Utility tokens are increasingly popular among the trading community. These are tokens created to power a particular Defi project and used for a certain purpose within a Defi ecosystem. For example, Ethereum’s ETH is one of the most popular and valuable ERC20-token-based utility coins that is used to pay for gas fees when using smart contracts on Ethereum’s blockchain. Multiple types of utility tokens have been used up to now in 2024 for very diverse purposes.

Best Utility Tokens to Buy in December 2024 – Top List

- Sui (SUI) – Utility Crypto that Gained Popularity During its Airdrop Launch

- Celestia (TIA) – Utility Crypto Focused on Improving Scalability

- Decentraland (MANA) – Best Utility Token for an NFT-based Virtual World

- Manta (MANTA) – Privacy Based Utility Crypto

- ApeCoin (APE) – Best Utility Token for Decentralised Gaming

- Binance Coin (BNB) – Utility Token Serving the Leading Crypto Exchange Binance

- Polygon (MATIC) – Utility Token with a High Market Capitalisation

- Chainlink (LINK) – Widely Traded Utility Token for Blockchain Technology

- Enjin (ENJ) – Best Utility Token for the NFT Gaming Industry

- Wall Street Pepe (WEPE) – Utility-Focused Meme Coin Inspired by Pepe

- Catslap (SLAP) – Meme Coin With Click-to-Slap Gaming Utility

- Flockerz (FLOCK) – Presale Crypto With a High Potential Utility

- Best Wallet Token (BEST) – Leading Wallet Crypto Focusing On Multiple Use Cases

Best Exchange to Buy Utility Coins

Utility coins are listed on crypto exchanges and brokerage platforms that support crypto trading. Hence, to buy a utility coin, you need to register for an account with your chosen platform and fund your exchange wallet to be able to buy cryptocurrency.

The biggest factors in selecting a brokerage platform is the exchange supports the utility coins you want to invest in, and is safe and secure, with low fees and the right trading tools. Our research indicates that eToro.com is the best platform to buy utility tokens and supports most of the tokens that are widely traded.

Top Utility Coins to Buy Now – Reviews

In this section, we will introduce to you the best utility coins to buy in 2024 and give a detailed review of every token separately.

SUI – Layer 1 Network for Web3 Infrastructure

Developed by Mysten Labs, Sui emerges as a formidable utility project in the blockchain space, positioning itself as a layer 1 network aimed at revolutionizing Web3 infrastructure.

With a focus on instant settlement and high throughput, Sui aims to support a wide array of next-generation decentralized applications. Backed by industry experts and powered by the MOVE programming language and Narwhal-Tusk consensus algorithm, Sui boasts scalability and efficiency. MOVE, based on RUST and developed by Facebook’s Libra project, enables parallel execution, while Narwhal-Tusk separates data transmission from transaction consensus, addressing issues seen in traditional blockchain designs.

This innovative approach allows Sui to scale horizontally, supporting millions of transactions per second without the need for specialized nodes, thereby reducing costs associated with hardware requirements. Sui’s vision of eliminating intermediaries and fostering seamless integration within Web3 applications signals its potential to disrupt the blockchain landscape and cater to the growing demands of the Web3 community. The project, with its focus on providing realistic use cases, has gained a lot of followers and is among the expected projects likely to succeed in terms of increasing value in the upcoming weeks.

Celestia – Utility Crypto Focused on Improving Scalability

Celestia stands out as a leading utility token in the blockchain space, thanks to its innovative solutions for scalability issues inherent in traditional blockchain systems. Through its modular design, which separates execution from consensus, and the integration of data availability sampling (DAS), Celestia maximizes flexibility and scalability, optimizing resource utilization and network efficiency.

By integrating trust-minimized bridges, sovereign chains, and efficient resource pricing, Celestia further cements its position as a pioneering utility crypto project. Its commitment to security, utilizing technologies like DAS and fraud/validity proofs, ensures robust protection for all network participants. The native token, TIA, serves as the backbone of the ecosystem, facilitating seamless transactions within the network.

