[kkstarratings]

In a few years, more drivers will be charging their electric cars than filling up with gas at BP stations.

Fortunately, the oil supermajor is in the electric charger and energy storage business and four other key low carbon businesses. BP was an early mover among the oil majors to invest in renewables. This advantage is paying off as the world shifts to clean energy over the next decade.

This guide looks at how to assess BP’s future growth opportunities, value BP stock, and find the best BP stock brokers as BP meets the dual energy challenge of meeting demand for oil and low carbon energy.

Should you invest in BP?

If you invest in FTSE 100 shares then you know the high market value of this large energy company. A doubling of BP profits to $12. 7 billion in 2018 sent the FTSE 100 soaring. Even in bad times, when you buy BP shares, you buy a hedge against stock price declines. BP will buy shares back to prevent dilution of your share holdings and pays a regular dividend with a healthy 5.59 dividend yield.

When you invest in BP shares, you are investing in one of the world’s energy supermajors. The oil company generates $300 billion in annual revenues, among the top 10 companies by sales. So the obvious question is, how will this oil major maintain its market value as it transforms into a low carbon company? With no intention of becoming a dinosaur of the fossil fuel world, BP is actively investing in its five low carbon businesses.

Pros of buying BP stock

Strong upstream and downstream cash flows

BP’s oil output increased to 3.7 million barrels of oil equivalent a day (mboe), up 2.4 percent. From its 19.75 percent stake in Rosneft, BP shared in the profits of 1.1 million barrels a day of production, plus $620 million in dividends. The $100 million Upstream Carbon Fund is helping upstream operations continue to reduce carbon emissions while producing more energy.

Low carbon strategy

BP is investing $500 million annually in its low carbon businesses (biopower, wind, solar, renewable products, renewable fuels).

BP has bought Chargemaster, the operator of the most electrical vehicle charging stations nationwide and ultrafast charging developer Storedot. BP has made over 40 active clean energy technology investments. If you are deciding whether to buy Tesla stocks or BP, BP pays a dividend with a high yield.

Operating efficiencies

BP is producing and refining energy assets more efficiently. Return on invested capital doubled to 11.2 percent in 2018. BP is lowering its breakeven on a barrel of oil to free up more cash flow for the low carbon business expansion.

Cons of buying BP stock

Oil price volatility

Oil prices plummeted from $83 a barrel in October to $59 by year end, before rebounding to $63 in 2019. OPEC has lowered production for the first half of 2019. Gas prices became more volatile in 2018, jumping briefly from $3 per BTU to $3.70.

Lower refining margins

Refining margins fell to $11 per barrel from $14.70. On the upside of the downstream business, fuel marketing and refining hit record profits. One way to hedge energy price volatility is to buy FTSE 100 stock ETFS. Three of the indexes top five holdings are integrated oil majors.

High investments in a low carbon strategy

BP is ahead on it’s low carbon strategy but behind what it could have been if it had not bailed out of it’s alternative energy business between 2011–2015. BP closed down BP Solar for a few years, and sold biofuels businesses, which are now core areas for development.

BP Stock: Current Prices and Summary

BP’s alternative energy strategy may seem like turning around a submarine in a bathtub, but with continued cost cutting and margin expansion across its core energy businesses, BP is finding the cash to make this low carbon maneuver. Operating cash flow increased 33 percent to $26.1 billion in 2018.

Fifteen new upstream projects are being developed with 35 percent higher cash margins, with a planned increase to 40-50 percent by 2025. Development costs are being lowered 20 percent. BP expects return on investments of greater than 10 percent by 2021 at $55 per barrel of oil.

BP’s price-to-earnings ratio is 16, significantly lower than 26 for the oil and gas production sector. But how will its expansion into low carbon businesses affect profits? In the solar and EV business, you would buy Tesla stock for its high revenue growth as the PE ratio is negative. Likewise, the renewables industry is generally not yet profitable. BP’s keen focus on margin expansion is the right one to maintain healthy profit margins while moving into the tighter margin alternative energy business.

Your capital is at risk.

BP price quote

| Price | $ 170.93 | Daily high | $ 171.44 |

| Volume | 18963658 | Low | $ 169.50 |

| Variation | 12:51 | Opening | $ 169.71 |

| + / -% | 00:30% | Day before | $ 170.42 |

Best BP Stock Brokers

|

|

|

|

|

|

|

|

|

|

| Pros: |

|

|

|

|

| Cons: |

|

|

|

|

| Spreads | • Spreads from 2 pips • Flat fee on withdrawal | •Fees are built into spread. • Spread cost : 0.35 • Unregulated broker | • Spreads from 2 pips | •Fees are built into spread. • Spread cost : 2 pips |

| Number of stocks available | 4,000 | 2,500 | 1,500 | N/A |

| Financing rate | 8.9% | 7.9% | 13.9% | N/A |

| Visit broker | |

[button href="https://www.insidebitcoins.com/visit/etoro-stocks" style="emboss" size="medium" color="#329e31" hovercolor="#81d742" target="_blank"]Visit Broker[/button] | [button href="https://www.insidebitcoins.com/visit/etoro-stocks" style="emboss" size="medium" color="#329e31" hovercolor="#81d742" target="_blank"]Visit Broker[/button] | [button href="https://www.insidebitcoins.com/visit/skilling" style="emboss" size="medium" color="#329e31" hovercolor="#81d742" target="_blank"]Visit Broker[/button] |

