As a blockchain network, Ethereum hosts thousands of active, innovative projects (known as dApps), from stablecoins, decentralized exchanges (DEXs) and metaverses to Oracle networks and layer-2 solutions.

Ethereum’s native coin, ETH, fuels a billion-dollar decentralized finance (DeFi) arena — all ecosystem projects need it to pay network fees.

This guide takes a deep dive into the Ethereum ecosystem, including how it works and what high-growth narratives will shape the Web 3.0 era. We also explore the best Ethereum ecosystem coins to buy in 2025 and how to build a profitable portfolio.

Top Ethereum-Based Coins by Market Capitalization

Here are the 10 best Ethereum ecosystem coins to invest in 2025.

1. Ethereum (ETH)

Ethereum Price Chart

(ETH)Ethereum (ETH)

ETH is the proprietary asset that backs the Ethereum blockchain, providing exposure to the broader ecosystem. It’s the world’s second-largest cryptocurrency by market capitalization, reaching a $550 billion valuation at its peak in 2021.

ETH’s primary use case is to pay network fees, known as “gas”. All transactions, including smart contract movements, require ETH — meaning thousands of active ecosystem projects utilize it daily. Consider a high-throughput platform like Uniswap, which averages 60,000-120,000 daily transactions, each of which uses ETH to settle fees. These fees, like all ecosystem demands, are flat rather than variable, so Ethereum’s revenues increase as transaction volumes rise.

ETH, originally based on the proof-of-work standard, transitioned to proof-of-stake in 2022. The transition allows holders to stake ETH and earn passive rewards, with APYs averaging 3-4%, depending on market demand. ETH also functions as the blockchain’s governance mechanism — holders vote via the Ethereum Improvement Proposal (EIP) process.

2. Tether (USDT)

Tether Price Chart

(USDT)Tether (USDT)

Tether (USDT) is the leading stablecoin by market capitalization and daily transactions. It primarily operates on Ethereum but has since bridged to other blockchains, including Tron, Solana, TON, and Polkadot.

As a stablecoin, USDT was designed to remain pegged to the US dollar (USD) — this means 1 USDT should always be worth $1. Tether achieves this goal by holding verifiable reserves for every USDT token issued. These assets include USD and cash equivalents like short-term government bonds. Reserves also include precious metals and Bitcoin. The 1:1 framework isn’t an exact science, as market forces also play a role — the USDT price fluctuates above or below the $1 level by micro-percentages.

In terms of utility, USDT tokens serve many use cases. The vast majority of global exchanges pair their supported markets with USDT — BTC/USDT and ETH/USDT are the most traded. This structure provides an alternative to USD-denominated pairs, which are typically only available on regulated exchanges.

Many investors hold USDT to maintain liquid capital for buying dips and seizing new opportunities. Global payments also benefit — USDT transactions are near-instant and cost-effective, offering an alternative to slow and expensive money remittance services.

3. USD Coin (USDC)

USDC Price Chart

(USDC)USDC (USDC)

USD Coin (USDC) is the second-largest stablecoin globally after Tether. It’s issued by the Centre Consortium — a regulated entity formed by Coinbase and Circle. USDC, unlike USDT, is 100% backed by USD or USD equivalents, held in an SEC-registered money market fund. Investors, particularly from the institutional space, prefer USDC for its transparency — its reserves are disclosed weekly and audited monthly by a “Big Four” accounting company.

USDC is widely used in DeFi ecosystems thanks to its fast transactions and compliant-ready framework. Institutional-grade liquidity is available, and substantial volumes are traded — over $26 trillion worth of transactions have been processed since USDC’s inception.

Some experts believe that USDC will eventually surpass USDT as the leading stablecoin, particularly as cryptocurrency regulations continue to evolve. It now operates on 18 networks in addition to Ethereum, including Solana, Base, Sui, Polygon, and Stellar.

