On this Page:

If you’ve considered investing in cryptocurrency, chances are Ethereum has caught your attention. As the second-largest cryptocurrency by market cap, Ethereum has established itself as one of the most important digital assets. The coin is the backbone of decentralized finance (DeFi), NFTs, and countless blockchain applications.

Ethereum provides a complete platform for developers to build and deploy smart contracts and decentralized applications, making it technologically useful as well as a worthwhile investment.

In this guide, we will explain everything you need to know about buying, storing, and using Ethereum securely. We’ll cover the common mistakes to avoid, the best exchanges to use, and the security practices that will help protect your investment.

Key takeaways

- Before buying Ethereum (ETH), set up a trusted wallet (hardware or software) where you can safely store your ETH, and don’t leave large amounts on exchanges.

- It’s best to buy ETH from a well-known and regulated platform to avoid scams and ensure transparent fees.

- Ethereum gas fees can fluctuate wildly based on network congestion, so check fees before you buy or transfer ETH to avoid overpaying.

Why Buy Ethereum?

Before understanding how to buy the coin, it’s important to know why many people choose to invest in Ethereum in the first place.

As a complete blockchain platform, Ethereum enables developers to build decentralized applications (dApps). Its native token, ETH, powers everything from financial services to digital art marketplaces.

With the recent approval of spot Ethereum ETFs in the United States, institutional adoption is expected to increase, potentially driving further interest in the asset. Major companies like Microsoft, JP Morgan, and Intel have joined the Enterprise Ethereum Alliance to develop business applications on the network. Obviously, people are more convinced when such corporate validation strengthens Ethereum’s position.

Unlike Bitcoin’s fixed supply of 21 million coins, Ethereum doesn’t have a hard cap, but after the move to Proof of Stake, new issuance has significantly decreased, and some ETH is even burned with each transaction, potentially making it deflationary over time.

Another factor is the strength of the community. Ethereum has the largest community of developers among all blockchain platforms. These enthusiasts and professionals continue to build new applications and use cases, expanding Ethereum’s utility.

Use Cases Beyond Investment

Ethereum has many practical purposes, and its adoption grows continuously. Here are several examples of how it can be used:

- Powers decentralized finance (DeFi) applications that offer traditional financial services without intermediaries

- Enables creation and trading of non-fungible tokens (NFTs)

- Supports smart contracts for automated, trustless agreements

- Provides a platform for decentralized applications across various industries

- Allows for cross-border transfers without traditional banking limitations

Risks and Volatility Considerations

ETH value fluctuates significantly, with daily price swings of 10% or more are not uncommon. Due to this inherent market instability, Ethereum should be considered a high-risk investment that is not suitable for your essential savings or emergency funds.

We generally advise limiting your cryptocurrency exposure to funds you’re prepared to potentially lose in a worst-case scenario, while maintaining a more diversified investment strategy for your overall portfolio.

Ethereum Price Chart

(ETH)Step-by-Step Guide to Buying Ethereum

Step 1: Open an Account on a Crypto Exchange

Everything begins with creating an account on your chosen crypto exchange. This process goes beyond typical website registration and involves several layers of verification to comply with financial regulations.

Start by selecting an exchange appropriate for your location, experience level, and trading needs. We’ve already mentioned some of the most prominent exchanges in the world. Regional availability varies, so make sure your chosen platform operates in your jurisdiction.

Registration begins with basic information: email address, password creation, and acceptance of the platform’s terms of service. Select a unique, high-strength password exclusively for this account, as cryptocurrency exchanges represent high-value targets for hackers. Immediately after registration, activate two-factor authentication (2FA) using an authenticator app rather than SMS, as phone number hijacking presents a significant security risk.

Most exchanges then require identity verification to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Prepare to submit:

- Government-issued photo ID (passport, driver’s license)

- Proof of residence (utility bill, bank statement)

- A selfie or video verification

- In some jurisdictions, additional tax identification information

Verification processing typically takes between a few hours to several days, depending on the exchange’s backlog and the completeness of your submission. More extensive verification may unlock higher deposit and withdrawal limits, though some platforms offer tiered verification levels based on your anticipated trading volume.

Step 2: Fund Your Account

After verification approval, you’ll need to deposit funds before buying the coin. The funding method you select impacts processing time, fees, and maximum transaction amounts.

The first method is bank transfers, which provide the most cost-effective option for most users. These transfers typically need minimal or zero fees but require 1-5 business days for processing. They generally offer the highest deposit limits, making them ideal for larger investments. International wire transfers work similarly but with higher fixed fees – typically $15-50 per transaction.

The second method is debit and credit cards, which deliver instant funding capability but at premium rates – usually 2-5% of the transaction amount. Card companies may also apply additional fees or interest for crypto purchases, sometimes treating them as cash advances with immediate interest accrual. While convenient, these costs can significantly impact your effective investment returns.

