About half of the world’s population of 7.8 billion conducts a search through Google Search or Google Maps each day. As the search giant diversifies into new businesses, it is proving its prowess as a leading digital marketer. The new businesses are growing leaps and bounds faster than Search as Google connects more consumers through Google Shopping, social media users through YouTube, and businesses through its Cloud services. In its biggest bet yet, Google is spending billions of dollars to make all of these services smarter and interconnected through AI and smart learning robots.

This guide will explain how to buy stocks in Goolge, evaluate the best Google stockbrokers, and assess the future performance of the company and how its expansion into cloud services, self-driving cars and other new ventures will affect Google’s stock value.

On this Page:

1. eToro – Best Stock Broker for Worldwide Customers

Both beginner and experienced stock traders can improve their returns on the leading social trading platform. On this peer trading website, you can copy individual trades, portfolios of high performing peer traders, or professionally designed portfolios across popular investment themes. OneClick trading ensures you can immediately act on investment opportunities. The market moves fast, so eToro provides trading tools that help you move fast, too. The minimum deposit to start social trading is $200, or $50 for U.S. investors.

Or if you want to trade securities directly, zero commissions are charged to trade over 1,000 stocks and ETFs outright or with leverage. Many other securities including currency pairs, indices and commodities can be traded using CFDs. On eToro, you will benefit from some of the lowest trading spreads among online brokers. Basic fees charged include a $5 withdrawal fee, $10 monthly inactivity fee and overnight fees on CFDs. The trading interface is simple and intuitive. If researching Alphabet stock, for example, you will find fundamental research, charts, analyst research and peer social trading feeds on four tabs. The live social media feeds from your peers provide better trading tips than some Wall Street analysts. eToro is regulated in multiple jurisdictions, with licenses from ASIC, CySEC, and the FCA.

- Simple and intuitive web and mobile platform

- An unlimited demo account

- Social trading

- High fees

- $5,000 account minimum for CopyPortfolios

Should I Buy Google Stock? Points to Consider

Before deciding whether Google stock is a buy or sell, you should consider the company fundamentals, along with historic price movements and forecasts.

Alphabet business model and share price history

The world’s favorite search engine is powered by multiple business lines today. The majority of revenues, though, still come from gobbling up global digital ad revenues. Since 2015, Google has operated under the parent company Alphabet as two main divisions: Google and Other Bets.