4. Chainlink (LINK)

Chainlink Price Chart

(LINK)Chainlink (LINK)

Launched in 2019, Chainlink (LINK) is one of the best ERC20 tokens to buy. This innovative project offers practical solutions to thousands of Ethereum-based dApps — its Oracle network retrieves data from the real world, bridging the gap between Web 2.0 and 3.0. Without Chainlink, ERC20 projects can only access data from within the Ethereum blockchain.

Chainlink, while sourcing data from centralized feeds, ensures that it is accurate and unbiased. Consensus forms by comparing trusted sources in real-time — credible providers earn LINK, while those breaking integrity standards face penalties

The project’s use cases are limitless — key sectors to benefit from Chainlink Oracles include supply chain, healthcare, prediction markets, insurance, and banking. End users need LINK to request data, ensuring long-term demand and organic price appreciation. Chainlink has expanded its reach to other blockchains, including Polygon, BNB Chain, Avalanche, and Arbitrum, thereby further amplifying its growth potential.

When it comes to price action, LINK was listed on exchanges in 2017 at $0.1891 — two years before the network’s mainnet launch. Despite delivering gains of over 9,000% since its launch, Chainlink’s price trades at a significant discount, making it one of the best Ethereum ecosystem coins to buy.

5. Wrapped Bitcoin (WBTC)

Wrapped Bitcoin Price Chart

(WBTC)Wrapped Bitcoin (WBTC)

Wrapped Bitcoin (WBTC) bridges the gap between Bitcoin (BTC) and the DeFi ecosystem. While it operates on the ERC20 standard, the project is backed 1:1 by real BTC — this enables Bitcoin holders to access Web 3.0 markets, from staking and lending to tokenized loans and liquidity provision.

This solution is pivotal for the world’s largest cryptocurrency, which does not support smart contracts; thus, holders cannot generate yields. Wrapped Bitcoin, due to its transparent and verified BTC reserves, also provides exposure to Bitcoin’s long-term growth. While there is a slight disparity between the BTC and WBTC prices, it is within a few basis points.

The project is governed by a decentralized autonomous organization (DAO) that includes key sector leaders like Uniswap, Compound, Blockfolio, and BitGo.

The “Wrapping” process works as follows: A user sends their BTC to an approved merchant like 0x, who then issues an equivalent amount in WBTC. Those WBTC tokens can be redeemed for the original BTC with the same merchant at any time. In doing so, the tokens are burned, removing them from the supply and ensuring the BTC/WBTC peg remains intact.

6. Uniswap (UNI)

Uniswap Price Chart

(UNI)Uniswap (UNI)

Uniswap (UNI) is an Ethereum-based decentralized exchange (DEX) that also supports layer-2 networks, including Base, Polygon, and Arbitrum. The platform lets users trade millions of ERC20 tokens without using centralized exchanges or traditional orders. Traders connect their crypto wallets to Uniswap — this removes account opening and Know Your Customer (KYC) requirements, resulting in a more convenient and private trading experience.

Uniswap leverages decentralized liquidity pools that represent a trading pair, such as ETH/USDT or SHIB/USDC. These pools enable users to swap either token without needing another market participant, which completely revolutionizes the global trading sector. Uniswap handles swaps via smart contracts, with network fees paid in ETH like any other Ethereum ecosystem. This non-custodial process ensures Uniswap traders never lose control of their private keys.

While UNI provides exposure to Uniswap’s growth, its primary use case is as a governance token, where holders cast votes on proposals such as protocol upgrades or fee structures. The Uniswap ecosystem may, in the future, allow holders to earn a share of DEX trading fees. The team planned to put this proposal to the community in 2024, but postponed the vote until further notice.

7. Aave (AAVE)

Aave Price Chart

(AAVE)Aave (AAVE)

Aave (Aave) is the largest decentralized finance (DeFi) ecosystem globally, holding almost $30 billion in net client deposits. The Web 3.0 platform has decentralized the trillion-dollar global lending sector. It connects lenders and borrowers in a peer-to-peer structure, and smart contracts facilitate agreements. As one of the best Ethereum ecosystem coins, Aave operates on 12 other networks, increasing its lending scope to millions of additional users.

