Cryptocurrencies have come a long way – reaching a total market cap of $3 trillion in 2021 – and the nascent industry is in a bull market.

Despite a correction in 2022, many crypto analysts are still bullish today in 2023 and heading towards the next Bitcoin halving in March 2024. Both retail and institutional investors are paying close attention to the virtual assets category as blockchain tech continues to grow in mainstream use.

Wondering how to buy cryptocurrency in the UK? In this how-to guide we’ll review a regulated crypto exchange and the best app to buy cryptocurrency.

[table_of_content]Where to Buy Cryptocurrency In The UK

Best UK Crypto Exchanges in May 2025

If you are looking for the best place to buy cryptocurrency in the UK, the list of brokers above have been selected because of what they offer – low fees, a reasonable minimum deposit, regulatory oversight, user-friendliness, and high liquidity.

They can also be used to buy Ethereum (ETH) which can then be used to buy NFTs (non-fungible tokens), a popular new emerging market alongside cryptocurrencies.

How to Buy Cryptocurrency UK – Quick Guide

If you do not have the time to go through the guide and quickly want to know how to buy cryptocurrency in the UK, these quick-fire steps should set you on the right path.

eToro is our recommended crypto broker, and we will be showing you how to buy any cryptocurrency you want on the social trading platform.

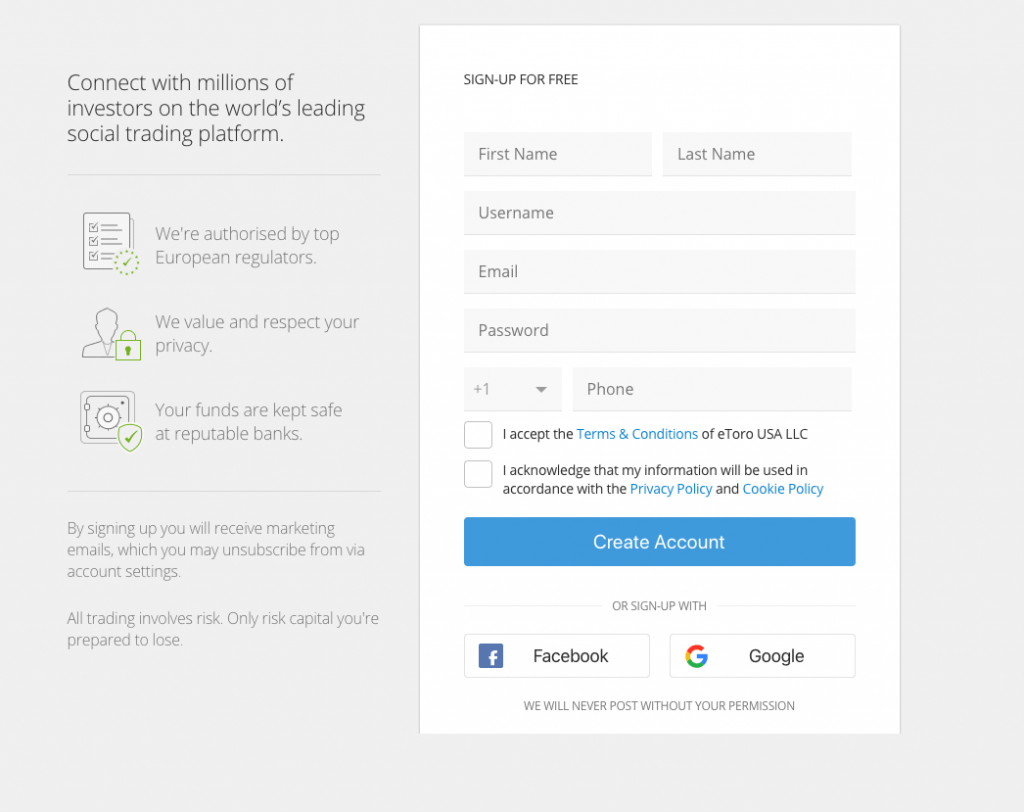

- Sign-up on eToro: Navigate to the eToro website and click on ‘Join Now’ to provide your full name, email address, mobile number, username, and password. You can also register with your Facebook or Google account.

- Verify ID: You will need to provide some form of identification to verify your account. You can do this by uploading a snapshot of your driver’s license or government-issued ID card and a recent copy of your utility bill or bank statement to show proof of address.

- Fund: You can fund your account using a bank transfer or any accepted payment method.

- Buy Crypto: To buy the cryptocurrency of your choice, type in the digital asset’s ticker symbol and click ‘Trade’ on the applicable result. Insert the amount of the asset you want to buy and click on ‘Open Trade’ to complete the transaction.

eToro Tutorial – Step by Step

We recommend using eToro to buy crypto within the UK.

In this section, we will give you detailed steps to get started.

Step 1: Open an Account with eToro

The first step will be to sign-up on the eToro website. To do this, click on ‘Join Now’ on the top right-hand corner and provide a few details.

This usually entails your full name, mobile number, username, email address, and password.

You can also choose to skip this typing process by registering with either your Facebook or Google account.

Step 2: Verify your Identity

You will need to complete the know-your-customer (KYC) process to unlock your new account. This process can also be completed online. What is required here is to take a snapshot of your driver’s license or official ID card.

Then upload a snapshot of a recent utility bill or financial statement reflecting your proof of address. After this, eToro will set about verifying your account.

Step 3: Fund your Account

The next step is to make a deposit. This can be done by clicking on the action tab and tapping the ‘Deposit Fund’ button.

Fill in the amount you want to fund your account and select the payment method you want to use. eToro supports a decent number of payment processors.