The third option is digital payment services like PayPal, which offer middle-ground convenience, though availability varies by exchange and region. These typically process faster than bank transfers but slower than cards, with fees falling between bank transfers and credit cards.

For your first deposit, consider starting with a modest test amount rather than immediately transferring significant funds. This transaction verifies that your payment details, verification status, and account settings function correctly. After confirming success, you can proceed with your primary investment amount with more confidence and ease of mind.

Always double-check deposit instructions carefully, particularly with bank transfers, where entering incorrect details might result in lost funds or significant recovery delays. Remember that cryptocurrency transactions lack the consumer protections of traditional banking, so verification before submission is especially critical.

Step 3: Execute Your Ethereum Purchase

After all these steps, you’re now ready to acquire Ethereum. Modern cryptocurrency exchanges offer several order types:

For most newcomers, a market order is the simplest approach. This instruction buys Ethereum immediately at the best available current price. While convenient, market orders during volatile periods may execute at prices slightly different from those displayed when you initiated the transaction – a concept known as “slippage.”

For more price-sensitive investors, limit orders offer more control. With this approach, you specify the maximum price you’re willing to pay per ETH. Your order executes only when Ethereum reaches or falls below your specified price. While this prevents overpaying during volatility, your order might remain unfilled if the market moves away from your target price.

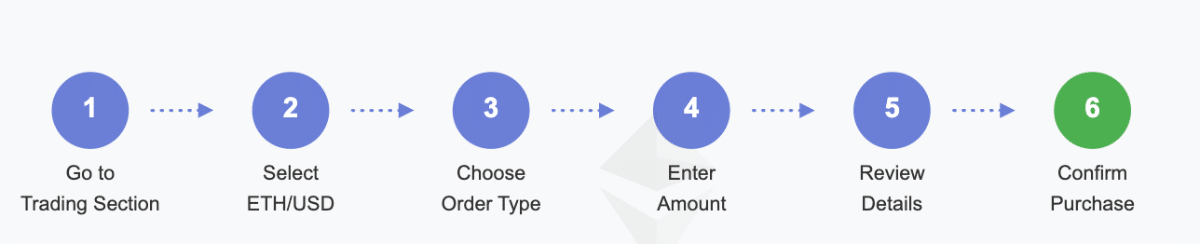

To place your first purchase, follow these steps:

- Go to the exchange’s trading section

- Select the ETH/USD trading pair (or ETH paired with your local currency)

- Choose your preferred order type

- Enter either the amount of Ethereum you wish to buy or the fiat amount you want to spend

- Review the transaction details, including fees and the estimated amount of ETH you’ll receive

- Confirm your purchase

After execution, your newly acquired Ethereum appears in your exchange wallet. For smaller amounts you plan to trade actively, leaving them on the exchange offers convenience. However, for bigger holdings or long-term investment, transferring to a personal crypto wallet provides much better security.

Alternative ETH Buying Methods

While major exchanges offer the simplest and straightforward path to Ethereum ownership, several alternative methods exist, and we discuss them below:

- Peer-to-peer marketplaces connect buyers and sellers directly, often offering more privacy and payment method flexibility. P2P trading typically involves higher premiums above market rates (3-8%) but enables cash transactions and supports regions where mainstream exchanges have limited availability.

- Crypto ATMs with Ethereum support provide a physical purchase option, though with significantly higher fees, often 7-12%. These machines require minimal technical knowledge, and some offer cash purchases as well.

- DeFi swapping protocols allow direct conversion from other cryptocurrencies to Ethereum without registration or identity verification. While offering privacy advantages, these platforms require existing cryptocurrency holdings and technical familiarity with Web3 wallets. Network gas fees can make smaller transactions economically impractical during periods of high congestion.

For gift card or cash payments, services like Paxful facilitate Ethereum purchases using retail gift cards or cash deposits, though often at premium rates. These methods typically involve higher counterparty risk, but people in regions or with limited financial infrastructure have access.

Before You Buy Ethereum

When making any type of investment, you need to know how digital asset storage works. Since ETH doesn’t exist as physical currency or in conventional bank accounts, you’ll need a specialized wallet system to access and manage your holdings on the blockchain network.

An Ethereum wallet functions more like a secure access point than a physical container. Rather than storing actual tokens, it protects the cryptographic private keys, verifying your ETH ownership on the permanent blockchain ledger. These keys are your digital signature, proving you have the right to move or use your Ethereum.

Types of Ethereum Wallets

Let’s discuss several types of wallets and their characteristics:

Hardware wallets provide the highest level of security by keeping your private keys on a physical device disconnected from the internet. Products like the Ledger Nano X and Trezor Model T are ideal for storing larger amounts of ETH you plan to hold long-term, as they protect against online threats.