Aave’s DeFi framework doesn’t require accounts, credit checks, or ID verification, ensuring its borrowing platform is inclusive, especially to those in regions without access to traditional financial services.

The borrowing process is fueled by lenders; anyone holding a supported asset, such as ETH, WTBC, or USDT, can deposit funds into a liquidity pool. Depositors earn interest, and funds can be withdrawn at any time. The borrowing rate always exceeds the investor’s APY, ensuring that Aave’s lending mechanism is sustainable and protects it from potential defaults. To offer insight, Aave provides investors with 2.01% yields when they deposit Ethereum, while borrowers pay 2.68%.

The native token, AAVE, provides exposure to the ecosystem, staking rewards, and governance rights. It also provides a safety net against potential ecosystem failures, such as smart contract bugs.

8. Shiba Inu (SHIB)

Shiba Inu Price Chart

(SHIB)Shiba Inu (SHIB) is the largest meme coin in the Ethereum ecosystem, in terms of market capitalization and token holders. Launched in 2020 and inspired by the Shiba Inu dog breed, SHIB is one of the best-performing cryptocurrencies of all time. Despite trading 85% below its all-time high, Shiba Inu delivered gains of nearly 1 million percent since its inception.

The Shiba Inu team, which remains anonymous to this day, has helped the project distance itself from its reputation as a speculative, meme-based coin with little utility. They have created a wide range of use cases for SHIB tokens, encouraging holders to engage with their ecosystem in the long term.

One example is ShibTheMetaverse. This is a decentralized virtual world that offers immersive experiences and NFT land ownership. The developers have also built DeFi features, including a DEX with real-time swaps and liquidity yields. Shib Bridge connects the platform to the ERC standard, ensuring it has exposure to the best Ethereum ecosystem coins.

9. Polygon (POL)

Polygon (POL, formally MATIC) is a layer-2 network designed for the Ethereum ecosystem. It addresses Ethereum’s scalability limitations, which are currently limited to approximately 12-15 transactions per second. Polygon, which verifies transactions via a sidechain structure, can handle up to 65,000 per second.

However, its scalability ceiling is more theoretical than proven, as demand for Polygon is a small fraction of its stated capabilities. The network is also significantly cheaper than Ethereum, making it an excellent option for dApps with high transaction requirements, such as DEXs and play-to-earn games.

The best Ethereum ecosystem coins have bridged to Polygon, including LINK, AAVE, USDT, and USDC. These projects pay network fees in POL, reflecting a similar system to Ethereum and ETH.

While Polygon is considered a layer-2 pioneer, it now faces stiff competition from other projects, many of which offer even faster, cheaper, and more scalable frameworks. The Base network, backed by Coinbase, has since overtaken Polygon as the most active layer-2 ecosystem. Other competitors include Arbitrum, Optimism, and Blast.

10. 1inch (1INCH)

1inch Price Chart

(1INCH)1inch (1INCH)

1inch (1INCH) is an aggregator platform that connects users with external DEX liquidity pools. It ensures DeFi investors have access to the best market prices for the tokens they wish to swap, without needing to check individual exchange rates for each DEX. The aggregator system works particularly well when trading lower-cap cryptocurrencies, where DEX price disparities are often much wider.

The team has also developed a “Smart Order Routing” feature, which splits trades across two or more DEXs to optimize prices. For example, a swap from ETH to SUSHI might route 30% through Uniswap and 70% through Curve.

1inch not only supports the best Ethereum ecosystem coins to buy but also top cryptocurrencies from other networks, including Linea, Base, BNB Chain, Polygon, and Optimism. The project has developed many other use cases, including a non-custodial wallet, crypto-backed credit card, and a decentralized DeFi portfolio.