Currently ranked as the 32nd largest crypto by market cap, TIA is poised to be among the potential top gainers in the future, reflecting Celestia’s promising trajectory in the evolving landscape of digital currencies.

Decentraland – Best Utility Token for NFT-based Virtual World

Another excellent utility token to invest in 2024 is Decentraland which is considered one of the most successful DeFi projects and is included among the 50 largest crypto assets with its market capitalization. Decentraland is a 3D virtual world where you can buy parcels of LAND, purchase avatars, develop them and later sell your LAND or avatar in the market. And all this is possible to do holding its native token – MANA which is traded at $0.954 at the time of writing. You hold the ownership of your avatars and LAND through NFTs.

Decentraland was founded in 2017 by Argentinians Ari Meilich and Esteban Ordino. It first introduced the Genesis City project to the public. The City consisted of more than 90,000 pieces of LAND (or parcels) which were available to buy for $20 at that time. The prices of LANDs have increased significantly and with the popularity of Meta and Virtual reality, they even reached $6,000-$10,000.

Decentraland’s MANA token is the fuel of the ecosystem. It is both a utility and a governance token. You can use MANA to purchase parcels of LAND, buy items to develop your LAND or avatars, and later sell them for higher prices in the market. As MANA is also a governance token it powers the holders with voting rights meaning you can take part in the decision-making process and vote on changes related to Decentraland.

Manta – Privacy-Based Utility Crypto

Manta Network (MANTA) distinguishes itself as a utility crypto project by prioritizing privacy, scalability, and secure transactions. As a privacy-preserving decentralized finance (DeFi) platform, Manta employs advanced cryptographic techniques to ensure transaction confidentiality and security, addressing prevalent concerns in the digital currency realm.

Leveraging the Substrate framework, Manta aligns itself with the Polkadot ecosystem, offering users and investors a seamless experience within this robust network. Its innovative blockchain technology enables faster transaction processing, mitigating scalability challenges common in traditional blockchains. Additionally, Manta’s governance token, MANTA, plays a pivotal role in driving network governance decisions and may offer further utilities.

Following its launch, Manta swiftly gained popularity, securing listings on top exchanges within weeks due to surging demand. Recent trends indicate escalating interest and value appreciation in MANTA, signaling its potential as a utility crypto project with a promising trajectory in the dynamic landscape of digital currencies. Currently priced at about $3.35, the token is speculated to be a top gainer in the next bull run.

ApeCoin – Best Utility Token for Decentralised Gaming

ApeCoin (APE) is the native token of the ApeCoin DAO and is also used as a utility token within the Ape ecosystem. The token was created by Yuga Labs and is meant to serve the Ape ecosystem. It is used for versatile purposes and is incorporated into the Ape community in various ways. First, it gives access to the holders to the unique parts of the ecosystem, including games, projects, and other services.

APE has also become the native token of such famous projects as Bored Ape Yacht Club which is among the most popular NFT collections in the DeFi market. It has 10,000 unique NFT drawings representing bored Apes which are quite valuable. The BAYC NFTs are popular among such celebrities as Justin Bieber, Snoop Dog, DJ Khaled, Eminem, Timbaland, and many others – most recently Madonna in May 2022.

Benji Bananas is another project that adopted APE cryptocurrency. It is an NFT game in which users can gain Membership Pass by holding APE tokens. One must have 25 APE coins to get a Membership Plan into the Benji Bananas where he can play and earn several in-game items and later swap them with APE tokens. Besides being a utility token, APE is also a governance token and APE holders have voting powers within the ApeCoin DAO. It is among the most tradable assets right now. It is a relatively new coin and was launched in March 2022 but the project has garnered a lot of popularity in a short time.