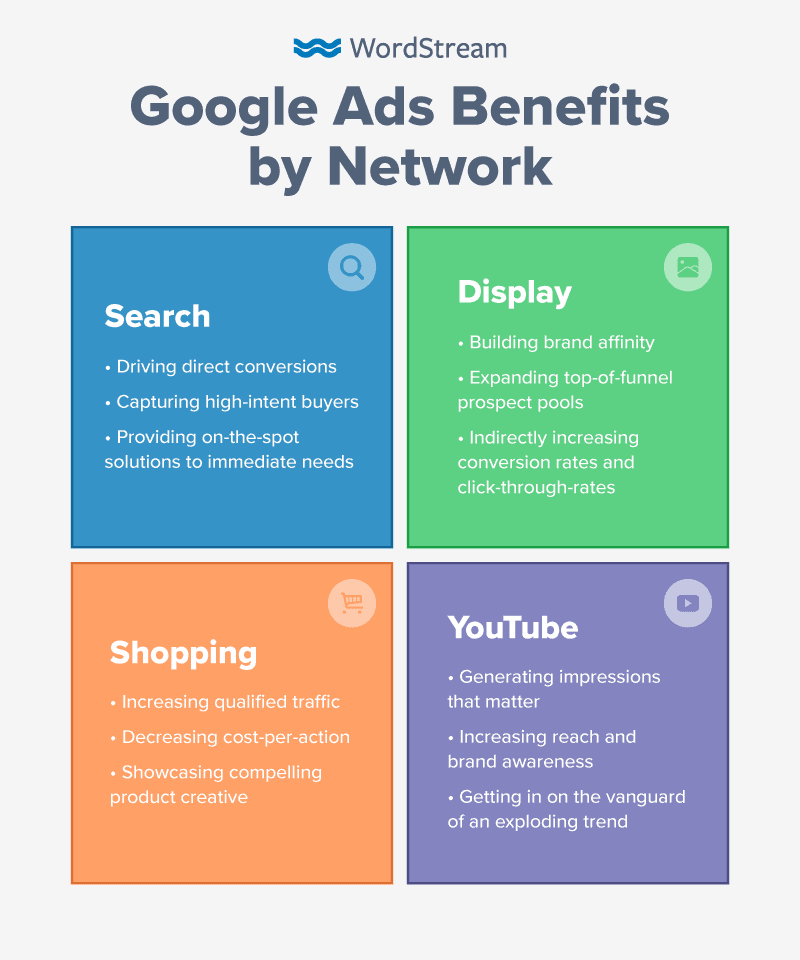

Google search and gargantuan ad revenues

Under Google digital advertising revenues, mainly from Google Search, make up 84 percent of revenues. The search engine giant commands over 80% of the global desktop search engine market and 95% of the global mobile search engine market. As the search engine successfully diversifies, two growth engines YouTube and Google Cloud now make up 25 percent of Google revenues. Google has ambitions to become an e-commerce giant to rival Amazon. Google Shopping ads can now be accessed from one homepage, with the convenient search, product comparison, reviews and check out services of a fully serviced e-commerce site. Digital ad spend is rapidly shifting to mobile searches–50 percent of all searches. Google mobile apps are among the most downloaded in the world including Google Search, Google Mail, YouTube, and Google Maps.

Other Bets – Despite its name, Alphabet is not rolling the dice on its non-core search and advertising businesses. The self driving car unit Waymo, health informatics company Verily, and AI research arm DeepMind are in the commercialization stages. The drone delivery service Wing Aviation and wind energy company Makani Technologies are commercializing products this year with major corporate partners. Other Bets has less than $1 billion in revenues, but these ventures will start ramping up revenues this year.

Artificial intelligence and smart robots

Across all its services, Google is enhancing services and interconnectivity through artificial intelligence. Google shoppers are being connected across YouTube, Search, and Google Assistant and other smart home devices. AI bots are switching to more responsive ads as the deep learning engine identifies which ads work best with search terms. And when businesses want smarter processes, Google Cloud offers one of the most advanced AI toolboxes for them to play with.

Unfortunately, Google Assistant cannot tell us what Google’s stock price will be in one or five years. But we can make a fairly accurate prediction based on a long history of delivering consistent revenue and earnings performance. Following the coronavirus crash, year-to-date, Google stock is down 9.92 percent. This performance is a tad inferior to that of what we call the FAAG (Facebook, Amazon, Alibaba, Google) stocks. We remove the option to buy Netflix stocks (part of FAANG) to compare direct competitors only. This grouping of high growth Internet services stocks is down 5.3 percent this year.

All FAAG stocks are down with the unless you buy Amazon stocks, up 10.5 percent, which is a positive trend for Google’s new shopping homepage. Google’s recent launch of Google Shopping this year makes it a more direct competitor to e-commerce and cloud plays Amazon and Alibaba. These e-commerce stocks have a 3-year average stock growth of 130.9 and 78.8, respectively, compared to 43.6 percent for Google. With Google Shopping open for business, we expect Google stock to capture more of this online shopping premium going forward. The e-commerce plays are growing faster. Amazon’s three-year earnings per share growth is 67.5 percent versus 20.9 for Google.

But Google is a more profitable company than some key competitors. GOOG has profit margins of 21.2 percent versus Amazon’s 4.1 percent. Among search engines, where Google has a 92.5 percent global market share and no direct competitors, Chinese search engine giant Baidu has profit margins of 2 percent. Yet the market is valuing Google lower at a PE of 24.5, below its 5-year average of 34.5. In comparison, China’s search engine giant Baidu has a PE of 115 and Amazon 88.8. Google’s lower valuation could indicate it is a good time to invest in Google stock.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Your capital is at risk.

