Algorithmic trading is a type of trading that uses pre-programmed computer software to automate the trading process. All the traders need to do is provide the parameters of their investment, and when these conditions are met, the software ensures that your trade is executed. The system is programmed to choose trading instruments, do the research part, and find the best opportunities on behalf of the trader.

This kind of trading saves you a lot of time and is able to generate profit so quickly and frequently that it is impossible for human traders. If you are interested in algo trading and want to learn how to use that, this guide is for you. Here we have reviewed the best algorithmic trading platforms in 2024, discussed the benefits of algorithmic trading, and introduced a step-by-step process for starting algo trading.

8 Top Algorithmic Trading Platforms in 2024

After careful research, here is a quick list of the brokers and trading platforms we have selected as the top algorithmic trading platforms for 2024. You can find short descriptions for each of them and make a choice based on your trading goals.

- eToro Copy Trading Platform – Best Algorithmic Trading Platform in 2024

- Learn2Trade – Best Algo Trading Platform for Forex Trading

- Quantum AI – AI-based Algo Trading Platform with a Wide Variety of Assets

- Bitcode AI – Bitcoin Trading Platform that Uses AI to Automate Trades

- Oil Profit – Algo Trading Platform Best Suited for Commodity Traders

- Bitcoin Era – Great Algo Trading Platform for Beginners in Bitcoin Trading

- Teslacoin – Beginner-Friendly Algorithmic Trading Platform for Crypto Traders

- Immediate Edge – Algorithmic Crypto Trading Platform for Beginners and Experts

The Best Algorithmic Trading Platforms Reviewed

Selecting the right trading platform is one of the most important things for having a profitable algo trading experience. A wide range of platforms offers various algo trading services, with all of them offering different features, pricing structures, and safety mechanisms. Hence, you need to explore these platforms to find out which best suits your requirements.

However, with so many options in the market, you may find it rather time-consuming to analyze all those platforms and finally choose the best one. To save you time, we have already done thorough research and picked the top algo trading platforms for you. In this section, you will find a detailed review of each of the platforms we have included in our list.

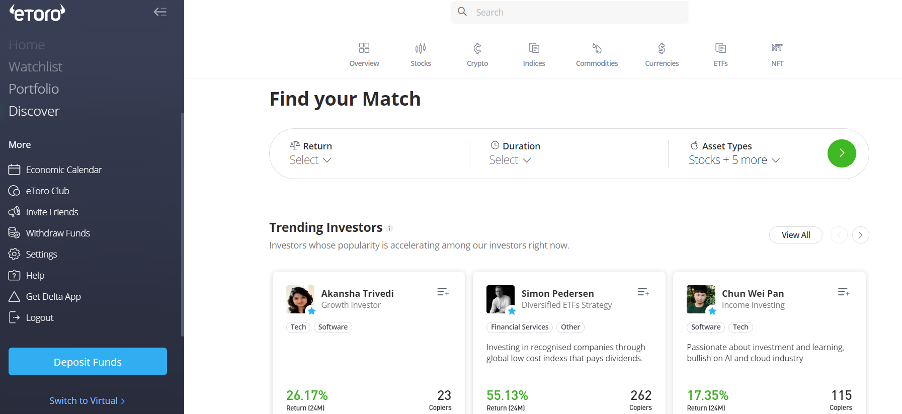

eToro Copy Trading Platform – Best Algorithmic Trading Platform in 2024

eToro is among the best well-established trading platforms, with tens of millions of users from around 100 countries of the world. The broker makes it possible to trade a great variety of assets on its platform, including hundreds of stocks, ETFs, exotic and minor currency pairs, popular cryptocurrencies, commodities, etc. And all of this you can enjoy with eToro’s social trading platform and algo trading services, like CopyTrader.

CopyTrader is one of the most widely used tools on eToro, enabling traders to copy other traders’ positions. The tool gives an excellent opportunity to automate your trades with a click of a button, and the program will open and close all the trades. You only need to browse the platform to find which traders you want to copy, explore their experience and profits, and start copying.

eToro’s CopyTrader is completely free to use, but you need to invest a minimum of $200 to be able to use this tool. Meanwhile, it also enables copying 100 traders with a maximum limit of $100,000 investment. eToro also enables you to adjust some parameters on your own, such as your stop-loss levels, positions, etc. Another advantage is that you can stop the copying process any time you want.