How to Buy BP Stock – Tutorial

How to buy BP stock on eToro

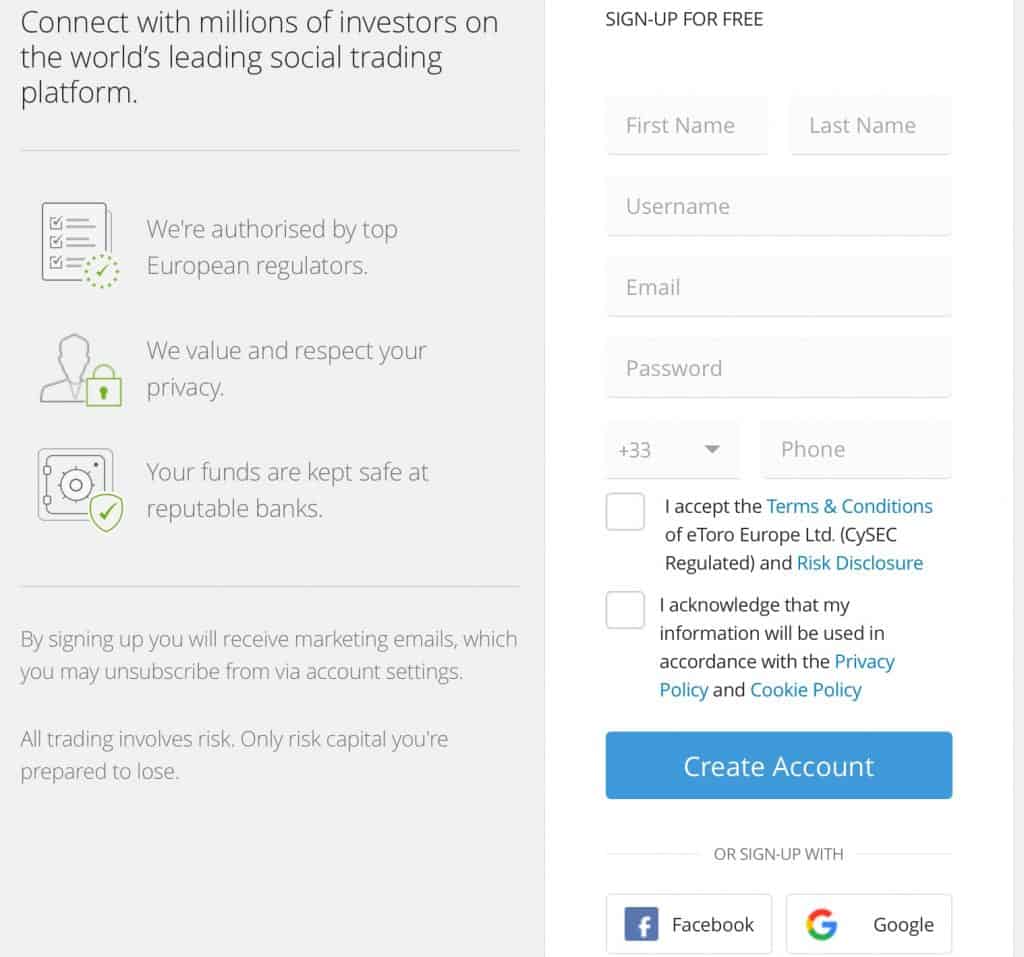

eToro has established itself as a reputable and trusted broker among traders since it launched in 2007. The leading online broker for social trading is regulated in several jurisdictions, including by the UK’s Financial Conduct Authority (FCA). Popular features include social feeds, research and One Click Trading. If you are deciding whether to buy BP shares on eToro, review these pros and cons.

Pros

- Fast account opening process

- CopyTrader™ platform

- CopyPortfolios™ across an investment theme

- One-click trade execution

- Low fees

- Low minimum deposit (200 euros)

- Range of payment methods

- User-friendly interface

- Full BCH trading

Cons

- Withdrawals can be slow

- Mostly CFDs

How to trade BP stocks on eToro

Step 1: Register your account

First, start by opening your eToro account here. Fill out your basic profile information. To determine your investor risk profile, you will be asked to answer a few short questions about your investment experience, knowledge and style, as well as your risk-return tolerance.

