Some cryptocurrency experts have dubbed Solana blockchain ‘the Ethereum killer’, as SOL attempts to relieve many of the concerns that Ethereum hasn’t addressed, such as high gas fees and scalability issues.

As a result retail investor interest in SOL in 2021 made it one of the most successful altcoins of all time, rising in value from under $1 to over $200.

[table_of_content]How to Buy Solana – Quick Guide

- Choose a cryptocurrency exchange – we recommend eToro

- Create your free account

- Deposit funds into your account

- Search ‘Solana’ in the drop-down menu

- Click ‘Trade’, select an amount of SOL to buy then open the trade

How to Buy Solana – Step-by-Step Guide

The next step after collecting detailed information about Solana is to open an account with a broker company. As Solana is listed on the Blockchain network, it is crucial to find a broker with access to blockchain. Some of the most prominent crypto brokers are listed above.

Below is a more detailed explanation of how to buy Solana online on eToro.

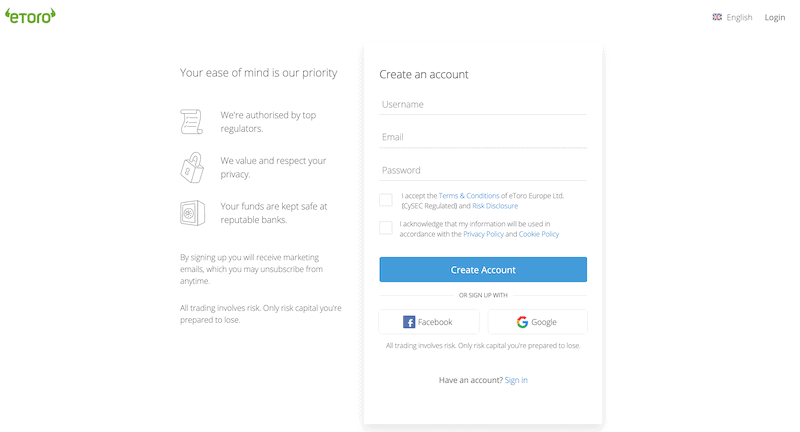

Step 1: Open an Account

The first step is to open the eToro website and register for a trading account by clicking on the “Join Now” button at the center of the screen.

- Full name

- Nationality

- DOB

- Address

- Contact Details

- Username and Password

How to signup at eToro

Don’t invest unless you’re prepared to lose all the money you invest.

Step 2: Upload ID

eToro will then require you to verify the provided identity with a copy of your driver’s license or passport. A copy of the utility bill or bank account statement will also be required to verify the provided address. The verification will then automatically happen once the documents are uploaded.

Step 3: Make a Deposit

The minimum requirement for opening an account with eToro is $200, which can be deposited through various methods.

eToro imposes a flat fee of 0.5 percent on all deposits, regardless of payment method. This is far less expensive than some of its key competitors, such as Coinbase, which charges 3.99 percent to buy Bitcoin with a debit card.

Furthermore, there is no transaction cost if you are a US resident depositing funds through a USD-backed payment method. The minimum deposit is $50 for residents of the United States and $200 for residents of most other countries.

Fortunately, eToro has recently added Solana (SOL) to their product offerings, and you can trade it just like all the other cryptocurrencies. It means all the major altcoins are now available under one roof, and you don’t need to go somewhere else.

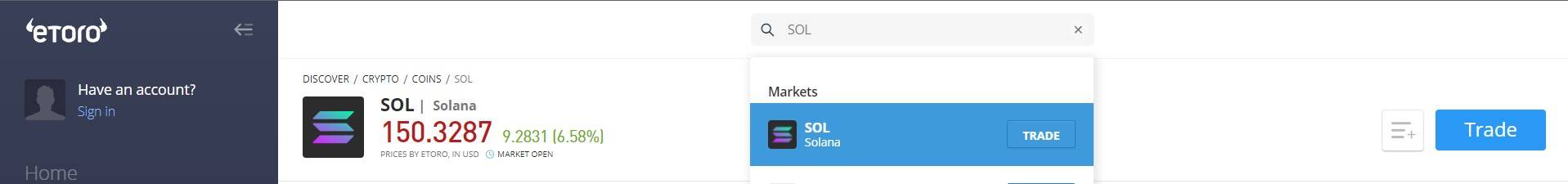

Step 4: Search for Solana

At this stage of our step-by-step guide, you should now have an eToro account that is funded. Now it’s time to buy Solana. The most popular way of doing this is to enter ‘SOL’ into the search box at the top of the page.

