The Bitcoin price opened in 2022 at a massive value of $46,000 (£33,000), an over 50% gain from its 2021 opening of $29,000. With this opening, the leading crypto asset provided its investors a higher return on investment (ROI) than other financial assets e.g. Gold and stocks.

At one point in 2021, Bitcoin hit its all-time highest value, $69,000 (over £50,000), and if the bull market continues Bitcoin could re-test that benchmark again.

Should you buy Bitcoin this year? Definitely, you should as some investors expect the price of Bitcoin to even reach six figures in 2022. In this guide, we’ll review the best Bitcoin exchanges for those researching how to invest in Bitcoin.

5 Best Bitcoin Exchanges in the UK

- eToro – Best Bitcoin Broker in the UK

- OKX – Flexible UK Bitcoin Exchange Offering Both CEX and DEX

- Bybit – A Beginner-Friendly Bitcoin Exchange in the UK

- Binance – Highest trading volume Bitcoin exchange

- Coinbase – Most popular Bitcoin exchange by no. of users

- Bybit – Best Bitcoin exchange for futures trading

- KuCoin – Best UK exchange for low market cap altcoins, alongside BTC

Best UK Bitcoin Exchanges Reviewed

If you are hunting for the best UK Bitcoin exchange for starting your crypto journey, then you are definitely at the right place. Read ahead as we review the best UK Bitcoin exchanges, and discuss their features, pros, cons, and a lot more.

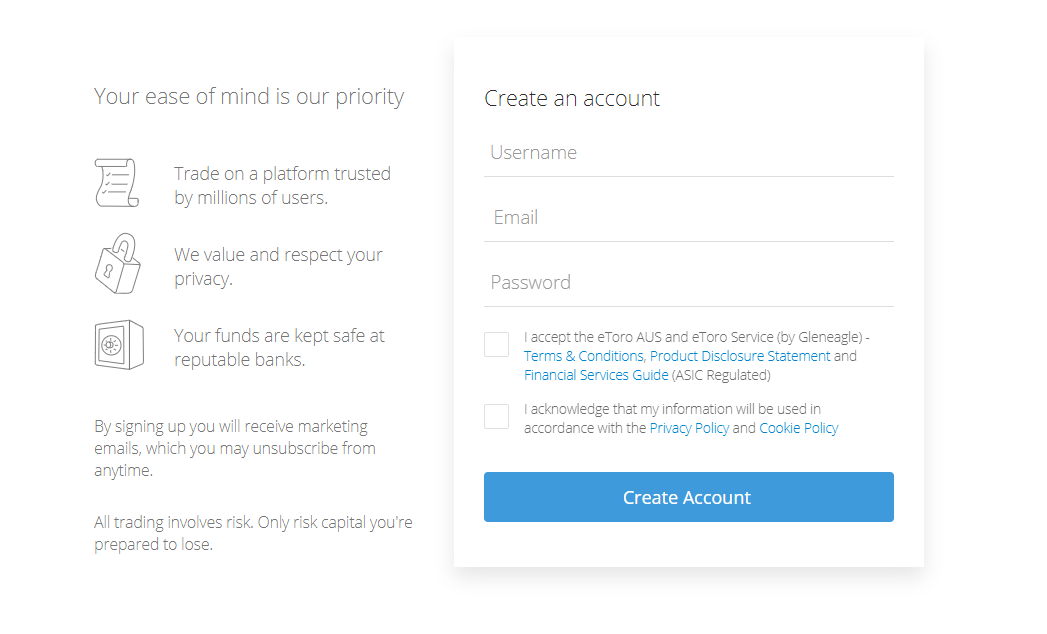

eToro – Best Overall UK Bitcoin Exchange

eToro is the leading Bitcoin exchange in the UK that provides traders and investors with an opportunity to start crypto trading. With over 20 million members from all around the world, eToro is the world’s largest trading and investing community. Many of eToro’s smart and experienced investors have outperformed market benchmarks.

This renowned Bitcoin exchange provides everyone access to over 2000 financial assets, including cryptocurrencies, ETFs, stocks, and commodities, etc.

eToro provides you with a premium feature called Smart Portfolios, which gives you ready-made investment portfolios based on a specific theme-based strategy.

