The cryptocurrency market cap hit the much-awaited figure of $3 trillion in November 2021, showing the potential of decentralized currency. It has consolidated and held above $2 trillion heading in 2022.

While Bitcoin has been a trendsetter, cryptocurrencies like Ethereum, Litecoin and others also deserve everyone’s attention as they support a wide range of use cases such as data storage, gaming, finance and the like.

Knowing this, should you invest in cryptocurrency in the year 2025? In this guide we’ll give an overview of the most important questions concerning Web3, how to invest in cryptocurrencies in the UK, how to build a good crypto investment portfolio, and the future of the best-performing financial asset of the last decade.

How to invest in cryptocurrencies in the UK?

We recommend eToro as the best place to invest in cryptocurrency, which provides you with insights from experts, trade-related information, educational courses, and more.

Trusted by more than 25 million users it is also a social trading platform where you can read, price analysis, trade news, and access other features. Its Copy Trader feature aids users in learning about crypto investing by allowing them to mimic the trades of the industry’s top traders.

It offers around 80 cryptos, and thousands of other financial assets, to invest in with a 0.5% fee to deposit GBP and a 1% fee on all crypto trades.

Step 1: Create your account with eToro

Don’t invest unless you’re prepared to lose all the money you invest.

Sign-up on the eToro website, and give your necessary details by clicking on the “Join Now” button.

The user will be required to provide their complete name, mobile number, email, password, and username. One can skip this process by directly registering with Facebook or Google.

Step 2: Get your identity verified

Complete the know-your-customer (KYC) process by providing your identity proof with the necessary documents.

This step can also be skipped at the start but doing so will mean users are unable to withdraw or deposit more than $2,000 (£1,700) until they complete it.

Step 3: Deposit money into your account

Once you have completed the KYC process, you are supposed to deposit money in your account by pressing the ‘Deposit Fund’ button.

You can choose any payment method from the following to make your deposit. Debit card deposits are instant while bank transfers take up to 48 hours – GBP deposits come with a 0.5% fee.

Step 4: Purchase your cryptocurrency

Finally, search for the required cryptocurrency in the search box at the top – eg ‘Bitcoin’ – and then click on the trade button on the next screen. Enter the amount you want to buy on the box that pops up, and open the trade. Crypto trades come with a 1% fee.

You can hold your crypto on eToro as it provides a free crypto wallet.

Cryptoassets are highly volatile and past performance isn’t an indicator of future success. Invest at your own risk.

Why invest in cryptocurrencies?

If you are excited about digital currencies but are unsure about investing in them, here are some reasons which can make you start investing in cryptocurrencies as soon as possible:

Decentralization of cryptocurrencies gives you control over your assets

Trading in cryptocurrencies is decentralized in nature, which means that there is no involvement of any third party in your trading transaction. You have complete control over your assets, and you can store these cryptocurrencies without any external influence. Further, its prices are also not determined by any exchange or broker.

Cryptocurrencies are mostly deflationary in nature

Cryptocurrencies are usually limited in supply, which makes them deflationary in nature. In other words, purchasing power gets increased with time. Most cryptocurrencies are pegged with an algorithm that puts a maximum limit on their total supply.

Cryptocurrencies are transparent and secure

The popularity of cryptocurrencies has skyrocketed because of their transparency and security. The usage of blockchain technologies in crypto transactions makes them secure and transparent and enhances investors’ confidence to make a humongous investment. Further, the presence of open-source and publicly-verifiable technology makes cryptocurrencies the favorite among all traders.

Crypto investment could give you big returns

The fact that cryptocurrencies give lucrative returns on investment is not unknown among the general public. If one can make an informed investment based on expert advice, price history analysis, and other important factors, then one could reap humongous returns on its investment in both short-term and long-term.

The availability of different cryptocurrencies like Dogecoin, Ripple, Binance Coin helps in diversifying the portfolio of the investors and also increases the probability of gaining wealth in their transactions.

Crypto trading provides you with the necessary independence and flexibility

Every trader wants to dive into the world of trading at a convenient time. The 24/7 accessibility of the crypto market allows all investors and traders to make their trading decisions at their convenient timings after doing proper research and analysis.

These things provide you with some amazing reasons to start investing in cryptocurrencies soon.