Step 4: Buy Cryptocurrency

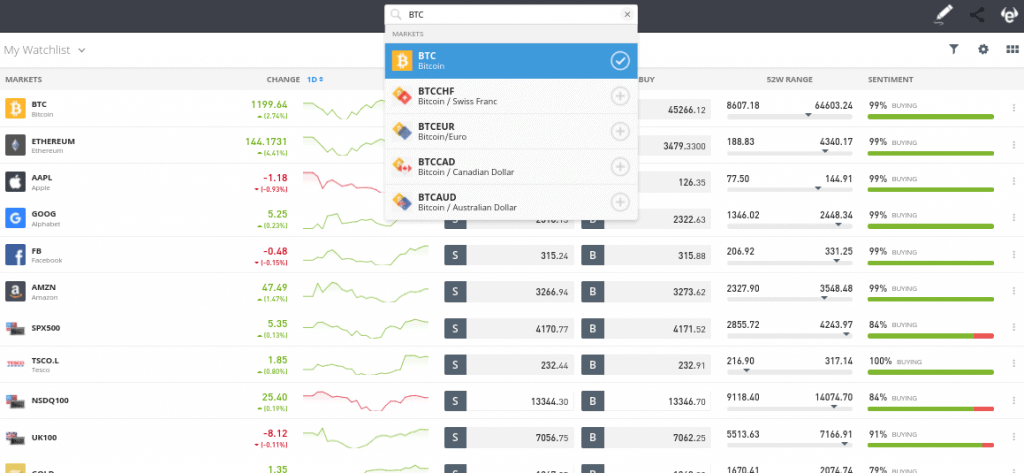

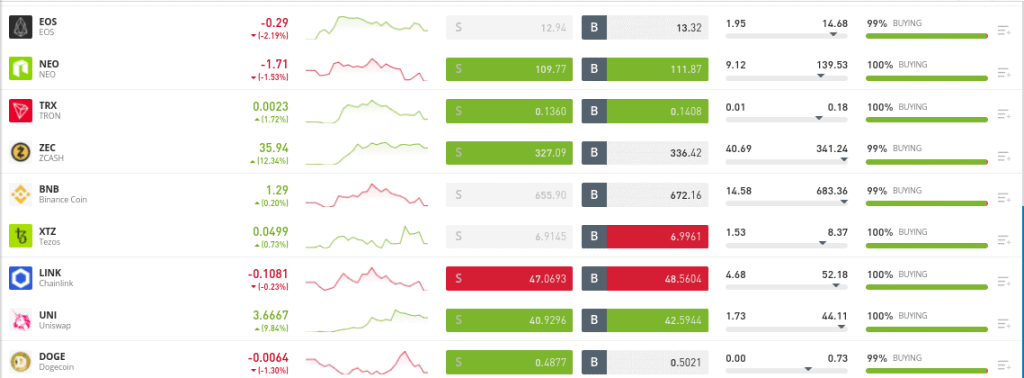

The final step will be to buy the cryptocurrency you want to invest in. You can complete this process by typing into the search bar the ticker symbol of the virtual currency you want to buy.

For instance, if you intend to buy Bitcoin on eToro, type ‘BTC’ into the search tool and click on ‘Trade’ to be taken to the order page.

Here, you can insert how much BTC you want to buy and click on ‘Open Trade’ to complete the transaction.

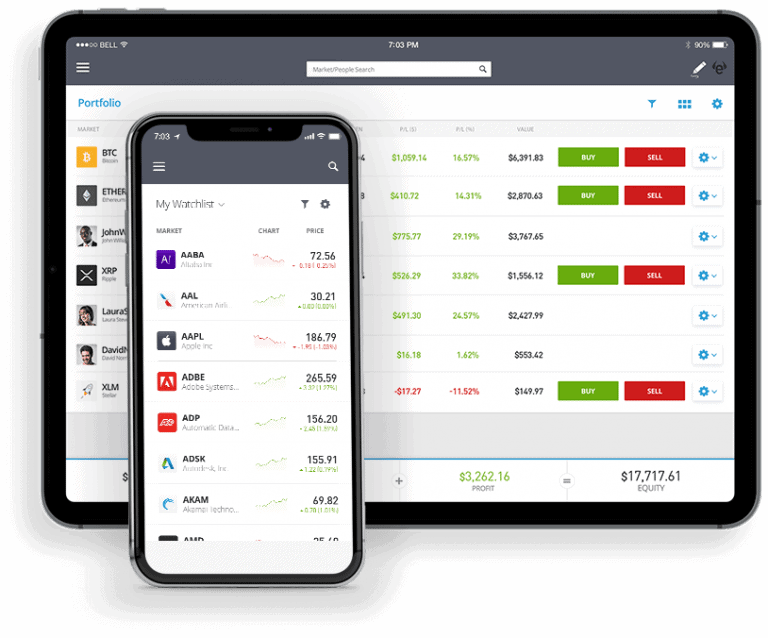

Step 5: Download The eToro Mobile App (Optional)

This step is entirely optional and you can choose to sidestep it. However, if you want to keep track of your investment while on the move, we recommend downloading the eToro Mobile App. It comes with the exact functionalities as the web platform and you can also store your cryptocurrencies here.

It is also complete with the required set of security protocols to ensure that no other person besides yourself has access to your account.

The eToro Mobile App is available on both Android and iOS devices and you can download it on the applicable mobile app stores.

Where To Buy Cryptocurrency In The UK

If you are searching for the best place to buy cryptocurrency in the UK, these mini-reviews should give you an insight into which broker or exchange to use.

1. eToro – Overall Best Platform to Buy Cryptocurrency in the UK

Established in 2007, the social trading platform eToro is the best place to buy cryptocurrency in the UK.

Its main office is in Canary Wharf, London, and the platform is known for its social trading functionality.

Past performance is not an indication of future results.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest

In the aspect of fees, eToro offers competitive prices. On eToro, you can buy most of the popular digital currencies including Bitcoin (BTC) and Ethereum (ETH). You can also make payments on eToro through a variety of payment methods. eToro has a minimum deposit of $10 (~8 GBP).

eToro is respected for its CopyTrade feature that allows users to mirror the successful trades of more advanced investors. This feature has proven successful for many as it allows users to mirror the strategies of expert analysts, and to tweak them to match their risk tolerance. The platform further provides a demo account that allows investors to test strategies without risking their funds.