Mobile wallet apps offer a balance of convenience and reasonable security for everyday transactions. Options such as Trust Wallet and Coinbase Wallet let you access your ETH on the go. This will be suitable for you if you need frequent access to smaller amounts.

Desktop wallets installed on your computer provide better security than web-based options while maintaining fairly easy access. MetaMask and Best Wallet are popular choices that give you direct control over your private keys with a user-friendly interface.

Exchange wallets provided by platforms like Coinbase and Binance offer the simplest experience but with lower security. These are best for active trading and temporary storage, as you don’t control the private keys—the exchange does.

What can be the best practice? A mixed approach: keeping modest amounts in mobile or desktop wallets for regular use while securing main holdings in hardware wallets for maximum protection.

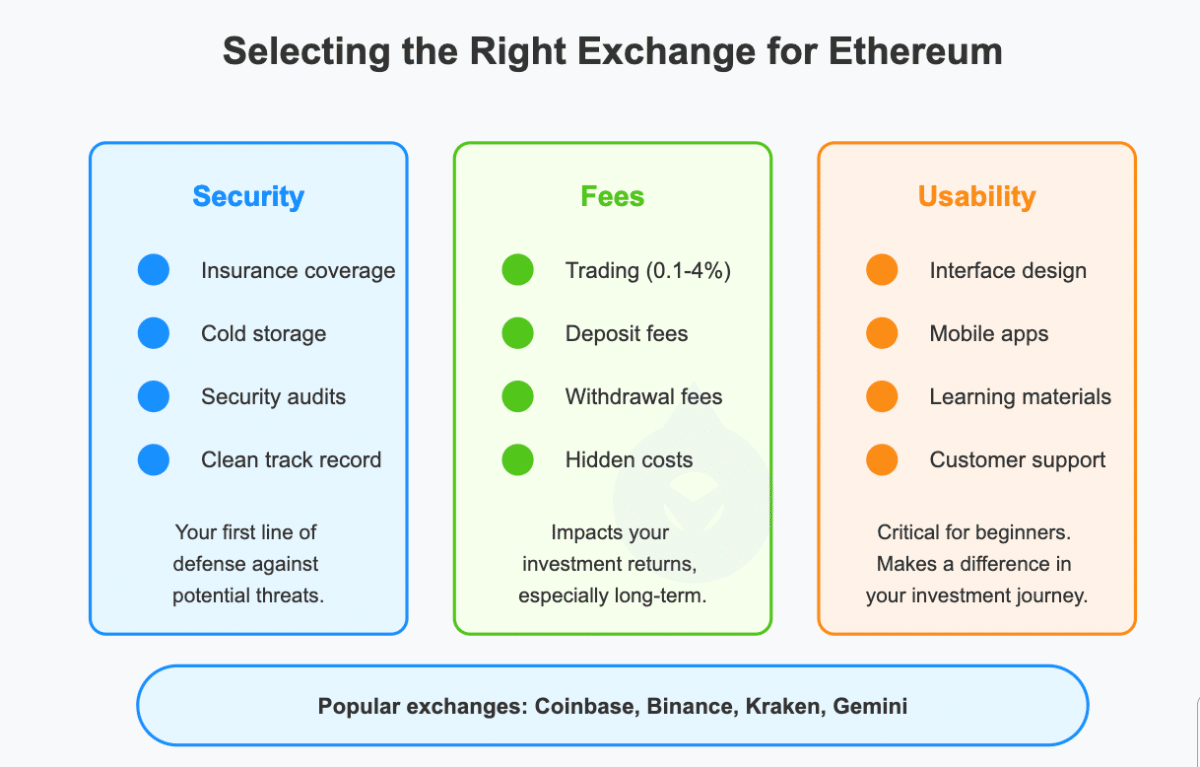

Selecting the Right Exchange for Ethereum

Before you buy, you’ll need access to an exchange – the digital marketplace where buyers and sellers trade ETH and other digital assets. Your exchange choice affects everything from costs and payment options to security and user experience.

The best exchange platforms implement protections like substantial insurance coverage, cold storage for most customer assets, regular security audits, and a clean track record free of major breaches. Never compromise on these security features, as they are your first line of defense against potential threats.

The fee structure can impact your investment returns, especially for frequent traders. While trading commissions typically range between 0.1% and 4%, don’t overlook the often substantial deposit and withdrawal fees. Some exchanges advertise low trading fees but compensate with higher costs elsewhere. So, carefully examine the complete fee schedule.

A well-designed interface with intuitive navigation can make all the difference. Consider whether the exchange offers responsive mobile applications, clear educational resources, and readily available customer support.

Traditional vs. Decentralized Trading Platforms

If you are a first-time buyer, centralized exchanges typically offer the simplest entry point with their regulated status and intuitive interfaces, so they might be a better option for you. As you become more comfortable with cryptocurrency concepts, exploring decentralized alternatives provides greater control over your digital assets.