- Have features like Smart Portfolio, Copy Trader function

- Accepts multiple payment options

- Limited technical analysis tools

- Not well-suited for the more advanced investor

Demo Account: Yes

Educational Material: Yes

Fees: 1% spread

Minimum deposit: 37.04 GBP for UK clients

Special Features: Copy Trader function, Smart portfolios

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

OKX – Flexible UK Bitcoin Exchange Offering Both CEX and DEX

OKX is a leading UK Bitcoin exchange that offers flexible solutions for buying Bitcoin. By that, we mean this platform offers both CEX and DEX. The DEX is a DEX aggregator that implements X Routing to find the best liquidity pools so that users can buy Bitcoin without having to worry about high network fees or high slippage.

OKX CEX, however, is where most of the main features of this platform are concentrated. Beginners can buy crypto with a card using a simple conversion mechanic through which they can basically swap their crypto for Bitcoin. P2P trading facilities are also available. And for veterans, spot trading, derivatives & margin trading facilities are present.

Users can start trading once they deposit as little as 0.00005 BTC to start trading. The method of deposit ranges from cryptocurrencies to over 112 different fiat methods. First-time depositors also gain access to rewards depending on what’s in season. OKX also features social features like copy trading and trading bots to make crypto investments simpler for beginners.

Security features on OKX are standard. However, OKX did include an OKX risk shield to keep a reserve, which contains a portion of the user’s assets as insurance in case of a hacking event. That risk shield if worth $700 million at press time.

The trading fee on the platform is nominal, following a maker/taker fee model. It ranges from 0.080%/0.1% to 0.060%/0.080%. The fee can be reduced further by holding OKB credits.

- Supports over 350 cryptocurrencies

- Offers Copy trading

- Crypto payments and 112+ fiat methods supported

- Multiple crypto analysis tools and an Earn Program

- Not available in the US

- A large number of OKB tokens must be held to reduce the trading fees

Demo Account: Yes

Educational Material: Yes

Fees: 0.080%/0.1% to 0.060%/0.080% depending on loyalty tiers

Minimum deposit: 0.00005BTC

Special Features: Crypto-staking, Copy Trader function, Trading bot

Regulation: OKX has acquired a license to operate in Dubai and is currently in the process of getting licensed in China.

Your capital is at risk

Bybit – A Beginner-Friendly Bitcoin Exchange in the UK

Bybit is another cryptocurrency exchange that has been making rounds in the crypto space. It is an inclusive exchange that has just become one of the top five cryptocurrency exchanges by market capitalization, ranking fifth on CoinMarketCap. At press time, this exchange maintains a trading volume of just above $400 million.

Bybit has listed over 100 cryptocurrencies and supports over 300 crypto trading pairs. Also, it supports both spot trading and margin trading with up to 10x leverage. This beginner-friendly Bitcoin exchange in the UK allows users to buy crypto with just one click. And those who don’t want to engage with the exchange but with other traders can use the P2P trading facility to buy and sell Bitcoin and other assets.

Bybit is also known for giving early access to promising projects via its launchpad utility. That utility is one of the factors responsible for helping Bybit grow, as that allows Bybit to be one of the first exchanges to list innovative cryptocurrency projects.

Bybit also offers Copy Trading facilities. Also, users can leverage the platforms’ trading bot to automate their crypto trades.

When it comes to trading fees, Bybit has a maker/taker model for VIP and Non-VIP traders. That status depends on a user’s trading volume. The trading fee is also differentiated between the type of trading facility. For instance, the minimum maker/taker fee for spot trading is 0.1%/0.1% for non-VIP members, but for Perpetual and Futures Contracts trading for the same members, the minimum maker/taker fee is 0.06%/0.01%.

Bybit also features an audited proof of reserve, which means it actually holds the assets that you store on the platform.