The eToro Money Crypto Wallet is also a safe place to store a variety of Web3 assets, being well suited to UK residents looking to invest in crypto.

- Social trading: Yes

- Minimum deposit: ~8 GBP for UK clients

- Security: Very secure

- WebTrader: Yes

- Demo Account: Yes

- Customer Base: 30 million registered users worldwide

Pros

- Dedicated eToro Money Crypto Wallet

- Reputable crypto broker

- Fast execution and low latency platform

- CopyTrade functionality

Cons

- Withdrawal fee of $5

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest

2. OKX – User-friendly exchange to buy cryptocurrency

OKX is a Seychelles-based cryptocurrency exchange.

OKX exchange platform boasts a wide range of trading services for hundreds of cryptocurrencies. The platform is lucrative for both new and experienced traders, as it guides crypto trade to NFT purchases. Thus, helping the trader every step of the way.

With OKX, one can buy crypto assets with fiat currency such as GPB, EUR, USD, or any other preferred local currency. The exchange supports payment methods such as Mastercard, Visa, ApplePay credit cards etc.

OKX stands out among all crypto exchanges because of its innovative and advanced financial offerings. The exchange caters to millions of users across 180+ regions globally through its advanced crypto trading and earning services.

With OKX, one can trade on derivative, spot, and margin markets using a variety of tokens and trading pairs. One can also manage their decentralized portfolio using the OKX web3 wallet. One can also transact in the OKX NFT marketplace. Apart from these, users can earn and take crypto-collateralized loans.

- Social trading: Yes

- Minimum deposit: 0.00005 BTC

- Security: Very secure

- WebTrader: Yes

- Demo Account: Yes

- Customer Base: 20 million registered users worldwide

Pros

- Spot, Margin, and Derivative markets trading

- Offers cutting-edge financial products

- Accepts popular fiat currencies

- Operating in over 180 regions globally

- NFT marketplace

Cons

- OKX does serve customers in the USA

- Relatively new crypto exchange

Your capital is at risk

3. Bybit – Buy and Sell Cryptocurrencies using Fiat and Crypto

Bybit is emerging as an inclusive cryptocurrency that supports altcoins with future potential.

For starters, this exchange platform supports both margin trading and spot trading, and thus it is a suitable option for experienced traders. Secondly, it has a good fee structure which is divided into VIP and Non-VIP traders. Thirdly, the platform offers an accurate market status which includes published graphs, articles, and studies of current market performance. All these tools help a trader to make a wise decision.

Bybit also offers copy trading, trading bots, and audited proofs of reserves. Additionally, it also provides an earning and loan program. At the moment, Bybit also allows users to shop across 90 million merchants in the world using cryptocurrencies. Bybit supports both fiat and crypto payments.

- Social trading: Yes

- Minimum deposit: $50

- Security: Very secure

- WebTrader: Yes

- Demo Account: Yes – Known as Bybit Testnet

- Customer Base: 10 million registered users worldwide

Pros

- Audited proof of its reserves

- Supports fiat and crypto payments

- Low trading fee

- Trading bots

- Spot and Margin trading

Cons

- Not available in the USA.

Your capital is at risk

4. Huobi – Reputable Place to Buy Crypto

Like eToro, Huobi has been operating since the early days of cryptocurrency. A long-established household name in crypto, it was founded in 2013.

In that time Huobi, also known as Huobi Global, has never been hacked or had any issues with user data or funds being compromised in any way. When Bitmart exchange was hacked the Huobi and Shiba Inu communities teamed up to offer their assistance.

Huobi offers both spot and margin trading – meaning as well as buying crypto you can also take a long position or short crypto on the platform, using leverage. It offers up to 200x leverage on some assets, more than most crypto exchanges.

One unique feature of Huobi is it offers the free use of a crypto trading bot that uses a ‘grid trading’ system. Currently it has a backtested 7-day annual yield of 44% – that ROI performance data is updated weekly.

It also offers high-yield crypto staking of up to 50% APY on several assets, crypto loans and a welcome bonus.

Pros

- A decade of operation without being hacked

- Crypto staking

- Grid trading bot

- Both spot and margin trading

Cons

- No social trading / copytrading unlike eToro

- 0.2% maker / taker fee is higher than Binance and Coinbase Pro

Your capital is at risk.

5. Crypto.com – Crypto Debit Card & App

Currently US traders can use the app and the VISA debit card, but not the exchange platform, although that may change in the future. The Crypto.com exchange offers both spot, margin trading and derivatives.

Crypto.com’s metal prepaid card pays up to 8% crypto cashback on purchases, and on the platform you can earn up to 14.5% interest on crypto holdings, the highest interest rates being for stablecoins like USDC. You can also farm and stake DeFi protocols, and like Huobi apply for a crypto loan.

Crypto.com supports 250+ cryptocurrencies and has over 10 million users. It also has its own NFT marketplace where you can create, showcase, sell and buy non-fungible tokens.

Pros

- Earn up to 14.5% per annum interest on crypto

- NFT marketplace

- DeFi staking

- Crypto debit card and wallet

Cons

- USA investors partially restricted

- High spreads

Your capital is at risk.

6. Evonax – Best Crypto Exchange For Trader Anonymity

Evonax was founded in 2016 and is one of the best crypto exchanges in the UK. One of the main selling points of Evonax is its trading fees.

You do not have to worry about fees because Evonax charges zero fees. It enjoys the trust and patronage of customers in more than 100 countries worldwide.

The crypto exchange platform is user-friendly and comes with top-notch security. They do not require users to provide any Know Your Customer (KYC) information and only require this when contacting customer support.

The exchange focuses on four crucial areas namely speed, ease, anonymity, and security. The highly secure platform supported cryptos include Bitcoin, Ethereum, Chainlink, Dogecoin, Litecoin, and 11 others.