Binance Coin – Utility Token Serving the Leading Crypto Exchange Binance

Anyone somehow familiar with cryptocurrency trading at least once heard the name Binance. It is a cryptocurrency exchange where traders can buy and sell more than 600 hundred digital coins and NFTs. Binance is the largest cryptocurrency exchange in the world with trading liquidity and its volume is equal to over $7 million. Binance Coin is the native token of the Binance exchange, Binance Chain and Binance.com and has the ticker symbol BNB.

BNB was initially an ERC-20 token and used the Ethereum blockchain. Once Binance created its own blockchain known as Binance Chain, BNB adapted to the Binance ecosystem and became the native coin of the Binance Chain. The purpose for creating BNB was for discounted trading fees, so initially, it was used for paying transactions and the trading fees on the Binance exchange and Binance Chain. But the cryptocurrency has become more versatile throughout its development.

BNB is accepted universally for different kinds of payments – via BNB you can make payments, purchase gift cards and lotteries, book travelling packages and even make investments in other coins.

The cryptocurrency once had a maximum supply of 200 million tokens, but it decreased over the years as Binance sometimes organizes burning events during which it buys some BNB coins and destroys them. By doing so, Binance decreases the supply of the coin meaning that its value can increase if there is a high demand for BNB.

Polygon (MATIC) – Utility Token with High Market Capitalisation

Polygon was founded in 2017 in India by Ethereum blockchain developers with the purpose to make transactions faster and cheaper. The problem with the Ethereum blockchain is scalability, meaning that if the number of transactions on its network increases, it takes more time to verify those transactions, and transaction fees rise accordingly. Polygon was created as a sidechain of Ethereum that will be run parallel to Ethereum’s blockchain offering fast and cheap transactions.

Polygon’s native cryptocurrency is MATIC which is called so because Polygon was initially known as Matic Network and was rebranded into Polygon only in 2021. MATIC is both a utility and a governance token for the ecosystem. It is used to pay for transaction fees or stake and become a validator. Additionally, MATIC holders have voting rights on the projects regarding the Polygon blockchain. MATIC had entered the market through ICO during which it sold approximately 1.9 billion MATIC tokens worth $5.6 million in the first 20 days.

Chainlink – Widely Traded Utility Token for Blockchain Technology

Chainlink is a blockchain technology aiming to use the global network of computers and provide real-world data to the blockchain-based smart contracts. Founded in 2017 by the Smart Contract company, Chainlink has become one of the most successful DeFi projects in the industry. Its native token LINK is among the 100 largest crypto assets by its market capitalization.

To accomplish its goals, Chainlink uses data providers who are known as “oracles”. The latter must process the data and provide accurate information for smart contracts. To assure that oracles will be away from any malicious actions, reputation scores are assigned to them. As a reward for their service, oracles get new LINK coins which is the native token of the Chainlink platform. LINK has a maximum supply of 1 billion tokens 35% of which were sold during the ICO process raising $32 million in total.

Enjin – Best Utility Token for NFT Gaming Industry

Enjin is a gaming platform that was created by Maxim Blagov and Witek Radovski in 2009, long before the cryptocurrencies became so highly incorporated into our lives. The main goal of the project is to develop the decentralized gaming industry and introduce innovations within that ecosystem. Enjin allows users to create in-game items and later use them within Ethereum-based games and platforms.

Enjin also provides a marketplace where users can buy new items and sell them paying very low transaction fees. To buy items on Enjin’s platform one must possess ENJ coins which is the native cryptocurrency of the project. ENJ coins are used to purchase and sell those items in Enjin’s marketplace. Additionally, Enjin provides its decentralized wallet where ENJ holders can store their digital money. The Enjin wallet supports other coins too, including Bitcoin, Ethereum, etc.

Enjin founders organized an initial coin offering of ENJ tokens in 2017 raising almost $10 million. Most of the money raised from the token sale went on building Enjin’s new blockchain. As for now, the ENJ token is among the top 100 largest cryptocurrency by its market capitalization which is equal to $570 million. The maximum supply of the coin is 1 billion ENJ tokens and almost 90% is in circulation.