- Supports over 100 cryptocurrencies

- Over 300 trading pairs are available

- Offers Copy trading

- Offers an Earn Program

- Not available in the US

Demo Account: Yes, through Bybit’s Testnet

Educational Material: Yes

Fees: Maker/Taker Fee Model – Different from Different Types of Trading

Minimum deposit: $50

Special Features: Crypto-staking, Copy Trader function, MetaTrader4

Regulation: Unregulated Cryptocurrency exchange

Your capital is at risk

Binance – Highest trading volume Bitcoin exchange

Binance exchange is the leading Bitcoin exchange in the world in terms of the trading volume. It offers a decent trading experience to all its users at a very low price. In this Bitcoin exchange, users are not allowed to pay any transaction fees for making their purchases, thereby increasing their earning without putting any additional expenses on their costs.

Further, Binance has a volume-based pricing system, and it supports Metatrader 4 software for all its users. This software allows you to stay up to date on all trends, trades, and alerts in real-time. The MT4 Binance trading platform’s popularity may be ascribed to the fact that it is one of the most straightforward and reliable ways to conduct business on the Forex market.

Using this trading platform offers a number of benefits, one of which is that it may help you learn how to trade and have a better understanding of how the entire trading process works. Customers of Binance can use the “Expert advisors” option to receive a variety of investing suggestions from professional traders in order to increase productivity.

Binance allows you to trade leveraged spot and margin trades. Finally, its dominance among crypto exchanges is demonstrated by the fact that it has the most altcoins on its platform.

