The inherent volatility of the Bitcoin market is moving people towards using systems with automatic trading functionalities. Known as Bitcoin trading bots or Bitcoin robots, these make investing simple by buying and selling assets on behalf of the investors. With their AI-driven mechanics, they are highly efficient. And with no emotions driving their trading decisions, bots have more accuracy than humans.

However, the prospect of easily navigating the volatility of the crypto market has led to the emergence of many crypto trading bots on the market, and many of them have been revealed as scams. That is why it is crucial to know about the best Bitcoin robots of 2024. Ones that are regulated and have proven their mettle in the crypto space.

Bitcoin Robots Investment Advice

- Always read online testimonials on sites like Trustpilot and make sure the score is good. Pay attention to fake reviews – they should be easy to spot, and those users should have 1-2 reviews total.

- Ensure you have the proper information about the robot’s founder(s) and the dev team. Their website should look legitimate and have all the necessary information about the project.

- Beware of “too good to be true” claims and unrealistic success rates.

- If you decide to invest, start with a smaller investment and try to make a withdrawal after some earnings. The robot is probably not legitimate if the withdrawal process is not going well.

- Many robots claim to use affiliated regulated brokers. Do your research and ensure those brokers are licensed and regulated in your jurisdiction (FCA in the UK, for instance). Otherwise, your investment will not be protected.

- Remember that cryptocurrencies are volatile and that some robots might be scams. Be careful and be prepared to take a loss.

Best Bitcoin Robots of 2024 with Positive Reviews

The recent surge in Bitcoin’s value has invited multiple Bitcoin robots to the fold. Here are the ones that are considered the best on the market:

- Dash 2 Trade – Overall the Best Bitcoin Robot on the Market

- Learn 2 Trade Algorithm – A Bitcoin Robot Boasting an Accuracy Rating of 79%

- OKX Trading Bots – Bitcoin Robot Powered by the World’s Sixth Biggest Cryptocurrency Exchange

- KuCoin Trading Bots – Leading Trading Bot with Nuanced Trading Strategies

- Bybit Trading Bots – Leading Exchange Featuring Unique Trading Bots like Futures Martingale

- Binance Trading Bots – Use Bitcoin Robots On The World’s Leading Crypto Exchange

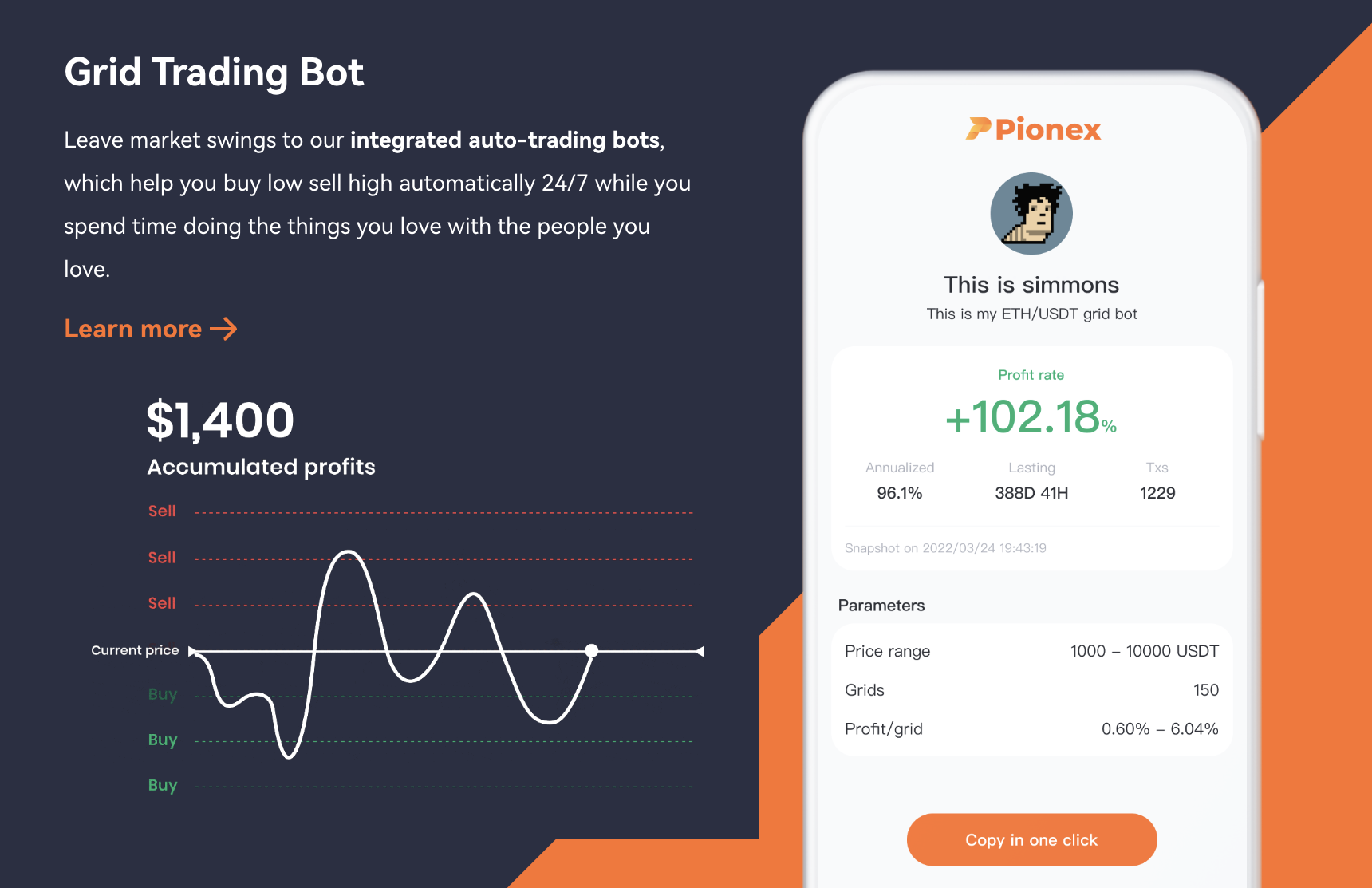

- Pionex – Bot-Centric Cryptocurrency Exchange Providing 16 Bots Free of Cost

- Bitsgap – Trading Bot Offering Algorithmic Orders and Portfolio Management Facilities

- SMARD – Automated Trading Tool Offering 5% Average Monthly Return

- Wundertrading – Crypto Trading Bot Platform Featuring 15,000 Bots

What is a Bitcoin Robot?

A Bitcoin robot is an auto-trading software that uses complex algorithms and mechanisms to scan the Bitcoin markets, read signals, and make decisions on which trades to place to provide profit.

As a robot, they are supposedly far more effective than humans because they can scan all information available on a particular crypto coin (in this instance, Bitcoin) and execute trades in seconds.

The way robots work is by looking at buy/sell signals. These signals allow the robot to be seconds ahead of the market, meaning you can make more significant profits than everyone else. When you read something like this, you only start thinking of emptying your bank account and investing all you have in trading robots. There lies the rub. Investing is sometimes difficult and, most of the time, risky. It doesn’t mean trading bots will boast a win rate that easily. As we mentioned, some robots work as scams. You must be careful, sharp as a tack, and only invest what you can afford to lose.

Advantages and Disadvantages of Bitcoin Robots

Understanding the advantages and downfalls of automatic trading is quintessential in extracting the best out of these tools. While robots have some similarities with humans, they differ greatly, which can make them both more accurate and riskier.

Advantages

- Robots are more effective than humans because they can scan all information available on a particular crypto coin and execute trades in seconds.

- Bitcoin robots are not subject to feelings or emotions – they claim to base their decisions on logic and algorithms. This makes their accuracy higher than those of humans. Some robots claim to have an accuracy of up to 99%, meaning they virtually do not place any losing trades.

- Bitcoin robot trading is said to be faster than manual trading. Instead of manually analyzing markets, opening an account on a cryptocurrency exchange platform, waiting for verification (this can take up to 2 weeks), waiting for a profitable trade, and going through the withdrawal process, the Bitcoin robot will seemingly take care of all this for you.

- Easier than manual trading: you must make a deposit and leave the system to it. You can then withdraw your profits daily, with no hassles.

Disadvantages

- Like manual trading, bitcoin robot trading has risks and is not 100% accurate all the time.

- Robot trading can be complicated for those who are not familiar with them

- The market is unregulated, and many scams are flying around, meaning that users must be well-informed before investing

- Like other types of trading, capital loss is a possibility.

Reviewing the Best Bitcoin Robots of 2024

In this section, we take a closer look at the best Bitcoin robots we mentioned. We explore their key features and how they can help investors generate gains even under volatile market conditions.

Dash 2 Trade – Overall the Best Bitcoin Robot on the Market

The leading Bitcoin robot on the market right now is Dash 2 Trade, which offers a large array of autonomous trading facilities and other perks to users.