Google stock dividend information

Google does not pay a dividend. Investors invest in Google for its strong growth in earnings for each dollar invested in GOOG shares, or earnings per share. The company has grown EPS at a three-year average rate of 20.9, a 2 percent and 7 percent increase over its five- and ten-year averages, respectively (gurusfocus.com). If the stock does decline, Google has over $100 billion in cash to support its stock price through stock buybacks. 2019 was its biggest year for stock buybacks at $18.4 billion, double 2018 stock repurchases.

Google stock forecast and outlook

The Googleplex—one of the largest employers of engineers in the world—is growing profits. Though 2019 revenue growth of 18.3 percent is slightly below its five-year average of 19.3 percent, profit margins of 21.2 percent are above the five-year average of 19.7. This is an impressive feat given the capital intensive businesses being developed under Other Bets. Alphabet’s R&D expenses have doubled in five years to $26 billion. But many of these businesses will drive out of the labs over the next few years, and will start generating revenues as soon as this year.

The average 2020 forecast for Google stock is $1,530, with a high estimate of $1,800 and low of $1,250. Here are our GOOG stock forecasts for the next five years.

2020 – Smart learning machines boost ad revenue

Google’s ad system is getting smarter. Artificial intelligence helped to increase the average revenue per user in recent quarters. Automated bidding and smart bidding analyze millions of data signals to optimize ad auction bids. With better targeted bids, advertisers are seeing their number of clicks, cost per acquisition, conversion rates, and overall ad spending improve. As machine learning gets better at optimizing ad effectiveness in real time, ad revenue per user is expected to grow over the next five years. Although Google has spent billions of dollars acquiring machine learning and robotics companies and its AI research arm reportedly has $1 billion in debt, AI is already creating value across Google services. Median stock growth is expected.

2021 – Smart robots on the cloud

Google is also widely viewed as having an AI edge in cloud services, which have been growing at 50% plus quarter over quarter. Google Cloud market share grew 3.1 percent to 8 percent of $96 billion in global cloud revenues in 2019 (Statista). Although Google continues to trail behind Amazon Web Services and Microsoft Azure in market share, GCP is the second fastest growing cloud provider after Alibaba Cloud. To stimulate growth, Google is augmenting both the human sales workforce and use of smart, learning machines. At its AI Hub, enterprises can access plug and play AI components, development building blocks and collaboration tools. Median-to-high Google stock growth is forecast.

2022 – No longer wagering on Other Bets

Other Bets ventures will start contributing substantially to revenue during this forecast period. Waymo’s commercial taxi service Waymo One and app officially launched in December 2019. The robo-taxi service will generate revenues of $114 billion by 2030, not including commercial delivery or logistics, forecasts UBS. Since the coronavirus confinement, business has doubled for drone delivery service Wing in its North American, European and Australian test markets. An $11.2 billion drone market by 2022 is forecasted to grow at a CAGR of 21 percent to $29 billion by 2027 (ResearchandMarkets). Several of Google’s health ventures are on the front lines combatting the coronavirus epidemic. Median-to-high Google stock growth is forecast.

2023 – Ubiquitous Google Shopping

Watch out Amazon! Google sites are becoming shoppable. This shopping will more frequently take place on Google Assistant (accessed on Android smartphones, growing 4.4% to 90% OS market share in 2025, IDC; and Google Smart Home speakers). In the smart home, Google Home market share is expected to double to 48.1% in 2025 when 75% of US households will use smart speakers, overtaking Amazon’s current lead (Loup Ventures). Median-to-high Google stock growth is forecast.

2024 – Big bets start paying off

By 2024, Other Bets will be contributing substantially to revenues. This could be the lift off year in which Google’s innovative projects reach 10–25 percent of revenues. Waymo will break out as a separate unit and could even be spun off into a separate public company to unlock shareholder value. Waymo will generate $1 billion in annual revenue by 2020 and $50 billion in annual revenue by 2029, estimates Bank of America. As these innovative ventures start contributing to revenues, median-to-high Google stock growth is forecast.

How to Buy Google Stock from eToro

Assuming you have a funded account, below are the simple steps to take buy Alphabet stock.