- Minimum deposit: Nil

- Security: Very secure

- Demo Account: Nil

- Customer Base: Unknown

- Regulation: Nil

Pros

- User-friendly interface

- Over 15 different cryptocurrencies

- Anonymous exchange services

- Highly secure

- User-friendly

Cons

- Delayed response from support

Your capital is at risk.

7. Coinbase – Top Crypto Exchange For Multiple Altcoin Offerings

Coinbase operates as a one-stop crypto platform. The Bitcoin exchange, which was established in 2012, operates a crypto wallet and an exchange.

Coinbase also offers legacy-based services. It has approximately 73 million verified users and it is operational in over 100 countries. You can choose to make deposits with your UK account or SWIFT account, but it does not currently support PayPal.

Coinbase is also secure. The bulk of cryptos on the platform are stored in offline storage and have two-factor authentication (2FA) enabled for extra security. The platform is also insured. They may charge fees when you buy, sell, or convert cryptocurrencies.

Coinbase supports several altcoins with over 100 currently traded on the easy-to-use platform. It is regulated as a money services business by the Financial Crimes Enforcement Network (FinCEN).

- Minimum deposit: 37.04 GBP

- Security: Secure

- Demo Account: No

- Customer Base: 73 million

- Analytical tools: Yes

- Regulation: FinCEN

Pros

- Easy to use for beginners

- Opportunities to earn cryptocurrency

- Lower fees for Pro users

Cons

- High transaction fees

- Reported cases of account hacks

Your capital is at risk.

8. Binance – World’s Leading Bitcoin Exchange

Binance is a crypto company that was founded in 2017. In just four years of service delivery, it has grown in leaps and bounds to become the foremost crypto exchange platform by trading volume with a daily minimum just north of $40 billion.

There are no fees charged for deposits on Binance but every trade carried attracts a standard service fee of 0.1%, while those who make use of BNB get a whopping 25% off.

The exchange has a healthy customer base of about 101 million users as ofthe third quarter (Q3) 2020. A series of initiatives to ensure their operations comply with as many applicable regulatory requirements as possible have been launched by the crypto exchange.

Their international compliance team has grown by 500%, as part of our ongoing efforts to offer fully compliant and licensed services in all regions where they operate.

Binance offers one of the largest libraries of digital assets with over 350 virtual assets currently changing hands on the platform.

- Minimum trade: 7.44 GBP

- Security: Very Secure

- WebTrader: No

- Demo Account: No

- Customer Base: 101 million

- Analytical tools: Yes

Pros

- Most liquid crypto exchange

- Supports over 300 altcoins

- Has low trading fees of 0.10%

- Low minimum deposit of 7.44 GBP

- Large customer base

Cons

- Not ideal for beginners

- No tier-1 regulatory license

Your capital is at risk.

Volatility Of Crypto Assets

The volatility of cryptocurrencies has been a major concern for many mainstream investors. Blockchain-based assets are especially weak in this aspect as they post several price actions within a particular trading window making them a high-risk investment.

However, the nascent industry has always rebounded time after time making it easy for investorsto recoup their losses easilys. Premier digital asset Bitcoin has been a notable volatile asset that has posted several record highs after seeing a large price drop.

To mitigate or combat the risk that comes with the volatility of crypto assets, retail investors are always advised to operate a diversified investment portfolio within an asset class.

This can be done by investing in a basket of crypto stocks or choosing crypto assets that have a large market capitalization.

Factors like positive or negative news can influence the volatility of an asset. While positive news has the tendency to push up the price of an asset, negative news will make the price of the asset fall.

Storing Cryptocurrencies – Best Crypto Wallets

Much like any asset, cryptocurrencies need to be stored. However, they don’t need a physical location as these assets are basically lines of computer codes. To store your crypto funds, you will need dedicated software wallets – also see our best UK Bitcoin wallets guide.

While there are several platforms that offer to store cryptocurrencies, there are only a few trusted crypto wallets. One of such is eToro Mobile Wallet which is available on both Android and iOS devices.

eToro Mobile Wallet

A crypto wallet is a piece of hardware or software that interacts with blockchains and allows users to store or trade cryptocurrencies of different types such as Bitcoin and Ethereum.

While there are several crypto wallets in the crypto space, eToro wallet remains one of the best. The digital asset wallet supports over 120 cryptocurrencies and contains an in-app feature that offers conversion functionality that supports over 500 crypto pairs.

The wallet is provided by eToroX Limited, a limited liability company incorporated in Gibraltar. eToro wallet charges a conversion fee of 1%.

Choosing The Right Cryptocurrency Broker

Of the various requirements the crypto space demands, a cryptocurrency broker is at the top of the list. A cryptocurrency broker is a firm that acts as a middleman between the crypto markets and a trader. They help to facilitate the buying and selling of crypto assets on the market.

Crypto brokers offer a wide range of services which include a suitable trading environment for new and more advanced traders alike.

1. Fees

When choosing a cryptocurrency broker, you need to consider the fees and other hidden charges required for each transaction. Depending on the value of the cryptocurrency being traded, the percentage of the fees that are applicable could, to a large extent, determine your potential profit on a particular crypto trade.

2. Payment methods

You can’t talk about the best way to buy cryptocurrency UK without touching on the payment methods offered. The best cryptocurrency exchange list a variety of everyday payment solutions to enable easy and affordable ways to fund their account.

Our recommended crypto broker offers a wide variety of payment methods to aid international users to make payments and conduct transactions, seamlessly.

3. Crypto Offerings

The number of cryptocurrencies and fiat currency pairings a crypto broker supports establishes just how competent and inclusive the broker is. A wide range of cryptocurrencies listed on the platform provides the users with opportunities to trade different cryptocurrencies and maximizes their chances of making profits.

4. Security and UK Regulation

The broker should be regulated by the relevant authority in the appropriate jurisdiction. The licenses from these regulatory bodies act as proof of the optimal security measures that have been put in place to protect the users from financial fraud and other related practices. Some of the best cryptocurrency brokers also offer insurance for users to ensure the security of their assets should the platform suffer a security breach.

