Join Our Telegram channel to stay up to date on breaking news coverage

The crypto market is holding firm, with Bitcoin trading slightly above $103,000 and Ethereum stable near $2,592. Altcoins like Solana, XRP, DOGE, and ADA are posting solid weekly gains, reflecting cautious optimism. Yet, despite strong trading volumes, market direction remains unclear.

Uncertainty around regulatory policy, especially under the Trump administration, is adding to the hesitation. In this quiet but active environment, identifying the top crypto to invest in right now is more important than ever. With momentum building under the surface, the right picks could lead the next breakout phase.

Top Crypto to Invest in Right Now

This article highlights some of the best tokens to buy now, including Avalanche, Solana, and The Graph. SOL is currently trading at $155.50, up 4.67% over the past month. Its growing strength is backed by fresh institutional partnerships and a successful MetaMask integration, which enhances usability and accessibility. At the same time, momentum is building around Snorter Token, which raised over $279,000 just hours after its presale launch.

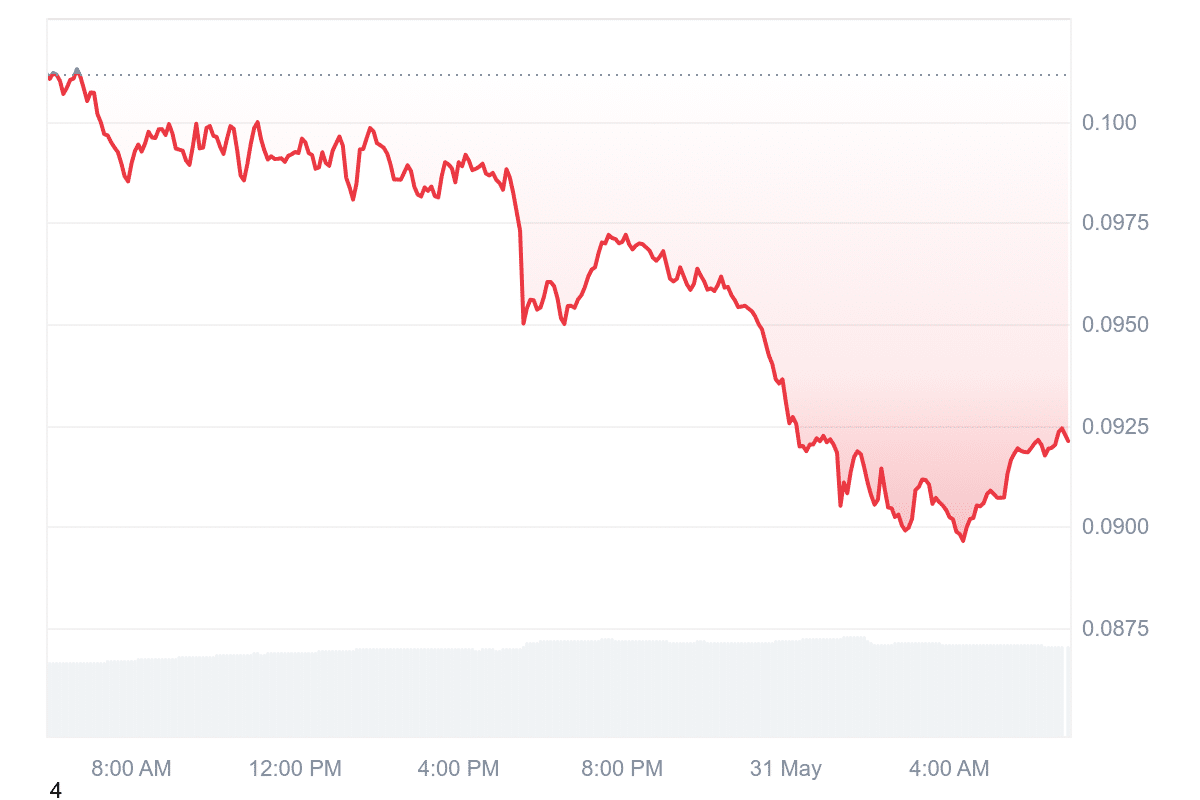

1. The Graph (GRT)

The Graph is trading at $0.09211 recording an intraday dip of 8.35%, which reflects a volatile short-term outlook. Despite the decline, trading volume has jumped over 20% in the past 24 hours to $73.18 million, indicating heightened market activity. The asset remains 56.19% below its 200-day simple moving average of $0.210494, signaling bearish sentiment.

