The DeFi space has grown despite low expectations. As of August, the Total Value Locked (TVL) in DeFi protocols, decentralized exchanges topped out at $157 billion, currently an all-time high. There are potentials for more growth given that DeFi is considered to still be in its infancy.

One of the factors that have contributed to the growth of DeFi is the emergence of new DEFI protocols with high-value propositions. Among the new protocols, one that has resonated with DeFi enthusiasts is Yearn.finance. Yearn.finance emerged in early 2020 courtesy of Andre Cronje. Andre Cronje is a South African financial technology developer who was inspired to roll out Yearn.finance due to the deficiencies he noticed in the yields offered by various DeFi applications.

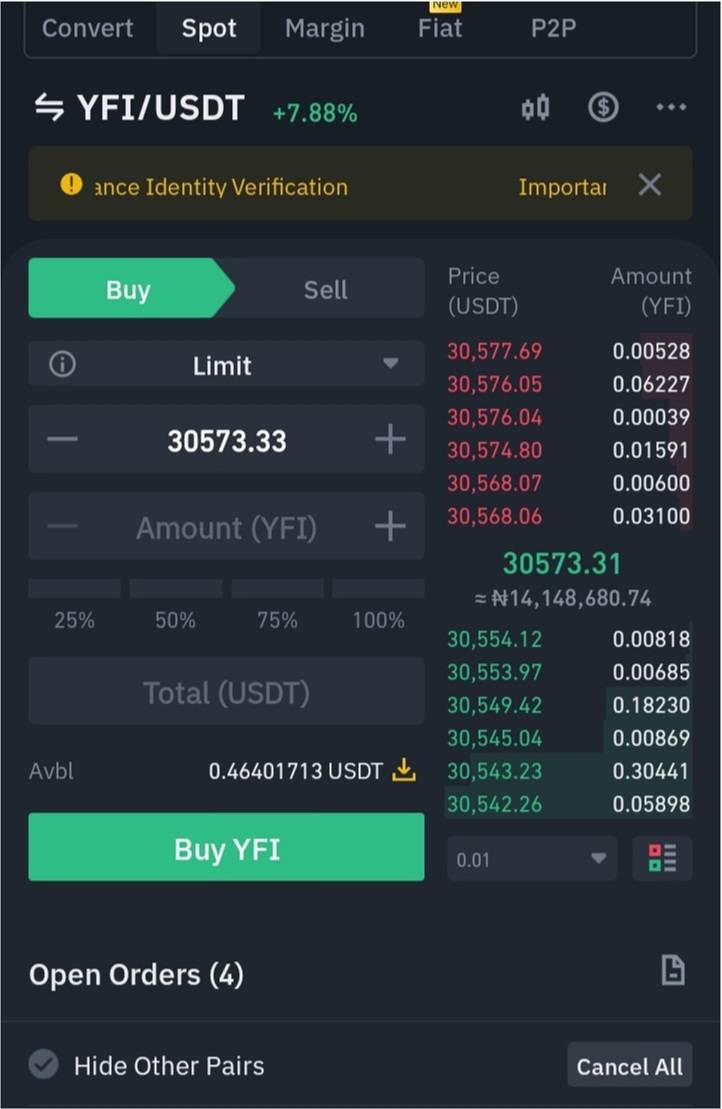

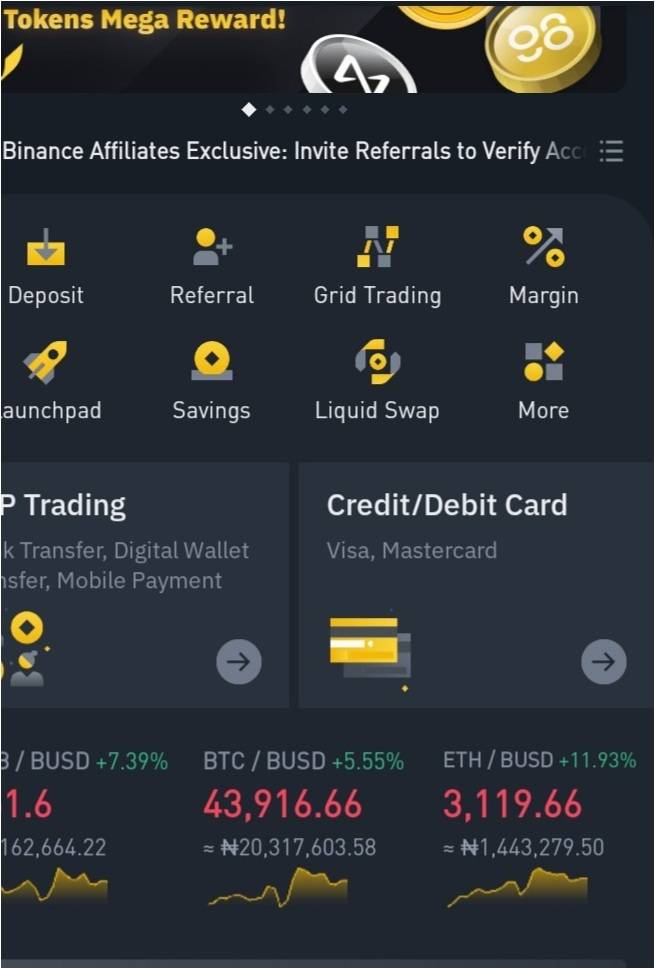

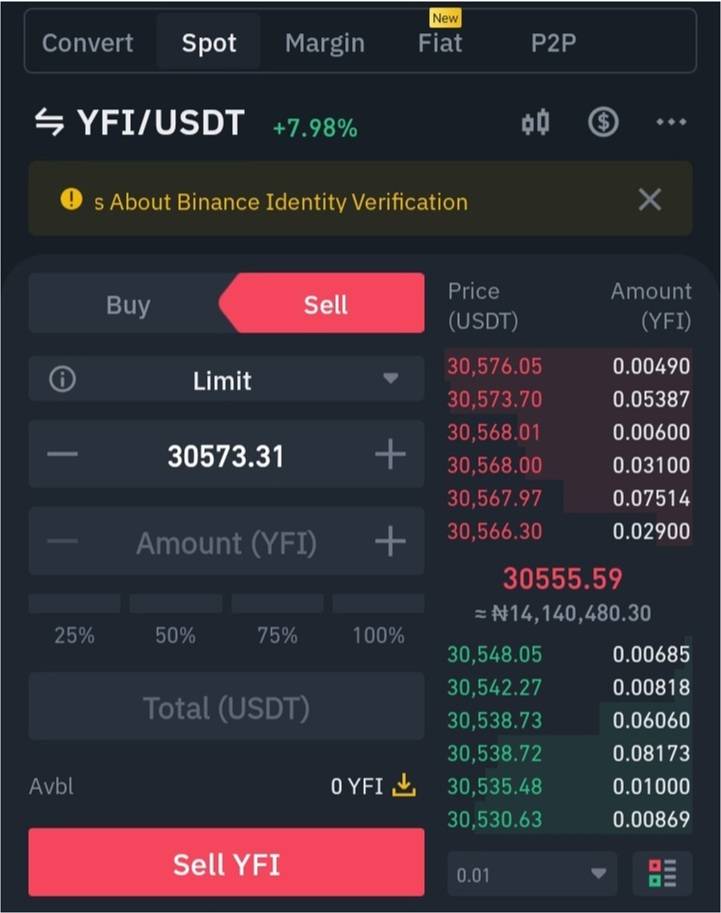

Yearn.finance’s launch was plagued by an exploit. However, Cronje revamped the protocol and rolled out a new set of products for the benefit of users. Yearn.finance may be a DeFi protocol but operates differently. The protocol’s most pivotal feature is known as Vaults. Just like most protocols, this feature allows users to deposit cryptocurrency in a pool and earn yields. The funds deposited are managed by a strategy that seeks to maximize yields and reduce risks or losses. As of Yearn. finance’s launch, the Vaults were designed to receive only deposits of stablecoins due to their ability to stave off price fluctuations. Recently, Yearn.finance’s vaults began endorsing deposits of other cryptocurrencies like ether, tokenized Bitcoin products (Wrapped Bitcoin- wBTC), Chainlink, and other coins. When these deposits are made, they are converted to stablecoins and Yearn.finance looks around for stablecoins pools with fewer risks to stake them. Users are given deposit certificates in form of tokens such as yDAI while they earn yields on the side. Yearn.finance also allows users to stake the certificate tokens on other pools. The importance of the Vaults on the protocol is such that they reduce the cost of interacting with Ethereum-based protocols. The funds deposited are gathered and only one account (the one that controls each vault) pays the transaction fees (gas) to yield the farm. Yearn.finance also provides other services such as Earn and Zap. Earn is an abridged version of the Vaults. Only stablecoins and tokenized Bitcoin are supported on Yearn.finance’s Earn. The Zap tool allows users to swap traditional stablecoins for LP tokens representing stablecoins. Andre Cronje and his team have other products in the works such as yInsure, a permissionless insurance protocol for DeFi enthusiasts, and StableCredit, which will aid decentralized lending and borrowing like in other DeFi protocols- AAVE and Compound. Most importantly, native and governance token YFI, is the linchpin behind the protocol’s growth. The YFI token did not launch with the protocol. It was an afterthought for Cronje following the exploit on Yearn.finance and a crypto market crash in March 2020. YFI is an ERC-20 token that gives users a governance or voting rights on the protocol. Users can farm the YFI token via certain means including being a liquidity provider on Balancer, a DEX and having a stake in Yearn.finance’s products. Although Cronje mentioned that YFI has no intrinsic value, the token has managed to acquire immense value due to its limited supply and high demand from investors. The YFI price rose as investors realized its value in participating in governance on the protocol. YFI has a total supply of 36,666 tokens. The limited supply of YFI stems from the decision of the protocol’s community. Several forks of YFI have been created by those who were dissatisfied with the decision on limited supply. When YFI first launched, it was trading at a mere $3 on Balancer DEX. Following the demand surge, YFI rose to $30,000 quickly. The