Several cryptocurrencies claim to be better substituted for Bitcoin. Litecoin is one of these cryptocurrencies and in a way, has lived up to expectations. Litecoin (LTC) is positioned solidly on the top 10 cryptocurrencies list and prides its development as a “light version of BTC”. This is because Bitcoin is known to be a less scalable blockchain that handles transactions way slower than other superfast blockchains like Cardano or XRP. The development of Litecoin is focused to offer a network that encourages transactional efficiency for all purposes while maintaining a reputation as a trustworthy store for value.

Litecoin has won the admiration of thousands of cryptocurrency lovers. Its reputation as a useful blockchain project has given it an edge over many other digital assets. Similar to popular crypto projects like Bitcoin, Ethereum, or XRP, Litecoin can also be traded on crypto exchanges and brokers. Its transaction fee isn’t too overwhelming which makes it turn out to be a favorite of institutional investors.

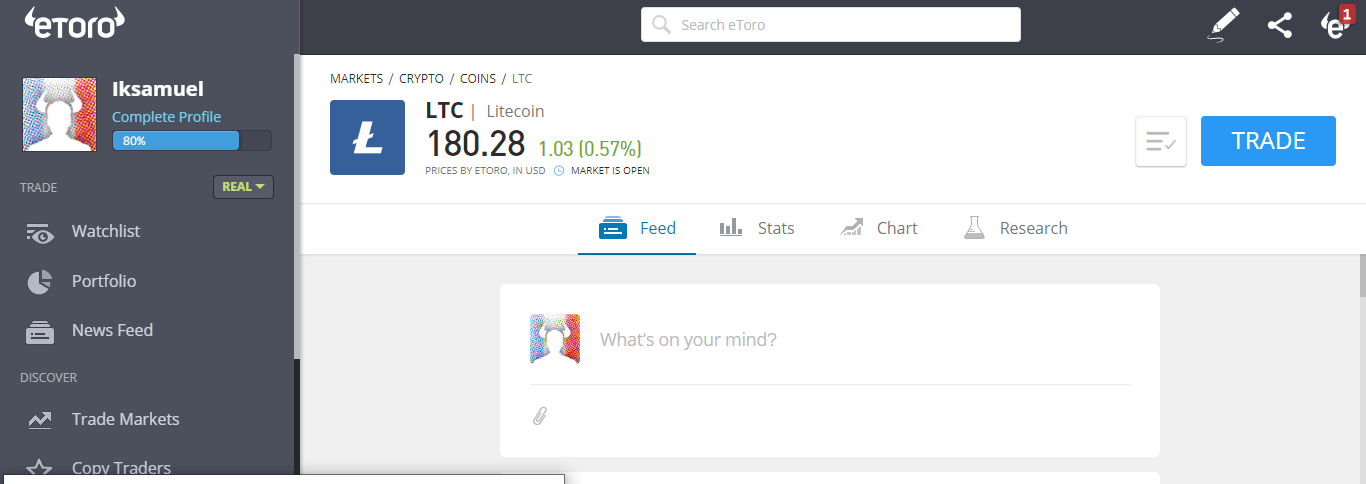

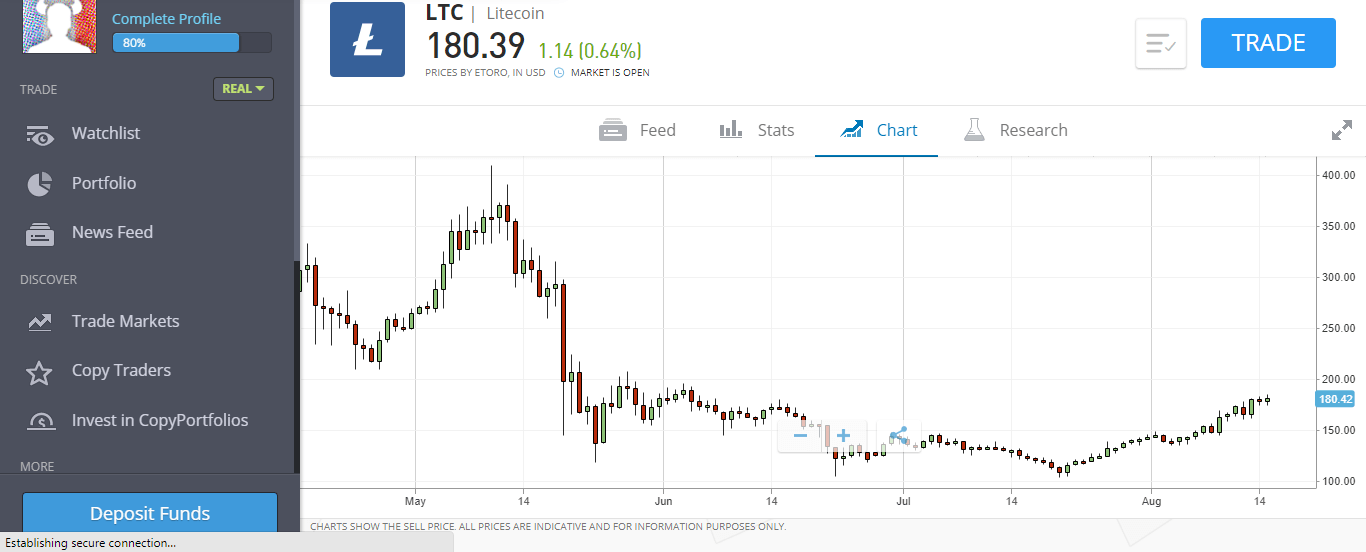

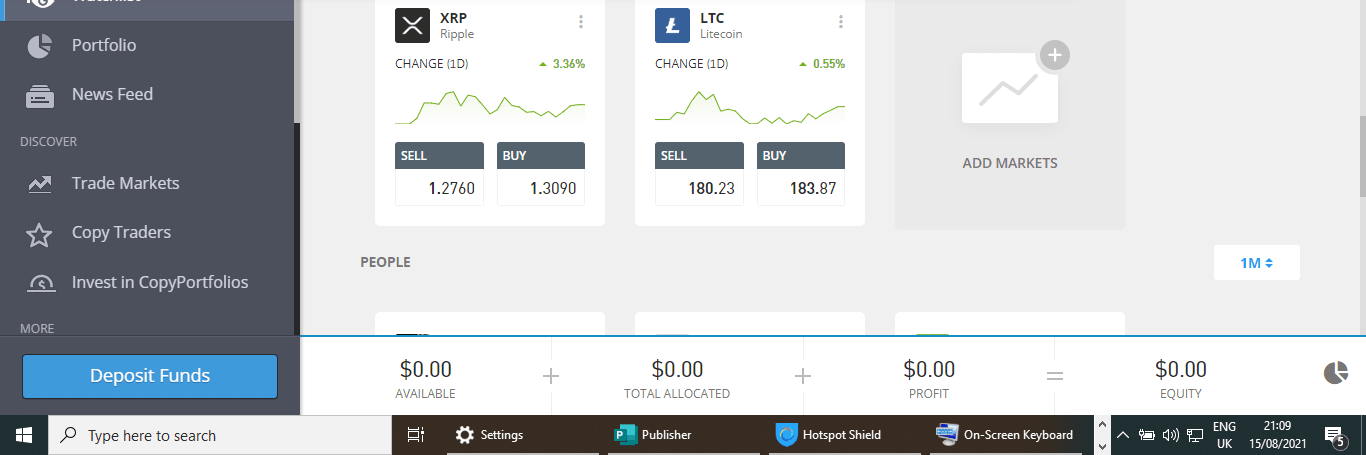

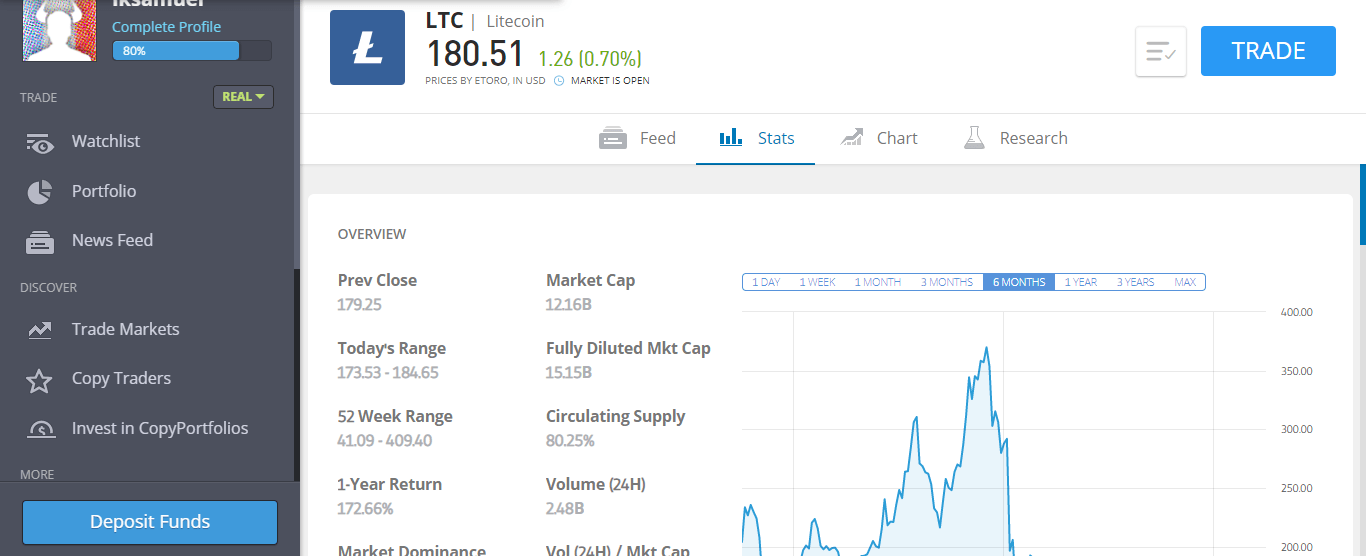

We suppose that this project might have caught your fancy. Possibly, you could have some Litecoin in your crypto wallet or gearing to buy some. Whichever scenario is in place, we have detailed this guide to take you on the easy routes to sell your Litecoin if need be. Understanding how to sell your Litecoin early enough would help you answer potential questions and ensure that you sell your holdings securely and efficiently. Let us begin by listing some of the best brokers that offer high-end liquidity for Litecoin. These brokers have been examined by industry experts and their uniqueness has set them apart from the vast competition. Primarily, they are up to speed with the relevant technologies and features that embrace seamless trading. With these brokers, the skepticism that your cryptocurrencies are not secured enough or could be intercepted by hackers is minimized. The aforementioned brokers have fulfilled the minimum requirements for a crypto trading platform. In addition, they have been vetted by industry experts and deemed to be suitable for crypto-related activities. To distinguish themselves from others, some exchanges make extra efforts to add products that their users would find interesting and useful. To enjoy the diverse benefits of these platforms, you would have to sign up and attain a proper verification status. Signing up successfully can be completed in minutes and you can get to perform transactions as soon as the process is completed. Fortunately, some of the brokers listed above feature great materials for beginners. These materials range from tutorials to special trading desks that lower the risk of investment. Reiterating the fact we mentioned above, Litecoin is a tradable digital asset. This implies that anyone can buy Litecoin, sell, or hold Litecoin due to the value it possesses. If you have some Litecoin that you would like to sell, you might likely have purchased it in a period when it was lower and value to sell when the value appreciates. Of course, this is the overall motive of crypto investors. However, if you don’t own Litecoin, you can purchase any quantity of it easily from the brokers listed above. Now that we have examined what Litecoin is and where to get it from, it’s time to explain the process of selling it. It would be necessary to let you know that selling any cryptocurrency including Litecoin isn’t a big deal. However, the essence of this tutorial is to describe how to sell it in a secure and fast way while liquidating them for the best value. For this tutorial, we would be highlighting one of the most efficient trading platforms – eToro. This broker is one of the top choices amongst the others listed above. It