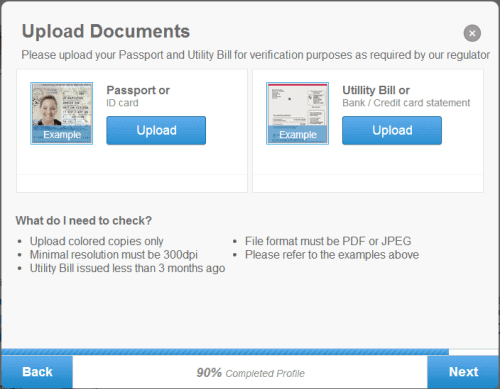

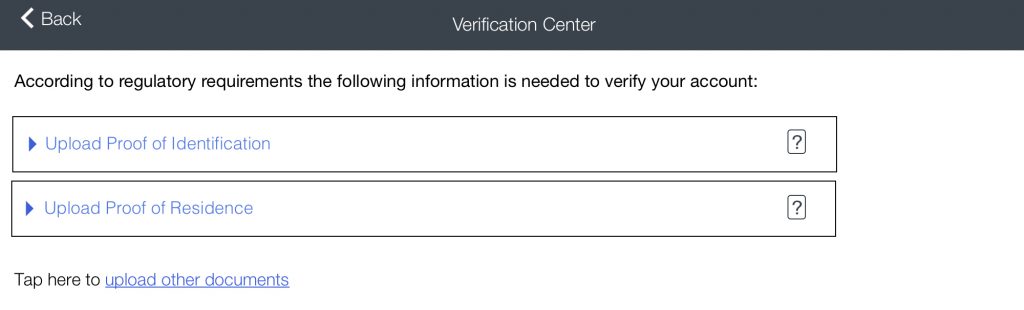

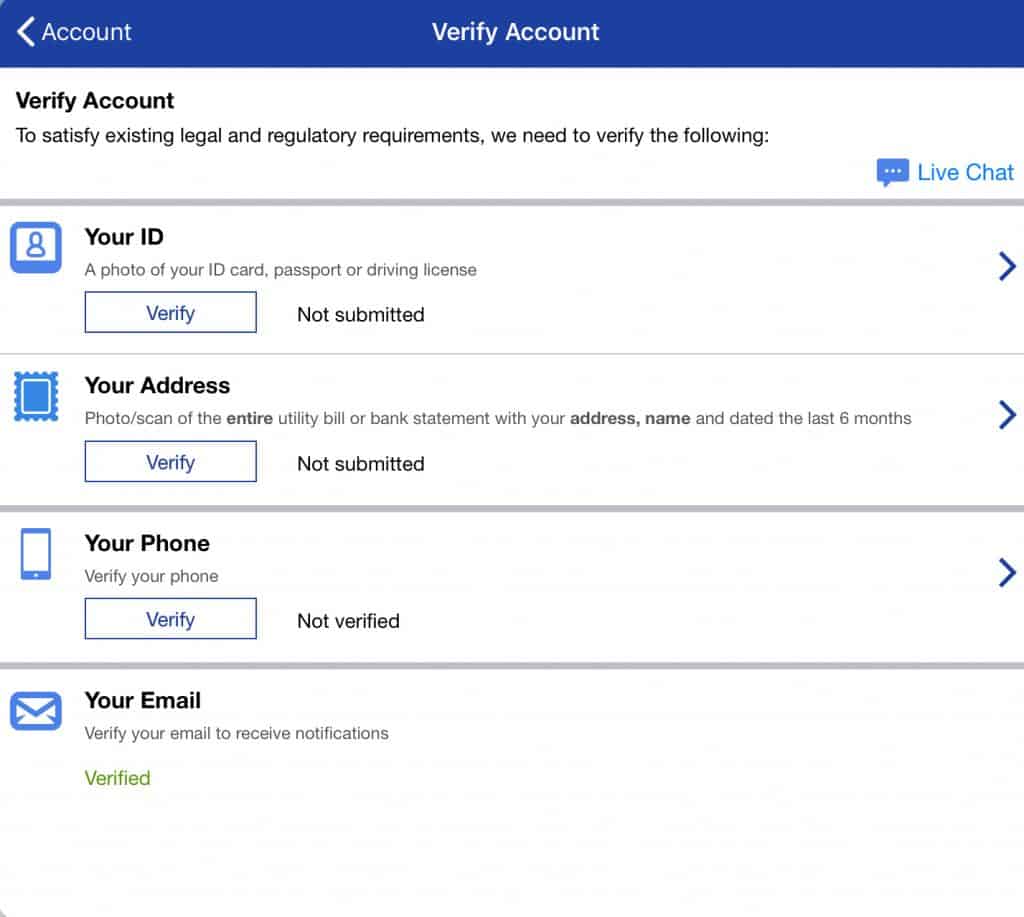

Step 2: Verify your identity

Attach and submit proof of identity for verification. US-based accounts are not accepted.