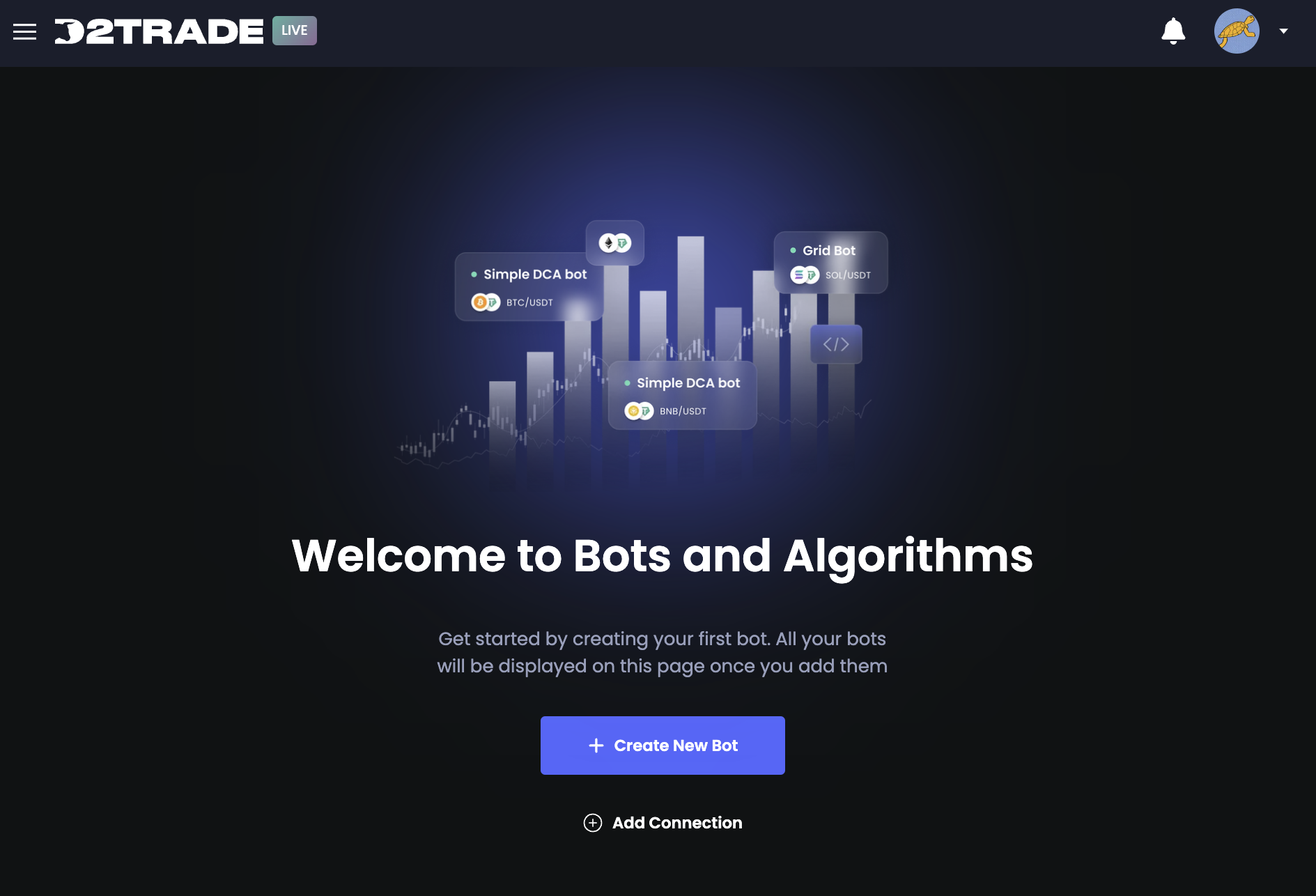

This recently released platform is the realization of the roadmap that the Dash 2 Trade presale revealed in 2022 and has now unveiled many of its key features. Even though many features are yet to be added to the fold, current ones include Dollar-Cost Averaging (DCA) and Grid trading bots across six cryptocurrency exchanges.

Dash 2 Trade is also an excellent strategy builder, offering simplified trading tools to users so that they can devise and backtest their strategies before using them on the live markets. The backtester allows users to create more than 10,000 different strategies.

Even though most of the platform’s autonomous trading facilities are there for paying customers, new users can explore some of Dash 2 Trade’s update-centric features for free. Users can learn about the leading crypto projects with the top social activity, top volume gainers of the day, and top-performing cryptos.

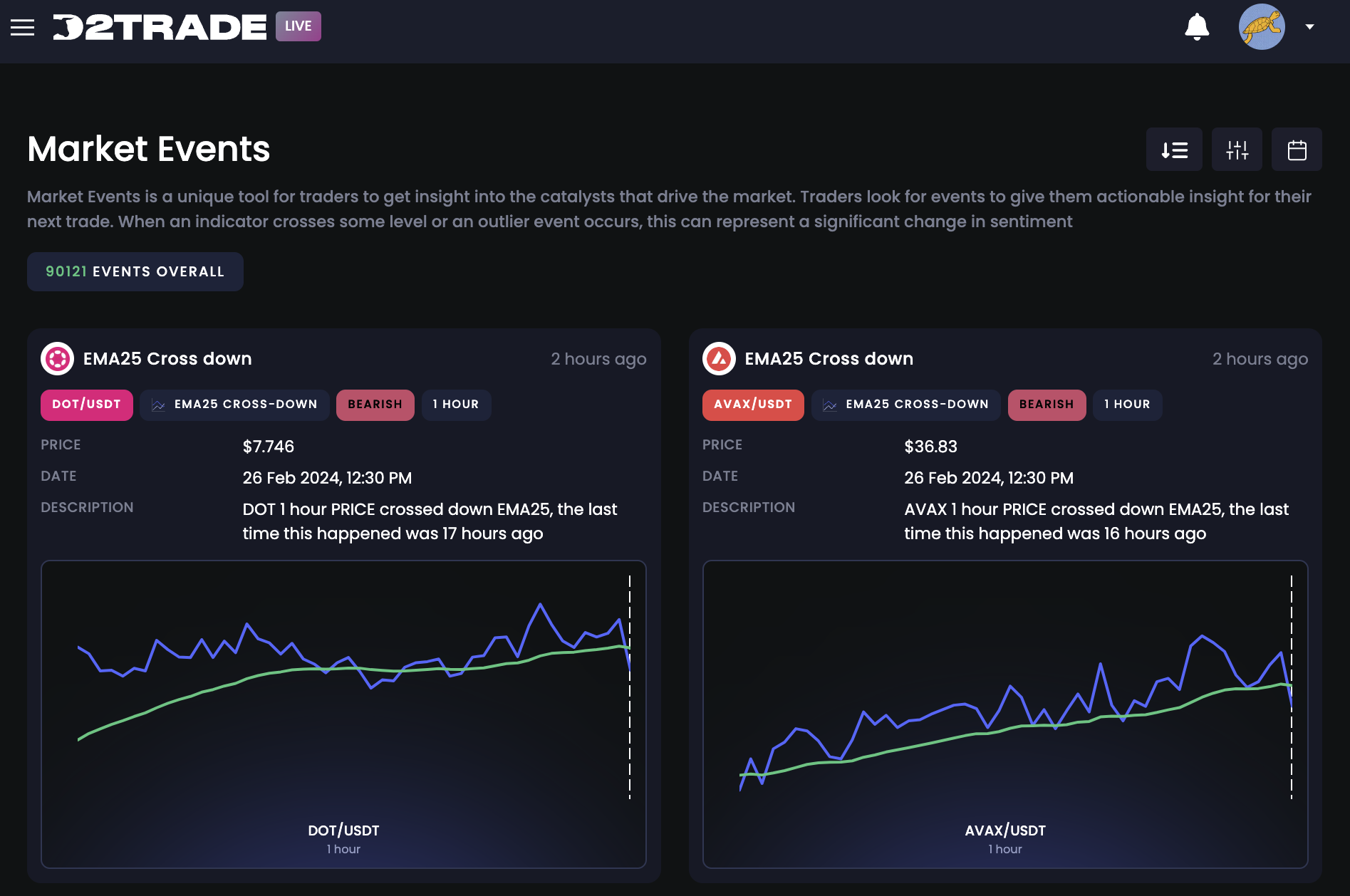

The platform also gives insight into the performance of over 400 cryptocurrencies through technical indicators. In addition to providing complex candle charts whose indicators can be adjusted easily, the platform also gives users an overview of the overall mood around a crypto asset.

The details provided also include social metrics, as well as key events of the asset.

When it comes to paid plans, Dash 2 Trade offers its facilities starting from $102 a year. The mode of payment is the $D2T token. This fee covers the entirety of Dash 2 Trade’s services, with the platform not requiring anything in comes to using the automated trading bots.

- Offers 2 trading bots – DCA and Grid

- Provides a bot creation tool

- Offers market monitoring facilities to users for free

- Multiple technical analysis tools are available

- Over 10,000 strategies can be developed through the builder

- More trading bots are yet to come to the platform

Learn 2 Trade Algorithm – A Bitcoin Robot Boasting an Accuracy Rating of 79%

Learn 2 Trade Algorithm is a crypto trading robot that’s backed by Learn 2 Trade, the world’s leading crypto signals provider known to offer free as well as paid forex and crypto signals.

While the signals are delivered through telegram and are meant for hands-on traders, the Learn 2 Trade Algorithm offers a complete autonomous trading facility, allowing investors a way to interact with the market without having to directly engage with it.

The Learn 2 Trade algorithm has been described as an autonomous trading system that scours the market for profitable trading opportunities and instant alerts users via Telegram. The platform is compatible with Cornix as well as leading cryptocurrency exchanges. that said, using the platform requires a user to register a Cornix account, which is only possible after buying the platform’s Telegram subscription.

Each signal that the Learn 2 Trade Algorithm delivers comes with a suggestion in terms of entry, take-profit, and stop-loss prizes. This unburdens users from deeply analyzing the conditions and reacting quickly. The platform works with a 1:3 risk-reward ratio and will place 40 positions per month.

Learn2Trade reports that it has an accuracy rate of 70%, which means more than two-thirds of trades can potentially generate profits. Upon checking the past L2T algo history, we found that Bitcoin Investors have been successful a lot.

A subscription model starts from £99 a month, which delivers up to 70 trades a month, as well as copy trading services. Those who want to engage with this platform for a long time can even opt for the £199 subscription, which gives users access to Learn 2 Trade’s facilities for three months.

Additionally, those looking for VIP signals can deposit $250 with Eightcap. It offers lifetime access to Learn 2 Trade’s VIP signals.

- Backed by a leading signals provider

- Claims to provide a win rate of more than 70%

- Offers signals over Telegram

- Fully autonomous trading platform

- Doesn’t require much time to set up

- It has a high fee requirement: £199 for three months.