is popular for being resourceful to beginners and superbly maintaining the requirements of a useful crypto broker. eToro is based in the UK and has registered offices in the USA and Australia. Interestingly, any United States resident can own an eToro account to trade and can leverage it to trade multiple cryptocurrencies. Update 2025 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum. Since we have chosen a good broker, let’s see how to maximize it to sell Litecoin using the four steps below. Before you can sell any cryptocurrency on any exchange or broker, you ought to own some of it. There are several ways to accumulate cryptocurrencies, one of the most effective ways is to buy them from the broker you’re using. eToro allows users to buy crypto within minutes. However, if you have your Litecoin elsewhere like another broker or independent Litecoin wallet, you can easily transfer it to your Litecoin wallet on eToro. Buy Litecoin Source: eToro Firstly, you have to sign up on eToro and follow the registration process to get verified. A green tick on your profile indicates that you’ve been verified. After this is done, you would have to deposit from your local bank, credit card, or third-party payment services like PayPal, Neteller, or Skrill. Once your deposit is confirmed you can proceed to buy Litecoin. Just as mentioned beforehand, the primary motive of investing in cryptocurrencies is to make some profits over some time. To evaluate if you have gained or lost, you have to know the difference between when you made a trade entry and your expected profits. Of course, there are tools on eToro that would help you determine if it’s the right time to sell. Tools like the historical trading chart make it easier to track your entry period. Litecoin chart on eToro The trading chart in eToro and other brokers can be viewed in diverse time frames. In essence, you can view price actions that occurred within months, weeks, days, hours, or even minutes. Being able to draw the difference between your entry and potential exit to ascertain your profit margin is always beneficial. However, you are at liberty to sell whenever you wish. eToro allows its users to view all their crypto stakes at once. At the click of a button, you’d be ushered into a page detailing all the positions that are currently active before you can choose which one to close. On eToro, the button to access your portfolio is located at the top left corner of the primary page as seen below. eToro overview Clicking on “portfolio” would give you a quick grasp of your overall holdings and the specific amount designated to different assets. From there, click on “Litecoin” and proceed to close your position. While navigating your portfolio, click on the digital asset that you want to sell. In this review, our concern is Litecoin. Note that you can sell any amount of Litecoin buy before you can successfully withdraw your funds on eToro, you need a minimum of $30 in your available balance. Closing trade on eToro When you have clicked the cryptocurrency, you would be prompted with a box to expand on how much of the asset you wish to dispose of. It is entirely up to you to make the decision. Fortunately, eToro does not charge any fees when you close an active position. After detailing the quantity of Litecoin you wish to sell, click on “close position”. The liquidated sum would instantly reflect on your available balance once the order is filled. There are certain criteria that a broker demands that a user must fulfill before they can withdraw their funds. These criteria vary from being registered properly to integrating an acceptable payment channel. Some brokers and exchanges might require you to opt for a more secure security feature, mostly the two-factor authentication setting. All these requirements make it easier for a broker to process your withdrawals while ensuring that everything