Here’s a comparison table for traditional and decentralized trading platforms:

| Feature | Centralized Exchanges (CEXs) | Decentralized Exchanges (DEXs) |

| Operation Model | Run by companies as intermediaries | Operate via smart contracts without middlemen |

| Popular Examples | Coinbase, Binance, Kraken | Uniswap, dYdX, Curve |

| User Experience | Simple, intuitive interfaces | Steeper learning curve |

| Fiat Currency Support | Direct deposits from bank/cards | Limited or no direct fiat on-ramps |

| Customer Support | Dedicated support teams | Community-based or minimal support |

| Asset Custody | Exchange holds your funds | You maintain control of your assets |

| Privacy Level | Requires KYC verification | Enhanced privacy, minimal verification |

| Security Model | Dependent on exchange security | Smart contract security, self-custody risks |

| Trading Volume | Higher liquidity for most pairs | May have lower liquidity for some assets |

| Transaction Speed | Generally faster | Depends on blockchain congestion |

| Best For | Beginners, fiat-to-crypto buyers | Experienced users seeking privacy and control |

Understanding Transaction Costs

Multiple fee types can impact your total investment and can significantly erode returns if not carefully managed.

- Trading commissions are the most visible expense, typically ranging from 0.1% for high-volume traders on professional exchanges to 1.5% or more on consumer-friendly platforms, which prioritize simplicity over cost.

- Payment method surcharges vary based on your funding choice. Bank transfers generally incur minimal fees (0-1.5%) but require several days to process. Credit card purchases offer instant gratification but at premium rates – often 3-5% plus potential cash advance fees from your issuer. Digital payment processors like PayPal typically fall somewhere between these extremes.

- Network fees (known as “gas” in Ethereum terminology) represent a unique consideration compared to traditional assets. These fees compensate network validators for processing your transactions and fluctuate based on network congestion, sometimes reaching prohibitive levels during peak demand periods. Unlike exchange fees, these costs apply when moving Ethereum between wallets, not just when trading.

- Withdrawal charges apply when transferring Ethereum from an exchange to your personal wallet. While some platforms cover these costs, others pass them along, sometimes with additional markup. Always verify the current withdrawal fee before initiating a transfer.

How to Approach Ethereum Investment Strategically

The timing and structure of your purchases can impact your investment outcomes. Investment strategies generally fall into one of two primary approaches, each with distinct advantages for different investor profiles.

The first one is dollar-cost averaging (DCA), and it involves investing fixed monetary amounts at regular intervals regardless of price fluctuations. This methodical approach reduces the impact of Ethereum’s volatility by spreading purchases across time.

For example, investing $200 every week instead of $800 once a month spreads your purchases across four different price points. This approach helps you avoid the risk of making your entire investment at an unfavorable price. If you invested the full $800 on a day when ETH was temporarily at its monthly high, you’d get less Ethereum for your money.

By spreading out your purchases, you’ll naturally buy more ETH when prices are lower and less when prices are higher. Many exchanges now make this easy with automated recurring purchase features that handle these regular investments without you having to remember to place each order manually.

In contrast, lump-sum investing is the second approach, which commits your entire investment amount in a single transaction. This approach maximizes potential returns if Ethereum rises in value following your purchase, but carries a bigger risk of buying at cyclical market peaks. Historical analysis of traditional markets suggests lump-sum investing outperforms dollar-cost averaging more often than not during extended bull markets, but cryptocurrency’s volatility may alter this calculation.

A hybrid approach involves committing a portion (between 30-50%) of your intended investment immediately while dollar-cost averaging the remainder. This balanced strategy provides immediate market exposure while reducing timing risk.

