What is Bitcoin and How Does it Work?

Do you know what was the first-ever transaction that was conducted through Bitcoin?

It was used to buy two Papa John’s pizzas for around 10,000 BTC, worth around $41 at that time, in May 2010. Fast forward to 2022, and the same amount of Bitcoins are worth around $486,510,000.

That’s how the journey for Bitcoin has been in the past decade. From being something associated with computer experts and engineers to breaking the barriers and joining the mainstream, it has certainly traversed a whole lot of situations and use cases.

However, if you are someone who hasn’t yet been able to grasp the concept of Bitcoin, it can get a little too complex at times. This page might help you out. Read this Bitcoin for beginners to make yourself aware of this digital behemoth, touted to become the ‘future of money’, and learn how to invest in cryptocurrency.

What is Bitcoin?

In the simplest of terms, Bitcoin is a digital currency that can be bought, sold or exchanged without the requirement of any intermediary in the entire transaction, i.e. a bank. It allows a person to conduct secure peer-to-peer transactions with the help of the internet.

While some people out there might think of Bitcoin as something similar to payment gateways like Paypal or any other digital wallet, it isn’t. While those methods certainly conduct transactions through the internet, they are still reliant on the traditional finance system.

However, when it comes to Bitcoin, any two people around the globe can conduct transactions with each other. Every transaction as such is then recorded on the blockchain ledger. This ledger which contains the transaction details is available for anyone to view on the blockchain, unlike a bank’s ledger. It isn’t in control or has the influence of any government, bank or any other supervising institution.

This is to ensure transparency and reduce the role of a single authority in this entire process.

Interestingly, what gives Bitcoin its value is the fact that it has a finite supply. There will only ever be around 21 million bitcoin that are going to be mined. This has made many traditional investors look up to Bitcoin as a way to shield them from inflation and volatility. At the time of writing, one BTC is trading at $46,000 (or £36,600).

How Does Bitcoin Work?

This analogy was given on the Bitcoin Matters podcast. In order for someone to understand how Bitcoin works, an analogy of a text message was used.

Bitcoin works like text messaging. The only catch is that you can send numbers instead of letters or words. These numbers that are sent are called Bitcoin and they are limited in supply (unlike text messages). Now, since there’s only a finite number of these Bitcoin messages to be sent, they can be used as a form of currency or money.

Just as someone needs a messaging app, say, WhatsApp to send a message to another WhatsApp user, the same is for Bitcoin. One Bitcoin user can transact money to another user through any of these Bitcoin apps.

Let us come to the technical part now. Bitcoin is essentially built on a digital platform of records called a blockchain. To put it simply, a blockchain is a unit of data compiled together, containing the necessary information called blocks.

How Does Blockchain Work?

As mentioned above, blockchain technology or Distributed Ledger Technology (DLT) is quite similar to a bank’s ledger. As a bank’s ledger, it contains the data about all the transactions that are taking place online. The key difference is its accessibility. It is accessible to anyone who wishes to view the transactions in the ledger.

A blockchain consists of three important elements.

- Blocks: Every blockchain consists of a series of blocks (hence, the name). These blocks are nothing, but data. In terms of Bitcoin, a block’s data consists of details like sender’s details, receiver’s details, number of coins and so on. The 32-digit number generated is called a nonce (number only used once). Apart from the data of any current transaction, every block consists of a hash. This hash is a unique fingerprint or signature. Moreover, there’s a hash of the previous transaction as well.

- Nodes: In order to keep the entire system decentralised, it has to be kept functioning through a series of nodes. No single device or supercomputer can run the entire system. Hence, Nodes can be any electronic device that maintains copies of the blockchain and keeps it functioning.

- Miners: Miners are an essential part of the entire process. Every bitcoin is required to be ‘mined’. This means that the miners use software that solves extremely complex maths problems to find a nonce that generates an accepted hash.

This is an intricate process, due to there being a possible 4 billion combinations that must be mined before getting the right one.

Now, coming back to how all of this works, there’s a Google Doc analogy that’s quite popular out there. Say, you are working on a Google Doc. Now, you want your co-workers to collaborate on the document and provide their inputs. Instead of sending them a copy of the document differently to each person, you simply share the document with them. This document is distributed amongst them.

Hence, you can continue working on the edits, observe their inputs and more. All of this is happening in real-time. So, this creates a decentralised distribution chain that allows everyone to access the document at the same time, making it transparent and accessible.

This allows everyone to see the changes in the document together and there’s no lock-out period for any of the selected users. While blockchain technology is quite expansive and complex, the analogy sits perfectly well with its core functioning.