It has only seen 14 green days over the last 30, and current RSI levels at 44.82 suggest neutral momentum with potential for sideways movement. Volatility remains low at 9%, offering a relatively stable environment despite the price correction.

The Graph powers data indexing and querying across major blockchains like Ethereum and IPFS, playing a key role in the infrastructure layer of Web3. Developers use it to create and access open APIs, known as subgraphs, which simplify blockchain data retrieval. This capability supports a wide range of decentralized applications in DeFi and beyond.

While current sentiment and technicals show weakness, the protocol’s core utility and high liquidity levels keep it relevant in the long term. As more blockchains are added and its decentralized network rolls out, the platform may gain stronger developer adoption, which could eventually reflect in improved market performance.

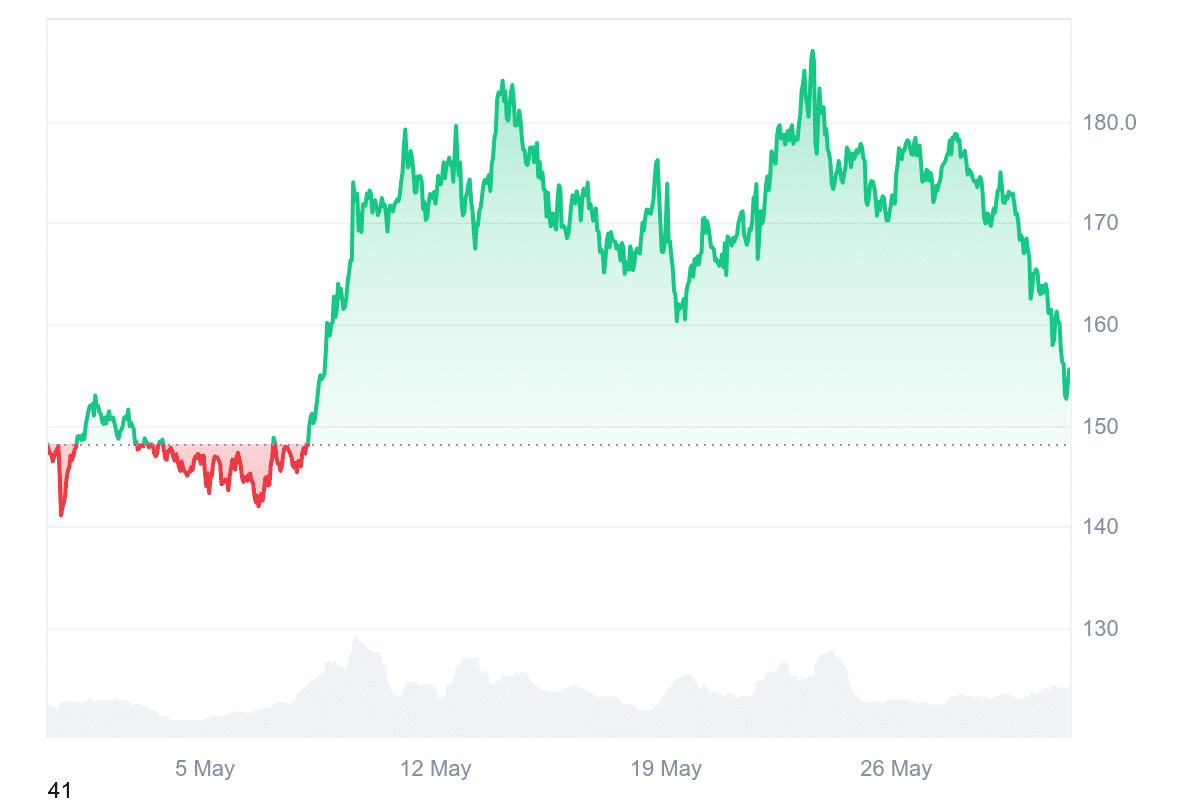

2. Solana (SOL)

Solana is currently priced at $155.50, reflecting a 4.67% gain over the past month. With 16 green days in the last 30, the token is showing steady momentum. Liquidity remains strong, as indicated by a 24-hour volume-to-market cap ratio of 0.1403. The 14-day Relative Strength Index (RSI) stands at 69.11, placing Solana in a neutral zone, which suggests the potential for sideways trading in the short term.

