Join Our Telegram channel to stay up to date on breaking news coverage

At the U.S. Department of Energy’s loan office, Greg Beard, CEO of Stronghold Digital Mining, has assumed a key role in the mining and energy industry. This development demonstrates the increasing convergence of federal energy policies with Bitcoin mining operations.

As the cryptocurrency industry enters a new stage of growth and development, astute investors are focusing on altcoins that provide value beyond hype. A few notable tokens, Litecoin, Amp, Cardano, and Synthetix, received renewed attention on June 1st.

6 Best Altcoins to Watch Today

Is there a surge in undervalued opportunities, or are essential players already establishing dominating positions in their respective niches? This carefully chosen collection delves into tokens addressing pressing issues, from safe digital payments and collateralized transactions to scalable smart contracts and synthetic asset generation. These cryptocurrencies symbolize a distinct blockchain segment, whether you’re looking for long-term growth, utility, or the next big project.

1. Litecoin (LTC)

Litecoin, inspired by Bitcoin, was the second cryptocurrency launched in October 2011. Technically speaking, the Litecoin main chain uses a significantly altered version of the Bitcoin source. The coding variations result in reduced transaction fees, quicker transaction confirmations, and quicker mining difficulty retargeting.

Two of Litecoin’s distinctive features include its use of the Scrypt hashing method, which makes mining easier, and its quicker block generation time of 2.5 minutes as opposed to Bitcoin’s 10 minutes. Due to these characteristics, Litecoin is a favored option for faster transactions and lower fees.