token reached an all-time high of $93,435 during this year’s market rally. However, since the prices of most cryptocurrencies, YFI has lost 97% of its ATH and is currently ranging at the $30,000 area. YFI is in high demand to date from investors who intend to participate in governance on Yearn.finance. In light of the demand, several exchanges, both centralized and decentralized have listed YFI on their trading platforms giving room for investors to purchase the token. Apart from having voting rights on Yearn.finance, investors also seek to profit from the token. For new investors, buying YFI, much less selling it, may be difficult. Selling YFI tokens is impossible without the assistance of a broker. Even though YFI can be sold via the peer-to-peer method, most investors favor selling YFI through a broker, also called an exchange. You can perform different trading transactions on an exchange aside from selling cryptocurrency or purchasing crypto assets. We have outlined a few exchanges in this guide where you can trade your YFI tokens with assurance. Additionally, note that these exchanges have been appropriately reviewed by industry experts and are similarly considered by experienced investors and crypto enthusiasts as reliable. These brokers provide a wide scope of services. They permit their clients to trade their YFI tokens for USDT or some other crypto or fiat pair accessible on their platforms. The outlined brokers are some of the leading crypto exchanges in the world. While attempting to pick a broker, there are certain benchmarks to pay attention to. On their part, exchanges attempt to satisfy the expectations of their clients by providing an intuitive trading interface. Traders have their preferences when it comes to trading with a broker or on an exchange. These preferences include security and 24/7 customer service. We have selected these exchanges on account of their standing among different exchanges. Moreover, there is high liquidity for the YFI token on their platforms. Liquidity is important to traders because, without it, they can hardly sell the YFI tokens successfully. Selling YFI is easy. In this guide, we will check out a leading digital asset trading platform, eToro on how to sell YFI. eToro has millions of users and offers a wide variety of cryptocurrencies and their trading pairs. The trading platform is US-based and has limited jurisdiction. eToro has a basic trading interface that guarantees that brokers do not have to struggle to sell YFI and other cryptocurrencies. Irrespective of being a beginner, you can easily navigate the platform to sell your YFI tokens. Below are five steps you are required to follow to sell your YFI on eToro without stress. You can’t sell YFI without purchasing or first owning it. Buying is the #1 step before you should think of selling. eToro permits clients to purchase YFI or you can purchase from another broker, then transfer it to eToro to sell. Only verified users are permitted to buy YFI on eToro. Thus, after signing up, you have to verify your account by submitting documents. When they have reviewed your documents, eToro licenses you to buy, sell and store assets in your account. eToro has provided many channels through which you can send funds into your account. You can send fiat to your eToro account and this might be done through your credit/debit card, local bank account or through third-party channels like PayPal, Skrill or Neteller. YFI / USDT pair on Binance Some investors buy YFI tokens intending to profit from them. While it is important to buy YFI from a reputable platform, it is equally relevant to know when to sell. Cryptocurrencies including YFI are volatile. As such, a trader should always have a target in mind so he can sell when the target is hit. eToro assists traders with making wise trading decisions by providing charts for every cryptocurrency. These charts contain candles and patterns alongside data