Best Share Dealing Account UK – Cheap Accounts Reviewed

In this guide, we explore some popular share dealing platforms UK of 2022. We also compare share dealing accounts in terms of fees, commissions, share markets, customer support, and regulations.

Key points on share dealing accounts

- Share dealing is a type of investing that involves purchasing company shares. Investors could then earn a profit if the stocks appreciate in market value or through dividend payouts.

- Every share is a single unit of ownership in a publicly-traded company.

- When a company’s market value increases so does its share price and market cap.

- Shares are traded on stock exchanges that are fully regulated and place standards on both the companies that list their stocks and investors who trade shares. As such, the majority of retail share dealers will exchange shares through an intermediary, otherwise known as a stockbroker.

Popular Share Dealing Account UK List

If you don’t have time to read our guide in full, here’s a list of popular share dealing accounts in the UK as well as some alternatives.

- Fineco Bank

- AvaTrade

- IG

- Hargreaves Lansdown

- Halifax

- Lloyds

- Plus500

What are Online Share Dealing Accounts?

Below we list the typical process associated with online share dealing accounts.

- First, you need to choose a stock broker that meets your needs

- You then need to open a UK share dealing account with your chosen broker

- Deposit funds with a UK payment method (debit card, bank account, etc.)

- Choose which company you wish to invest in

- Enter the number of shares that you want to purchase

As you can see from the above, share dealing accounts enable users to buy stocks online. In fact, the process of selling your shares and withdrawing the proceeds back to your bank account is just as straight forward. With that being said, the most difficult part of the process is knowing which share dealing account to open.

After all, there are literally hundreds of providers active in the UK, so you need to spend some time thinking about what your priorities are. Share dealing accounts are those that offer heaps of stocks, low fees and commissions, and top-notch customer support. Most importantly, you’ll need to ensure that your chosen share dealing account is regulated by the FCA.

Cheap Share Dealing Accounts UK

To help you navigate your way through the Wild West of online share dealing accounts, we are now going to discuss the a range of popular options. Each of the platforms listed below offer low fees, give you access to the several UK and international markets and have a strong regulatory standing.

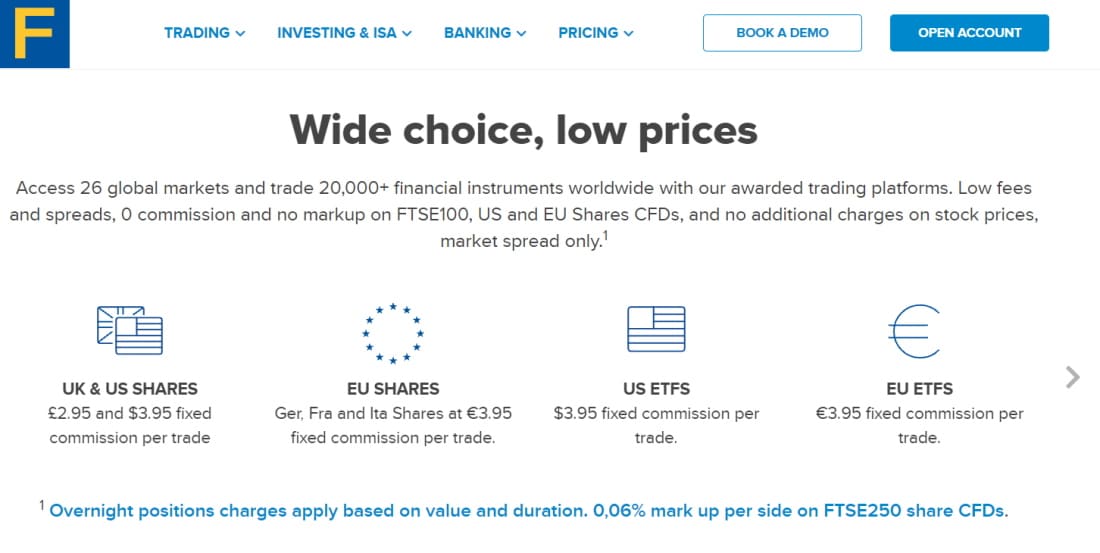

1. Fineco Bank

This platform offers incredibly low prices for share dealing. UK share deals cost just £2.95 per trade while US share deals cost just £3.95. If you want to invest in funds, Fineco Bank charges a very competitive annual management fee of 0.25%. Fund dealing is completely free and you can get started investing with just a £100 minimum investment.