- Highly reputable broker

- User-friendly platform

- Factor Authentication (2FA) Login

- No formal address or head office

- Not licensed in some regions

Demo Account: No

Educational Material: Yes

Fees: 0.1% for Binance, reduced to 0.075% if BNB coin is used to pay fees

Minimum deposit: 7.44 GBP

Special Features: supports Metatrader 4 software, no transaction fees

Regulation: Binance is in the process of applying for UK regulation

Your capital is at risk

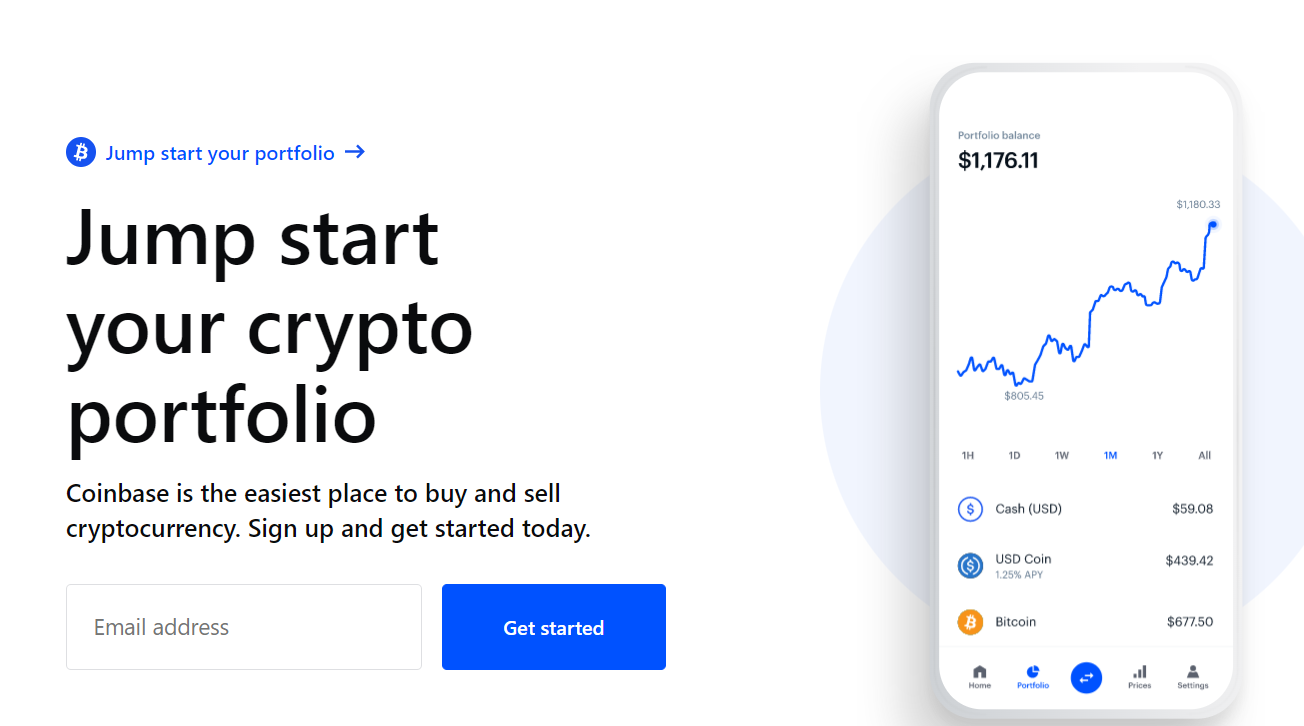

Coinbase – Most popular Bitcoin exchange by no. of users

Coinbase is one of the largest Bitcoin exchanges, with over 10 million members, where you can buy and trade a range of cryptocurrencies such as Bitcoin, Ethereum, Dogecoin, and others.

One of the benefits of utilizing Coinbase to acquire Bitcoin is that you can use a variety of payment methods to do so, including debit/credit cards, bank transfers, PayPal, and so on. Furthermore, Coinbase’s platform only allows for spot trading; it does not allow for leverage trading. Coinbase Pro is a premium feature of this cryptocurrency broker that allows you to trade by placing a limit order on the chart.

On its platform, Coinbase has extensive security procedures in place to ensure that your transaction is completely secure. For example, it checks for two-factor authentication (2FA) every time you log in and includes multi-signature logins to secure your investment.

Coinbase has a fee cap in place for various transactions. When you deposit or withdraw money, as well as when you buy or sell a cryptocurrency, you will be charged. On Coinbase, the total transaction cost is roughly 1.49 percent of the transaction value.

As a result, if you want to buy $100 in Bitcoin with your debit card, you’ll have to pay $1.49. Overall, Coinbase is a good choice for anyone looking for a decent Bitcoin exchange.

- Supports many cryptocurrencies

- Highly user-friendly

- Offers several platforms for different users

- Multiple payment options

- Huge customer base

- Charges high fees for its beginner platform

- Doesn’t support credit card transactions

Demo Account: No

Educational Material: Yes

Fees: 0.1% for Coinbase

Minimum deposit: 37.04 GBP

Special Features: massive customer base, advanced security measures

Regulation: Financial Crimes Enforcement Network (FinCEN)

Your capital is at risk

Bybit – Best Bitcoin exchange for futures trading

Bybit is another famous Bitcoin exchange with a global subscriber base of over 1.6 million people. It takes a customer-centric strategy and seeks to provide the greatest user experience possible.

This top platform uses a maker/taker fees approach in its services rather than a buy-sell spread. It charges a fee of roughly 0.1 percent for spot trading and a rebate of about 0.025 percent for limit orders in margin trading.

Apart from Bitcoin trading, limit orders, conditional orders, market orders, and partial orders are among the main orders it supports on its platform. This reliable Bitcoin exchange is considered the preferred platform for trading crypto derivates since it has an insurance policy in place to protect its users in the event of a loss.

Furthermore, all investors and traders have free access to this exchange via mobile applications and desktop-based programs. Bybit offers a market maker rebate, as well as high leverage and low trading fees.

Unlike Binance, Bybit is regarded as having the ‘lowest spread,’ with a maker rebate. Another benefit of adopting Bybit is that the KYC (know-your-customer) process is not required. Unless you wish to withdraw more than 2 BTC each day, which is more than most traders require, you do not need to submit a copy of your license or passport for identity verification.

