Tesco PLC is a multinational supermarket chain with its headquarters in Welwyn Garden City. The company is behind thousands of stores both domestically and internationally, and it still holds the largest market share in the UK. Tesco has since expanded into other revenue streams – such as insurance, clothes, mobile telecommunications, and home deliveries – subsequently allowing the firm to diversify out of its core grocery offering.

It is important to note that Tesco has had a somewhat turbulent time in the financial markets since 2014. This was in response to the infamous accounting scandal that saw national regulators enforce monetary penalties on the chain. With that said, Tesco shares have been in an upward trajectory since 2016, so you still have a chance to buy stocks on the cheap.

As such, if you’re wondering how to buy Tesco stocks today, be sure to read our in-depth guide which will give you a step-by-step overview of how to purchase shares in the company, the best stock brokers to do so and a full breakdown of whether or not Tesco stocks represent good value.

Best U.S. Platform to Buy Tesco Stocks

We’ve scoured the web to find the best stock broker in the U.S. for investing in Tesco and found Stash Invest to offer the best platform, lowest fees and most appealing bonus. Click the table below and get started with $5 only today.

Best Platform to Buy Tesco Shares outside the U.S.

Based in a country other than the US? If so, we would suggest checking out the merits of Webull. The US-based stock exchange platform hosts thousands of shares – including that of Tesco. You won’t be accustomed to any fees or commissions – other than the spread.

How to Buy Tesco Stocks in the U.S.

The best U.S. stock broker for investing in Tesco is the broker Stash Invest. Stash Invest is one of the many banking and micro-investing stock trading apps with 4 million + users available for Android and iOS users.

Residents in the United States who are at least 18 years old can open an account and invest as little as $5. Its users only need to pay $1 per month for using its investing and banking services.

Step 1: Create your Stash Invest account

You’ll need to create your account by entering your email address and password after clicking the “Get Started” button on its website. If you want to download the Stash Invest app, go to the App Store and install it.

Step 2: Fill out your profile

You’ll need to provide your basic information by answering some questions. By getting your answers to these questions, Stash Invest will be able to better guide you in making investment decisions. Remember to be as honest as possible when answering these questions.