is done with legal confines. The requirements are also necessary for the measures to prevent financial crimes like money laundering and to conform to KYC regulations. For eToro, the requirements are not too tasking or too lightweight either. This broker is working hard to ensure that users enjoy its seamless trading and withdrawal benefits while keeping the platform secure. A good way to ensure that security is enhanced, withdrawals are only processed for accounts that are verified. Verification also means that you must opt for the two-factor authentication setting. You must also reside within the US or areas that the platform offers service to. Note that you cannot withdraw from eToro if you do not have a balance of $30. eToro processes your payments to your local bank so you would have to input your bank details as required. Having added 35 fiat pairs recently, eToro has about 44 fiat currency pairs on its platform. These fiat pairs consist of currencies that are widely used in Europe, America, Japan, Canada, Australia, and New Zealand. There is a dedicated exchange page that details the live exchange rates of these fiat currencies. Converting from USD to other fiat currencies would cost a small conversion. eToro charges an average withdrawal fee of $5 which isn’t too demanding. Courtesy of a ruling in 2014, the Internal Revenue Service (IRS) in the United States has classified crypto as a property or an asset. In essence, cryptocurrencies are subject to taxing and every investor is expected to keep to that. Certainly, no one enjoys being at the wrong end of the law, the IRS isn’t joking about their measures to see that the law is kept. Understanding how crypto taxing works is very crucial as a law-abiding citizen. Crypto taxing is in effect if you make income from it. The IRS requires a yes or no reply on questions about your use of cryptocurrencies. You might have to consult a tax planning professional to ascertain the best way to make your tax reports or make more findings on the IRS website. Fortunately, crypto taxes are measured in a fair equivalent to the USD. Therefore, if you make purchases in cryptocurrency, your tax would be equated with the dollar at the time of purchase. Taxable crypto events are classified into two categories – short-term capital gain tax and long-term capital gain tax. The difference between these two is that the former is in effect if you hold crypto less than a year, while the former applies when you hold cryptocurrencies for more than a year. You are taxed when you mine crypto, gain airdrops, sell cryptocurrency for cash, pay for goods and services, or receive staking rewards. However, you are not taxed if you transfer crypto between wallets or when you donate them to tax-exempt charity organizations. To reconcile your capital gains and losses, you can report events on Form 8949 via Schedule D. An indispensable aspect of the crypto industry is crypto exchanges. They are vital in the trading, exchanging, and securing of digital currencies. Cryptocurrency exchanges help traders to explore the crypto market and effectively leverage the price momentum of numerous projects. However, it might be stressful to select the best exchanges to trade your cryptocurrencies. Just as they are several cryptocurrencies, they are also several exchanges. Because you practically can’t test all these exchanges to determine the most suitable, analysts have been able to handpick the best amongst all others. These exchanges are reputed to be efficient, secure, functional, and convenient for anyone. While no one can deny that the crypto market is volatile, some of these exchanges have certain features that can help to minimize the risk levels. Litecoins, just like Bitcoin and Ethereum are stored in cryptocurrency wallets. The primary types of crypto wallets are digital walkers also known as hot wallets, and then physical