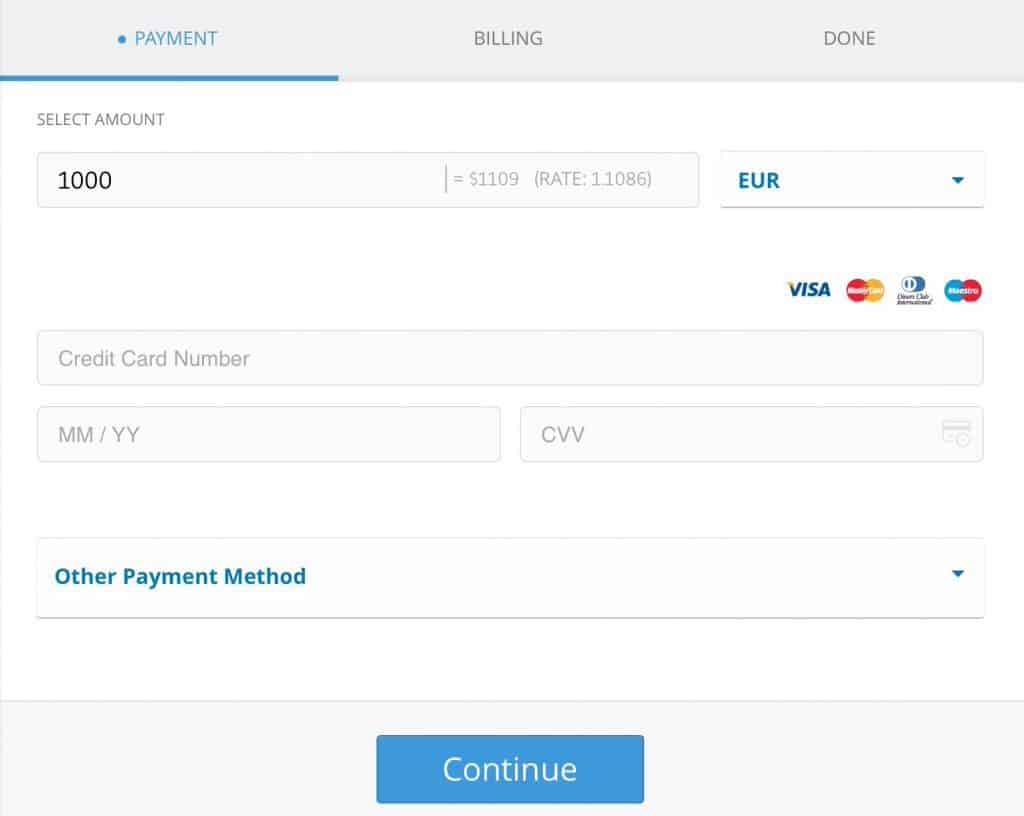

Step 3: Fund your account

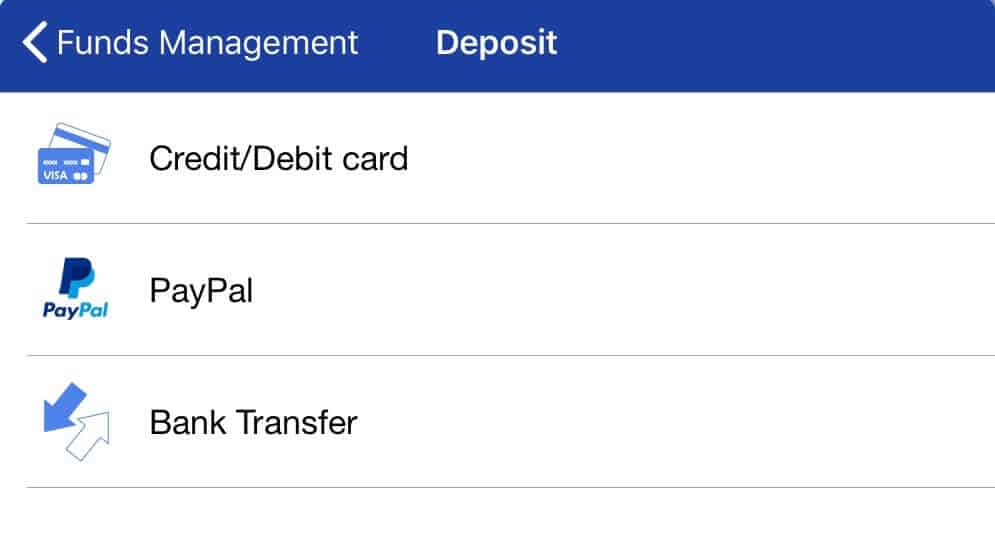

eToro provides a wide variety of payment methods. Check to see if your preferred method is available in your country.

Step 4: Trade BP stock

On eToro, you can invest in BP through traditional securities trading and social investing. To help you find the best investments for your portfolio, eToro assigns the portfolio of every trader a risk score based on the volatility – average daily price movement – of the instruments invested in on a scale of 1–6, 6 representing the highest risk. Here are three ways to invest in BP stock on the leading social trading platform.