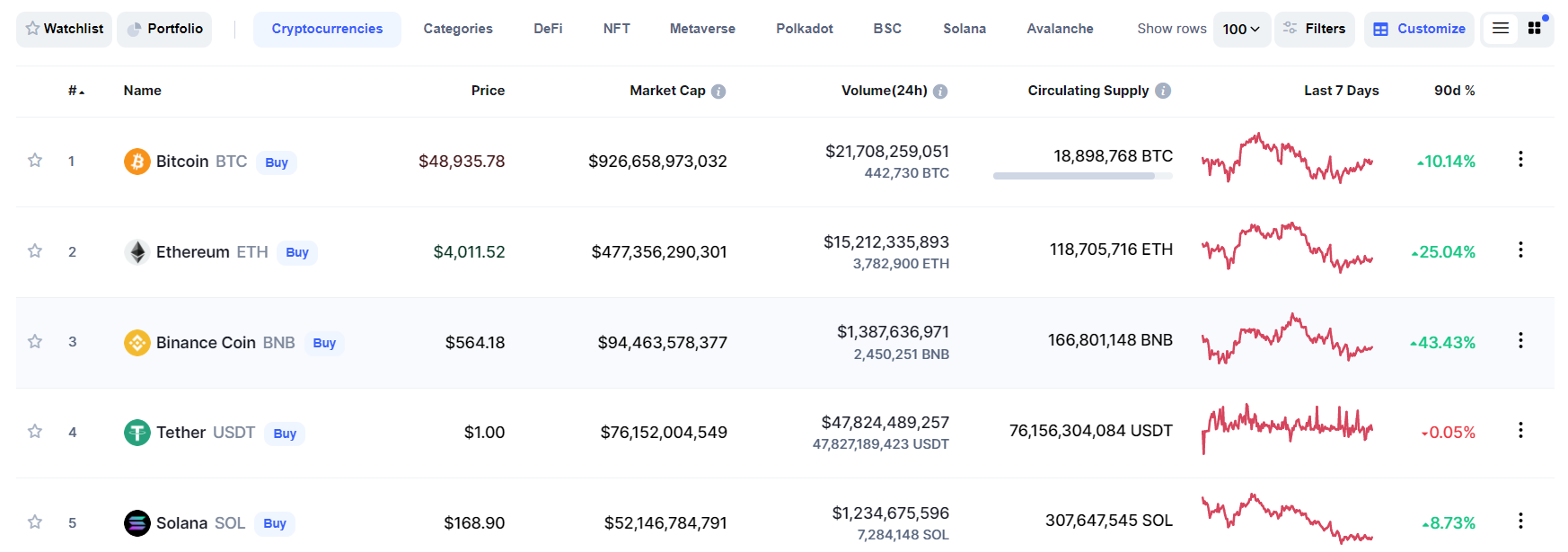

Major cryptocurrencies and their market cap

Where can you buy crypto in the UK?

Finding the right trading platform can sometimes be a tough task for beginners. Therefore, we have compiled a list of places that provide a user-friendly interface for cryptocurrency trading.

eToro

Overall, this platform is the best place to buy cryptocurrency in the UK. It was established in 2007 and has more than 25 million global users. Further, it uses Secure Socket Layer (SSL) technology to make sure that users’ transactions are safe and secure on their platform.

eToro allows users to buy around 80 cryptos with a 1% fee, including popular tokens such as Bitcoin, Ethereum and Solana.

It has a copy trading feature and portfolio management tool, with users able to copy the positions of more experienced traders.

This broker has a minimum deposit of $10 (£8) and users can also access thousands of other financial assets such as stocks, commodities, CFDs, and ETFs.

Cryptoassets are highly volatile and past performance isn’t an indicator of future success. Invest at your own risk.

OKX

Another great platform that one can use to invest in cryptocurrency in the UK is OKX. OKX is a flexible cryptocurrency exchange that features multiple tools to make it easier for traders to buy and sell cryptocurrencies.

OKX features both OKX DEX and OKX CEX. OKX DEX is a DEX aggregator through which anyone, anywhere in the world, can swap cryptos easily. With OKX CEX, other nuanced features like spot trading, margin trading, derivatives trading, etc., are given to users.

OKX supports both cryptocurrency and fiat options. For the latter, there are more than 112 ways to deposit funds into one’s trading account. Other special features on OKX include copy trading, a trading bot, the OKX risk shield, and more. With the OKX Risk Shield, part of the user’s assets are protected inside a reserve so that users can recuperate their losses if there is any hacking attempt.

Your capital is at risk

Bybit

Bybit is also a good cryptocurrency exchange that you can use to invest in Bybit. it is a beginner-friendly trading platform, with its interface being similar to OKX in some ways. However, this, too, has become the fifth biggest cryptocurrency exchange by market capitalization, with a 24-hour trading volume averaging around $300 million to $400 million.

Bybit offers spot trading and margin trading on 10x leverage. Users can also convert their assets into other cryptos using the “Convert” utility. This feature also doesn’t require users to pay any fees.

The platform also features a host of learning tools, such as market overview – which is suitable for doing market research. With the trading bot facility, users can automate their trades. Bybit also has MetaTrader4, which allows users to dive into advanced mechanics to automate their trades.

The fee structure of Bybit is the traditional maker/taker model. The platform also features proof of reserves, which is a validation that Bybit does hold the assets that users store in their Bybit trading accounts.

Your capital is at risk

Evonax

If you want to experience crypto trading by maintaining your anonymity on the trading platform, then Evonax is the right trading platform for you. Founded in 2016, Evonax allows its users to deal in cryptocurrencies with zero trading fees. This feature of zero transaction fees distinguishes its platform from other service providers.

This platform has its presence in more than 100 countries all over the globe, and investors from different regions have reposed their trust in this platform. Its user-friendly interface is backed by secure technology that keeps the sensitive data of its users safe.

As mentioned earlier, there is no requirement of giving your Know Your Customer (KYC) information to this platform. This information would only be required in case users require any assistance from their customer support program.

Coinbase

Founded in 2012, Coinbase operates not only as a trading platform but also as a crypto wallet. It has over 73 million verified users in over 100 countries. Further, it is trusted by more than 10,000 institutions and 185,000 ecosystem partners.

For a beginner, this is one of the easiest places to buy, sell, or deal in cryptocurrencies. It ensures that users’ information remains safe and secure on its platform, and provides a healthy trading experience to all its users. For ensuring extra security, it deploys two-factor authentication (2FA) for storing the bulk of cryptocurrencies.

It charges fees for trading on its platform and is home to a plethora of digital currencies. Users have to submit a minimum deposit to start trading on this user-friendly platform.

Binance

Binance is the world’s largest crypto exchange as far as the daily trading volume of cryptocurrencies is concerned. Founded in 2017, Binance company has made humongous success within just 4 years from its inception.

Users do not have to pay any fees for their deposits on this crypto exchange, however, fees are generally charged whenever users do any trading on this platform. This fee gets reduced whenever BNB is used by the investors on this platform.

