When Saudi Arabia sold a 1.5% stake in its state-owned oil group Saudi Aramco last December, the company was valued at $1.7 trillion. It was the world’s largest-ever stock market flotation and made Aramco the most valuable company on the planet, eclipsing the likes of Apple (Find out how to buy Apple stock here) and Microsoft. To put such a gargantuan valuation in context, Aramco is now worth more than Exxon Mobil, Total, Royal Dutch Shell, Chevron and BP – the next five most valuable oil companies – combined.

There’s no denying that Aramco’s record-breaking IPO captured the world’s attention, but actually investing in the oil giant isn’t straightforward. In fact, because Aramco (SAOC) is only listed on the Saudi stock exchange, Tadawul, you’ll struggle to invest without some sort of special access. You can, however, opt to trade SAOC via CFDs.

Thinking of investing in Aramco stock? This guide will explain how to buy Aramco stock, take a look at the best stockbrokers and consider the company’s prospects going forward.

On this Page:

Where to Buy Aramco Stock

Because the company is only listed on the Saudi stock exchange, foreign investors aren’t able to buy Aramco stock. However, online trading platforms like eToro offer CFD trading for Aramco, so you can speculate on the company’s price fluctuations. Here are the top brokers on which you can trade Aramco stocks in the form of CFDs.

”1.

” image0=”” pros1=”800+ stocks to buy outright or trade as CFDs” pros2=”Beginner-friendly stock trading platform” pros3=”0% commission on stock trading” cons1=”$5,000 account minimum for CopyPortfolios” cons3=”” cta-label=”Visit eToro Now” cta-url=”https://insidebitcoins.com/visit/etoro-stocks” disclaimer-text=”75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.” paragraphCount=”1″]

Should I Buy Aramco Stock? Points to Consider

Looking to invest in Aramco, or similar stocks such as BP stock? We always recommend researching the company fundamentals and considering historic price movements and forecasts before you invest.

Aramco business model and share price history

Officially known as the Saudi Arabian Oil Company, Saudi Aramco is the world’s biggest oil producer, most profitable business and, since its blockbuster IPO last December, the most valuable company on the planet.

Aramco, which is controlled by the Saudi state, went public in December 2019, selling off a 1.5% stake for $25.6 billion in an IPO that valued the company at $1.7 trillion. After two days of trading the value leaped up even higher, making Aramco the world’s first $2 trillion company.

The Aramco IPO is linked Saudi Crown Prince Mohammad bin Salman’s Vision 2030 plan, which seeks to reduce the country’s dependence on oil by diversifying its economy. To do this, Saudi Arabia needs a multi-trillion-dollar mega-fund. The Aramco float is part of this fundraising strategy.

As impressive as Aramco’s IPO undoubtedly was, the company finds itself in the midst of a challenging, geopolitically fraught oil market. Indeed, the first few months of 2020 have seen a collapse in oil prices that sent SAOC shares into freefall.

This came about because Saudi Arabia ramped up its oil output, and lowered its price, in response to a spat with Russia and the collapse of the OPEC deal after three years of cooperation. The situation has since been stabilized thanks to a new OPEC deal that will see member states cut output to offset a global slump in demand.

At the start of May, the oil market was showing signs of a revival and Aramco was up 2.3% as Saudi Arabia’s stock market began to outperform the region. The situation remains tense, however, and investors will be conscious that Aramco share prices are highly vulnerable to prevailing geopolitical winds.

Aramco stock dividend information

Saudi Aramco has initially pledged an annual dividend of $75 billion for the first five years. The first payment, for Q4 2019, was made to shareholders on March 31.

Aramco stock forecast and prediction

As SAOC is only listed on the Saudi exchange therefore not available to most foreign investors, analyst forecasts are hard to come by. Overall, the outlook seems to be uncertain, with oil demand down and geopolitical events always liable to impact Aramco share prices. All things considered, we’d err towards a Hold rating for SAOC.

How to Trade Aramco Stock on eToro

It’s quick and easy to trade Aramco CFDs at our recommended broker, eToro. Assuming you’ve signed up and funded your broker account, follow these simple steps to trade Aramco stock.