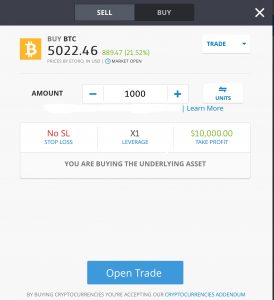

Step 4A: Place a BP stock trade

We have chosen to invest in the Horizon Medical Marijuana ETF (HMMJ), which provides diversified exposure to medical cannabis stocks. BP (BP) stock is a top holding. Click on Trade. Select Market (current price) or other price level you want to enter the market at. Enter the amount you want to trade and leverage (X1, X2, X5). Your Stop Loss and Take Profit levels are preset by you. You can also set up a One Click Trade option and preset the above parameters. (The stock profile page provides social feeds, stats, charts and research. Social feeds often provide helpful technical analysis tips and updates on how a stock is trading relative to various benchmarks.)

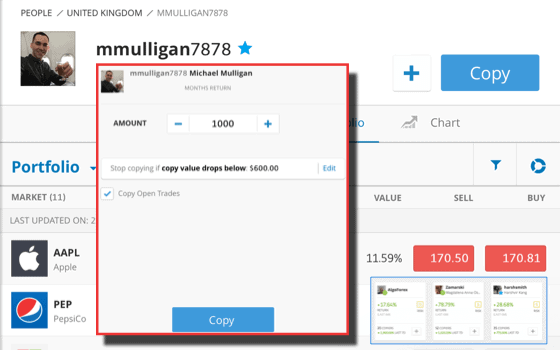

Step 4B: Place a CopyTrader™ trade

Choose from the selection of copy traders by reviewing their risk score, trading performance stats, charts, and portfolio. Also check out the traders on the Editor’s Choice List. Copying a portfolio that holds BP is a way to buy BP stock while diversifying risk. Click Copy. From the copy trade box, choose the amount you want to trade and the copy trade stop limit. Press Copy.

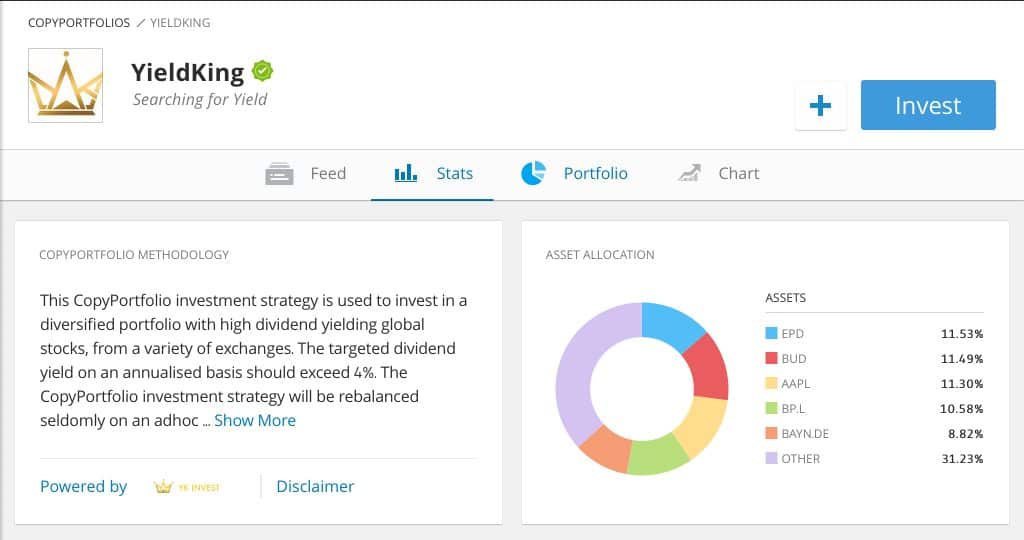

Step 4C: Place a CopyPortfolios™ trade

Choose a portfolio among dozens of investment themes. CopyPortfolios™ copies multiple portfolios and traders following that theme. BP is a top holding of the YieldKing portfolio, which invests in companies with high yielding dividends.

Review the risk profile and portfolio performance. Click on Invest. From the Invest box, choose the amount you want to invest and the stop investing limit. That’s it! To open your eToro click here.

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

How to buy BP Stock on Markets.com

The official online broker of the Arsenal Football Club provides all the basic tools and education a retail trader requires. markets.com is owned by Playtech, a public company listed on the London Stock Exchange. Like its PlaytechOne one wallet – the one account solution for playing on casino, poker, sports and other gaming sites – markets.com seeks to provide quick and easy access to a good range of investment products. If you are deciding whether to buy BP shares on markets.com, review these pros and cons.