Latest Ethereum News

Securing Your Ethereum Investment

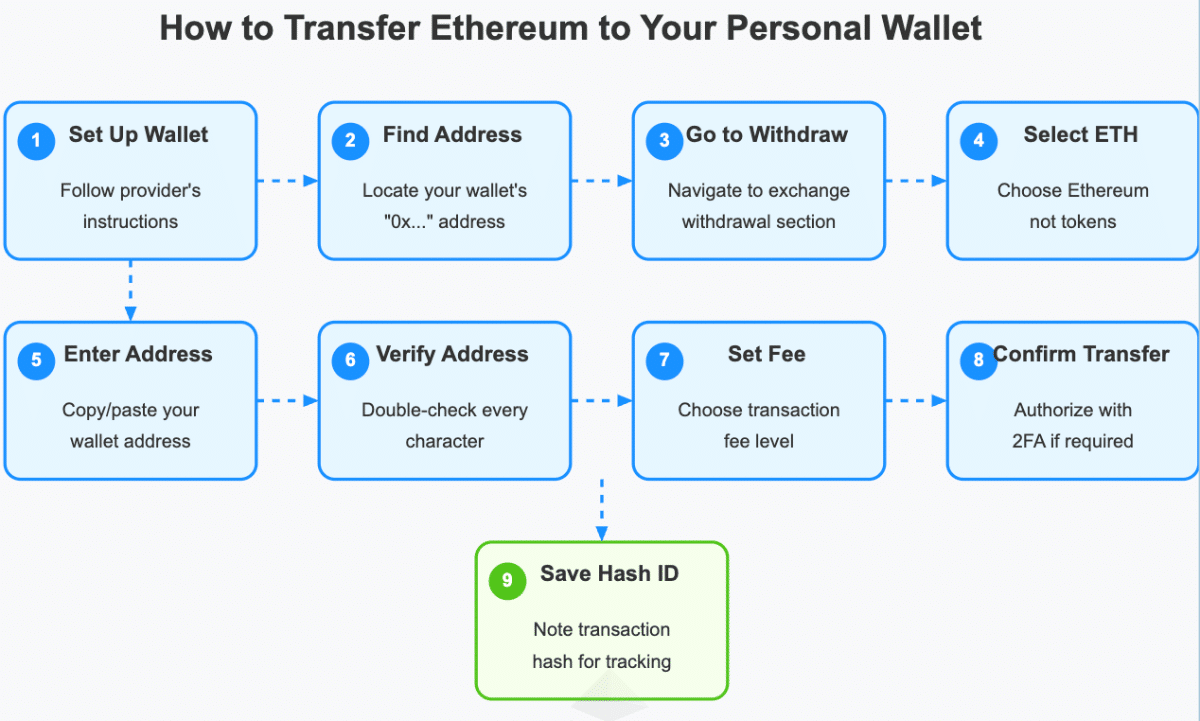

Once you’ve bought the coin, transferring it from the exchange to a personal wallet is a crucial security upgrade. While straightforward, this process requires careful attention to detail to prevent potentially irreversible errors.

The main principle driving this recommendation is captured in the cryptocurrency community’s maxim: “Not your keys, not your coins.” When your Ethereum remains on an exchange, the platform controls the private keys, giving you a promise rather than direct ownership.

Exchanges can be valuable targets for hackers and have suffered numerous security breaches historically. Additionally, exchange-held assets remain vulnerable to account freezes, platform insolvency, or operational disruptions.

Here are the steps for transferring your Ethereum to a personal wallet:

- Locate your wallet’s receiving address – a long alphanumeric string starting with “0x”

- Within your exchange account, navigate to the withdrawal section

- Select Ethereum (ensuring you’re not selecting an Ethereum token or alternate blockchain)

- Enter your wallet’s receiving address (ideally using copy/paste to avoid transcription errors)

- Double-check the address – even a single character discrepancy will send funds to an unintended destination, which cannot be reversed.

- Select your preferred transaction fee (higher fees typically result in faster confirmation)

- Initiate the transfer and authorize it using any required 2FA

- Note the transaction hash provided by the exchange for tracking purposes

And, let’s repeat this again: For your first withdrawal, consider sending a minimal test amount before transferring larger holdings. This initial transaction confirms that your wallet setup and address details are correct.

After initiating the transfer, your Ethereum should arrive in your personal wallet within minutes under normal network conditions, though congestion can sometimes extend this timeframe. You can verify receipt by checking your wallet balance or searching for the transaction hash on a blockchain explorer like Etherscan.

Understanding Ethereum’s Fee Structure

Ethereum’s transaction fee system differs from traditional financial networks, operating on a market-based model rather than fixed costs. Unlike bank transfers or credit card payments, Ethereum fees (known as “gas”) fluctuate continuously based on network demand.

Each transaction requires computational resources from the network, with more complex operations requiring more “gas” than simple transfers. During peak usage periods, such as popular NFT releases or significant market volatility, fees can increase dramatically as users compete for limited block space.

Gas fees are denominated in “gwei” (1 billionth of an ETH) and consist of two components:

- Base fee – burned (removed from circulation) during transaction processing

- Priority fee – optional tip to validators for faster inclusion

When initiating an Ethereum transaction, most wallets offer fee options, including:

- Fast – Higher gas price for quicker confirmation (1-2 minutes)

- Standard – Balanced approach likely to confirm within several minutes

- Slow – Lower fees with potentially extended confirmation times

To optimize your Ethereum transactions, you need to:

- Schedule non-urgent transfers during network off-peaks

- Batch multiple operations when possible to share certain fixed gas costs

- Consider using Layer 2 scaling solutions like Arbitrum or Optimism for significantly reduced fees

- Monitor gas prices through services like Etherscan’s Gas Tracker before initiating transactions

Recent Ethereum protocol upgrades have improved fee predictability and reduced extreme spikes, but gas costs remain a significant consideration for smaller transactions. For this reason, alternative methods are more economical for certain use cases.