- The process starts with logging into the account by entering the username and password.

- Type Solana or SOL in the search box.

- The popped-up search results will bring forward a list, and investors will have to click on the desired cryptocurrency.

Step 5: Buy Solana

You can now buy Solana by typing the amount you want to invest in the ‘Amount’ box.

Then, click on the ‘Trade’ button and enter the desired amount of money you want to invest in the shares. Finally, clicking on ‘Open Trade’ will execute the function, and investment in Solana coin will be made successfully.

Where to Buy Solana in the UK – Top List

Solana is a highly functional open source project that provides decentralized finance (DeFi) solutions to banks without the permission of blockchain technology. Fundamental work on the project started in 2017. Solana was officially launched in March 2020 by Solana Foundation, with headquarters in Geneva, Switzerland. One of the essential innovations Solana brings to the desk is the proof-of-history (PoH) consent developed by Anatoly Yakovenko. This concept allows for greater scalability of the protocol, which boosts usability.

We spent time vetting hundreds of platforms for this guide and ended up with this shortlist. Our list of Solana exchanges provides information about each one’s features, costs, and why it’s different.

To narrow down the research, the review of the most popular online trading platforms in the UK for buying and selling Solana is mentioned below.

1. eToro – The Best Broker to Buy Solana in UK

Solana ecosystem is rapidly gaining traction across a variety of platforms and exchanges. According to an official website announcement from the eToro team, eToro is capitalizing on the enthusiasm, announcing support for the SOL cryptocurrency on October 12th.

Various Payment Options

Traders can use various payment methods through debit cards, bank transfers, or e-wallets. Another exciting service offered by eToro is that investors can also buy and sell other assets such as stocks and ETFs. For all traders, it means traders can buy a fraction of stocks and have no need to buy a single share of a company with their share trading account eToro.

Buying and selling on eToro can be done online as well as on mobile devices through their application. The opening process of an eToro account is straightforward and takes about a couple of minutes. The payment can be deposited in various ways, including debit cards, e-wallet, bank transfers.

Pros & Cons of the eToro platform:

- eToro offers copy & social trading

- Renowned mobile trading app.

- Performing advanced technical analysis can be challenging for pro-traders.

Don’t invest unless you’re prepared to lose all the money you invest.

2. OKX – Top Crypto Trading Platform to Buy Solana in UK

For purchasing Solana and other cryptocurrencies, turn to OKX, a reputable digital asset trading site. The platform offers unique UI which makes watching market and movement of cryptos easy.

Further, the cryptocurrencies/crypto projects are divided into various categories such as GameFi, Layer 2, DeFi and even Football which makes sure traders can trade according to their interests.

Supported Cryptocurrencies

All the major cryptocurrencies such as Bitcoin, Bitcoin Cash, and the main crypto of this page, Solana, are available on OKX. Many traders and investors are aware about the dual-layer storage system that keep their deposits and cryptos safe on OKX.

Deposit and Withdrawal Fees

Deposit fees are not charged by OKX. Withdrawal costs, which vary based on the particular cryptocurrency being withdrawn, are nonetheless charged. The OKX website contains a complete list of withdrawal costs.

OKX Academy

In order to help its users, OKX established the OKX Academy, a learning resource hub with a variety of resources on cryptocurrencies and blockchain technology. The Academy offers seminars, videos, and articles on subjects including risk management, technical analysis, and trading methods. This programme exemplifies OKX’s dedication to assisting its consumers in becoming profitable cryptocurrency traders.

Platform Security

OKX takes security very seriously and uses a variety of safeguards to guard user money and data. These actions include: Cold storage wallets keep the vast bulk of user crypto offline, lowering the chance of theft through hacking or other security lapses. Using multi-signature wallets, OKX makes it more difficult for unauthorised parties to access funds by demanding several permissions for transactions. The platform employs SSL encryption to safeguard user information and conversations.

Pros & Cons of the OKX platform:

- Various trading options, including spot and margin trading, futures, and options.

- Advanced trading tools and order types for experienced traders.

- Passive income opportunities through staking, savings, and yield generation.

- Access to decentralized finance (DeFi) services and non-fungible tokens (NFTs).

- A user-friendly interface and mobile app for trading on the go.

- Performing advanced technical analysis can be challenging for pro-traders.

- Past customers’ have mixed reviews.

- Certain currencies have low liquidity.