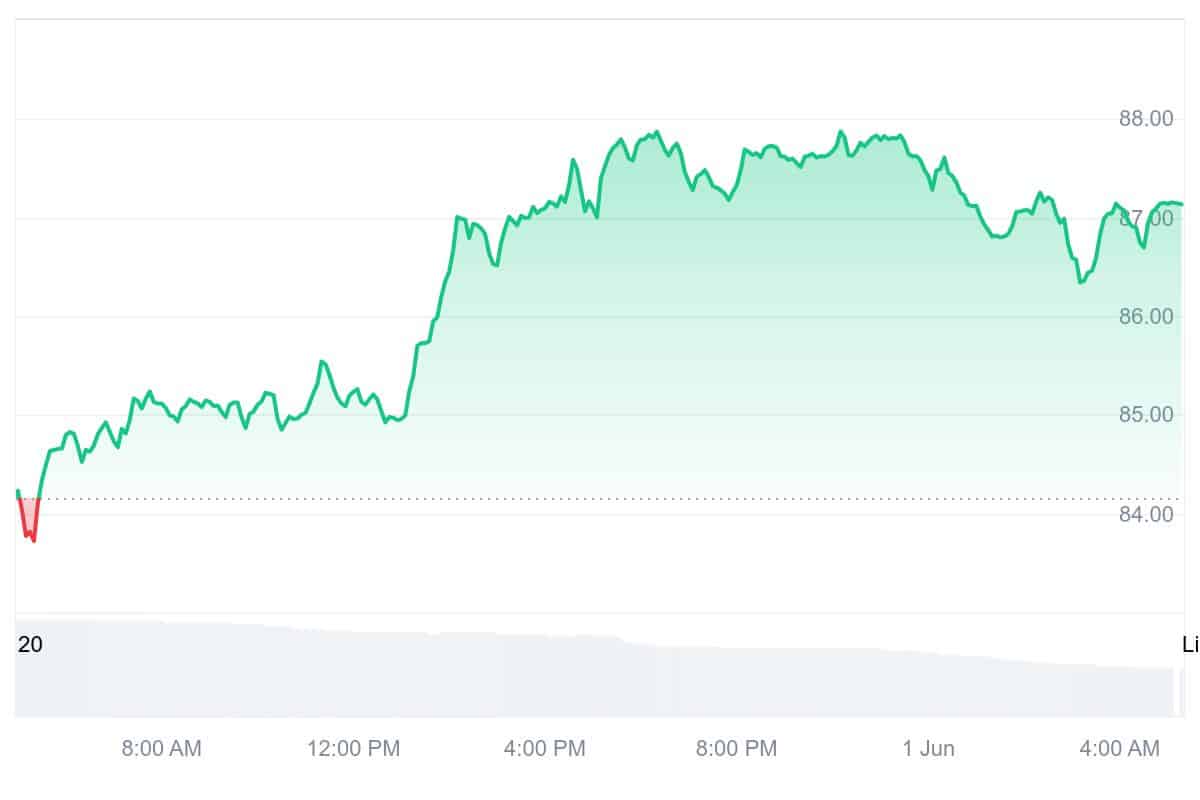

Over the last 30 days, the price of LTC has fluctuated, reaching a high of $106.00 and a low of $81.39. This indicates a volatility rate of 6.19%. Despite recent volatility, the Fear & Greed Index is at 56, indicating “Greed” in the market.

I'm cool now. https://t.co/KVl1ueDY25

— Litecoin (@litecoin) May 30, 2025

Its collaboration with Cardano on decentralized finance (DeFi) projects, which aims to improve the effectiveness of blockchain-based financial solutions, is a noteworthy step. Valour has introduced Litecoin Exchange-Traded Products (ETPs) on the Spotlight Stock Market to increase institutional exposure to LTC further.

2. Amp (AMP)

The digital collateral token Amp aims to enable quick, safe, and decentralized transactions on various blockchain-based payment systems. It is the original collateral asset of the Flexa Network and is essential to lowering settlement risk and guaranteeing transaction finality, which gives cryptocurrency payments practical applications.