- Doesn’t offer bot customization tools

OKX Trading Bots – Bitcoin Robot Powered by the World’s Sixth Biggest Cryptocurrency Exchange

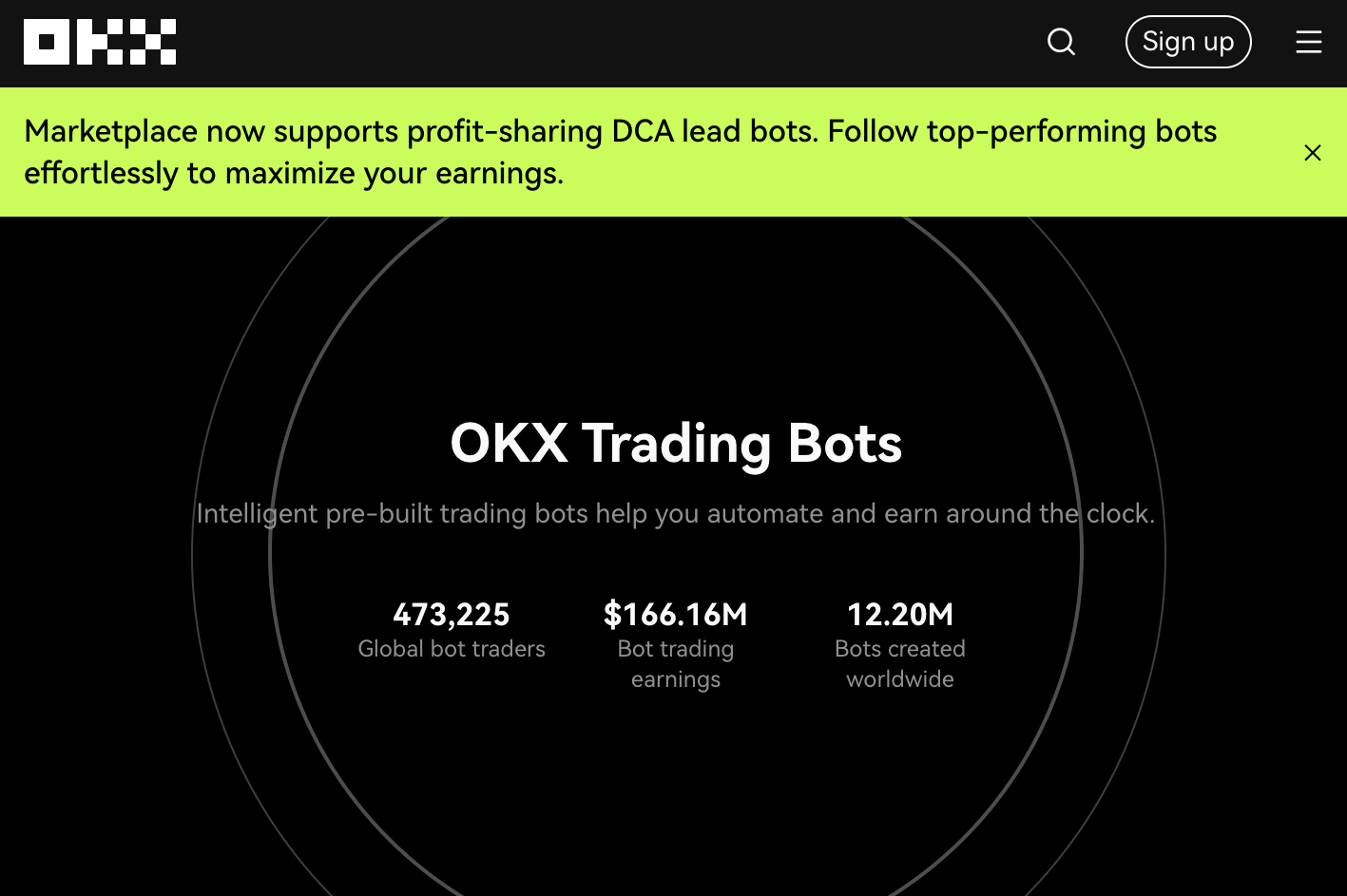

OKX trading bots are powered by the world’s sixth-leading cryptocurrency exchange – OKX – and have accumulated over 450k bot traders across the globe. Per the official website, this trading bot has accumulated more than $166 million in terms of earnings, and users have leveraged its customized bot builder to develop more than 12.02 million bots.

When it comes to bots, OKX offers Grid bots, which allow investors to create spot grid, futures grid, infinity frig, as well as moon grid bots; OKX also offers DCA bots in which investors can create their own Futures DCA (Martingale), spot DCA, and Recurring buy bots.

With Arbitrage bots, OKX offers the facility of multi-currency portfolio management, auto-rebalancing, and smart arbitrage. In this section, investors can create bots for smart portfolios, Dip Sniper, Peak Sniper, and Arbitrage.

OKX also features slicing bots, allowing investors to split large orders, reduce slippage, and find the best offers. Under this section, OKX lets users create Iceberg and TfWAP bots.

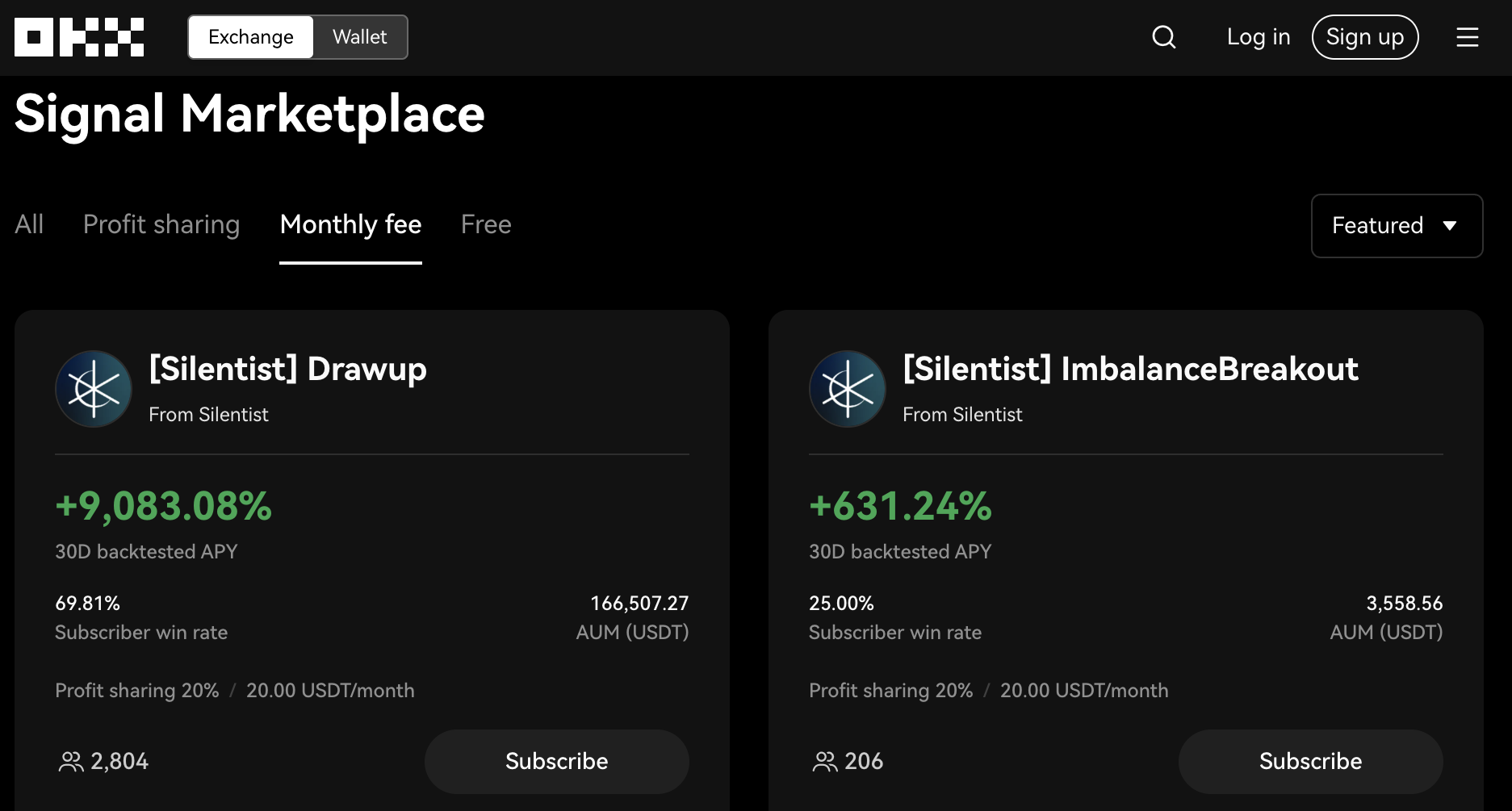

In addition to delivering bot services, OKX also features a signals marketplace, letting traders offer their strategies on subscription. Some signals have a profit-sharing model, and others have a monthly fee associated with them. There are also some that offer free signals.

OKX doesn’t offer a ready-made bot with pre-defined strategies. Investors are required to use the available tools to create a Bitcoin robot on their own. However, once the bot is created, these can be sold on the Bot marketplace to other newcomers.