Notably, Fineco Bank does a lot more than just share dealing. This brokerage also supports CFD trading, bond dealing, and options trading. So, you can easily develop a complex portfolio that includes stocks, bonds, mutual funds, options, and even forex. Stock CFD trades are commission-free, while forex trades start with spreads as low as 0.8 pips.

Fineco Bank has a desktop investment platform called PowerDesk. It includes dozens of technical studies and advanced drawing tools to help you monitor the market. However, one disappointment is that this platform isn’t available on mobile devices. Fineco’s mobile trading app is primarily designed to help you monitor your portfolio and enter orders, and it has few features for in-depth technical analysis.

Fineco Bank is regulated by the Bank of Italy and is publicly traded on the Milan Stock Exchange. The broker is also regularly rated as the #1 broker in Italy. Fineco Bank offers support by phone and email if you ever need assistance with your account.

Fineco Bank fees:

| Commission | As low as £2.95 per trade |

| Deposit Fee | Free |

| Withdrawal fee | Free |

| Inactivity fees | None |

Sponsored ad. Your capital is at risk.

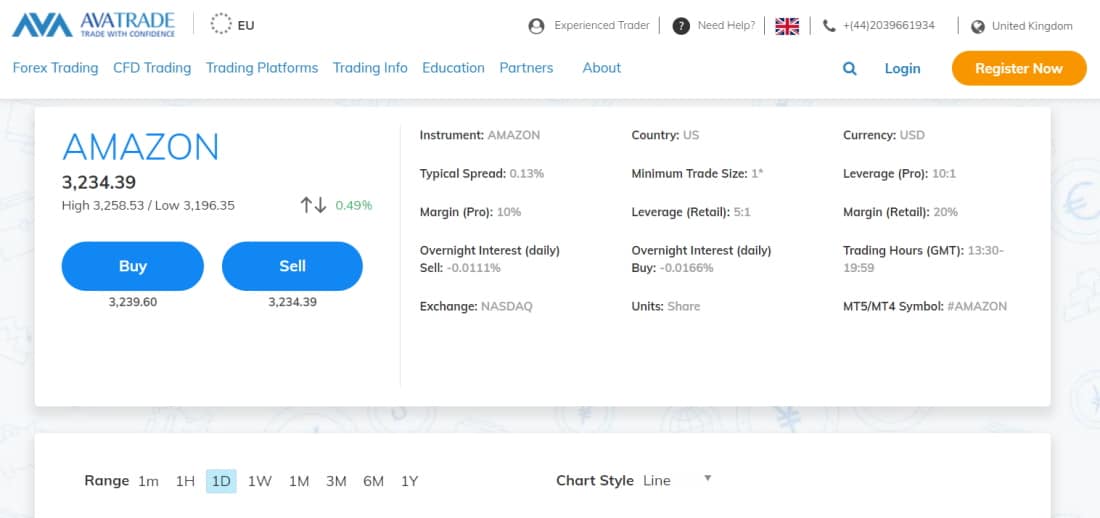

2. AvaTrade

AvaTrade is a popular FX and CFD broker that was founded in 2006 and is authorised by several financial regulators, including the Australian Securities and Investments Commission (ASIC) and the Central Bank of Ireland. Users can trade forex, CFDs, and cryptocurrencies without paying a commission at AvaTrade.

AvaTrade provides access to forex trading as well as a broad range of CFD derivatives, covering stocks, bonds, exchange-traded funds, commodities, and indices. Furthermore, AvaTrade has a wealth of resources and tools for new traders, including a free paper trading account with $100,000 in virtual funds to practise your trading strategy in a risk-free environment, as well as access to more than 250 financial instruments, including crypto trading for professional traders.

Fees and commissions

The only trading fees you’ll pay with AvaTrade are the bid-ask spread and the overnight financing fee if you keep positions open past the usual trading hours. When it comes to non-trading fees, there are no deposit or withdrawal fees, as well as no account fees. However, after three months of inactivity, AvaTrade brokerage accounts are subject to a $50 inactivity fee. Following that, after one year of inactivity, a $100 annual administration fee is withdrawn from the trading account.

Payments

As previously stated, AvaTrade offers a variety of payment options when depositing or withdrawing funds. Credit cards, wire transfers, and e-payments like Skrill, WebMoney, and Neteller are all supported.

Is AvaTrade safe?