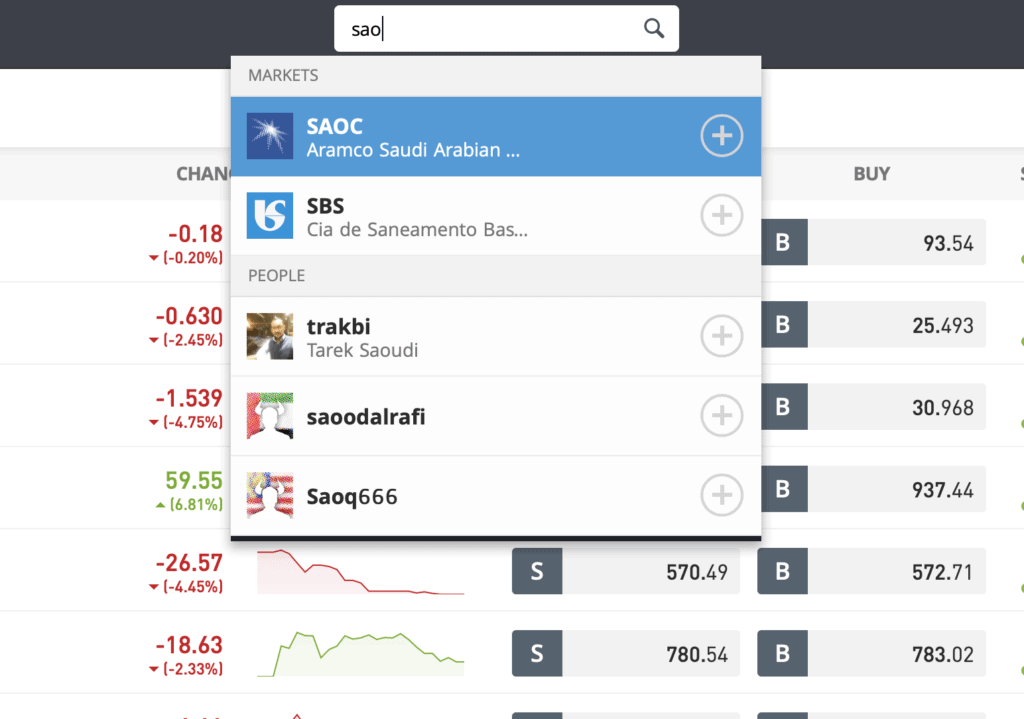

Step 1: Search for Aramco Stock

Look up Aramco by typing the ticker symbol SAOC into the search box.

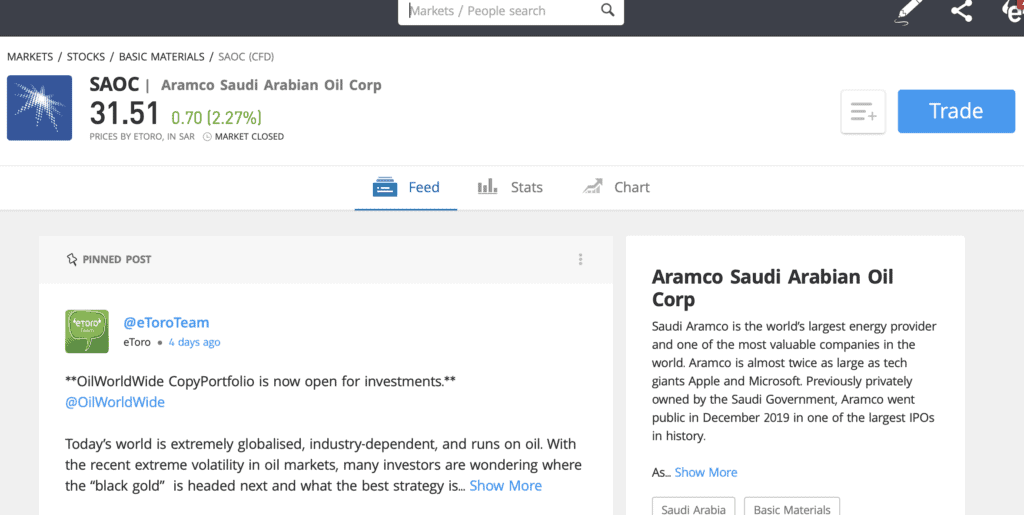

Step 2: Click on trade

Click Trade in the top right corner of the Aramco page.

