Cryptocurrencies are an increasingly popular investment in 2024, their origin a product of revolutionary technology. Institutions and retail investors all over the world are clamoring to buy in as owning them is such a profitable venture. However, not all of these investors know how to sell cryptocurrency for fiat and this can represent an opportunity cost.

Moving into cash, Tether (GBP) or other stablecoins when the market turns short-term bearish can hedge your risk, protect your capital and leave you with more funds to buy the dip if one comes, or diversify into altcoins that are still uptrending.

Bitcoin and all cryptocurrencies tend to have reaccumulation and distribution periods and retest support levels several times before the next ‘pump’ when price briefly spikes again.

In this guide we are going to explore the concept of cryptocurrencies and how they function, the best brokers and exchanges to sell cryptocurrency in the UK, how to sell cryptocurrency for GBP, and more. We want to ensure that you are well-equipped by the time you complete reading this guide to exchange your digital assets for cash.

[table_of_content]Understanding Cryptocurrency

Crypto just like the traditional fiat currencies is simply a form of money. Although its development incorporates more revolutionary technology and style, the concept strives to satisfy the characteristic of being a complete innovation to facilitate the exchange of value between individuals, institutions, or even governments.

Cryptocurrency is a revolutionary development that integrates a whole lot of features. Transactions performed using this innovation are verified and secured by the blockchain using an innovation known as cryptography.

The issuance, validation, and base of cryptocurrency are centered on a decentralized system and cannot be exposed to centralized authorities like the government, the commercial banking sector, private institutions, or any individual. The peculiarities of this concept draw into becoming a suitable outlet for the flow of personal wealth without restrictions.

Some of the features that cryptocurrencies enable include anonymity, private distribution, and efficiency. These features are not easily obtained using traditional banks or conventional third-party payment services like PayPal, Stripe, or Cash app.

Cryptocurrencies like Bitcoin are considered a good store of value and a blockchain that is focused on security while other cryptocurrencies like XRP, Litecoin, Cardano, and Dogecoin are considered to be more efficient blockchains in the terms of transaction speed.

There are a lot of other native features that many blockchains offer. Primarily, not all blockchains or crypto projects offer similar benefits; a few might go out in their way to incorporate more features. These features can be targeted to a specific class of people or simply for everyone. For instance, there are blockchains and crypto networks that offer payment services for the movement of funds and cross-border payments for institutional entities.

Others are focused on delivering efficient service to the entertainment sector, while others are focused on local and international logistics to ensure that products and services easily get to the intended party without getting lost or tempered.

Blockchain technology is so revolutionary that it is capable of changing the entire systems that we are used to and installing a world governed by decentralized policies instead. Precisely, this is already in existence through the concept of decentralized autonomous organizations (DAOs).

Best UK Exchanges for Selling Cryptocurrency in 2024

Cryptocurrencies like Bitcoin, Ethereum, Ripple, Dogecoin, or Litecoin can be sold on several exchanges back to the original source you deposited with, or you can exchange them into stablecoins like Tether (GBP).

Selling cryptocurrency in the UK can pose quite a problem to people who haven’t tried to previously. The basic advantage of exchanges is that you can avoid the risk of losing your digital assets along the way or being scammed by third parties. It is also important if you want to gain the actual value of your crypto without large fees that affect your profits.

Here are some of the best exchanges to use whenever you are looking to sell your cryptocurrency for fiat:

The brokers/exchanges above are some of the most popular in the cryptocurrency industry.

How to Sell Cryptocurrencies in the UK in 2024

If you are looking to sell your cryptocurrency in GBP with the exchanges above, this section would make it a lot easier for you. There are a couple of steps you must take before you would be able to dispose of your crypto assets and we are going to go over them briefly.

- Own an account: To access the selling feature, you should have an account with one of the above brokers. You can get started by clicking them and joining as a user.

- Own crypto or an active balance: You can’t withdraw any crypto if you don’t have it. To withdraw crypto to fiat, you need to deposit the assets by either sending them in through another wallet or simply purchasing them with fiat.

