If you’re looking to buy cryptocurrencies like Bitcoin, Ethereum and other popular cryptos, you may be hard-pressed to know how to get started. Before you buy crypto assets, it’s important to check online review sites for reviews of the best sites to buy cryptocurrency, their fee structures, payment methods, trading platform features and wallets to securely store the crypto tokens you’ve purchased.

In this complete how to buy cryptocurrencies guide, we’ll explore the ins and outs of crypto and the best places to buy cryptocurrency in 2024 safely at a regulated exchange unaffected by any of the ‘crypto contagion’, insolvency or bankruptcy issues that affected now-defunct sites like FTX in the past.

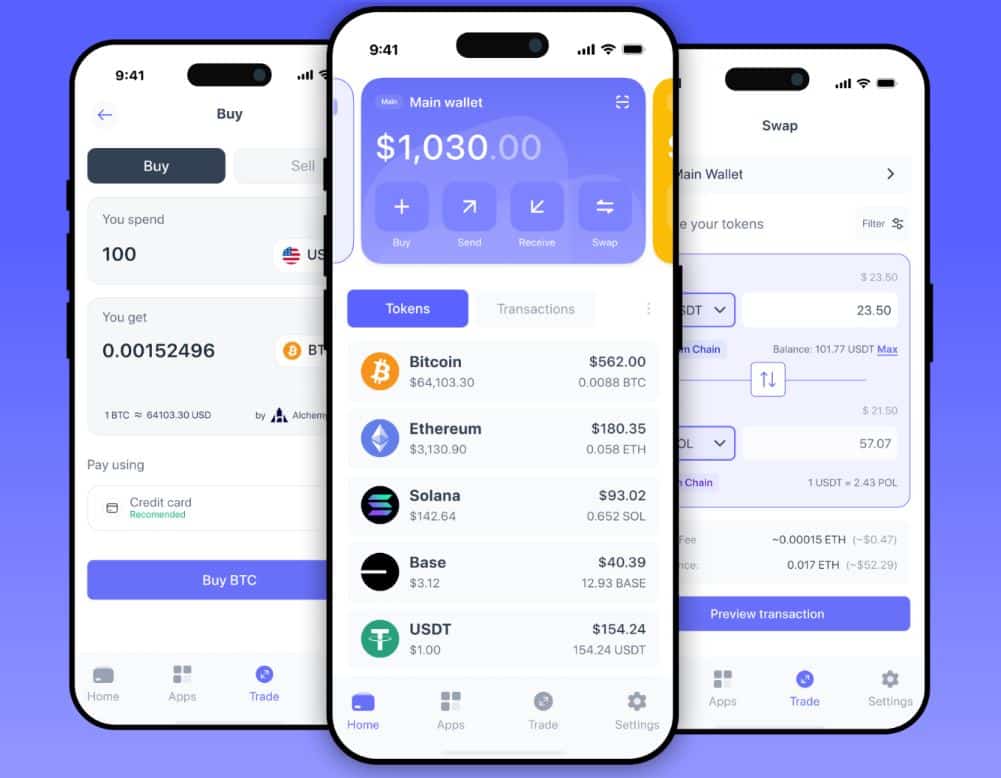

How to Buy Cryptocurrency with Best Wallet – Quick Guide

Want to buy crypto using Best Wallet? Follow the steps given below.

- Download Best Wallet – Go to the App Store or the Play Store to download Best Wallet.

- Create an Account – Create an account or connect your Google or Apple accounts to sign up.

- Select Onramp Provider – Select from the list of Onramp providers.

- Buy Cryptocurrency – Once you have selected the Onramp provider, select the crypto to buy, pick a payment method and complete the transaction.

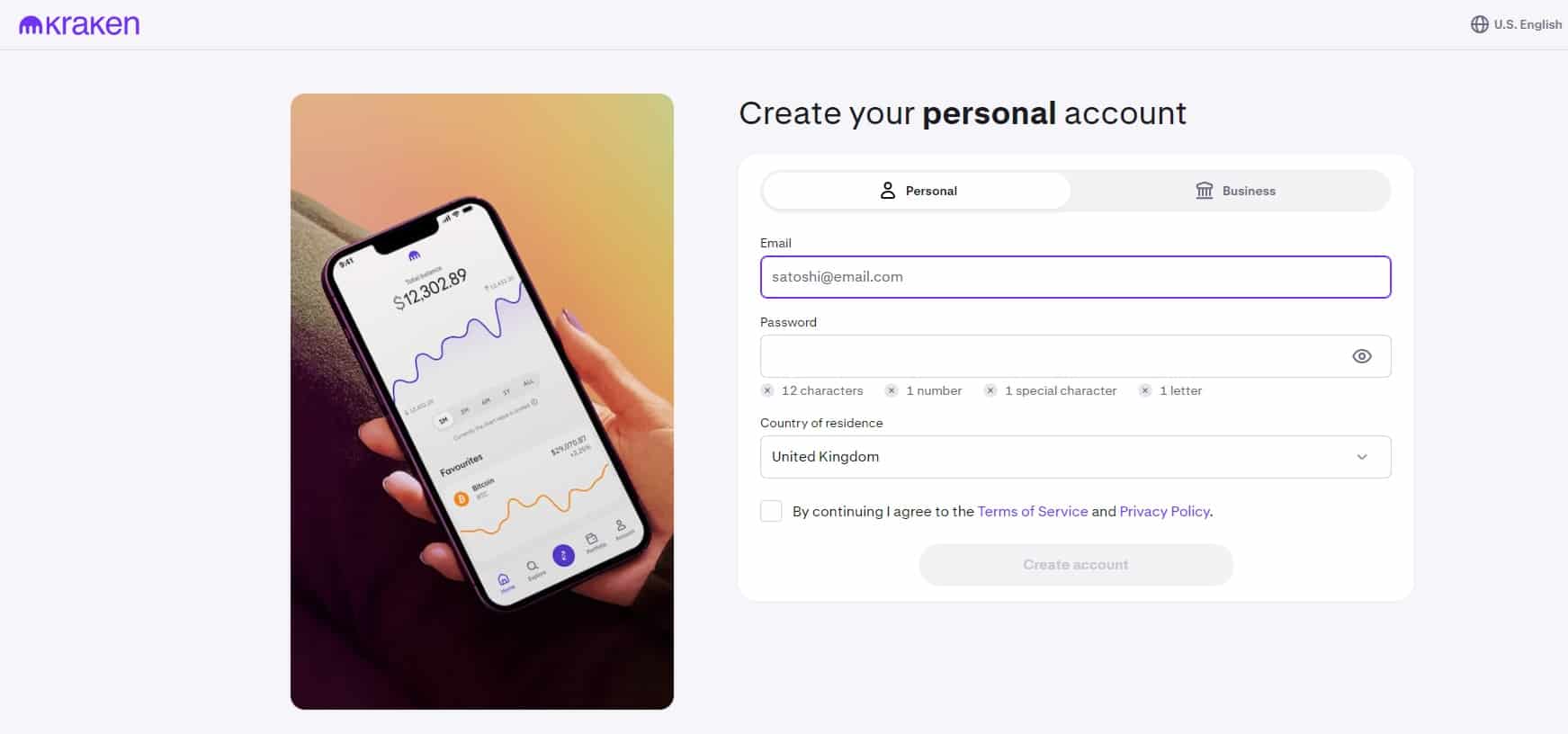

How to Buy Cryptocurrency with Kraken – Quick Guide

Do you want to buy cryptocurrencies like Bitcoin right now? If yes, you can follow the four quickfire steps outlined below to get started.

- Open an account: You’ll first need to open an account with a trusted cryptocurrency broker. We recommend Kraken, as the platform offers multiple fiat deposit options and it has low trading fees.

- Upload ID: Due to regulatory compliance requirements, Kraken will ask you to upload a copy of your government-issued ID.

- Deposit: Depending on your country, you can deposit funds with a debit/credit card, Paypal, Apple Pay, SEPA or bank wire.

- Buy Cryptocurrency: Search for any cryptocurrency of choice and click ‘Buy’.

Best Exchanges to Buy Crypto in November 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Buy Crypto with Best Wallet in 4 Simple Steps

Want to get started? Here’s how you can buy cryptocurrency in just a few minutes using Best Wallet:

Step 1 – Download Best Wallet:

Head to the App Store or Google Play and download the Best Wallet app!

Step 2 – Create an Account:

Setting up your account takes just a few moments. Enter your email, choose a secure password, and you’re in! Best Wallet uses advanced encryption to ensure your account and funds stay secure.