Known for its liquidity, this exchange uses high safety and security standards to ensure the non-tampering of any users’ sensitive data. It allows trading in more than 500 cryptocurrencies like Bitcoin, Ethereum, Litecoin, Dogecoin, etc.

Users are required to submit their KYC information to start trading on the Binance exchange. Apart from its exchange-specific services, this platform also provides services related to staking, conversion of cryptocurrency into fiat currency, etc.

Best cryptocurrency to invest in

What should be the best cryptocurrency to invest in? Every beginner has this same question whenever he starts planning his investment in the crypto market. Looking at the current price trends, Bitcoin should be the ideal investment avenue for every trader if he is planning to earn enormous returns on his investment.

Ever since its launch in 2009, Bitcoin has always made headlines on the crypto price charts. Its popularity is the reason why cryptocurrencies have made their mark in the financial market in recent times. If any investor wants to have a stronghold in the crypto market, then Bitcoin should come out as its obvious choice since this single most currency accounts for around 40% of the overall market capitalization.

With a market capitalization of about $3 trillion, this cryptocurrency has recently hit an all-time high in 2021 ($69,000 in November 2021). Often recognized as the leader of the pack, Bitcoin has been accepted by many businesses, including Visa and Tesla, for making payments. Its feature to get accepted in form of a currency distinguishes it from many other currencies and brings multiple benefits to its users.

Since Bitcoin long-term price predictions expect its price to go as high as $330,000 by the end of 2025, it remains the best one to go for investment in terms of long-term growth. The deflationary tendencies of this currency have ensured that it retains its price dominance on the crypto charts.

Though this crypto has also seen bearish trends, however, it is less vulnerable to price crashes than other altcoins because of its strong fundamentals, and old market presence. Given the increasing adoption of this currency in mainstream use, this currency unravels enormous prospects for its investors and traders.

This digital gold has seen the rise of more than 9 million percent from its meager launch value of $0.08 in 2009. For all the above reasons, you should buy Bitcoin at the earliest before its price crosses $100,000.

Cryptoassets are highly volatile and past performance isn’t an indicator of future success. Invest at your own risk.

Major cryptocurrencies to invest in

Apart from Bitcoin, crypto price predictions of many digital currencies have made headlines in recent times, which have them a lucrative investment avenue.

Ethereum (ETH)

Ethereum comes second to Bitcoin in terms of its market capitalization in the entire crypto ecosystem. It is the front runner altcoin in the decentralized financial market, which uses a proof-of-work (PoW) consensus mechanism, though it is planning to make a switch proof-of-stake platform.

This decentralized, open-source blockchain network allows the creation and usage of many smart contracts and decentralized applications (dApps) without any third-party interference.

These all features make Ethereum the best alternative to Bitcoin. Ethereum has come a long in its aim of creating a decentralized collection of financial products which could be accessed by any person around the world irrespective of nationality, faith, or any other parameter.

It has been one of the best performing cryptocurrencies since its launch in the financial market. Having seen a rise of over a hundred thousand percent in value from its launch, Ethereum has been able to bring a smile to the face of its investors many times.

Experts believe that this crypto price would increase in the upcoming years as Ethereum long-term price predictions suggest that it would cross the figure of $15,000 towards the end of 2025.

The recent price trends show the bullish run of this crypto in the crypto market. With the increasing application of decentralized financing in every sector, Ethereum would continue to make its mark with the use of its DApps and DeFi technology.

Many investors are keeping their eye on Ethereum 2.0 as it is expected that this upgradation would give stiff competition to the king of the cryptocurrency market, Bitcoin.

Considering the chances of huge gains in the forthcoming years, investing in Ethereum could provide a high ROI.

Cryptoassets are highly volatile and past performance isn’t an indicator of future success. Invest at your own risk.

Cardano (ADA)

Cardano is one of those cryptocurrencies that operates on a proof-of-stake blockchain platform called Ouroboros. This cryptocurrency is ranked 6th in terms of its market capitalization in the cryptocurrency market. It is a popular alternative to Bitcoin and uses fewer energy costs for validating transactions.

Cardano was founded by Charles Hoskinson, the same man who founded Ethereum. Despite their similar founder, these two currencies operate on a different system. Cardano uses a proof-of-stake Ouroboros consensus mechanism, while Ethereum uses a proof-of-work blockchain system.

Cardano aims to be the “most environmentally sustainable blockchain platform”. The proof-of-stake mechanism provides Cardano a competitive advantage over other Blockchain technology. The goals of this cryptocurrency are to increase interoperability, scalability, and sustainable development.

This year saw a great run of this crypto on the market chart where Cardano was seen overtaking Litecoin, Dogecoin, and even Ripple to becoming, at one point, the third-largest cryptocurrency in terms of market capitalization. Cardano is forecasted to have positive momentum in the crypto market due to its increasing presence in the smart contracts arena.

Should you invest in Cardano? Yes, Cardano’s price will soon be in two digits as per the expert’s predictions. Cardano long-term price predictions show that it would get to the figure of $10 by the end of 2025. Further, this crypto also invites investors’ attention due to its resilient nature as its price does not fluctuate much in the event of a market crash. Because of its promising performance in the last few years, Cardano finds a good place in your investment portfolio.

Cryptoassets are highly volatile and past performance isn’t an indicator of future success. Invest at your own risk.

Ripple (XRP)

XRP is the native cryptocurrency of the Ripple network. XRP Ledger uses this currency to make international currency exchange and remittances. This crypto is generally utilized as a form of a bridge between transactions involving different currencies on the XRP network. XRP is currently the 8th largest cryptocurrency in terms of its market capitalization.

XRP is generally very speedy, less expensive, and more scalable when compared to other digital currencies and payment methods like SWIFT. The proficiency of Ripple in making payments can be estimated from the fact that it could process 1,500 transactions per second when compared against Bitcoin (7 transactions per second) and Ethereum (15 transactions per second).