Multi-Layered Security Best Practices

Protecting your Ethereum investment requires a strong security approach. Since cryptocurrency transactions are irreversible and lack traditional banking protections, preventative security measures become especially critical.

Access Control Protection

Implement unique, complex passwords (16+ characters mixing types) for all cryptocurrency-related accounts. Password managers like Bitwarden or 1Password can generate and store these securely.

Enable 2FA using authenticator apps rather than SMS, as phone number hijacking is a common attack vector. Consider dedicated authentication devices like YubiKeys for exchanges that support them.

Maintain separate email addresses for cryptocurrency accounts, ideally with their own 2FA.

Recovery Phrase Protection

Your wallet’s recovery phrase (typically 12-24 words) provides complete control over your funds, making its protection essential. Never store this phrase digitally – not in cloud storage, password managers, or digital documents.

Instead, record your phrase on physical media, with multiple redundant copies stored securely. Options include:

- Engraving or stamping on metal plates resistant to fire and water damage

- Writing on paper and storing it in waterproof containers in secure locations

- Splitting the phrase between multiple secure locations for higher-value holdings

Never share your recovery phrase with anyone – legitimate services will never request it. Any request for this information is definitely a scam attempt.

Operational Security

Consider a dedicated device for significant cryptocurrency management – either a separate computer or a mobile device used exclusively for this purpose.

Verify all wallet addresses through multiple channels before sending large amounts. Small test transactions, while incurring additional fees, provide valuable confirmation.

Be vigilant regarding phishing attempts. Verify website URLs manually rather than clicking links, and consider bookmark usage for sensitive financial sites.

For substantial holdings, hardware wallets are the security gold standard. These devices keep private keys isolated from internet-connected systems, protecting against malware and remote attacks.

Managing Your Ethereum Investment

After you have acquired ETH and have kept it safe, there are several ways you can handle your investment. In this section, we discuss how you can manage it.

Selling and Converting Your Ethereum

When the time comes to liquidate some or all of your Ethereum holdings, several methods offer different balances of convenience, speed, and cost-effectiveness. Understanding these options in advance ensures you’re prepared to act efficiently when market conditions align with your exit strategy.

Exchange-Based Selling

The most straightforward approach is transferring your Ethereum from your personal wallet back to an exchange for conversion to fiat currency. This process essentially reverses your initial purchase:

- Send ETH from your wallet to your exchange account (incurring network fees)

- Place a sell order for your desired amount

- Choose between immediate market orders or price-targeted limit orders

- Upon execution, withdraw the resulting fiat to your linked bank account

This method offers competitive rates and reasonable fees for most investors. Withdrawal to your bank account generally takes 1-3 business days, depending on the exchange and your location’s banking system.

Peer-to-Peer Selling

For potentially better rates or payment flexibility, peer-to-peer platforms connect you directly with buyers. These marketplaces incorporate reputation systems and escrow protection to reduce fraud risk. The process generally follows this pattern:

- List your Ethereum at your chosen price

- Select acceptable payment methods (bank transfer, cash, payment apps)

- Wait for interested buyers to contact you

- Use the platform’s escrow service during the transaction

- Release the Ethereum only after confirming payment receipt

While potentially offering better rates than exchanges (particularly in certain regions), P2P selling requires more time investment and introduces additional counterparty risk considerations.

Direct Usage

Rather than converting to fiat currency, consider using your Ethereum directly with merchants and services accepting crypto payments. This approach avoids selling fees and potential tax events in some jurisdictions. Options include:

- Cryptocurrency-compatible debit cards that convert ETH at the point of sale

- Direct merchant acceptance through payment processors

- Gift card purchases on platforms accepting cryptocurrency

For significant holdings, some investors utilize over-the-counter (OTC) desks offered by major exchanges and specialized firms. These services handle larger transactions (typically $100,000+) with personalized service and potentially reduced slippage compared to regular exchange trading.

Tax Implications of Ethereum Transactions

Ethereum transactions carry some tax obligations in most jurisdictions. While specific rules vary by country, most tax authorities classify Ethereum as property rather than currency for tax purposes. This classification creates taxable events in several scenarios:

- Selling Ethereum for fiat currency (capital gains/losses)

- Trading Ethereum for other cryptocurrencies (typically taxable exchanges)

- Using Ethereum to purchase goods or services (potentially taxable as sales of the underlying ETH)

- Receiving ETH as income (typically taxable at fair market value when received)

- Earning staking rewards (generally taxable as ordinary income)

In many jurisdictions, the holding period impacts tax treatment. For example, in the United States, Ethereum held for over one year qualifies for long-term capital gains rates (0%, 15%, or 20% depending on income bracket), while shorter holdings face higher short-term rates equivalent to ordinary income (up to 37%).

