Decentraland (MANA) is a virtual world powered by the Ethereum blockchain, and it’s used for buying, selling, and trading items. Investors have become increasingly interested in cryptocurrency in recent months due to its rapid price increase, and they want to know the answers to these frequently asked questions.

Decentraland (MANA) is a popular cryptocurrency that stormed the crypto world last year. On November 25th, 2021, the cryptocurrency reached an all-time high price of $5.90, but the gains remained short-lived. In 2022, the MANA coin fell dramatically by over 90% to trade at $0.3. The token has since rebounded and is now heading to recapture $1.

This guide will show you how to buy a Decentraland coin, analyze its price and features, and suggest the best digital wallets to store your MANA coins.

How to Buy Decentraland Coin – Quick Guide

If you want to instantly buy Decentraland crypto you can simply follow the 5-steps below:

- Choose an Exchange – We recommend Capital.com.

- Open an Account – Head over to the Captial.com website and sign up for an online trading account.

- Upload ID – To verify your ID, you must upload a picture of your passport or any national ID and a document verifying your proof of address.

- Deposit –Deposit the low minimum of 20GBP.

- Buy Decentraland Coin – Search for Decentraland (MANA) coin, insert the amount you want to buy, and click the ‘Buy’ button.

Where to Buy Decentraland Coin

The Decentraland coin is not yet available on many crypto exchanges, so you’ll have to find an exchange or an online trading platform that supports this coin. To help you find where to buy Decentraland coins, we suggest two platforms that allow you to trade Decentraland tokens.

1. Capital.com – The Most Innovative Trading Platform to buy Decentraland

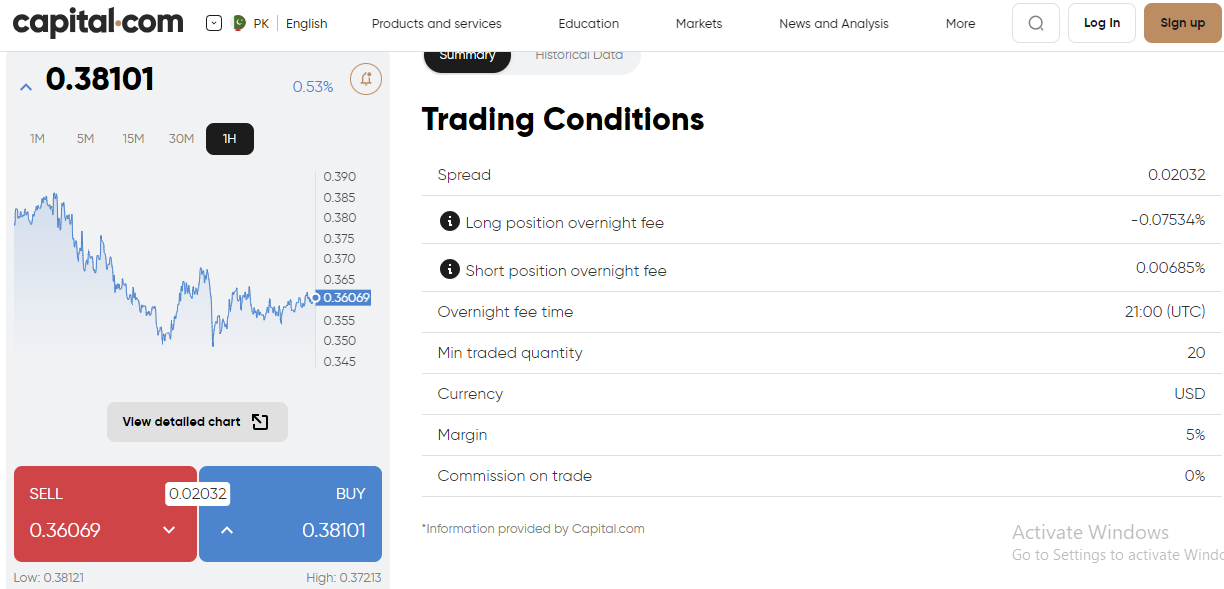

In terms of the fundamentals – if you decide to buy Decentraland crypto via Capital.com, you’ll have to pay a spread of around just 0.01 pips (a dynamic spread). Further, you do not have to pay fixed trading fees when trading via traditional crypto exchanges. As Capital.com enables you to utilize margin trading, you must consider an overnight fee of 0.05% for long positions and 0.014% for short-sell positions.

