Note – it’s currently not possible to buy Ripple stock, but you can invest in the Ripple cryptocurrency (XRP) itself. Read our guide on how to Buy Ripple.

The altcoin boom has thrown up hundreds of crypto projects. Many appear unrealistically idealistic, some seem cynically speculative, but Ripple is a blockchain platform that demands to be taken seriously. Already partnered with 300+ financial institutions, including some of the world’s biggest banks, this blockchain-based cross-border payment platform beats the status quo on speed and cost and might just revolutionise global payments. So, are you wondering how to buy Ripple stock?

Read on to learn more about Ripple, its native coin XRP, and how to invest in this exciting cryptocurrency.

On this Page:

Where to Buy Ripple Stock 2024

If you’re interested in buying XRP, you’ll need to find a trustworthy crypto broker or exchange. Here’s a couple of our favourite crypto brokers.

”1.

” image0=”” pros1=”800+ stocks to buy outright or trade as CFDs” pros2=”Beginner-friendly stock trading platform” pros3=”crypto wallet and exchange” pros4=”0% commission” cons1=”$5,000 account minimum for CopyPortfolios” cta-label=”Visit eToro Now” cta-url=”https://insidebitcoins.com/visit/etoro-stocks” disclaimer-text=”67% of retail investor accounts lose money when trading CFDs with this provider.” paragraphCount=”1″]

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

How to Buy Ripple Stock Online

If you’re interested in making an investment in Ripple, it’s worth pointing out that you can’t buy Ripple stock like you might buy shares in a stock market listed company. You can, however, buy XRP, Ripple’s native coin and investment asset.

The acquisition of an altcoin like XRP is often conducted on an exchange, such as Binance or Huobi. Simply put, crypto exchanges provide a platform for users to exchange one asset for another asset. This could be the exchange of fiat currency (like USD or EUR) for cryptocurrency (like XRP or BTC) or the exchange of one cryptocurrency for another cryptocurrency (BTC for XRP, say). In either case, the exchange will be conducted at an agreed exchange rate, typically the current market price.

All exchanges are different. Some allow you to buy altcoins with fiat currency, others only offer crypto pairs. So, for instance, an exchange may require you to first acquire Bitcoin or Ethereum in order to exchange it for XRP.

Alternatively, you can buy XRP from a crypto broker like eToro or Plus500. Brokers act like an intermediary or middleman, buying and selling XRP at a fixed price. Purchasing your XRP from a regulated broker ensures a degree of safety that isn’t always present when using an exchange.

With online stockbrokers, you can also trade altcoins like XRP without buying the underlying asset. Trading platforms like eToro and Plus500 allow you to speculate on an asset’s price fluctuations via CFDs (Contracts For Difference). This type of trading enables you to open a Long (Buy) position on XRP if you think It’s going to rise in value, or a Short (Sell) position if you reckon it’s set to fall in value.

CFD trades also introduce the possibility of using leverage, which enables you to boost the value of a trade beyond your upfront capital in order to gain greater exposure. Needless to say, leverage is a form of borrowing that ramps up your potential losses and caution is advised.

How to Buy Ripple Stock in USA

US citizens can buy XRP using a crypto exchange or broker, as detailed above. Obviously, you’ll need to find a platform that services US citizens. Luckily, eToro is available for buying cryptocurrencies, either from the regular platform or via the eToro wallet, in most states across the US.

Keep in mind that CFD trading isn’t permitted in the United States so CFD-only platforms are a non-starter.

Should I buy Ripple Stock? Points to consider

The question of where Ripple stands on the ‘spectrum of decentralisation’ is a contentious one. Suffice to say, Ripple is positioned as a streamlined remittance solution that is faster and more cost-effective than established methods and, as such, speed and efficiency are more prominent selling points than decentralisation.

It’s fair to say that Ripple is designed to disrupt and potentially revolutionise the global payment industry from the inside. Ripple’s plan involves partnering with financial behemoths rather than going toe-to-toe with them.

Ripple’s native coin, XRP, plays a central part in the system, effectively facilitating transactions by acting as a bridge between whichever currencies are being transferred. As such, XRP is Ripple’s principal investment asset. It’s also the crypto market’s third largest altcoin, based on market capitalisation, after Bitcoin and Ethereum.

Ripple is a serious endeavour that enables lightning fast cross-border transfers. Compared to most of its cryptocurrency counterparts, its goals are narrowly focused and relatively pragmatic. The fact that it already partners with over 300 financial institutions across 40 countries gives some indication of the inroads it’s making into mainstream banking.

Investors must also consider XRP’s price, of course. Like most cryptocurrencies, XRP is a volatile asset that should be approached with caution. At the time of writing, XRP is struggling to stay above $0.20 and investor sentiment still seems spooked by the uncertainty of Coronavirus-impacted markets. The crypto market is no different (excluding BTC, which has done extremely well in the crisis) and there is no doubt that XRP represents a risky short-term investment right now.