wallets also known as cold wallets. Both categories perform similar functions, however, the difference lies in the convenience of their use. Digital wallets are easier to access and to make transactions with while physical wallets are more constricting. There are autonomous crypto wallets like Trust Wallet that can be used to store and transact with cryptocurrencies. Exchanges and brokers also have native crypto wallets too. Your ideal crypto wallet should be well secured, unrestricted, and efficient. You can pick the most suitable wallet to secure your digital wallets by reading our guide on the Best Litecoin wallets. If you are wondering when should be the right time to sell your Litecoin, you’re not alone. This guide would help you identify the best circumstances to sell your Litecoins. Of course, you shouldn’t trade if you are yet to develop a good trading strategy. Like we mentioned before, crypto trading might be too risky if you are uninformed and uncertain. If you want to become a smart crypto investor, a good trading strategy should not be undermined. Before you buy or trade a digital asset, you must state your overall expectations beforehand and monitor the market till you attain them. No one is capable of guaranteeing that you would attain 100 percent of your trade expectations since the crypto market is speculative, however, using a trading strategy equips you with the necessary standard. Your trading goals can be categorized into short-term, mid-term, or long-term. Short-term traders often use a day trading or swing trading strategy while long-term investors primarily hold cryptocurrencies till they attain their targets. Essentially, a trading strategy helps you identify when you have reached your targets. You should sell your Litecoin if you have reached the price targets you set for it, whether short-term or otherwise. It is pertinent that investors do not allow greed or general market sentiment to determine when they should close their positions. This is because the growing momentum in the market can be short-lived and you’d find your position liquidated. In other scenarios, you should sell your Litecoin if you perceive that it would take a downtrend. Alternatively, you can access viable crypto Litecoin and other predictions on this website. Here, we consistently update our readers with useful trading tips and predictions from renowned experts and analysts. Aside from predictions, you can access a vast library of information about several digital assets and potential whale moves. The cryptocurrency market is still young with a whole lot in store for it. While investing, take out time to explore the blockchain concept and examine the development revolving around the assets you are trading. Accurate information would give you an enviable lead ahead of the uninformed crowd, making it easier for you to maximize the industry. Litecoin’s price has been relatively volatile in recent years. However, while its market capitalization fluctuates, it is still surging in transactional activity recently. The average number of transactions in this blockchain is rated in thousands daily, making it one of the most tradable digital assets. Although Litecoin isn’t as popular as Bitcoin or Ethereum, it is still a top 10 cryptocurrency. Litecoin as an alternative cryptocurrency was released in October 2011, just two years after Bitcoin. Since then, the price momentum of Litecoin has been impressive. Sometime in 2021, its price spiked up to a whopping $388. Litecoin has maintained a clear lead over most altcoins since then and it might attain more highs in the future. Every crypto investor would like to make the most of the crypto market. However, some requirements must be fulfilled before one can maximize the market. Some of the most important factors include time, expertise, and trading capital. Although anyone can have some capital to begin