It is worth noting that though CopyTrader is free to use, you will need to pay transaction fees every time you buy and sell an asset. However, eToro offers quite a competitive pricing structure, which includes low commission fees and bid/ask fees which differ depending on the asset type. For example, you can trade stocks and ETFs without a commission fee, but a 1% commission fee is charged for cryptocurrencies.

This makes eToro an affordable platform to start with, as non-trading fees are also quite efficient. The broker does not take any deposit fees, and a flat fee of $5 is charged for the withdrawal, irrespective of your payment method. If you are a starter in trading, you can also use eToro’s Demo account option, which gives you non-real money to practice trading before you step into actual trading.

With eToro, you also don’t need to worry about the safety of your funds. The broker is heavily regulated by top-tier financial organizations, including FCA, CySEC, and ASIC. This makes eToro one of the safest brokers to trade CFDs, forex, cryptocurrencies, and commodities. The broker has a user-friendly interface and a social trading platform to communicate with other traders and take part in discussions.

For those, who prefer mobile trading, eToro also supports a mobile app that can be downloaded from online markets and installed on both iOS and Android devices. The broker has good customer service, which is provided through email or phone, and has a well-designed website with a lot of educational content about the platform’s features and trading – see our complete eToro review.

Update – As of 2024, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Your capital is at risk

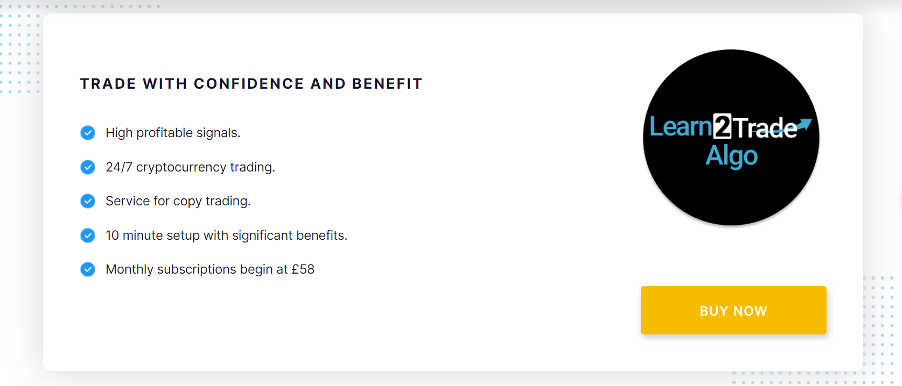

Learn2Trade – Best Algorithmic Trading Platform for Forex Trading

Learn 2 Trade is a popular crypto and forex signals provider and educational platform. It has been especially popular with its premium membership plans for crypto and forex trading signals, providing users with up to 5 daily signals, trading tips, and real-time alerts on its VIP Telegram channel. Learn 2 Trade’s signals have 76% accuracy, making Learn 2 Trade one of the best signal providers in the market.

Apart from providing accurately predicted signals, the platform also offers algo trading membership plans. It means that you will not only get alerts about the most profitable signals, but your trades will automatically be executed based on these signals sent on Learn 2 Trade’s Telegram channel. To use its algo trading service, you need to select the membership plan, make the purchase, link the bot and the exchange with your L2T account, and execute the trades.

There are 3 membership plans for algo trading – 1-month, 3-month, and 6-month subscriptions with a price of £99/m, £67/m, and £58/m, respectively. By selecting any of these packages, you will be able to get up to 40 signals monthly with a 79% success rate, 24/7 cryptocurrency trading, copy trading service, and much more.

Once you choose the membership plan, you will join the VIP Telegram channel where the signals are sent. If you want to automate the whole trading process, first, you will need to open an account on Corvix and link it with L2T. As Learn2Trade supports Binance and ByBit exchange, you must have an account on any of these platforms and link it to L2T again.

After all these steps, you can select if you want to execute all the signal alerts automatically or manually select which ones to execute. Alternatively, you can also select any other membership plans on the Learn 2 Trade, such as crypto or forex signals packages, and get those signals without automated trading.

All the signals are provided by the Learn 2 Trade team experts with over 15 years of experience in trading. The platform has over 70,000 active members and has provided over 3000 signals. Apart from algo trading and trading signals, you can also find a great amount of educational content on Learn 2 Trade’s website and learn about forex and trading strategies.

Your capital is at risk.