- Advanced tools backed up by cutting-edge technology

- Supports multiple orders on its platform

- One can get up to 100x leverage on cryptocurrencies

- Not suitable for spot trading

- Your data may be shared with third parties for marketing purposes

Demo Account: Yes

Educational Material: Yes

Fees: 0.1% for Bybit

Minimum deposit: None

Special Features: lowest spread, no mandatory KYC process, fewer fees

Regulation: N/A

Your capital is at risk

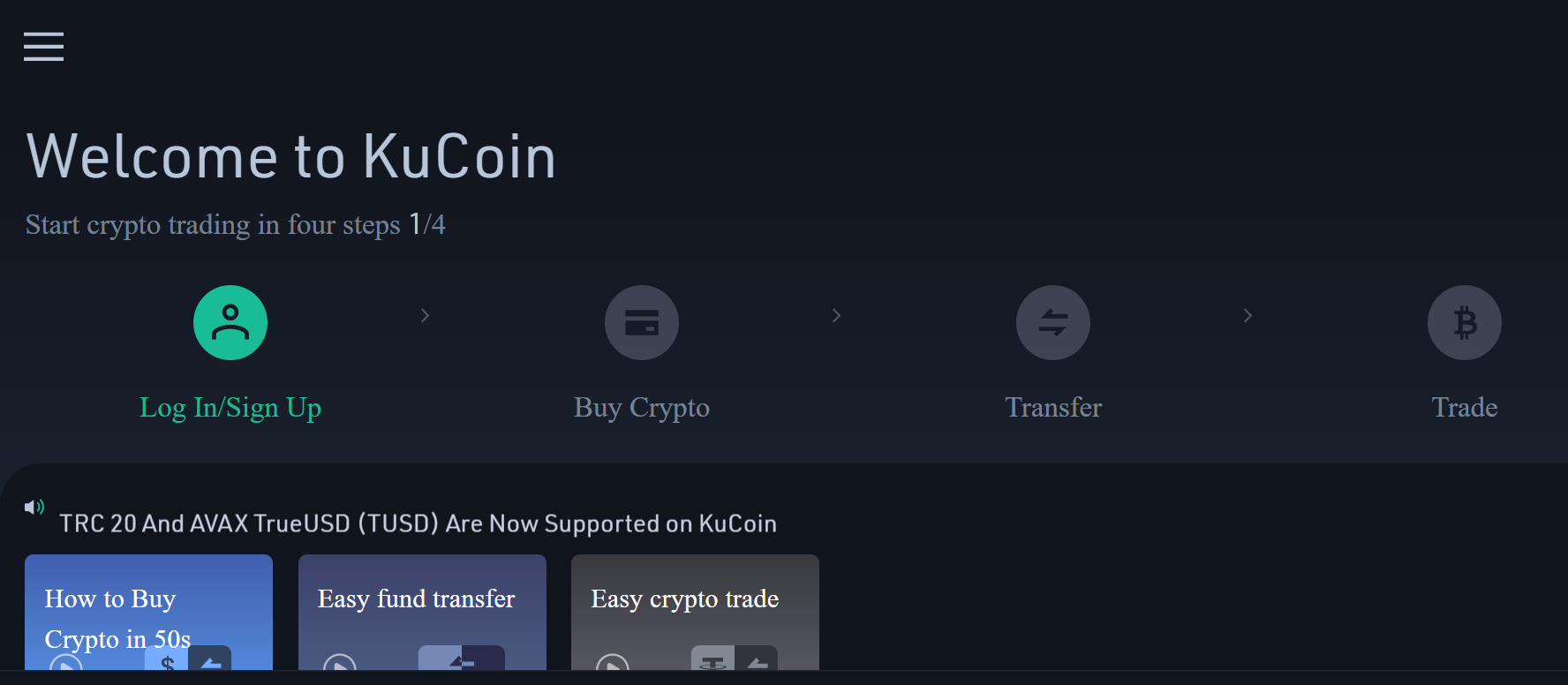

KuCoin – Best UK exchange for low market cap altcoins, alongside BTC

KuCoin is well-known for offering a user-friendly experience to all of its users, thereby making it simple for beginners to trade Bitcoins. In addition to Bitcoin trading, it provides a plethora of services, including fiat onramp, margin trading exchange, crypto staking, and lending, futures trading exchange, peer-to-peer (P2P) marketplace, non-custodial trading, and many other crypto services.

Aside from all of these benefits, this crypto exchange provides a fantastic crypto trading experience with cheap trading and withdrawal fees. It also supports a wide range of cryptocurrencies on its platform, making it simple for traders to diversify their holdings.

Furthermore, if you want to make some passive income, this platform provides you with the option to do so through the crypto staking tool. KuCoin has implemented extensive security features in its systems, such as dynamic multifactor authentication and multi-level encryption, to assure the entire safety of your Bitcoins.

KuCoin is a good alternative for all new starters because it has a high degree of liquidity, a huge number of users, a varied selection of supported assets and services, and low trading expenses.