trading, not everyone can afford the time nor possess the expertise to trade successfully. For instance, if you have a job or might not be available on certain occasions, you might miss the chance to get into a trade at the appropriate time. Your trade might even be subject to lose if you aren’t quick enough to close your positions. If the above circumstances sound like conditions that affect your trading journey, then you might have to consider automated trading. Automated trading is a system that leverages trading robots to execute trading orders autonomously at the appropriate time. What this means is that you won’t have to monitor your computer all the time to keep up with your trades. Trading bots monitor market trades based on your preferences and preset conditions, they are capable of buying cryptocurrencies and selling when the time is right. These trading bots are computer programs that are encrypted to provide automatic assistance to any crypto investor. Trading bots are used by individual traders, corporate bodies, and even hedge funds. A beautiful side of trading bots is that one can maximize the crypto market overnight which previously was a strenuous task on human traders. With trading bot technology, every investor is accorded a level playing field to participate in the financial market. The most popular trading bots are arbitrage trading bots, trend trading bots, Coin-lending bots, and market-making bots. Their functions are diverse but essential. For investors who would prefer to take advantage of the constant price changes of cryptocurrencies, trend trading bots are employed. However, trading bot software is unregulated, so you should only deposit funds into bots that you can afford to lose. Our review team has a vetting system to help filter out genuine trading software from the rest. Some of the notable trading robots that we’ve reviewed include: Everyone knows that trading cryptocurrencies aren’t devoid of risks. The entire market is speculative, a good trade might likely sink to the bears at any time or pump up to the bulls. However, this shouldn’t deter anyone from investing. The heavy risk factors can be managed by a good trading strategy and necessary caution. If you want to discover how to invest safely in cryptocurrencies, you should implement the steps listed below. Litecoin is a cryptocurrency that is subject to volatility in the cryptocurrency market. This implies that it can take on a positive or negative trend anytime soon. Like most alternative cryptocurrencies, its rise or fall is largely influenced by Bitcoin. However, if you want to know if 2025 is the best time to sell Litecoin, you should consider the following scenarios: Litecoin is one of the most notable crypto projects so far. Its major use case is to institute a blockchain that is much more scalable than its predecessor Bitcoin. While Litecoin hasn’t overtaken Bitcoin yet, it is steadily growing in volume and adoption. To sell Litecoin, you need a good broker that offers high liquidity. Brokers like eToro are a great option as they are befitting to any trader irrespective of their experience levels. eToro offers withdrawals to local banks or third-party payment services like PayPal. Their exchange rates are commendable as well, therefore it is a suitable broker for anyone in approved locations. While trading or selling Litecoin ensure that you’re filing your tax returns, this would save you from a lot of trouble with the IRS. Equally, invest safely and wisely, implement a bankroll management strategy and stay updated with relevant information about the crypto industry in this place, at any time. Our recommended best exchange to sell Litecoin in 2025 is eToro as they are regulated internationally and support withdrawals by bank wire, VISA, Skrill, Neteller and a range of other methods. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk.

