Popular Investment Trusts UK – Full Reviews

If you’re looking to take a hands-off approach to the financial markets – it might be worth considering an investment trust fund.

In doing so, the trust will buy and sell assets on your behalf – allowing you to invest in a truly passive nature. This is especially beneficial if you have some money to invest but you don’t quite know how to choose individual stocks or bonds.

In this guide, we review the Most Popular Investment Trusts UK. We also explain how trust funds work and how you can get started with an investment.

Popular Investment Trusts UK List

Below you will find which providers made our list of the most popular investment trusts UK. You can read a full analysis of each trust by scrolling down.

- Scottish Mortgage Investment Trust

- The City of London Investment Trust

- Monks Investment Trust

- Mercantile Investment Trust

- Federal Realty Investment Trust

Popular Investment Trusts to Watch Reviewed

In choosing the most popular investment trust UK for your needs – you need to do a bit of research. This is the ensure that the trust aligns with your financial goals and attitude towards risk.

For example, what assets does the trust fund invest in and what sort of financial returns has it made over the past five years? You also need to consider the annual fees charged by the fund and what the minimum investment is.

To help point you in the right direction, below we discuss a selection of the most popular investment trusts UK for 2022.

1. Scottish Mortgage Investment Trust

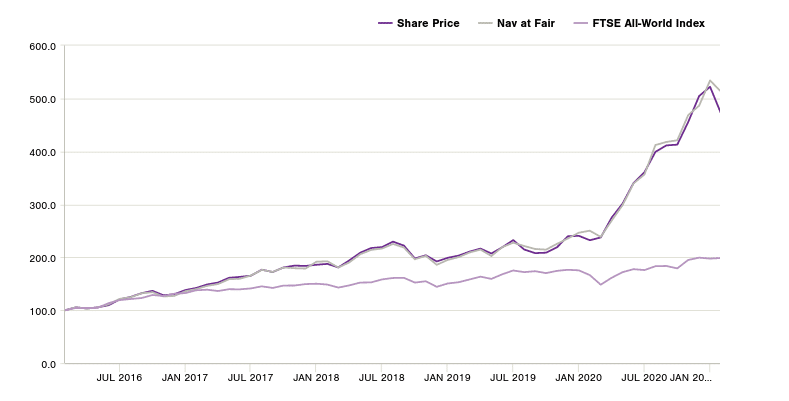

Launched in 1909 and owned by Baillie Gifford – Scottish Mortgage Investment Trust is one of the most established funds in this space. The fund – which mainly invests in stocks, typically carries between 50 and 100 assets at any given time. This comes from a broad range of markets and exchanges, albeit, the main objective is to outperform the FTSE All-World Index over a 5-year period.

Breaking down the fund’s portfolio, there are large holdings in Tesla (8.8%), Amazon (6.5%), and Illumina. There are also investments in Chinese companies such as Tencent Holdings, NIO, Meituan, and Alibaba Group. This ensures that you are well diversified across multiple economies.

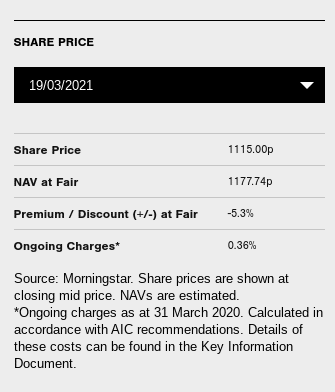

The Scottish Mortgage Investment Trust has performed very well in recent years. For example, 5-year returns stand at over 338% and 3-year returns at 143%. Over the past 12 months, the fund has returned over 133%. Although there is no performance fee attached to this UK investment trust – you will be charged an annual expense ratio of 0.36%.

2. The City of London Investment Trust

The City of London Investment Trust is even more established – with the firm launching way back in 1891. Unlike the previously discussed fund, this investment trust focuses on companies listed on the London Stock Exchange. It primarily looks to generate returns through both income trust dividends and growth.

The fund uses the FTSE All Share Index as its benchmark – which it will actively look to outperform. The City of London Investment Trust is well diversified across many UK sectors and industries. With that said, 27% and 20% of its stocks are held in financials and consumer goods.

The rest is distributed across basic materials, healthcare oil and gas, telecommunications, and utilities. Looking at the trust’s portfolio, it holds 3.9% in British American Tobacco, 3.46% in Rio Tinto, and 3.4% in Diageo. There are also holdings in Royal Dutch Shell, Unilever, RELX, HSBC, BHP Group, and more.