It is also worth investigating whether the provider has undergone a security breach.

5. Minimum Deposit

Brokers who offer a low minimum deposit amounts are usually considered as one of the best, as they empower retail investors with little capital to trade the markets.

6. Social Trading

Social trading is a form of investing by observing and implementing the trading behaviours of user peers and expert traders. This feature enables new traders on the market to imitate and learn intuitively with the trading patterns of expert traders. This is an assurance of maximized output with minimal risks as most new traders are prone to losing assets during the course of learning the ropes.

7. Support

Users need brokers that can offer full time support to technical and educational problems when using the platforms. The presence of a good support channel on the broker platform builds trust between the broker and the users as disputes can easily be resolved in a short period of time.

8. Usability

An easily accessible broker platform is a factor that should not be compromised on. Most technical errors and losses incurred by new traders are due to the complex nature of certain broker platforms. A broker with a user-friendly interface that can be intuitively navigated is a good choice when considering a cryptocurrency broker.

9. Analytical Tools

Analytical tools are a set of research tools which helps users make more informed decisions about a particular trading pair by providing information on the trends and price action of various currencies. These analytical tools help users maximize profits by giving insight into the most likely price projections of a crypto asset, enabling them to gain insight on the asset’s future price. Brokers with this sort of feature are most suitable for advanced level traders.

Which Cryptocurrency to Buy in 2025

At the moment of writing this article, there are over 12,500 cryptocurrencies in the market with more coming on board almost on a daily basis. This presents a huge problem especially if you are just starting out and find it difficult to choose which cryptocurrency to buy.

To address this challenge, we have listed some of the top-performing and most popular cryptocurrencies in the crypto market. These three top dogs are taken from the foremost virtual asset, foremost altcoin, and the foremost joke cryptocurrency in the nascent industry.

1. Bitcoin (BTC)

Are you looking to buy Bitcoin? You should. As expected, Bitcoin remains the top cryptocurrency to buy in 2021. Despite posting less explosive growth than the broader altcoin community of digital currencies, Bitcoin has been able to hold its own and currently controls over 43.1% of the global decentralized economy. This makes it the foremost crypto asset in the nascent financial space.

Bitcoin’s stronghold on the market has not been due to a slew of upgrades like other crypto protocols but it has been able to retain its price dominance largely due to its deflationary tendencies.

At launch, only 21 million Bitcoins have been programmed to ever be mined by pseudonymous creator Satoshi Nakamoto. This makes Bitcoin a scarce commodity and has led several institutional investors to term the benchmark crypto as ‘digital gold.’ With such strong fundamentals, Bitcoin has hit record highs in an overall bullish trend for the crypto market this year.

The premier digital asset surged to an all-time high (ATH) of $69,044.70 after previously retesting its former record value of $65,000. This has seen BTC rally more than 9 million percent from its paltry launch price of $0.08 in 2009.

With institutional and national adoption through the roof, Bitcoin remains one of the best cryptocurrencies to buy now.

2. Ethereum (ETH)

Ethereum is currently the second most valuable cryptocurrency by market cap with over $500 billion in total value locked (TVL). With a 19.1% market dominance, Ethereum is considered the foremost alternative currency (altcoin) by many and this is for a good reason.

Using the ancient proof-of-work (PoW) consensus algorithm, the Ethereum network powers much of the new-generation financial tools currently gaining traction. The smart contract-enabled platform is home to over 3,000 top-performing decentralized applications (dApps) which sees it control over 97% of the decentralized finance (DeFi) and non-fungible token (NFT) ecosystems.

Coupled with this is the protocol’s plans to transition to a proof-of-stake (PoS) consensus algorithm from PoW which will make it more environmentally sustainable, more scalable, faster, and cost-efficient.

Following this expected migration, the Ethereum price has surged in value and has grown more than 481.83% year-to-date (YTD) with a higher surge of 809.22% year-over-year (YoY). With a growing use case, Ethereum is one of the top cryptocurrency to buy now.

3. Dogecoin (DOGE)

The origin of Dogecoin is as humorous as its mission. Founded four years after Bitcoin’s official launch in 2009 in December 2013 by Billy Markus and Jackson Palmer, Dogecoin is a sort of Bitcoin knock-off. At its core, Dogecoin is a fork of a fork as it is a fork of the Litecoin network which is also a fork of Bitcoin.

According to founders Markus and Palmer, Dogecoin is a comic take on the sudden explosion of altcoin following Bitcoin’s growing prominence. The crypto asset was created to mock the love affair with blockchain tech and finance.

However, the crypto project has gone through a series of changes over the years. Leaving the project in 2015, Dogecoin has since grown to become the public face of the meme coin niche with the Shiba-themed crypto seen as a fun cryptocurrency.

The parody coin has now been designated the people’s coin given the low mining entry bar and the ease of completing transactions on the network. The fun and playful side of the meme coin has since attracted a drove of admirers with Tesla and SpaceX boss Elon Musk being one of the most outspoken.

In a crypto market that has seen more bullish activities than bearish trends, Dogecoin surged to an ATH of 74 cents in early May largely due to Musk’s tweets and not due to its real-world use case. The premier memecoin has not hit the $1 mark since inception but it has surged 8,015.45% YoY. YTD figure of 4,950.42% shows that the memecoin is one of the best cryptocurrency to buy now.

Alternatives to Bitcoin

While Bitcoin has been the public face of the crypto market, several others have performed admirably as well. In this section, we highlight some of the top-performing altcoins at the moment and alternatives to Bitcoin you can also invest in.

4. Aave (AAVE)

Aave is one of the top decentralized finance (DeFi) borrowing and lending protocols that has taken the crypto market by storm. Started in 2017 as ETHLend, Aave is currently the third most valuable DeFi protocol with $13.34 billion in total value locked (TVL).