AvaTrade is a global CFD and forex broker that’s regulated in multiple jurisdictions by several financial institutions such as ASIC, and Japan’s Financial Services Agency.

According to AvaTrade, client funds and data are protected by:

- 256-bit SSL encryption throughout the site

- Implements McAfee Secure to combat credit card fraud and identity theft

- Embedded True-Site identity assurance seal

- Client funds are held in segregated bank accounts

AvaTrade Platform Fees:

| Commission | 0% commission |

| Deposit Fee | Free |

| Withdrawal fee | None |

| Inactivity fees | $50 per quarter after 3 months |

Sponsored ad. 71% of retail investor accounts lose money when trading CFDs with this provider.

3. IG

IG covers multiple bases in the online trading space. Not only can you open a traditional share dealing account, but you can also trade CFDs. The platform also offers spread betting services – meaning that your profits will not be liable for UK capital gains tax. In the case of its share dealing services, you will have the ability to buy and sell over 10,000 equities.

This makes IG one of the most comprehensive in the space. Crucially, you will have access to thousands of UK companies across both the London Stock Exchange and the AIM. You can also trade international shares from several markets. This includes the US, Australia, South Africa, and more. When it comes to fees, this depends on the underlying instrument. For example, buying shares at IG costs £8 per trade.

But, if you managed to place 3 or more orders in the prior month, then this is reduced to £3. If you want to trade share CFDs, then you will pay a variable fee. This will vary depending on the market. For example, UK stock CFDs come with a commission of 0.10% (£10 minimum). US share CFDs cost $0.02 per stock, at a minimum of $15. Both the CFD and spread betting departments offer leverage facilities, as well as the option of ‘going short’.

This is ideal if you think that a stock is overpriced. It is also important to make reference to the platform’s long-standing reputation in the brokerage scene. Not only was IG launched back in 1974, but its parent company is listed on the London Stock Exchange. The platform has since attracted over 239,000 clients worldwide, and it is in possession of multiple regulatory licenses. This includes the FCA – so your money is safe at all times.

IG fees:

| Commission | £8 per trade. Reduced to £3 when you place 3 or more trades in the previous month. |

| Deposit Fee | Free |

| Withdrawal fee | Free |

| Inactivity fees | £12 a month after 2 years inactivity |

Sponsored ad. Your capital is at risk.

4. Hargreaves Lansdown

For example, it takes just minutes to set up an account at Hargreaves Lansdown, and you can deposit funds instantly with a UK debit card. Then, you will have access to thousands of financial instruments across several markets. On top of UK and international shares, you can also invest in UK Gilts and corporate bonds. Investment trusts, ETFs, and mutual funds are also available.

Hargreaves Lansdown is also popular with UK investors that wish to gain access to IPOs. The online broker offers some of the leading market insights and analysis pieces, too. For example, it offers in-depth research on major shares – covering everything from earnings reports to dividend payments, and even market projections.

On the flip side, Hargreaves Lansdown can be an expensive option. For example, you will pay an entry rate of £11.95 per share investment – which you will need to pay at both ends of the order. You can get this price down, but you will need to be actively trading. Crucially, although a fee of £11.95 might not be an issue if you plan to invest large volumes, it will if you want to start off with small amounts. Finally, Hargreaves Lansdown is licensed by the FCA and your funds are protected by the FSCS.

Hargreaves Lansdown fees:

| Commission | £5.95 – £11.95 per trade |

| Deposit Fee | Free |

| Withdrawal fee | Free |

| Inactivity fees | N/A |

Sponsored ad. Your capital is at risk.

5. Halifax

Launched in 1996 as a subsidiary of Halifax Bank and was later bought by Lloyds Banking Group. Halifax Share Dealing is a UK-based stockbroker that is authorized by the UK’s Financial Conduct Authority. To use Halifax’s services you need to be a permanent resident in the United Kingdom.

Halifax has low non-trading fees, offers free deposits and withdrawals, and supports a seamless onboarding process with the option to sign up to a tax-exempt ISA account.

Fees and commissions

On the flip side, Halifax has above-average trading fees for stocks and ETFs. For example, to trade US stocks you’ll be charged £9.50 per trade and a 1.25% exchange rate for international trades. But, if you use the ShareBuilder to create a regular savings plan and invest a minimum of £20 a month, then trades cost just £2 each.

While there are no inactivity fees, deposit or withdrawal fees associated with this share dealing account, there is a £36 annual administration fee. The minimum deposit at Halifax is $0, which is ideal for beginner traders who want to start buying and selling assets with a low-cost share dealing account.

Payments and regulations

At Halifax, GBP is the only available base currency. This means that if you buy and sell international assets, Halifax will charge a 2.99% conversion fee. Halifax does not charge any deposit fees and you can add funds to your account via a debit card, credit card, or bank transfer. Wire transfers can take a few business days, while credit/debit card deposits are instant and more convenient.

The UK’s Financial Conduct Authority regulates Halifax making it one of the popular ISA share dealing accounts across the board. Should Halifax go into liquidation, users are eligible for compensation up to £85,000 by the FCA.

Halifax Fees:

| Commission | £9.50 per trade on US stocks |

| Deposit Fee | Free |

| Withdrawal fee | None |

| Inactivity fees | None |

Sponsored ad. Your capital is at risk.

6. Lloyds

Lloyds is one of the largest global financial institutions. As well as offering banking, lending, and insurance services, Lloyds also provides retail share dealing accounts for active trading. With Lloyds, you can access the full UK stock market as well as those in the United States and Europe. Even better, this broker offers over 2,000 mutual funds for trading as well as pre-built portfolios for passive investing.

What can you buy with a Lloyds Share Dealing Account?

Lloyds currently offers stock trading on all major shares listed on the LSE (London Stock Exchange), and all FTSE 250 constituents. This includes some of the hottest shares such as Tesco and Royal Mail.

Lloyds Share Dealing Charges, Fees and Commission

Lloyds share dealing accounts charge a £40 annual fee, but you can set up an individual savings account (ISA) without any added fees. In addition to that £40 annual fee you’ll need to pay £11 per trade.

Alternatively, it costs just £1.50 per trade to buy or sell funds, and £1.50 to buy assets if you use the Lloyds scheduled investment service.

Is Lloyds safe?

It’s worth noting that Lloyds is highly regulated and under quite a lot of public scrutiny. All investments are regulated by the UK’s FCA. Furthermore, given the fact that Lloyds is a publicly-traded equity, making up the FTSE 100, it publishes its finances quarterly for market analysts to review.

Lloyds Fees:

| Commission | £11 per trade to buy and sell stocks |

| Deposit Fee | Free |

| Withdrawal fee | None |

| Inactivity fees | None |

Sponsored ad. Your capital is at risk.

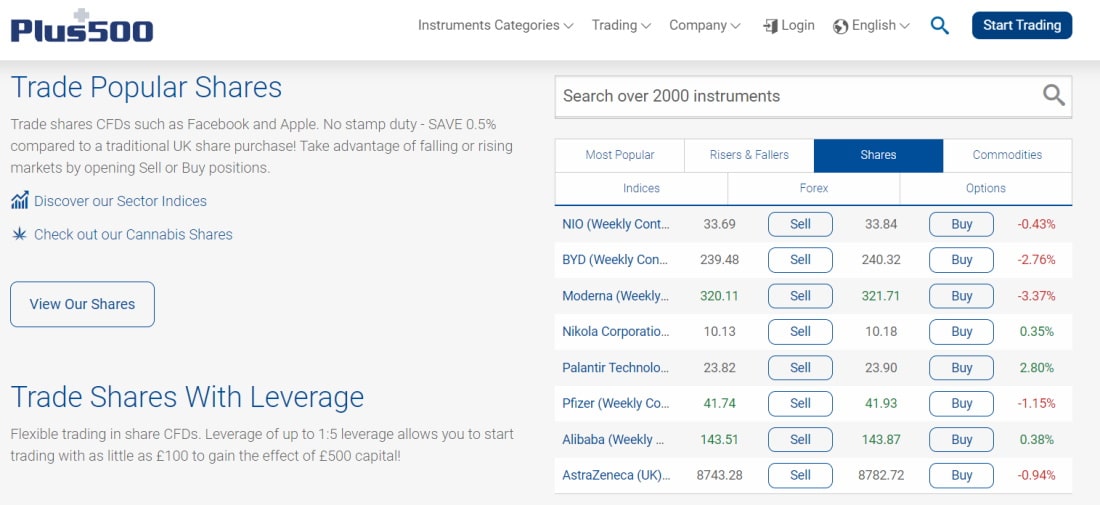

7. Plus500

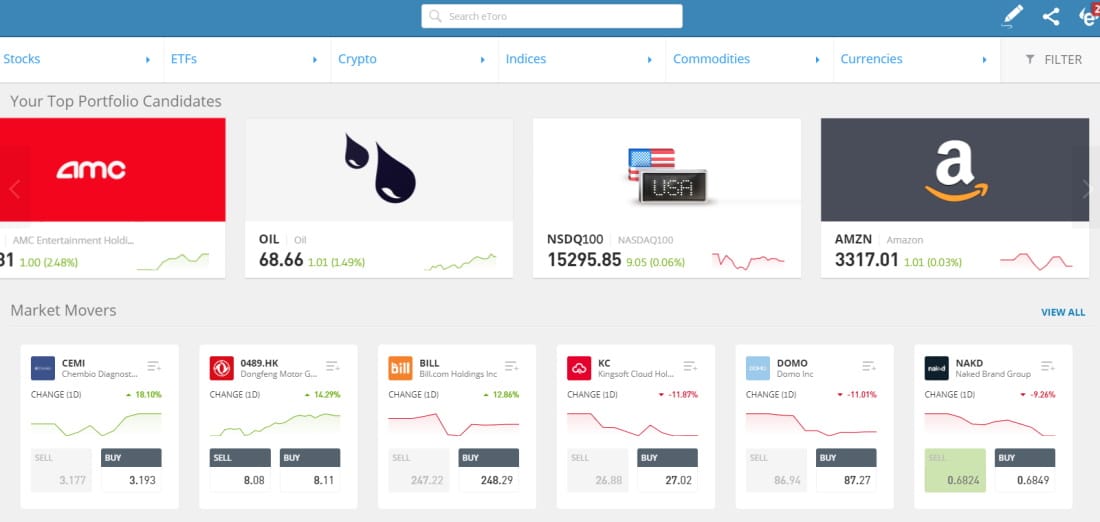

Plus500 is also popular with UK traders. The online platform specializes in CFD products, meaning that you will be ‘trading’ shares as opposed to investing in them. This is highly conducive if you want to actively trade on a short-term basis. For example, Plus500 allows you to choose from buy and sell positions on each of its 2,000+ stock CFDs.

In Layman’s terms, this means that you can profit from both the rise and fall of your chosen instrument. Plus500 is also suitable for short-term trading because it allows you to apply leverage. When trading stock CFDs, this stands at 1:5 for UK retail clients. As such, by holding a balance of £100, you would be able to trade with £500. Higher leverage limits are offered on other asset classes – such as indices, commodities, and forex.

Irrespective of what stock CFDs you wish to trade at Plus500, the platform does not charge any commissions. Much like Fineco Bank, it’s only the spread that you need to pay. You will, however, need to pay overnight financing fees if you plan to keep your leveraged position open past market hours. This is why Plus500 could be suited for short-term trading. In terms of its investment platform, you can access Plus500 via its desktop website. You can also trade on your phone via the Plus500 mobile app.

If you do like the sound of Plus500, opening an account takes minutes. You will need to provide some personal information and then meet a minimum deposit of £100. The platform allows you to do this with a debit/credit card, bank transfer, and e-wallet. There are no fees to deposit or withdraw funds. Plus500UK Ltd is authorized & regulated by the FCA (#509909), so you should have no concerns with safety. Its parent company is publicly-listed on the London Stock Exchange, too.

Plus500 platform fees:

| Commission | 0% |

| Deposit Fee | Free |

| Withdrawal fee | Free |

| Inactivity fees | $10 per quarter after 3 months inactivity |

Share Dealing Accounts – A Comparison

| Broker | Number of Shares | CFDs or Real Shares? | Pricing Structure | Price for Trading Amazon Shares | Account Fee |

| Fineco Bank | Covers 13 stock markets | Both | Commission & bid-ask spreads | $3.95 fixed commission per trade | None |

| Plus500 | 1,000+ stocks | CFDs | Spreads | Spread of 24.16 pips or 0.75% | None |

| AvaTrade | 600+ stock CFDs | CFDs | Spreads | Typical spread of 0.13% | None |

| IG | 16,000+ stock CFDs plus UK-traders can trade real stocks from 8 markets | Both | Trading commission for share CFDs, real shares, and options. Spreads for forex, stock index CFDs, commodity CFDs, and bond CFDs | Minimum spread of 0.10% | None |

| Hargreaves Lansdown | Covers stocks listed on 21 international exchanges | Real shares | Fees for stocks are volume-based. For example 0-9 trades in the last month equates to £11.95 commission per trade | Fees for stocks are volume-tiered. | None |

| Halifax | Offers stocks listed on 9 stock markets | Real shares | Flat fee of £9.50 per trade | £9.50 per trade. | £36 administration fee per annum |

| Lloyds | Supports stock trading on 9 exchanges | Real shares | £11 per trade to buy and sell stocks | £11 per trade. | For basic accounts there is no fee, for premium accounts the total annual account maintenance fee is £336. For a breakdown of all the account types and their relevant fees click here. |