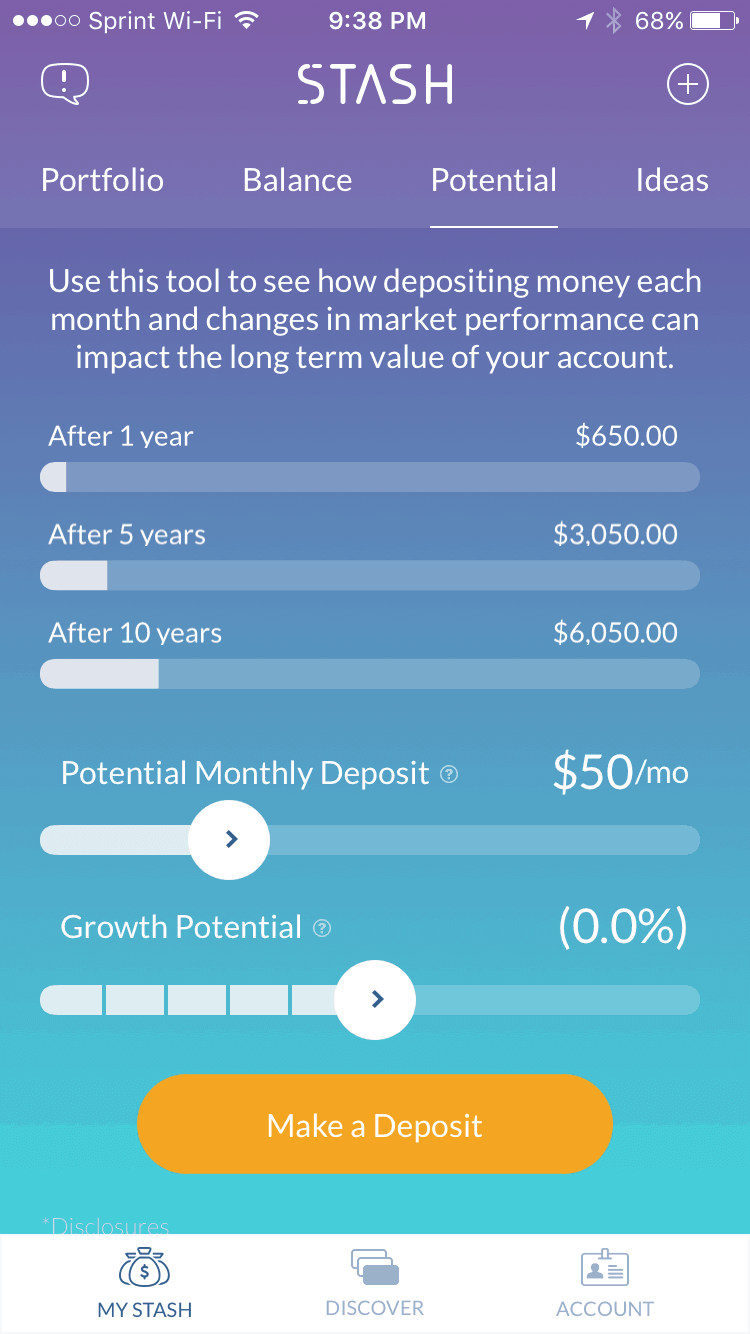

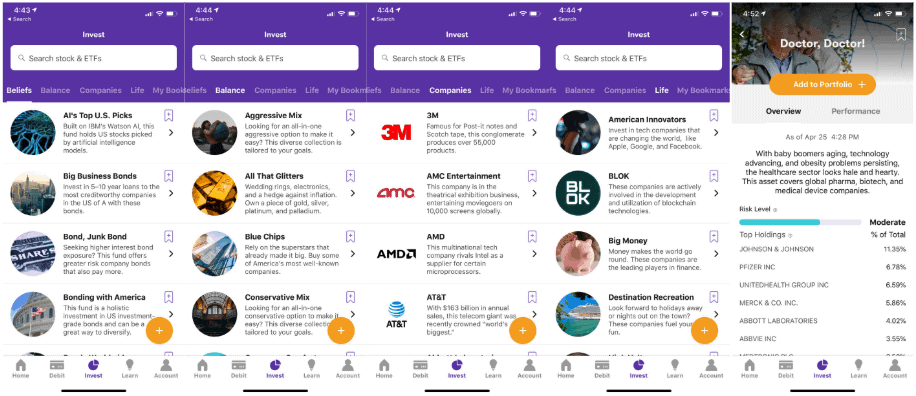

Step 3: Check your investment options

Based on your answers, Stash Invest will give you investment options that are aligned to your risk tolerance. Your risk tolerance can either classed as be conservative, moderate or aggressive. Moreover, instead of presenting you with names such as ticker symbols and ETFs, you’ll see easy to understand “themes” that you can relate to.

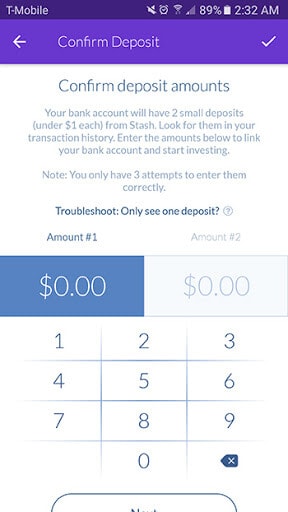

Step 4: Fund your account

Connect your bank account that you want to use to deposit money on Stash Invest. This will also be the bank account that will be used to withdraw your investments. Take note that it takes two to three days to deposit money to Stash Invest.

Step 5: KYC & Verification

Verify your identity by providing the needed documents then create a pin number with 4 digits.

Step 6: Buy Tesco stocks

Search for the Tesco stock, enter the amount you want to invest then click the “Buy” button.

How to Buy Tesco Stocks outside the U.S.

If you’re based outside of the US and you want to buy Tesco stocks today, it might be worth using Webull. Not only is the broker regulated by the US SEC (FCA), but its parent company is listed on the London Stock Exchange. As such, Webull has one of the best reputations in the online stock trading space.

With that said, we’ve outlined the step-by-step process you will need to take with Webull if you want to buy Tesco stocks.

Step 1: Open an Account With Webull

To get the ball rolling, you will need to head over to the Webull website and open an account. The broker will ask you a range of questions pertaining to your personal and financial standing. For example, you’ll need to enter your first and last name, home address, date of birth, and contact details. Make sure the information is correct, as you’ll be asked to verify it in the form of documentation.

To complete the verification process – which is a requirement with all regulated brokers, you will need to upload a copy of your government-issued ID. This needs to be a passport or driver’s license. Depending on where you live, Webull might also ask for a proof of address. If they do, you’ll need to upload a recent copy of a bank statement or utility bill.