Most importantly, Capital.com has created a perfect trading platform that is easy to use and uses Artificial intelligence technology to send you trading ideas based on your previous searches and trading activity. This technology works very similarly to other AI platforms (Netflix, YouTube, Facebook, Amazon, etc).

Finally, Capital.com is an FCA-regulated broker. And to get started, users need to meet a low minimum deposit of just 20 GBP.

Cons

71.2% of retail investor accounts lose money when spread betting and trading CFDs with this provider.

2. Binance – Best Cryptocurrency Exchange to Buy Decentraland

Further, Binance is also a great solution for one-time cryptocurrency purchases with credit and debit cards, though you won’t be able to buy MANA coins directly. Instead, you must buy Bitcoin BTC or Ethereum ETH first and then exchange it with MANA on the Binance marketplace. Binance is somewhat expensive if you want to buy cryptocurrencies with credit or debit cards, as it charges a 3.5% fee per transaction or a minimum of 10 USD. On the other hand, when it comes to trading fees, Binance charges a fee of 0.10% or lower (volume-based pricing structure), which makes it one of the ‘cheapest’ cryptocurrency exchanges in the world.

Cons

Your capital is at risk.

Decentraland Coin Payment Methods

When it comes to paying for Decentraland, you have several options. Let’s look at some top payment methods to buy Decentraland coins.

Buy Decentraland Coin with PayPal

You can buy Decentraland coins with PayPal using any crypto broker that accepts PayPal deposits.

Another option is to buy Bitcoin with PayPal directly. Once you own Bitcoin, you can transfer your tokens to any cryptocurrency exchange – including Capital.com and Binance – and use them to buy Decentraland coins.

Buy Decentraland Coin with Credit Card or Debit Card

You can also use a credit or debit card to buy a Decentraland coin. Most top crypto exchanges, including Capital.com and Binance, accept bank card deposits from Visa and Mastercard.

Buy Decentraland Coin with Bank Transfer

If you want to use a bank transfer to buy Decentraland coins, you can do that on Capital.com and Binance as both accept bank transfers. Just note that bank transfers typically take a few days to complete, so you won’t be able to buy Decentraland coins right away.

What is Decentraland Coin?

In simple terms, Decentraland is a virtual reality (VR) platform powered by the Ethereum blockchain network that enables users to build, create, and develop artwork in the form of Non-Fungible Tokens (NFTs) by using smart contracts. It is the first fully decentralized world where users can do anything they want – create avatars, connect with other users, buy and sell virtual lands/wearables/names, and participate in many other virtual reality activities.

Through the Decentralized Autonomous Organization (DAO), users fully control any element that appears in the Decentraland virtual reality world. For example, they can choose the wearables items of the avatars, the land policy, content, and many more. The Decentraland coin (MANA) is the digital currency that exchanges goods and services on the Decentraland virtual platform.

The coin was launched in 2017 by Esteban Ordano and Ari Meilich, and at the time of writing, the company has a market cap of slightly above $2 billion. This makes Decentraland the 68th largest crypto coin in the world among the more than 4,000 cryptocurrencies currently in existence.

MANA has a total supply of 2,194,378,827 and a circulating supply of 1.58 billion.

Why Buy Decentraland Coin? Decentraland Coin Analysis

Overall, the Decentralnad network and the Decentraland are somehow unusual. Thus, you must understand the concept of the Decentraland virtual world and why the price of MANA might rise.

First and foremost, Decentraland is the world’s largest and most used crypto-based virtual platform. Essentially, everything on this platform exists in virtual reality, and parcels of land on Decentraland can be traded for a lot of money. In a way, buying lands and other NFTs on Decentraland has the same process as buying lands in the real world with fiat currencies. As of March 2021, one parcel of LAND in Decentraland was sold for an average of 6,900 MANA coins, or $5,800 USD. And, as virtual land prices have been booming over the last year, the Decentraland network could likely become even more significant in the upcoming years.