XRP is impossible to mine as is a pre-mined asset and already 100 billion tokens of XRP were created by its ledger. Coming to the long-term price predictions for Ripple, it is expected to reach $4.58 by the end of 2025.

Should Ripple find a place in your portfolio? Yes, Ripple is a promising investment as this crypto will play a big role with the increasing adoption of cross-border payments and with the growing integration of finance with technology.

Cryptoassets are highly volatile and past performance isn’t an indicator of future success. Invest at your own risk.

Small cryptocurrencies to invest in

Every investor needs to keep track of prominent small cryptocurrencies which can be a good source of revenue if invested smartly. Given below are some important cryptocurrencies which should be followed on regular basis:

Dogecoin (DOGE)

The year 2021 has been the year of Dogecoin. Based on the popular “doge” meme, this crypto bears the picture of a Shiba Inu on its logo. Dogecoin did not receive much attention from the investors during the beginning of 2021.

The tweets of Elon Musk on this meme coin brought bullish growth on its price charts. Soon, its listing on popular trading platforms like Coinbase generated the confidence of the traders for this cryptocurrency. Consequently, this year saw the all-time highest figure of this crypto, i.e. $0.74 (£0.55), thereby registering over a twenty thousand percent rise in its value from its launch in 2014.

Currently, this cryptocurrency has been ranked 11th in terms of its market capitalization. This open-source digital currency has an uncapped supply, which means there is no upper limit on the number of Dogecoins that could be mined.

Its popularity has made its usage possible for mainstream purposes, for instance, social media platforms like Twitter and Reddit use Dogecoin for the purpose of rewards and tipping systems respectively.

The potential future trends for this crypto signal a positive sign towards the investors. The meme coin is expected to go as high as $0.64 by the end of 2025. However, the nature of the cryptocurrency market is unpredictable, and one could not invest in any digital currency by merely considering the immediate past performance and potential future trends.

Therefore, consider investing in Dogecoin only after doing the background research, price analysis, and after considering the experts’ advice and market trends.

Cryptoassets are highly volatile and past performance isn’t an indicator of future success. Invest at your own risk.

Shiba Inu (SHIB)

Shiba Inu was launched in August 2020 for giving some competition to Dogecoin in the crypto market. It was founded on the Ethereum blockchain with a total supply of 1 quadrillion coins. Within a short period, this cryptocurrency has gained significant traction in the digital finance market.

The fact that it has been launched to give competition to Musk’s favorite coin has provided it the much-needed attention of the investors. It is currently ranked 13th in terms of its market capitalization in the crypto market. Further, its recent listing on the largest US-based crypto exchange, Coinbase, increased its value by the whopping figure of 40%, thereby bringing this coin into the spotlight.

The price of this cryptocurrency varies between the amount of $0.00000667 and $0.00000701 with an average daily trading volume of $219 million. The thing which makes this token more unique is its special dog icon. This icon has motivated many artists around the globe to ensure that it gets secured in the non-fungible token market.

Despite the entire buzz around this coin, a lot of work is required to make sure that it becomes a promising asset in the eyes of investors. Though it is predicted that its price would touch the mark of $1 in the upcoming years, however, the long-term investment could only be made in this crypto after carefully assessing its prospects, price history, and other important trade-related factors.

From the angle of short-term investment, this token becomes the right place to pour money as its price usually gets high whenever this coin is in the headlines.

Cryptoassets are highly volatile and past performance isn’t an indicator of future success. Invest at your own risk.

Polkadot (DOT)

DOT is the native token used in the Polkadot network. Polkadot is a protocol that enables the transfer of any data or asset across the blockchains. It unites multiple blockchains across its network and ensures high security and scalability. DOT is used on this platform for securing the network or for connecting new chains.

Unlike Bitcoin and Ethereum, Polkadot uses a proof-of-stake consensus mechanism for securing its network and validating its transactions. Further, users on this network have the opportunity to earn rewards in DOT by staking and participating in the network.

Currently, this cryptocurrency has been ranked 9th in terms of its market capitalization. A total of 1 billion DOT tokens have been allocated by Polkadot currently. Its first initial coin offering (ICO) took place in October 2017. It was launched with a total of 2.24 million tokens for $0.29.

Experts believe that DOT price would highlight a bullish run on its price chart. Its value is expected to reach $146 by the end of 2025. Since DOT is a more sustainable project with strong fundamentals, it is better to invest in this crypto from the long-term perspective.

Cryptoassets are highly volatile and past performance isn’t an indicator of future success. Invest at your own risk.

New cryptocurrencies to invest in

The advantage of making an early investment in new cryptocurrencies is unparalleled as it allows you to get potentially strong crypto at a low price, which later on gives you humongous returns when the digital currency displays soaring prices on its market charts.

Given below are some of the new cryptocurrencies which are having the potential to be in the top 10 cryptos in the upcoming years:

Cosmos (ATOM)

Cosmos is a decentralized blockchain system that allows scalability and interoperability among multiple blockchains. ATOM is the native cryptocurrency of this platform. It is a proof-of-stake chain, which allows its users to stake ATOM tokens for maintaining the network.

This blockchain system aims to allow faster and cheaper decentralized applications to run on their blockchains. Interchain Foundation (ICF) has backed Cosmos by financing its blockchain projects.

The native Tendermint BFT byzantine fault-tolerant consensus engine is used by Cosmos for ensuring that the processing time of blockchain transactions does not take longer time. Further, the Cosmos SDK platform allows developers to develop convenient frameworks for integrating blockchain technology with real-life projects.