- USA users cannot access it

3. Bybit – Preferred Solana Exchange with Affordable Fees

Bybit is one of the few renowned platforms which offers a ‘One-click Buy’ feature for Solana. It not just allows trading, but also offers P2P transactions, and effortless conversion. The ‘Markets’ section of Bybit provides comprehensive details about the ongoings of the crypto market. Coming to the speed aspect, the Platform boasts a 100,000 transaction per second transaction speed.

It has been around 5 years since its launch and Bybit has gained high reputation among the crypto enthusiasts, making it rank among the top exchanges for cryptocurrency derivatives.

The minimal design makes it an ‘easy to use’ platform for beginners and experiences traders alike. Users can also download data concerning important aspects of crypto trading in a variety of forms, simplifying the analysis of market trends. At last, we suggest checking out the ‘Copytrading’ and the Web3 related features of Bybit which are increasingly being used by investors worldwide.

Pros & Cons of the Bybit platform:

- User-Friendly Platform for beginners and experienced traders alike.

- Educational resources available for even absolute beginners.

- High-speed transactions that can handle up to 100,000 transactions per second.

- Traders can trade on up to 100x leverage.

- Supports a number of advanced trading options, up to 100x leverage.

- Risk associated with leveraged trading.

- Complexity in some functions that may make inexperienced traders struggle.

- Users may encounter geographical restrictions.

4. Coinbase

Coinbase is among the most well-known cryptocurrency exchanges in the United States, and it’s one of the world’s largest. Nevertheless, keep in mind the hazards of trading these speculative currencies. Coinbase, the largest cryptocurrency trading platform in the United States, was founded in 2012 in San Francisco.

CoinMarketCap.com, a market research website, is also among the top crypto exchanges globally in terms of traffic, liquidity, and trading volumes. Coinbase is a cryptocurrency brokerage that provides custodial services for institutional cryptocurrency storage and a cryptocurrency payments network for businesses. Furthermore, USD Coin (USDC) is a stable cryptocurrency pegged to the US dollar.

Coinbase became the first crypto trading company in the United States to be listed on a US exchange in April, with an IPO valued at roughly $86 billion. While bitcoin brokerages are not covered by the Securities Investor Protection Corporation or SIPC, Coinbase covers its site for any losses incurred due to theft or hacking. Back on June 18, the official team of Coinbase made an announcement and listed a number of coins, including Solana.

Solana (SOL), Chiliz (CHZ), and Keep Network (KEEP) are now available on Coinbase.com as well as the Coinbase Android and iOS apps. Customers of Coinbase can now trade, transmit, receive, or store SOL, CHZ, and KEEP in the majority of Coinbase-supported regions, with the exception of CHZ and KEEP in Singapore and CHZ in New York State. Coinbase Pro also supports trading in these assets.

Pros & Cons of the Coinbase platform:

- It offers access to more than 50 cryptocurrencies.

- Low minimum to fund an account.

- Cryptocurrency is insured in the event a website is hacked.

- Higher fees than other cryptocurrency exchanges.

5. AvaTrade

Focusing on CFDs and forex trading, AvaTrade has been operating since 2006. The organisation is headquartered in Australia, although it also maintains offices in Japan, the British Virgin Islands, Canada, and South Africa.

AvaTrade gets a lot of things right. For individuals who want to do some research before investing, it has an easy-to-use interface, interoperability with numerous trading platforms, and a variety of education and research resources.

AvaOptions, a proprietary platform where users may trade FX and retail options, will have to be the crème of the crop for this service. AvaTrade has a high minimum deposit balance of $100, which is one of its disadvantages. Its price structure is extremely convoluted, with a number of settings that determine how much you pay for transactions.

Pros & Cons of the AvaTrade platform:

- Excellent security system.

- AvaOptions

- Regulated platform

- A large minimum deposit sum is required.

6. Binance

Binance is without a doubt the greatest eToro alternative. Binance is the world’s largest cryptocurrency exchange by daily transaction volume, with over $20 billion in deals per day. It gives you access to hundreds of assets as well as a smooth trading service that makes it simple to make money.

The advantages of Binance are pretty astounding. The trading commission starts at 0.0750%, which is extremely low. The more exciting part is, the fee keeps getting lower and lower as your level gets higher.

Expert traders can use sophisticated tools including futures and margin trading, and the exchange offers a variety of deposit and withdrawal methods. When you combine this with Binance’s high liquidity, it’s easy to see why it’s so popular.