The broader outlook for Solana has improved significantly following a $1 billion institutional raise and the launch of its first public liquid staking strategy. These moves are being viewed as key catalysts that could drive SOL toward the $300 mark, particularly as they enhance capital efficiency and attract deeper institutional engagement.

Further reinforcing Solana’s position, the blockchain has secured new institutional partnerships and successfully integrated with MetaMask. These advancements improve accessibility and usability for a broader range of users, including those already familiar with Ethereum-based tools.

Introducing the @solanaappkit by SEND ecosystem 📱

An open-source React Native kit to build iOS and Android mobile apps on Solana in ~15 minutes

Ft. 18+ protocol integrations 🧵 pic.twitter.com/nNOloSlZFU

— Solana (@solana) May 30, 2025

As the ecosystem continues to expand, these developments position Solana as a leading innovative contract platform capable of competing with more established networks. If momentum sustains, current price predictions suggest a potential climb to $164.94 by early June, making Solana one of the more closely watched assets in the current crypto cycle.

3. Aave (AAVE)

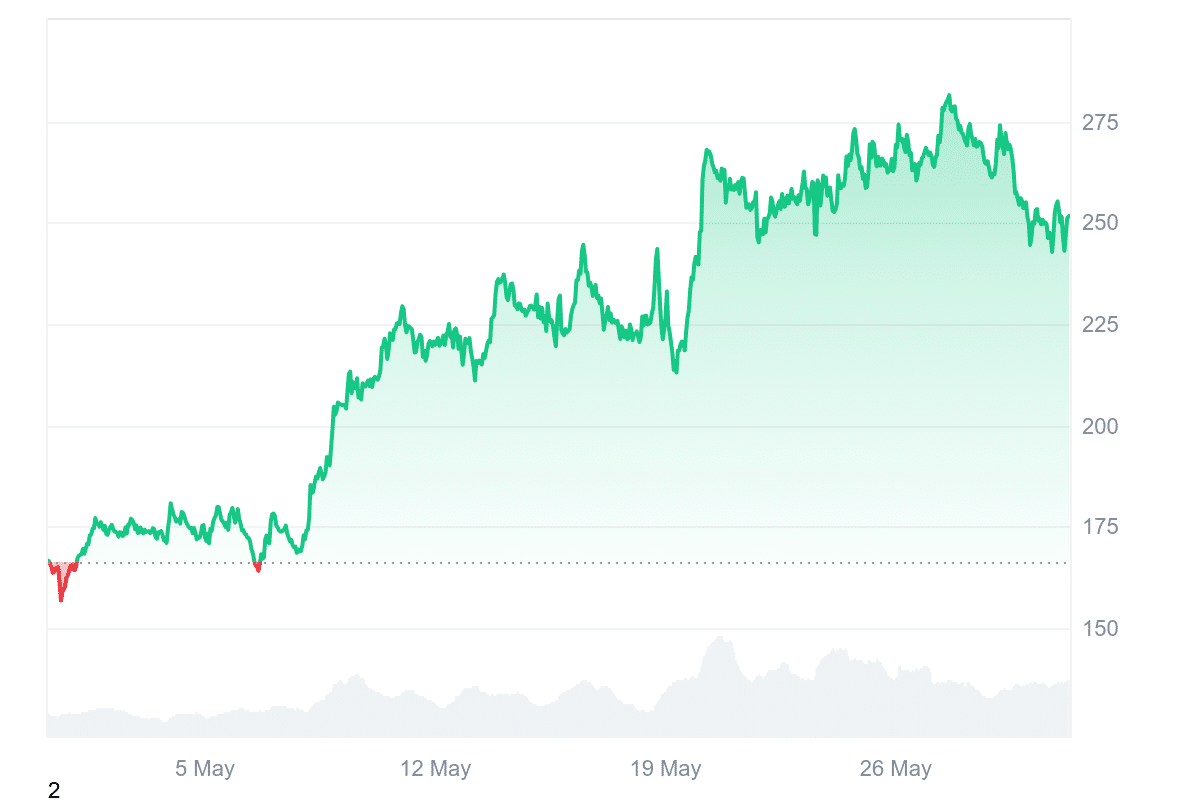

Aave is currently priced at $251.66, showing a strong 48.75% gain over the past month. With 19 green days in the last 30, it has outperformed many of its DeFi peers. The asset is trading 18.04% above its 200-day simple moving average of $213.30, reflecting solid upward momentum. Liquidity remains high relative to market cap, and the 14-day Relative Strength Index (RSI) sits at 52.73, suggesting neutral conditions with potential for sideways price action in the short term.

As one of the largest decentralized lending protocols in the DeFi space, Aave stands out for offering features like stable interest rates and flash loans, which allow users to borrow funds without collateral within a single transaction. The protocol operates through lending pools, making the borrowing process efficient and instantaneous.

With over $5 billion in total value locked, Aave’s scale and infrastructure continue to draw both lenders and borrowers. Recent price strength and bullish sentiment align with Aave’s expanding ecosystem and continued relevance in the decentralized finance landscape.

Trading conditions are currently neutral, as shown by the Fear & Greed Index reading of 50, but the protocol’s technical indicators suggest resilience. If momentum holds, Aave may continue its steady climb as market conditions improve and on-chain activity picks up across the lending and borrowing space.

4. Snorter Token (SNORT)

Snorter Token (SNORT) is quickly gaining traction as the next breakout Solana meme coin, having raised over $279,000 within hours of its presale launch. But this isn’t just another viral pump; Snorter brings real utility to the meme coin space.