Quantum AI – AI-based Algo Trading Platform with a Wide Variety of Assets

Quantum AI seems to be a new player in this market, but it has already gained some popularity. The broker is designed to leverage artificial intelligence’s power and help beginners effectively allocate their funds. Quantum AI claims to use advanced AI technologies to provide its users with best trading practices conducted through platform managers.

Though it is mentioned on Quantum AI’s website that the platform is mainly designed to help beginners start their path in trading, advanced users also trust the platform to automate their trades and save time. The website claims to provide algo trading services on different types of assets, including forex, crypto, stocks, commodities, and indices.

Quantum AI enables traders to get into the algo trading from any part of the world with stable WiFi, as the platform is compatible with any device, from desktops to tablets and smartphones. Getting started with Quantum AI includes a 3-step process.

First, you need to register on its website; next, you need to browse and get familiar with the platform. Once you have chosen the strategy for trading, you can share the parameters with your account management and start trading. The minimum amount you will need to start trading with Quantum AI is $250.

The platform claims to partner with over ten regulated brokers, so the safety of your funds is taken care of. Though everything on Quantum AI is automated through your account manager, the final word in your trades is yours, and you can decide which parameters to change regarding your trades. The platform also says that it does not charge any withdrawal or extra fees to make the trading experience affordable for the users.

Check out our full insight into this trading bot in our QuantumAI review.

Cryptocurrencies are unregulated. Trading with unregulated brokers will not qualify for investor protection.

Bitcode AI – Bitcoin Trading Platform that Uses AI to Automate Trades

Bitcode AI is another trading platform based on artificial intelligence to provide and execute accurate trades on behalf of its users. It claims to use sophisticated AI technology to do proper research and improve passive trading among investors. Due to its algorithm, Bitcode AI is able to monitor the market thoroughly, gather important data about the price performance of the overall market, and place trades based on this data.

The platform’s main focus is on cryptocurrencies, and it supports over 20 cryptocurrencies, including Bitcoin, Iota, Dash, Zcash, Cardano, and other popular digital coins. It is also possible to do margin trading with Bitcode AI, including CFDs, futures trading, etc. The platform claims to be fully automated, and all you will need to do with this platform is to spend some minutes per day checking the positions.

Bitcode AI is available to use on a desktop, and it has a mobile app for those who prefer mobile trading. Its trading platform is designed to be easy to use for beginners and provide them with a seamless experience in trading. The platform’s algo trading service automates everything, but users can still adjust the parameters if they want to.

Not much information is provided on Bitcode AI’s platform, so we can’t say much about its safety and reliability. However, according to the platform, it partners with a number of popular brokerage platforms to execute your trades. To start trading with Bitcode AI, you must meet its minimum requirement of $250.

Cryptocurrencies are unregulated. Trading with unregulated brokers will not qualify for investor protection.

Oil Profit – Algo Trading Platform Best Suited for Commodity Traders

While most of the innovative trading platforms are concentrated on cryptocurrency, stock, and forex trading, it is hard to find a trading platform specifically designed for commodity trading, like oil. Oil Profit is one of the popular platforms of this kind that is customized to boost algo trading of this commodity.

Oil Profit believes that oil is one of the most interesting assets to trade now as it is a global locomotive. While cryptocurrencies can crash, companies can go bankrupt; oil still plays a vital role in the global economy despite the popularization of greener energy. However, creating an algo trading platform focused on oil trading requires taking into account other factors that oil price depends on.

These factors include global political and economic conditions, which can affect oil prices. Oil Profit claims to take into account these factors while building its AI-based technology to boost oil investment. The platform’s main aim is to make the difficult world of oil trading accessible for beginners. Hence, there is no need to have any knowledge or do research about this sector to get into oil trading.

The minimum deposit to start trading oil with Oil Profit is $250. The platform does not charge any other non-trading fees, such as deposit, withdrawal, or account fees, as all profit is generated from the transaction fees you pay while trading oil. The registration process is quite simple. You need to spend some minutes to sign up for an account, and later you can use those credentials to enter your brokerage account to execute trades.

As with other commodities, trading oil does not mean that you actually buy the oil, and you don’t need to store the oil you invest in. This simply means that you trade on oil’s price that is kept in receive, and nothing will be delivered to you. Oil Profit is available in most countries except the USA.

The platform supports a number of payment options to charge your account, including credit cards, wire transfers, and PayPal. If you want to trade with Oil Profit, visit its website and start registering.