Similarly, the IBC protocol from Cosmos promotes compatibility among the blockchains by allowing easy transfer of data or communication.

Cosmos is currently ranked 33rd in terms of market capitalization with its value predicted to increase in the upcoming years. The second half of 2021 saw this crypto hitting its all-time high figure of $44.80. It has witnessed tremendous growth of more than 400 percent from the beginning of this year.

Experts have predicted a decent future for this digital asset. It is believed that ATOM would cross the boundary of $100 by the end of 2026. Considering the huge prospects of this crypto, investors will start investing in Cosmos to ensure high returns in the forthcoming times.

Cryptoassets are highly volatile and past performance isn’t an indicator of future success. Invest at your own risk.

Curve (CRV)

Founded by Michael Egorov, a Russian physicist in 2015, Curve DAO is a newly founded decentralized finance (DeFi) protocol that is built on the Ethereum network. This automated market maker protocol has its token, CRV, that was recently launched in 2020. The native token is used for voting on governance by getting locked for a while.

Further, this decentralized finance platform allows its users to swap between ERC-20 tokens, for instance, stable coins (USDC and DAI) and Ethereum-based Bitcoin tokens (WBTC and renBTC).

Curve allows users trading of cryptocurrencies using pools of these digital assets maintained by the users. Users could also earn fees through their deposits on this platform. Currently, this token is having a market capitalization of $1,740,403,258 and is ranked 73rd in terms of its market cap.

By 2025, the price of Curve is predicted to reach the lowest possible figure of $14.44. Looking at its current trading price of $4.02, its value is expected to multiply three times of its current figure. Therefore, this crypto comes out as a good investment option for all those investors who are planning to invest in new cryptocurrencies for longer periods.

Cryptoassets are highly volatile and past performance isn’t an indicator of future success. Invest at your own risk.

Solana (SOL)

Solana has been touted as the “Ethereum Killer” by many crypto enthusiasts. It is a decentralized computing platform that attempts to sort out the limitations of Ethereum. This platform uses SOL to pay for transactions.

A combination of a proof-of-stake consensus mechanism and a proof-of-history system is used to enhance the scalability of this blockchain. It is estimated that Solana could execute around 50,000 transactions in a second without compromising with decentralization.

SOL saw its dream run in the year 2021 where it provided enormous profits to its retail investors. This crypto has witnessed a huge price rise from $0.75 to $214.96 in early September. The launch of the Degenerate Ape Academy NFTs, a prominent NFT project, on its platform has provided a huge impetus to Solana in terms of its growth and popularity.

Apart from this project, Solana also allows the running of many crypto apps on its platform like Ethereum. SOL has seen a growth of over 100% since August 2021, and experts believe that its bullish run on the price chart would continue for some period. Further, its price is predicted to get as high as $4,263 by the end of 2023. Within a short period, it has managed to rank 5th in the market capitalization index of the crypto industry.

SOL looks to be a good long-term investment, however, from the point of short-term investment, investors have to do some background research and monitor the market before taking any immediate call.

Solana, as a platform, is also having a bright future in the crypto industry as it is already a host to a plethora of projects on its platform. Projects like Serum, Chainlink, and Audius are quite well known in the digital finance industry.

These all things clearly indicate that Solana is having huge potential for being a long-run player in this volatile market.

Cryptoassets are highly volatile and past performance isn’t an indicator of future success. Invest at your own risk.

Best cryptocurrencies to invest in 2025 for the long-term

The Crypto industry is known for its price fluctuations or volatility. Over the years, this industry has seen both significant price rises and heart-rendering market crashes.

In light of the variable nature of this market, it is necessary to not pump your entire resources into a single currency as you stand the possibility of losing everything in case that currency crashes on the market chart.

For all these reasons, experts have always advised you to diversify your portfolio if the investors are opting for long-term investments. Here, we will give you some recommendations regarding what all cryptocurrencies are best suited for your long-term investment, and how much percentage of your money you should allocate to every single crypto.

Bitcoin will be the obvious first choice if any investor is aiming for long-term growth. Market projections show that the Bitcoin price could cross the mark of $300,000 by 2025 and $380,000 by 2027.

With an increase in acceptance of cryptocurrencies in mainstream usage, Bitcoin’s importance will continue to soar as this is the widely known crypto among the general public after all.

However, you can’t risk out your entire investment on Bitcoin, therefore, Ethereum should be the next in line for your crypto investment. Ethereum has been one of the best performing digital currencies in recent times. It has recently witnessed its all-time high of $4,850 in 2021.

Considering its promising future, it comes out as the best alternative to Bitcoin and may overtake BTC one day in what traders call ‘the flippening‘.

Almost every investor who bought Bitcoin or Ethereum has minted profits whereas many altcoin projects have failed and been abandoned. Therefore, it would be a smart move if you keep the majority stakes of these currencies in your portfolio, let’s say, 40% each.

For the remaining ones (20%), you can go for majors like Cardano, or invest in some newer small marketcap coins like SOL or CRV, which can give you a high return on investment (ROI) in a bull run.

Best cryptocurrencies to invest in 2025 for short-term

If you are planning to make a short-term investment in cryptos, you should target those coins whose prices get increased whenever they are in the headlines. One could invest in Shiba Inu the price of which pumped significantly when it got listed on a recognized crypto exchange.

The popularity of crypto gaming has also led Axie Infinity to come into the eyes of investors. Axie Infinity provides opportunities to its users to earn tokens by showcasing their gaming skills. As crypto gaming is becoming popular among all gaming enthusiasts, this crypto is bound to display positive growth in upcoming years.