Maintaining detailed transaction records is essential for accurate tax reporting:

- Date and time of all acquisitions and disposals

- Cost basis (amount paid, including fees)

- Fair market value at the time of the transaction

- Specific identification of which units were sold (for tax-optimization purposes)

Several specialized cryptocurrency tax software platforms can integrate with exchanges and wallets to automatically track transactions and generate tax reports.

Long-Term Ethereum Storage Considerations

Obviously, additional security and management considerations become relevant for investors planning to hold Ethereum for extended periods (months or years).

Cold Storage Optimization

For maximum security, consider upgrading from standard hardware wallets to better cold storage solutions:

- Multi-signature wallets requiring multiple independent authorizations for transactions

- Air-gapped signing devices that never connect directly to the internet

- Geographically distributed key fragments requiring multiple physical locations to be compromised

These approaches significantly increase security, though at the cost of added complexity and reduced transaction convenience.

Technological Obsolescence Protection

Wallet technologies and standards are changing over time. You can stay current with these simple steps:

- Periodic software updates for hardware wallets

- Maintaining awareness of security vulnerability disclosures

- Migrating to newer wallet solutions when significant security improvements emerge

- Understanding that recovery phrases typically remain compatible across wallet generations

Periodic Security Audits

Establish a regular schedule (perhaps quarterly or semi-annually) to review and enhance your security posture:

- Verify the physical security of the recovery phrase storage

- Confirm hardware wallet functionality through test transactions

- Update any password manager software storing exchange credentials

- Review account recovery mechanisms for exchanges and email services

Avoiding Common Pitfalls

Being successful in crypto investing requires technical knowledge as well as psychological attributes. In this section, we discuss some of the red lines that need to be avoided.

Psychological Challenges in Ethereum Investing

Ethereum’s price volatility creates psychological pressures that can lead even experienced investors to make costly errors. Understanding and preparing for these emotional challenges might improve your chances of investment success.

Fear of missing out (FOMO) is a condition that drives many investors to purchase during dramatic price increases, often near cyclical peaks. This emotion-driven buying frequently leads to acquiring assets at inflated valuations, followed by significant paper losses.

On the contrary, panic selling during sharp declines locks in losses that might otherwise recover with patience. Market history shows that reactionary selling during downturns typically underperforms disciplined holding strategies.

Another factor is overconfidence bias, which leads many investors to overestimate their ability to time market movements or select outperforming assets. This frequently results in excessive trading, timing errors, and underperformance compared to simple buy-and-hold strategies. Counter this tendency by:

The cryptocurrency market’s 24/7 nature can create obsessive price checking that increases stress without improving results. This behavior often leads to impulsive decisions and trading primarily to relieve anxiety. Establish healthy boundaries through:

Some people tend to maintain a trading journal documenting their decisions and emotional states. This practice might help you become aware of psychological patterns affecting your investment choices and build self-knowledge that will improve your future decision-making.

Technical Mistakes to Avoid

Beyond psychological challenges, several technical errors consistently plague investors. These mistakes, while often simple, can result in permanent loss of funds due to Ethereum’s irreversible transaction nature.

Address verification errors are one of the most common and costly mistakes. When sending the coin, even a single incorrect character in the destination address will direct your funds to an inaccessible or unintended wallet. Always copy and paste addresses rather than manual entry, and send test transactions with minimal amounts before larger transfers.

Network mismatches occur when sending Ethereum or tokens through incompatible blockchain networks – for example, sending ETH to an exchange deposit address via the BNB Smart Chain rather than the Ethereum network typically results in permanently lost funds. Confirm network compatibility before making any transfer.

Smart contract interaction errors can occur when connecting to decentralized applications. Malicious contracts can drain wallets given improper permissions. Research projects in great detail before connecting your wallet, and use separate wallets for different risk categories (one for trusted applications, another for experimental protocols).

Recovery phrase exposure through digital storage is a critical vulnerability. Your recovery phrase should never exist in digital form – not in cloud storage, not in password managers, not in email, not in smartphone notes. Secure physical storage represents the only appropriate approach for this critical information.

Keep in mind that the Software update negligence can leave wallets vulnerable to known security exploits. Maintain regular update schedules for hardware wallet firmware, wallet applications on all devices, operating systems hosting wallet software, and browser extensions used for Web3 connectivity.

By avoiding these common technical errors, you can significantly enhance the security posture of your Ethereum investment and reduce the risk of preventable losses.

Recognizing and Avoiding Ethereum Scams

The crypto space is a popular stomping ground for scammers targeting inexperienced users. Awareness of fraud patterns and common crypto scams can provides essential protection for your Ethereum holdings.

Legitimate investments never guarantee specific returns. Any promise of fixed cryptocurrency yields represents a near-certain scam, regardless of how professional the presentation appears.

Remember the fundamental principle: if someone asks you to send cryptocurrency with a promise to send more back, it’s invariably fraudulent, regardless of the apparent sender’s identity.

Always download wallet applications directly from official websites or app stores, verifying the developer’s identity and reading user reviews before installation.