- Less trading and withdrawal fees

- User-friendly platform

- No mandatory KYC (know-your-customer) checks

- Allows crypto staking

- Limited payment options

- Limited collection of educational resources

Demo Account: Yes

Educational Material: Yes

Fees: 0.1%

Minimum deposit: None

Special Features: Crypto staking, User-friendly platform, advanced security mechanisms

Regulation: N/A

Your capital is at risk

What is a Bitcoin exchange?

A Bitcoin exchange is an online marketplace where you can buy and sell your favorite crypto assets using different cryptocurrencies or fiat currencies. In simple words, it acts as an intermediary between buyers and sellers of Bitcoins.

Basically, this exchange works similarly to a brokerage, and here you can make your Bitcoin purchase through various means of deposit. To transact on a Bitcoin exchange, you have to register with the exchange and get your identity verified.

The words “Bitcoin brokers” and “Bitcoin exchanges” are sometimes misunderstood by newcomers. Because of this ambiguity, both names are frequently used interchangeably. An exchange, in simple terms, is a company that acts as a trustworthy third party for people who want to transfer their assets with others. The exchange protocol’s function is to match the orders and settle the contract, and users who have placed orders are often listed in an order book.

A Bitcoin broker, unlike a Bitcoin exchange, operates as a middleman for a trader or investor and a market (or exchange). Users do not own the item they are trading, and they do not swap any digital assets they own, unlike on a Bitcoin exchange. When someone says Bitcoin broker, they mean that you do not actually own the Bitcoins; instead, you’re trading long or short contracts for it with leverage.

Bitcoin brokers charge reasonable fees because they act as an intermediary and complete the trade for you. Furthermore, a stock/forex broker must have a significant amount of capital to even trade, such as $25k, in order for them to supply you with their services.

On the other hand, anyone can easily trade on a Bitcoin exchange in tiny amounts as little as a few dollars. Given these distinctions, you must use caution when using the phrases broker or exchange in relation to Bitcoin trading.

How do we rank the best UK Bitcoin exchanges?

With so many Bitcoin exchanges currently available in the crypto market, deciding which platform to start with can be challenging. Because no two exchanges are alike, it’s important to consider your priorities and requirements while selecting the right Bitcoin exchange.

We’ve included some of the features we look for when making recommendations for the best Bitcoin exchanges in the UK below:

Safety & Regulation

It is important to keep your Bitcoins protected from malware, hacks, and security failure. That is why crypto enthusiasts must always select those Bitcoin exchanges that have an advanced security system to protect their Bitcoins safely. For example, one can choose the Coinbase Bitcoin exchange, which has extensive security procedures in place to ensure that your Bitcoins remain completely secure. It checks for two-factor authentication (2FA) every time you log in and includes multi-signature logins to keep your investment safe.

Similarly, many a time people express their fear about the fact that the bulk of Bitcoin exchanges operate in an unregulated sector. Always choose those exchanges that are well-regulated or licensed by prominent worldwide agencies such as the Financial Conduct Authority (FCA) in the United Kingdom or the Cyprus Securities and Exchange Commission (CySEC).

Fees

You’ll have to pay a fee to buy and sell Bitcoins on an exchange in the usual course of your transaction. This normally comes in the form of a trading commission. It is recommended that you use Bitcoin exchanges that charge lower transaction costs.

Similarly, a minimum deposit is required by many Bitcoin exchanges. Before joining up with a new exchange, ensure that this criterion is within your budget. You should also look into whether or not there is a cost for withdrawals.

Automated and Copy Trading

Famous Bitcoin exchanges provide their users to learn the art of Bitcoin trading through its various features. One of these features includes the Copy trader function that allows its users to mimic the trade moves of an experienced investor and trade in the same way they do. This feature also prevents excessive profit losses by controlling drawdowns.

Payment Methods

Reputable Bitcoin exchanges allow their users to invest in their favorite cryptocurrency using a variety of payment methods.

Customer Service

Customer is the king of every business! Delivering excellent customer service is the hallmark of the best Bitcoin exchanges. For healthy business growth, every query of the customer must get resolved on time. Therefore, exchanges that focus on addressing customer problems on time find themselves on the wishlist of every investor.