Cryptocurrencies are unregulated. Trading with unregulated brokers will not qualify for investor protection.

Bitcoin Era – Great Algo Trading Platform for Beginners in Bitcoin Trading

Bitcoin Era is the next popular trading platform on our list that supports and automates cryptocurrency trading. It claims to use top-notch AI technology and secret trading strategies developed by professional traders to help you make huge profits in the volatile cryptocurrency market. The registration process on Bitcoin Era is effortless and can be finished in a couple of minutes.

Bitcoin Era does not charge any deposit or account maintenance fees. The platform also claims to provide free trading for a year if you succeed in registering through the lottery slots. Other useful features that Bitcoin Era offers include its Demo trading account to help you get familiar with the platform before starting the actual trading.

It supports a mobile-friendly app that is available to use not only on smartphones but also on desktops. The interface of the app is easy-to-use, and you will have a seamless experience trying to use its features. The platform also integrates advanced security mechanisms to protect its users’ accounts. You will also need to verify your account if you want to use the features of Bitcoin Era.

The minimum amount of money required to start trading with Bitcoin Era is $250. After charging your account, you will have your personal manager help you set up the account. While your trades will be automated, you can also set your own conditions and apply the trading strategies you want.

Cryptocurrencies are unregulated. Trading with unregulated brokers will not qualify for investor protection.

Teslacoin – Beginner-Friendly Algorithmic Trading Platform for Crypto Traders

Tesla Coin is another algo training platform with a focus on automated cryptocurrency trading. It stands out among other platforms in our list with the feature that all the funds on this platform are held in its native token – TES coin. Tesla Coin does not charge any commission fees on your trades or any additional trading fees, so the platform is quite affordable.

However, there is little information on its website that can help us clearly understand its security features. Among its features is a demo account enabling you to experience trading with virtual money and practice trading on the platform. TES coins can be used to buy many of the popular cryptocurrencies, including Ethereum, Cardano, Litecoin, and others.

The minimum deposit to start trading with Tesla Coin’s platform is $250, which you can deposit through a credit card, wire transfer, or e-wallets, such as PayPal. You can access the platform through its website. Tesla Coin does not offer a mobile app; however, its website is also available through mobile browsers.

As for the registration process, Tesla Coin supports straightforward registration. It also has versatile options for customer support, including live chat and email. With its features and services, Tesla Coin is better suited for short-term trading rather than using the platform to hold cryptocurrencies in the long term.

Read our full TeslaCoin trading software review.

Cryptocurrencies are unregulated. Trading with unregulated brokers will not qualify for investor protection.

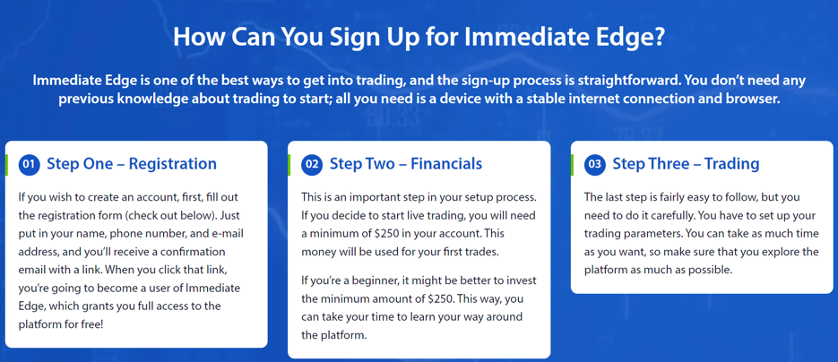

Immediate Edge – Algorithmic Crypto Trading Platform for Beginners and Experts

Immediate Edge is another alternative to algo trading platforms, which uses advanced software programs to provide you with automated trading and cut your time spent on research. The platform supports different types of assets, with the main focus on cryptocurrencies. You can use three fiat currencies to trade on Intermediate Edge; a minimum deposit of $250 is required to use the platform.

Immediate Edge claims to support a demo account to better understand if the platform suits you. When it comes to fees, the platform does not charge any commissions or trading fees from your trades. Additionally, the platform allows you to withdraw funds from your account for free 10 times a month.

One of the key features of Immediate Edge is its fast trading system which enables users to place 15 different trades in one minute. The platform also supports CFD trading with up to 5000:1 leverage. Its customizable parameters also enable users to set conditions on when the trade must be executed, and the platform will take care of it once the perfect market conditions appear.