Further, one could also watch out for Floki Inu, which is an ERC-20 token on the Ethereum blockchain technology. It is dubbed as the next Shiba Inu by all dog-themed meme coin lovers. Floki Inu is also in the area of play-to-earn gaming through its flagship product called Valhalla. This meme coin has managed to pull on steady growth since its inception.

Considering the new blend of the crypto market and gaming industry, Floki Inu comes out as a good alternative to other altcoins in terms of short-term investment.

How to build a good crypto investment portfolio?

How to assess an investment portfolio in cryptocurrency? This question is common among all beginners. You must understand that it is important to have a diversified portfolio whenever you are dealing with volatile assets.

If one allocates its entire money on a single digital currency, then one stands a chance of losing its entire amount in the case that currency crashes. Therefore, it is advisable to ensure that you pour reasonable money into different stocks so that you could minimize the risk of losing your complete investment.

How many cryptos do you need to invest in?

Having too few cryptocurrencies or too many cryptocurrencies in your wallet can be risky. An ideal blend of having volatile and stable coins in your wallet guarantees you good profit in the long run. Many investors open accounts on several crypto exchanges and brokers to access different altcoins.

Though there is no set in stone way to build a crypto portfolio, as an example you might consider having a 40% share of Bitcoin and Ethereum in your portfolio, with the other 20% invested either in small marketcap altcoins and speculative new meme coins.

How long would you need to hold your investment?

The cryptocurrency market is volatile and unpredictable. One can’t set any time limit for a specific set of investments as the duration of every investment is dependent upon factors like the nature of crypto, market factors, trade-related news, etc.

However, in case of cryptocurrency price crashes, one must understand that bear markets can last for 2-3 years. Having said that, the duration of crypto investment can only be decided after proper research and analysis.

How much you would need to invest?

Don’t put all your eggs in one based and invest your entire net worth in cryptocurrencies, especially volatile and unpredictable altcoins. Even if you’re bullish on crypto as a long-term investment, you should keep some capital aside to buy the dips.

To be on the safer side, some investors put 20-30% of their savings into these digital currencies and also diversify into other assets. Alongside crypto, eToro offers stocks, forex, commodities, and ETFs.

In case you have excess or less disposable income, then that figure can be adjusted accordingly. However, don’t pour too much money into cryptocurrency as that would bring unnecessary risk to you, and don’t invest too little (say $50) expecting to become a millionaire.

If you are willing to take on more risk open accounts on several cryptocurrency exchanges to split up your funds and keep some of your funds in Bitcoin, which has never had a 90% or higher price correction, as many altcoins have.

For example the bear market from $20,000 to $3,000 was an 85% drawdown and took three years to recover. Some altcoins lost 95-99% of their value and never recovered (Ethereum was one that did).

How to store your crypto investment in a secure wallet?

Cryptocurrencies are generally like computer codes. They can’t be saved in a physical location, unlike traditional fiat currencies. That is why we need crypto wallets which are hardware or software that allows storing or trading of cryptocurrencies by interacting with blockchains.

One needs to have dedicated crypto wallets for storing these virtual currencies. Though there are a lot of platforms available in the market which provides storage services for crypto, however, we have compiled a list of some best crypto wallets that are secured and trusted by many investors.

eToro Money Wallet

The eToro money wallet is available on both Android and iOS devices. It allows storage of 120+ cryptocurrencies and is built with a feature that offers conversion functionality.

The digital wallet is a secured on-chain private key service, which makes sure that users do not lose their backup phrase.

A conversion fee of 1% is charged on the eToro wallet, and the amount of minimum transaction on this wallet comes out at $10.

Cryptoassets are highly volatile and past performance isn’t an indicator of future success. Invest at your own risk.

Coinbase Exchange Wallet

The reputable crypto exchange, Coinbase, also has a separate crypto wallet. The best part of this wallet is that users do not need to have an account on Coinbase to utilize this wallet. However, it allows the transfer of money to your Coinbase account quickly.

You can store over 500 different cryptocurrencies on this wallet along with many different NFTs. Further, this wallet ensures the high security of your information and funds through biometric authentication and optional cloud backups.

Your capital is at risk

Binance Exchange Wallet

Binance crypto wallet allows you to store your digital currencies and provides you with an opportunity to earn rewards through staking.

This wallet is available in form of a mobile app and is used by about 10 million people around the world.

With its easy interface, you can easily buy, send trade, or exchange, hundreds of cryptocurrencies with this wallet.

Your capital is at risk

Responsible investing

You have to be careful whenever you are dealing with cryptocurrencies due to the unpredictability of this market. If you are making your first-time investment, then it becomes more important to carry due diligence because you stand a big chance of losing tremendous money in case you make an irresponsible investment.

You have to do the necessary research, monitor market conditions, and then take your call regarding where you have to invest your money.

Further, you have to limit your exposure. A smart investor will never stake too much of his capital into virtual currencies. Therefore, it is advisable to distribute your investment in different currencies and have a balanced division between stable assets and volatile currencies.

Also read our guide to responsible investing for the warning signs of developing a gambling addiction when investing in cryptocurrency.

Security and risks of crypto investing

The first and foremost risk associated with cryptocurrency is its volatility. Unanticipated changes in the market could lead to a huge change in its price. It should not be forgotten that it is common for cryptocurrencies to lose their value in hundreds, if not thousands of dollars.

Another risk associated with cryptocurrencies is that they are not regulated by any government, central bank, or monetary authority. Further, they are at risk of getting banned in countries by the government due to a lack of regulation by any competent authority.

Trading on cryptocurrencies is also susceptible to technical glitches, hacking, error, and any other human mistake. Since the market is not regulated, there stands a possibility of scams, corruption, etc. For instance, hackers stole more than $450 million amount of cryptocurrencies from Mt Gox in 2011, though steps are being taken to repay all those people who have lost their money during that scandal.