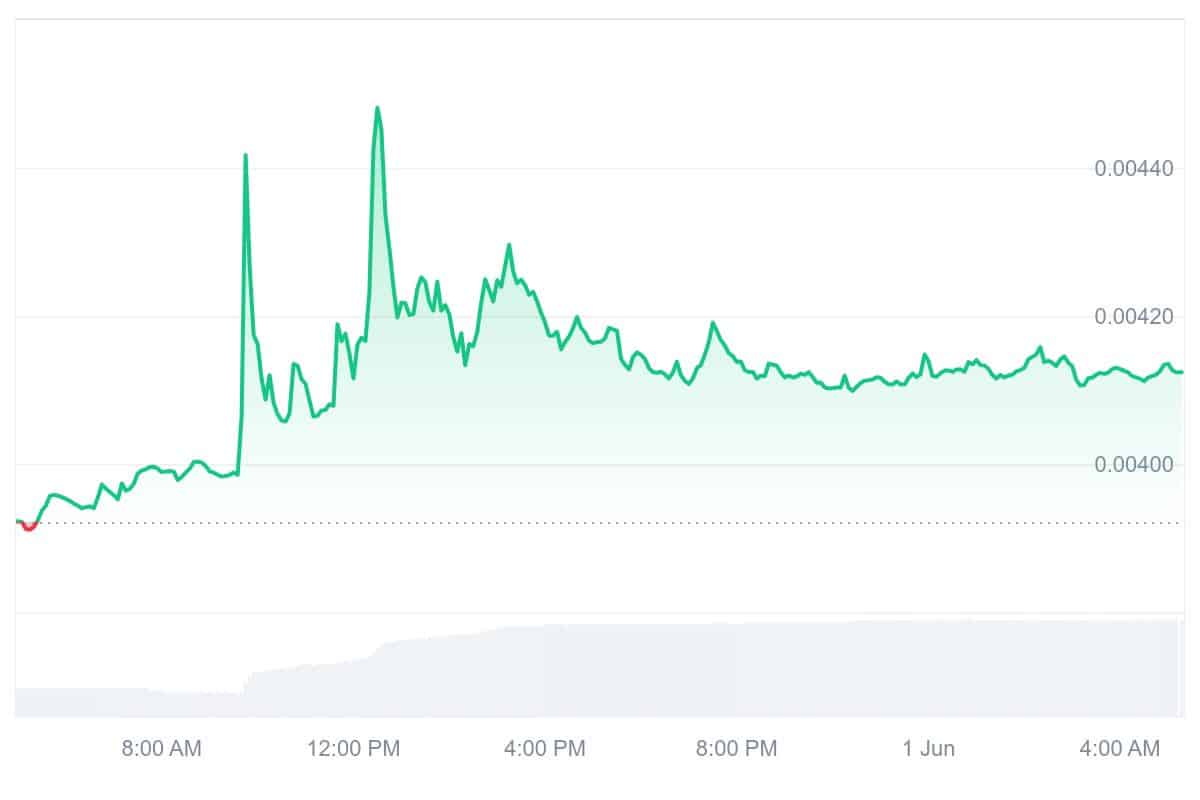

Amp lowers the risk of fraud and default by ensuring that transactions can be completed immediately through collateralization. This feature is advantageous for payment networks and merchants since it eliminates the need for conventional intermediaries and enables instant transaction finality.

Price projections for AMP indicate a possible rise in the future. According to CoinCodex, for example, Amp may rise by as much as 167.51% from its present price by December 2025, trading between $0.007296 and $0.011044. These estimates are susceptible to market volatility, just like any cryptocurrency.

#Consensus2025 was a movie… and it was only the beginning. #PoweredByAMP $AMP https://t.co/CThP9dg1XE

— Amp (@ampdotxyz) May 25, 2025

Amp just revealed a strategic alliance with a significant blockchain platform, allowing the AMP token to be integrated into their ecosystem. These partnerships increase the usefulness and uptake of Amp on a variety of platforms.

3. Cardano (ADA)

Cardano was created using a research-driven methodology and employs a novel proof-of-stake consensus process called Ouroboros, which is intended to be secure and energy-efficient. The platform’s tiered structure improves scalability and flexibility by keeping the settlement and computing layers apart.

The Cardano ecosystem recently formed a strategic cooperation with the Pontifical Catholic University of Rio de Janeiro (PUC-Rio) to further blockchain research and development. This partnership focuses on topics including digital assets, decentralized finance (DeFi), along with programs in the energy industry.