- Bot powered by a leading cryptocurrency exchange

- Offers complex tools to create their own trading bots

- Features a robust bot marketplace

- Investors can create their bots for free

- Technical expertise required to create bots

- No out-of-the-box bots are available from any place other than the bot marketplace

KuCoin Trading Bots – Leading Trading Bot with Nuanced Trading Strategies

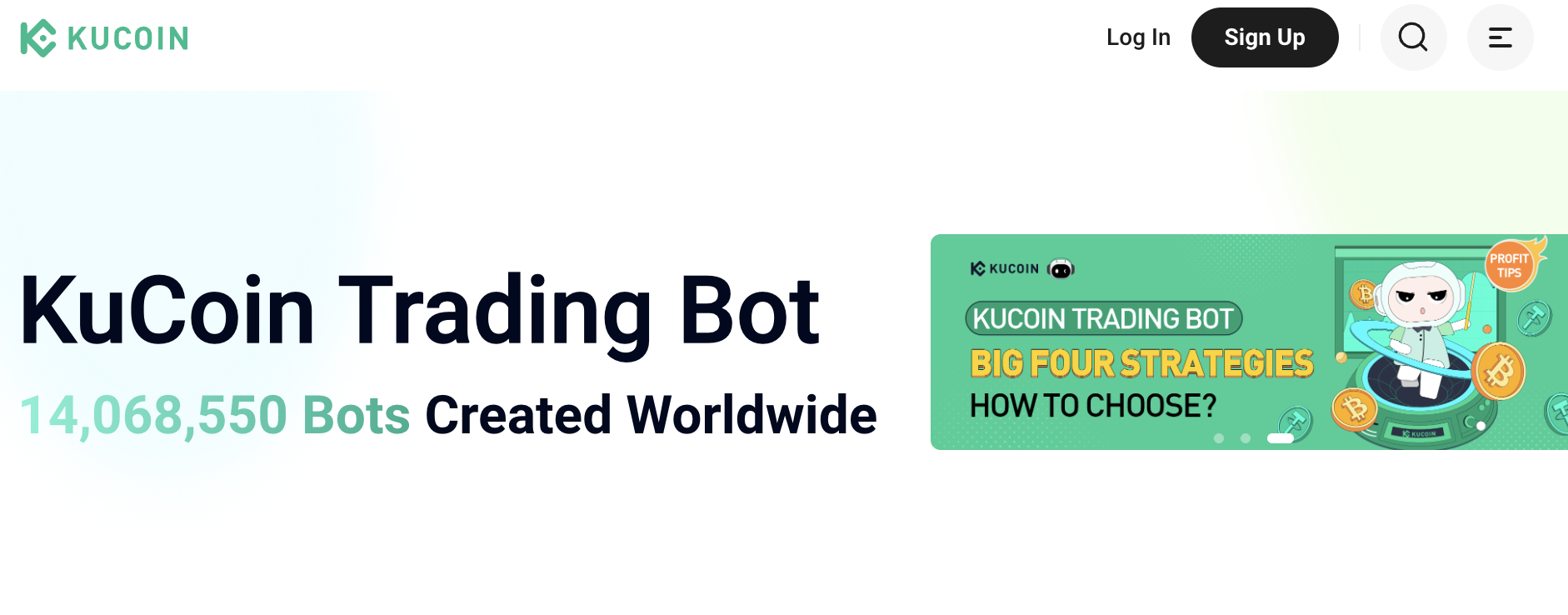

Kucoin is another mainstream cryptocurrency exchange offering bot-creation facilities to its user base. To date, the platform reports that over 14 million bots have been created, and users can create more with nuanced trading strategies.

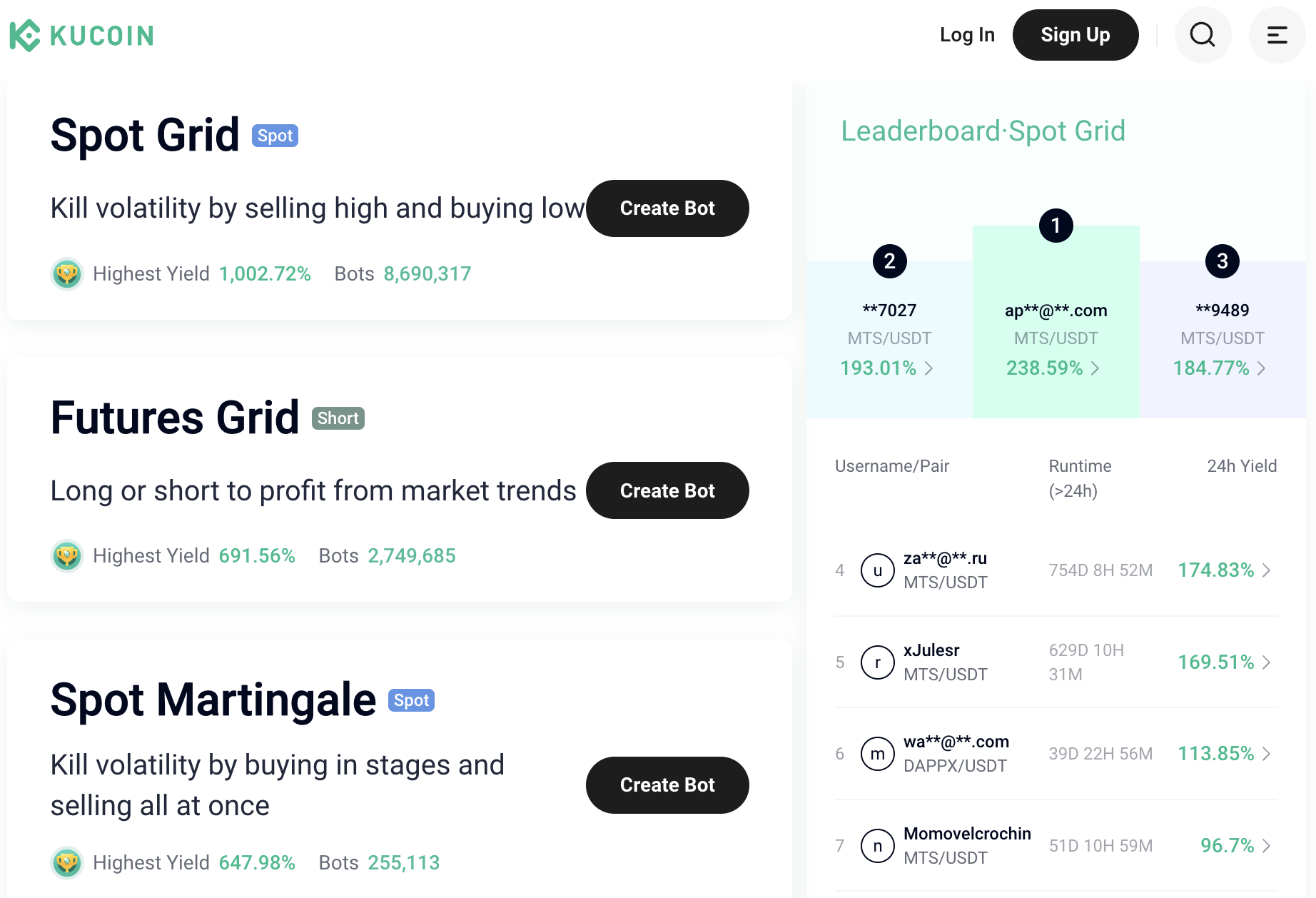

The bots available on the platform involve spot grid, futures grid, sport martingale, smart rebalance, infinity grid, and DCA.

The Kucoin trading bot is a free-to-use application that requires users to create their own bots instead of relying on the ones developed by the platform itself.

Additionally, investors can also join the community of existing bot developers and tap into the profits they are able to deliver. To find the best, users only need to look at KuCoin’s leaderboards that showcase the run-time of a bot, its name, and its 24-hour yield.

However, as the platform offers the facility to create trading bots, a lot of technical know-how is required. Thankfully, KuCoin does provide a tutorial center, allowing newcomers to learn how to create their own trading bots. It is also possible for investors to pick from the existing trading bots. However, these bots aren’t necessarily free, for they are user-created.

- Gives users the ability to create bots

- Offers tutorials on how to create trading bots

- Delivers spot grid, futures grid, spot martingale, smart rebalance, and other types of bots