Wall Street Pepe (WEPE) – Utility-Focused Meme Coin Inspired by Pepe

With Bitcoin edging closer to $100k, the crypto market is ripe for experimentation, especially in the meme coin sector. Meme coins no longer have to rely solely on viral potential; they can now introduce meaningful use cases as investors become more receptive to utility-driven projects. Wall Street Pepe is a prime example of how this evolution is taking shape.

Inspired by the legendary Pepe meme, Wall Street Pepe builds on its predecessor’s viral legacy. However, while Pepe’s success was primarily due to its unique imagery, Wall Street Pepe distinguishes itself as a utility-first meme coin. This focus on practicality and functionality positions it as one of the best utility tokens to buy this year.

Wall Street Pepe offers a range of use cases designed to empower its community. From trading insights and rewards to access to the exclusive WEPE Army community, the token provides both active and passive benefits. Staking, with its dynamic reward structure, allows holders to earn passive income while contributing to the ecosystem. These utilities align with the token’s broader mission: to challenge the status quo of the meme economy, where only a few typically profit. Wall Street Pepe aims to democratize these gains, ensuring its community has equal opportunities to thrive.

This thoughtful blend of memes and use cases is central to Wall Street Pepe’s appeal. Its mascot—a Pepe dressed in a shirt, pants, and tie—represents the relatable, everyday individual striving for success. The token’s utilities, from staking to trading perks, are practical tools designed to support this aspiration. Wall Street Pepe embodies a community-first ethos, with the goal of lifting all boats in the rising tide of the crypto market. For those looking to invest in a meme coin that combines relatability with purpose, Wall Street Pepe is a standout choice.

Catslap(SLAP) – Meme Coin Meme Coin With Click-to-Slap Gaming Utility

Catslap ($SLAP) is one of the most popular meme coins in the market, and has taken no time to reach at the top of DexTools. While adhering to the traditional meme coin concept, the project features a browser-based game where users can virtually “slap” Pepe the Frog in their cat-avatar. The unique click-to-slap gaming concept builds a distinct engagement style, and will also incorporate play-to-earn (P2E) to appeal to a broader user base.

One of the project’s major selling points is its strong technical foundation with a SolidProof smart audit. Its 9 billion token supply and zero-tax tokenomic structure are two more significant draws for investors. 50% of this supply has been locked for 60 days for Uniswap liquidity.

The remaining tokens will fund a dedicated development fund, staking and community incentives, and team allocation to be vested for ten years. Token owners can lock up their $SLAP tokens for possible future gains, thanks to the integrated staking platform and timely rewards.

It should come as no surprise that the token launch has piqued investor interest in the project, along with boosting trading and social media activity. Since its launch, $SLAP has already spiked by 3000%. The present momentum and early indicators suggest that prospective investors should keep a watchful eye on the token.

Flockerz (FLOCK) – Presale Crypto With a High Potential Utility

Investors have their eyes on Flockerz as a strong utility token, offering more than just speculation—it’s building a community that actively participates in the platform’s evolution. At the heart of its utility is the “Vote to Earn” system, a feature that gives real power to token holders by allowing them to influence key decisions within the Flocktopia ecosystem. This community-driven governance model not only ensures decentralization but also incentivizes participants by rewarding them for their involvement, adding practical value to holding FLOCK tokens.

The “Vote to Earn” mechanism is designed to align with the interests of all holders, giving each participant the ability to shape the future of the project while earning rewards along the way. This is more than a voting system; it’s a structure that encourages active community involvement, which is crucial for the project’s long-term sustainability and growth. For those interested in utility tokens, Flockerz offers a compelling case—holding FLOCK gives you a direct role in decision-making while also benefiting financially from participation.

Flockerz is built on Ethereum and Binance Smart Chain, ensuring that holders benefit from the security and reach of both networks. This dual-chain setup also means that participants can choose between more secure or cost-effective transactions, adding flexibility to the experience. The current presale price of $0.00567 per token makes Flockerz accessible to a wide audience, with early investors having the potential to buy in at the lowest possible valuation.