Another crucial factor that makes Decentraland unique is that it is currently one of the largest platforms for NFTs. These assets can’t be replicated and can be stored on the blockchain technology ledger. By the way, this year, despite the huge rise of Bitcoin and other cryptos, NFTs are certainly the biggest crypto craze after one NFT item was sold for $69 million. In that aspect, Decentraland is the largest virtual blockchain world (VBW) and perhaps the largest NFT marketplace for virtual real estate.

Read more: Best NFTs to Buy

Factors to Consider When Choosing a Broker

The growing popularity of cryptocurrencies means more financial investment service providers are now offering these digital assets.

It can be difficult to filter the best from the rest. Below are some criteria to consider before selecting a crypto broker to buy Decentraland.

Fees

First on your list of priorities should be the fees the crypto broker would likely charge you for using its platform. This considers trading fees, hidden charges, and deposit and withdrawal fees. While some offer structured fee plans, some may not be too clear on how much you will pay in bills.

Security

The safety of your funds and personal details should feature prominently on your list. Before selecting a broker, we advise looking at online reviews on their security mechanisms. A review website like Inside Bitcoins offers up-to-date on all the major crypto brokers in the industry. Here, you will know the security protocols the broker employs and if they have a history of losing user funds or being hacked.

Regulation

A regulated crypto broker means you can rest assured that your funds will not be mismanaged. We recommend selecting a broker with top tier-1 regulatory clearances from the UK’s Financial Conduct Authority, Cyprus Securities and Exchange Commission (CySEC), Australian Securities and Investment Commission (ASIC), and other financial supervisory organizations. Having these licenses will go a long way in covering the potential loss of capital in the event of a liquidation.

Customer Support

While new-generation crypto exchanges are great for interfacing with virtual assets, some lack robust customer support services.

On the other hand, many crypto brokers offer top-notch customer support services to customers. We recommend selecting a broker with 24/7 support and multiple support channels spanning emails, chatbots, voice calls, and social media. This will go a long way in addressing issues if you are in a tight spot.

Multiple payment methods

Multiple deposit and withdrawal methods mean more payment and withdrawal flexibility. A limited deposit crypto broker will be challenging, especially if your region does not support the deposit method. The best crypto brokers support bank wire transfers (local and international), credit/debit cards, and e-wallet solutions like PayPal, Skrill, and others.

Decentraland Price

In December 2017, the nascent Decentraland cryptocurrency made its market debut with an initial price of around $0.025 per coin. Over the following years, its value underwent fluctuations, ultimately witnessing a significant surge that drove it above the $0.24 threshold.

However, this peak was not long-lasting. The coin faced resistance that pushed it back to its previous support levels. Over an extended period, Decentraland’s price remained relatively stable within a narrow range. There were minimal price movements observed throughout the beginning of 2021.

Then, like a powerful tsunami wave, Decentraland’s fortunes dramatically turned. The cryptocurrency entered a bullish phase, gaining significant momentum starting in December 2020. Its value surged to approximately $1.05 during this period, signaling the onset of an impressive and optimistic upward trend.

The upward trajectory persisted until April 2021, reaching an impressive peak of $1.56. Regrettably, this pivotal point was swiftly followed by a corrective phase, resulting in a sharp decline that caused the price to plummet below $0.43.

The following months saw Decentraland’s price undergo a series of fluctuations until the close of October 2021. At that point, an unexpected surge occurred, propelling the cryptocurrency’s value to unprecedented levels above $3.5.

This upward trend persisted, culminating in a new record high of $5.90 in November 2021. However, as commonly observed after such milestones, Decentraland experienced a notable correction, leading to its retreat to around $2.

As the calendar turned to December 2022, Decentraland was valued at $0.30, marking an 80% retracement from its peak in May 2022. The broader crypto winter that impacted various digital assets played a significant role in Decentraland’s bearish turn during this period.

Another factor also came to light—the lack of inclusivity in the cryptocurrency. The high cost of entry into the Decentraland metaverse discouraged potential investors from participating, particularly during the crypto winter when market sentiment was uncertain.

Despite various challenges, Decentraland began to follow a positive trajectory in January, gradually distancing itself from the influence of FTX’s impact. The coin achieved stability within the price range of $0.6 to $0.8, moving closer to reaching the $1 mark. This achievement sets the stage for potentially retesting the highs seen in May 2022.