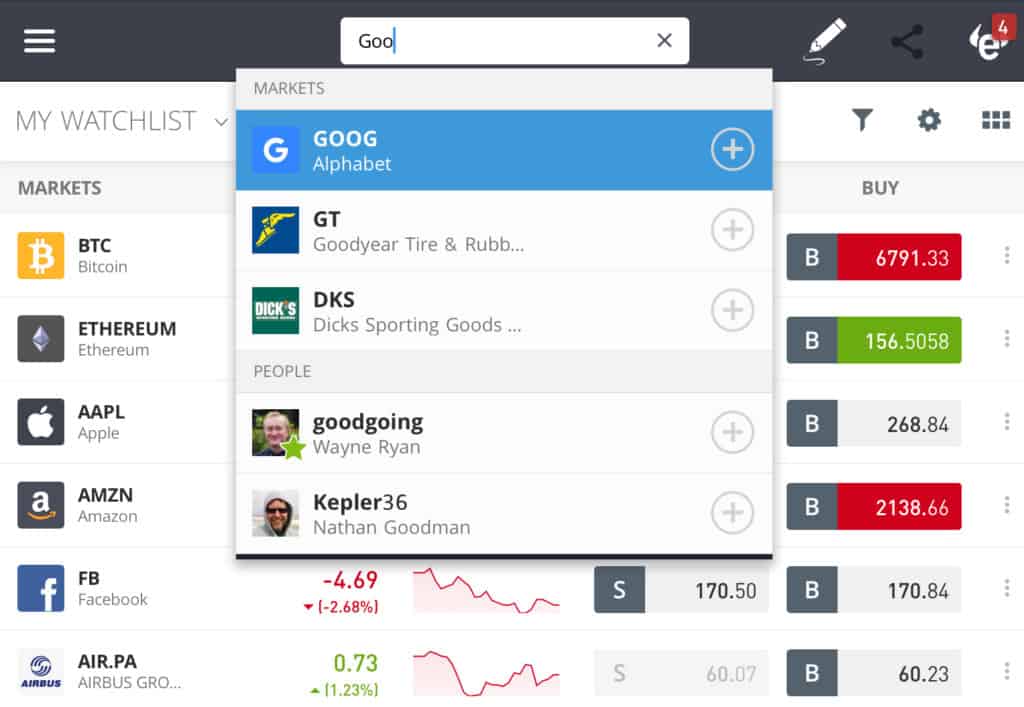

Step 1: Search for Google (GOOG) Stock

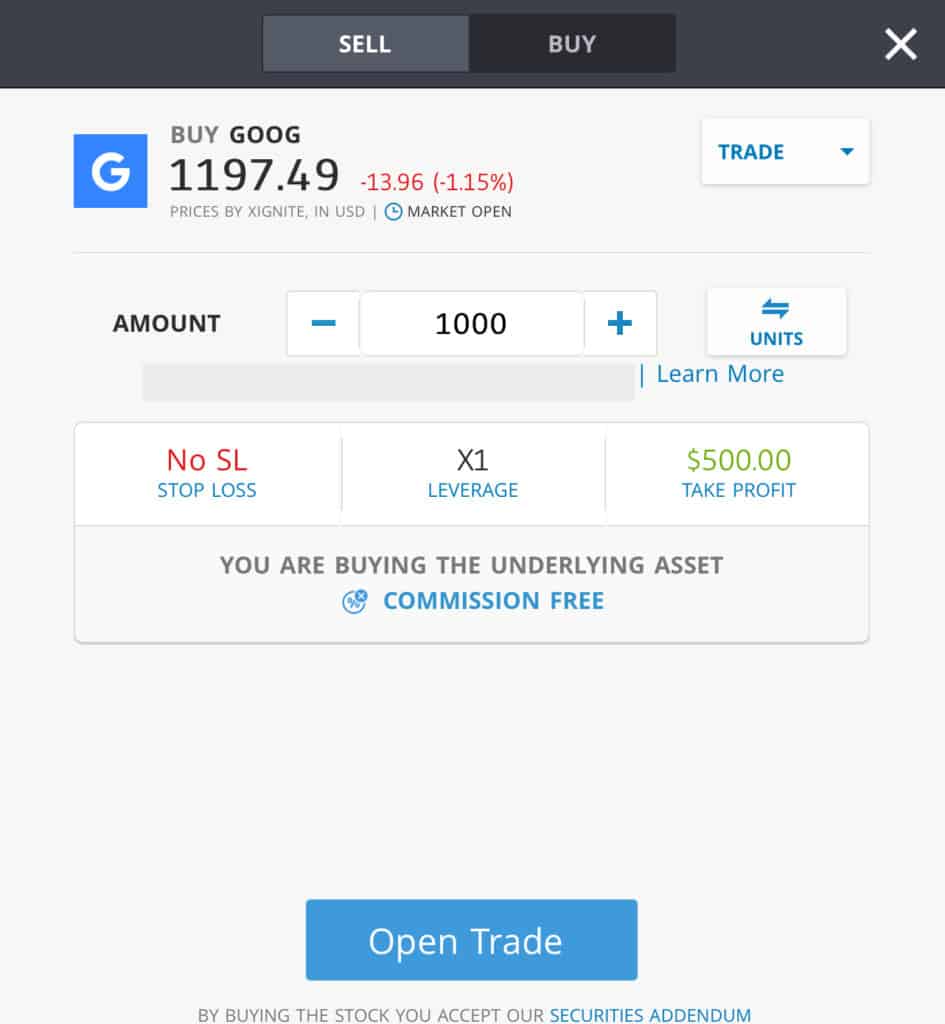

Step 2: Click on trade

Step 3: Specify ‘Buy’

Specify ‘Buy’ on the top tab, change the leverage to X1 to purchase real stock and proceed to set your order. And if at this point you haven’t put money into your account, you’ll be prompted to do so.

Investing in Google Shares – Final Thoughts

So, should you buy Google stock? Can Google be as successful in online shopping, autonomous cars, and flying drones, as it has been in the internet search business? We think Google’s engineers will continue to lead in innovation and translate high R&D spend into smarter internet services, and thusly higher revenue and earnings growth long term.

When you are ready to buy Google stock, we recommend doing so via a regulated online broker such as eToro if you’re a UK customer, and Stash Invest for U.S. customers. If you’re looking for other stock options, check out how to buy Tesla stocks here

Read more:

FAQs

In 2015, Google Inc. formed a new holding company Alphabet Inc. Alphabet now trades under the Google stock symbol GOOG. Google–home of Google Search, Cloud and YouTube— is now one subsidiary of Alphabet. The other is Other Bets, which houses former Google Ventures companies, including Calico, Chronicle, Capital G, Verily, Waymo, DeepMind, and others.