Additionally, Flockerz offers an impressive staking program with an APY of 7000% for early stakers, which complements its utility features. Not only does the staking mechanism generate returns, but it also incentivizes holders to stay committed to the project, ensuring that the community remains engaged and active.

Best Wallet Token (BEST) – Leading Wallet Crypto Focusing On Multiple Use Cases

With the rise of Bitcoin, the scales have once again gone in favor of utility crypto, which was previously held by meme tokens. Best Wallet Token is a utility-centric project that doesn’t just show users visions of a utility that might arrive, but instead, it is associated with an existing project that has already been well-received by the crypto community.

The product that this token powers is known as Best Wallet. Best Wallet is a crypto wallet that offers a vast array of features, including access to crypto presales, decentralized exchanges, and staking perks. It is also shaping up to be an interface of sorts that allows users to interact with a wide array of decentralized applications.

Best Wallet Token is a facilitator of these perks, and it also enhances them. The token can be leveraged for lowering the fee and even gaining access to tokens that are yet to launch to the public.

This unique utility is especially important in today’s day and age, where the need for a more utility-centric crypto has risen. Due to its use case, the token has the potential to provide long-term benefit to investors, as the rise of the crypto space will likely introduce many beginners who seek an easy way to interact with it.

What are Utility Coins?

If you are interested in buying utility tokens it is also crucial to understand what they are and what purpose they serve. A token is a common thing for the cryptocurrency project and while stepping into the DeFi world you will hear the multiple token types. In fact, the same crypto project can have more than one token: for example, it can have both a utility and a governance token. But these are not the same and there is a huge difference between coins, utility tokens, governance tokens, and security tokens.

In the first place, you need to understand the difference between coins and tokens. While coins are simply created to hold some value and therefore be used as a means of exchange, tokens are more than that. Tokens can be valued too, but apart from it they also have additional use cases within their community. These use cases can be of different types, hence there are different types of tokens with the most popular ones being security, governance, and utility tokens.

As its name implies, security tokens represent a share of the company that is tokenized, so by holding a security token, you actually have a part of the company. Pretty much similar to security tokens are governance tokens, which grant voting rights to the holders. By having governance tokens of a cryptocurrency project, users can participate in voting regarding the changes to that project.

Utility tokens do not grant any voting power, nor do they represent a share of the company but they give a lot of advantages to the holders within a particular ecosystem. For example, those holding utility tokens can have discounts for different services, they can use these tokens for paying services within the community, and can also be staked to generate rewards.

Utility tokens also have value meaning that they can be traded to profit from the price movements. One of the best things about the utility tokens is their versatile use cases. It means that even if their value decreases they can still be useful for other purposes. For that reason they’re considering among the best altcoins to buy.

How We Reviewed the Best Utility Coins to Invest in

The cryptocurrency market is filled with thousands of different coins and tokens which makes it a hard choice to find the ones that can be profitable and safe. Below are some of the metrics we use when researching the market and recommending which coins to purchase in 2024.

Use Cases

Having another useful purpose apart from being a tradable asset makes a cryptocurrency more valuable. People will buy it not only for trading purposes but also use it within its ecosystem which will increase the demand for it. Moreover, if the project that the crypto was created for becomes a well-established one and gains popularity within the Defi community it will attract more interest and attention.

Past Performance

It is also crucial to take a look at the past performance of the cryptocurrency you want to purchase. You need to analyze its price movements and understand the best signals to buy it. Along with the market analyses, you should also take into account the fundamental analyses of the asset as long as its future projects and goals can significantly influence its popularity and value.

Potential to Growth

In our recommendation list, we mostly included those tokens that have a lot of potential to grow in the future. Especially the first two tokens in the list – Lucky Block and DeFi Swap have rather market capitalization (#3217 – LBLOCK, and #4266 – DEFC), but their projects have a lot of room for growth and great service to offer in the future. So, if the projects succeed in accomplishing their goals, their values will rise as a result.