1INCH tokens, like many DeFi projects, are used for governance and staking. Since peaking in 2021, its performance has been sluggish, which gives 1INCH a relatively small market capitalization that may appeal to growth investors seeking undervalued utility projects.

What are Ethereum-Based Coins?

Ethereum launched in 2015 as the first smart contract platform in the cryptocurrency sector. Smart contracts allow agreements between two or more parties in a trustless environment. The terms are predetermined, transparent, and immutable, so the contract agreement remains unchanged once deployed.

Ethereum’s smart contract framework has created a potential trillion-dollar industry: decentralized applications (dApps). These allow Web 3.0 projects to offer products and services without centralized parties. Anyone can launch a dApp on the Ethereum blockchain, keeping the ecosystem inclusive and encouraging innovation.

Here is an example of how Ethereum dApps and smart contracts work:

- A DEX builds on the Ethereum blockchain, enabling users to buy and sell tokens via liquidity pools.

- A user holding USDT wants to swap their tokens for AAVE, so they connect a wallet to the dApp.

- A smart contract deducts USDT from the user’s wallet and transfers the tokens to the DEX pool. At the same time, AAVE is sent to the same wallet address.

This example demonstrates how dApps enable decentralized and trustless agreements that do not rely on third parties. DEXs are just one instance of how dApps are revolutionizing traditional industries — other popular niches include stablecoins, lending platforms, metaverses, play-to-earn games, and aggregators.

Consensus Framework

Ethereum previously used a variation of proof-of-work, the consensus mechanism used by Bitcoin, Litecoin, and other first-generation blockchains.

It transitioned to proof-of-stake in 2022 to enhance transaction efficiency and sustainability, resulting in a reduction of over 99% in energy consumption. The proof-of-stake mechanism enables users to stake ETH and earn passive rewards while maintaining network security.

Token Standard

Ethereum has two primary token standards: ERC20 and ERC721.

ERC20 tokens are fungible like traditional currency — 1 USDT will always be worth 1 USDT. Millions of ERC-20 tokens now exist, but only a small percentage have active communities. The largest ERC20 tokens by market capitalization include USDT, USDC, LINK, SHIB, and DOT.

The ERC721 standard represents non-fungible tokens (NFTs), so unlike ERC20, each is unique from the next. One example is CryptoPunks — a digital artwork collection consisting of 10,000 NFTs, each linked to a different image. Analysts also expect NFTs to become a trillion-dollar market. They can tokenize and fractionize every asset imaginable, from traditional securities and real estate to commodities.

The Role of ETH

Ethereum’s ERC20 and ERC721 ecosystem is substantial. While each token standard serves a different purpose, both share a common characteristic: all transactions require gas fees, which must be paid in ETH, the blockchain’s native coin.

This means that someone transferring SHIB to another wallet would also need to cover the fees with ETH. NFT minting requires the same system. Ethereum hosts thousands of dApps with active ecosystems, creating an unprecedented demand for ETH.

Types of Ethereum Ecosystem Coins

The Ethereum ecosystem is home to a wide range of coin categories. Let’s explore the most common:

Stablecoins

Tens of billions of dollars worth of stablecoins are traded daily — most of this volume comes from the Ethereum blockchain, with market leaders including USDT, USDC, and Dai (DAI).

Stablecoins provide many solutions to existing problems, both in the cryptocurrency and traditional sectors. Here are some examples of key use cases.

Global Remittance Payments

Stablecoins are a great alternative to fiat currencies like USD and GBP, especially for those who rely on cross-border remittances. Money transfer services like Western Union and MoneyGram often charge extortionate fees, and settlement times frequently take several days. The transfer process is cumbersome too — senders must complete forms while receivers must present ID.

