As it becomes increasingly clear that testing is going to play an important part in the planet’s eventual emergence from the COVID-19 pandemic, companies that are leading the drive to develop dependable tests, such as Abbott Laboratories, are bound to attract plenty of interest.

Abbott’s ID Now rapid coronavirus diagnostic test was granted emergency use authorisation by the FDA in March and has been widely heralded for its fast turnaround. Recent claims that the test simply isn’t accurate enough are contested by Abbott.

Thinking of investing in Abbott stock? This guide will explain how to buy Abbott stock, take a look at the best stockbrokers and consider the company’s prospects going forward.

Where to Buy Abbott Stock

If you want to invest in Abbott, start by creating an account with one of our recommended online stockbrokers. If you’re outside the United States, eToro is the best platform on which to buy ABT stock. If you’re inside the US or Canada, our top pick is Stash Invest.

1. eToro – Market Leading Broker Built on Social Trading Innovation

eToro is a leading social trading platform that allows you to buy Abbott stock and purchase the underlying asset, as well as trading CFDs with leverage of up to 1:5. Stock trading at eToro is commission-free, and there are over 800 stocks to choose from.

As a social trading broker, eToro allows users to engage with fellow members of the community. There's also the famous CopyTrader tool, which allows you to copy the portfolios of top performing traders with the click of a button.

If you're new to trading, you can get to grips with things courtesy of eToro's $100,000 demo account. When you want to move on to real money investing, you'll need to deposit at least $200 to get started.

You can choose from a range of payment methods, including PayPal. You can also buy Abbott stock on your mobile, thanks to the eToro trading app for iOS and Android devices.

- 800+ stocks to buy outright or trade as CFDs

- Beginner-friendly stock trading platform

- 0% commission on stock trading

- $5,000 account minimum for CopyPortfolios

Should I Buy Abbott stock? Points to Consider

It’s always best to do your research before you buy Abbott stock or other pharma assets like Gilead stock or Glaxo stock. We always recommend taking a closer look at the company fundamentals and researching historic price movements and forecasts before you invest money.

Abbott business model and share price history

According to a recent report by TechSci Research, the global coronavirus diagnostics market is expected to reach $2.2 billion by 2025. Having leapt ahead of the pack by producing three distinct COVID-19 tests in March and April, Abbott is well-placed to take centre stage in this burgeoning market.

Abbott’s three COVID-19 tests are designed to meet distinct needs. The first two, released in March, are molecular coronavirus detection tests, the third is an antibody blood test designed to determine if a person has previously been infected with COVID-19.

Abbott released its Q1 earnings report on April 16, posting stronger than expected results. Earnings for the three months ending in March came in at 65 cents per share, up 3.2% from the same period last year and 7 cents above analyst predictions. Revenue was similarly impressive, rising 2.5% to $7.7 billion and beating the $7.4 billion analysts’ estimate.

Nonetheless, like many companies in these uncertain times, Abbott suspended its previously announced annual guidance for 2020 ‘due to uncertainties regarding the duration and impact of the coronavirus (COVID-19) pandemic’.

ABT shares rose 16.7% in April, peaking at $98.00 on April 20, but have since slipped to $90.61.

Abbott stock dividend information

Abbott Laboratories pays an annual dividend of $1.44 per share, with a dividend yield of 1.56%. On average, ABT increases its dividend 10.75% each year

The next quarterly dividend will be paid to shareholders on May 29.

Abbott stock forecast and prediction

Abbott’s median 12-month target price according to CNN – based on 16 analyst forecasts – is $103.50, with a low target of $79.00 and a high target of $113.00. The median target represents a 12.28% increase on the current price of $92.18.

MarketBeat’s analyst ratings are slightly lower, reporting a median target of $99.56 and a consensus rating of Buy.

How to Buy Abbott Stock on eToro

It’s quick and easy to invest in Abbott stock at our recommended broker, eToro. Assuming you’ve signed up and funded your broker account, follow these simple steps to buy ABT stock.