- A withdrawal channel: You must have integrated a withdrawal channel to sell your crypto. You can link a bank account to get funds deposited into your account.

Now, if you have satisfied the above criteria, then you are good to begin your journey to sell your cryptocurrency.

How to Sell Crypto – eToro Tutorial

The following steps will show you how to sell your cryptocurrencies such as Bitcoin, Ethereum, or Ripple.

eToro will be used as an example.

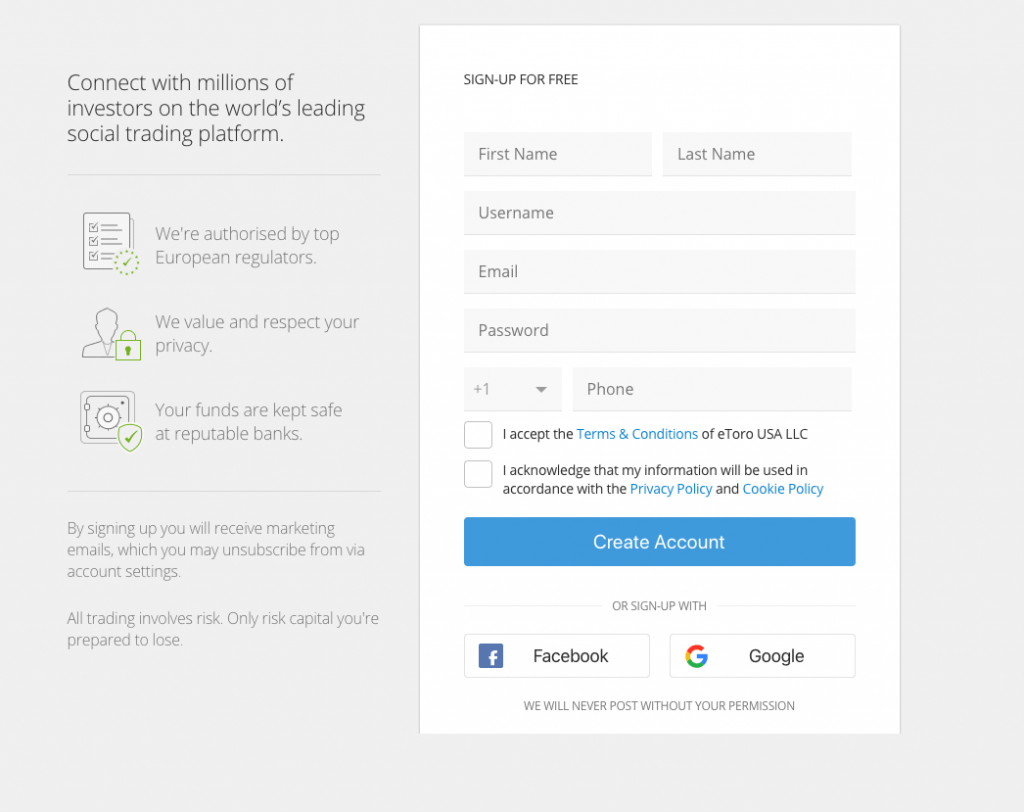

Step 1: Create An Account And Input The Withdrawal Channel

The first step is to Open an account and get started. You can sign up with eToro and submit your KYC details.

Next, you can link your chosen payment method/withdrawal channel.

You are well-advised to integrate channels that tally with your details on the platform as dictated by KYC procedures. Inputting valid withdrawal channels is one of the most important steps you should take, especially if you want to convert your cryptocurrency to GBP.