Analysts have recently cautioned that Decentraland’s $MANA token might significantly decline due to the US Security and Exchange Commission’s (SEC) classification of the token as an unregistered security. In the legal cases brought against Coinbase and Binance last week, the SEC categorized the MANA token as a security, leading to a sharp drop in its price.

Throughout 2023, Decentraland’s price demonstrated resilience and a resurgence in momentum. The cryptocurrency experienced an impressive rebound of nearly 24% from its previous levels, indicating a renewed interest and potential for growth. The crypto community eagerly awaits to see if Decentraland can sustain this upward trajectory and continue making strides within the dynamic realm of digital assets.

Investing in Decentraland vs. Trading Decentraland Coin

Long-term investors want to analyze the strengths of the Decentraland network, the coin’s price predictions, and the potential return over the longer term. If this is the case, it seems that the Decentraland coin is an interesting long-term investment, especially if you have high hopes that the virtual world will become an integral part of our real world and that NFTs are not just a trend.

But, a much safer option to trade this coin is by making short-term trades. Currently, MANA has an average daily volume of around $200 million, which is enough liquidity for a trader to easily buy and short-sell the coin many times in one trading day without the concern of getting stuck in a market where you cannot find buyers or sellers at some point in time.

Buying Decentraland as a CFD Product

The proliferation of crypto brokers has led to the offering CFD products in the crypto space. A CFD, which stands for contract for difference (CFD), is a financial derivative agreement between a buyer and seller that captures the difference in the current value of an asset when the agreement is made and the value when the contract expires.

If you are a conventional trader and are conversant with CFD trading, you can also apply the same procedure in trading Aave as a CFD product. This allows you to trade small price changes in the asset without directly owning the asset.

Best Decentraland Wallets

Now that you have purchased the Decentraland coin, you must find a digital crypto wallet to store your coins. This is an important decision, and there are several factors you need to consider before you choose a crypto wallet. First, you need to choose between a hot and cold wallet. The difference is that hot wallets are connected to the internet, while cold wallets are physical devices that allow you to hold your crypto coins offline. If you hold a large amount of money or digital assets, storing your coins on a cold hardware wallet like Ledger or Nano is recommended.

Another option is the Binance Trust Wallet, which is a hot wallet. This wallet allows you to store digital assets directly in its wallet, which is an integral part of the Binance exchange. It supports over 500 digital assets and is a good option for more advanced traders and those who can easily manage their funds on a complex trading app.

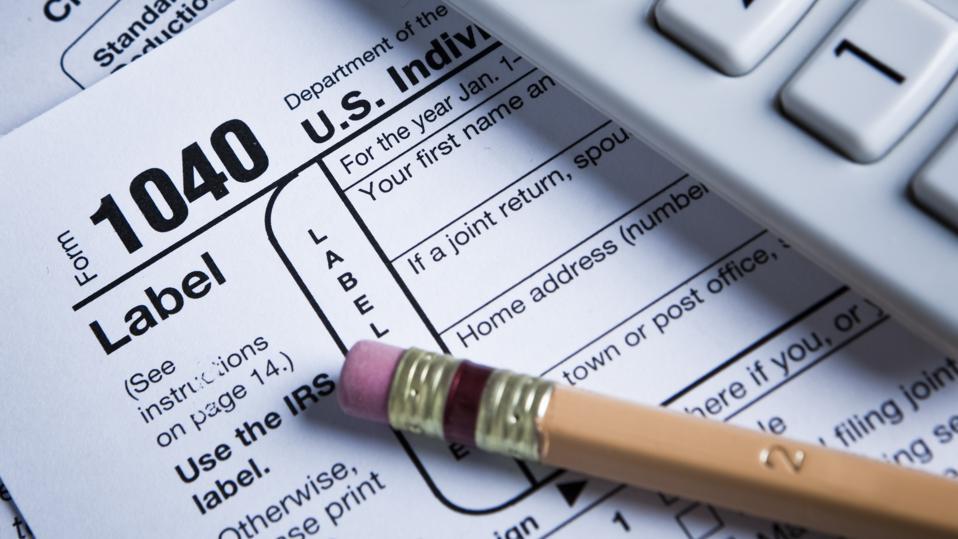

Decentraland Tax Earnings

The Internal Revenue Service (IRS) considers cryptocurrencies as financial assets and defines them as ‘property.’ This categorization puts crypto under the capital gains tax and income tax brackets.