For maximizing protection, join established cryptocurrency communities where members actively identify and document emerging scams. These collective knowledge bases often identify fraudulent schemes before they become widespread, and provide early warnings for potential targets.

Conclusion

Buying Ethereum is increasingly accessible for everyday investors. As the second-largest cryptocurrency and foundation for an expanding Ethereum ecosystem of applications, the coin continues to attract interest.

There are several essential considerations before you buy Ethereum, from selecting appropriate exchanges and wallets to understanding fee structures and implementing security practices. We’ve examined the advantages and limitations of various purchasing methods while highlighting common pitfalls that newcomers often encounter.

Remember that Ethereum, like all cryptocurrencies, represents a high-risk investment with significant volatility. Approach your investment with thorough research, careful planning, and risk capital you can afford to lose. Consider your time horizon, technical comfort level, and security requirements when determining your optimal purchase and storage approach.

By following the best practices outlined in this guide, you can minimize many common risks associated with Ethereum investment. Start with smaller amounts as you build familiarity, gradually implementing better security measures as your holdings grow.

FAQs

What is the best exchange to buy Ethereum?

It varies based on your location, experience level, and priorities. Coinbase offers superior usability for beginners despite higher fees, while Binance provides lower costs with a steeper learning curve. Kraken and Gemini balance these factors with strong security track records. Research the platforms available in your region, comparing fee structures, security measures, and user reviews specific to your circumstances.

Can I buy Ethereum without verifying my identity?

While most regulated exchanges require identity verification, some alternatives still exist. Decentralized exchanges like Uniswap allow trading without KYC, though you'll need another cryptocurrency to exchange. Some peer-to-peer platforms enable limited transactions without full verification, though these typically involve higher premiums and potential counterparty risks.

What is the cheapest way to buy ETH?

For minimum costs, fund a major exchange account via bank transfer (ACH in the US) and place limit orders during low-volatility periods. Some exchanges offer trading fees under 0.2% for this approach. Avoid credit card purchases (3-5% fees) and consider exchanges offering fee discounts for using their native tokens or maintaining minimum balances.

How long does an Ethereum transaction take?

Under normal network conditions, Ethereum transactions typically confirm within 15 seconds to 5 minutes, depending on the gas fee you've selected. Higher fees result in faster inclusion in the blockchain. During periods of extreme network congestion, lower-fee transactions might require 30+ minutes for confirmation. Time-sensitive transfers warrant higher gas fees to ensure timely processing.

Why are Ethereum gas fees so high sometimes?

Ethereum's gas fees increase during periods of high network demand as users compete for limited block space. Popular NFT launches, DeFi protocol opportunities, and significant market movements can all trigger congestion. The network processes a fixed number of transactions per block, creating an auction-like environment where fees rise until enough users defer their transactions to restore balance.

Is it better to store ETH in a hot wallet or a hardware wallet?

This decision depends on your usage patterns and risk tolerance. Hot wallets offer convenience for active trading and smaller amounts but remain vulnerable to malware and phishing. Hardware wallets provide substantially enhanced security through physical isolation of private keys, making them optimal for larger holdings and long-term storage. Many users employ both: hardware wallets for savings and hot wallets for trading and everyday transactions.

Can I buy ETH with cash?

Yes, you can. P2P platforms like LocalCryptos offer in-person cash trades with escrow protection. Some Bitcoin ATMs support Ethereum purchases with cash, though with premium fees (7-15%). For larger amounts, certain exchanges accept cash deposits at partnered bank branches. These methods typically offer enhanced privacy but involve higher costs and potential inconvenience compared to online purchases.

What happens if I send ETH to the wrong address?

Unfortunately, the transaction cannot be reversed or canceled due to the blockchain's immutable nature. If the address belongs to another person, recovery depends entirely on their willingness to return the funds. If the address doesn't correspond to a valid wallet or contains errors, the ETH becomes permanently inaccessible.

What are the risks of using a DEX to buy Ethereum?

Decentralized exchanges introduce several distinct risks compared to centralized alternatives. Smart contract vulnerabilities could potentially lead to a loss of funds through coding exploits. Lower liquidity often results in higher slippage (price movement during transaction execution), particularly for larger trades. The absence of customer support means transaction errors or interface misunderstandings have no resolution pathway. Additionally, DEXs require a greater technical understanding of wallet connectivity and gas fee optimization.

How can I use Ethereum for DeFi and staking?

To participate in DeFi, connect your wallet to established protocols like Aave for lending, Uniswap for trading, or Curve for stablecoin exchanges. For staking, you can either run a validator node (requiring 32 ETH minimum) or use liquid staking services like Lido or Rocket Pool that accept any amount. Both approaches generate yields but carry smart contract risks and potential lockup periods. Research each protocol thoroughly and start with small amounts while learning the ecosystem.