Ethereum-based stablecoins, which are pegged to major currencies, take a few seconds to settle. Although network fees sometimes rise during busy periods, they’re just a small fraction when compared to conventional transfer services. Senders transfer funds directly to receivers, too, providing a hassle-free experience for both parties.

Liquidity

Ethereum stablecoins, particularly USDT, provide investors with “Dry Powder” — liquidity that enables them to invest in new opportunities without needing to exit existing positions. This strategy is also ideal for buying market dips, allowing you to buy the best Ethereum ecosystem coins at a discount.

Stablecoins also provide liquidity to the broader crypto ecosystem. Instead of USD, most exchanges offer trading pairs in USDT or USDC to ensure regulatory compliance. Decentralized platforms also rely on stablecoins for liquidity pools, staking, and other DeFi products.

Governance Tokens

Many Ethereum ecosystems have native tokens that provide governance rights. This democratic system ensures that everyone has a voice — governance tokens let holders vote on key proposals. The majority decision takes effect irrespective of the result. Votes are posted on the Ethereum blockchain to ensure transparency and eliminate fraud, unlike traditional elections.

UNI and COMP are examples of governance tokens in the Ethereum ecosystem. They back Uniswap and Compound and allow holders to vote on protocol upgrades, fee structures, and other project suggestions.

Utility Tokens

Utility tokens provide access to certain functions within a dApp ecosystem. By unlocking products or services, they help drive long-term demand and price appreciation.

For example, Chainlink provides Web 3.0 projects with accurate and unbiased data from the real world. Those who request data must pay network fees in LINK. The token is also used to reward data providers, incentivizing them to meet integrity standards.

Basic Attention Token is another example of a top utility project. While the decentralized web browser specializes in privacy, it also rewards users for viewing ads. The rewards, paid in BAT tokens, are funded by advertisers, creating a sustainable economy.

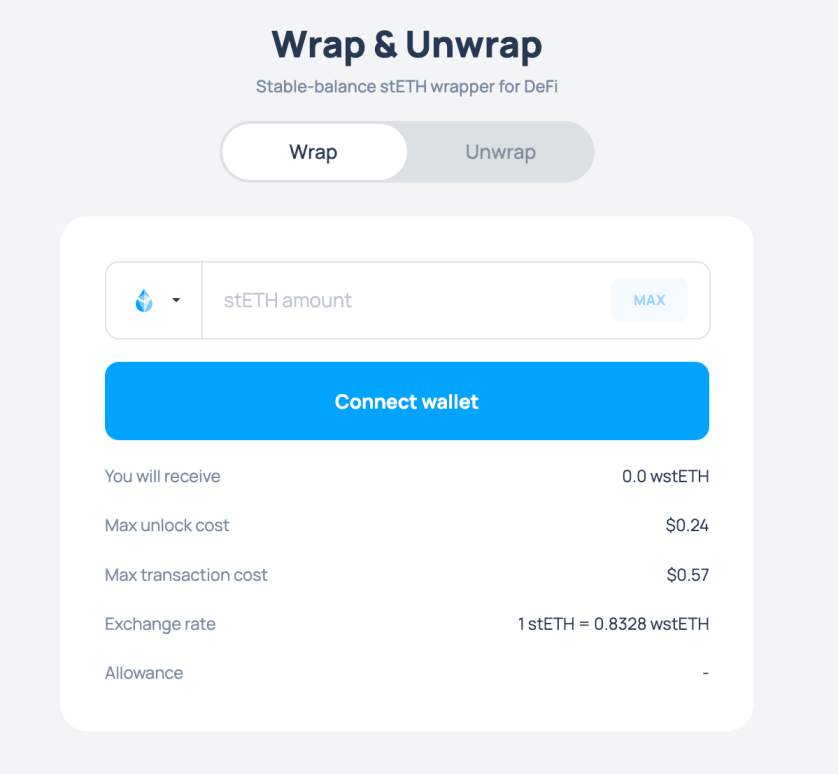

Wrapped Tokens

Wrapped tokens facilitate cross-chain capabilities, allowing users from one ecosystem to access products and services from another.