Step 3 – Choose Your Onramp Provider:

Best Wallet automatically pairs you with the best provider for your purchase, but you can also choose from over 20 trusted providers. Whether you want a faster process or prefer no document checks, you’ll find the perfect option that suits your needs.

Step 4 – Buy Cryptocurrency:

Enter the amount you’d like to buy, select your payment method (pick from credit or debit card, Apple or Google Pay, bank transfer, and more), and tap ‘Buy.’ Your crypto will go straight to your Best Wallet, ready for use!

How to Buy Cryptocurrency – Kraken Tutorial

Gaining access to cryptocurrencies can be tedious if you are not using the right platform to do this. For beginners, we recommend using the Kraken platform to buy and sell cryptocurrencies. In this section, we will explore how you can buy cryptocurrencies in as little as five minutes:

Step 1: Open a Brokerage Account at Kraken

To get started, visit the official website of the Kraken platform and create a free account.

You will be redirected to a signup page where you will need to provide your name, email address, and password.

Step 2: Verify your identity

The next step is to verify your identity. Every new user will need to complete the know-your-customer (KYC) process to have their accounts verified.

This requires a copy of your:

- Passport, driver’s license, or national ID card

- Utility bill or bank account statement issued within the last 3 months

In most cases, Kraken will authenticate your documents straight away and subsequently remove all account restrictions.

Step 3: Fund Your Account

To begin trading, you will need to fund your Kraken account. The minimum deposit is $150. In addition, Kraken offers multiple payment methods to make this process easy for you.

You can choose from:

- Debit/credit card (Visa, MasterCard, Maestro)

- Paypal

- Apple Pay/Google Pay

- Local bank transfer (country-specific)

- International bank wire

Step 4: Buy Cryptocurrency

The final step is to buy the cryptocurrencies that you want. Kraken allows you to choose from over 200 cryptocurrencies. You can buy Bitcoin, Ethereum, ADA, or even Dogecoin. To get started, head to the search bar and type in the cryptocurrency you want to purchase.

Say, for example, you want to buy Ripple or Bitcoin, type ‘XRP’ or ‘BTC’ into the search bar and click on the first result that pops up. Once you get to the asset page, you can click on the ‘Stats’ button to get the financial track record of the digital asset.

To complete the purchase process, click on the ‘Buy’ button.

Best Places to Buy Cryptocurrency – Exchange Reviews

As cryptocurrency adoption grows, so does the number of platforms offering access to these assets. Today, there are literally thousands of platforms where you can buy cryptocurrency. However, this creates a problem for traders. Finding the best platform to buy cryptocurrency could be challenging, especially for first-time traders. To save you on the hassles and hours in research, we did the heavy lifting. We reviewed hundreds of platforms before arriving at the best places to buy cryptocurrency.

The crypto platforms reviewed below are all security-conscious, meaning your details and funds are safe with them. You can also store your digital assets in their crypto wallets safely, and they also comply with standard anti-money laundering (AML) and know-your-customer (KYC) policies.

1. Best Wallet – The Simplest Way to Buy Crypto this Year

Looking to buy Bitcoin, Ethereum, or other cryptocurrencies but unsure where to start? Best Wallet makes buying crypto easier, faster, and more secure than ever. With an intuitive interface and access to the best exchange rates, Best Wallet is the perfect companion whether you’re new to crypto or an experienced trader.

Best Wallet doesn’t just give you access to over 20 onramp providers (including Stripe, Revolut, and Topper); it automatically picks the best one to ensure you get the most crypto for your money. You can also choose providers with no document checks or quicker verification—it’s all clearly labelled in the app, making your crypto-buying journey smooth and straightforward. Unlike using exchanges, Best Wallet delivers your purchased crypto directly into your wallet—no transfers, no hassle.

Download Best Wallet now to buy your first crypto in minutes! No hassle, no unnecessary fees—just an easy, secure way to build your portfolio.

With Best Wallet, you can enjoy a seamless crypto-buying experience that’s built around convenience and security. Why wait? Join thousands of users who trust Best Wallet to manage their crypto purchases today!

Pros

- Best fiat-to-crypto exchange rates on the market, selected automatically by Best Wallet

- Buy BTC, ETH, USDT, and 100s more in-app

- Get your new crypto directly to your wallet

- Available in most locations

- Pick the providers with the lowest fees

- User-friendly interface means buying crypto is simple and quick

- Select a provider with no KYC

Cons

- Some buying restrictions due to geography

- Some purchase amount limits for no KYC providers

2. Kraken – Third Largest Cryptocurrency Exchange

Kraken was founded by its current CEO Jesse Powell and is owned by Payward Inc. It is one of the original cryptocurrency exchanges and was created way back in 2011. After its official launch in 2013, Kraken managed to quickly gain recognition, thanks to its high-quality product. At the time of writing, it is the third largest cryptocurrency exchange in terms of volume traded and is a reputed name in the industry.

The exchange caters to over 8 million users and institutions globally and has its offices set up in various parts of the world. It is headquartered in San Francisco and has backing from some of the biggest VC firms in the finance domain. Kraken hosts over 120 cryptocurrencies and has constantly ensured to list top projects on its roster. It features three major stablecoins which include USDC, USDT and DAI. Kraken is also one of the only exchanges with a wide variety of Fiat currencies. It supports seven options, which is a major advantage for investors.

Kraken has a pro version, which can be used for paying lesser fees and using advanced trading products. It is also highly secure since all the assets are stored in cold wallets and are under 24-hour surveillance along with armed personnel providing security.

Pros

- Excellent customer service – won the 2024 European Customer Centricity Awards

- Well-established track record

- Available in most of the states in the U.S

- Optimal security

- Low fees

- Supports a wide range of digital assets

Cons

- Kraken does not offer services to residents of Washington and a few other states in the United States

- Retail clients from the United Kingdom cannot trade futures

3. MEXC – Vast Crypto Selection

Founded in 2018, MEXC quickly rose to prominence, boasting a user base exceeding 10 million across 170 countries and regions worldwide. One standout feature of MEXC that has enhanced its market acceptability is its trading engine which has the capacity to execute over 1.4 million transactions per second.

MEXC provides easy access to over 2,000 crypto assets and up to 2,200 trading pairs. Those willing to purchase crypto through the exchange can do that using the Express feature, P2P, and other supported third parties. Users can also compound their gains and maximize their crypto assets by taking advantage of MEXC’s staking mechanism which supports major cryptos like ETH.

MEXC also prioritizes users’ safety and has been complying with global regulatory standards to deliver the highest level of security. It holds key licenses from key regulatory entities across several countries and has also integrated high-security elements to protect users from the malicious activities of hackers. Therefore, if the goal is to buy cryptocurrency at an exchange with optimal security, MEXC is one of the places to consider.

Pros

- Excellent user experience

- Fully backed by top regulators

- Supports a vast collection of cryptocurrencies

- Unblemished track record

- Welcome bonus for new users

Cons

- Limited fiat options

4. eToro – Beginner-friendly Crypto Exchange

Established in 2007, eToro is one of the longest-serving online trading platforms on the planet. It supports buying, selling and trading of a broad range of tradable crypto assets including Bitcoin, Ethereum, Dogecoin, Bitcoin Cash, Cardano, and many more. Buying or selling crypto on eToro attracts a 1% fee, making it a great choice for every trader.

With a user base surpassing 40 million worldwide, eToro has positioned itself as one of the most sought-after crypto exchanges around. It offers an appealing interface alongside interactive functionality to deliver a hitch free user experience. More so, eToro has a mobile application that’s compatible with Android and iOS devices.

While buying crypto on eToro, users can make deposits into their accounts using popular payment methods like PayPal, bank transfers, iDeal, POLi, Skrill and Rapid Transfer. eToro charges no fees for any deposits and withdrawals made in USD. In addition to this, eToro is fully backed by top regulatory agencies in the world, including the Financial Conduct Authority (FCA) and Cyprus Securities and Exchange Commission (CySEC).

Update – As of 2024, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Pros

- Demo trading

- Sleek interface

- Offers technical analysis

- Supports a considerable number of crypto coins

- Supports staking

Cons

- $5 withdrawal fee

5. Uphold – Trusted Across 150 Countries Worldwide

Uphold is a go-to spot for both experienced investors seeking to elevate their trading endeavors and newbies looking to securely dive into the rapidly evolving crypto realm. Among the industry-leading features found on the site is its support for 7 different blockchains and more than 1,000+ trading pairs. At its core, Uphold provides access to over 300 crypto assets, including Bitcoin, Ethereum, Solana, Ripple, Avalanche, and even top meme coins like Dogecoin, Shiba Inu, and Pepe.