which traders can study to familiarize themselves with the history and price action of these digital assets. Clicking on YFI leads you to the token’s charts on eToro. YFI Chart on Binance Other than YFI, there might be different assets you are holding in your portfolio. In this guide, we are focusing on the DeFi token, YFI. Knowing the total value of your portfolio will assist you with deciding whether the quantity of YFI tokens you wish to sell is up to the necessary sum. eToro has a minimum withdrawable sum of $30. So you ought to have up to that amount or above before selling. Binance Overview To know the value of YFI in your portfolio, click the top left corner of your eToro dashboard. There, you can find other cryptocurrencies you are also holding. While trading on eToro, you might have an open position on the YFI token. Otherwise, you will most likely be unable to sell. However, if the YFI tokens in your possession are more than enough, you can sell those you did not open positions with. After selling your YFI tokens, the same amount in stablecoin or fiat- depending on the trading pair- reflects in your portfolio. There are instances where the amount which reflects is less. This is often due to slippage. Slippage occurs when a digital asset lacks deep liquidity such that traders can execute trades at the best prices available. Closing YFI trade on Binance When you need to close an open position on YFI through your eToro account, you click on the portfolio icon where you are shown every one of the assets you hold. There, you can tap on YFI and you are taken to the trade section. In this section, you can decide to sell all or half of your YFI tokens. Also, you can utilize the search icon to search for a YFI pair of your choice that you intend to sell. After following any of the two options, you can sell your asset and then withdraw it. Withdrawing funds on eToro is quite easy, provided you’ve fulfilled verification requirements. There are instances when withdrawal challenges could arise, but it is not likely to happen if you already have an idea of what to do. Other instances include incomplete verification, errors while initiating withdrawals or missing withdrawal channels. The minimum limit for YFI withdrawals on eToro is $30 worth of YFI with a percentage fee of 0.5. eToro’s min withdrawal fee is $1 while the max is $50. This signifies that eToro is user-friendly not only in terms of user interface but also in fees for every activity executed on its platform There are currently no taxes for cryptocurrencies in the US. However, the proposed infrastructure bill is poised to introduce taxes for capital gains within the country, with varying tax percentages on short and long term gains. Due to the decentralized nature of cryptocurrencies, enforcing tax obligations on their owners might be a difficult thing to pull off. US authorities have continually expressed concerns over cryptocurrencies being used for illegal activities. Thus, they are looking to enact regulations that will encapsulate and safeguard against such acts. The Infrastructure Bill will serve as one. There are more than 400 exchanges around the globe with varying jurisdictions. Usually, crypto exchanges are meant to make cryptocurrencies accessible to investors and crypto enthusiasts. Amongst all crypto exchanges, some have been able to stand out and resonate with millions of people around the globe. There are certain benchmarks used to identify the best crypto exchanges. These benchmarks include security, friendly UI, efficient customer support, a guide on how to use the exchange, and a growing community. Only a few exchanges have been able to meet these benchmarks to offer the best to their users. We have outlined a few reputable crypto exchanges below: Since YFI is a digital asset, it requires proper and secure storage. Cryptocurrencies like YFI are stored in digital wallets. Crypto holders have different ways