Binance, on the other hand, is a crypto-only exchange. The exchange also charges high credit card transaction fees, and the primary portal isn’t particularly user-friendly.

Furthermore, the Binance interface is not particularly user-friendly for newcomers. The charts and menu options may be bewildering for first-time Solana buyers.

Binance listed Solana (SOL) and began trading for SOL/BNB, SOL/BTC, and SOL/BUSD trading pairs on April 9, 2020. Users can now begin depositing SOL in order to trade.

Pros & Cons of the Binance platform:

- Very good liquidity

- Exceptional security features

- Professional traders have access to sophisticated products.

- Not suitable for newbies.

7. Revolut

Revolut is a digital financial institution. It began as a travel card with low exchange rates in 2015 and has since evolved into a bank. It is the most rapidly developing digital bank with the most features. For frequent travelers, this is an excellent option.

Revolut has a customer base of over 2 million people. These clients, according to the company’s website, have performed more than 150 million transactions worth more than £15 billion. Due to its genuine exchange rates, Revolut has saved clients £560 million in costs.

Another Fintech service that is gaining deserved attention these days is Revolut. This is a full-scale neobank based in London that offers a full range of financial services to customers. Although Revolut only began offering Solana services in 2021, it is doing a terrific job.

On the platform, users may now purchase, sell, and exchange Solana. The trading interface is one of Revolut’s many advantages. The app’s design and structure are remarkable, allowing users to readily notice buttons and make their way around.

Pros & Cons of the Revolut platform:

-

Can be topped up in and held in many currencies.

-

An ever-expanding list of optional features (e.g. crypto trading, disposable virtual cards)

-

Variety of premium subscription levels, each with its own set of benefits (e.g. travel insurance)

-

A large number of cryptocurrencies are available.

-

The user interface is fantastic.

- Revolut card comes with delivery fees.

- Due to security concerns, customer accounts may be temporarily locked.

8. CryptoRocket

They offer exceptionally competitive trading conditions across a wide range of trading instruments and asset classes, including Forex, cryptocurrency, stocks, indices, and commodities. Clients receive outstanding service 24 hours a day, seven days a week, as well as the option of Bitcoin trading accounts and funding.

The broker also trades equities, indices, and commodities in addition to foreign currency pairs and cryptocurrencies. They provide up to 1:500 leverage, as well as substantial liquidity and great customer service 24 hours a day, 7 days a week. CryptoRocket has received a lot of excellent feedback on the internet, with many clients stating that they are satisfied with the broker’s service.

Furthermore, it has a lot of features that users will appreciate, including the lack of transaction and deposit fees. You won’t have to pay commissions if you use its Live Trader platform.

Pros & Cons of the CryptoRocket platform:

- Up to 1:500 leverage

- No hidden fees

- A trading environment that is quick, stable, and dependable

- A wide range of built-in analytical tools for performing in-depth market research

- Trading signals, copy trading, and one-click trading are all options.

- Expert Advisors are used to automate trading (EAs)

- Not available in the United States.

What is Solana (SOL)?