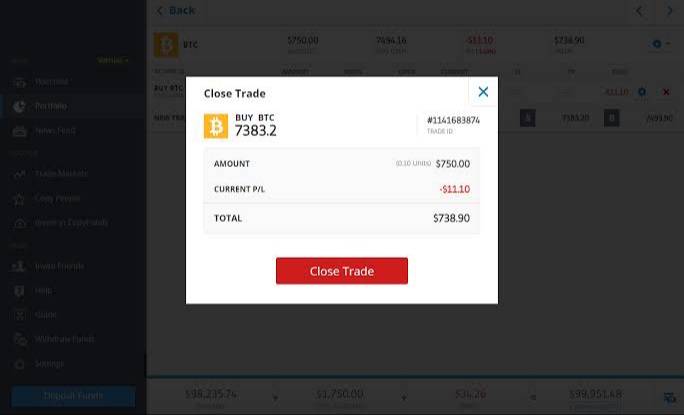

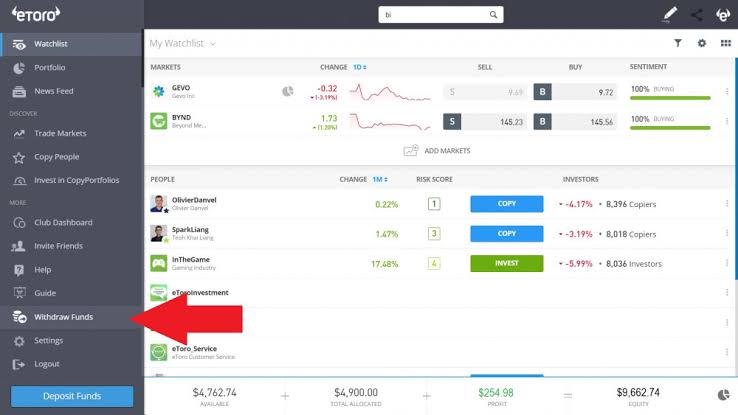

Step 2: Close Active Positions

Before you can withdraw funds on eToro, there must be value in your available balance where the withdrawal would be drawn from. To check your active positions, click portfolio. You’ll then see a page detailing your activities and can expand them to see more details.

This broker has a Web and mobile version of its trading platforms and you can close your active positions on both. To close your positions on the Web version on a red “X” button close to the trade you wish to close.

After this, you’d be prompted with a button asking if you want to close the trade; go ahead and click that. The same applies to the mobile application, only that you are expected to swipe left on the position you wish to close.

You can also close your trades automatically using the stop loss/take profit function. After closing a position, the recovered funds reflect on your available balance.

Step 3: Withdraw Your Funds

Now that you have closed positions on active trades and the funds are now reflecting on your available balance, you can now initiate a withdrawal process that would see the funds appear in your traditional bank account.

Withdrawing funds in eToro is straightforward. Users need to click “withdraw funds” on the bottom left corner of the menu.

A popup window will automatically appear, detailing your available balance. Fill in the amount you wish to withdraw, having in mind that eToro charges a fixed $5 fee for withdrawals.

After this, choose your reason for withdrawal and select the desired withdrawal channel.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest

Understanding Withdrawal Requirements and Exchange Rates

Brokers that let users withdraw funds often require that certain conditions are fulfilled before facilitating the transaction. In most cases, the user has to be a verified member of the platform as well as using the service from authorized locations.

However, these requirements must be met before users can make withdrawals. This is in a way to guarantee the security of user funds by implementing Know Your Customer requirements.

For brokers that process payments to your local bank, they must offer proper exchange rates to ensure the accuracy of the withdrawn sum. Not all brokers or exchanges offer accurate exchange rates, others might charge exorbitant withdrawal fees at a fixed rate or in percentages.

The basic requirements a broker needs to facilitate your withdrawal transactions include user verification (in some cases 2-factor authentication), a minimum withdrawal amount, a withdrawal channel, and a withdrawal fee.

Cryptocurrencies that Can Be Sold

Nearly all cryptocurrencies can be liquidated to cash; it is dependent on the broker and the digital assets that it offers. If an investor owns crypto like Bitcoin or Ethereum, they can access liquidity within the platform and have their crypto converted to fiat, which is ultimately withdrawn to their bank account.

Below are some of the popular cryptocurrencies that are subject to instant liquidity. They are often considered a great store of value and they are recognized in hundreds of exchanges.