of storing their digital assets. Some store theirs in digital wallets while others transfer the assets to hardware wallets, also known as cold wallets. Each of these wallet types has its pros and cons. Based on your preferences, you can decide to store your YFI in any wallet provided you take measures to protect your assets. Here, in another guide, we have compiled some of the best crypto wallets you can store your YFI tokens in. Investors normally adopt different methods when investing. Some take the short-term path where they only have to wait within the range of a day to a week before deciding to sell. Others could buy YFI and keep it medium-term, meaning in some weeks or months, they’ll come back to check if they have made any profits on their investments. A long-term investment strategy means holding for years before selling off. In essence, you only sell if the price of the token has hit your target. YFI’s price has done well over the past few months, more so since DeFi became a rave. Due to the utility of the YFI token, it is bound to perform well in the future. Being a native token to the protocol puts it in a great position among DeFi tokens. As long as decentralized finance continues to appeal to investors, there are great prospects for all DeFi tokens including YFI. YFI has reached $93k registering more than a 2000% increase in its price last year. YFI has a circulating supply of 36,666 and an overall supply cap of 36,666 as well. Automated trading was created to assist traders who hardly have the time to monitor their trades. A lack of attention could lead to huge losses. As part of trading rules, a trader is meant to be in the right frame of mind to maximize opportunities in the market. This is why apart from risk management, a trader is supposed to have strong trading psychology as well as emotional stability. Trading robots automate the trading process such that traders can have time for other engagements. Trading bots utilize algorithms to trade cryptocurrencies. Nonetheless, they require a bit of human involvement to function effectively. They cannot function on their own, a trader has to activate a trading range based on his strategy, which these bots rely on. One reason trading bots are important is that they are designed to respond to opportunities in the market faster than humans. Some of the trading robots that we’ve reviewed include: Almost everyone is now interested in investing in cryptocurrencies because of their numerous benefits. The thing is crypto is not something to jump into without first learning the ropes. It is beyond having the capital to invest. The volatile market should be a red flag to a new investor. There are a whole lot of other qualities a crypto investor is expected to possess. Yearn Finance (YFI) has good potential, owing to its utility in decentralized finance. Thus, it is a crypto asset to watch out for. Its price could reach $100,0000 in the long term (currently $30,000 at the time of writing). Here are some key things to note before deciding to sell YFI: Yearn Finance (YFI) is one of the top cryptocurrencies with a market capitalization of $1.1 billion. It is a digital asset, so it can be bought, stored and sold without hassles. YFI can be found on most exchanges including on the platforms of the brokers listed above. To sell YFI on eToro and other brokers’ platforms, you need to close positions. You can trade the asset against USDT or the fiat currency of your residing country and then withdraw to your local bank account. YFI can be stored in a wallet, whether hardware or software. It is safe to the extent of the owner’s diligence and security consciousness. Our recommended best exchange to sell Yearn Finance in 2025 is eToro as they are regulated internationally and support withdrawals by bank wire, VISA, Skrill, Neteller and a range of other methods. Update – As of 2025, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