Immediate Edge does not provide a mobile app but supports a beginner-friendly desktop platform. It has customer service available through email. However, the information on its website is not enough to make a clear judgment about the safety and efficiency of the platform.

Cryptocurrencies are unregulated. Trading with unregulated brokers will not qualify for investor protection.

What Are Algorithmic Trading Platforms?

Algorithmic trading platforms are brokerage platforms that use computer programs to place trades on behalf of a user according to preliminarily defined algorithms. It enables traders to set the parameters of their trades, including when and how they will be executed, and the software will execute the trades when it spots the most profitable opportunities in the market. They’re sometimes also referred to as trading robots.

One of the main benefits of algo trading is that everything is automized, and you don’t need to follow the market to find the perfect moment and put your trades. Instead, you can simply provide the details about your trade, and the code will execute it for you. Algo trading also enables traders to get profits at a speed and frequency that is impossible for human traders.

Algo trading comes with a lot of advantages and disadvantages. Among the most popular benefits are the best possible executions, as long as the algorithm is able to find and place the trade at the most efficient price. It also ensures that trade placements are accurate and quick, excluding the risks of human-made errors.

Such factors as human traders’ emotional or psychological state can also affect the efficient execution of the trades, which does not happen in the case of algo trading. Other possible benefits may include low transaction costs, backtesting through the available data, simultaneous checks of various market conditions, etc.

In the meantime, algo trading comes with a number of disadvantages that you need to consider beforehand. The most significant disadvantage is that, after all, you trust a computer to manage your trades, and technical problems can disrupt the execution of trades and even result in losses. It means that you must be careful when selecting an algo trading platform and choose the one that has already proven reliable services.

Different Types of Algo Trading Platforms

Along with the popularity and high demand of algo trading, a lot of software programs emerged offering algo trading services. Different platforms incorporate algo trading services, so you can find many algorithmic trading options.

In this section, we have introduced the most popular types of algo trading, which can help you better decide which platform to select for algo trading.

Automated Trading

Automated trading helps traders to set up their own algo trading systems and execute their trades with the help of the computer. Automated trading is especially popular with Meta Trader 4 and Meta Trader 5 trading platforms, which usually provided on some of the best forex brokers. Automated trading helps you not to miss any market trends without being involved in them.

Another benefit of automated trading is its more efficient risk management strategy. The system makes more efficient decisions on the trader’s behalf, considering their portfolios. It also manages your trades and takes a systematic approach without the interference of any emotions or biases.

Copy Trading Systems

Copy trading systems are especially popular among beginner traders as they allow you to mirror the trades of an expert trader. This saves you a lot of time, and instead of randomly opening and closing positions, you follow a professional trader for a more efficient trading experience. This also enables you to automate your traders if you want to take a break from your device, so advanced traders also rely on this algo trading service.

Lots of brokers offer copy trading tools, but our top pick is eToro with its CopyTrader and CopyPortfolio tools. These tools are completely free to use and are quite reliable. One of its advantages is that eToro provides a separate section for each trader that you can copy. On this page, you can find information about the trader and check its previous performances. Besides, eToro is a regulated and safe broker, ensuring you can enjoy trading.

Trading Signals

Trading signals are commonly used among many investors, and they represent recommendations for opening and closing a certain position at a certain time. These signals are based on automated programs that conduct market research and offer the best options to buy or sell an asset.

Trading signals help beginners and advanced traders profit without spending time on research and market analyses. Different trading platforms, including also Learn2Trade from our list, provide crypto trading signal services. By subscribing to these services, you can get a limited number of signals each month. The signal information usually includes the name of the asset, when to open and close the position, RRR, entry and stop-loss levels, and some other details.

Does Algo Trading Really Work?

Algo trading can really be profitable, and it gives you a number of advantages over manual trading. However, it also depends on the algo trading platform you select to use and also what strategies you integrate into your algo trading experience. But algo trading comes with many benefits that help you maximize your profits and conduct trades efficiently even if you are not a professional trader.

First, due to algo trading, you don’t need to continuously keep your eye on the market. You provide the algorithm with the details about your trades and will place the orders once favorable conditions are favorable. Fear, biases, and other emotions can negatively affect the trading process, but they are excluded with algo trading.

Hence, algo trading makes sure that the fear of missing out and any other emotions or errors that can be made by you do not hinder the trading process and that the trades are placed accurately.