Pros

- Suitable for day traders

- Demo account

- Low commissions

- Good quality news flow

- Good set of analytical tools

Cons

- Limited order types

- Not many deposit options

- Customer service not very effective

- Unregulated broker

Start trading BP stock on markets.com

Step 1: Register your account

You will be prompted to download the markets.com stock trading apps to register. After filling in basic profile information, a brief questionnaire on investment experience and knowledge, as well as income and assets, will determine your trading level and leverage. 1:30 is the leverage for the average retail investor. So with a $500 deposit, you can trade up to $15,000.

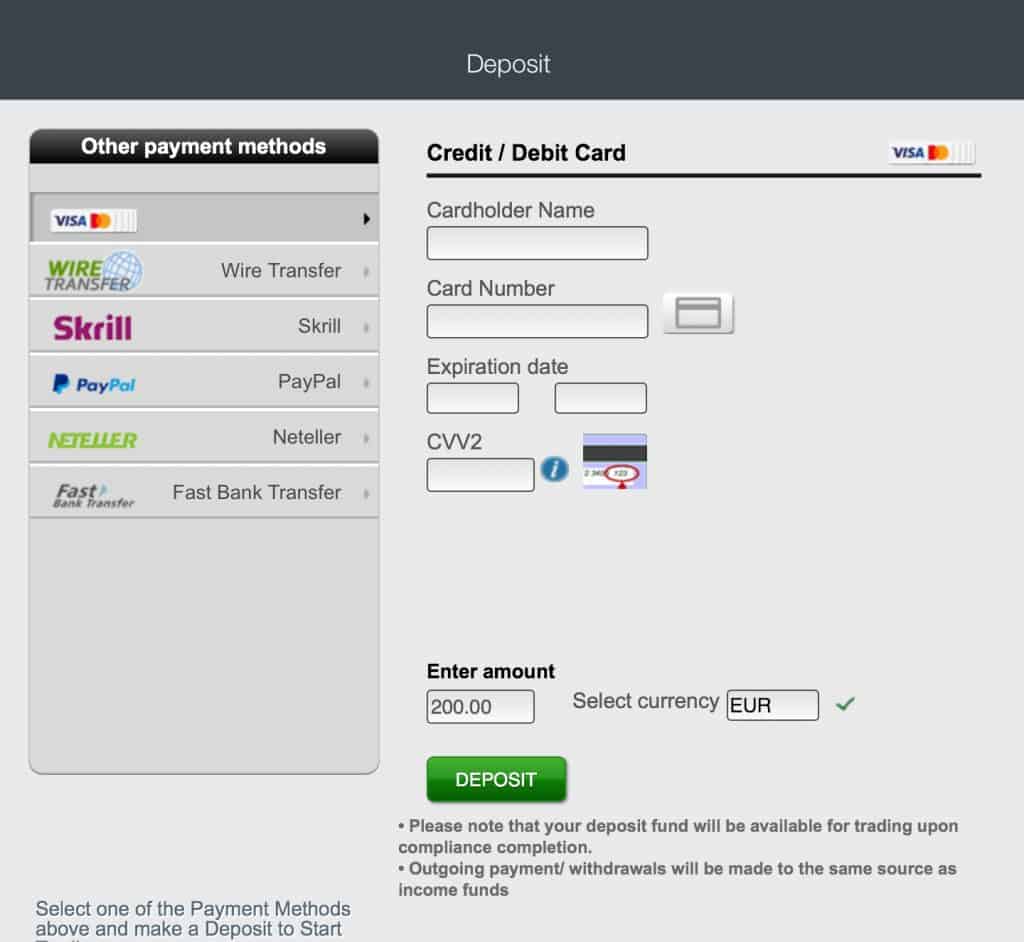

Step 2: Fund your account

If depositing by credit card, you will need to first have it verified. Click on Verify Credit Card on the My Account Page.

Step 3: Verify your identity

Attach and submit proof of identity and a utility bill for verification. Residents of the USA, Canada, Australia, Hong Kong, Japan and some other countries are restricted.

Step 4: Trade BP stock

On Markets.com, you can choose to invest in BP stock, or a wide range of ETFs and indexes. Other securities include forex, cryptocurrencies (a handful of majors), bonds, blends, and grey markets in Uber and Lyft ahead of their IPOs. Trending Now displays a list of top moving stocks.

The BP stock profile provides basic stock price charting information and a market sentiment indicator. Place the trade by choosing the Buy or Sell button.