For those scouting new, promising, and low-cap cryptos, Uphold presents one of the best avenues for them to get in on the ground floor and compound their gains. There is also a “Baskets” tool where they can easily track their diverse portfolios and make timely decisions. The next attractive component of Uphold is its self-custody wallet solution – Uphold Vault – built within the exchange app to help users maintain total control over their assets while maximizing potential opportunities in the market.

That being said, seasoned traders on Uphold can take advantage of its advanced trading tools, spanning take profit, trailing stop, repeat transaction, and limit orders to reduce their exposure to market risks and amplify their gains. Thanks to its integration of multiple CEXs, DEXs, and layer-2 chains, Uphold has a deep liquidity book. As such, traders can rest assured that they will get the best market prices while engaging in cross-chain token swaps.

Beyond crypto trading, Uphold also provides other reliable avenues for traders to earn consistent income. One such way is its interest-bearing initiative, featuring staking, referral, and USD interest accounts. With these rewarding programs, traders are provided with an additional source to boost their returns.

Pros

- Supports over 300 cryptocurrencies

- Deep liquidity

- Multiple interest-driven programs

- Low fees

- Provides a strategic asset diversification tool for users.

- Self-custody wallet service

Cons

- Basic charts

6. OKX – Good Cryptocurrency Exchange to Buy Over 350 Crypto Assets

Established in 2017, OKX is a cryptocurrency exchange based in Seychelles. The platform started with minimal features, but within the period of 2021- 2023, it has added a large selection of features allowing users to diversify their investments. When it comes to trading, OKX supports conversion, spot trading, margins and derivatives trading. A P2P trading facility is also available. And while OKX was once a crypto-only trading exchange, it has recently added support for fiat payments – allowing users to buy crypto using 100+ fiat currencies.

OKX allows users to discover markets and opportunities based on their niche of interest. For instance, if a user is looking for the best metaverse or gaming project to invest in, they can find these projects through the platform. OKX also features an earning program that allows users to earn APY (Annual Percentage Yield) through staking and APR (Annual Percentage Return) through a savings account. Crypto loans, as well as copy trading, are also one of the highlights of OKX.

To buy cryptocurrency on OKX, users are charged on the basis of maker/taker fees that range from 0.080%/0.1% to 0.060%/0.080%. The fee charged is divided into tiers that are dedicated to how many OKB tokens users are holding. VIP users with assets exceeding $100,000 are subject to lower fees.

Pros

- Offers Copy Trading

- Offers Staking and Savings accounts

- Low fees, which can be further reduced by holding OKB tokens

- Offers copy trading

- Spot trading, futures trading, margin, and derivatives trading supported

- Simple interface

Cons

- Requires a high number of OKB tokens to reduce fees

- Not available in the US

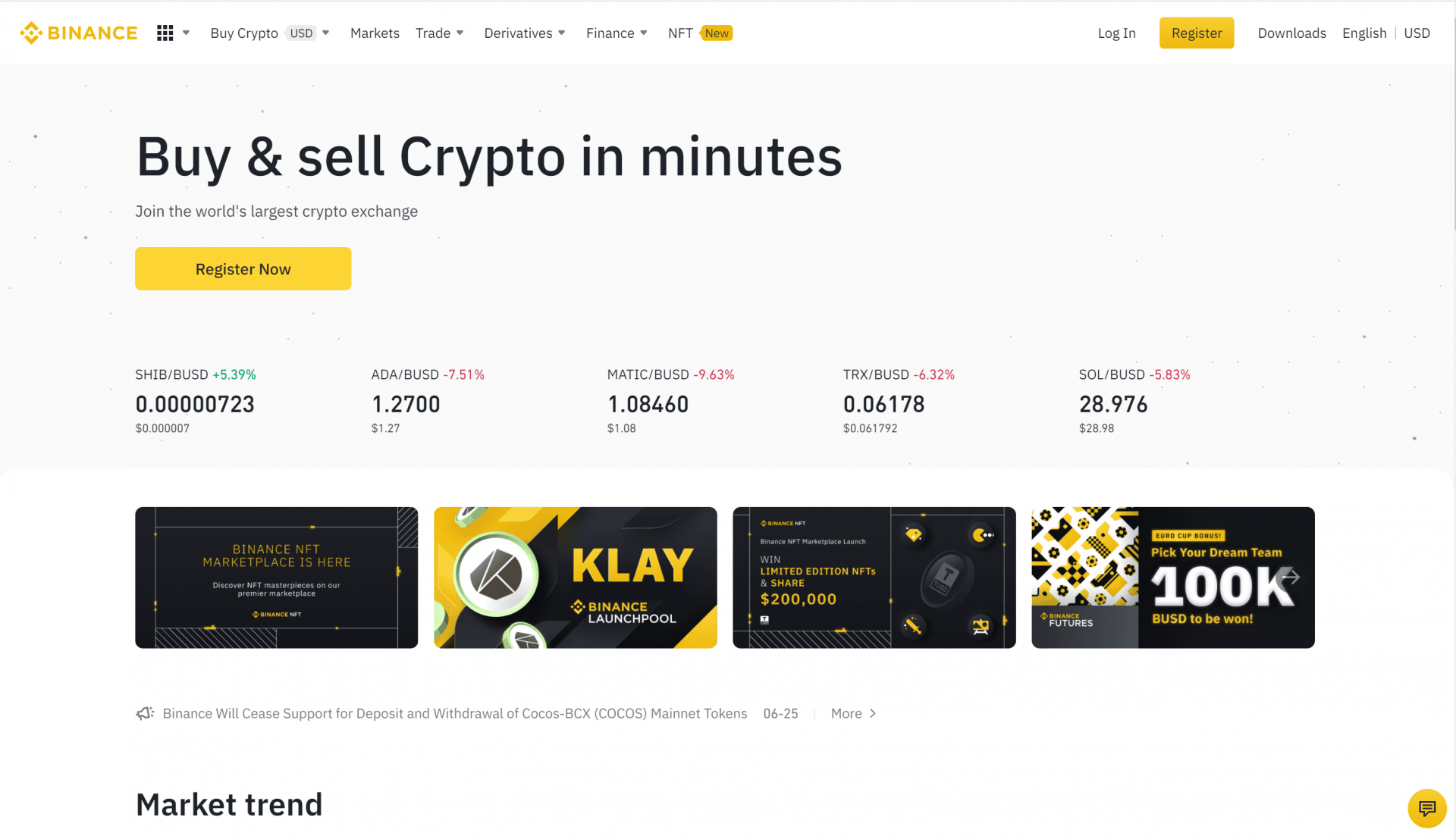

7. Binance – Top-Rated Exchange to Buy Cryptocurrency

Binance exchange is known for one thing; its sheer size. Founded in China, Binance is a rapidly-growing crypto ecosystem. Boasting decentralized exchange (DEX) platforms like PancakeSwap, Binance is the largest cryptocurrency exchange by trading volume.

It’s also one of the best platforms to trade cryptocurrencies due to its low trading fees of 0.10%. Also, if you own its proprietary coin BNB, you get discounted fees when you pay with the token.

Binance offers a wide variety of trading options, and users can execute margin trades, futures, and leveraged trading. Binance allows users to buy crypto with fiat currencies and offers over 300 crypto assets with thousands of trading pairs.

See our page on the best utility tokens, one of which is BNB. Aside from crypto trading, Binance runs an earning program for passive income.

Pros

- More liquidity

- Low trading fees

- Great platform for experienced traders

- Largest crypto exchange

- Supports credit/debit deposits and fiat

Cons

- Debit/credit fees are expensive

- Not ideal for new traders

8. Bybit – Beginner-Friendly Cryptocurrency Exchange Offering Huge Bonuses to First-Timers

Bybit was launched in 2018, and at the start, it was a low-cap cryptocurrency exchange. However, with time and the influx of more crypto assets. Bybit start to add more utilities, including more trading features and tools to make the crypto investment viable for investors.

Many features of Bybit are geared towards beginners, including the One-click buy option. P2P trading is also available – allowing users to buy and sell crypto from other parties at zero fees. The platform also offers a range of market data through its overview that categorizes the best gainers, losers, and leading investors. New listings are also common on this platform, and Bybit has gained a lot of renown, being among the first exchanges to be open to listing innovative projects.