Speed & platform user experience

If you have just started your crypto investment, then you must have realized the importance of using a user-friendly platform for Bitcoin trading. Every investor wants to trade on an exchange that gives him a healthy trading experience through its user-friendly interface.

What fees do UK Bitcoin exchanges charge?

When it comes to Bitcoin trading, investors have a lot of options, but many exchanges hide their fees structure and mislead users with overlapping charge structures and discounts. In this part, we will unravel the cost structure of famous Bitcoin exchanges, which will help you in estimating the cost of your Bitcoin investment:

Trading fees

Trading fees are the main source of revenue for the Bitcoin exchanges. Generally, it is charged on all types of Bitcoin trades: fiat and crypto-crypto trades. Many exchanges keep less trading fees for the market makers. While some of the exchanges do not charge any trading fees from their users.

Deposit/Withdrawal Fees

Deposits and withdrawals are subjected to fees on some Bitcoin exchanges. Usually, deposit fees are less prevalent than withdrawal ones as exchanges want their users to deposit money in their accounts. Similarly, many exchanges charge the blockchain transaction costs in the form of withdrawal fees, and some exchanges even charge additional fees in case the user is from a different country or region.

Kucoin, a famous Bitcoin exchange, charges withdrawal fees from its users. While exchanges like Bybit and Coinbase do not usually charge any funding fees from their customers.

What are the UK Bitcoin Taxes?

In the case of cryptocurrencies, Her Majesty’s Revenue and Customs (HMRC) has released guidelines that define what constitutes taxable and non-taxable events. The taxes levied on Bitcoins are equivalent to those levied on conventional income. Losses suffered while owning these crypto-assets can be deducted from the total taxable income earned by your Bitcoins, and such losses can be carried over to the next year.

Bitcoins are subject to capital gains tax if they are sold, received as a form of payment from work or mining, traded from Bitcoin to another crypto, or used to purchase goods and services. The HMRC rules also enable taxpayers to determine how much capital gain is subject to taxation. You must subtract certain allowable expenditures from your gains when calculating capital gains tax.

These costs could include transaction fees that must be paid before the transaction is uploaded to the blockchain, valuations used to calculate gains for a specific transaction, costs associated with drafting contracts for a transaction, buyer or seller advertising charges, and so on. It is also possible to offset capital losses against gains to arrive at an actual taxable total; however, these losses must first be declared to HMRC.

Short-term capital gains and long-term capital gains are the two main types of capital profits. Profits earned from selling a cryptocurrency that has been held for less than a year are classified as short-term capital gains, but profits earned from selling a cryptocurrency that has been held for more than a year are classified as long-term capital gains.

Long-term capital gains have lower tax rates than short-term capital gains. As a result, it’s always a good idea to keep your crypto assets for a longer length of time to avoid paying capital gains taxes on them.

How are UK Bitcoin exchanges regulated?

Cryptocurrency is considered as a property in the United Kingdom, but not legal tender. Furthermore, Bitcoin exchanges must register with the Financial Conduct Authority (FCA) in the United Kingdom and are prohibited from trading crypto derivatives. The objective of such regulations is to ensure that consumers’ assets are safeguarded by the exchanges in this volatile industry.

For the same reason, many renowned Bitcoin exchanges operate under the licensing of regulatory authorities.

How to get started on a UK Bitcoin Exchange?

Despite the bearish sentiments in many countries, Bitcoin’s price increased by more than 70% in 2021, and additional gains are projected in the future year. In case you are looking forward to investing in Bitcoin this year, then do follow these steps to make your purchase from the best Bitcoin exchange in the UK, the eToro platform:

Step 1: Opening an Account

Visit the official website of the eToro platform and select “Join Now.” After that, generate your login credentials by filling in the required information, such as your name, address, user name, phone number, and email address. You can also use your Google or Facebook account to sign up.

Step 2: Uploading Your Identification

Complete the KYC (know-your-customer) process by having your identity verified after you’ve opened an account on the eToro platform. You can verify your identification by sharing a copy of your passport or driver’s license. Include a utility bill or bank statement as evidence of address. Your account will be authenticated within minutes after you’ve uploaded all of the necessary papers.

Step 3: Depositing Funds

The next step is to put funds into your eToro account after you’ve completed the registration process. eToro accepts a variety of payment methods for funding your account. To finance your account, you can use debit cards, a bank account, and other methods.

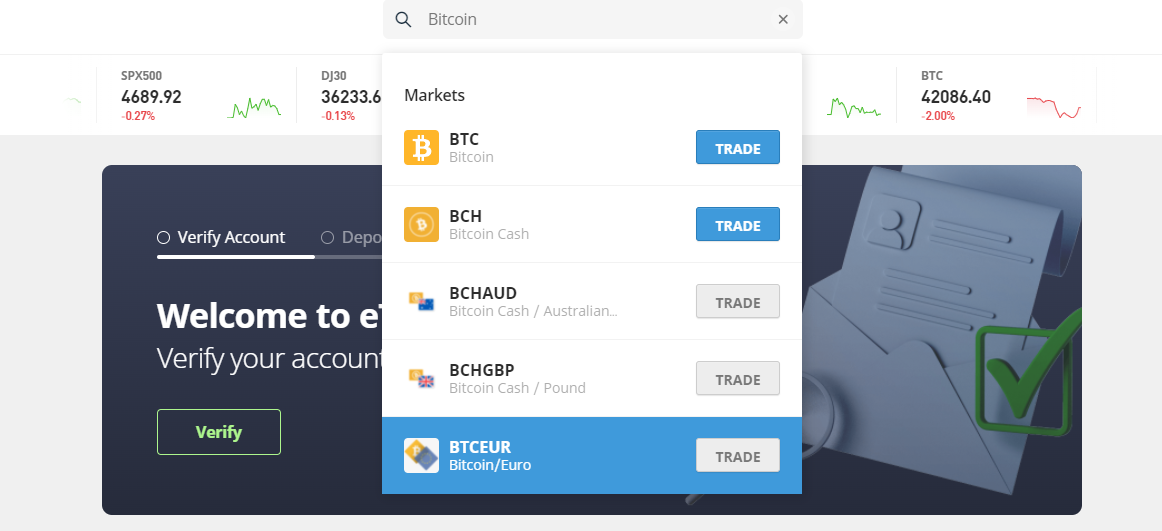

Step 4: Exploring the Bitcoin market

After you’ve deposited funds into your account, use the search field to type in the name of the cryptocurrency (here, Bitcoin (BTC) you want to purchase.

Step 5: Placing the Trade

After you’ve mentioned the name of the Bitcoins, select “Trade.” To complete the transaction, enter the amount you wish to invest in that cryptocurrency and then click the “Open Trade” button.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

Conclusion

Bitcoin is expected to display exponential growth in its price in the years to come. The fact that it has started off the New Year with a decent amount is a testimony to this prediction. Given these reasons, it comes at the top place on the wishlist of every crypto investor.

If you are planning to start your crypto journey this year, then we would suggest you choose the best Bitcoin exchange as it is a crucial step in guaranteeing a successful financial career. We understand that it could be difficult to find the right exchange due to the availability of a plethora of crypto exchanges in the market.

FAQ

How do Bitcoin exchanges work?

A Bitcoin exchange acts as an intermediary between buyers and sellers of the Bitcoins. It is a company that acts as a trustworthy third party for people who want to transfer their assets with others. The exchange protocol's function is to match the orders and settle the contract, and users who have placed orders are often listed in an order book.

Which Bitcoin exchange should I use?

The Binance platform is well-known for offering its users an amazing trading experience with features like cheaper trading commissions, different payment alternatives, and an advanced security system, among others.

Can you transfer Bitcoins from one exchange to another?

Yes, you can transfer Bitcoins from one exchange to another. For doing so, go to your target exchange and look up the Bitcoin deposit address. Once you have that information, go to the source exchange and withdraw your Bitcoins, or send them to your target exchange's deposit address.

How many Bitcoin exchanges are there?

The popularity of Bitcoin among crypto enthusiasts has led to the flux of many Bitcoin exchanges in the industry.

What exchange does Bitcoin trade on?

Bitcoin can be traded on many reputable exchanges, including OKX, Binance, Coinbase, KuCoin, Bybit.