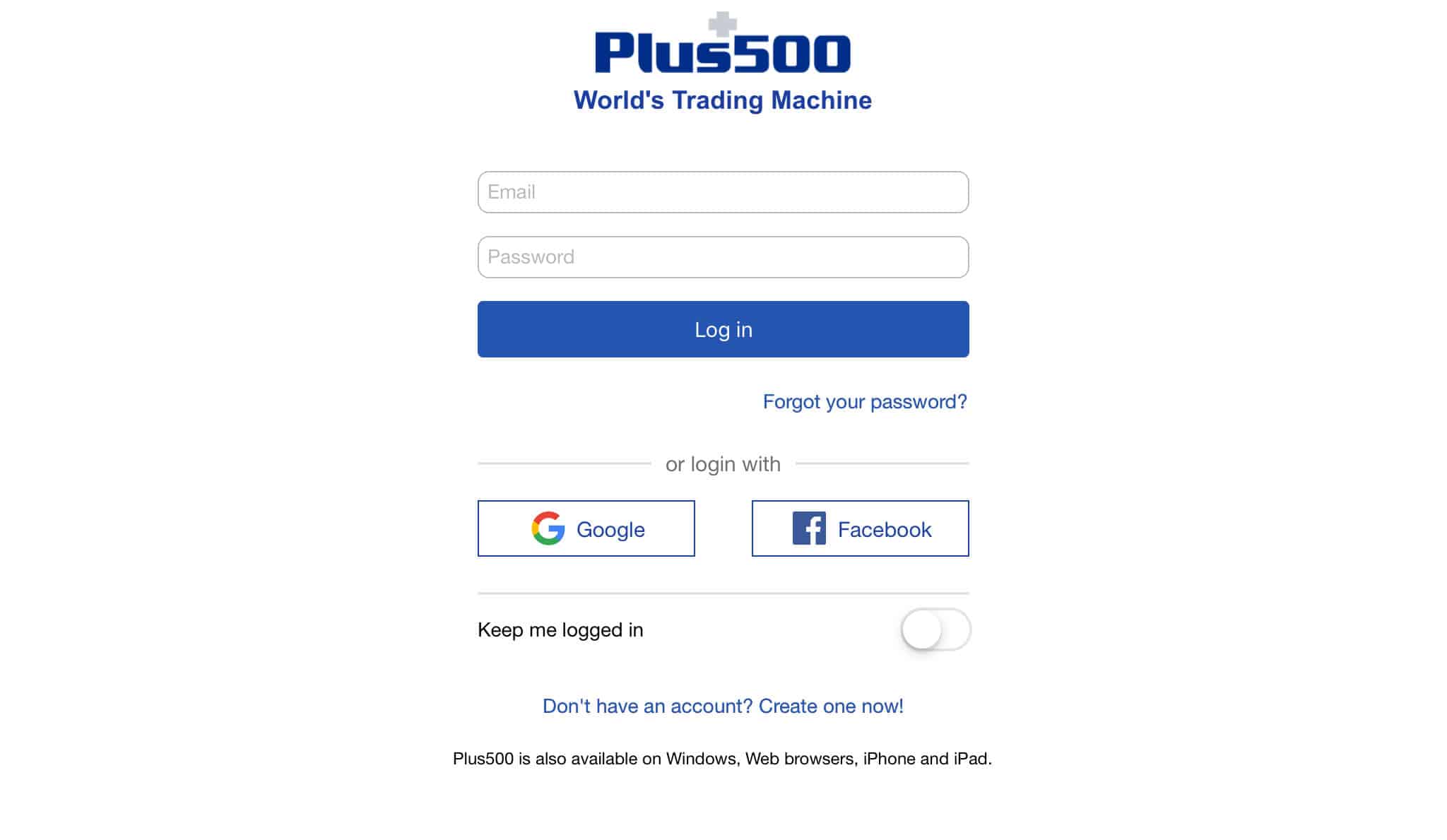

How to buy/sell BP CFD stocks on Plus500?

Novice retail traders may find this platform lacks the trading interface, research tools and education they depend on for general guidance. The experienced trader with their own tools, stock data and news will be at home with the simple, intuitive interface and over 100 technical indicators. Traders who qualify for a professional account (with a minimum portfolio value of €500k) can raise their leverage levels, for example, from 1:5 to 1:20 for stock trades. If you are deciding whether to trade CFD on BP shares on Plus500, review these pros and cons.

Pros

- FCA regulated

- Listed on the LSE

- Easy to use platform

- Great mobile platform

- High order volume

Cons

- Experienced traders only (no fundamental data)

- Only CFD trading

- High financing rates

- No scalping allowed

Start trading BP CFD stocks on Plus500

Step 1: Register your account

You will be prompted to download the Plus500.com mobile app to register. Select between a Demo and Real Money account. After filling in basic personal information, you will gain access to the unlimited demo account. Before you can use it, you will be prompted to answer a few questions to establish your investor risk profile.

Step 2: Fund your account

When you are ready to trade with real money, fund your account. Three payment options are provided. You may be asked to verify your payment method.

Step 3: Verify your identity

Attach and submit proof of identity for verification.

Step 4: Trade CFDs on BP stocks

Plus500 offers a wide variety of CFDs on investment instruments, including stocks, ETFs, indexes, forex and cryptocurrencies. For the advanced investor, options trading is also available on many stocks. Query BP and the price quotes for the stock appear on the screen.

All stock information and the Buy/Sell commands are displayed on the general stock page for the serious trader who wants to execute quickly. The bottom half of the page displays the price chart and provides access to a broad selection of technical analysis indicators.