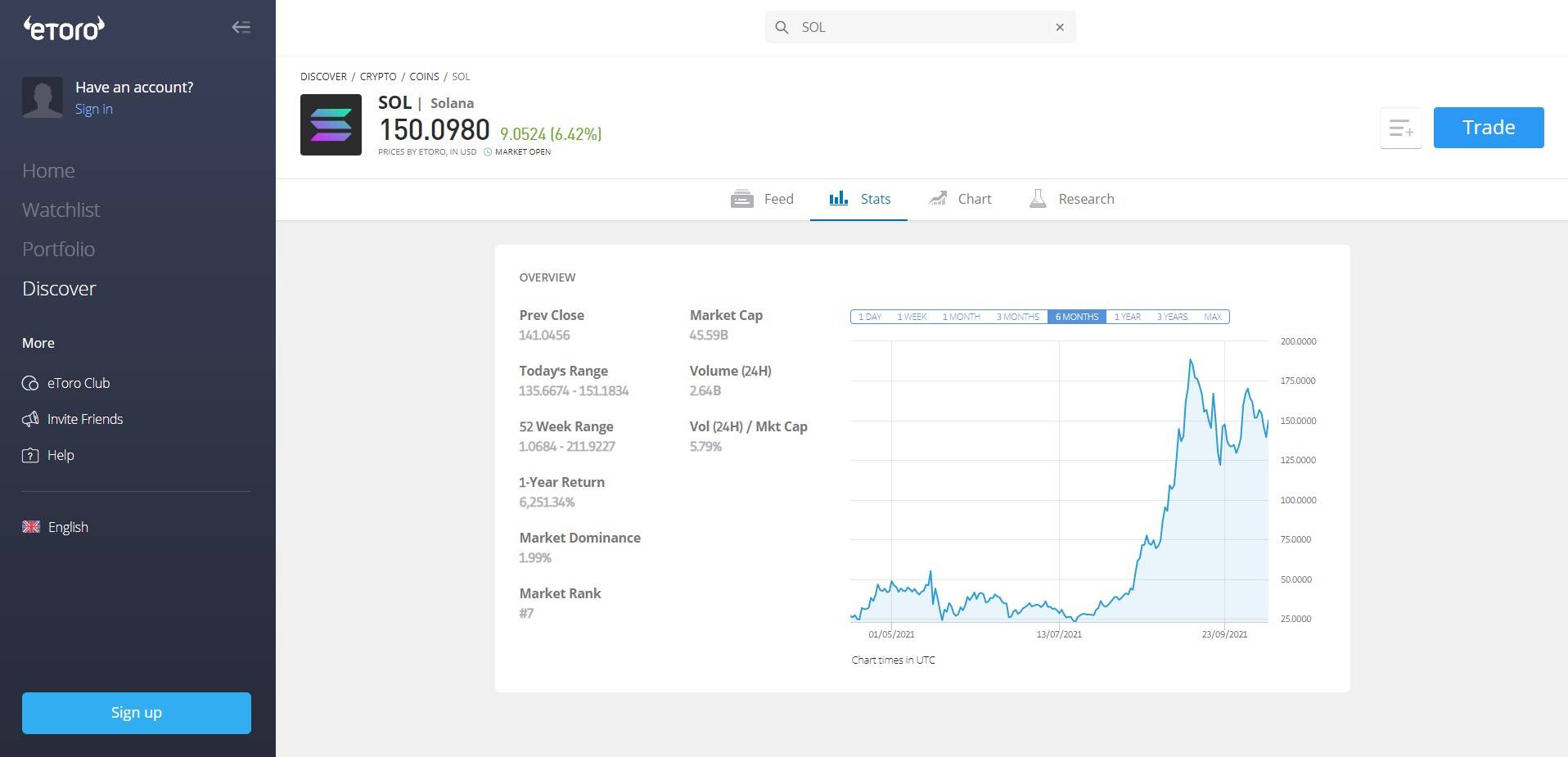

Solana (SOL) is a decentralised computing platform that uses SOL to pay for transactions. It aims to achieve high transaction speeds without sacrificing decentralization. Solana (SOL) improves blockchain scalability by using a combination of proof of stake consensus and so-called proof of history. Solana can support 50,000 transactions per second without sacrificing decentralization. Solana was initially launched in April 2020 and has gained popularity over the last 18 months. The price of Solana has climbed from $0.75 to a high of $214.96 in early September.

In August 2021, prices for Solana suddenly rose from around $30 at the start of the month to around $75 three weeks in, drawing mainstream attention to the altcoin. Solana gained its positive traction from one of the biggest crypto trends of the summer: the launch of a primate-themed NFT collectible project. Specifically, the Degenerate Ape Academy NFTs, the first major NFT project to launch on Solana blockchain.

Solana (SOL) isn’t only a cryptocurrency but a flexible platform for running crypto apps like Ethereum. It’s major innovation is speed, which works through a bundle of new technologies, including a consensus mechanism called “proof of history.” Solana can process 50k transactions per second, compared to 15 or less for Ethereum (the ETH2 upgrade). Although Solana is so fast, congestion and fees remain low. Solana’s founders believe that high speeds and low fees will ultimately enable Solana to scale to compete with centralised payment processors like Visa.

Anatoly Yakovenko is the most influential character behind Solana’s development. His professional career began at Qualcomm, where he promptly moved up the ranks and became senior staff engineer manager in 2015. Following that, his professional path changed, and Yakovenko entered a new position as a software engineer at Dropbox.

Yakovenko started working on Solana project in 2017. He collaborated with his Qualcomm colleague Greg Fitzgerald to launch a project called Solana Labs. Attracting numerous more former Qualcomm colleagues in the process, Solana protocol and SOL token were released to the public in 2020.

Is it Worth Buying Solana in 2025?