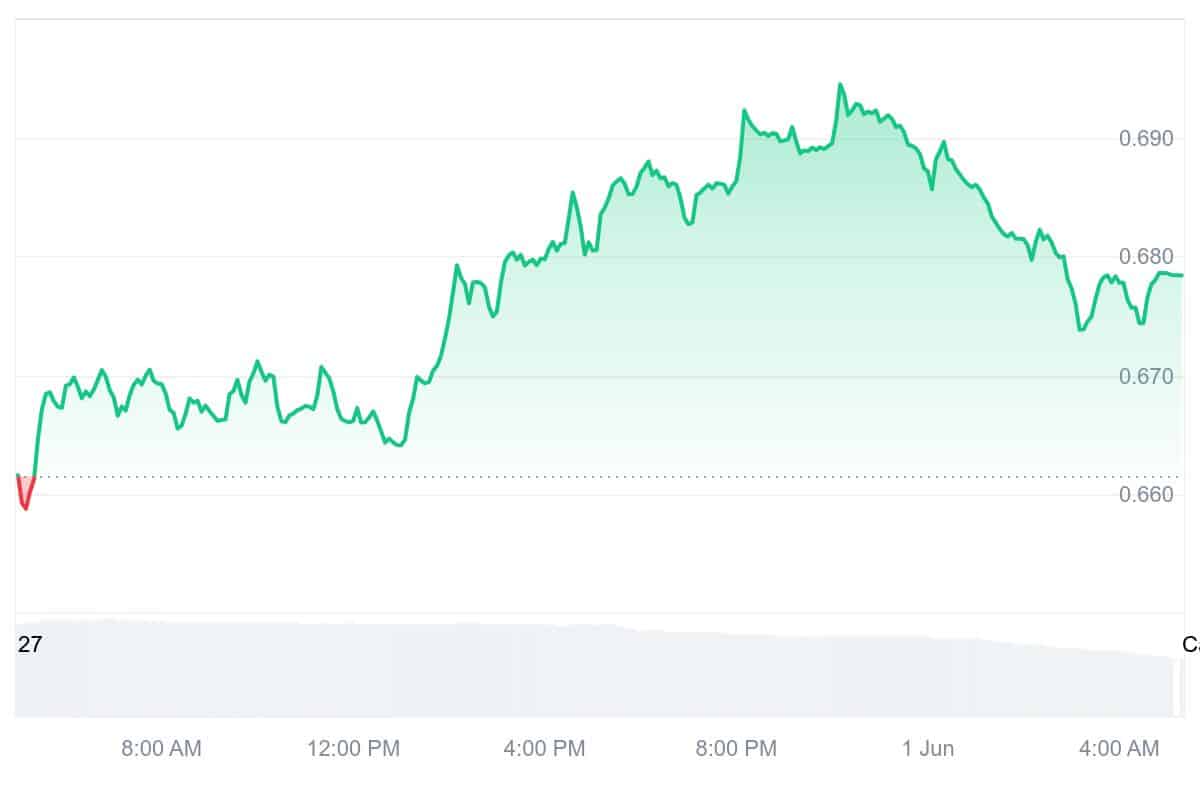

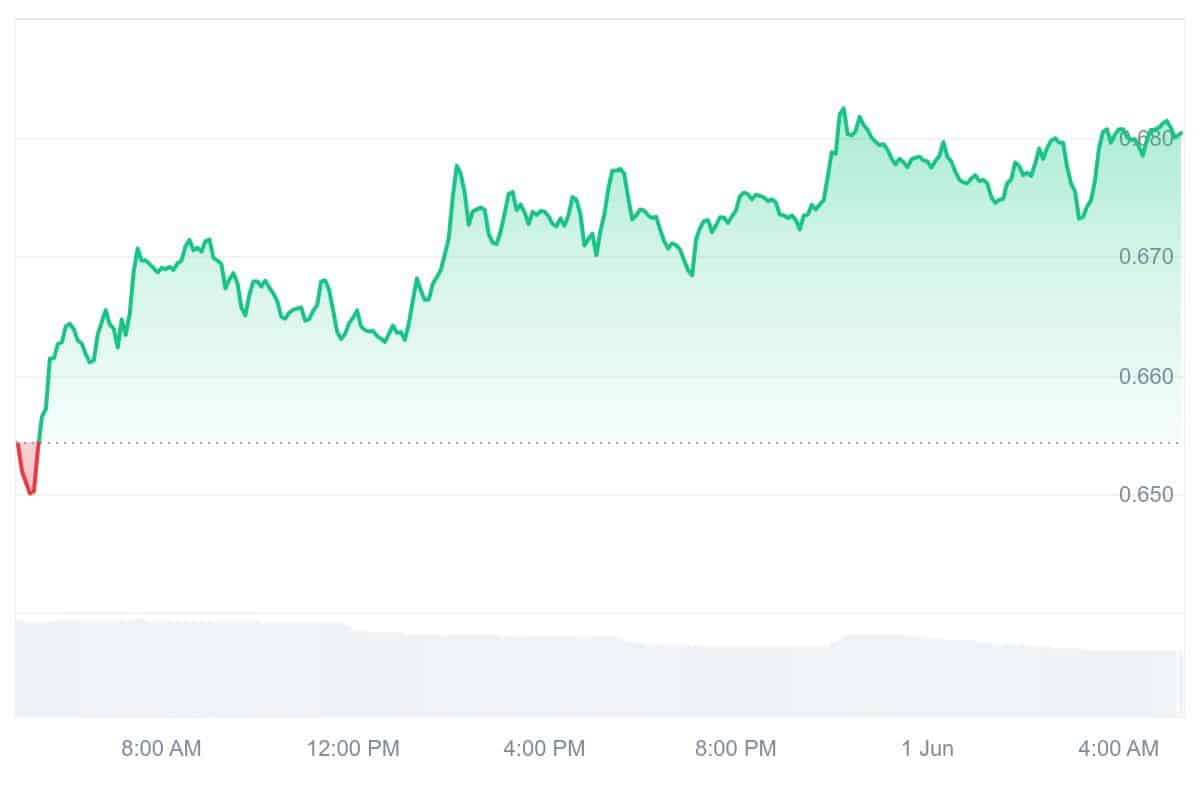

With a 24-hour trading volume of $1.10 billion and a market value of $23.97 billion, ADA is now trading at about $0.6786 as of June 1, 2025. Using market capitalization, this places ADA in the top tier of cryptocurrencies.