At its core is the Snorter Bot, a Telegram-native, ultra-fast crypto trading suite designed for retail traders. It automates the entire on-chain trading process, including sniping, swapping, stop-losses, limit orders, and copy trading. Already the fastest Solana sniper bot, it plans to expand across EVM chains like Ethereum. Its key advantages include sub-second execution, MEV resistance, and the lowest fees in the market, just 0.85% for $SNORT holders.

Snorter also offers robust anti-rug protections, including on-chain scanners to detect honeypots and scams. Its Telegram-native interface makes sophisticated trading accessible to everyone.

$150k raised in 24 hours.

My phone autocorrected ‘Snorter’ to ‘profit.’ Even AI knows what’s up. pic.twitter.com/vfVUvupXFV

— Snorter (@SnorterToken) May 29, 2025

Backed by a meme-worthy mascot, Snort the Aardvark, the project combines Solana’s meme coin hype with functional utility.

The presale is currently live at $0.0935 per $SNORT token, offering staking rewards with an APR exceeding 2650%, and pricing is set to increase in upcoming rounds. With early momentum and a rapidly growing crypto bot market, $SNORT is positioned as a potential 10x gem for the Solana ecosystem.

5. Avalanche (AVAX)

Avalanche is currently trading at $20.12, showing an intraday decline of 7.81%. It is down 25.39% from its 200-day simple moving average of $26.97 and 86% below its all-time high. Despite these bearish indicators, Avalanche continues to demonstrate strong liquidity, with a 24-hour volume-to-market cap ratio of 0.1174.

The 14-day Relative Strength Index (RSI) sits at 64.04, suggesting neutral momentum and the potential for sideways trading. Volatility remains low, with a 30-day average of just 7%, indicating relatively stable price movements in the short term.

Amid this market backdrop, Avalanche has partnered with Mogul to launch a tokenized real estate investment platform. This collaboration is led by Ava Labs and its CEO, Emin Gün Sirer. The initiative aims to expand access to real estate investment through blockchain technology, bringing over $22 million worth of assets on-chain.

Real estate:

Once the playground of moguls.Now? A playground for everyone. @mogul__club makes it possible—with blockchain, ambition, and a sharp eye for what’s next. pic.twitter.com/vqsPrlSNvz

— Avalanche🔺 (@avax) May 30, 2025

This development opens new possibilities for both retail and institutional investors. It could increase liquidity and lower the barrier to entry for real estate investing. Ava Labs has emphasized compliance and transparency as core parts of the platform, ensuring it aligns with regulatory requirements. This move represents a notable step in bridging traditional assets with blockchain infrastructure.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage