Join Our Telegram channel to stay up to date on breaking news coverage

One the most highly respected crypto traders, @Pentosh1, has tweeted that ‘the flippening’ could happen within 18 months. He’s holding $ETH and $LINK in 2025.

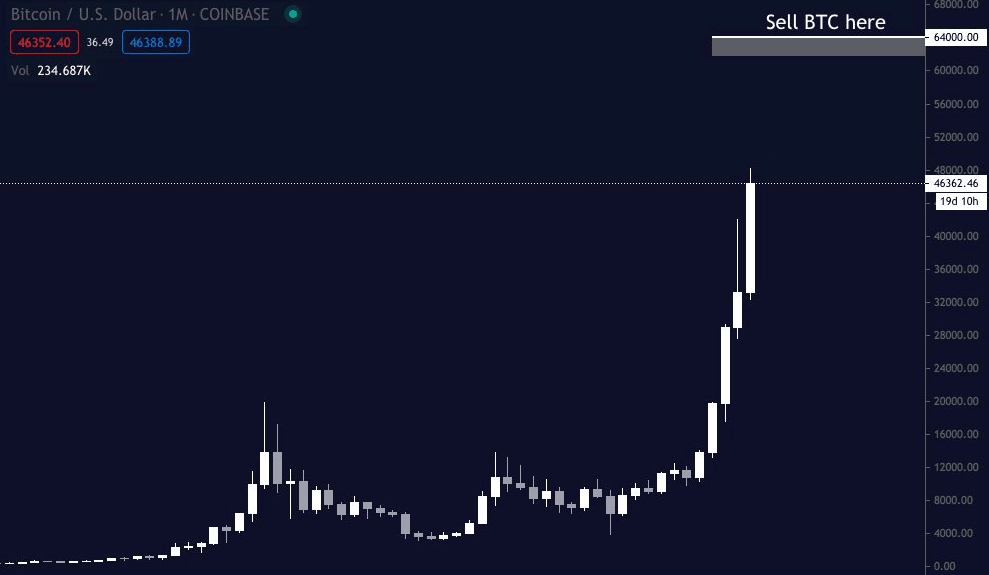

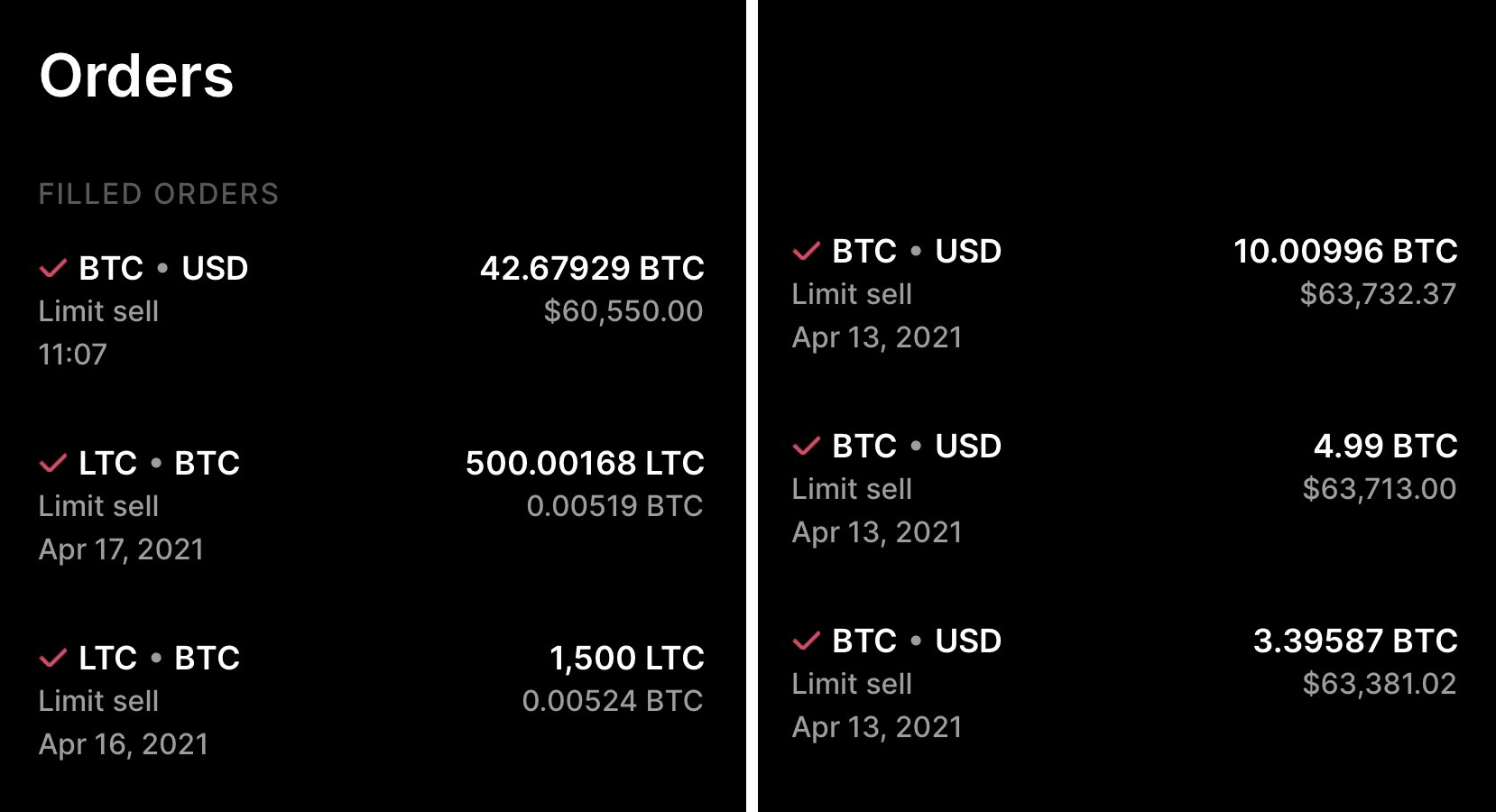

Perhaps the best cryptocurrency trader to follow on Twitter, Pentoshi trades with millions of dollars and passed the 200k follower mark after predicting the $64k top (posting the chart above in February) and selling there, posting screenshots of his filled sells (below, from the Coinbase Pro app)

Pentoshi (now over 500k followers in 2025) he alerted Crypto Twitter – or CT as it’s known – of red flags in the price action on several time frames. On the daily chart the Bitcoin price had broken out after consolidating for 50 days, then dipped back into the range.

The weekly candle was looking ugly – at the time forming a bearish gravestone doji. The monthly candle was also potentially forming a doji.

Selling the Top

The move above the previous top around $62,000 did turn out to be a deviation – similar to a fakeout – and Bitcoin would begin its over 50% dump after breaking the lower line of his triangle.

Before that happened though Pentoshi correctly sold 42 BTC for $2.5 million and thousands of Litecoin (each worth over $300 at the time).

Pentoshi had already sold around 10 BTC and half his altcoin holdings at $63.5k a few days before, citing the Bitcoin dominance level as a factor in his risk management system.

Best Cryptocurrency Trader to Follow – His Analysis

He admitted his emotions were telling him to keeping ‘apeing’ (going all-in, longing the top with 100x leverage, following Michael Saylor’s advice to take out a mortgage on your house to buy Bitcoin, etc.) but the smart call was to derisk, scale out and compound his gains if the correction did come.

He added ‘Have a plan and execute. Markets are about probabilities not certainties. Alts are up 10-100x. And at an inflection point. Manage risk. If you can’t understand this bc it goes against your bias. Ngmi’ (not going to make it).

Buying the Bottom

The next day he tweeted he’d be buying the dip, but not yet. He made a plan to buy back his spot 60k BTC at under $50k and over $45k, as in his opinion that would be as low as it’d go on the first impulse down.

Bitcoin did indeed bounce at $47k and go back to almost $60k – another perfect prediction.

One more piece of good advice he tweeted was ‘It’s okay to not always be in a trade. Once you learn that you’ll become much more profitable. If you can learn this. You’ll keep + make more wealth. Because you’ll have discipline and patience to take A+ trades. I use to close one trade and enter another early on in my career.‘

Pentoshi was still macro bullish, but considered that we’d formed a local top, and discounts were an opportunity to buy the dip. He also moved a lot of his holdings into Ethereum and Link.

After the first bounce Bitcoin did go under $45k but he kept buying spot posting ‘$30k is not the new $6k, they are nothing alike’ (under the tweet below). While many Twitter cryptocurrency traders were bearish and calling for $20k, he tweeted that was ‘not happening’.

Just as he called the top, he called and bought the bottom around July 19th.

The Flippening

So what is the best cryptocurrency trader to follow tweeting about lately, and what is the flippening?

Today Pentoshi commented he had sold $6.4 million worth of Ethereum at $2655, but is still holding some anticipating it will hit $2800 – $3200 in the next few weeks.

He tips ETH to flip BTC (overtake it in market cap) within the next 18 months, by the end of 2022, based on the current buzz around EIP-1599, staking, NFTs, DeFi, Goldman Sachs and part of Ethereum’s deflationary supply being burnt.

He compared the current ETH / BTC chart price action since breaking out of its three year accumulation base to position 5 on Livermore’s speculative chart, saying that should see a new ATH – although ‘it will take time‘.

Will Ethereum flip Bitcoin? It remains to be seen if he’ll be right again but it’s hard to doubt Pentoshi’s technical analysis (TA) skills and knowledge of the fundamentals.

He’s our pick for the best cryptocurrency trader to follow on Twitter, being one of the few whales to make their trades and position sizes public and providing free value – or ‘alpha’ – to retail investors. Similar to Crypto Face on Youtube.

We’ll be reviewing other accounts that give out free tips and tricks here at InsideBitcoins, stay tuned to our cryptocurrency news feed for more good follows.

As for small cap altcoins, Pentoshi also tweeted July 31st that he’d bought $6 million worth of Chainlink (LINK), dollar cost averaging in under $20 ahead of their Smart contracts launch.

His current positions are in BTC, ETH and Link, after avoiding altcoins for the two months when Bitcoin was in a downtrend.

Another of the best crypto traders to follow is @SmartContracter.

Follow Traders

On his Twitter Pentoshi reminds followers that he rarely uses leverage and you don’t need it to be profitable. In fact it only takes one mistake to get wiped out if you do use it.

One of the easiest fiat gateways to purchase spot Ethereum and Link (own the underlying asset, not just speculate on the swings with leverage) is on the exchange eToro.com that accepts VISA, credit cards, Paypal, Skrill, Neteller and more deposit methods.

Regulated in the UK and US, you can safely buy and hold on their free to download wallet for the long-term. If you invest in Ethereum on the platform, an added benefit is eToro supports locked Ethereum staking (in the run-up to ETH 2.0). So you can earn yield on ETH that you own while waiting to see if Ethereum will flip Bitcoin – earning an APY even if it doesn’t happen.

You can also read profiles of some of the best professional cryptocurrency traders to follow on there and copytrade their positions, using a built-in feature of eToro where your portfolio mirrors theirs – buy when they do, sell when they do. Or choose to allocate your crypto portfolio of altcoins how they do.

You can also copy trades of forex or stock market experts, if you invest in those alongside investing in crypto.

Join Our Telegram channel to stay up to date on breaking news coverage