Growth companies return value to shareholders in the form of increases in stock value and invest cash flows in acquisitions and stock buybacks to sustain growth. Google has made over 200 acquisitions over the decade. Over the past five years (to December 2019), an investment in the S&P 500 with dividends reinvested returned 11.7 percent whereas GOOG returned 20.5 percent over the same period.

Google has a 92.25% share of the global internet search market, followed by Bing (2.41%), Yahoo! (2.07%), and YANDEX RU (0.63%). Google processes 3.5 billion searches a day, or 1.2 trillion searches a year. A Google search produces 1.2 million references to Google as the ‘search giant’.

Indexes and ETFs provide a cheap way of getting diversified exposure to five of the highest performing technology stocks, known as FAANG (Facebook, Apple or Alibaba, Amazon, Netflix, Google). The following ETFs have high exposure to the FAANG stocks. MicroSectors FANG+ ETN (FNGS) – 50%, 10% in each FAANG stock, iShares North American Tech ETF (IGM) – 37.3%, Invesco QQQ (QQQ) – 30.3%.

You can buy Google stock from online stockbrokers. eToro and Stash Invest are examples of online broker platforms where traders buy and sell Google shares. After signing up online, type in the GOOG ticker, place your order and you will become an owner of Google shares. When did Alphabet Inc. become the parent of Google?

Does Google pay a dividend?

Why is Google called the Search Giant?

How do I invest in the FAANG stocks?

Where and how can you buy Google stock?

Comments are closed.