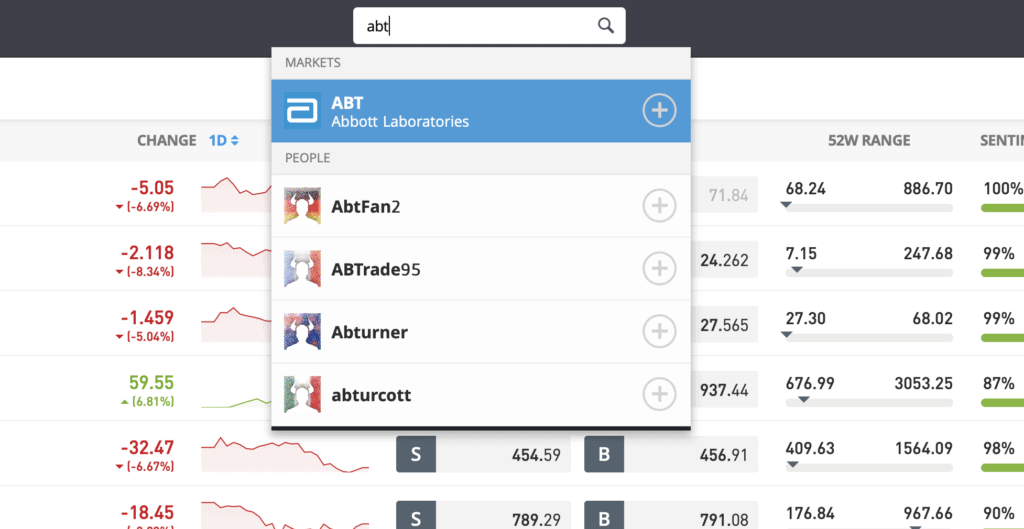

Step 1: Search for Abbot (ABT) Stock

Look up Abbott by typing the ticker symbol ABT into the search box.

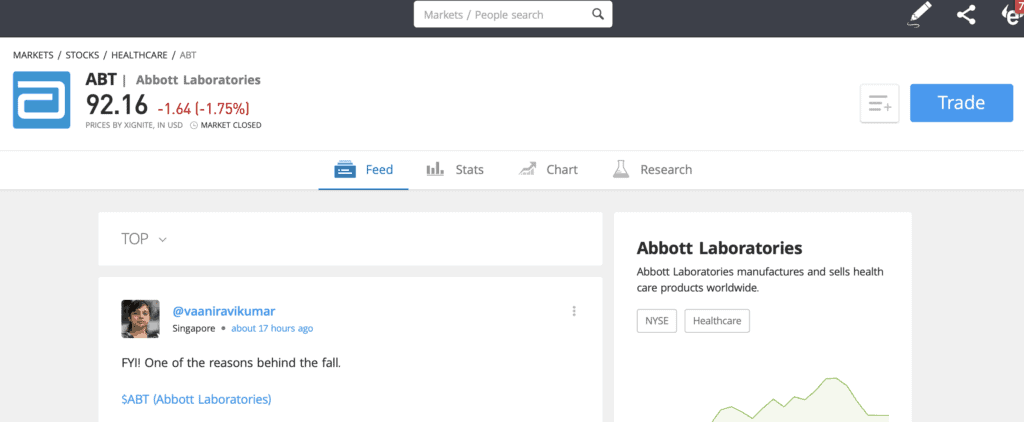

Step 2: Click on trade

Click Trade in the top right corner of the Abbott page.