Getting Started with Algorithmic Trading – How to Start Algo Trading

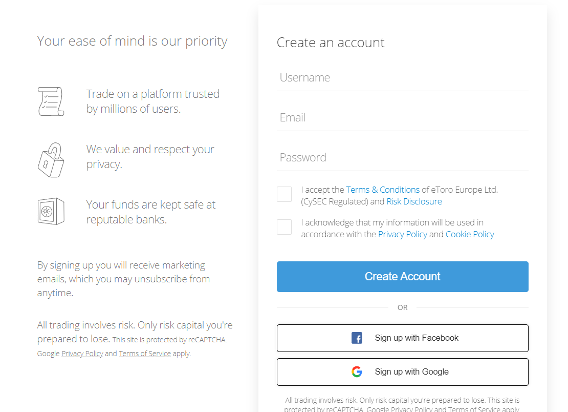

If you have already learned enough about algo trading and are ready to start it, our guide can be quite helpful for you. This section will walk you through the process and show all the steps you need to make in algo trading with eToro.

Step 1 – Create an Account

Your first step is to simply open an online account with eToro, for which you must visit the broker’s website. This process is really easy with eToro, and you just need to provide your name, surname, and birth date and create a username and password for your account. To complete the registration, eToro will also ask you some questions about your investment goals, strategy, budget, etc. Still, the overall process is no longer than 10-15 minutes.

Once you finish the registration, there is 4 step account verification required by eToro. This is needed to keep your trades safe and secure, as eToro is heavily regulated by a number of financial institutions. The first two stages are simple verifications with a mobile phone and an email.

Next, you will need to undergo identity verification with a copy of a government-issued ID card or driver’s license. Finally, the last phase is address verification which you can complete with a copy of a bank document or a utility bill. Once all the requirements are provided, eToro will verify your account in a short time.

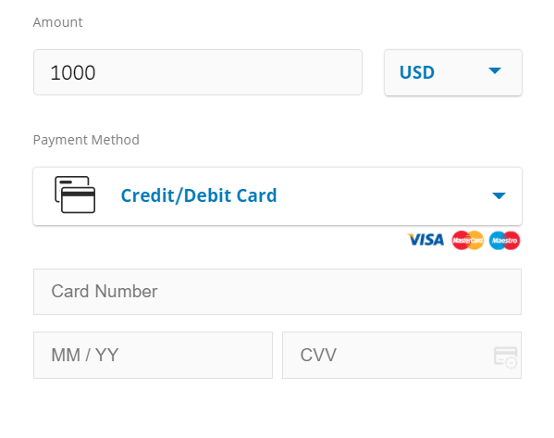

Step 2 – Deposit Funds on Your Account

Obviously, you can’t trade without charging your account; hence your next step is to fund it with some money. eToro supports several payment options, so you can choose the most convenient one for you, provide the details, and deposit funds. Consider that the minimum requirement for algo trading is $200. The broker does not charge deposit fees; a conversion fee will be added for non-USD contracts.

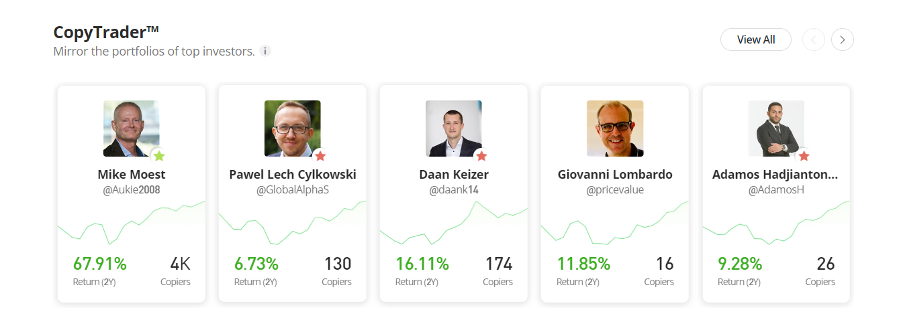

Step 3 – Select a Trader to Copy

Your next step is to browse the website to find the trader you want to copy. Click on the “Discover” section on eToro’s main page, and you will be navigated to a page where you can find a section named CopyTrader. Click on the View All button to discover and explore more traders.

On this page, you can adjust your investment goals, such as the assets you want to buy, the duration of your investment, and the risk level. You can also browse the sections to find the most suitable one for you. There are different categories of traders, including the most copied ones, ETF-focused traders, energy investors, etc.