Similarly, crypto trading carries the additional risks of hard forks or discontinuation. Whenever hard forks happen, significant price variation is observed on the price charts. For a beginner, it becomes more important to avoid pump and dump groups, obvious Ponzi schemes, leverage trading as a beginner is more vulnerable to frauds or scams in crypto trading.

Considering all these risks, it is essential to deal with a secured crypto exchange and have a high security-proof wallet.

Compare UK Cryptocurrency Exchanges

[side_by_side_comparison id=”17″ type=”Crypto”]Is cryptocurrency mining a better investment?

Mining is the process of validating and recording transactions on the blockchain platform. There are different ways of mining in the crypto industry. Many famous cryptocurrencies like Bitcoin and Ethereum, use a consensus mechanism called proof-of-work, where miners are required to show proof of work to ensure that a block is added to the blockchain.

This entire process provides rewards to the miners for their services. However, this process is very costly as it requires special equipment, huge computing power, and an ample amount of electrical energy from the end of miners.

Another famous cryptocurrency mining mechanism includes proof-of-stake. In this mechanism, miners allocate some amount of crypto coins in the network to have the responsibility of adding a new block to the blockchain. This process requires miners to store their cryptocurrencies, which is done through a process called staking. A miner must have ample coins to be able to mine adequate cryptocurrencies.

Proof-of-space protocol requires miners to allot some spare hard disk space in the network. Consequently, they get rewarded with new coins for this. The more space you allocate, the more coins you get. For earning more coins, miners buy extra hard disk space for allotting them in the network.

From the above description, all mining mechanisms are time-consuming and require a significant amount of investment from miners for getting more currencies mined. In the case of Bitcoin and Ethereum, it becomes more cumbersome as it requires a lot of resources and time.

Therefore, cryptocurrency mining is not a better alternative to crypto investment. Crypto trading is an easier and simpler way of making money with the help of virtual currencies. Though there are risks associated with trading, however, it gets significantly reduced if one invests responsibly.

Is cryptocurrency staking a better investment?

Staking is the process of storing your cryptocurrencies on a platform and earning interest or rewards on them over time. This is the process by which proof-of-stake technology works. The annual percentage yield earned by you would be dependent upon the number of cryptocurrencies you have in your staking pool.

To increase your earnings, you have to stake more coins. In recent times, staking has become very famous among crypto enthusiasts as many traders use this method to earn some passive income in the form of rewards or interest. The launch of the Ethereum 2.0 staking model is ready to take this industry by storm.

However, there are some risks associated with staking too. In the last few years, there have been some incidents of hacking on small crypto exchanges and decentralized protocols.

Whenever a user locks up the asset whose price has been on the decline, it faces the risk of sustaining an impermanent loss in case the price of that asset does not bounce back. Further, when staking has been done by an investor through a SaaS platform, the investor bears the risk of incurring losses if the transaction is not processed due to the inefficiency of the validator.

Considering all these things, staking can’t be considered at par with crypto trading as the former requires a huge amount of investment in terms of time in staked assets, while trading in cryptocurrencies is comparatively easier, faster, and simpler to staking.

What are the expert opinions on the crypto market?

Cryptocurrencies are the future of the finance industry. One has to accept this fact. Many leading industrialists and market experts share the same opinion. In the words of Elon Musk, founder and CEO of Space X, “To clarify speculation, Tesla has not sold any Bitcoin. I have not sold any of my Bitcoin. Tesla has diamond hands.”

Further, billionaire Barry Silbert has been the frontrunner investor in Bitcoins since 2012. His love for cryptocurrencies can be predicted from his tweet, “In 2013, everybody thought we were crazy for launching a Bitcoin investment fund. Well, look at us now.”

The founder of Grayscale has also predicted the market situation at the time when cryptocurrencies would be there on the lists of the prominent stock exchange and important banks, “Once Wall Street starts putting money into Bitcoin – we’re talking about hundreds of millions, billions of dollars moving in – it’s going to have a pretty dramatic effect on the price.”

Similarly, Mark Cuban, a billionaire TV personality, has gone to the extent of comparing Bitcoin with Gold. His statement that smart contracts would change everything has proved to be true in light of the fintech revolution brought about by these contracts with the creation of DeFi and NFTs.

Cryptocurrency market cap – currently over $2 trillion

The Winklevoss twins have become billionaires by buying Bitcoin. Their prediction for Bitcoin has been expressed in the following remarks, “Our thesis is that Bitcoin is Gold 2.0, that it will disrupt Gold as a store of value. If it does that, it has to have a market cap of 9 Trillion, so we think it could price one day at $500,000 a Bitcoin.”

While Bill Miller, a legendary Wall Street value investor, has also commented that every major bank, every major investment bank, every major high net-worth firm will eventually have some exposure to Bitcoin, which is Gold or some kind of commodities.

The above opinions show how much acceptance cryptocurrencies have received in mainstream society. Almost everyone is sharing the same thoughts that cryptocurrencies, mainly Bitcoin, will bring storm in the finance market, and every institution including a major bank, major investment firms, should start acknowledging this fact.

Selling your cryptocurrency investment

In crypto investing its especially important to take profits on the way up and de-risk once you’ve made a high return on your investment, as the price can always crash back to your entry. Every cryptocurrency can be instantly converted into either cash, Bitcoin or stablecoins like Tether (USDT).

You should always sell cryptocurrency on a trusted trading platform to ensure your transaction is secure and safe. eToro is our top recommended exchange to sell cryptocurrency.

With eToro, you first have to input the withdrawal channel on your account. Then, close your active positions (open trades), and ensure that you have the minimum withdrawal value in your account ($10). Once funds are reflected on your available balance, you can start the withdrawal process by clicking on withdraw funds on the bottom left corner of the menu.