- A leading cryptocurrency exchange

- Only user-generated bots are available

- Bot creation tools aren’t simple to use

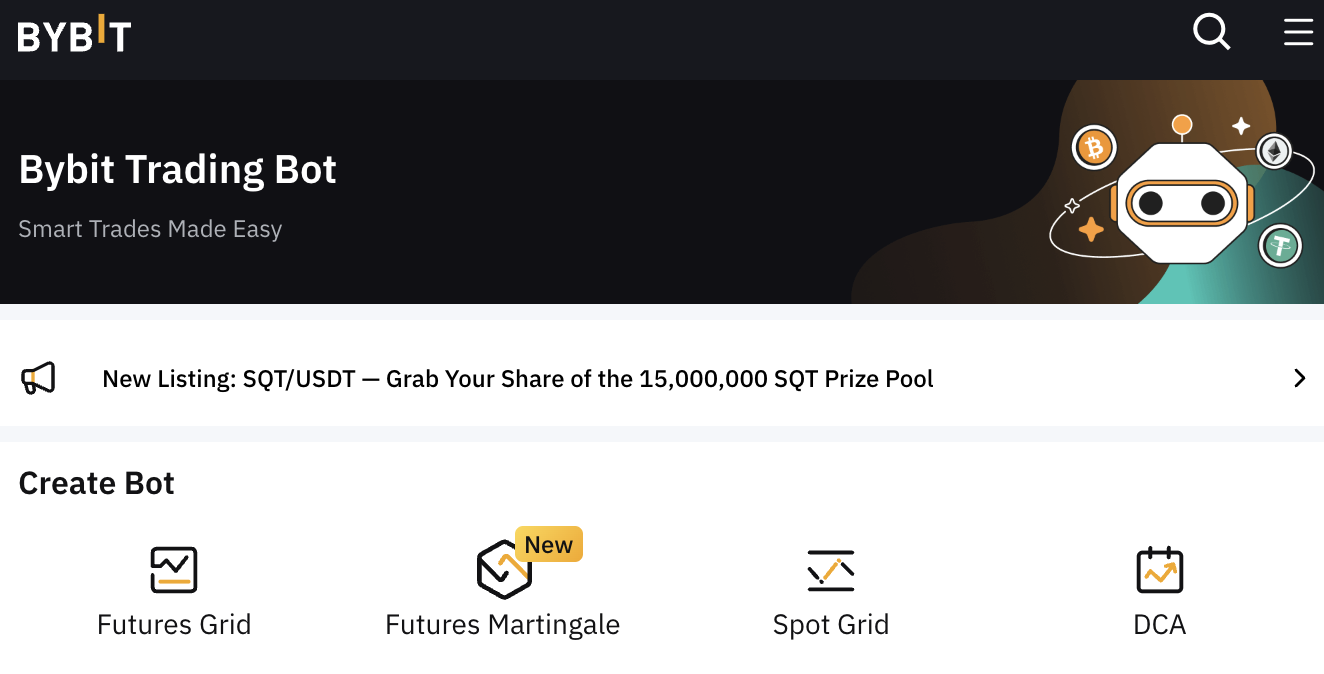

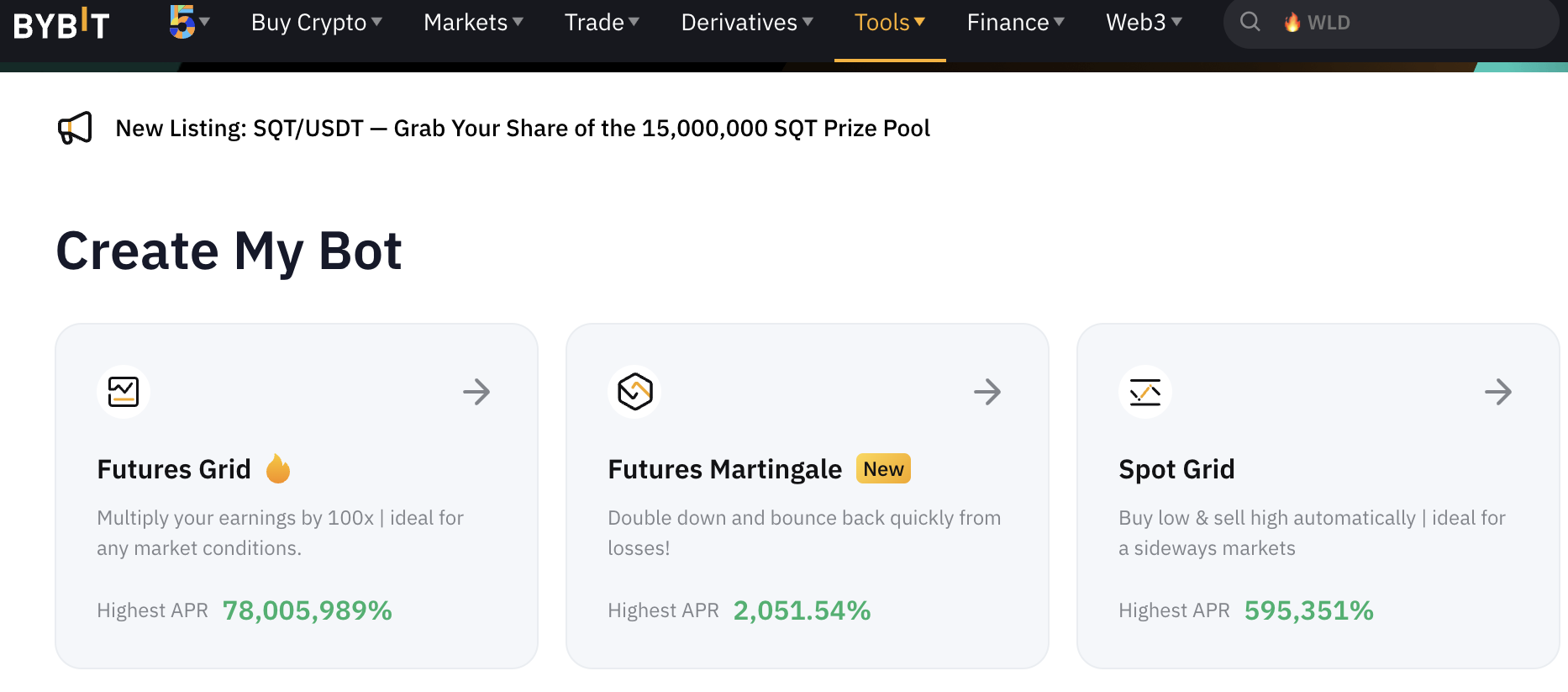

Bybit Trading Bots – Leading Exchange Featuring Unique Trading Bots like Futures Martingale

With its unique trading bot that not only delivers a way for users to make gains but also engages with the community in the form of competitions, Bybit has established itself as a top platform for Bitcoin robots.

Bybit allows users to create futures grid, futures martingale, spot grid, and DCA trading bot. Creation of these trading bots is possible through mobile since downloading the mobile application is a crucial step to start using Bybit and its services.

Bybit takes the same free-to-user bot approach as the other cryptocurrency exchanges on this list. It also offers copy trading facilities and leaderboards that highlight the best trading bot active at any moment. Those who use copy trading facilities can copy the bots for free. However, there are a few trading bots that investors can “sell” via Bybit.

These trading bots can be used to participate in competitions as well. At press time, the competition involves a prize of up to 95,000 USDT.

In addition to providing autonomous trading services through free-to-use bot creation, Bybit also allows investors to find the next best crypto to invest in. A Bybit card is also available to use crypto as a way to buy and sell tokens. With Bybit Web3, users can find the leading opportunities in the Web3 space.

Another autonomous trading facility is provided through TradeGPT, which allows investors to tap into Bybit’s AI investment assistance and learn about the upcoming cryptos or the best investment opportunities.

These services are provided via a unified trading account that has all the options available.

- Offers a free-to-use bot creation tool

- Organizes competitions around trading bots

- Has a simplified approach to bot creation

- Supports spot grid, futures grid, futures martingale, and DCA bots

- Finding the best bot to follow might be difficult

- While some bots can be copied for free, there might be other ones with charges involved