Bybit has implemented a nuanced approach to fees based on VIPs and Non-VIP-users. VIP users’ fee rate range from 0.06%/0.04%, and for non-vip users, the fee rate ranges from 0.1% to 0.03%.

Security is a major concern for this cryptocurrency exchange – which has motivated it to create a triple-layer security module. It also has audited proof of reserve when it has a 1:1 reserve of all user’s assets on the platform. And those who create an account on the platform get a 5030 USDT bonus.

Pros

- Beginner-friendly UI

- Offers multiple trading options

- Low trading fees

- Copy trading available

- Features multiple Web 3 elements, including NFTs

- Has an Earn program

Cons

- Not available in the US

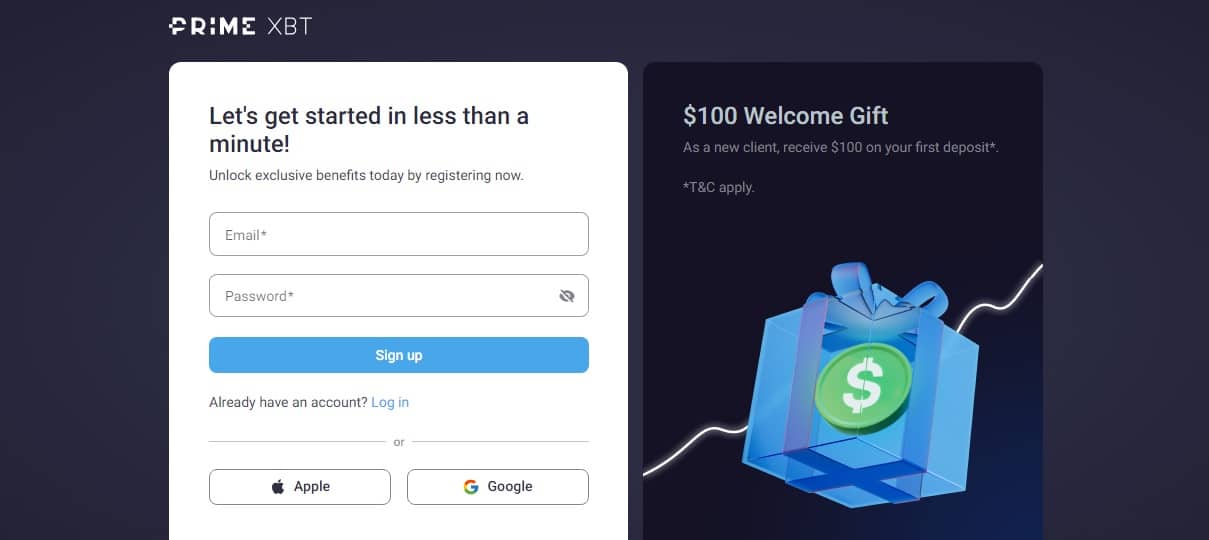

9. PrimeXBT – Dynamic Web & Mobile Versions

PrimeXBT is an all-in-one cryptocurrency exchange that specializes in cryptocurrency and commodities, indices, and forex trading. Through its dynamic web and mobile versions, users can dive into more than 100 popular markets, including crypto futures. PrimeXBT allows buying and selling of a wide range of cryptocurrencies including BTC, ETH, XRP, LTC, and more.

Users can also engage in crypto-fiat trading on PrimeXBT. It supports crypto-fiat pairs like BTC/USD, ETH/USD, SOL/USD, SHIB/USD amongst others. For those interested in trading crypto futures, PrimeXBT provides instant access to eight contracts including Bitcoin, Ethereum and Litecoin. More so, it offers up to 200x leverage on Bitcoin and Ethereum CFDs.

Above all, PrimeXBT appeals to both beginners and experienced traders with its competitive fees, ultimate security system, round-the-clock customer support, and sleek interface. Since the platform is highly customizable, users can always tailor it to complement their trading goals. At press time, PrimeXBT serves more than 1 million users across 150 countries of the world. This feat speaks to its popularity among crypto traders.

Pros

- Trusted by more than 1 million users

- Supports a wide range of crypto/fiat pairs

- 200x leverage on Bitcoin and Ethereum CFDs

- Intuitive interface

Cons

- No demo account

10. Margex – Top Crypto Derivatives Exchange

Margex is a top crypto derivatives exchange that has been earning the loyalty of a huge collection of traders. As one of the most respected trading platforms, Margex allows users to find and invest in some of the most promising cryptocurrencies in the market. Users can create accounts with Margex and trade their favorite cryptocurrencies within a few seconds as it does not mandate KYC verification.

In addition to this, Margex allows copy trading so that newbies can make money by imitating the strategies of successful traders. Complementing this standout feature is its custom-built trading engine that boasts the capacity to process up to 100,000 transactions per second. To help users make insightful and informed trading decisions, Mergex regularly displays real-time Mather data.

Margex is also trusted by millions of users globally. Being a platform that’s committed to safeguarding users’ funds and privacy, Margex has adopted the highest security standards. Finally, it provides up to 100x leverage and more than 40 different trading pairs.

Pros

- Easy registration process

- Friendly interface

- Buying and selling of top cryptocurrencies

- 100x leverage

Cons

- Limited crypto options

Volatility Of Crypto Assets

If you have been around long enough in the crypto circles, you may have come across terms like volatility a couple of times. This is because cryptocurrencies are highly volatile. This means you may make a killing in one trading session and see your gains erode in the next couple of minutes.

A classic example is Bitcoin’s price which rose over 100% in the last six months, reaching a record $64,350 valuation but has struggled to break above the $35K mark for the last couple of weeks. Critics have pointed to these wild price swings as a reason why cryptocurrencies cannot replace cash.

Nonetheless, cryptocurrencies are an exciting investment class to watch out for.

To guide you in your quest, we recommend checking out expert crypto review sites (like ours) with dedicated teams of experts working round the clock to give you the best recommendations on the ever-changing market trends. This will save you lots of heartaches as you will be exposed to crypto projects with growth potential and proven track records.

Storing Cryptocurrencies

Just like every item, cryptocurrencies need to be stored. Given that they are lines of computer code, they cannot be stored in a physical location. You will need a crypto wallet to keep your crypto funds. Aside from storage, crypto wallets also allow you to do some other stuff like execute trades, monitor market trends, and make crypto-to-crypto swaps almost instantaneously.

Choosing the right crypto wallet goes a long way in determining your digital assets’ security, so we have selected the best crypto wallets available for mobile and desktop users.

Selling Cryptocurrencies

If you intend to sell your cryptocurrencies, either because you no longer want to hold a particular crypto asset or you have made profits from investing in them, then the process is just as when you initially bought it. Since the crypto asset is within a digital wallet, you can easily initiate the withdrawal request.

Although there are several means you can employ to offload your crypto holdings, the best and safest way is to do this through an exchange like Kraken. This way, you get a guarantee that your account will be credited when you decide to sell off your asset.

Choosing The Right Broker

Previously, it was not easy to buy cryptocurrencies as only a few brokers offered crypto custody services. However, times have changed with cryptocurrencies becoming a major market segment. Now, several trading platforms are offering crypto-related services.

As good as this may sound, it presents a new challenge, and this is, how do you select the right broker to buy cryptocurrencies through? As dire as this situation may seem, we have chosen a few criteria to help you in your quest.

Brokers are unique in their offerings, and you need to ensure whichever you choose to work with ticks the following boxes:

1. Fees

This is the first parameter to consider in choosing a broker. You need to know how much a cryptocurrency broker charges for deposits and withdrawals. Another cost to consider is the commission for trades. It is now an industry norm for brokers to offer commission-free trades. Platforms like Capital.com offer such perks. You should also consider hidden fees that a broker may be charging and its inactivity fee structure.

2. Payment Methods

This is also necessary. The more payment channels a broker boasts of, the easier it is to fund your account. Some brokers allow you to buy Bitcoin with PayPal. Others do not accept credit card deposits, while some may take longer to process bank wire transfers. Look out for these signs.

3. Crypto Offerings

Given that we are discussing investing in digital assets, you need to know how many cryptocurrencies a broker supports. Some brokers offer crypto CFDs meaning you do not have to worry about custody of the underlying asset. If this works for you, you should try such brokers out.

4. Security

You need to find out if your chosen broker is a regulated entity. Licenses from reputable regulatory bodies like the FCA show that the broker is secure, meaning your funds will not suddenly disappear into thin air. Your data will not also be compromised in the event of a breach due to the constant audits the broker will be undergoing.