How does share dealing work?

Share dealing is a way to buy and sell shares in publicly-traded companies, allowing you to manually build a diversified investment portfolio.

A share is a unit of ownership in a business. The value of a share is calculated by dividing the company’s market value by the number of shares available for purchase. This is a key metric to consider when selecting the shares to buy right now.

Let’s look at an example

If a company listed on the London Stock Exchange is valued at £100 million and there are 50 million shares available to buy, the share value is £2. However, this figure can increase or drop depending on market volatility, conditions and macroeconomic events.

Share dealing is a type of investing. It allows you to trade shares in publicly listed companies using a stocks and shares ISA.

Purchasing shares

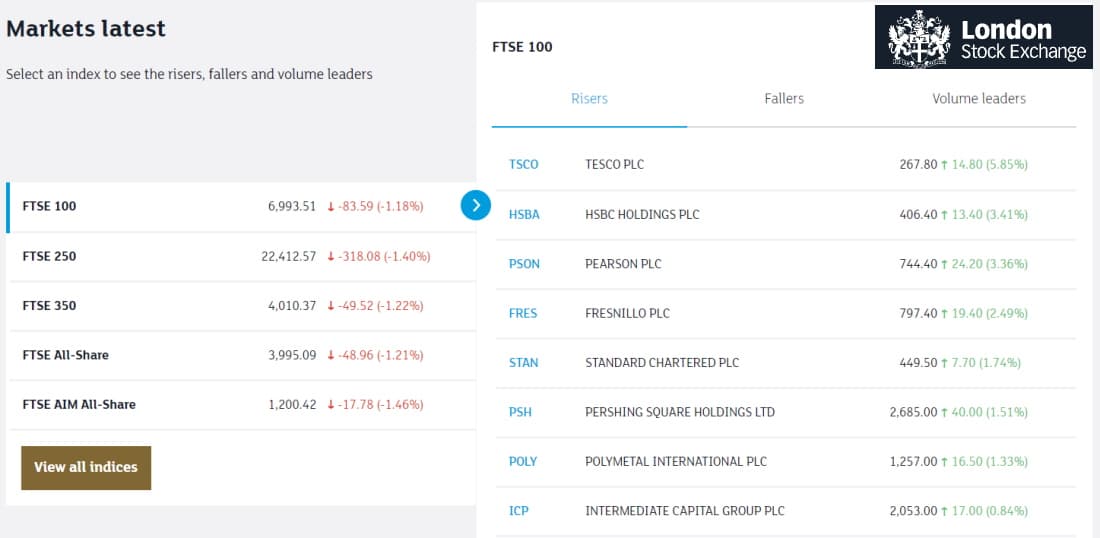

Two popular UK stock exchanges that allow you to buy and sell shares are:

- The LSE (London Stock Exchange) – This stock market lists more than 3,000 companies, covering both multinationals and smaller-cap UK firms.

- The Alternative Investment Market (AIM) – This stock market lists more than 3,500 companies, and provides access to shares in smaller, start-up companies that are still in the research and development stage.

AIM-listed companies are subject to less strict regulatory requirements in contrast to LSE-listed shares. In comparison, this means AIM shares inherently carry risk and volatility.

Some of the share dealing accounts allow you to buy and sell shares in companies listed on international exchanges including the NASDAQ, NYSE, and Hong Kong Stock Exchange (HKG).

Choosing the right type of share dealing broker

When opening a share dealing account with a stock broker you’ll get unbridled access to the trading platform, but you can also choose how much they participate in the trades.

- Execution-only Brokers allow you to buy and sell shares independently without any investment advice. This means you have full custody of your portfolio of stocks.

- Advisory brokers give you support and financial advice on which shares to buy and sell right now. Nevertheless, the decision-making process is still up to you.