Solana’s price has climbed over 100% since the start of August 2021, making it the 10th-largest crypto by market capitalization. According to the latest data, Solana hit an all-time high of $80.12 on August 18. If you’re interested in buying Solana just because you’re hoping for another 100% jump next month, you might need to think again.

Without a doubt, Solana is a wonderful long-term investment, but investing in the hopes of making a quick profit is never a sensible idea. Alternatively, you should look at the fundamentals and use them to evaluate how Solana stacks up against other investment opportunities. The fact that it is not an old coin could be the cause for this. It is relatively new, so it’s difficult to examine its past performance.

However, it does have the powerful capacity that helps attract some reputable investors. Moreover, there are already approximately 400 projects on Solana network. Few of the projects like Chainlink, Serum, USDC (the Circle stable coin), and Audius are well known in the crypto world.

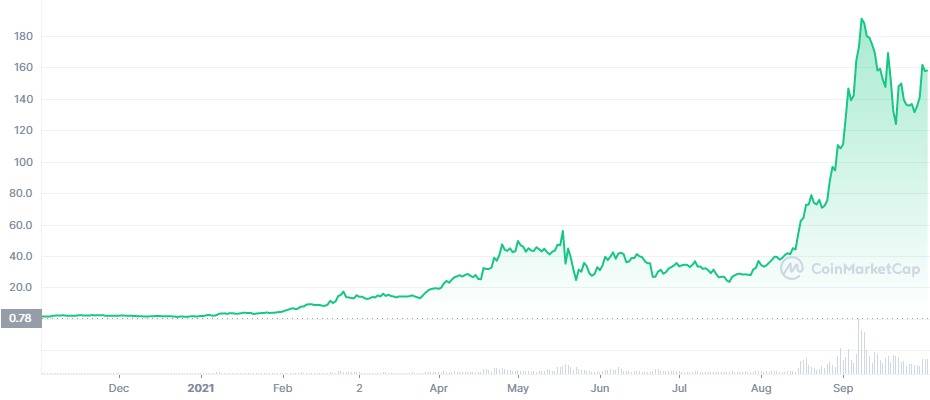

Solana Price Chart – Coinmarketcap

Cryptoassets are highly volatile and past performance isn’t an indicator of future success. Invest at your own risk.

Will the Price of Solana (SOL) Go Up in 2025?

Yes, it seems that the price of Solana will go up in 2025, though forecasts vary significantly.

Our price prediction offers the most optimistic projections, both believing that SOL still has some juice left to reach or even blast past its current ATH before the end of the year.

How to Choose the Right Crypto Broker

Given the abundance of brokers from which to purchase Solana, it’s critical that you make the best decision possible. As you look for the best broker for you, consider the following factors:

1. Fees

When trading cryptocurrencies like Solana , finding a broker with low costs is crucial. What’s the significance of this? Because fees can quickly accumulate. Get a breakdown of the broker’s fee structure before deciding on a trading platform. Fees for withdrawals and deposits, transactions, and trading should all be included.

2 – Safety

To avoid illegal access to your assets, the correct broker should have appropriate safety and security standards in place.

3. Support

A reputable broker will also have a strong customer service department to assist you with your every requirement.

4. Deposit Options

You want to be able to make as many deposits as feasible. There is always a lot of choice, from bank transfers to credit cards to payment processors. Just keep in mind that each one comes with its own set of expenses.

When you’re considering an investment, follow these things:

Solana is relatively new, so it’s difficult to examine its past performance. However, every cryptocurrency comes with risks, and this is especially true in the case of Solana. So, whenever you invest, it is important that you don’t get drawn into FOMO. It does not make sense that if anyone is investing in something, then you also have to invest in it.

1 – Research, research, research: Investment is an endless adventure. You have to always expect the market, and research is the best way to get that done. Do your research and be confident before you invest.

Set a goal: When investing, always have a goal in mind.

Here are the several methods we looked into:

- Explore several social media networks.

- Examining the course of forthcoming events.

- Look into the fundamentals.

- Find out what’s hot & trending right now.

- Use specialist forums to your advantage.

- Attend cryptocurrency meetups.

- Keep an eye on the number of transactions.

2 – Monitor the market: The market could move in a different direction from what you expect. Therefore, you always have to be careful while monitoring the market in order to know how best to react. You can also explore review sites and see what they recommend.

UK Taxation on Solana Earnings

UK traders and investors are subject to capital gains tax (CGT) on their profits when they sell, which need to be reported annually by self-assessment.