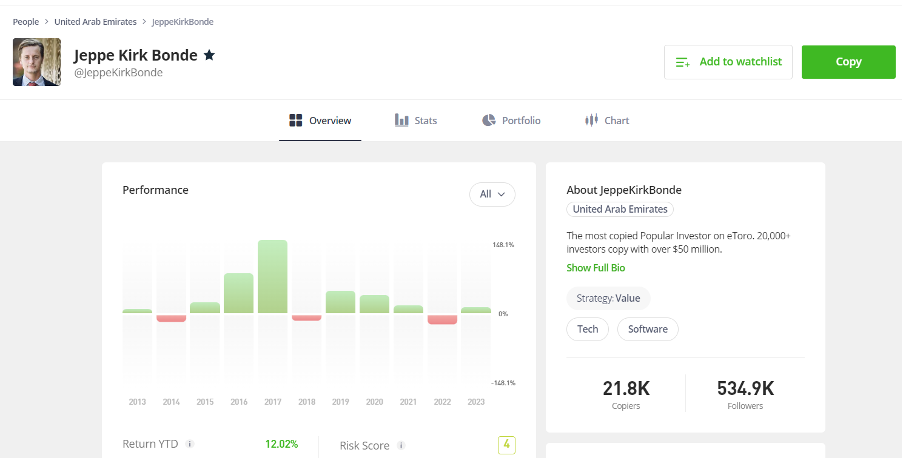

Step 4 – Copy the Trader

After selecting which trader you want to copy, click on its name to start copying. eToro also has separate pages for each trader, where you can find information about the trader and explore the trades it executed and their performance. Once you are ready, click on the “Copy” button next to the trader’s name and fill in the amount of money you want to use for copying.

To finalize the transaction, click on the “Copy” button. After finishing the process, you will find all the information about the performance of your trades in your portfolio section. The broker also enables you to stop copying or adding new funds to your investment at any time you want.

Best Algorithmic Trading Platforms – The Verdict

Algorithmic trading is certainly growing in recent years, and for a good reason. Nowadays, it is possible for the average retail trader to find an algo trading platform and invest without much effort and knowledge. In this guide we listed and review the best algorithmic trading platforms of 2024 and beyond.

Algo trading platforms make it easier for you to execute trades efficiently if you don’t have enough time to do research and organize your trading on your own. However, you need to also be careful about the fact that you trust all your money to the algorithm. Hence, it is important that the algorithm takes care of your trades efficiently and safely.

With this being said, you need to select a trustworthy brokerage platform that has already proven to provide efficient algo trading tools. According to our thorough research, eToro ranks among the best algorithmic trading platforms to invest with in 2024. With eToro, you can copy trade professional investors that make use of algo trading tools like Napoleon-X.

To start algo trading with eToro, you will need to deposit at least $200 on your eToro account, select the traders you want to copy, and simply mirror all their trades with a click of a button.

FAQs

How much money do I need to invest to start algo trading?

To start using an algo trading platform, you must meet the minimum requirement of various brokers, which differs depending on the platform. eToro is one of the most affordable algo trading platforms in this sense, with a minimum requirement of $200 and a maximum requirement of $500,000. The platform also enables you to copy the trades of up to 10o investors at the same time.

Is it possible to automate trading with Python?

Python is one of the most efficient and popular coding languages used in algorithmic trading. You can use this programming language to create efficient strategies for algo trading. However, knowing any coding language to use algo trading is not mandatory. If you don’t know Python or any other coding language, you can always use an Algorithmic trading platform for this purpose.

What is the cheapest algo trading platform?

Whether you need to select a cheap algo trading platform depends on your investment goals and intentions about trading. Many platforms can provide cheap algo trading services, but this is not the only thing you need to consider. To be a good platform, the exchange must also be reliable and secure and provide a versatile trading experience. Hence, it is important to consider a number of other factors along with the price. In this regard, we consider eToro one of the most reputable brokers with quite a competitive pricing structure. The broker charges no commission fees for stock trading, while other assets can be traded at average market prices. eToro is also heavily regulated, so you can be assured your money is safe with this broker.

How do I trade with algorithmic software?

All you need to do is to select a suitable brokerage platform and create an online account. With such regulated brokers as eToro, you will also need to go through the KYC process, after which you can deposit funds in your account and browse the platform to find the investor you want to copy.