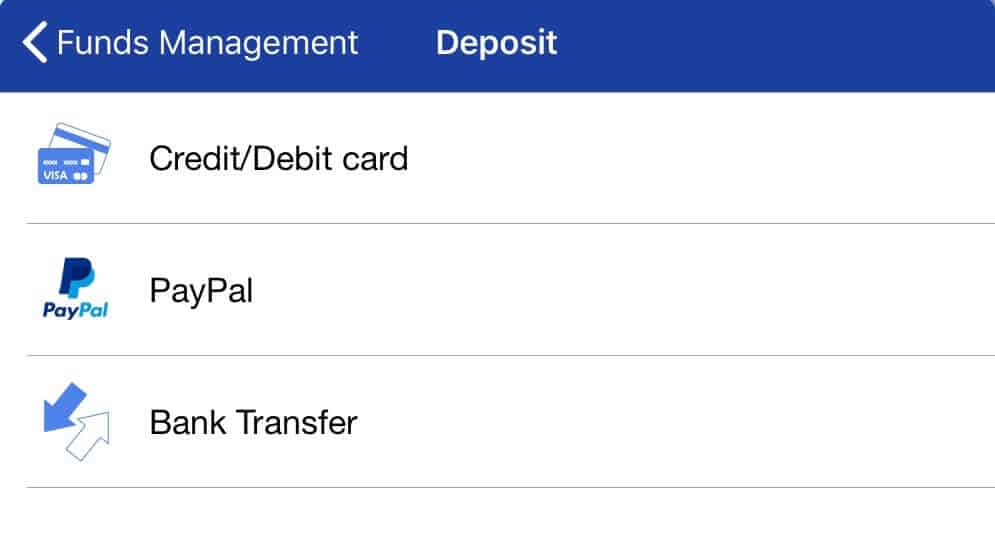

Step 2: Fund your Webull Account

Once you’ve opened your Webull account and verified your identity, you will then need to deposit some funds. The broker offers heaps of payment methods to choose from. This includes a debit/credit card, bank transfer, or an e-wallet PayPal.

Take note, the minimum deposit amount at Webull is $/€/£100. Apart from a bank account transfer – which can take 3-5 working days to arrive, deposits at Webull are usually instant.

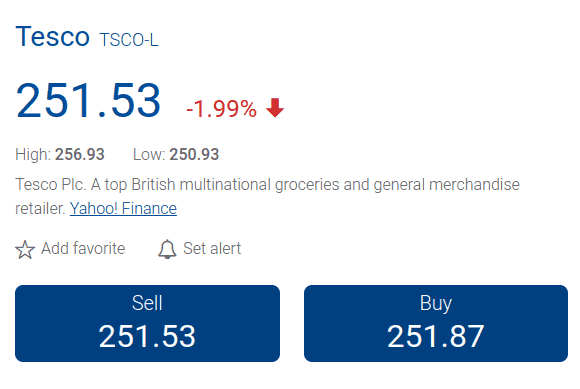

Step 3: Buy Tesco Stocks at Webull

To get Tesco shares, enter ‘TESCO’ into the search box, and decide whether you want to go long (buy) or short (sell). You then need to enter the amount of shares that you wish to trade.

Finally, you then need to decide whether you want to place a limit or market order. If opting for the former, this means that you need to enter the price that you want the trade executed at. If you want to take the next available price, go with a market order.

Should you Invest in Tesco?

Whether or not you decide to invest in Tesco will be determined by your long-term investment goals. On the one hand, the company still dominates the UK groceries space and thus – continues to retain its spot as the number one supermarket in terms of market share.

This is largely due to its re-transformation program that has sought to reduce its reliance on mega-stores, and instead, focus on more profitable Tesco Express store. Not only do such stores allow Tesco to keep operating costs to a minimum, but it can typically charge more on core products. This has the desired effect of increasing those already-thin profit margins.

Crucially, it appears that the infamous accounting scandal that broke in 2014 is finally becoming a distant memory. Although the stock price of Tesco is yet to recover to its previous all-time high, shares have been on an upward trajectory since 2016 nonetheless. This is great news for investors that kept faith in the supermarket giant.

Pros of Investing in Tesco Stocks

Cons of Investing in Tesco

Conclusion

In summary, if you’ve read our guide from start to finish, you should now have a firm understanding of whether or not Tesco stocks are right for your long-term investment goals. On the one hand, it appears that the re-transformation program being implemented by Tesco management is fully beginning to show signs of success. In fact, not only is Tesco still the largest UK supermarket for market share, but its share price has been on an upward trajectory since late 2016.

On the flip side, Tesco stocks are still worth significantly less than they were before the accounting scandal broke in 2014. Although it is concerning that the company has not been able to recover its prior all-time highs, this also means that you have the potential to buy Tesco shares at a discount. In this respect, we’ve shown you how you can buy Tesco stocks at the click of a button.

If you’re in the US, the easiest way to do this is via the regulated platform Stash Invest. Alternatively, if you’re based outside of the US, then it might be worth considering the merits of SEC-regulated broker Webull. Either way, just make sure that you perform independent research on Tesco prior to buying any stocks – and never make a purchase on the back of somebody else’s advice.

FAQs

This depends on the broker that you decide to use. In most cases, you'll be able to deposit funds with a debit/credit or bank transfer. Some brokers even allow you to fund your account with an e-wallet like PayPal.

It is no longer a requirement to buy 'whole' shares when trading online, meaning that you can buy as much or as little as you wish. However, you still need to meet the broker's minimum deposit amount, so do bear this in mind.

At the time of writing, Tesco is predicted to make £1.7 billion and £1.8 billion in 2020 and 2021, respectively. If it reaches its 2021 target, this could represent an increase of nearly 100% over 2014 levels.

If you're currently in possession of Tesco stocks and wish to offload them, you will need to sell them back to the broker that you bought them from.

If you buy Tesco shares from a traditional stock broker, you will be entitled to dividends and investor rights. However, if you buy Tesco stocks in the form of CFDs, you won't be entitled to dividends as you do not own the underlying asset. What payment methods can I use to buy Tesco stocks?

What is the minimum number of Tesco shares that I can buy online?

How much profit is Tesco forecasted to make in the coming years?

How do I sell my Tesco stocks?

Will I get dividends if I buy Tesco stocks?