This is the kind of real-world impact Cardano was built for.

A Georgian vineyard. Anti-fraud QR tech. @Cardano’s blockchain securing the authenticity behind every bottle. 🍷

Brilliant article by @lido_phuffy. Raise a glass, and give it a read: https://t.co/PtlePmmWxV https://t.co/yEdVnMfaKC pic.twitter.com/bsvHnW7v0w

— Cardano Foundation (@Cardano_CF) May 29, 2025

Moreover, Cardano has been investigating partnerships to broaden the use of the RLUSD stablecoin and has proven the power of its Hydra Layer-2 protocol, surpassing 1 million transactions per second in a gaming test.

4. Synthetix (SNX)

Synthetix allows users to create and trade synthetic assets, which are tokenized derivatives that mimic the value of actual holdings like indices, commodities, and currencies. To improve accessibility and liquidity in the DeFi ecosystem, Synthetix plans to introduce conventional financial instruments to the blockchain by offering on-chain exposure to various assets.

To ensure the system’s solvency, users can mint synthetic assets (Synths) with SNX tokens backed by a collateralization ratio. This method enables exposure to a range of assets without requiring possession of the underlying asset, providing flexibility and diversity.

From its peak of $28.63 on February 14, 2021, to the current price of $0.6815, there has been a notable decline. With a 98% drop from the high, the present price may indicate undervaluation or market mistrust.

Synthetix is going all-in on Ethereum mainnet, staking just got a massive upgrade, and perps are evolving.

Learn what's happening at Synthetix in our next Biweekly community call. You’ll want to hear this one.

📅 June 4, 22:30 UTC

🎙️ On X Spaces: https://t.co/9Qt7HyZm50 pic.twitter.com/5wv1XaJH2O— Synthetix ⚔️ (@synthetix_io) May 28, 2025

Aiming to incorporate options and improved perpetual trading into its ecosystem, Synthetix recently proposed a $27 million acquisition of Derive, a decentralized options platform. However, the deal has been suspended because of community concerns about the exchange rate and overall benefits. Synthetix also introduced sUSD staking with 5 million SNX in rewards to reduce sUSD circulation and foster liquidity.

5. Solaxy (SOLX)

The SOLX token presale is still going well and has raised more than $42 million so far. This outstanding number demonstrates the community’s strong support and investors’ faith in the project’s prospects. The presale will end in a few weeks, so early adopters will only have a short window of time to purchase SOLX tokens at a competitive price.

Do you know the $SOLX whitepaper inside and out? 🛸🪐

Refresh your memory here 👇https://t.co/arr34146aR pic.twitter.com/UeOB408WUk

— SOLAXY (@SOLAXYTOKEN) May 31, 2025

Scalability is only one aspect of Solaxy‘s creative strategy. With the introduction of the Igniter Protocol, the platform enables SOLX holders to produce and distribute their own tokens, promoting a thriving network of meme coins and decentralized apps. By connecting Solana and Ethereum, Solaxy’s multichain feature gives users unmatched freedom and access to both networks’ enormous liquidity.

SOLX offers an alluring prospect for individuals who are thinking about entering the cryptocurrency market or who want to diversify their holdings. Given its special fusion of technological innovation, community involvement, and strategic placement within the Solana ecosystem, this project has much room to develop.

6. Jito (JTO)

Developed on the Solana blockchain, Jito is a decentralized finance (DeFi) system that seeks to maximize user incentives and optimize liquid staking. By introducing extensive DeFi connections and MEV-optimized infrastructure, it tackles issues with staking efficiency and liquidity, providing unparalleled staking performance and liquidity.

Its capacity to offer MEV-optimized infrastructure, which improves staking effectiveness and liquidity on the Solana network, is Jito’s specialty. By incorporating MEV tactics, Jito hopes to preserve network security and decentralization while optimizing staker payouts.