Security

Eventually, it is essential to invest in those assets that are backed by a promising team and stand out with their unique and innovative plans. You need to do a bit of research to make it clear if the cryptocurrency has a good development plan or if it is another scam that will burst shortly. All the tokens included in our list are analyzed carefully which indicates that they have strong plans and goals to bring innovations into their industries.

Are Utility Coins a Good Investment?

First of all, we should note that all cryptocurrency investments involve a lot of risk because of being quite new in the market and have high volatility. However, some cryptocurrencies are riskier than others. These crypto-assets are just copies of another crypto project and are created for fun. They usually do not have sophisticated technologies or goals and can become viral for a certain period and then lose their value or crash. Meme coins are among such cryptocurrencies.

In contrast to them, utility tokens usually serve a particular purpose. They are developed to fuel this or that ecosystem and used within those networks for various purposes. They become the native tokens of more serious and revolutionary crypto projects. Consequently, they involve lower risks and the rewards are lower too compared to the risky investments.

Still, utility tokens are excellent investments in long-term perspectives. The projects backing them need to develop over the years to prove their technology and be adopted by the community. It means that they are more stable, have more potential to grow, and have less probability of crashing in the future.

If you are looking for a place to buy some of the hottest utility tokens in the market, consider P2B. You can also read our P2B review.

Where to Buy and Trade Utility Coins?

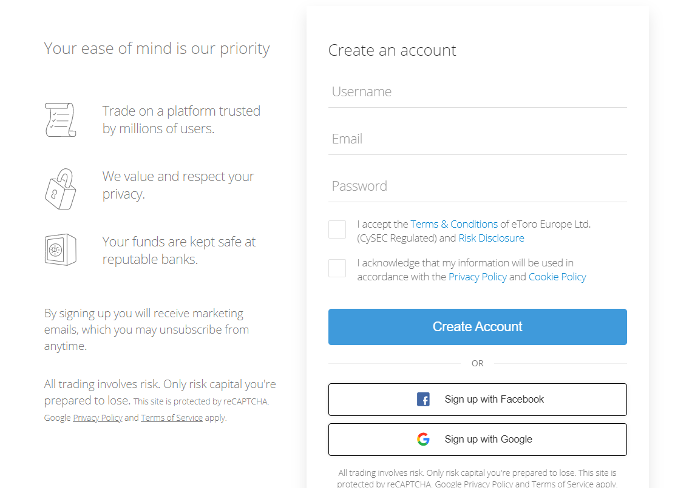

Cryptocurrencies are supported by several brokerage platforms and crypto exchanges that are available worldwide. To buy or sell utility coins you must have a verified account with the broker of your choice. eToro is one of our most recommended brokerage platforms to buy or sell utility tokens as it supports most of the tokens included in our recommendation list and it charges fairly low trading fees.

eToro is a leading broker in the industry with millions of customers from more than 100 countries. This is due to the extremely user-friendly interface and cost-effective trading fees which make eToro an excellent place to invest in utility tokens.

One of eToro’s excellent features is its social trading platform with multiple trading tools. Such popular tools as CopyTrader or CopyPortfolios enable the users to mirror the trading portfolio of an expert trader with a few simple steps.

The broker guarantees the safety of your trading and protects your account from fraud with top-notch security features.

Update – As of 2024, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

How to buy Utility Coins – Step by Step

After learning about utility tokens you may be wondering about how to buy utility coins through a crypto platform of their official site. In this section, we will walk you through the whole process and explain step-by-step what you need to do.

For MANA, APE and various other utility tokens visit eToro and sign up for a free account on the platform. The eToro registration process is straightforward and involves providing such details as your name, surname, address, phone number, email, and creating a password.

Once all the details are registered appropriately, you can get to verify your account. For this purpose, you will need such documents as your passport, ID, or driver’s license and a bank document with your address or a utility bill.