5. Minimum Deposits

Minimum deposits are also crucial. You need to know what the lowest financial bar a broker requires to admit a new client. This can be a great way to test your trading strategies with little capital before investing large sums.

6. Social Trading

Social trading is gradually becoming an industry standard. It’s the process where trading platforms to provide a means for traders to follow the latest market trends and news. This also allows new traders to develop themselves to connect and learn from their more experienced counterparts.

7. Support

Although many traders may not count this as important, customer support is crucial to handling sticky situations. Given that the cryptocurrency space is still evolving, many traditional investors are still confused about how the asset class works. Great customer support from a broker can make this process easier and more seamless. Many brokers now offer support in several languages. You should also look out for 24/7 technical support putting into perspective the weekends when you might want to place trades.

8. Usability

The ease of use of a trading platform is also important. Can you find your way quickly and easily around the trading platform? Can you get things done on time and leverage on market trends? Given that we are busier now than ever before, this can be a major challenge if a trading platform is not user-friendly. Whichever broker you choose to work with must be user-centric and make the trading experience painless and seamless.

Cryptocurrency exchanges can also be used to buy Ethereum (ETH) which can then be used to buy NFTs (non-fungible tokens), a popular new emerging market alongside cryptocurrencies.

9. Analytical tools

Just like the traditional financial markets, cryptocurrency trading requires analytical tools. A good trading platform must offer good statistics and great insights on a chosen digital asset. This will help guide your investment decision and make it easier for you to choose the cryptocurrency you want to invest in.

These parameters can help you in your search only so much. The best means of getting the best trading platform advice is checking out review sites on a particular broker. Even though it may sound like a cliché, it is very important if you intend to take cryptocurrency trading seriously. There are so many trading platforms that are popping up by the day with fantastic offerings. You need to know how to sieve the wheat from the chaff.

Knowing a reliable broker from the less-trustworthy ones can be difficult. Review sites will help you out in this regard as they will break down the finer details and offerings of a particular broker. Also, the comparison parameter will make it easier for you to compare between two platforms and know their pros and cons. Another benefit lies in the fact that you will learn if a broker is a scam or legit, which is very important if you intend to avoid bad actors from stealing your funds.

Which Cryptocurrency To Buy in 2024?

With both large and small-cap cryptocurrencies seeing exponential growth in the last six months, it can be difficult to decide which cryptocurrency to buy. Even though Bitcoin still leads the emerging industry, several crypto protocols also get investors’ attention either by their value proposition or by user adoption.

However, choosing the best cryptocurrency boils down to you. If you are a value-driven investor looking to buy low and sell high, several small-cap cryptocurrencies will likely fit into your budget. Another metric may be the future proposition for a given project.

The more use case and adoption a crypto asset sees, the more growth potential it has. Meanwhile, relying solely on a crypto project’s whitepaper and claims will not likely cut the ice in returns. A great way to stay on top of market developments and shifting trends is to peruse review sites like InsideBitcoins with a dedicated team of experts who are familiar with the inner workings of the crypto market and can make the safest recommendations for you.

Here are recent articles we did on the best cheap cryptocurrency to buy and a new crypto Reddit users are interested in.

Bitcoin

Bitcoin is a well-known digital currency. Over 95% of Americans equate the crypto market with Bitcoin. This is, in a way, true due to the large stake the oldest cryptocurrency has in the nascent sector. Launched in 2009 following a whitepaper by mysterious founder Satoshi Nakamoto in 2008, Bitcoin is the largest cryptocurrency and, at the moment, the most valuable.

Since its debut, it has grown more than 9,000,000% and has seen wide adoption by retail and institutional investors and world governments. Despite its outstanding success, Bitcoin is the most criticized cryptocurrency for several reasons: environmental concerns, government inability to influence policies in the Bitcoin network, volatility, and its use by criminals to move funds.

- Bitcoin

(BTC) - Price $88,191.00

- Market Cap

$1.74 T

Meanwhile, Bitcoin has not slowed in its strides, and 2021 was its big break. Opening the year at a little over $30K, Bitcoin more than doubled its value rising to an all-time high (ATH) of $64,350 in mid-April, then making another all-time high of $69,000 in November.

Even though it has since seen its value slashed by half, Bitcoin still commands the largest trades and sits top of the global crypto table. If you want to add the top crypto asset to your investment portfolio, read out how to buy Bitcoin guide.

Ethereum

Besides Bitcoin, Ethereum is the only cryptocurrency that pulls significant weight in the crypto industry. Controlling 17.1% of the crypto market, Ethereum is a popular decentralized applications (dapps) platform founded by a group of software engineers and scientists led by Russian-Canadian Vitalik Buterin.

Even though most of the early founders have since left to form independent crypto projects, Ethereum is the most recognized dapps platform and the official home of the booming decentralized finance (DeFi) space. It’s also central to the metaverse – see our list of the best metaverse coins.

- Ethereum

(ETH) - Price $3,068.70

- Market Cap

$369.64 B

Even though it has been criticized for its high gas fees and network congestions occasioned by its continued reliance on proof-of-work (PoW) consensus protocol, Ethereum has over 200 DeFi protocols actively transacting on its blockchain. It has continued to see its influence grow by the day, given the exponential increase in DeFi projects. It surged to a record $4,350 before market pressures saw it lose more than 50% of its value. However, Ethereum may see its fortune change once it transitions to the less energy demanding proof-of-stake (PoS) protocol by the end of the year.

If you want to learn more about the Ethereum project, you can check out our How to Buy Ethereum guide.

Dogecoin

Meme-based cryptocurrency Dogecoin has been a revelation this year. Even though it has not crossed the $1 mark since its debut in late 2013, the parody coin has come close to doing so. Rising to a record $0.74 in the heat of the crypto wave, Dogecoin increased 15,000% year-to-date (YTD). Its phenomenal gains have seen the joke cryptocurrency attain a pop star status attracting celebrity support and birthing a whole bevy of dog-themed cryptocurrencies.

- Dogecoin

(DOGE) - Price $0.371

- Market Cap

$54.5 B

Even though Dogecoin has no generic use case aside from the Shiba Inu (not to be confused with a similarly named crypto project) being a fun and cute crypto protocol, Dogecoin has continued to make waves and temporarily surpassed the likes of Ford Motors and Twitter in the market valuation.

Trading way below its record high, Dogecoin is not going anywhere soon, with Tesla boss Elon Musk aiming to make it a next-gen interplanetary currency in the future. We have highlighted some market-moving trends of Dogecoin in our How to Buy Dogecoin guide here.

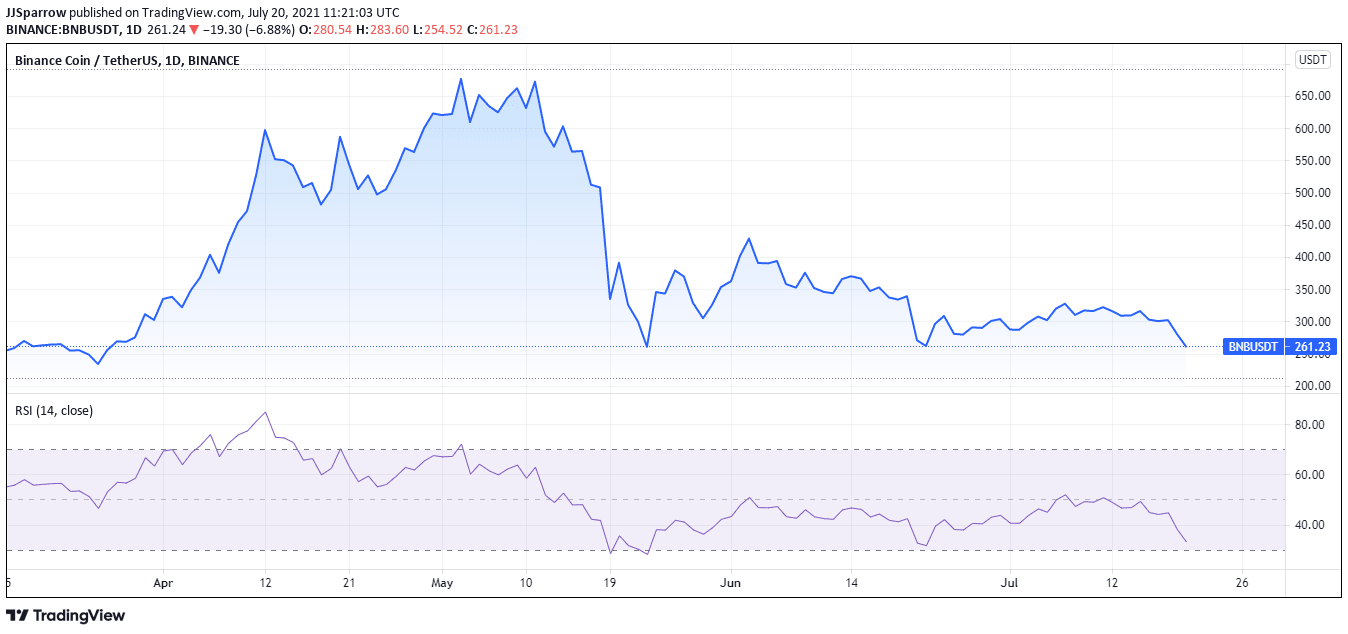

Binance Coin

Known simply as BNB, this digital token is not tied to a crypto protocol but a centralized cryptocurrency exchange known as Binance Holdings. It plays several roles in the rapidly expanding Binance ecosystem and enables its holders to enjoy lower fees on Binance-owned platforms.