Taxable events that fall under the capital gains tax bracket:

- Making purchases and services with crypto

- Exchanging crypto for fiat

- Swapping one crypto for another, either through an exchange or a peer-to-peer (P2P) platform

Taxable events that qualify under income tax:

- Block rewards from mining crypto

- Interests earned from lending to DeFi protocols

- Receiving crypto airdrops

- Receiving payment for services with crypto

- Crypto earned from staking

Meanwhile, you can use your trading losses to offset some of your tax obligations up to $3000, depending on how long you hold the cryptocurrency.

Calculating Your Capital Gains Tax

Determining how much you will pay in short- and long-term capital gains tax largely depends on how long you hold the assets.

a) Short Term Capital Gains Tax

Short-term capital gains tax is when you’ve held a crypto asset for less than a year. Under this condition, you will be taxed according to your regular income tax bracket. Meanwhile, you can use some of your losses to reduce this to at most $3,000, and you enjoy the privilege of carrying your tax forward into the following year.

b) Long Term Capital Gains Tax

Long-term capital gains taxes are billed after you must have held an asset for upwards of a year. This will see you pay between 0%, 15%, or 20% based on your income tax bracket against 35% in short-term taxes.

Crypto Robots

Automated trading systems are becoming rampant in financial circles, and these sophisticated algorithms have also found their way into the crypto space.

Crypto trading robots are becoming popular because cryptocurrencies are highly volatile – meaning massive gains coexist with huge losses.

Crypto trading robots cut down on these risks by using dedicated artificial intelligence (AI) and natural language processing (NLP) technologies to read the crypto market.

The technologies allow the bots to understand better where the market is heading and identify good trading opportunities. This software can work with little human intervention and also set trading parameters.

Crypto trading robots mitigate risks by processing large volumes of data at neck-break speed while pushing the profits margin higher. Both beginners and advanced traders can leverage the power trading software to tap into the market with little risk to their capital.

Decentraland Mining

Crypto mining is one of the oldest methods of bringing new coins into circulation. Sophisticated machines or mining rigs run 24/7 to validate transactions.

However, this process has been criticized for its high energy intensity and slow validation. This has led to backlash from environmental activists who have called for a ban on crypto mining.

But new generation protocols like Decentraland utilize proof-of-stake (PoS) consensus algorithms that do not require mining to validate transactions. By this, Decentraland cannot be mined due to using the PoS model.

The new means of getting new coins is through crypto staking, which means locking your coins for a specified period. In return, stakers are rewarded with newly staked coins.

Mitigating Risk in Decentraland Investment

If you are just entering crypto, you must have heard the word ‘volatility’ thrown around a lot. This is not just a catchphrase but shows that cryptocurrencies are more sporadic in their movements than other investment vehicles.

We recommend putting the following parameters in place to reduce the risks of losing your capital:

Monitor fundamentals and technical performances

The only way to do this is to conduct extensive research and see how far the crypto asset has grown in the past year. This will see you look at technical charts to determine the asset’s following action. You can use specialized social media platforms or YouTube channels to get all the necessary information. You will also need to throw into the mix the fundamentals of the project. Examine the value proposition, their roadmap, and how they plan to achieve their goal.

In addition, integrations and adoptions should feature prominently in your research. These two datasets will give you the confidence to buy and hold for the long term instead of trading on social media hype.

Hedge your bets

After you are convinced about the project’s success and ready to invest, we advise putting only a small portion of your capital. Cryptocurrencies are high-risk investments mainly due to the unpredictability surrounding most projects. If you want to buy into the project, we recommend setting 1% to 10% of your investment portfolio.

Diversify

The crypto ecosystem has several sub-sectors open for maximizing gains. This means you have multiple playgrounds to invest in. Don’t concentrate on one niche and abandon the rest. You can invest in oracles, DeFi, meme coins, NFTs, and the newly opened Metaverse ecosystems. This will help you better spread your risks and diversify your portfolio.