When it comes to returns, this fund seems to be somewhat volatile. For example, in the financial year ending 2016, 2017, and 2019 – the fund generated attractive returns of 9.3%, 12.6%, and 20.5%. However, in the financial year ending 2018 and 2020 – the fund made losses of 8.5% and 11.8%.

3. Monks Investment Trust

If you are looking to build portfolio that focuses on long-term capital growth – the Monks Investment Trust might be worth considering. This trust fund – which was launched in 1929 – invests in a diverse basket of stocks from several marketplaces. Primarily, it concentrates on equities listed in the US and the UK.

Regarding the former, this consists of stocks such as Alphabet (Google), Amazon, Shopify, Microsoft, MasterCard, and Tesla. In terms of UK stocks, the Monks Investment Trust currently has holdings in BHP Group, Rio Tinto, and Ryanair. With that said, this investment trust also has exposure to various other international markets.

For example, you have the likes of Naspers (South Africa), SoftBank Group (Japan), and Meituan Dianping (China). All in all, this is one of the most popular investment trust funds UK for those of you that wish to build a globalized portfolio of equities. The Monks Investment Trust is slightly more expensive than the market average – costing 0.48% per year.

This is, however, justified when you consider that you will be gaining access to multiple international economies. Furthermore, and perhaps most importantly – this investment trust has generated some very attractive returns in recent years. For example, had you invested in this trust fund 10 years ago – you would be looking at gains of over 320%. 5-year returns stand at 248%.

4. Mercantile Investment Trust

While the trust funds that we have discussed this far typically focus on large-cap stocks – some of you might want to gain exposure to smaller companies that are still growing. If this sounds like you, one popular options is the Mercantile Investment Trust. Put simply, this trust will invest in small-to-medium UK stocks listed outside of the FTSE 100.

This strategy comes with both its pros and cons. On the one hand, backing stocks with a smaller market capitalization does mean that your investment returns are going to be more volatile. But, the upside potential on these stocks are often much greater than established firms listed on the FTSE 100.

Taking a closer look at its portfolio, the Mercantile Investment Trust has holdings in Intermediate Capital, Bellway, Softcat, National Express, and Electrocomponents. There are also holdings in Games Workshop, Countryside, Watches of Switzerland, Computacenter, and Dunelm Group.

In terms of sectors, this investment trust has a heavy focus on industrials (27%) and consumer services (23%). In terms of growth, this is another investment trust that has performed well in recent years. This stands at an average annualized return of 11.40% and 12% over a 10-year and 5-year period.

This is particularly attractive when you consider the benchmark average over the aforementioned periods was just 8.8% and 6.7%. This means that over the past 10 years, the Mercantile Investment Trust fund has outperformed the FTSE All-Share (ex FTSE 100, ex Inv Companies) benchmark with ease.

5. Federal Realty Investment Trust

All of the investment trust funds discussed so far have had a strong focus on stocks and shares. However, it’s also worth considering an alternative fund that targets other asset classes. One such example is the Federal Realty Investment Trust. This trust fund specialises in retail-based properties – such as shopping malls.

All US-based, the fund holds in excess of 100 large-scale properties – which consists of over 23 million square feet. It has malls scattered across New York, Los Angeles, Miami, Washington, Boston, and more. In terms of how this trust fund works, the provider makes its money in a similar nature to a property fund investment.

That is to say, tenants – which are retail stores, will pay rental to Federal Realty Investment Trust. In turn, you and your fellow investors will be entitled to your share of rental payments – proportionate to how much you invest.

The fund was priced at $129 per share before the pandemic came to fruition. At the time of writing, you can invest in the fund at just $100 per share. In addition to this, the fund must distribute 90% of its rental income to investors – so you will benefit from ongoing dividend payments.

Alternative Popular Investment Trusts UK

There are heaps of trust funds to consider in 2021, albeit, we have discussed five of the most popular providers above.