Aside from this, the proprietary coin is used in settling online services purchases, ticketing, and several other utilities.

The BNB may not be a top crypto project, but its meteoric rise is nothing short of outstanding. Coming into the year at little over $40, BNB surged to a whopping $650 in the May crypto frenzy. This saw it occupy the fourth most valuable cryptocurrency, and it has retained the position for much of the year. With a burning schedule done every quarter, BNB slowly sees its 200 million tokens become more valuable by the day. Meanwhile, its present trade below $350 may be a great position to buy the BEP-20 token.

Crypto Presales

New crypto ICOs, private sales or presales offer the lowest entry point possible in price terms, and therefore the highest upside potential.

Some of the most promising cryptocurrency assets we’ve reviewed are those about to launch, as its important to buy low and sell high as a trader. See our full list of the best crypto launches early in their roadmap.

Alternatives To Bitcoin

Bitcoin is the premier digital asset, no doubt, and there is a slim chance that any crypto protocol may topple it from its first position on the crypto ranks. However, 2024 has seen many crypto assets making a bold entrance into the crypto space. With several digital assets posting remarkable gains, investors are looking for small-cap cryptocurrencies with growth potential.

In this section, we will briefly explore five of such crypto protocols:

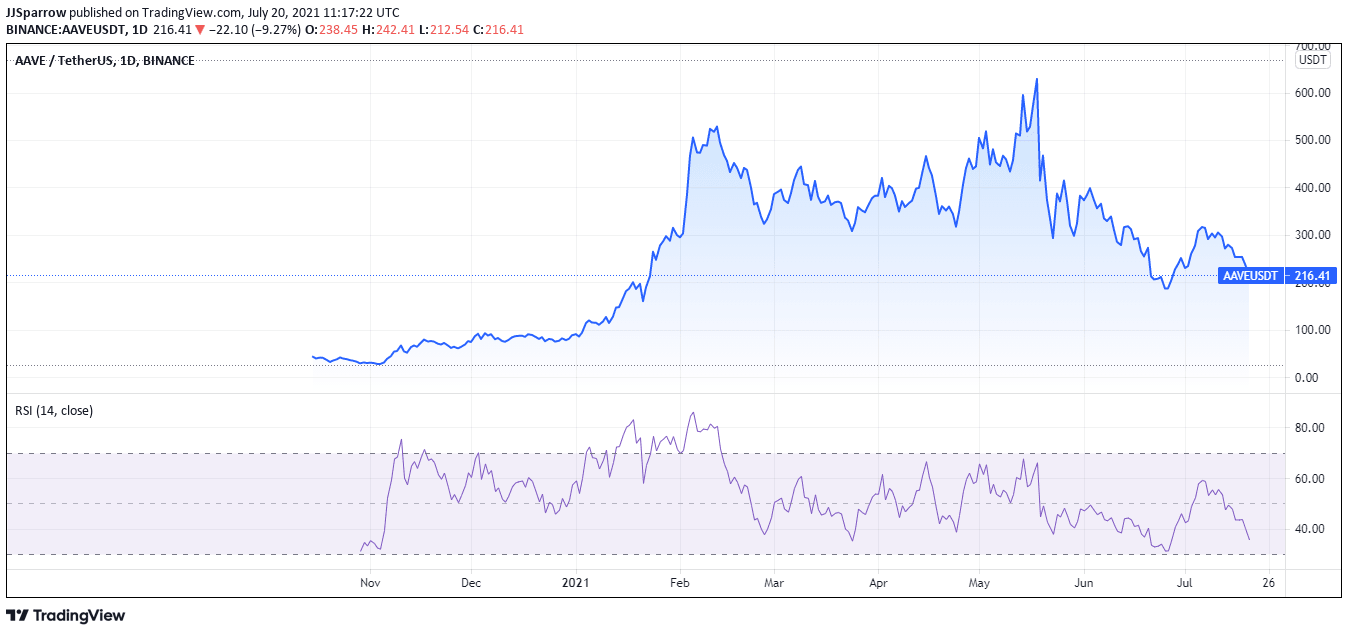

AAVE

The digital token of the crypto lending protocol Aave, this digital asset, has been a revelation this year. With the protocol enabling cryptocurrency owners to earn passive income from lending out their crypto holdings, Aave is the most valuable DeFi protocol with a controlling share of 16.64% in the burgeoning DeFi market.

Read our list of the best DeFi coins to invest in, one of which is AAVE.

The AAVE token has shown good growth metrics surging from $88.05 on Jan. 1 to $643.07 on May 18, increasing more than 4,000% in the process. Even though it has dipped in value, AAVE is still a crypto asset to watch out for and may become the next Bitcoin in the emerging DeFi sub-sector. Read more from our how to Buy AAVE guide.

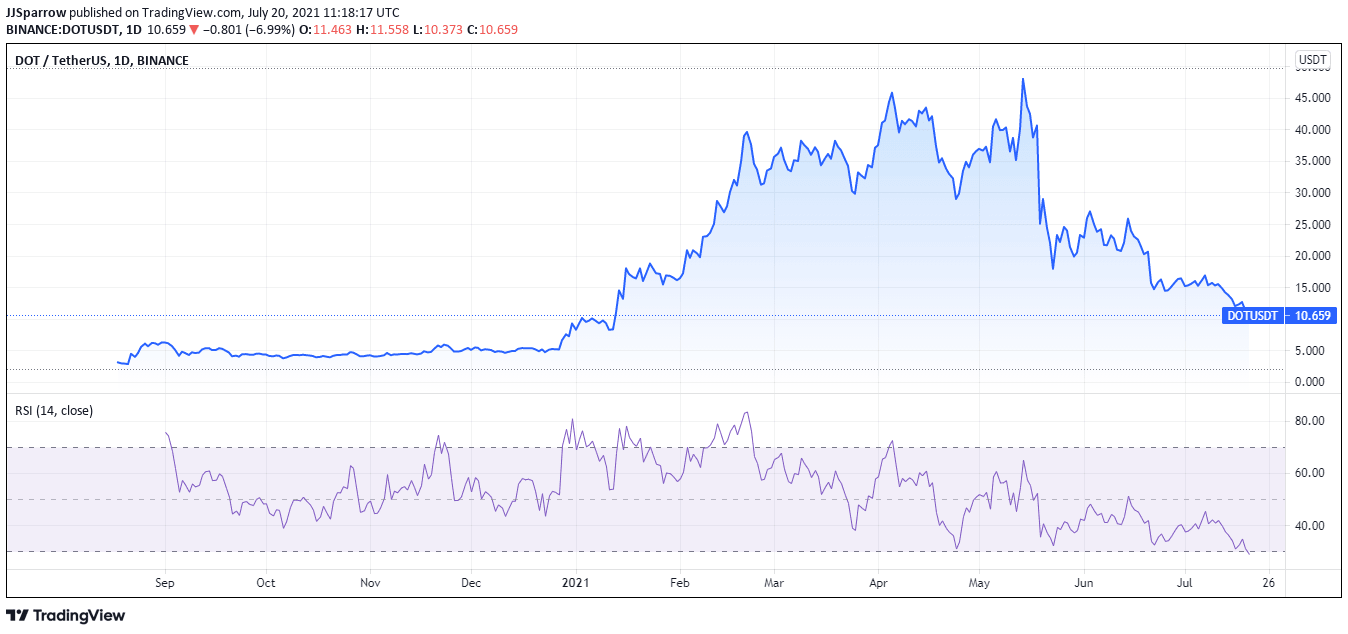

DOT

Polkadot is the result of a failed Ethereum dream of building an interoperable and scalable network. Founded by former CTO and co-founder of Ethereum Gavin Wood, the heterogeneous multi-chain solution has been dubbed an ‘Ethereum killer’ from the get-go.