The protocol is unique for its flash loan feature which allows DeFi users to borrow over 20 digital assets and repay within the space of a transaction. This has seen Aave termed the first ‘uncollateralized loan option’ in the DeFi space.

Aave has been one of the top performers in a market principally controlled by Bitcoin and Ethereum. The Ethereum-based protocol has surged 209.56% year-to-date (YTD) after hitting a record value of 661.69 in mid-May.

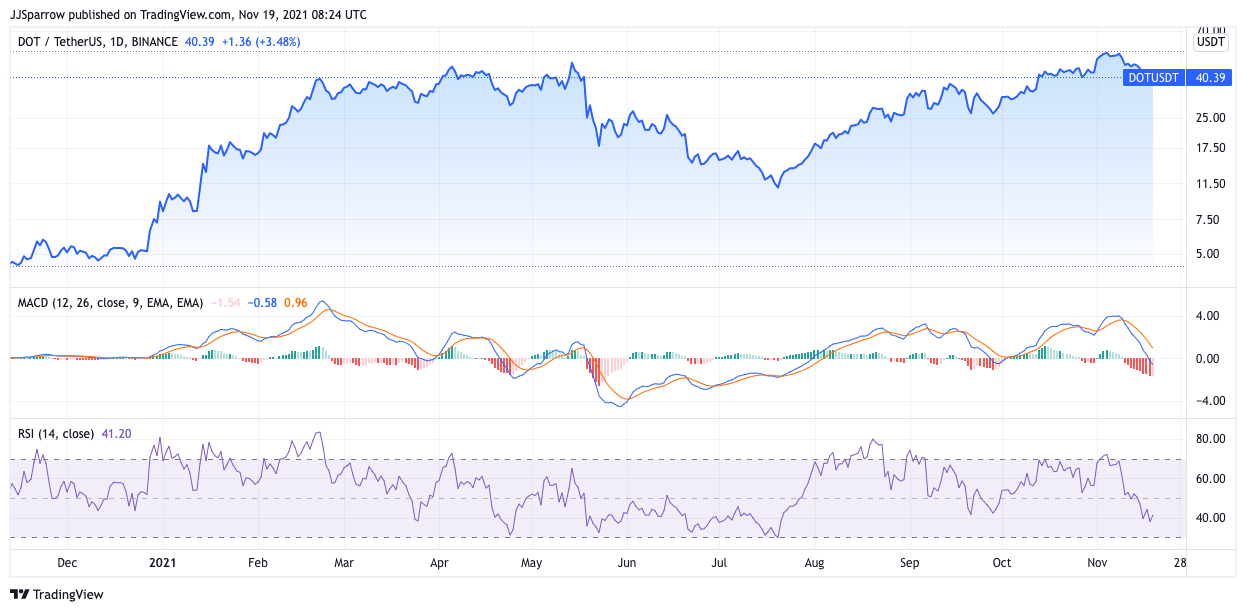

5. Polkadot (DOT)

Polkadot is a heterogeneous network that aims to resolve the scalability issues plaguing older blockchains like Bitcoin and Ethereum. It uses sharded technology to enable seamless transfer of different asset types across different blockchains. Polkadot is seen as an Ethereum competitor as it also features a robust network usable in the development of decentralized applications (dApps) network which is needed for DeFi and NFTs.

Polkadot is currently launching its parachain auctions which represent the final steps towards a full public launch.

6. Cardano (ADA)

Cardano is another popular alternative to Bitcoin. The governance token of the Cardano network, ADA is one of the top cryptocurrencies and has seen exponential growth so far.

Like Polkadot, the Ouroboros protocol aims to revolutionize the blockchain space. It is also building out the network and launching periodic upgrades. Cardano is headed by one of Ethereum’s early founders Charles Hoskinson and is the only peer-reviewed blockchain. This has seen many admirers call Cardano ‘the blockchain for innovators.’

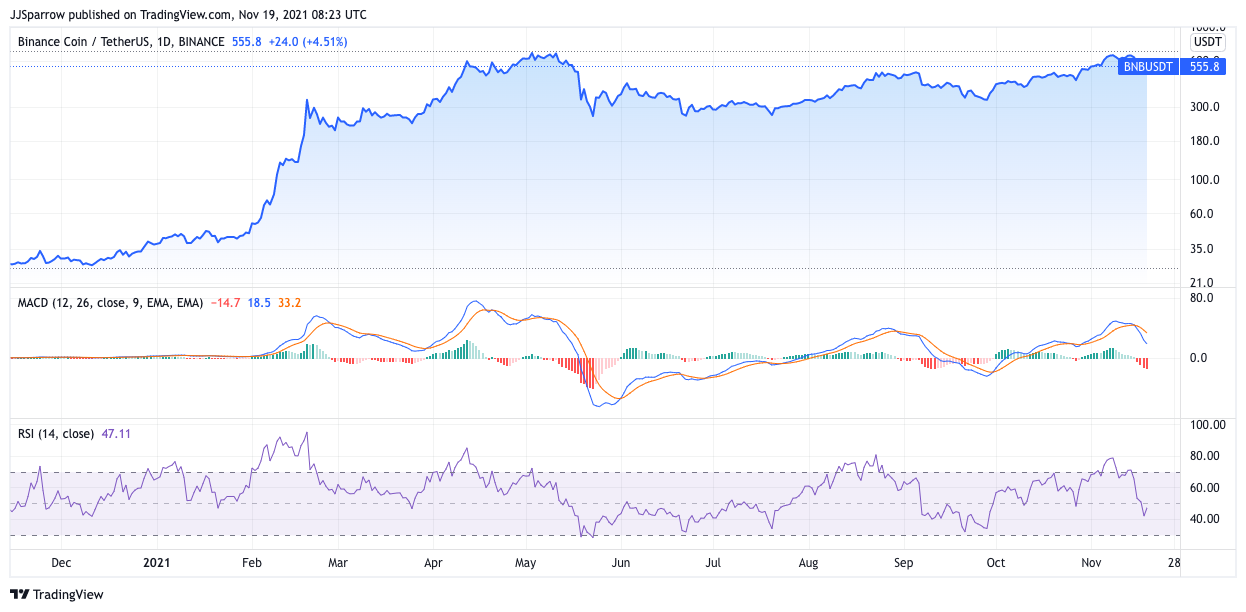

7. Binance Coin (BNB)

Binance Coin is the utility token for the world’s largest Bitcoin exchange Binance. BNB is used as a discount token for trading fees by users trading on the Binance platform. The BEP-20 token has since acquired new use cases and is a popular feature across most of Binance’s crypto products and services.