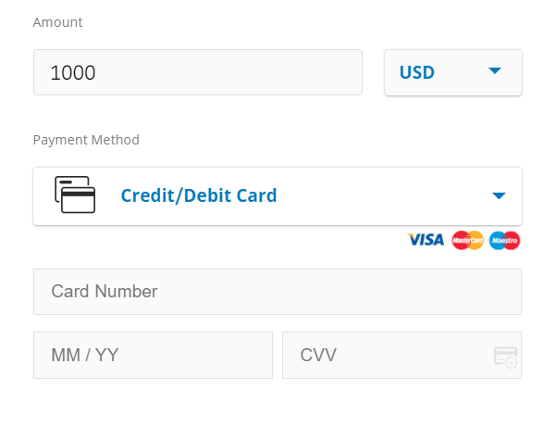

Fund Your Account

To fund your eToro account you have several options – credit or debit card, wire transfers, Neteller, Skrill, Paypal, etc. Click on the “Deposit” button to select one of these methods and deposit some money into your account. eToro does not charge deposit fees for funding your account but a small conversion fee is taken for non-USD transactions.

Search the Cryptocurrency, and Analyse the Coin

Now you have all the necessary things to purchase your selected utility tokens – a verified account and funds on it. What you need to do is to browse the cryptocurrency section to find the coins you want to buy or simply type its ticker in the search toolbar.

Place an Order

Once you find the cryptocurrency you want to buy, eToro will show you a news feed dedicated to that asset. You will also find some charts, graphs, news, and other tools which can help you to do one last research before buying it. When you are sure about making the purchase, click on the “Trade” button and fill in the necessary boxes to place the order.

Where to Trade Utility coins?

For crypto trading, you will need a reliable, versatile, and quick-to-operate brokerage platform. Additionally, you had better select a broker that charges low trading fees not to lose a part of your capital on fees every time you buy or sell an asset. Below we have included the best platforms to trade utility tokens after thorough market research.

- eToro

- OKX

Conclusion

In a nutshell, there are a number of utility tokens that were founded to serve the ecosystems of promising blockchain projects. These projects mostly belong to the decentralized exchange, gaming, virtual worlds, NFTs, and other ecosystems and have a lot of potential to succeed in what they are planning to do.

Wall Street Pepe, ApeCoin, Binance Coin and Decentraland are a few examples of such projects which are worth considering as an investment. These tokens are not only used for trading but have more serious purposes above it – they are used to fuel their networks. You can buy and trade these cryptocurrencies on crypto exchanges and brokerage platforms and eToro is one of the leading platforms that support many of these crypto assets.

FAQs

What is a utility coin in the crypto market?

A utility token is a type of cryptocurrency that can have several use cases within a particular ecosystem. For instance, PEPU is a utility token that allows users to leverage a blockchain of the Wall Street Pepe ecosystem and earn rewards.

Can I trade utility tokens?

Yes, utility tokens are listed on several major crypto exchanges, hence you can easily buy and trade them through an online account.

What is the difference between utility and security tokens?

If you have a security token it means you own a stock of the company. So, a utility token is a share of a certain company that is tokenized. In contrast, a utility token does not represent a share but it grants you some rights within an ecosystem.

What are the best utility coins to buy right now?

The best utility coin at the moment is Wall Street Pepe. This token has a strong community backing, which means that it may have a critical utility soon.

What is the purpose of utility tokens?

Utility tokens are created to fuel a particular ecosystem and enable holders to do some actions within that ecosystem. For example, they can be used to pay for transaction fees, stake and generate rewards, buy in-game items, etc.

How can I buy utility coins?

To buy utility tokens you must register for an online account with a trustworthy brokerage platform, deposit some funds and make a purchase.

What is the total market capitalization of utility coins?

From the list of the utility coins that we recommend investing in, Binance Coin has the highest market cap and is the 5th largest cryptic with the market cap. In contrast, DeFi Swap and Lucky Block fall behind with their market cap and have below #4000 and #3000 rankings on the charts.