Bitcoin

Bitcoin (BTC) is the leading digital asset. It maintains high dominance over other cryptocurrencies with a large market cap. Bitcoin is often considered the best store of value in the cryptocurrency market aside from stablecoins.

At times you may want to sell Bitcoin to cash or USDT if you think the market is over-extended, or if you want to take partial profits on a trade that went well.

Ethereum

Ethereum (ETH) is the second-largest cryptocurrency by market cap. This cryptocurrency is famous for being a utility blockchain that hosts several DeFi projects. Ethereum is a huge network and is evolving rapidly, crypto analysts are expecting it to launch into a proof-of-stake consensus very soon.

You may want to sell Ethereum if Bitcoin dominance is increasing, and you expect the Ethereum price to go into a correction.

IOTA

IOTA was a popular altcoin during the 2017 bullrun, but in recent years has underperformed Bitcoin and other projects.

Investors may want to consider selling IOTA for a new coin with more hype and potential.

Ripple

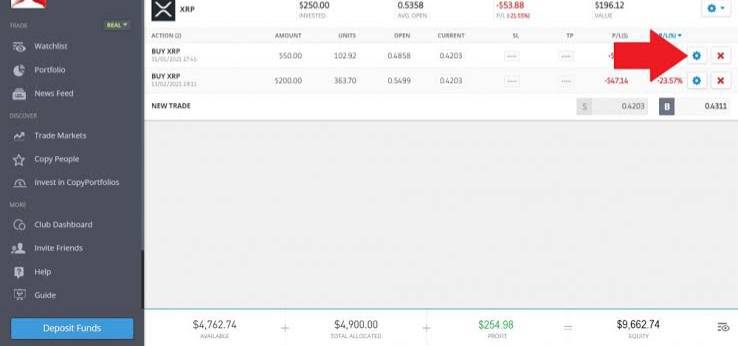

Ripple (XRP) is a famous blockchain developed by Ripple Labs. This cryptocurrency flaunts a very scalable network and prides itself as a better alternative to Bitcoin. XRP is available in several exchanges globally and is subject to liquidity.

Read our full guide on how to sell Ripple if you’re looking to book profits on a big pump, as XRP likes to have short-lived bull cycles where it marks up in price followed by a longer bear cycle.

Litecoin

Litecoin (LTC) is considered a “light version of Bitcoin”. This blockchain is synonymous with faster transaction speed and scalability. It is among the top 10 cryptocurrencies and is available in several exchanges as well.

Read our page on how to sell Litecoin if you want to move profits back into Bitcoin, USD or another altcoin.

EOS

EOS hasn’t moved in price much for the last couple of years, it may be in a long-term accumulation range.

While it may pump in the future, some investors are deciding to sell EOS and in the short-term ride the wave of enthusiasm in smaller DeFi projects and newer altcoins, rather than hold onto their EOS position.

Kyber Network

Lesser known altcoins can be sold on Binance, the best exchange for altcoins, before they eventually get listed on larger exchanges.

Read our page on how to sell Kyber Network (KNC).

Polkadot

Polkadot (DOT) has seen several hundred percent gains in recent years, as one of the most popular altcoins.

If you’ve made profits investing in DOT you may want to take partial profits and set a stoploss at your entry point. Read our Sell Polkadot guide for more info.

Shiba Inu

Low marketcap altcoin Shiba Inu has seen high price gains in recent months, before correcting. Some investors have decided to take profits and sell Shiba Inu.

Stellar Lumens

Stellar Lumens (XLM) was a very popular altcoin during the 2017 – 2018 bullrun alongside XRP but hasn’t made much movement since then and underperformed Bitcoin during the run up to $65,000.

Investors may want to Sell Stellar Lumens for a new project with more hype and investor interest surrounding it.

Libra Coin

Libra Coin, also known as the Facebook Diem, is an incoming cryptocurrency pioneered by top-tier enterprises like the social media platform Facebook and third-party payment services like PayPal and Mastercard.