In October 2021, the HMRC announced it will be sending nudge letters to crypto investors to remind them to report crypto sales on their yearly tax returns. The first £12,570 of income is not taxed, and the tax rate for income above that is 10% if you are employed in the basic rate income band (up to a £50,270 salary).

Automated Trading With Robots

A trading robot is a computer program that, on a computerized basis, executes all of the activities of a professional trader on an exchange. The computer software is a fully automated version of tried-and-true trading techniques. Regardless of the direction in which asset values are moving, robots tend to outperform humans during periods of substantial market volatility. This is because they rely on trading strategies that are meant to generate profits even when the market is down.

In addition, the most successful bitcoin bots in the world are known for their lightning-fast research and execution. As a result, they can complete a huge number of transactions every day and thereby take advantage of any trading opportunities that arise.

Trading Solana can be a difficult profession for anyone, and there is no assurance that your market analysis will result in a profit. There are other sure ways to grow your capital with little to no effort to get around this problem. Ideally, the bots make a profit, and that profit is bigger in risk-adjusted terms than if you had just bought and held the same coins throughout.

Solana Mining: Can You Mine Solana?

No, because Solana is a proof-of-stake coin, it cannot be mined, no matter how powerful your device or how deep your pockets are.

Minimizing Risk in Solana Investment

Every investor needs to find ways to protect themselves from any big loss. If you want to cap your exposure, then follow these rules:

Use multiple exchanges: To reduce risk in crypto trading, I use a variety of exchanges, employ hardware wallets, and invest in a variety of narratives (Oracles, Defi, or Insurance). To reduce risk when trading, trade only when truly strong patterns form or when a coin has reached its bottom.

Fundamental & Technical analysis: When it comes to investing, I prefer to focus on coins with strong fundamentals. I only invest on rare occasions in response to news or other events. If I decide to invest, I will also do technical analysis. I consider things like where the currency is in its life cycle. Are there any trading patterns? For the coin, there is support and resistance, recent price history, news, and forthcoming events. If I invest in fundamentally sound coins, I can stay calm even if the price changes a lot because I know the price will eventually rise.

Hedge your risks: You should always have a well-balanced portfolio of investments. Use financial instruments strategically to mitigate the risk of adverse price movements. On the other hand, the investors hedge one investment by making a trade-in another.

Use a stop loss: A stop-loss order is used to restrict an investor’s loss on an adverse move in a security position. You don’t have to monitor your holdings on a daily basis if you use a stop-loss order. An investor’s ally is a stop loss. Be a note of it and make sure you stick to it. When things don’t go as planned when investing, you’ll want to know when to take your money out.

Set a target: Short-term traders who want to manage their risk should employ take-profit orders. This is because they can exit a transaction as soon as their predetermined profit target is met, avoiding the risk of a market decline. Traders that follow a long-term strategy dislike such orders since they reduce their profits.

Solana vs. Other Cryptocurrencies

Solana vs. Bitcoin and Ether

Solana is a blockchain network that aims to create a cryptocurrency-powered ecosystem of businesses and services. Solana is not like Bitcoin, although it has some similarities to Ethereum. It distinguishes itself from the Ethereum network by offering faster transaction times, reduced costs, and a programming capability that emphasizes flexibility.

Solana can now process over 50 000 transactions per second, which is more than Ethereum and Bitcoin combined, and at a fraction of the cost. On Solana blockchain, developers can also create and publish customized applications in a variety of computer languages.

Solana Price Predictions: Where Does Solana Go From Here?

Solana is an efficient, fast, secure, censorship-resistant blockchain that gives the open infrastructure required for global adoption. Solana was trading around $6 at the start of 2021. However, since then, the price of Solana has witnessed a sharp rise. We forecasted Solana’s price at the end of 2021 to be $461.

Solana Price Prediction 2021-2022

Solana’s price began in 2021 at $5.93. Solana is currently trading at $156.83, a 2545 percent rise from the start of the year. The anticipated Solana price at the end of 2021 is $612, with a year-to-year change of +10220 percent. The increase from today through the end of the year is +290 percent.

In the first half of 2022, Solana price will rise to $1,499; in the second half, the price will rise by $65 to complete the year at $1,564, representing an increase of +897 percent over the current price.