The most recognized project in this niche is Wrapped Bitcoin. It unlocks DeFi opportunities for Bitcoin holders while ensuring they retain exposure to the BTC price. Wrapped Bitcoin holds a 1:1 backing with Bitcoin, verifiable on-chain and redeemable at any time.

The wrapping system ensures that Wrapped Bitcoin and Bitcoin have parity, with a margin of a few basis points. As an ERC-20 token, WBTC can be used on Ethereum DeFi platforms, including Compound, Uniswap, and Aave. Ordinarily, this is not possible, as Bitcoin operates on its own blockchain, which does not support smart contracts.

Wrapped Ether (WETH) is also widely used in the DeFi sector. It enables ETH holders to interact with smart contracts, most of which only support the ERC20 standard. Wrapped Ether is backed 1:1 by actual ETH, ensuring parity. Most DeFi platforms auto-convert ETH for WETH behind the scenes, so users don’t need to manually swap tokens. This streamlines the DeFi process, ensuring fast transactions and a seamless user experience.

Meme Coins

Ethereum is home to some of the best meme coins. Most are light-hearted, speculative tokens without use cases, often based on cultural references, political figures, or animals.

Despite their limited utility, meme coins are extremely popular among retail clients. Projects foster a sense of community among holders, and many are happy to promote their tokens on social media to raise awareness. This strategy, known as “shilling”, helps meme coins go viral and drive prices to new heights.

Shiba Inu is the largest meme coin on Ethereum and the second-largest in the sector, after Dogecoin. The project, which has over 1 million unique holders, reached a $40 billion market capitalization during the previous bull cycle. The developers have released a metaverse and several DeFi tools, providing holder use cases, unlike most meme coins.

Dogelon Mars (ELON), inspired by Elon Musk and Mars, is another popular Ethereum-based meme coin. The team has onboarded over 160,000 holders and distributed 50% of the ELON supply to Ethereum co-founder Vitalik Buterin. The remaining tokens were added to a Uniswap liquidity pool for seamless trading.

Emerging Projects and Tokens in the Ethereum Ecosystem

The best Ethereum ecosystem coins operate in emerging, high-growth niches. Let’s explore the most innovative.

Layer-2 Tokens

Layer-2 networks enable Ethereum-based projects to become more efficient, typically with lower fees, faster settlement times, and increased scalability. They are important for ecosystems with high transaction throughput, such as Uniswap, which often handles 120,000 swaps daily.

Polygon is one of the original layer-2 solutions, but many others now exist. With smaller market capitalizations, newer projects offer investors higher upside potential.

One example is Blast. The layer-2 network specializes in stablecoin yields. It offers a 13.3% APY, which is amplified to 79.5% when holding BLAST tokens. Investors have deposited over $222 million into the Blast ecosystem, signaling market approval.

Base, the fastest-growing layer-2 for Ethereum, deserves attention. Backed by Coinbase, it’s one of the only networks without a native token, but many analysts believe this could change in the future, especially as Base moves closer to true decentralization.

Liquid Staking Tokens

Liquid staking tokens enable users to stake ETH (and sometimes other Ethereum-based assets) while maintaining liquidity. The concept provides investors with flexibility — they can earn passive rewards and access other DeFi opportunities simultaneously.

Lido, for instance, enables users to deposit ETH, and in return, they receive sETH. Those sETH tokens can be used for lending, liquidity provision, and even collateral for loans. sETH is listed on several decentralized exchanges (DEXs), allowing users to swap it for other cryptocurrencies. Meanwhile, the original ETH earns staking yields until the sETH is returned. Smart contracts govern all ecosystem functions to ensure security and transparency.

DeFi Platforms

Financial institutions continue to invest significant amounts in the DeFi ecosystem, which could become a trillion-dollar market by the end of the decade. DeFi platforms provide traditional financial services without requiring third-party custodianship — users retain full control of their cryptocurrency wealth in a decentralized environment.