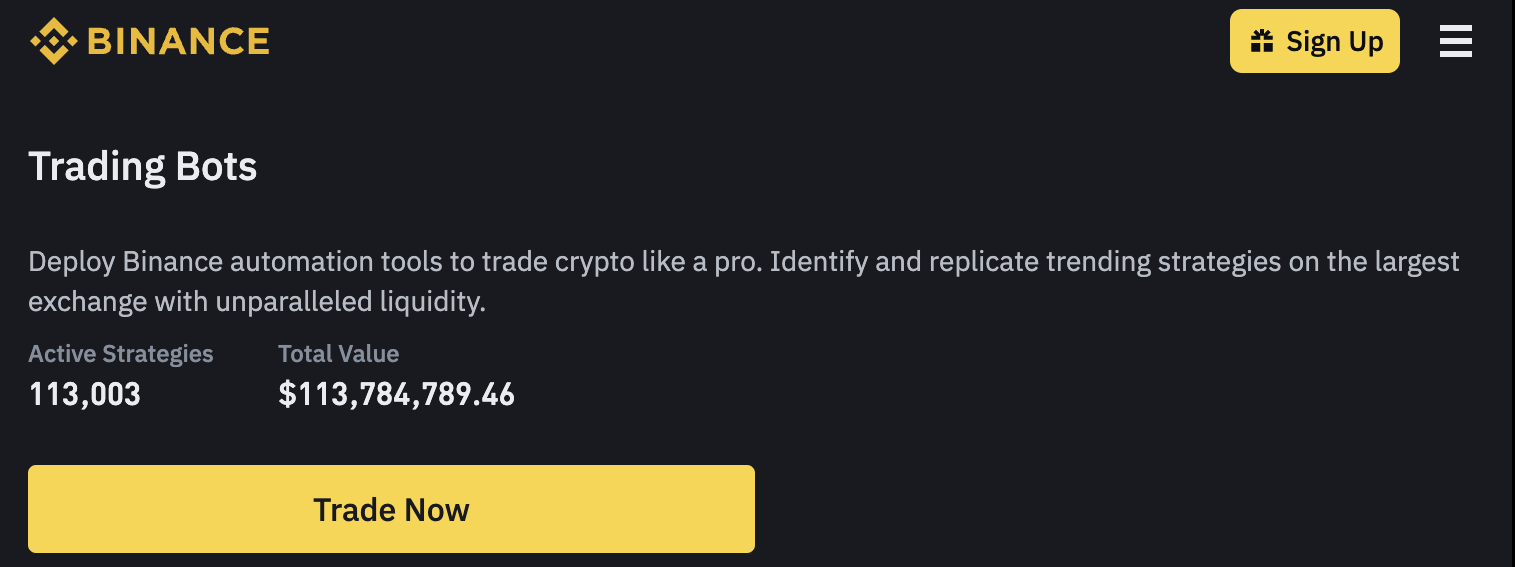

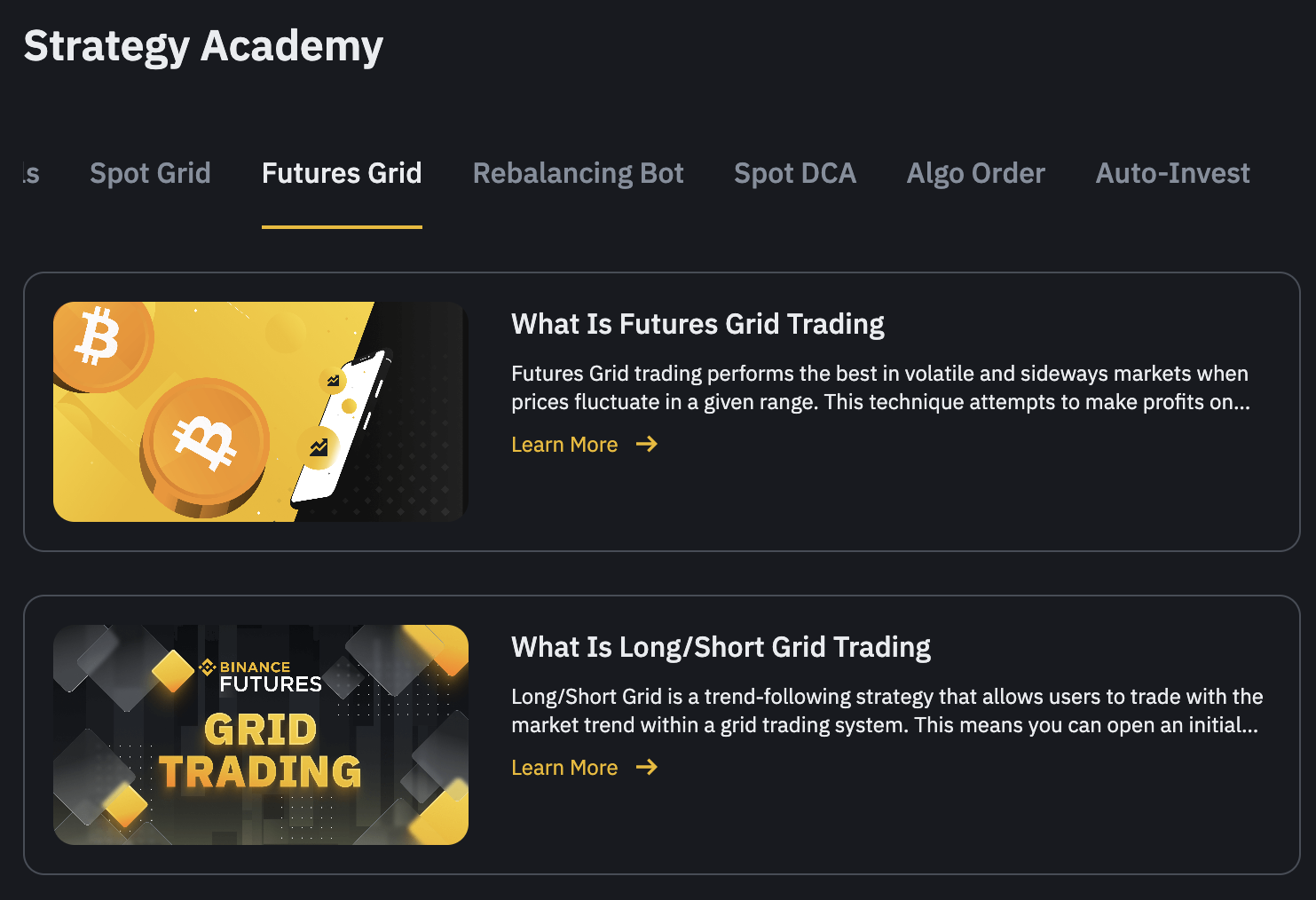

Binance Trading Bots – Use Bitcoin Robots On The World’s Leading Crypto Exchange

Binance is perhaps the most thorough when it comes to providing trading automation tools. The platform also enables identifying and replicating existing trending strategies.

Starting to create a bot on this platform is simple, as there is a tutorial given at the top of the screen. Once the tutorial is complete, users can choose from a large list of bots that include spot grid, which is suitable for volatile markets; futures grid, which is suitable for short orders; rebalancing bot, which is suitable for curbing the risks, and spot algo orders, which is a way to enhance execution on large orders via an API.

Other four bots that investors can create include Auto Invest, which accumulates crypto over time; futures TWAP, which reduces execution costs by splitting orders; futures VP, which divides large orders among specific market volumes; and spot DCA that auto place buy-sell orders for a better average price.

There are over 113k strategies created via Binance trading bots so far, and the total trading volume using bots exceeds $113.7 million. Beginners who don’t have the expertise to create their own bots can use the bot marketplace and engage with a community of bot creators to pick and choose the best bots.

Beginners who are willing to try, however, can indulge in Binance’s strategy academy. There, investors will get tutorials in videos and other formats to learn and create bots.

- Bot powered by a leading cryptocurrency exchange

- Offers nuanced tools to create their own trading bots

- Features a robust bot marketplace

- Investors can create their bots for free

- Technical expertise required to create bots

- Bot marketplace is not always accessible

Pionex – Bot-Centric Cryptocurrency Exchange Providing 16 Bots Free of Cost

Pionex has differentiated itself among cryptocurrency exchanges by focusing on autonomous trading facilities. Featuring three trading bots – grid bot, smart trade, and DCA bot – Pionex has been named one of the biggest Binance brokers and shares deep liquidity with the leading cryptocurrency exchange.

One of the key facilities provided by Pionex is that it not only provides 16 bots free of cost, but these bots are pre-made and can be integrated inside Binance. Even though there are ways to create your own bots, this approach is suitable for newcomers who find the prospect of creating bots too technically intensive.

The trading bot offers a host of features, including laddering buy and sell, trailing take profit, smart trade, and trailing buy.

While the trading bots are free to use, there is a minor fee involved. Those who leverage the bot must pay a low trading fee of 0.05%.

The platform supports 379 cryptocurrencies as of press time and is active in 100 counties. There are more than 100 million trades on the platform daily, and its monthly trading volume is more than $50 billion.

- Features over 16 trading bots for free

- Leading Binance broker

- Features bot creation tool

- Supports spot grid, futures grid, DCA, and smart trader

- Has some learning curve

- Demo mode doesn’t work on live markets

- The pricing model is too expensive: £59.99 per month

Bitsgap – Trading Bot Offering Algorithmic Orders and Portfolio Management Facilities

Bitsgap asserts to offer a smarter way of automating trading with features that include crypto trading bots, algorithmic orders, portfolio management and a free demo mode.

Bitsgap has also been integrated with multiple cryptocurrency exchanges, including Binance, OKX, Bybit, and Kucoin, all of which we have reviewed in this list. Additionally, Bitsgap’s Bitcoin robot has been reviewed favorably on sites like TrustPilot, where it has an average of 4.4 out of 5 stars from 566 reviews.

When it comes to trading bots, Bitsgap offers an autonomous trading system that’s active 24/7. Users can set up effective back-tested GRID and DCA strategies to build custom strategies for themselves. Investors can also leverage smart orders. Through this, they can control their risk/reward ratio in the exchanges that don’t offer facilities like Stop Loss, Take Profit, Trailing Take Profit, and more.

The bots supported on the platform include grid bot, DCA bot, BTD bot, DCA futures bot, and Combo Bot.

Considering that Bitsgap enables users to trade on multiple exchanges, its trading terminal facilitates a simple switching process. Users can instantly switch from exchanges without having to deal with latency issues.

Through Bitsgap, users have been able to create more than 3.7 million bots. Its trading volume to date has been $300 billion, and it has over 500k users worldwide. Even though the trading tools that it offers don’t have a simplified approach, it is still a good choice for those looking for a trusted trading system to back up.

Another key facility that makes Bitsgap an enticing trading bot is the availability of a 7-day free trial. The trial also does not entail any credit card, which is suitable for risk-averse investors.

- Offers multiple trading bots

- Features a free-trail period

- Supports DCA, spot, grid, BTD, DCA futures, and Combo bot

- Features smart trading facilities

- Does not offer a free plan

- The basic plan does not involve futures trading

SMARD – An Automated Trading Tool Offering 5% Average Monthly Return

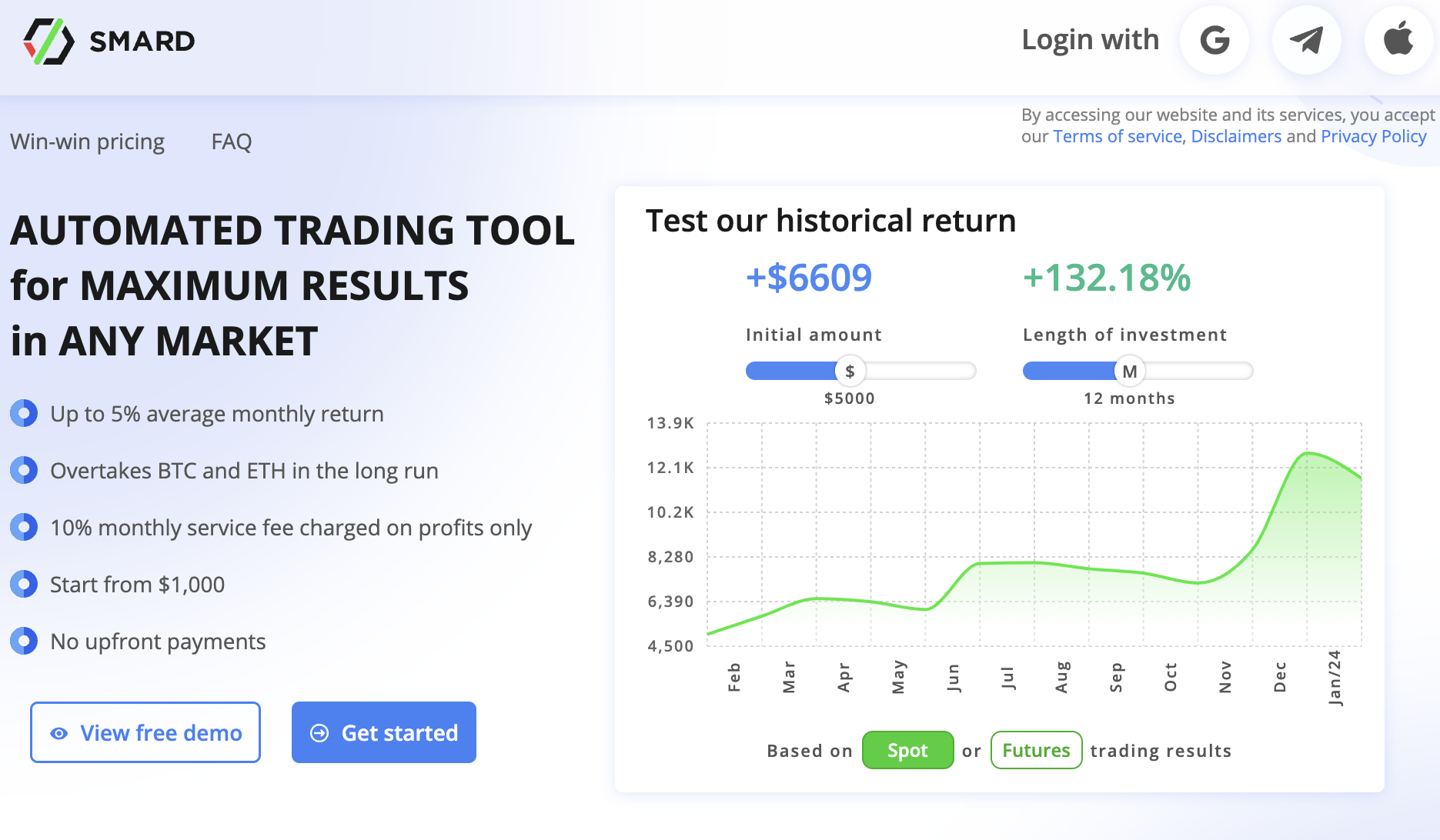

SMARD is a leading Bitcoin featuring up to 5% average monthly return and is said to be a tool that can yield maximum results in any market.