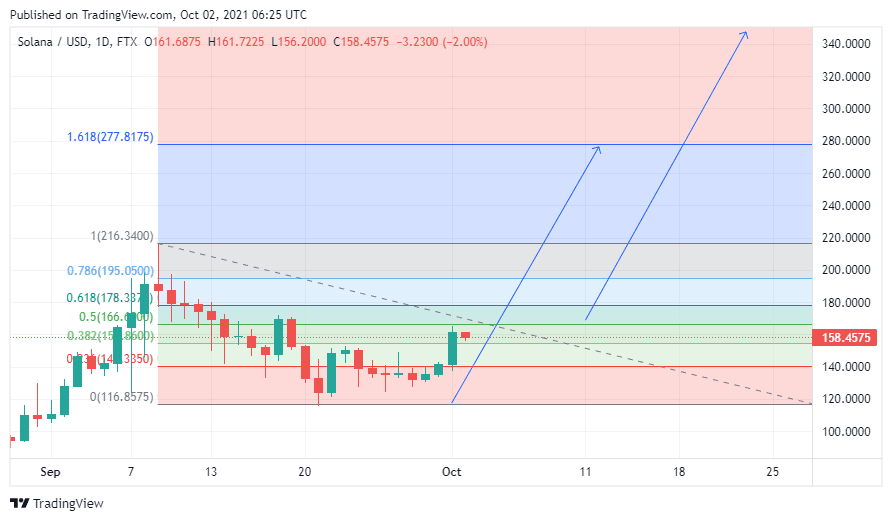

Solana (SOL) Price Chart – Tradingview

Solana Prediction 2023-2027

Over the next five years, the price of Solana would skyrocket from $1,564 to $12,101, a 674 percent increase. Solana will begin 2023 at $1,564, rise to $2,698 within the first six months of the year, and end 2023 at $4,263. That is a +2,618 percent increase from today.

Solana (SOL) Price Chart – Fibonacci Extension

Solana Prediction 2028-2032

During this time, Solana price would increase by 105 percent, from $12,101 to $24,754. Solana will begin 2028 at $12,101, then rise to $14,267 in the first half of the year, and finish at $17,025. It is around +10,756 percent higher than now.

Cryptoassets are highly volatile and past performance isn’t an indicator of future success. Invest at your own risk.

eToro – Best Place to Buy Solana

Solana is an efficient, fast, secure, censorship-resistant blockchain that gives the open infrastructure required for global adoption. Solana was trading around $6 at the start of 2021. However, since then, the price of Solana has witnessed a sharp rise. We forecasted Solana’s price at the end of 2021 to be $461.

If you’re ready to take the plunge to get in on the action, you can complete your crypto journey using eToro.

You should also keep the following in mind:

- Investing in and trading Solana necessitates extensive research and effort

- Solana is a high-risk, high-reward investment

- Only invest what you can afford to lose

- Only use registered brokers and exchanges when trading or investing

- You should also consult review sites and online specialists for their thoughts on investing in Solana

FAQs

Any risks in buying Solana now?

Solana has gained a lot of attention, and its market cap has soared to $61 billion. Moreover, it's heading north to retest its all-time high at $215. Considering the fundamental and technical analysis, Solana seems to have potential in the longer run. Hence, there's less risk involved in buying Solana now.

Should I buy Solana?

If you're buying Solana with the hopes of another 100 percent increase next month, you might want to reconsider. Solana may be a smart long-term investment, but investing in the hopes of making a quick buck is never a good idea. Instead, consider the facts and utilize them to compare Solana to other investment prospects. Solana is currently trading at $202 and can break above the $215 (all-time high) level amid an optimistic technical outlook. So yes, it's worth adding Solana to your portfolio.

Where can I spend my Solana?

Solana is still not as widely used as Bitcoin. However, there are an increasing number of stores that are now accepting it. In any case, you can always convert Solana into other cryptocurrencies like Bitcoin, Ethererum, or Tether to make payments online.

Is it safe to buy Solana?

Solana is now one of the quickest programmable blockchains in crypto. It's also one of several coins being considered as prospective heirs to the Ethereum (ETH) throne. Besides, it's audited by a Fortune 500-preferred security firm. Iron-clad immutability for global scale.

Will Solana ever hit $10,000?

Solana is one such coin that had a slight impact even after the crypto market crashed. Solana coin's market cap is also expanding daily. As a result, Solana coin may take a long time to reach $10,000. Without a doubt, Solana can go up to $10,000. However, you are mistaken if you believe that Solana coin will reach $10,000 by 2025 or 2030. Though, it's a good coin to invest in.