In the short-term, much depends on the intricacies of the crypto market. Some anticipate a rally if bullish sentiment prevails, but resistance could also knock the price back down. Ultimately, it’s far easier to assess Ripple’s long-term prospects, which could be immense if the technology meets its stated objectives.

How to Buy Ripple Stock on eToro

It’s quick and easy to invest in Ripple at our recommended broker, eToro. Assuming you’ve signed up and funded your broker account, follow these simple steps to buy or trade XRP.

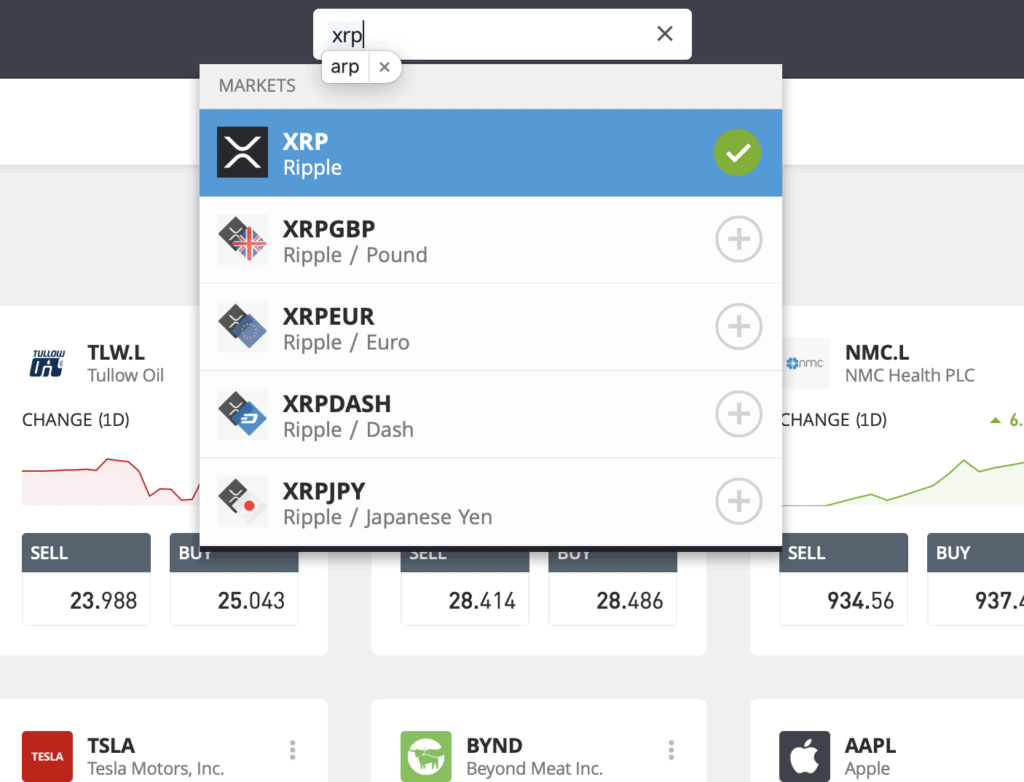

Step 1: Search for Ripple (XRP)

Look up Ripple by typing the ticker symbol XRP into the search box.

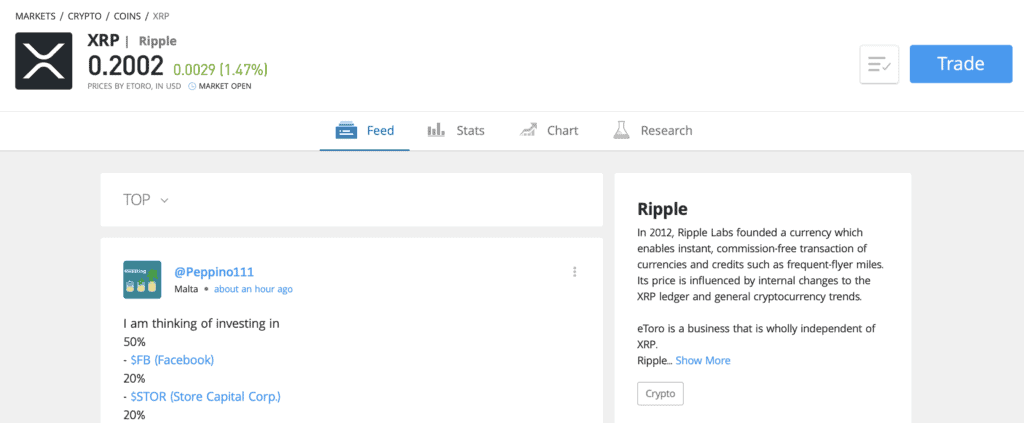

Step 2: Click on trade

Click Trade in the top right corner of the XRP page.