BNB has remained one of the top digital assets in the past year and is the third most valuable behind only Bitcoin and Ethereum on the crypto ranks.

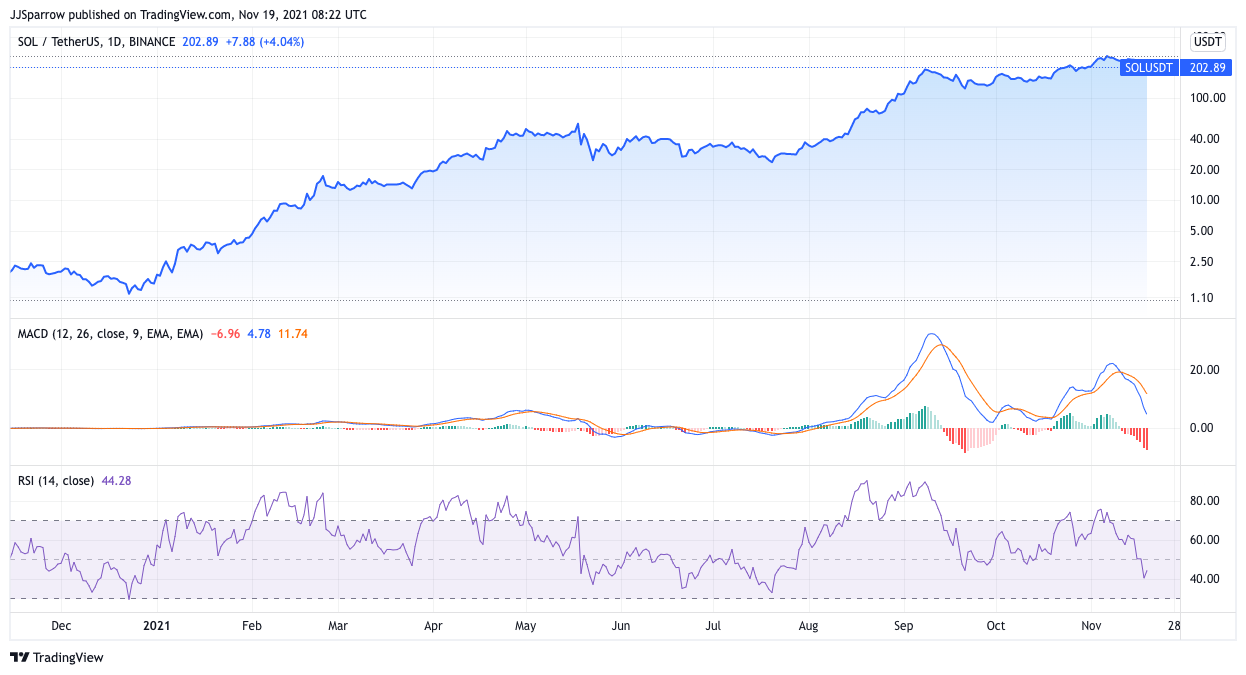

8. Solana (SOL)

Solana, like Polkadot and Cardano, is an Ethereum rival. It uses a combination of proof-of-stake (PoS) and proof-of-history (PoH) consensus mechanisms to offer a highly scalable, clean, cost-efficient blockchain protocol. Averaging over 50,000 throughputs, Solana has become a popular alternative to Ethereum.

SOL has been positively impacted by this blockchain interest and the governance token surged to an ATH of $259.96 earlier this month. SOL has continued to average over $200 despite a strong bearish trend in the market.

Cryptocurrency Trading Robots

Cryptocurrencies are generally high-risk investments which mean traders can suffer substantial losses. However, a growing wave of sophisticated trading software is currently used to mitigate these potential losses.

Bitcoin trading robots are automated software that is powered by artificial intelligence (AI). These complex lines of code are emotionless and require human supervision in placing buying and selling orders. Processing thousands of market data simultaneously, they are better able to get the full picture of how the crypto market is performing and easily denote the best strategy to employ.

Crypto trading bots have high success rates which will go a long way in reducing your risks in the long term. They also ensure that you profit from a large chunk of your trades.

However, Bitcoin trading robots are largely unregulated which presents an opportunity for fake crypto trading bots to deceive investors. Our list of reviewed Bitcoin bots are genuine and post good returns.

Taxing Crypto Gains in the UK

With the widespread adoption of cryptocurrencies, the UK has publicly declared crypto assets as property and as such are liable to taxation in the country.

Her Majesty’s Revenue and Customs (HMRC) issued guidelines that outline what stands as taxable events and non-taxable crypto events. Duly stated in the guideline are the conditions which warrant the Capital Gains Tax on crypto assets. They include:

- When crypto assets are sold.

- When crypto assets are received as a means of payment from employment or mining.

- When gains from selling a particular asset goes above the tax-free allowance.

- When exchanges are made from one cryptocurrency to another.

- When crypto assets are used to buy goods and services.

- When the crypto assets are given away to another individual except in the event of the token being a gift to a spouse of a civil partner.

Calculating Your Capital Gains Tax

The HMRC module on crypto assets is also a guide to enable taxpayers to know just how much they owe in taxes. To pay Capital Gains Tax on your crypto assets, you must calculate your gains on each transaction.

