBM is able to capitalize as per its focus on cutting-edge cloud technologies, many would argue that IBM can be purchased on the cheap. While there is no guarantee that IBM will regain the all-time high of $205 that it hit in 2013, if it does, returns would be very healthy for those making an investment at current prices.

In fact, at today’s price of $150, this would represent a very juicy increase of 36%. Moreover, when you factor in IBM’s consistent history of paying healthy dividends, this would further amplify the potential long-term yield.

Cons of Investing in IBM

❌ IBM Growth is Lagging Behind Fellow Tech Giants

Although it is often argued that age-old tech companies like IBM are limited in how much they can grow, one only needs to look at its industry counterparts to see that this isn’t the case at all. For example, in the 10 years leading up to Q4 2019, IBM shares increased by just 20%.

This is far below the mean, so investor concerns are completely justified. More specifically, the likes of Microsoft and Oracle grew by 430% and 270% during the same period, which further highlights that IBM is being left behind.

❌ Huge Cash Resources Spent on Red Hat Purchase

While we are huge advocates of acquiring tech firms that are still up and coming, many would argue that the $36 billion spent on Red Hat could have been reduced by some distance had management acted sooner. The same was said with the likes of Salesforce and Abode. which IBM eventually turned down when they were worth just a fraction of their current market value.

Back to Red Hat, the $36 billion purchase represents almost 10 times 2018 revenues for IBM, which is huge. Crucially, Red Hat is only just about profitable, so it remains to be seen when shareholders will see a return on the purchase. Ultimately, this could potentially prevent IBM from making future acquisitions in the coming years.

❌ Juicy Dividends Does not Over-Shadow Slow Growth

On the one hand, it is true that IBM dividends are somewhat juicy, with an average annualized yield of 4.5%. As such, the stock makes a great addition to those seeking steady income. However, it is important to remember that the slow growth of IBM’s share price does not over-shadow its dividend policy.

In Layman’s Terms, you would be far better focusing on stocks that pay in dividends in the 2-3% region, but also have a promising long-term outlook in the growth department. This isn’t something that can be said of IBM at present.

Conclusion

In summary, although IBM is still one of the most established and forward-thinking companies in the global tech space, shareholders have much to be concerned about. At the forefront of this is a share price that seems to have been stagnating for some time now. For example, while fellow tech giants Microsoft and Oracle have made stock gains of 430% and 270% respectively between 2009-2019, IBM grew by just 20% in the same period.

This illustrates that the company is falling further and further behind its market counterparts. Moreover, it still remains to be seen whether or not IBM’s $36 billion purchase of Red Hat will reward investors in the long-run. With that being said, if you do think that IBM has a positive future, you can still buy stocks at a discount – as per current market prices.

As such, if you do want to invest in IBM stocks today – and you’re based in the US, we would suggest using regulated platform Stash Invest. Alternatively, if you’re based outside of the US, we would suggest global SEC-regulated broker Webull or eToro.

FAQs

If you use one of the brokers that we have recommended on this page, you'll have the choice of a debit/credit card, e-wallet, or bank transfer.

A number of online brokers - such as Stash Invest, now allow you to buy fractional shares. This means that although IBM stocks are priced at $150 per share, you can buy just a small fraction of this.

IBM last hit its all-time high share price in 2013, when the stocks were worth $205.

You will need to sell your IBM stocks back to the broker that you used to buy them. The process works the same as when you bought them, but in reverse.

You won't get any dividends if you buy IBM stocks via a CFD broker. What payment methods can I use to buy IBM stocks?

What is the minimum number of IBM shares that I can buy online?

What is IBM's all-time share price?

How do I sell my IBM stocks?

Will I get dividends if I buy IBM stocks in the form of CFDs?