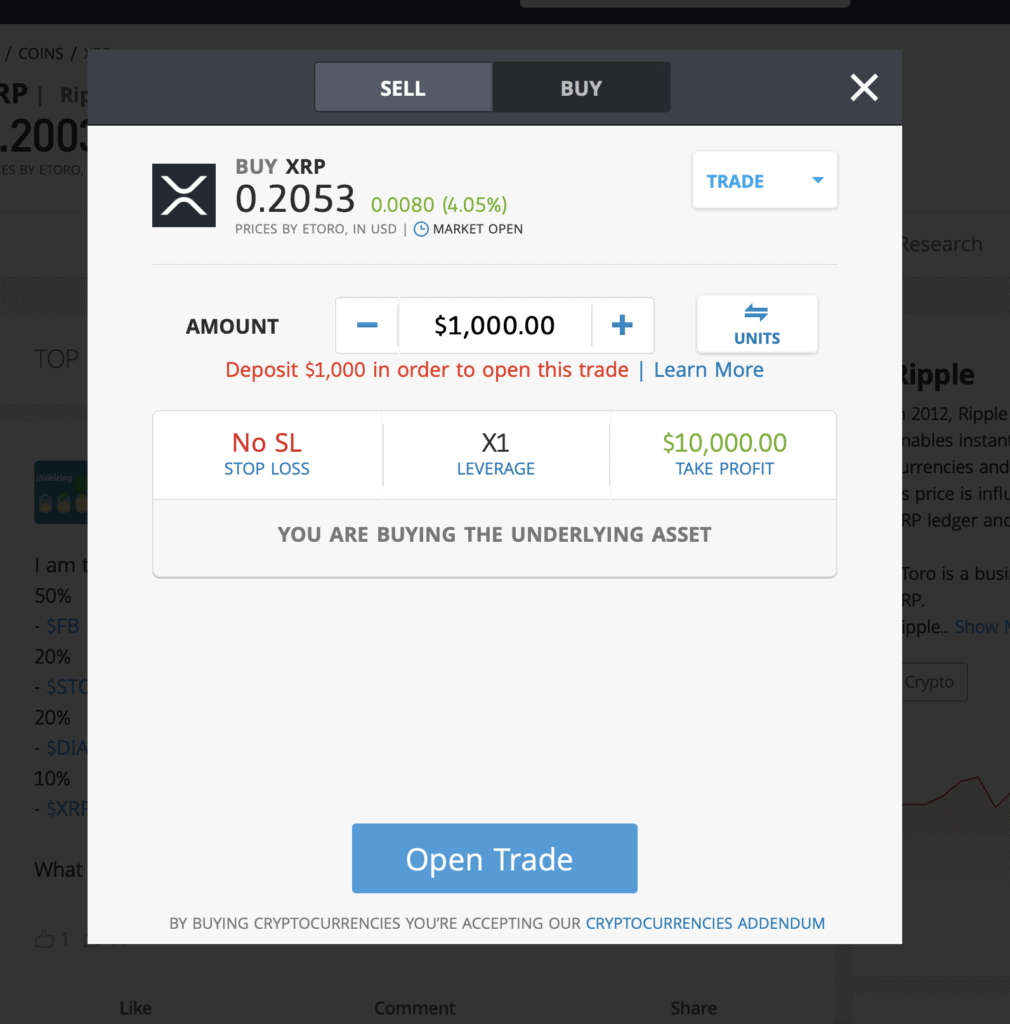

Step 3: Specify ‘Buy’

If you want to purchase the underlying asset, specify ‘Buy’ on the top tab, change the leverage to X1 and proceed to set your order. To trade XRP CFDs, set your leverage amount, Stop loss and Take profit order limits, then click ‘Set Order’.

Conclusion

Given the volatility of the crypto market, forecasting altcoins is a tricky business, but Ripple is doing plenty to offer prospective investors a credible roadmap towards a bright future.

It may not satisfy the demands of some crypto purists, but Ripple delivers high speed, low cost transactions and attracts partners like Bank of America, American Express, Santander and HSBC. If you’re looking for a serious crypto investment that has the potential to transform the banking sector, Ripple looks like one of the most plausible candidates.

FAQs

How do I buy Ripple stock?

There are several ways to purchase XRP. Some brokers allow you to buy crypto assets with a credit card or PayPal. Or you can exchange another crypto, like Bitcoin, for XRP at a crypto exchange.

Where can I buy Ripple stock?

You can buy Ripple’s XRP coin from a crypto broker, like eToro, or from an exchange, like Binance.

What are the fees when buying Ripple stock?

On eToro, no fees are charged when opening a position, instead fees based on the spread, which can vary based on liquidity and market conditions.

How do I sell Ripple stock?

You can sell crypto assets like XRP via an exchange platform, where you should be able to exchange XRP for fiat currency like USD or GBP.