It has not proven its supporters wrong, barreling its way into the top ten most valuable cryptocurrencies and making remarkable strides towards enabling an interconnected blockchain ecosystem. The DOT token has seen a mixed price action like most cryptocurrencies, but it has been able to keep its head above water. Coming into the year with an $8.88 valuation, DOT has grown more than 200%, plateauing at $48.36 on Apr. 14.

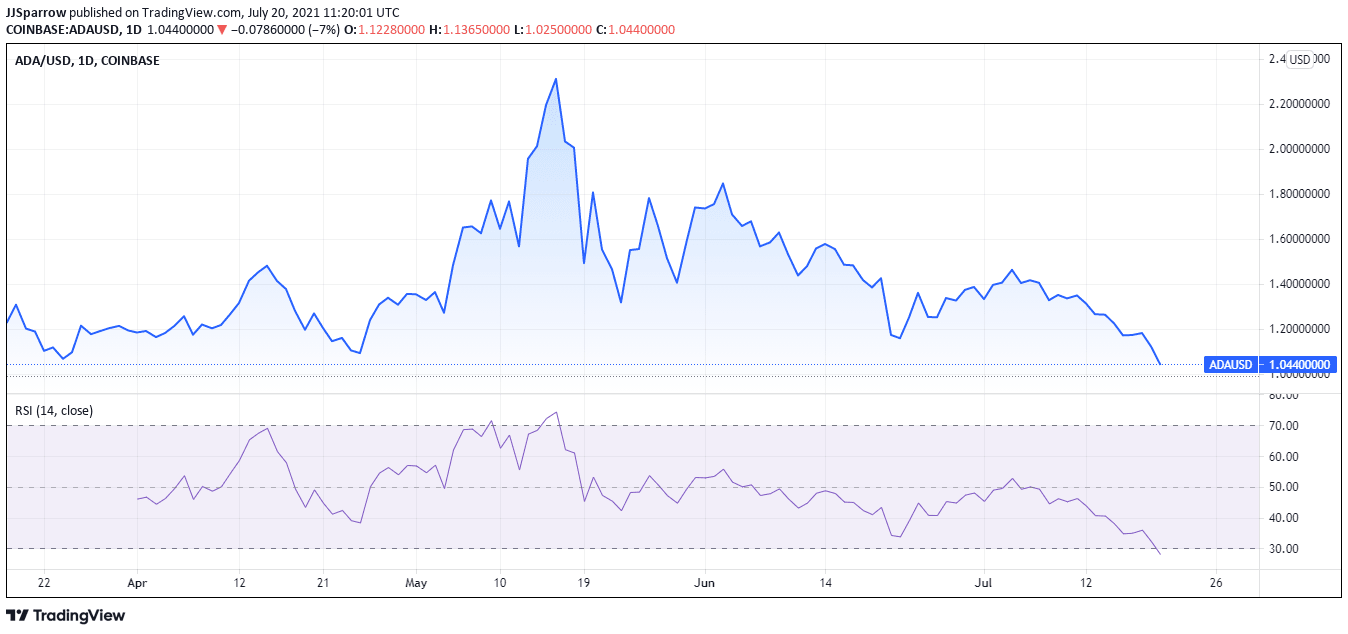

ADA

Another popular ‘Ethereum killer’ and one with a history to the popular dapps platform. ADA is the digital token of the Cardano network, which is developed by Hong Kong-based software firm Input Output Hong Kong (IOHK) and Emurgo. Cardano is a proof-of-stake (PoS) blockchain network that uses the self-styled Ouroboros mining protocol to validate transactions on its protocol. The beauty of the Cardano network is that it is still under development, but the project has quickly grabbed investors’ attention, given its value proposition.

The Cardano aims to build a new financially inclusive ecosystem where anyone can participate without fear of censorship. With its promise of lower fees and interoperability, Cardano’s ADA has been one of the best-performing crypto assets in the last few months. It surged from under a dollar valuation to over $2.45 in May.

Cardano’s low price and future potential is a great investment opportunity for any investor. Read more from our how to Buy Cardano guide.

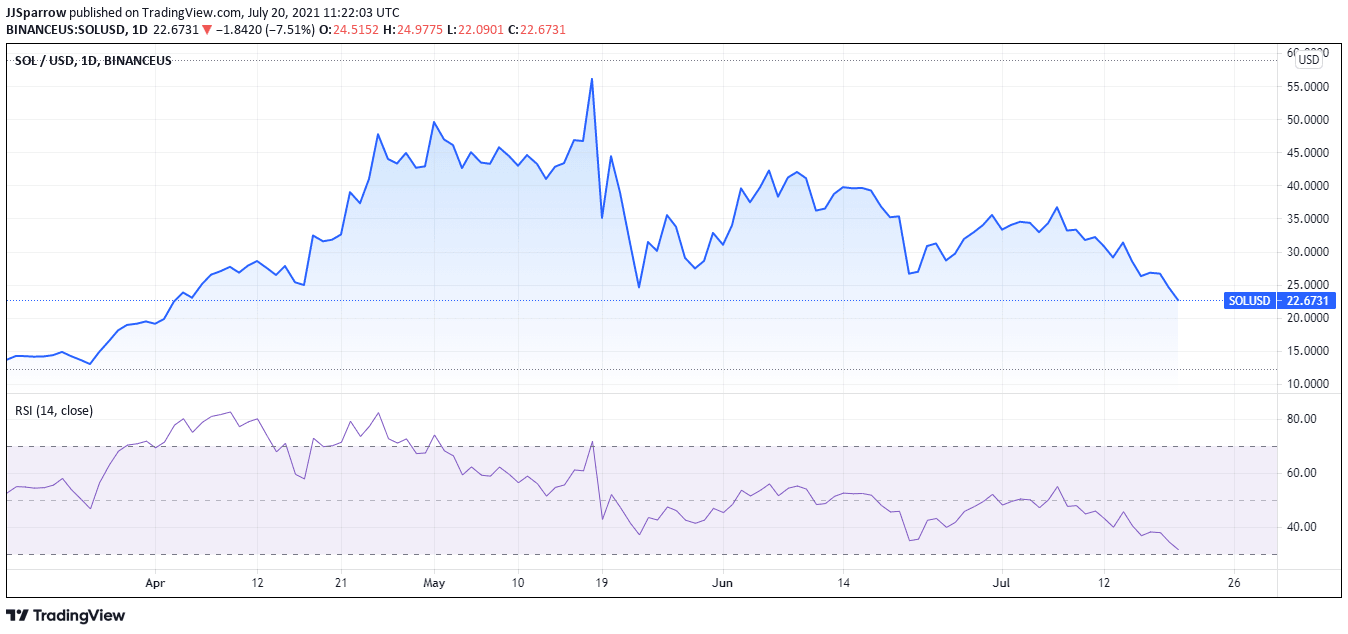

SOL

Another potential alternative to investing in Bitcoin is blockchain protocol Solana. Also dubbed the ‘Ethereum killer’ tag, Solana is a permissionless, open-source crypto platform that enables DeFi solutions. It also claims to be faster in verifying transactions than the Ethereum network with a reputed 50,000 transactions per second (TPS) record. Using an innovative consensus algorithm proof-of-history (PoH) and the proof-of-stake (PoS) protocol, Solana has seen growing adoption with more DeFi projects migrating their services to the Solana network.

With DeFi set to continue its parabolic rise with growing investor interest in the sub-sector, Solana may soon challenge the Ethereum network as one of the best platforms to build DeFi protocols. Its SOL token has also seen positive price action moving from $1.8 to a record $55.91. It is projected to continue its uptrend despite the market downturn.

Crypto Signals

Also see our guide to the best crypto trading signals. These automated crypto buy and sell signals are an alternative to way to trade crypto with low risk, letting a team of professional traders provide trade setups and investing strategies.

Taxing Crypto Earnings

Crypto assets are placed in different umbrellas by different government agencies. While some countries prefer to see them as commodities, some others have pegged them as securities.

However, most tax agencies are ramping up efforts to generate revenue from the booming crypto space. The US Internal Revenue Services (IRS) considers cryptocurrencies as “property,” making them subject to capital gains treatment.