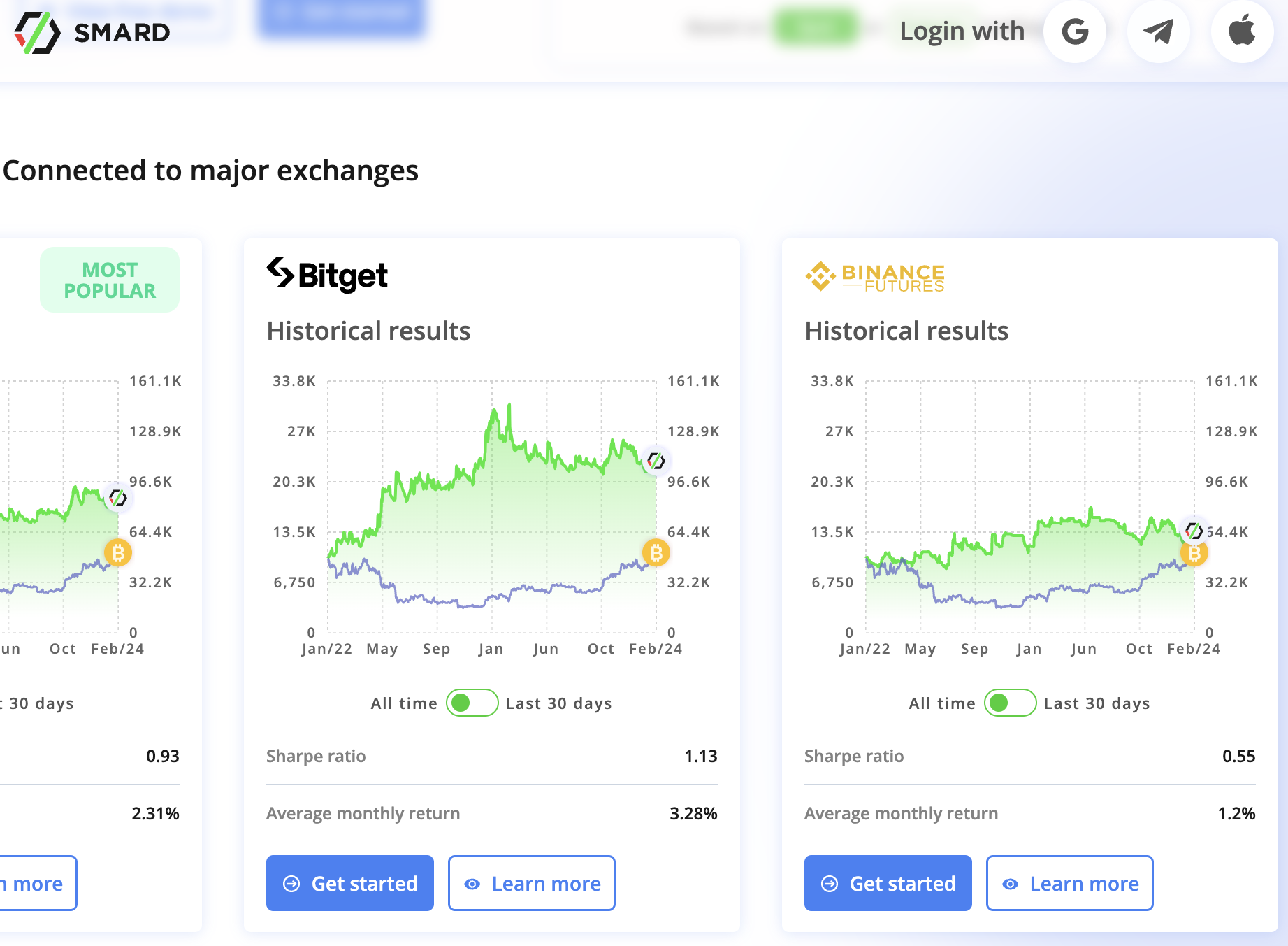

The platform is equipped with standard autonomous trading features and is connected to an array of cryptocurrency exchanges, including OKX, Binance, Bitget, and Binance Futures.

SMARD is also planning future integration with other exchanges such as Kraken, Deribit, KuCoin, Bybit, dYdX, BigX, Bybit, and Phemex.

The platform’s unique utility comes from its momentum effect, which is said to be verified as the number of tried-and-tested techniques to increase trading performance. This approach is said to help it systematically find the best investment opportunities in the future.

Additionally, the platform is equipped with standard risk management tools like stop-losses and trailing stops. At times, it is also said to use a combination of both.

The algorithmic trading bot employed by this system is said to manage the size of any position flexibly by controlling the amount of risk taken in each trade. However, its main aim is to look at long-term usage, which means the focus is on providing gains that can be sustained over a long time.

The platform also allows investors to look at its historical returns based on the amount deposited.

Overall, SMARD provides users with a fully automated platform with all the bot parameters already configured. There are no calculated risks involved, and the security features on the platform focus on whitelisting the IP addresses.

When it comes to billing, investors are expected to pay 10% of profits generated every 30 days.

- Offers a simple approach to trade autonomously

- All the trading parameters are already set up

- Offers a way to look at the historical return rate

- Only inquiries fee on profits

- Has a high initial deposit requirement of $1000

- No way to create a custom trading bot

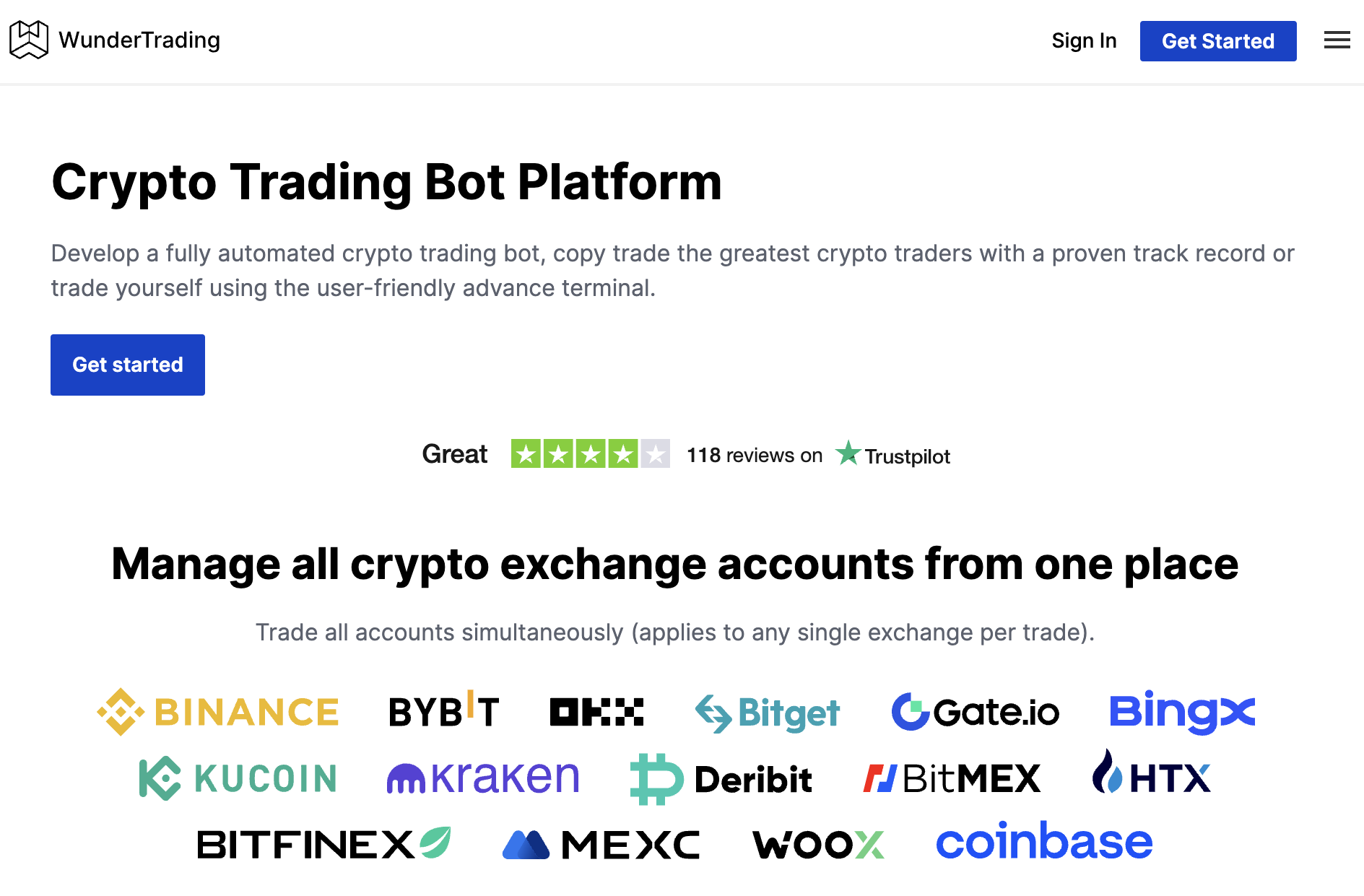

Wundertrading – Crypto Trading Bot Platform Featuring 15,000 Bots

Wundertrading is a fully automated crypto trading platform whose crypto trading bot can be utilized inside multiple exchanges, including Binance, Bybit, OKX, Bitget, KuCoin, MEXC, Kraken, HTX, and more.

There are over 90,000 traders active on the platform who have created more than 150,000 bots. The trading volume on this platform averages at $330 million for a month.

Wundertrading supports four kinds of trading bots. TradingView Bot, GRID Bot, DCA Bot, and an AI Bot. Through crypto automation on Wundertrading, investors can transform TradingView scripts into trading bots. This helps in the rapid creation of Bitcoin robots that can be leveraged by other users on the platform as well.

Key features of Wundertrading include smart trading, pairs trading, DCA bot, crypto portfolio tracker, multiple account management, arbitrage trading, and GRID bot. Those who want to explore these facilities can leverage the platform’s paper trading utility to test them within a risk-free simulation.

Those who sign up for the first time get a free 7-day trial. When it comes to premium services, there are three pricing models. With a starter, which is $3.47 per month, users will get 1 active signal bot. Basic costs $13.97 and offers up to 5 active signals. With the Pro version, which costs $27.97 per month, users will get access to up to 15 active Signal bots.