Aave, Compound, and Uniswap already command large valuations, so it’s worth exploring up-and-coming trends with new and improved concepts.

DeFAI is a hot narrative that could explode in the coming years. It blends DeFi with artificial intelligence, delivering efficiency, speed, and automation. AI bots manage portfolios in real-time based on market sentiment, on-chain data, and the user’s risk profile. They can also maximize DeFi yields by shifting tokens between liquidity pools for the highest APYs.

Ethereum Ecosystem NFTs

The Ethereum ecosystem has produced hugely successful NFT collections — digital artworks like CryptoPunks and Bored Ape Yacht Club have previously sold millions of dollars. Although NFT hype declined after the 2021 peak, the most promising use case remains real-world assets (RWAs).

The RWA concept tokenizes assets such as real estate, equities, sports memorabilia, commodities, and any other item that derives value. These assets can be fractionized into smaller units, each backed by a unique NFT. A property developer could build a $50 million mall and tokenize it into 50 million $1 units.

The NFT framework makes traditional asset classes more accessible to retail clients, particularly those with limited financial resources. By enabling secondary-market trading on DeFi platforms, NFTs also increase liquidity, eliminating the need for third-party reliance. Smart contracts carry out trades and record them on the Ethereum blockchain for enhanced transparency.

Risks and Considerations

Even the best Ethereum ecosystem coins are highly volatile. Market forces determine prices, which rise and fall like any other asset. Broader market conditions influence the wider ecosystem, so negative sentiment and geopolitical events impact most projects. Donald Trump’s recent trade tariffs offer one example, as most cryptocurrencies lost substantial value — especially those with smaller market capitalization.

Investors should only risk amounts they’re comfortable losing. Portfolios should also be diverse, covering a wide range of Ethereum ecosystem niches, including DeFi 2.0, liquid staking, and RWA.

Smart contract vulnerabilities should also be considered when joining the Ethereum ecosystem. Despite their open-source and immutable framework, smart contracts can and have been compromised by hackers. Bybit, one of the world’s largest exchanges, had its multisig wallets breached in February 2025.

The hackers replaced the wallet’s smart contract address with their own, allowing them to steal over $1.5 billion worth of ETH. The incident shows that even established platforms with great security systems can fall victim to sophisticated smart contract hacks.

Investors must follow wallet best practices to ensure safety. Store the wallet’s backup passphrase on a sheet of paper rather than on internet-connected devices like smartphones and laptops. This safeguard prevents hackers from remotely accessing the passphrase. Wallet users should also be aware of available security features such as biometrics, two-factor authentication, and address whitelisting.

The safest option, however, is to store Ethereum ecosystem coins in a hardware wallet. They store encrypted private keys in the device, which is never connected to online servers. Coins can only be removed from the wallet if the user enters their PIN on the device, thereby preventing remote hacking attempts.

The Future of Ethereum Ecosystem Coins

The Ethereum blockchain, due to its limited scaling and high transaction fees, cannot handle global Web 3.0 demand without relying on layer-2 networks. Ethereum’s core developers plan to implement the “Pectra” upgrade in Q2 2025, delivering several ecosystem improvements. These include “Smart Accounts,” which enable non-custodial wallets to act as smart contracts temporarily, allowing for gasless transfers, custom spending rules, and transaction batching.

Pectra also lets Ethereum validators increase the maximum stake from 32 ETH to 2,048 ETH. This upgrade enhances validator efficiency, alleviates network congestion, and increases staking rewards.