In this guide, we recommend selling YFI via an exchange as you are guaranteed the safety of the transaction. There are other means by which you can sell. P2P is an alternative, but the risks are high.

When you use a broker like eToro, selling your YFI can be concluded in minutes after a few clicks. The exchange features withdrawal options as well.

Several brokers can be used to sell YFI. However, the following are considered the best by expert traders that have explored other options. They are eToro, Capital, Libertex, Plus500, Coinbase, Binance, AvaTrade, Revolut, Cryptorocket, and Changelly.

There are different regulations on crypto globally. So if you are willing to know if selling YFI incurs any tax, you may have to resort to the financial regulations in your country.

To sell your YFI for USD, you need an exchange that permits payment to your local bank or third-party payment service. Some of the best choices are eToro, Coinbase, AvaTrade, and Binance.

Some of the exchanges where YFI can be sold include eToro, Capital, Libertex, Plus500, Coinbase, Binance, AvaTrade, Revolut, Cryptorocket, and Changelly.

To quickly sell your YFI, you need an account with eToro or any other exchange listed above. Setting up your account doesn't take a lot of time. If you have your YFI already, you can transfer them to the wallet on the exchange and sell them there instantly.

To sell YFI for fiat, you should initiate a withdrawal request on eToro or any other exchange. Ensure that you've chosen your desired currency. When you withdraw, the exchange helps you convert the funds to cash and pays into the proper channel.

PayPal only supports four cryptocurrencies, which include Bitcoin, Bitcoin Cash (BCH), Ethereum (ETH) and Litecoin (LTC). However, you can buy YFI with any of the supported cryptocurrencies.

Some wallets help you sell your YFI directly. To sell them on the wallets, you need to integrate a payment method and follow the necessary procedures to sell YFI.

Often, you can swap your YFI for other cryptocurrencies on brokers like eToro or Coinbase. Once you complete a swap, the actual value of YFI sold reflects in your portfolio. On this Page:

Tutorial On How To Sell YFI

How to Sell YFI in June 2025

Step 1: Buy YFI

Step 2: Always Know When to Sell

Stage 3: Know The Total Value Of Your Portfolio

Step 4: Close All Active Positions

Step 5: Withdrawal Requirements And Exchange Rates

Crypto Taxation In The US

Best Crypto Exchanges

Storing YFI In The Best Wallets

When Is the Best Time To Sell My YFI?

Price Of YFI

Guide To Automated Trading

How To Invest Responsibly In Crypto

Should I Sell YFI In 2025?

Summary

FAQs

Where to Sell YFI

How Easy it is to Sell YFI

What are the Best Brokers for Selling YFI?

What are the Taxes for Selling YFI?

Where to Sell YFI for USD?

What Exchanges Sell YFI?

How to Quickly Sell YFI

How to Sell YFI for Cash

How to Sell YFI on PayPal

How to Sell YFI from Wallet

How To Sell YFI For Other Cryptocurrencies