80.5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the risk of losing money.

A Brief Overview of the History of BP

BP has its roots in Iranian oil exploration and production as the Anglo-Persian Oil Company, founded in 1908. BP expanded through a series of acquisitions and in 1988 merged with Amoco to form BP Amoco, later renamed BP plc. In the 1970s and 1980s, the government started to privatize BP and sold its 50 percent stake to the public. In 2012, when the Russian oil company Rosneft acquired TNK-BP Holding, BNP received a 19.5 percent stake and two seats on the board of Rosneft.

It may surprise some to learn that the world’s largest oil company was an early mover in renewable energy. In 1981, British Petroleum acquired a 50 percent stake Lucas Energy Systems, which eventually became BP Solar. Several biofuel businesses were developed. BPs black mark on it’s greening environmental record was the closing and divesting of these businesses between 2011-2015. BP has made other divestitures to pay a fine in excess of $23 billion for the Deepwater Horizon oil spill in 2010 in the Gulf of Mexico, the largest oil spill in history. BP produces 3.7 million of barrels of oil equivalent per day and has 19,945 million barrels of oil equivalent of proved reserves.

BP Shares: Forecast 2019–2023

BP’s dual energy challenge ahead is to meet the world’s oil demand while transitioning to low carbon energy sources.

Oil demand will fall 30 percent to 5.5 million barrels a day over the next decade, according to OPEC. Renewables will increase 281 percent to 7.6 mboe. Natural gas will double to 13 mboe. In the business as usual scenario, a production increase of 10 percent to 110 million barrels of oil a day (mboe) would increase GHG emissions by 10 percent. To meet the GHG goals of the Paris protocol, a 20 percent decrease in production would lead to a 50 percent reduction in greenhouse gases.

BP’s strategy is to reduce emissions in operations, develop more energy efficient products and create more renewables and other low carbon businesses.

2019 – Rising demand from China and India

The BHP lower 48 assets are already contributing to earnings and cash flow. New pipelines will help boost oil supply in 2019. BP’s strategy is to reduce emissions in operations so that an increase in production does not result in an increase in emissions. The median analyst BP stock price forecast is 47, with a low of 38 and high of 60.

2020 – New projects online

Fifteen new projects will have come online between 2018–2021, raising production to 900,000 barrels a day by 2021. In renewables, Lightsource BP will be producing solar projects in its 10 markets, expanded from 5. India is an active area of development. Median-to-high growth is forecasted for BP stock.

2021 – Who’s fuelling the electric car?

Chargemaster, the EV vehicle charger, has a large market opportunity. If the UK follows Germany and requires all vehicles to convert to electric by 2030, you may not want to buy Tesla stock but the owners of the UK’s largest charging station network instead. BP is adding 2000 new EV chargers for a total of 9000 by 2021 and 400 ultra-fast chargers. Median-to-high growth is forecasted for BP stock.

2022 – From black to green

A total of 20 oil production projects are expected to become operational over this five-year period. More solar as well as biofuel projects will be commercialized. Median-to-high growth is forecasted for BP stock.

2023 – Oil financing for the low carbon economy

Analysts forecast robust compound annual growth of 30 percent for BP over this five-year period, partly fuelled by demand from China. Oil prices will increase modestly between 2019–2023, according to Brent oil forward prices, helping to fund new energy products. Still, the leap from carbon to green energy seems ambitious. A few years ago, you would not have imagined you could buy Amazon stocks for a portfolio of solar and wind farms. BP’s transition from high carbon to low carbon energy businesses is more feasible and already commercialized. Median-to-high growth is forecasted for BP stock.

Conclusion

As BP increases investments in low carbon businesses to meet the dual energy challenge, rising energy demand and prices are funding the transition. The high dividend yield is another reason to invest in BP shares.

When you are ready to buy stocks, we recommend doing so via a regulated online broker such as eToro (check out our eToro review here) if you’re a UK customer, and Ally Invest for U.S. customers.

FAQs

The British government privatized BP in 1979 by selling 80 million shares equaling 5 percent of its 50 percent holding to the public. In 1987, the remaining shares were sold. BP trades as BP on the LSE, NYSE, and FSE.

Yes, BP pays a regular and rising dividend. The current dividend is $10.55. The dividend yield is 5.6.

Yes. The Global Invest Direct purchase plan (DPP), administered by JPMorgan Chase, allows investors to buy non-US stocks without having to pay high commissions to a broker.

Yes. Global Invest Direct also provides a dividend reinvestment plan (DRIP) for BP.

You can buy BP stock from online stockbrokers. eToro and Plus500 are examples of online broker platforms where traders buy and sell BP stock. After signing up online, type in the BP ticker, place your order and you will become an owner of BP shares. When did BP go public?

Does BP pay a dividend?

Can I buy BP stock directly from BP?

Does BP have a dividend reinvestment plan?

Where and how can I buy BP stock?