However, there is a select number of other trust funds that are popular with investors – which you will find listed below:

- Smithson Investment Trust: Invests in a global portfolio of small and medium-cap stocks

- F&C Investment Trust & Global Trusts: Combines investments in the US, Asia Pacific, and European equities

- Temple Bar Investment Trust: Focuses exclusively on UK-listed stocks from a variety of sectors and industries

- Bankers Investment Trust: Seeks to outperform the FTSE World Index and pay dividends that outpace inflation

- Edinburgh Investment: 80% focus on UK stocks with the balance held in international assets

You can find out more about the funds listed above by heading over to the provider’s website.

What are Investment Trusts?

In many ways, investment trusts are very similar to mutual funds. This is because they allow you to invest in the financial markets in a 100% passive nature. Once you invest, the trust fund will determine which assets to buy and sell – and when. Crucially, and much like mutual funds – investment trusts look to outperform a specific benchmark.

For example:

- Let’s say that the investment trust is looking to outperform the FTSE 100 Index

- In year one, the FTSE 100 grows by 9.5%

- If the investment trust makes gains in excess of 9.5% – then it has achieved its target

- On the other hand, if the fund grows at a slower rate than the FTSE 100 – then it is underperforming

Sticking with the same example as above, an investment trust that seeks to outperform the FTSE 100 will carefully select stocks that it believes represent viable long-term growth.

In other words, while a FTSE 100 ETF will buy all 100 companies listed on the FTSE, an investment trust might opt to buy just 50. This allows the trust to avoid companies in which it believes are undervalued and involved in adverse marketplaces – based on current economic conditions.

Making Money From the Most Popular Investment Trusts

When it comes to making money from an investment trust – the process is largely the same as a conventional fund. This is because the trust will be listed on a public stock exchange and trade just shares. For example, the Scottish Mortgage Investment Trust is listed on the London Stock Exchange.

The aforementioned fund will have a share price that goes up and down throughout the trading week. This share price movement is based on the NAV of the fund – which is one of two ways in which you can make money.

Investment Trust NAV

The NAV of an investment trust is calculated by taking all of the assets held by the fund – and multiplying this by the current market price.

As a simplistic example:

- Let’s say that your chosen investment trust is holding 100 million shares in Uniliver

- Priced at £4 each – this means that the fund has £400 million worth of Unilever shares

- The investment trust is also holding 50 million shares in AstraZeneca

- Priced at £7 each, his means that the fund has £350 million worth of AstraZeneca shares

- In total, this means that the investment trust has a NAV of £750 million

Now, in terms of how you make money through the NAV, this will happen if the assets held by the investment trust collectively increases.

For example:

- You invest £5,000 into the investment trust fund

- At the time of the investment, the fund has a NAV of £750 million

- 12 months later, the NAV stands at £900 million

- This means that the NAV has grown by 20%

- On an investment of £5,000 – your money is now worth £6,000

In theory, an increase in NAV will be reflected in the share price of the investment trust. However, there is often a slight discrepancy between the two figures – which can either be in your favor (premium) or against you (discount). Plus, you also need to factor in the fees involved with the respective investment trust.

Investment Trusts for Income

On top of capital gains via an increased NAV, investment trusts UK for income also generate dividend payments. This will, however, largely depend on the type of assets held by the fund.

For example, if the trust has a heavy focus on established dividend stocks, then the bulk of your investment returns will come in the shape of quarterly payments. The amount you receive will be proportionate to the size of your investment.

Here’s an example of how this works:

- You have £5,000 invested in a trust fund that focuses exclusively on dividend stocks

- At the end of the year, the fund has generated a dividend yield of 7%

- On a £5,000 investment – you would have received dividends of £350

- This would have been paid across four quarters

If you’re looking for investment trust UK for income, you may wish to focus on portfolios that consist of high-yield dividend stocks, bonds, and real estate.

Reasons Why People Invest in Investment Trusts

If you are primarily interested in a passive investment strategy – there are many options to choose from. On top of investment trusts, you also have mutual funds, ETFs, index funds, and even Copy Trading.

With that said, there are many reasons why people choose to invest in investment trusts over other fund types – which we elaborate on in more detail below.

Fees

First and foremost, investment trusts typically charge very competitive fees. In fact, because trusts need capital from outside investors – the fees charged are often just to cover their own expenses. For example, the Scottish Mortgage Investment Trust charges an expense ratio of just 0.36%.

This means that for every £1,000 that you have invested in the fund – you will pay £3.60 per year.

For example, investment managers will have a team of experienced analysts that will research the markets around the clock. In turn, the fund will determine which financial instruments to buy and sell – and when to time the market.