Make sure you enter the funds keeping in mind that a fixed fee of $5 is charged for withdrawals, while there is a 1% fee on all crypto trades. Choose your desired withdrawal amount and channel, and complete the process to have your money out of the investment.

If you want to short sell cryptocurrency, i.e. open a short position with leverage on an asset you think will drop in price, we recommend Bybit exchange as it pays a 0.025% maker rebate, meaning you get paid to open limit orders on their futures exchange.

KuCoin and Bitfinex also offer margin trading with a slightly smaller maker rebate of 0.02%, and a slightly smaller taker fee than Bybit.

Taxes and regulations regarding crypto in the UK

The increasing adoption of cryptocurrencies has made many countries make laws regarding their taxation. Such is also the case of the UK, where cryptocurrencies are being dealt with as property and hence, are liable to taxation in the country.

There are guidelines issued by Her Majesty’s Revenue and Customs (HMRC) that determine what taxable and non-taxable events are in the case of cryptocurrencies. The taxes charged on these digital assets are placed in a similar tax bracket as ordinary income. One can deduct its losses incurred during the time of holding any crypto assets from its total taxable income generated by those cryptocurrencies, and carry forward those losses to the next year.

Capital Gains Tax is charged on cryptocurrencies in case they are sold, they are received as a means of payment from employment or mining, they are exchanged from one cryptocurrency to another, they are used to buy goods and services, they are given to another individual except in the situation of the token being given as a gift to a spouse of a civil partner.

The HMRC guidelines also allow the taxpayers to ascertain how much capital gain has to be paid in form of taxes. While calculating your capital gains tax, you must deduct certain allowance costs from your gains.

These costs could be transaction fees which have to be before the transaction is added to the blockchain, valuations when working out gains for a certain transaction, costs incurred in drawing up contracts for a transaction, advertisement expenses incurred by the buyer or seller, etc. One could also adjust its capital losses against its gains, and then arrive at an actual taxable figure, however, these losses have to be firstly reported to HMRC.

Generally, capital gains are divided into two classes: Short-term capital gains and long-term capital gains. Profits accrued from selling a cryptocurrency that has been held for a period less than a year would be considered under short-term capital gains, while accrued from selling a cryptocurrency that has been held for a period more than a year would be considered under long-term capital gains.

The tax rates for the long-term capital gains are more favorable than those of short-term capital gains. Therefore, it is always advisable to hold your crypto assets for a longer period to ensure fewer capital gains taxes are being charged on them.

Conclusion

Cryptocurrencies are here to stay and shape the future of the finance industry. The crypto market has witnessed exponential growth in the last few years. This trillion-dollar industry is impossible to be overlooked by the regulators. Perhaps this is the reason why governments of many countries are recognizing these digital currencies formally or informally.

It has to be noted that investment institutions who were once suspicious of crypto, such as Goldman Sachs, have now indicated in publications that allocating a percentage of your portfolio to these blockchain-based assets is a wise investment plan. It is just a matter of time before cryptocurrencies completely revolutionize the way we buy and sell goods and services.

Though crypto assets are volatile in nature, however, investors have realized that they could make huge returns on their investment with proper market research and analysis.

For doing all background research behind any crypto, we propose using social trading leader eToro, which has more than 25 million users.

FAQ

Can you invest in cryptocurrency in your ISA allowance?

You can't hold cryptocurrencies directly in an ISA.

Is it possible to invest in cryptocurrency risk-free without experience?

As the nature of the crypto industry is volatile or unpredictable, it is not possible to invest in cryptocurrencies risk-free without any experience. It is always advisable to do necessary due diligence before making your investment call.

What is the best cryptocurrency to invest in?

Considering the current price trends, Bitcoin should be the ideal investment avenue for every trader if he is planning to make enormous returns on his investment. The future price predictions for this crypto are also very promising. For instance, it is expected to cross $330,000 by the end of the next four years, i.e. 2025.

How to start investing in cryptocurrency?

eToro is a crypto broker that allows users to trade over 70 cryptos.

Is it worth investing in cryptocurrency?

Cryptocurrency has already become a trillion-dollar industry within a few years. It is here to stay for a long time. One can make massive income out of crypto trading with proper strategy and investment decisions. Therefore, it is worth investing in cryptocurrency.

How much to invest in cryptocurrency?

The amount of your investment is completely dependent upon your preferences, disposable income, and other factors. However, don’t pour too much money into cryptos as that would bring unnecessary risk to you, and don't invest too little (say $50) as that would hardly bring any return to you.

Is it safe to invest in cryptocurrencies?

Though the crypto market is unregulated, decentralized, and volatile, however, that does not mean that it is unsafe for the investors. People have made billions of money from this market with their trading skills and strategies. All that is required in this industry is the informed investment decision made by the traders.

How many people are investing in cryptocurrency?

Though there is no exact data regarding how many people are investing in cryptocurrency, however, it is estimated that over 100 million people have started investing in these digital assets. Some people even claim that around 10% of the world's population is investing their money in cryptocurrencies.

How to learn to invest in cryptocurrency?

Investors should conduct independent research to find out which crypto to invest in. eToro allows users to invest in around 80 coins via its mobile platform.

How to invest in cryptocurrency for beginners?

Beginners should select a trusted crypto exchange or broker to invest in crypto.

How to invest in cryptocurrency ETF?

Find a trusted exchange or broker that offers crypto ETFs.

Are banks investing in cryptocurrency?

All big banks around the world have started investing in cryptocurrencies, for example, London-based Standard Chartered Bank, BNY Mellon, Citibank, etc.