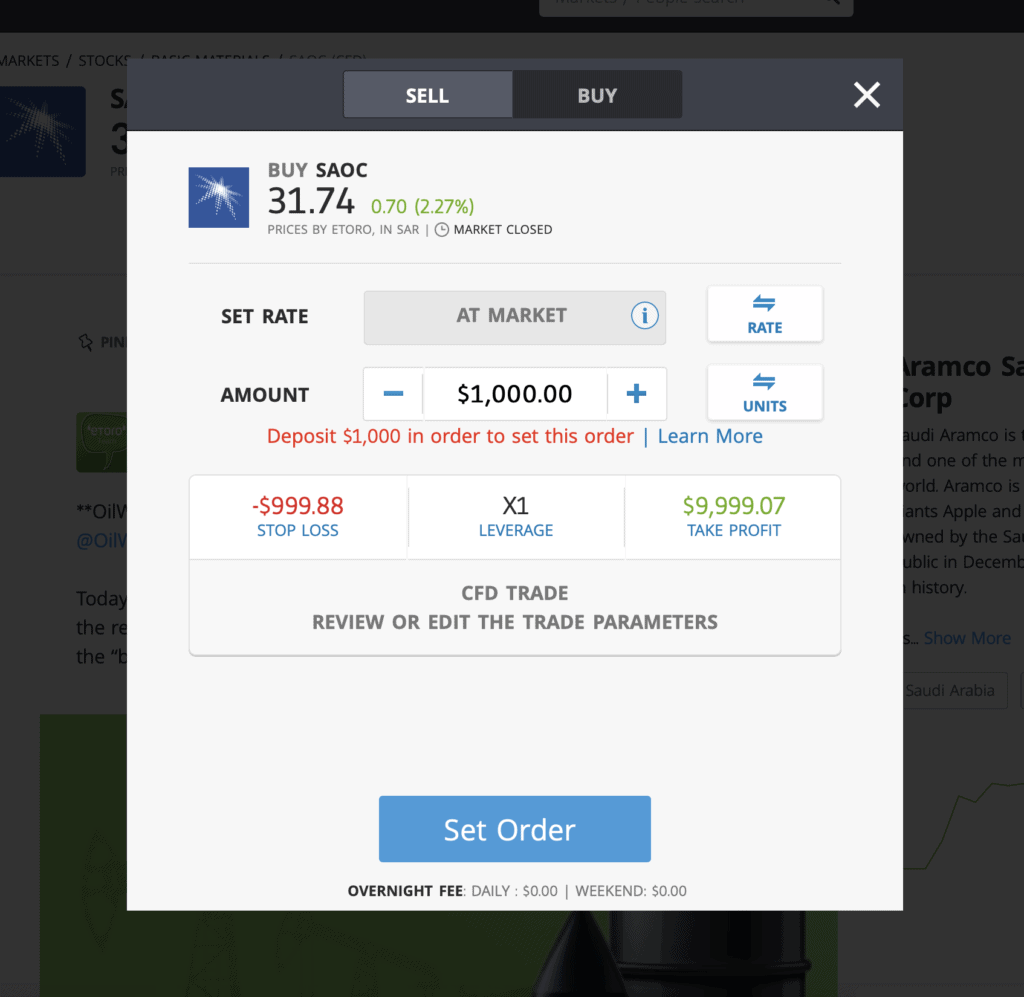

Step 3: Specify ‘Buy’

To trade Aramco CFDs, set your leverage amount, Stop loss and Take profit order limits, then click ‘Set Order’.

Investing in Aramco Shares – Final Thoughts

It’s hard to analyze Aramco’s prospects given that the company is so closely linked to the fortunes of the Saudi state. While the country and Aramco are both focused on diversifying away from oil dependency, that target remains a distant one.

In the meantime, the country’s standing in the global oil market remains strong thanks to its enormous oil reserves. Indeed, Saudi could strengthen its position as oil production growth slows elsewhere. This doesn’t necessarily make Aramco a good investment, however. Geopolitical risk and questionable corporate governance are factors to be considered.

If you do want to trade Aramco stock, simply sign up to one of our recommended online stockbrokers. Go for eToro if you live outside the US, and if you do live in the States we suggest you choose Stash Invest.

FAQs

Should I buy Aramco stock or wait?

Access to Aramco stock is limited by its Tadawul listing. For the foreseeable future most investors will only be able to trade SAOC.

What are the fees when buying Aramco stock?

Currently, foreign investors can only invest in Aramco stock via CFDs and ETFs, so the fees depend on the broker you choose. Both eToro and Fidelity offer 0% commission trading, but you'll have to consider fees like spreads, overnight fees and potential withdrawal fees.

Is there an Aramco stock price prediction?

In January, analysts from Morgan Stanley gave Aramco a price target of 28.10 riyals (the current price is 31.65 riyals), rating it Underweight.

What does the Aramco stock dividend pay?

Aramco’s first dividend, for Q4 of 2019, was 0.0738 riyals per share.