When calculating CGT, a certain allowance cost may be deducted which includes a proportion of the pooled cost of the token while calculating gains. One can also make use of capital losses to reduce gains when calculating CGT, however, those losses must be reported to the HMRC first. Certain costs are termed allowance costs which can be deducted from CGT, they are:

- Transaction fees which are paid before the transaction is added to the blockchain

- Valuations when working out gains for a particular transaction

- Drawn up contracts for a transaction

- Advertisements of a buyer or seller.

Short-term Capital Gains

Short-term capital gains are profits accrued from selling a particular asset that was held for less than a year. The taxes placed on crypto assets are in the same tax bracket as ordinary income. It is worthy of note that losses incurred during the course of holding the crypto asset can be deducted from the total taxable income generated by the asset and these losses can be carried over into the following year.

Long-term Capital Gains

Long-term capital gains are the profits that are accrued from selling assets that have been held for longer than a year. Long-term gains from such crypto assets are usually taxed at a more favourable rate using a percentage system. To reduce capital gains tax on crypto assets, holding such assets for over a year is advisable.

Why You Need to Invest In Crypto Responsibly

Crypto gains may be mind-blowing, but you still need to be careful when buying or trading digital assets. We recommend carrying out your due diligence as a first-time investor who plans to buy cryptocurrency in the UK. Cut out the loud noise and don’t allow the fear of missing out (FOMO) to drive you to invest without doing the necessary research.

Also, remember to limit your level of exposure. Do not stake too much of your capital into cryptocurrencies. Instead, you can allocate between 1 to 10% of your portfolio to crypto-assets and put the rest in more stable assets.

Should You Buy or Trade Cryptocurrencies?

The answer to this question largely lies in what your preferences are. If you are new to the crypto market or do not have the time to trade, you should buy cryptocurrencies to hold for the long term.

However, if you have the technical expertise and time, you should consider trading the volatile asset class. You can use crypto brokers like ByBit, KuCoin, and Bitfinex to apply leverage and increase your potential profits on each trade. Those platforms support margin trading of crypto for UK users.

Cryptocurrency News – Latest Updates in May 2025

- Largest Switzerland bank, UBS comments on US cryptocurrency regulation

- Intel announces plans to venture into Blockchain technology

- Russian government making moves to legalize cryptocurrency and mining

- Coindesk executive – ‘Central bank digital currencies (CBDCs) will boost demand for crypto’

- India relaxes stance on cryptocurrency regulation

The total crypto market cap opened December 2022 at $820 billion, based on the Tradingview monthly chart.

The 2022 yearly open was $2.19 trillion, versus a 2021 yearly open of $760 million. So the crypto markets gained in valuation by several hundred percent over 2021, then dropped by over 50% in 2022. Many analysts predict the crypto bull run will continue in 2023 or following the next Bitcoin halving which is estimated to take place in May 2024.

Conclusion

Cryptocurrencies are here to stay, as evidenced by the growing institutional investment in virtual assets. Even investment banks that in previous years were skeptical of crypto such as Goldman Sachs have now stated in reports that it is a smart investment strategy to allocate a portion of your portfolio to these blockchain-based assets.

Despite being volatile by nature, cryptocurrencies have outperformed the general financial market and have seen exponential growth. Decentralized finance (DeFi) has a compelling use case and potential for adoption.

For those looking to buy crypto in the UK, we recommend eToro. It has good copy trading features and a comprehensive suite of educational resources.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest

FAQs on Buying Crypto in the UK

How Can I Buy Cryptocurrency?

Cryptocurrencies can be purchased from several crypto exchanges and brokers in the industry. We recommend using crypto broker eToro, which has good social trading features.

How Can I Sell Cryptocurrency?

In whatever exchange you are using, you can sell via the same interface.

Where To Buy Cryptocurrency?

You can buy cryptocurrencies from several platforms presently. However, we recommend using reputable and regulated crypto brokers and exchanges..

What are the Best Brokers To Buy Cryptocurrencies From?

While there is no perfect crypto broker, a few like eToro, Binance and Coinbase are popular destinations for many. These exchanges have good trading liquidity and are usually secure.

What Payment Methods Can I Use To Buy Cryptocurrencies?

Cryptocurrencies can be purchased with everyday payment methods. You can easily buy crypto in the UK through several payment methods.

What Is A Cryptocurrency Exchange?

A cryptocurrency exchange is a trading platform that enables the buying and selling of digital assets. Like the regular stock exchange, you can set limit orders, trade future perpetual, as well as long or short digital assets on it.

What is a Bitcoin Exchange?

A Bitcoin exchange is another word for a cryptocurrency exchange. It performs similar functions by enabling users to buy and sell cryptocurrencies.

How Does A Bitcoin Exchange Work?

A Bitcoin exchange operates much like a regular stock exchange. It allows traders to set their entry and exit prices. Traders can also use leverage to increase their potential profit and use stop-loss (SL) to mitigate potential losses.

Is Buying Cryptocurrency Safe?

Cryptocurrencies are considered high-risk investments and this is because they are highly volatile. Bitcoin, for instance, is known to surge astronomically and also dip in value. However, cryptocurrencies are known to always recover their gains with time. This makes them a safe investment for many.

Do I Have To Pay Taxes When Buying Or Selling Cryptocurrencies?

There are tax obligations you will have to meet when you buy or sell cryptocurrencies. We recommend seeing our section on the subject to gain more insight.

Which Cryptocurrency Should I Buy?

This largely depends on you. However, you should always consider a crypto asset’s value proposition foremost before making a decision. If it has a real-world use case, then there is a possibility of it being a success. However, several investors choose Bitcoin as their first crypto of choice.

What Are The Safest Cryptocurrencies To Buy?

Although cryptocurrencies are not safe by nature, a few of them can be considered safe. These include Bitcoin, Ethereum, Binance Coin, Polkadot, Solana, and the generality of the top 10 most valuable assets.

What Are The Most Popular Cryptocurrencies To Buy?

The most well-known digital currencies are Bitcoin and Ethereum.