To sell Litecoin, you need to get a verified account on a platform like eToro. Buy or transfer Litecoin to your wallet, close your active positions and finally withdraw to your preferred payment channel.

You can sell your Litecoin on a crypto broker/exchange. OTC desks and peer-to-peer methods are still useful.

It isn't a big deal to sell Litecoin. Once your verification is confirmed, you can execute your Litecoin sales in minutes.

Litecoin taxes depend on the period of your hold. The short-term capital gain tax applies when you hold Litecoin less than a year while long-term capital gain tax applies if you hold Litecoin for more than a year.

Platforms like Binance, eToro, or Coinbase are suitable to sell your Litecoin in exchange for USD. However, you can still opt for other methods like P2P.

Top choices for Litecoin liquidity are eToro, Capital, Libertex, Plus500, Coinbase, Binance, AvaTrade, Revolut, Cryptorocket, and Changelly are some of the best options.

Get your identity verified on platforms like eToro, integrate an acceptable payment channel that matches your identity. However, withdrawals from your broker to your local bank might take three business days.

eToro allows users to withdraw their funds from liquidated assets like Litecoin to their PayPal accounts. Skrill and Neteller are also great options.

Certain crypto wallets feature the sale of cryptocurrencies. However, you can check our guides on Litecoin wallets to select your favorite choices.

To swap your Litecoin for other cryptocurrencies, an exchange is needed. Navigate the platform to discover several assets you can swap with. The value swapped is equivalent to the initial cryptocurrency. On this Page:

How to Sell Litecoin in 2025 Step by Step

Step 1: Get Some Litecoin in Your eToro Wallet

Step 2: Know When it’s Right to Sell

Step 3: Evaluate Your Crypto Portfolio

Step 4: Close Your Litecoin Position

Withdrawal Requirements and Exchange Rates

Crypto Taxation in the US

Best Crypto Exchanges

Storing Litecoin with the Best Wallets

When is the Best Time to Sell My Litecoin

The Price of Litecoin

Guide to Automated Trading

How to Invest Responsibly in Crypto

Should I Sell Litecoin in 2025?

Summary

FAQS

How to Sell Litecoin?

Where to Sell Litecoin?

How Easy is it to Sell Litecoin?

Taxes for Selling Litecoin?

Where to Sell Litecoin for USD?

What Exchanges Sell Litecoin?

How to Quickly Sell Litecoin

How to Sell Litecoin for PayPal Funds

How to Sell Litecoin on Crypto Wallets

How to Sell Litecoin for Other Cryptocurrencies?