Currently as the project hasn’t launched there’s no way to buy or sell Libra but we can expect that to be possible on all the major exchanges.

Yearn Finance

Yearn.Finance (YFI) is an exciting project and their token almost reached a six figure valuation in 2021.

Since YFI has now corrected almost 66% some investors may look to sell Yearn Finance and look into other projects that are still in a bullish uptrend.

Crypto Taxation in the UK

The HMRC in the United Kingdom is bearing down on digital currencies and it has developed a taxing structure for the industry. It is important that potential or active investors in the United Kingdom know the basics of this structure to stay on the safe side.

Unlike many other countries, the UK doesn’t have a short-term and long-term Capital Gains Tax rate. All capital gains are taxed under the same rates. The amount of Capital Gains Tax you’ll pay depends on how much you earn with the rate ranging from 10-20% and an additional 20%.

Taxable events involving cryptocurrencies include converting crypto to fiat, using crypto to purchase goods and services, swapping or trading crypto assets (this is better seen in peer-to-peer exchanges), and gifting crypto. For more details on taxation on cryptocurrencies, visit HMRC crypto tax guide.

Compare Platforms to Sell or Short Cryptocurrency

Just as mentioned earlier, there are hundreds of crypto exchanges and trading platforms. A great number of these exchanges claim to fulfill the primary functions required of crypto exchanges like offering a trading desk for the purchase and sales of digital currencies and other features.

Unfortunately, not all of these exchanges fulfill the desired requirements needed by every trader, some that manage to do so often have other deficiencies.

So it can be useful to compare between them. Here is a comparison between two of the leading cryptocurrency exchanges to sell cryptocurrency.

OKX- Flexible Platform to Sell Cryptocurrency

OKX is a cryptocurrency exchange platform which is based in Seychelles.

In a short period, it has spread across the globe in over 180 regions and has gained millions of users. OKX provides a variety of trading services in lieu of a wide range of cryptocurrencies. This exchange platform provides both OKX CEX and OKX DEX features and is different from other exchanges which only provide a single mode.

With the OKX centralized exchange, traders can transact on crypto in spot trading, derivatives market trading, and margin trading. The OKX web3 wallet allows users to collect all their decentralized assets in one place and help manage their DeFi portfolio. It allows an NFT marketplace where users can create, buy, and sell NFTs. Users can also earn and take crypto-collateralized loans.

It allows users to buy cryptocurrency using popular currencies like GPB, USD, EUR, and other local currencies. One can purchase digital assets on this exchange via popular modes such as Visa, Mastercard, or ApplePay credit.

Pros

- Flexible crypto exchange platform

- NFT marketplace

- Spot, Margin, and Derivative markets trading

- Offers both DEX and CEX

- Accepts popular fiat currencies

Cons

- Not available in the USA

Bybit – Sell Cryptocurrencies using Fiat and Crypto

Bybit is a popular crypto exchange in the UK to sell cryptocurrencies.

The platform allows traders to trade on both spot trading and margin trading. Thus, it is a reliable fit for more experienced traders. The beginner-friendly interface also makes it easier for beginners to use this exchange for all their crypto-selling needs. Additionally, the platform provides market studies, published crypto articles, and graphs to communicate to its community about the current market performances and trends.

The platform has a low fee structure and is divided into VIP and Non-VIP traders. Other lucrative features are its trading bots and copy trading facility. The exchange also offers audited proof of its reserves. Users can also earn via its earning program and can request crypto-backed loans via its loan program. Bybit supports both fiat and crypto payments for any transactions.

Pros:

- Beginner friendly platform

- Supports fiat and crypto payments

- Low fee structure

- Earning program

- Spot and Margin trading

- Provides tools for current market status

Cons:

- Not available for customers in the USA

Best Wallets to Store Cryptocurrencies

Cryptocurrencies are a digital form of money and because they are tied to a value, they deserve to be secured. Crypto wallets are simply like the conventional wallets that you are familiar with but this time, in the digital aspect.