- Discretionary brokers make trades on your behalf and typically come with a portfolio management charge and a financial adviser.

How to Choose A Share Dealing Account

So now that we have covered a handful of brokers, we now need to discuss how you can compare share dealing accounts.

Invest in Shares or Trade Stock CFDs

You will be entitled to dividends and will remain a stockholder until you sell the shares. One potential option in this respect is Fineco Bank, as the platform does not charge any commissions or monthly/annual fees.

If you join a platform that specializes in stock CFDs, then you will be trading the shares on a short-term basis. You can choose from a long or short position, and even apply leverage. Stock trading is focused on smaller profits, but on a much more frequent basis. CFD platforms like Plus500 even allow you to earn dividends on your long positions.

Licence

Once you have established the type of investing/trading that your share dealing account provider offers, you then need to look at regulation. Put simply, you should never join a trading platform if it is not regulated by the Financial Conduct Authority (FCA). Crucially, FCA brokers must follow a range of regulatory standards, such as:

- Keeping client funds separate from their own working capital

- Asking all clients to upload ID

- Clearly present the risks associated with investing and trading

- Ensuring that your leverage account does not go into negative territory

Tradable Assets

You then need to explore what assets you will be able to gain exposure to. In the case of stocks, explore what markets the broker covers. For example, is it just UK shares that you can invest in, or can you also buy international stocks?

If you are interested in other asset classes – such as investment trusts, ETFs, or mutual funds – you will need to check whether this is offered before opening an account.

Fees

Potentially one of the most important metrics to consider is that of fees. In the vast majority of cases, UK share dealing account providers will charge you a commission every time you make a purchase or sale. This can vary considerably, which is why you need to do some homework.

For example, Hargreaves Lansdown charges £11.95 when you buy shares, and again when you offload them.

Share dealing fees – admin and maintenance fees

Most brokers will charge a fee to keep your share dealing account open. The frequency of these fees varies depending on the stock trading platform. Some charge a fee every month, quarter, or year. Furthermore, the charge could either be a percentage of your portfolio’s total worth or a fixed fee.

Commission fees

Most brokers nowadays facilitate commission-free trading on real stocks and stock CFDs. Some popular and trusted examples include Fineco Bank, AvaTrade, and Plus500. This 0% commission offering has given rise to the so-called discount brokers or free trading platforms.

You’ll also get some global forex and CFD brokers that charge low trading commissions but zero bid-ask spreads. But, for the most part more traditional brokers charge a fixed commission such as Lloyds, Hargreaves Lansdown, and Halifax. For example, Halifax charges a flat fee of £9.50 per trade, and Fineco Bank charges a fixed commission of £2.95 per trade on UK shares and $3.95 per trade on US shares. However, when it comes to share CFDs Fineco Bank charges a fixed commission of £0 on FTSE 100, US and EU share CFDs.

Volume-tiered commission

Some stock brokers like Hargreaves Lansdown charge less commission if you execute higher trading volumes each month. To see this volume-based pricing model in action let’s examine Hargreaves Lansdown’s share dealing charges:

| Trading volume previous month | Dealing charge |

| 0-9 deals | £11.95 |

| 10-19 deals | £8.95 |

| 20 or more deals | £5.95 |

The type of commission you pay can be broken down into three main categories:

- Frequent trader rate – some stock brokers charge lower fees if you trade frequently in high volumes as we saw with the example above from Hargreaves Lansdown.

- Telephone trading – this is typically a percentage fee of the total amount you trade. Online trading is more cost-effective in comparison.

- Regular investing – a handful of brokers offer lower fees by combining your stock investment with other trades to qualify for cheaper rates.

Transfer fees

If you transfer existing stocks from your old brokerage account to a new broker you could be charged a fixed fee per holding.

Inactivity fees

The majority of brokers charge an inactivity fee after a set period, such as three or twelve months. This is something you need to pay attention to when choosing the right share dealing account for you. If you plan to make a handful of stock investments and then hold them for the long term, you’ll want to opt for a broker that doesn’t charge inactivity fees.

What is Stamp Duty Tax?

Every time you buy shares listed on UK exchanges, you’ll have to pay a 0.5% stamp duty tax on the total buy price. Investors use an online system dubbed CREST to declare and pay this tax. However, Fineco Bank absorbs Stamp Duty and Financial Transaction Tax for its users where applicable. This translates to an extra saving of 0.5% in the UK, 1% in Ireland, 0.3% in France, and 0.1% in Italy.