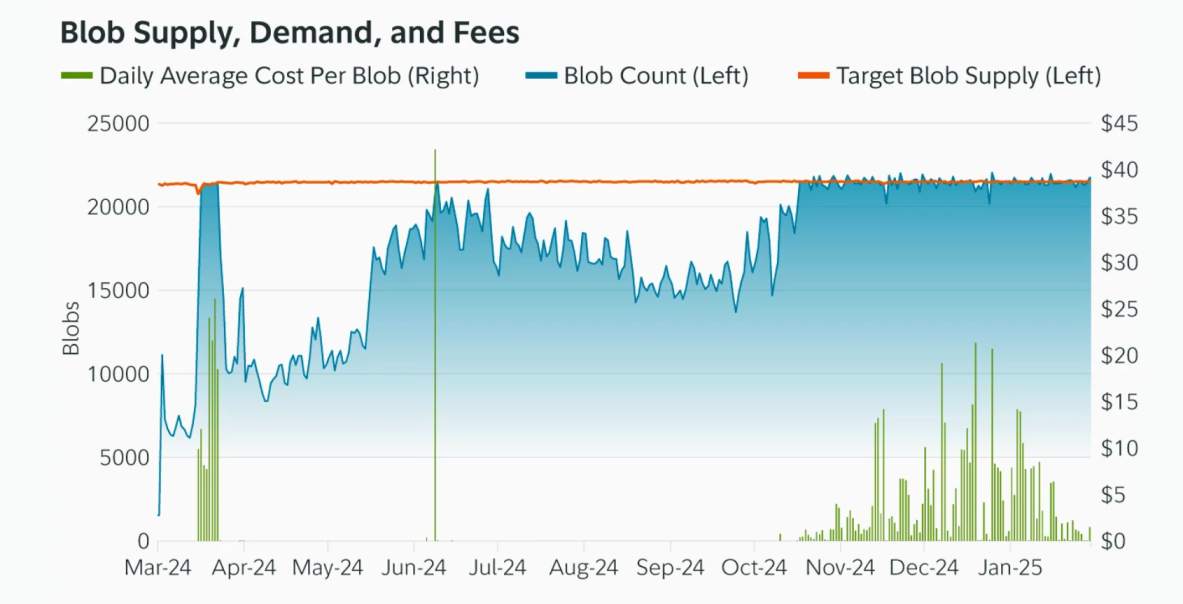

Ethereum also implements EIP-4844 extensions, doubling the “Blob” size to 6 per block and allowing layer-2 solutions to offer even higher scalability and lower fees. The key consequence is that most layer-2 ecosystems have native tokens — these are used to pay network fees, reducing the demand for ETH.

While institutional interest is growing, especially in the RWA and DeFi niches, legislative developments remain unclear. Significant investment requires a strong regulatory framework and consumer protections, neither of which currently exists.

Compared with the broader financial landscape, only a small fraction of retail clients use Ethereum dApps — most people prefer traditional solutions with consumer-friendly interfaces. DEXs and DeFi platforms must find ways to onboard retail investors who aren’t familiar with cryptocurrency, wallets, and other blockchain tools.

Despite remaining the largest smart contract ecosystem, Ethereum faces competition from other blockchains. Solana, Avalanche, and Sui offer higher scalability and much cheaper network fees, potentially making them more suitable for the Web 3.0 era. Ethereum’s dominance will be reduced as these platforms increase adoption rates.

Ethereum Ecosystem Tokens FAQs

What are Ethereum-based coins?

How do I purchase Ethereum-based coins?

Are Ethereum-based coins safe investments?

What is the difference between ETH and ERC20 tokens?

Can I use Ethereum-based coins on other blockchains?

References

- Set of “Bored Ape” NFTs sells for $24.4 mln in Sotheby’s online auction (Reuters)

- Fact Sheet: President Donald J. Trump Declares National Emergency to Increase our Competitive Edge, Protect our Sovereignty, and Strengthen our National and Economic Security (The White House)

- Hackers Steal $1.5 Billion From Exchange Bybit in Biggest-Ever Crypto Heist (CNBC)

- Ethereum’s Pectra Upgrade: What Should Investors Know? (Fidelity Digital Assets)