Set a target

While daily increases may seem like a good point to take out profit, we recommend setting a price target and sticking to it. In the past five years, holders of Bitcoin and Ethereum have made more in profits than those who sold their assets earlier. If you are convinced of the project’s potential to grow substantially, we recommend setting a target and holding for the long term.

Decentraland vs. Other Cryptocurrencies

Below are some other top cryptocurrencies you should watch out for besides Decentraland.

Decentraland vs. The Sandbox

Decentraland and The Sandbox are based on the Ethereum network; both platforms create a pathway into the metaverse. While The Sandbox is still under development, Decentraland has enabled users to create, share, and monetize content and applications.

The Sandbox is gearing up to launch soon, contributing to its recent price gains and interest in the metaverse ecosystem. Decentraland has a strong advantage over the metaverse rival largely due to its popularity.

Decentraland vs. Ethereum

Ethereum network operates as the motherboard for all the DeFi-facing ecosystems. This makes it a principal character in the new world of finance that is opening up.

Ethereum is way ahead of Decentraland and is the foremost altcoin in the crypto market, and Ethereum commands such a strong pull in the crypto market.

Decentraland vs. Shiba Inu

At their core functionalities and value propositions, both projects are very different. While Decentraland looks to make the metaverse more accessible, Shiba Inu is a meme coin.

However, the canine-themed cryptocurrency is gradually fledging out an entire ecosystem with the launch of a decentralized exchange (DEX) platform called ShibaSwap. Efforts are ongoing for a non-fungible token (NFT) game called Shiboshi, which is expected to introduce NFTs and further broaden its real-life use cases.

Decentraland vs. Cardano

Decentraland and the Cardano network have different goals. Cardano, founded by former Ethereum co-founder Charles Hoskinson, has aspirations to become a DeFi hotspot for protocols like Decentraland to call home. It is a peer-reviewed blockchain, meaning everything is scientifically vetted before release.

This makes Cardano appeal to several logical and data-driven investors who believe that Cardano is working on social good.

Despite being under development, Cardano is a top 5 most valuable crypto asset showing the growing popularity of the project. The project has remained in the public domain due to its consistent roadmap. For one, if the Cardano network eventually scales through the development phase, it could become an Ethereum rival.

Decentraland (MANA) Price Predictions: Where Does Decentraland Go From Here?

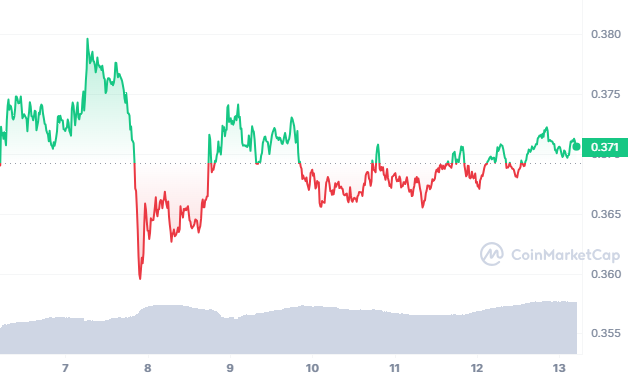

Decentraland (MANA), a cryptocurrency, is currently trading at $0.379758. Over the past 24 hours, it has seen a slight increase of 0.64%. The trading volume during this period amounted to $67.50 million, contributing to its market capitalization of $699.99 million. As for market dominance, it stands at 0.06%.

Decentraland’s historical trajectory reveals notable price milestones. On November 25, 2021, the decentralized platform reached an impressive all-time high of $5.85. However, it also experienced a significant dip on October 13, 2017, with the token hitting a record low of $0.007796.

Decentraland has witnessed price fluctuations since reaching its peak. It experienced a cycle low of $0.285641 and a cycle high of $0.838710. Currently, the prevailing sentiment regarding Decentraland’s price prediction leans towards bearishness. These price dynamics have also influenced the Fear & Greed Index, a metric used to gauge market sentiment, which has settled at 51 – indicating a neutral stance among investors.

Decentraland’s circulating supply currently stands at 1.89 billion MANA tokens out of a maximum supply of 2.19 billion. It is worth noting that the annual inflation rate for supply is calculated at 2.20%, resulting in approximately 40.67 million MANA tokens generated over the past year.