What is Capital Gains Tax (CGT)?

Capital Gains Tax is the tax charged on profits made from trading assets. CGT is only chargeable on realised profits, not the intrinsic value of an asset. For example, let’s say you buy £10,000 worth of shares in Tesco stock and later sell for £50,000. This means a return of £40,000. You’ll then pay Capital Gains Tax on £40,000 only.

You pay Capital Gains Tax on any shares purchased that aren’t held in an Individual Savings Account (ISA) or a Personal Equity Plan (PEP).

Trading Tools and Features

While some share dealing account providers offer a skin-and-bones service, others come jam-packed with features and tools. Some of the most important to look out for are:

- Trading Platform: Look to see whether you can buy and sell shares through the broker’s website, or if you need to download and install software.

- Market Insights: Regardless of whether you plan to invest or trade, you should choose a platform that offers market insights. This might come in the form of fundamental news developments or in-depth research.

- Educational Tools: If you are just starting out in the world of online shares, you’ll want to choose a share dealing account provider that offers educational tools. This will help you become a better investor – and should include guides, videos, explainers, and webinars.

- Technical Indicators: Seasoned stock traders have an understanding of the technicals – meaning that they are able to interpret chart trends. In order to do this, you will need to use an online share dealing platform that offers technical indicators. This should be complemented by chart drawing tools.

Usability & Mobile App

It is also important to assess whether or not the share dealing account is suitable for newbies. If it isn’t, you might find it difficult to navigate yourself through the site.

Similarly, you should also explore whether or not the broker allows you to trade on your mobile phone. Share dealing platforms typically offer a native investment app, meaning that you can buy and sell stocks on the move. In most cases, the broker will offer support for both iOS and Android devices.

Payment Methods

You will, of course, be required to deposit funds into your share dealing account. As such, you need to choose a broker that offers your preferred funding method. Most platforms allow you to deposit with a UK debit/credit card and bank transfer.

But, if you want to deposit with an e-wallet, fewer platforms support this. Fineco Bank and Plus500 each offer e-wallet facilities. You also need to check what deposit/withdrawal fees are applicable. You can normally check this out from the broker’s website before opening an account.

How to Get Started with a Share Dealing Account

So now that you know how to choose a provider, we are now going to show you how to get started with a share dealing account today.

The process of signing up, depositing funds, and making an investment is fairly similar across all UK brokers.

Step 1: Open a Share Dealing Account

Simply head over to the stock trading platform of your choice. The majority of FCA-regulated brokers require you to open a verified trading account. The process takes just minutes, and simply requires some personal information.

This includes:

- Full name

- Home address

- Nationality

- Date of birth

- National Insurance Number

- Email address

- Mobile number

You will need to choose a username and password, as well as confirm your email address and mobile number.

Step 2: Identity Verification

All FCA-regulated brokers need to confirm the identity of each and every account holder. As such, you will be asked to submit some documents. This includes a copy of your passport/driver’s license and a proof of address.

You don’t need to upload the requested documents straight away if you do not plan to deposit more than £1,800-ish. You will, however, need to do this before you can make a withdrawal request.

Step 3: Deposit Funds

You will now be asked to deposit some funds.

You can usually fund your account with a:

- Debit card

- Credit card

- PayPal

- Skrill

- Neteller

- Bank transfer

Step 4: Add Stocks to Your Share Dealing Account

If you don’t know which shares you want to buy, spend some time exploring the stock library and the stock markets.

Alternatively, if you know which shares you wish to purchase, enter the name of the company in the search box and click on the composing result. In our example, we are buying BT shares.

Then, you will need to click on the ‘Trade’ button.

The final stage of the share purchase process requires you to enter the size of your position. In simple terms, you need to specify how much you wish to invest in your chosen stock – in US dollars.

To complete our share purchase, we need to click on ‘Open Trade’. In doing so, the stocks will be added to our share dealing account instantly.

Conclusion

In summary, buying and trading shares in the UK has never been easier. No longer do you need to call an old-school stock broker to achieve this goal. On the contrary, there are hundreds of share dealing accounts available online. This means that you can buy shares at the click of a button.

With that said, knowing which platform is most suited for your investing goals can be challenging. This is why we have presented a selection of popular providers as of 2022. We have also shown you what you need to do to find a share dealing account yourself.