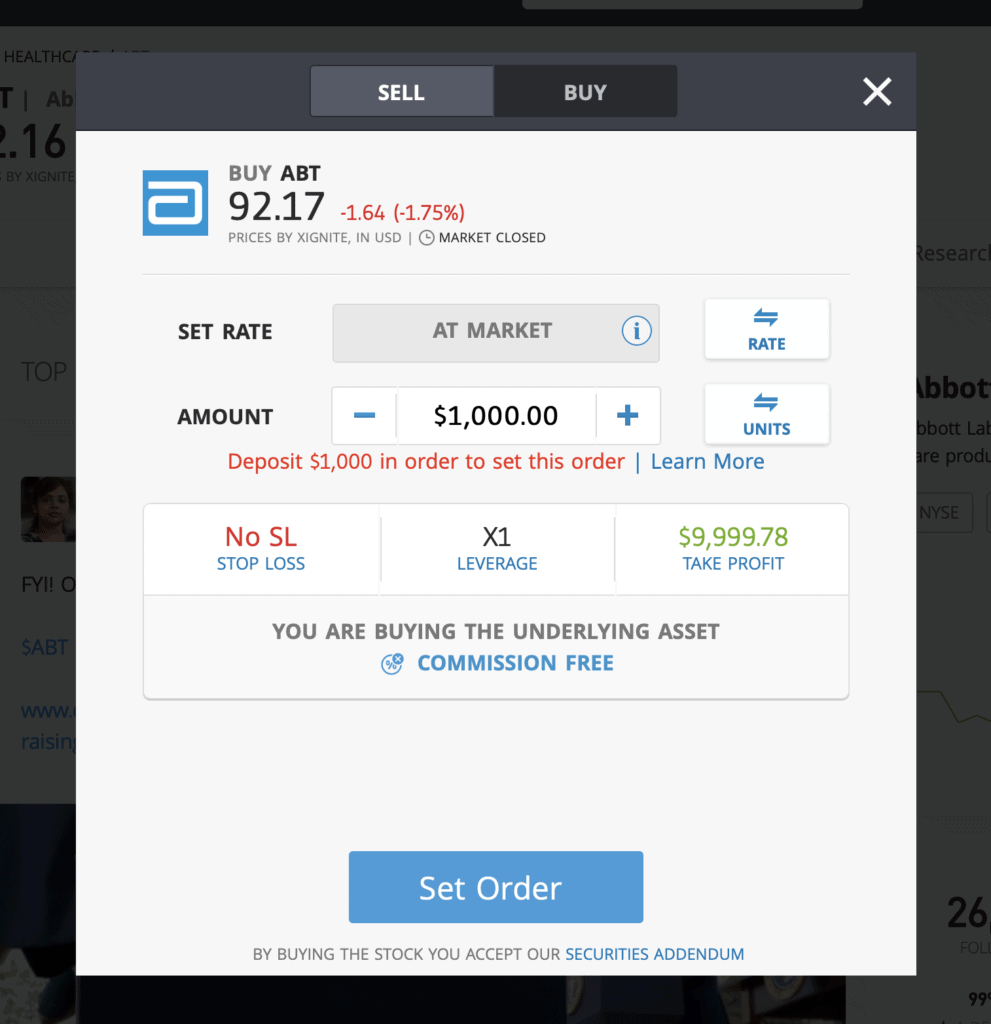

Step 3: Specify ‘Buy’

If you want to purchase the underlying asset, specify ‘Buy’ on the top tab, change the leverage to X1 and proceed to set your order. To trade Abbott CFDs, set your leverage amount, Stop loss and Take profit order limits, then click ‘Set Order’.

Investing in Abbott Stock – Final Thoughts

Abbott’s ability to develop and distribute a variety of COVID-19 tests in sufficiently high volumes makes it a key player in the global battle to beat Coronavirus. With three commercialised tests already in use and a further lateral flow serology test in development, the company clearly sees the huge demand for COVID-19 screening as an opportunity.

Of course, it’s important to look beyond Coronavirus testing when assessing ABT stock, and the Q1 earnings report – too early to factor in the COVID-19 tests – offers plenty of encouragement.

If you want to buy Abbott stock today, we recommend registering with one of our recommended stockbrokers. eToro is our number one broker if you’re outside the US, while we suggest US traders go with Stash Invest.

FAQs

Should I buy Abbott stock or wait?

Like most analysts we think ABT is in good shape and should be considered a Buy stock.

What are the fees when buying Abbott stock?

Zero-commission stock and ETF trading is available to European clients who trade on eToro. This means that eToro doesn't add a dealing charge or any administrative fees when you buy ABT stock.

Is there an ABT stock price prediction?

Analysts estimate a median 12-month forecast of $103.50, which represents a 12.28% increase on the current MYL price of $92.18.

What does the Abbott stock dividend pay?

Abbott currently pays an annual dividend of $1.44 per share.