- Offers multiple trading bots

- Connected to more than 14 cryptocurrency exchanges

- Fully autonomous crypto trading platform

- Customization of crypto trading bots available

- Does not offer a free version of the site

- Only a simple bot is offered by choosing a Starter subscription

How Do The Best Bitcoin Robots Work?

Robo-trading has existed in forex and stock day trading for the last ten years. However, this method seems to have gained popularity in the crypto industry in the last two to three years.

Trading bots claim to involve the application of sophisticated computer algorithms to analyze investment data and make trading decisions. The analysis happens superfast to ensure that trades are placed before the markets adjust to new information.

The technology behind a Bitcoin robot makes it possible for users to see the logic behind their profits or losses. These tools rely on computer algorithms coded using the trading strategies of some crypto traders to scan the bitcoin market data and execute trades based on this data. We didn’t find any evidence; therefore, we can’t verify the statements. It could be that this tech jargon is used for marketing purposes only.

Some trading robots in the forex and stock market can capture valuable information, such as breaking news, and make corresponding trades.

According to some robots, when a trader earns profits, it is possible to tell how they did it since the algorithms can show the analyzed data and the corresponding investment decision. Market data analysis is said to happen super-fast, which makes it possible to make money even on the slightest price movements. We can’t assure this is true.

Other trading robots seem to depend on forex signals, stock signals, or crypto signals from industry gurus. These tools copy the trading strategies of the identified experts and execute them in the user’s account in a method known as social copy trading.

Crypto robots are said to apply similar algorithms to analyze cryptocurrency market big data and make investment decisions. Some industry players are based on advanced Artificial Intelligence and Machine Learning technologies. Such robots are likely to make more accurate decisions than their counterparts. Although this sounds incredible, we can’t vouch for the truthfulness of what is stated.

Algo trading can be identified as a mathematical formula of a predetermined trading strategy. The mathematical formula keeps improving in AI and ML-based algorithms as it is subjected to more market data. In other words, the more it trades, the more accurate it becomes. We are not 100% sure if this is the case. Trading is not easy and doesn’t carry profit each time you decide to invest money, no matter what formulas you use.

What Type of Trades Can I Place with a Bitcoin Robot?

BTC robots are said to be fully customized for Bitcoin and other crypto trading. As mentioned, these tools come fully equipped for crypto trading but do not support other asset trading.

With BTC robots, you can trade either manually or automatically. Manual trading involves the robot doing the market analysis and the trader manually placing trades based on the robot’s research. Automated trading, on the other hand, involves the bot conducting market research and placing corresponding trades.

Most trading robots offer both manual and automated trading options. The robot appears to do the market analysis in manual trading and recommends investment strategies, but the trader must decide whether to implement them.

On the other hand, bitcoin robots say that automated trading involves the robot carrying out investment research and automatically executing trades based on this research. While manual trading requires constant monitoring, automated trading does not. Most automated accounts seem to require less than 20 minutes of daily monitoring.

Either way, InsideBitcoins recommends scheduling trading sessions and closing all your trades after these sessions. Remember that Bitcoin robots are not without risk, which means that you may find yourself experiencing huge losses if you are not monitoring your account regularly.

Some BTC robots claim to have a demo account to help traders familiarize themselves with their trading platforms before live trading. A demo trading platform is equipped with virtual money and is simulated on real but historical data. While demo trading somehow reflects the potential of the trading robot, it does not give the full picture. This means the results you will get in live trading will likely differ from those in demo trading.

Some of the best Bitcoin robots claim they have a broker tasked with executing buy and sell orders on behalf of the trader. These brokers are said to be responsible for facilitating deposits and withdrawals and are the ones to reach out to when in need of clarifications regarding trading. The companies behind the robots claim to operate hand in hand with these brokers to ensure that everything is running smoothly. We can’t say brokers come together with trading robots because we didn’t test them and are unsure if they are regulated.

Are Bitcoin Robots a Scam or Legit?

Once you decide to trade and start researching trading robots, you will find many of them claiming to be legit. Countless statements and claims where after reading, you will be convinced that they deserve your attention and money. Although they all look tempting, you need to be extra careful since some of them pose as scams.

Not all Bitcoin Robots are legit. A good Bitcoin robot should be able to beat the markets most of the time and generate considerable returns for the traders. Most crypto traders today promise investors to make thousands of dollars daily with an initial investment of as little as $250. These results may be achievable with some, but not always.

Do not subscribe to a Bitcoin robot with the mentality that you will get rich quickly. With some robots, the profits may be small initially but will increase as you upgrade your account. InsideBitcoins reviews give you a true picture of what to expect with different Bitcoin robots regarding profitability.

Bitcoin Robots and Possible Risks

Even the best Bitcoin robots won’t tell you there is a risk in trading with these tools. It is there, nonetheless, meaning it is possible to lose all your investment. Unlike long-term investments, day trading involves rapidly getting in and out of trading positions, which makes it possible to experience profits and losses.

As a rule, never trade with an amount you cannot afford to lose. Remember that speculative investments should never take over 10% of your portfolio. We recommend starting small with Bitcoin robots and reinvesting your profits as your account grows. The same case should apply to trading robots.

It is important to note that most Bitcoin robots promise an accuracy level of 99% and above, which, when loosely translated, means that with their robots, at least 9.9 trades out of 10 are correct. And given that there is no way to confirm this, InsideBitcoins recommends doing enough due diligence to confirm how often your Bitcoin robot delivers these results. The best place to start is by reading our unbiased and comprehensive robot reviews and guides.

What is an Auto-Trading Robot?

While a bitcoin robot only offers cryptocurrency trading, trading robots offer forex and stock trading.

While a Bitcoin robot is a trading robot, not everyone is a Bitcoin robot. Simply put, trading robots are multi-asset traders, which may or may not include Bitcoin. On the other hand, Bitcoin robots are meant for Bitcoin trading even though they may offer access to other cryptocurrencies.

While trading robots are a bit more complex, bitcoin robots can allegedly be used by almost anyone. In other words, these robots claim you do not need any background in finance or cryptocurrencies to trade with them. But it doesn’t mean that’s true. Any good Bitcoin robot will come with a user guide to help you set up an account and start trading. Nonetheless, these guides won’t help you get rich overnight.

How Do I Choose a Trading Robot?

Similarly to bitcoin robots, there are also a lot of trading robots scams going around the web.

The trading robots below, rated with positive reviews, are those that InsideBitcoins has thoroughly reviewed. Those with insufficient ratings may be legitimate, but we have not found enough evidence of this effect, and we think they may be scams. Read our comprehensive trading robots reviews to learn more by clicking on the brand name.

What Are Robot Brokers?

Robot brokers are algorithmic trading platforms allowing you to trade with cryptocurrencies, forex, stocks, CFDs, commodities, and indices. They use trading platforms such as MetaTrader4 and WebTrader to support trades.

Regarding robot brokers, the most important thing is to choose the regulated one. Remember that even though some robot brokers are trustworthy, they do not support you in making investment decisions.

Auto trading robots are said to connect to online brokers to function, and through the robot, you can choose the broker you want to trade with. By doing that, you will have the option to trade in auto-trade mode, but at the same time, you will have access to the vast investment choices offered by robot brokers. However, it is not sure that trading robots are connected to brokers and that brokers will help you trade. Investigate more if you want to make money work for you.

Final Thoughts on Robots

To conclude, if you’re looking to trade cryptocurrencies, stocks, forex, or even cannabis stocks, a robot is probably a good choice. The technology behind them is likely based on algorithms, meaning they will make better choices nine times out of ten than humans. Automated trading robots allegedly have shown that you don’t need to be an expert to be able to make a side income.

However, when trading with bitcoin robots, or regular auto-trading robots, we strongly recommend you research beforehand. Is the robot legit? Does it have a professional website? Are there testimonials you can read? Is there information on the web about the founder and how the software operates? These are questions that you should ask yourself before investing.

Only once these answers have been provided should you invest.

Also, remember that each investment, either through a human or a robot, carries a risk. Invest only the money you are prepared to lose, and start with smaller amounts until you get used to the system. Additionally, try withdrawing some money before reinvesting to see how the robot or affiliated broker will handle your withdrawal request.

Furthermore, it is also important to choose a platform that lets you look at the market holistically so that you can make an informed decision. Dash 2 Trade is a platform that offers this facility.

Bitcoin Robot FAQ

How do bitcoin robots work?

Bitcoin robots are algorithms that make lots of Bitcoin trades in short periods of time. They read the markets, knowing the right moment to buy and sell for maximum profits. Users pool their money so that the robots have funds to invest, then the robots share their profits with the people who put their money forward in the first place.

Can I buy Bitcoin with a bitcoin trading robot?

Actually, no. Bitcoin robots settle all accounts with cash. You'll invest with dollars (or whatever your local currency is) and your returns will also be in dollars. No BTC actually trades through the platform.

Are bitcoin robots all scams?

No. Some Bitcoin robots are scams. Other Bitcoin robots are not scams. Learn to tell the difference by following our reviews.

Do other kinds of investing use trading robots?

Yes. Stocks, bonds, you name it. Wherever there are assets being traded on the internet, there are robots trying to beat the system.

Why do celebrities get associated with bitcoin robots?

For the most part, celebrities do not endorse Bitcoin robots. Most of what you hear about are marketing ploys from robot scams.

Where do I go if I want to buy real bitcoin?

Brokers like Coinbase will allow you to buy real Bitcoin with your local currency.

Is Bitcoin run by robots like these?

No. Bitcoin is partially run by computers, but these computers are not used for trading. They're used in Bitcoin mining, which secures the network and introduces new Bitcoins to the marketplace.

Do other cryptocurrencies have trading robots?

All of the popular cryptocurrencies have trading robots, especially Bitcoin, EOS, Ripple, and Litecoin.

Will Bitcoin be able to keep up its current momentum?

Bitcoin's recent performance has inspired confidence and people believe that another surge might be coming. However, nothing can be said for certain since the market continues to be very volatile.

Is now a good time to buy Bitcoin?

Bitcoin is now trending up has crossed its long-standing $50k resistance. While it might be a good time to buy, investors might want to look at other factors before investing. Platform's like Dash 2 Trade can give users an overview of the sentiment around this crypto.