"JitoSOL is the only LST on Solana that enables a user to instantly execute a $10M sell and have it absorbed for under 4 basis points of slippage."

Analysis by @push_xx ON–341: Liquid Staking on @ournetwork__: https://t.co/bljkK3Oxjv pic.twitter.com/FT56NF26Cp

— Jito (@jito_sol) May 29, 2025

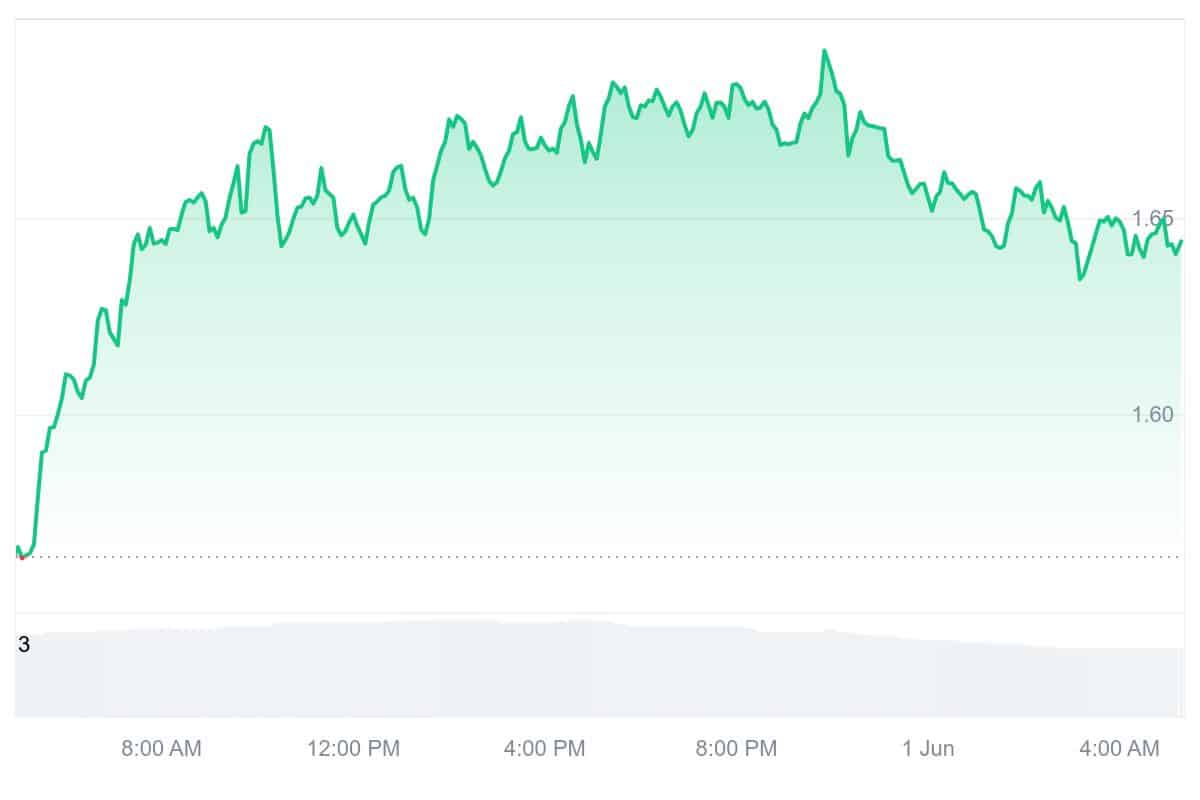

Over the past 24 hours, the token’s price has increased by 5.32%. It is still 69% lower than its peak of $5.26, which was attained on April 3, 2024. 334.70 million JTO are currently in circulation, 33% of the 1 billion available tokens.

Jito recently revealed that the LA Mad Drops of Major League Pickleball will be their new front-of-jersey sponsor, introducing the Solana DeFi to one of America’s fastest-growing sports.

Learn More

Join Our Telegram channel to stay up to date on breaking news coverage