Decentraland, a cryptocurrency entity, holds an impressive 18th rank among Ethereum (ERC20) Tokens. This highlights its prominent position in the industry as a significant player. In the realm of NFT Tokens, Decentraland further solidifies its influence by securing the second rank. Notably, it also occupies the second position in both Gaming and Metaverse sectors, emphasizing its substantial presence in these innovative domains.

As market dynamics continue to evolve, Decentraland finds itself at a pivotal juncture. With price predictions leaning bearish and sentiment markers revealing neutrality, investors, and enthusiasts await further developments to determine the subsequent trajectory for this influential token in the metaverse landscape.

Decentraland Price Prediction for 2023

Decentraland has entered this year with flying colors, witnessing an upswing by more than 2x thanks to Bitcoin getting more support from the cryptocurrency space.

If MANA can keep up this momentum, its price can reach $1.5 by 2023.

Decentraland Price for 2024

Many say the crypto winter will end before 2023, creating a resurgence of new cryptocurrencies and new interest in the crypto space. More innovations will arrive in the metaverse that will make the ecosystem more inclusive and less exclusive since Decentraland is one of the flagbearers of the metaverse, we will likely see it making a comeback and reaching $2.35 by the end of 2025.

Decentraland Price for 2025

We predict that by 2025, crypto will become part of the general conversation surrounding technology, which would mean that it will become less volatile. That would dampen the chances of making parabolic gains. Experts say this stability will wick the MANA price slightly above its 2024-end at $2.70.

Decentraland Price for 2026 and Beyond

The state of cryptocurrency will be very different from how it is today. Right now, governmental authorities are still mulling over whether to allow cryptocurrencies to exist. And to what degree can the regulations encroach on the blockchain space? However, we believe that by 2026, much of the conversations surrounding crypto will become stable. We hope progressive regulations will be introduced into the blockchain space that doesn’t deter innovations.

That leniency will allow metaverse projects like Decentraland to explore new territories, which can pump Decentraland’s price beyond $5.

Decentraland Reddit – A Great Source of Further Information

Over the last few years, various Reddit groups have played a pivotal role in the cryptocurrency market. And, much like Dogecoin, it seems that the Reddit Decentraland group has had a significant impact on MANA price movements since the beginning of the year. Currently, the Decentraland Reddit group has 31.5K members.

Capital.com – Best Way to Buy Decentraland

To sum up, Decentraland is not a conventional project and cryptocurrency token, and it has plunged sharply since the beginning of the year. Since it has entered the oversold zone, its outlook is very positive. To buy or trade Decentraland crypto, you must find a platform supporting MANA tokens. If you’re wondering where to buy Decentraland, our research found that Capital.com and Binance are the best options for crypto investors.

FAQs

Should I buy Decentraland Coin?

In general, if the projections that the virtual reality world will grow in the next years are correct, then the Decentraland coin is also expected to continue to rise. Further, as NFTs are becoming increasingly popular, Decentraland can therefore be the largest marketplace for this new form of digital assets.

Where can I buy Decentraland Coin?

Decentraland is a digital asset that trades on cryptocurrency exchanges and online trading platforms. From our research, some of the best options to buy Decentraland include Capital.com and Binance.

Is Decentraland a good investment?

Like many other cryptocurrencies, it's hard to know what is the future of Decentraland. That said, many analysts believe that Decentraland has the potential to rise to around $5 and even higher by the end of 2026.

How much Decentraland Coins should I buy?

Overall, Decentraland is trading at a fairly low price so you can invest a small amount of money to purchase a large number of coins. Also, you need to consider the leverage ratio you might get on online trading platforms and crypto exchanges.

What is Decentraland stock?

Decentraland is operated by Metaverse Holdings Ltd, a Cayman Islands-registered that was founded in 2017. Metaverse is not yet a public company. However, if it goes public, you'll be able to buy its stocks on the market it will be listed on.

How much is Decentraland Coin worth?

At the time of writing, one Decentraland coin is worth $0.96.

Will Decentraland Coin go up?

Yes, according to many price predictions, Decetraland can reach $2 by the end of the year and around $5 by 2025.