However, there are physical crypto wallets like the Ledger, users can store their crypto assets physically using it. Nevertheless, digital crypto wallets are the most popular and are widely used by several investors globally.

They function as a haven for digital assets like Bitcoin, Ethereum, Ripple, Litecoin, and others. Below are a few of the most efficient digital wallets.

Bitcoin Wallets

Bitcoin wallets are integrated into several exchanges like Binance, Coinbase, Exodus wallet, and so many more. Bitcoin wallets come with a designated address which is shared with benefactors who want to distribute Bitcoin to you.

Ethereum Wallets

Ethereum wallets are simply used to store ETH, and just like Bitcoin wallets, they are integrated into exchanges like Binance, Coinbase, Exodus, and others. They possess private keys which are needed as a sort of identification for your ownership of some Ethereum.

Ripple Wallets

Ripple wallets are integrated into exchanges as well and are used to store XRP. Depending on the exchange offering Ripple wallets, they can be used to facilitate the exchange of XRP from one wallet to another.

Litecoin Wallets

These wallets are required to secure LTC. They are native to several exchanges and are peculiar to their owners. Litecoin wallets are designed to help users transfer their LTC easily and trade them as well.

Tron Wallets

Tron wallets are used to secure TRX and can be used to transfer them from one wallet to another. Users often square down to Coinbase, Binance, Guarda, and Exodus for the most efficient Tron wallets.

Day-Trading vs Long-Term Investment, How it Affects You

Notwithstanding the sweet talks, investing in cryptocurrency isn’t always a bed of roses, it does come with a couple of ups and downs. A welcome characteristic of crypto assets is their volatility which makes them quite suitable for long-term investment or regular day trades. However, it is a decision that should be left at the discretion of the trader to make.

The volatility of cryptocurrencies displays a two-way feature. It can be detrimental to the investor as well as beneficial. Before we proceed, let’s expand on the basics of both concepts.

Day Trading

Day traders in the cryptocurrency market take advantage of the price fluctuations within daily intervals to make gains. They are often expert traders who have spent time making technical analyses and studying the development of a digital asset. They can predict the short-term future of a cryptocurrency and trade it to make profits.

There is practically no limit to the number of gains a day trader can make within a daily interval. This is because crypto can take on a massive swing within a one-day interval which can result in enhanced profits.

On the flip side, digital assets can still take on a declining trend thereby liquidating the positions of a trader and clearing substantial values from their trading capitals. Aside from the concerns of volatility, day traders are often subject to more taxes as they close numerous positions daily thereby making profits that are taxed.

Long-Term Trading

In cryptocurrency terms, long-term trading is also known as “Holding”. You can hold digital assets like Bitcoin, Ethereum, Ripple, and the rest for long or short periods. Investors hold crypto long-term if they believe in that digital asset. The motive of long-term trades is to allow the digital asset to attain its potential within the holding period.

Long-term trading might not be entirely fun but it is a great way for beginners to kick off. Investors who trade crypto long-term are somewhat protected from the Intra-day volatility as long-term trades are not closed frequently.

In the same vein, they can miss out on high profits that can occur within daily intervals. One of the biggest benefits of long-term trading is the reduction in taxation long-term traders might not need to pay taxes depending on the accrued income at the end of the holding period.

The Best Strategy

No one can decide the best trading strategy for you. You should decide by weighing your overall expectations, your budget, and of course your expertise. An investor who is occupied with a job or another time-consuming venture would likely opt for the long-term trading strategy.

This is because day trading could also be like a full time, requiring that you dedicate lots of time to evaluating the trending markets, trading them, and keeping your investments from hitting rock bottom.

Another deciding factor could be your trading volume. If you have a small amount tied to your crypto portfolio, it’s safer to opt for long-term trades with the right assets. If you decide to play in the day trading arena with little funds, the intra-day volatility would be too risky for you. It is often suggested that you allocate a small percentage of your funds to day trading while leaving the bigger chunk in long-term trades.