Meanwhile, sometimes they are also treated as income and are subjected to the income tax laws. In the US, the following crypto trading activities are considered capital gains taxable events:

-

-

- Exchange crypto for fiat currencies

- Paying for goods and services with cryptocurrencies

- Swapping a crypto asset for another through an exchange or peer-to-peer channels

-

Income tax earnings for crypto are listed below:

-

-

- Airdropped crypto

- Income generated from lending on DeFi platforms

- Block rewards gained by mining crypto

- Crypto gains made from staking and liquidity pools

- Getting paid with crypto

-

However, you can still repurpose your losses to offset your capital gains tax obligations. You can even save up to $3,000 on income tax when you hold on to your crypto assets for a long period.

Calculating Your Capital Gains Tax

The total amount you will pay for trading cryptocurrencies or owning digital assets depends on long you have held them. This will go a long way in determining your:

Short-term Capital Gains

This will be determined if you started trading crypto less than a year ago. Whatever gains or losses you may have incurred will be taxed at the same rate as your normal ordinary income and is subject to the short-term capital gains tax. However, your losses could help to offset your taxable income up to $3,000. You can also move those losses into the following year.

Long-term Capital Gains

Long-term capital gains operate differently from the short-term variant. If you have held crypto-assets for more than a year, you are eligible to pay 0%, 15%, or 20%, depending on your income. You can see a revised list from the IRS here.

How To Invest In Crypto Responsibly

Starting with the launch of Bitcoin in 2009 by Satoshi Nakamoto, the crypto market has only been on an upward trajectory. Meanwhile, the first-ever cryptocurrency has grown more than 9,000,000% since inception leading the infant sector into a unicorn status in the shortest time possible. This remarkable feat has seen both retail and institutional investors join the bandwagon and research how to get into crypto.

However, investing in crypto comes with its own set of risks. Keep the following in mind when trading digital assets:

Constant Research

The crypto space is an ever-evolving space with new crypto projects and Web3 projects springing up by the day. To make the best gains, you need to stay updated on the latest market trends and movements by researching.

Social media channels highly influence cryptocurrencies, and you can leverage social trends and make gains before market pullbacks. You can also turn to crypto market news on major financial channels and listen to expert analyses on cryptocurrencies. One such review website is InsideBitcoins which will provide you with the latest updates on Bitcoin and the best altcoins.

Limit Your Risk Exposure

Cryptocurrencies are known to be highly volatile, which means they can spike up and crash within hours. This could be disastrous if you did not properly hedge your bets. When the market is turning against you, make sure you pull your investment to limit your risk exposure.

Do not rely on the idea that it will rise immediately. It may take days – even months – before the bears lose grip of the market. Always keep in mind that cryptocurrencies are high-risk high-reward assets and invest funds that you can handle losing.

Should You Buy Or Trade Cryptocurrencies?

You may need to consider a few factors like your budget, time constraints, and risk tolerance. If you want to day trade, trading low marketcap altcoins may be more suited to you. However, if you are more long-term in your investment strategies, you may consider buying more established crypto assets like Ethereum for the long haul.

There are a few differences in both strategies. Buying is a mid to long-term investment with lower risk, lower reward, and you buy and own the underlying asset and can make payments with it if needed.

Trading cryptocurrency is a short-term investment with higher risk, higher rewards, where you own virtual contracts for differences (CFDs) rather than the underlying asset and speculate on the price direction.

Cryptocurrency News – Latest Updates in November 2024

- Coinbase’s Brainchild: The Rise of Base Chain in the Ethereum Layer 2 Arena

- FTX Founder Bankman-Fried Seeks Court Relief Amid Legal Quagmire

- Coinbase Halts Certain Stablecoin Trades in Canada

The total crypto market cap opened August 2023 at $1.14 trillion, based on the Tradingview monthly chart, and dropped to the $1 trillion area following rumors of Elon Musk’s SpaceX selling their Bitcoin holdings.

The 2022 yearly open was $2.19 trillion, versus a 2021 yearly open of $760 million. So the crypto markets gained in valuation by several hundred percent over 2021, then dropped by over 50% in 2022. Many analysts predict the crypto bull run will continue in Q4 2023 or following the next Bitcoin halving which is estimated to take place in May 2024.

Our Beginner Cryptocurrency Guides

Now that you’re more familiar with how to buy cryptocurrency online safely, check out our other beginner’s guides:

Conclusion

The crypto market is an exciting field to invest in. Cryptocurrencies are fast-growing digital currencies and are considered by many to be the future of money.

Crypto assets are also highly volatile, meaning they experience wild swings. Browse review sites like Inside Bitcoins to do your own research (DYOR) before investing in cryptocurrencies and consider dollar cost averaging (DCA) rather than going ‘all in’ at one time.

Many trading platforms and exchanges offer crypto assets and you may wish to open accounts at several to split up your portfolio and take advantage of different features such as crypto staking. That being said, our top pick for the best place to buy cryptocurrency safely this year is Best Wallet.

Best Wallet - Manage Your Crypto

- Access DeFi and Web3 Dapps Across Multiple Chains

- Comes With Your Own OpenAI Powered Chat Bot Assistant

- Get Early Access to Upcoming Token Launches & ICOs

- Integrated Decentralized Exchange To Buy & Trade Crypto

- Store Crypto And NFTs With Industry Leading Security

FAQs

How Can I Buy Cryptocurrency?

You can purchase your desired cryptocurrencies through several means. One way is to use cryptocurrency exchanges like Kraken. However, most crypto exchanges are not regulated, which presents a risk to your investments. Another means is to buy through traditional trading platforms that offer crypto exposure and are licensed to provide financial services.

How Can I Sell Cryptocurrency?

You can sell your crypto holdings in various ways, but we recommend selling them through the platform you initially bought them from. This will ensure that you get your money back and avoid bad actors.

Where To Buy Cryptocurrency?

With many trading platforms now offering crypto services, it can be difficult to choose where to buy cryptocurrency. However, some of the most well-known platforms are Kraken, MEXC, eToro and others reviewed in this guide. All these exchanges offer different packages, and you need to compare them to know which one you are comfortable with.

What Are The Best Brokers To Buy Cryptocurrencies From?

Our most recommended brokers to buy cryptocurrencies are Kraken, MEXC, eToro, OKX, Binance, Bybit, PrimeXBT, Margex, KuCoin, Huobi, and Crypto.com.

What Payment Methods Can I Use To Buy Cryptocurrencies?

There are numerous payment methods for buying cryptocurrencies. You can buy cryptocurrencies with credit/debit cards, Paypal, Neteller, Skrill, Sofort, and bank wire transfers. It all depends on the platform you transact with.

What Is A Cryptocurrency Exchange?

A cryptocurrency exchange is a trading platform that allows you to buy and sell cryptocurrencies. Following the traditional exchange style, you will utilize analytical tools, perform technical analysis, look at the order book, and place trades. Some like Binance also offer financial services like earning interest on your crypto savings and borrowing.

What is a Bitcoin Exchange?

A Bitcoin exchange is another term for a cryptocurrency exchange.

How Does A Bitcoin Exchange Work?

A Bitcoin exchange operates much like Nasdaq. It facilitates trade between a buyer and seller, albeit in cryptocurrencies. A Bitcoin exchange adopts the same operational module as a brokerage firm, and you can fund your account through a bank transfer or other means. However, you will pay a fee for the service.

Is Buying Cryptocurrency Safe?

Buying from regulated entities like Kraken is safe, and you can be assured that bad actors will not steal your funds.

Do I Have To Pay Taxes When Buying Or Selling Cryptocurrencies?

According to the US IRS department, trading cryptocurrencies is taxable and falls under the capital gains tax. Check out our section on taxation to know how much you need to pay as taxes.

Which Cryptocurrency Should I Buy?

Before deciding on which one to invest in, you need to conduct thorough research on the digital asset you are interested in. Even though Bitcoin is a clear favorite, several other alternative currencies (altcoins for short) have growth potential.

What Are The Safest Cryptocurrencies To Buy?

The crypto market is highly volatile, which means gains can be wiped out in seconds. Another major challenge is that altcoins are tied to Bitcoin’s price movement. This means if Bitcoin goes up, other digital assets also rise and vice-versa. Bitcoin price action is a good marker to evaluate crypto investments.

What Are The Most Popular Cryptocurrencies To Buy?

The most popular digital assets include the likes of Bitcoin, Ethereum, Binance Coin, Dogecoin, Cardano, XRP, Polkadot, and UniSwap.

Bitcoin

Bitcoin

Comments are closed.