You then have the underlying costs involved in placing trades with the respective clearinghouse, processing deposits, and withdrawals, and providing customer service.

Performance

As we briefly noted earlier, while ETFs will look to track a specific marketplace, investment trusts seek to outperform it. In order to quantify whether or not the investment trust has achieved this purpose – the fund will base its returns (or losses) or a particular benchmark.

For example:

- The City of London Investment Trust uses the FTSE All Share Index as its primary benchmark.

- This particular index tracks 600 companies listed on the London Stock Exchange

- In the five years prior to writing this guide, the FTSE All Share Index has grown by just 13%

- Over the same period, the City of London Investment Trust has increased its share price by 28%

- Put simply, the investment trust has outperformed its bench index by over 115%

As is evident from the above, had you opted to invest in the FTSE All Share Index via an ETF – you would have made significantly less than the City of London Investment Trust returned.

Diversification

Another reason that people invest in trust funds UK is that you can build a highly diversified portfolio. For example, the Monks Investment Trust gives you access to stock markets all over the world.

Not only does this include equities listed in the UK and the US, but Japan, South Africa, China, France, and other emerging markets. Attempting to invest in these non-UK markets yourself would not only be cumbersome, but expensive. This is because you would need to pay an individual share dealing fee on each investment – which would also likely include an international FX surcharge.

But, by investing in a relevant trust – you can invest in a globalized portfolio of assets at the click of a button – often for less than 0.5% per year.

Compound Growth Trust

UK investors are also keen on trust funds because they allow you to achieve compound growth. This is because on top of capital gains – most funds pay dividends every three months.

As soon as you receive your dividend payment, you can then reinvest the money straight back into the fund. This means that on each subsequent quarter – you are slowly but surely increasing your exposure to your chosen fund and thus – your capital can grow at a much faster rate.

Tax-Efficient Options

Other than a few rare cases, the vast majority of investment funds in the UK can be placed into your ISA or SIPP. This means that you can shield some, or all, of the capital gains and dividends tax that you would ordinarily need to settle with HMRC.

In other words, as long as you are not investing more than £20,000 in a single UK tax year – you should be able to keep all of your financial returns!

Popular Investment Trusts Brokers

If you have decided which investment trust meets your financial goals – it’s then time to find a suitable brokerage site. Make sure your chosen provider is regulated by the FCA, offers competitive fees, and gives you plenty of trust funds to chose from.

To save you from having to research dozens of stock brokers yourself, below you will find a selection of the most popular investment trust UK platforms for 2022.

How to Invest in Investment Trusts

To conclude this guide on the Most Popular Investment Trusts UK – we are now going to walk you through the process of entering the market via an FCA broker.

Open an Account and Upload ID

First and foremost, you’ll need to open an account with your broker – which should take you no more than a few minutes. All you need to do is head over to your broker’s website and sign up.

You will then be asked to enter some personal information – such as the following:

- First and Last Name

- Home Address

- Date of Birth

- Mobile Number

- Email Address

- National Insurance Number

- Username and Password

Your broker will also need a copy of your passport or driver’s license so that it can verify your identity. For proof of address, you’ll also be asked for a recent copy of a utility bill or bank statement.

Add Funds to Your Investment Account

You can now proceed to make a deposit. Most brokers offer several UK payment methods – most of which are processed instantly. This includes debit/credit cards (MasterCard, Visa, Maestro), e-wallets (Paypal, Skrill, Neteller), and a traditional bank transfer.

Search for an Investment Trust

Assuming you opted for a debit/credit card or e-wallet deposit – your account will now be funded. As such, you can proceed to search for your chosen investment trust.

How to Invest in a Trust Fund UK

On the next page, click on the ‘Trade’ button to bring up the order box for your chosen investment trust. Then, you need to enter the amount that you wish to invest.

Once you are happy with everything, confirm the transaction and your investment will be complete.

Popular Investment Trusts UK – Conclusion

As we have shown in this article, investment trusts are a popular asset option for all type of trader. As always, make sure to never invest more than you can afford to lose and employ proper risk-management procedures.

If you’re looking to invest in the most popular performing investment trusts right now, it’s wise to partner with an FCA-regulated broker, to ensure you are trading safely.

FAQs

What is an investment trust?

How do investment trusts work?

How can I invest in investment trusts?

What are real estate investment trusts?