However, just as we recently mentioned, it is up to you to decide the most favorable trading strategy for you. The most important considerations are often connected with your availability, capital, expertise. Besides, the entire cryptocurrency market is a volatile sphere and virtually anything is bound to happen at any time.

How to Invest Safely in Crypto

Cryptocurrencies have come a long way up in a short time. Bitcoin, the first and leading digital asset was launched in 2009 and has grown thousands of times over, benefiting investors in the long run. Other digital assets have done so too, with some sprouting up rapidly in months and some cases, weeks.

This highlights the positive side of the innovation and the potentials they wield in long-term proportions. However, this does not insinuate that cryptocurrencies are entirely safe crypto is one of the most speculative financial markets in history.

There are hundreds of reports about investors that lose large amounts of money to the volatile crypto market. The reason is often that these traders rarely research the digital assets that they are investing their money into. In other cases, most investors jump in on crypto assets based on FOMO (Fear of Missing Out).

When investors are not careful enough to make analyses, fundamental and technical, they risk losing their trading capital. Since crypto is an evolving industry, it would be profitable to look before your leap to ensure that you are investing in good digital currencies with the potential to make you good returns based on your expectations.

To invest safely in cryptocurrency, here are a few measures you can capitalize on to ensure that you are protecting your funds from unnecessary losses.

Begin With Small and Clear Amounts

This rather sounds counterintuitive but it is one of the most important principles if you want to make the best of your trading journey. The volatility of cryptocurrencies could empty your portfolio as a beginner, therefore, it is only safe to explore at first with small amounts that you can afford to lose.

These amounts should be a small percentage of your income, especially as a beginner. This way you’d have a specified budget for cryptocurrency investment.

Make the Best Choices of UK Crypto Brokers & Wallets

Whether you like the idea or not, it is a fact that your brokers and the wallets you choose determine the safety of your funds in the cryptocurrency market. For instance, if you use an exchange that isn’t secure enough, hackers could attack them and get to your assets; the same goes for crypto-wallets. You should make good choices with the cryptocurrencies that you choose. These assets must have good use cases and have the potential for long-term growth.

Invest in Knowledge

The cryptocurrency market is based on a sentiment most times. News, rumors, developments, and government policies affect them largely at this stage. To understand how this works, it is suggested that you invest in knowledge and ensure that you are abreast of new developments to know the stand you’d be employing.

- To easily sell cryptocurrency, you should employ the best brokers and exchanges recommended by experts.

- Before selling your crypto, ensure that you are a verified user of these brokers.

- Setup a withdrawal channel as recommended by your broker.

- Ensure that you have closed your open positions and have the minimum amount required to facilitate withdrawals by your broker.

- Some brokers have daily and one-time withdrawal limits, learn about them.

Conclusion

One of the most important steps to earn from digital assets is learning how to accumulate them as well as sell them when you are inclined to.

Selling your crypto could be a difficult job without accurate information concerning the right brokers to use, the best wallets to store them, and knowledge about taxes in the United Kingdom. This is what this guide is developed to help you with.

Our recommended best exchange to sell cryptocurrency is eToro as they have good copy trade features and a long time in the market, offering crypto as far back as 2014.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest

FAQs

How to sell cryptocurrency in the UK?

You can sell cryptocurrencies directly on the platform where you buy them. You can also use other options like a Bitcoin ATM in the case of BTC. However, using a trusted online exchange is the safest and the most cost-effective option.

Can you sell cryptocurrency for real money?

You can use an exchange like eToro to sell cryptocurrencies for real money. After you sell your holdings, you can transfer the funds from the platform to your bank account and withdraw them.

Is there a tax on selling cryptocurrency in the UK?

You are liable to pay capital gain tax on the profit made by you while selling your crypto. Visit HMRC site for more details on taxation.

When is the best time to sell cryptocurrency?

You must time the market well to make profits from selling cryptocurrency. Crypto assets are highly volatile and involve high risks and many investors suggest using the technical features of different exchanges to earn profits.

How to sell cryptocurrency for cash?

The safest option would be to use a trusted broker to sell cryptocurrencies for cash.