Top Crypto Exchanges to Buy Bitcoin

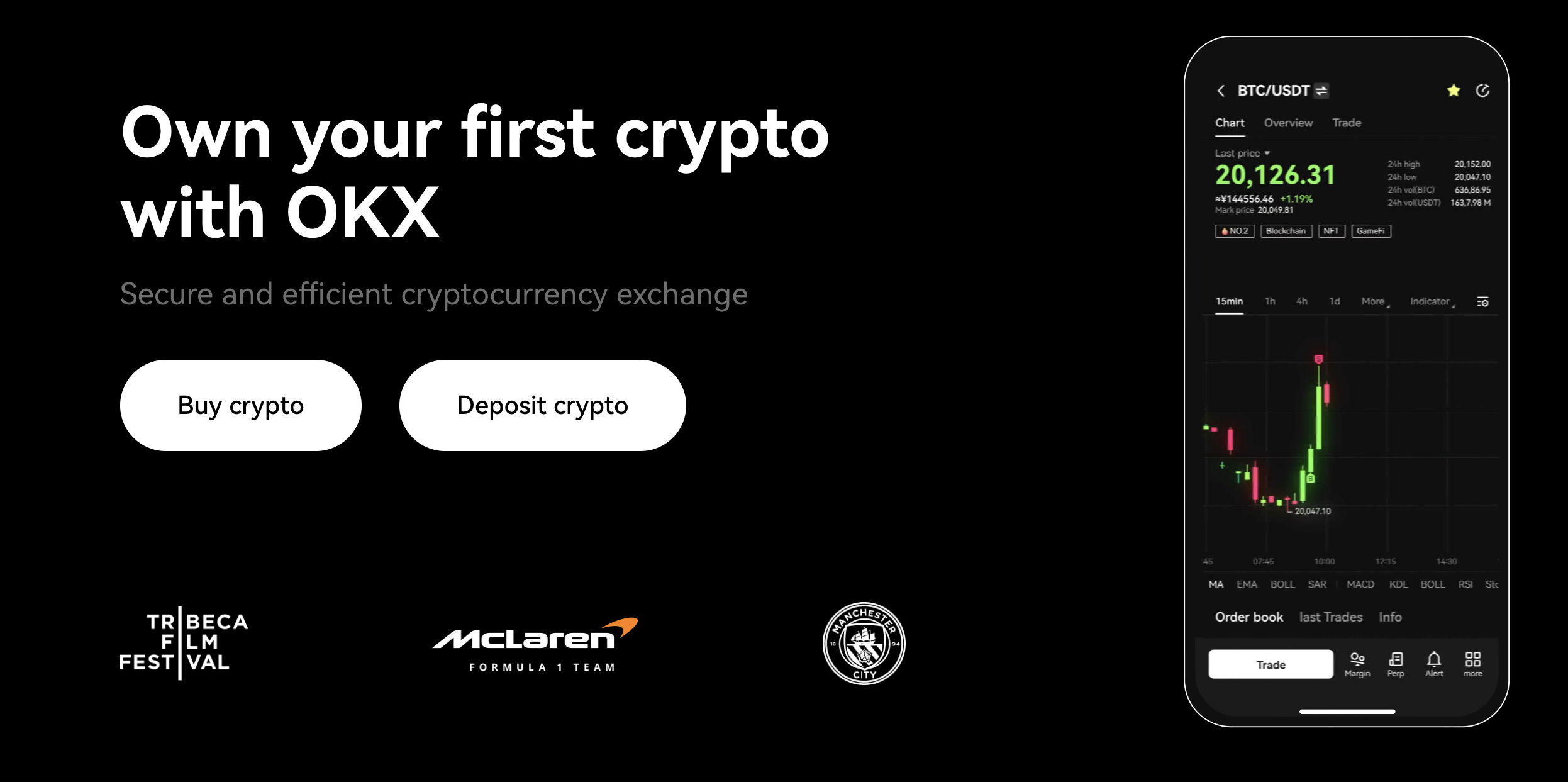

1. OKX

OKX is a leading digital asset trading platform for buying Bitcoin and other crypto coins. Since its launch in 2017, the exchange has grown rapidly and now boasts a customer base of millions of users in 100 countries. OKX is one of the best options for traders as it also offers a comprehensive trading experience.

Users can buy cryptos through Apple Pay, or any other convenient payment method. The platform is not just limited to allowing trading of crypto, it also offers access to new, high-quality crypto projects through its ‘Jumpstart’ initiative.

As of now, there are more than 1.5 million followers of this initiative keeping an eye on 13 projects. The platform also offers an entirely separate section for institutional investors which displays its versatility to a lay-user. Overall, while buying BTC is easy on OKX, we suggest checking out its other features too.

Pros

- Various trading options, including spot and margin trading, futures, and options.

- Advanced trading tools and order types for experienced traders.

- Passive income opportunities through staking, savings, and yield generation.

- Access to decentralized finance (DeFi) services and non-fungible tokens (NFTs).

- A user-friendly interface and mobile app for trading on the go.

Cons

- Past customers’ have mixed reviews.

- Certain currencies have low liquidity.

- USA users cannot access it.

2. Bybit

From NFT Marketplace to Spot Trading, and from Web3 exposure, to simple crypto trading, Bybit offers these all. The Platform provides fast, reliable and secure trading environment, offering trading speeds of 100,000 transactions per second. As of now, there are 10 million+ registered users on Bybit that contribute to 7 billion+ daily trading volume. Users can trade worry-free with Bybit’s 99% availability track record even while going through volatile market periods.

A user can simply use the credit and debit card, or go with bank transfer to facilitate payment related works. Most of the users in the crypto world expect quick customer support as it gives them the much required assurance. Bybit scores good in this aspect as they offer 24/7 multilingual support that helps in getting answers, always.

PRO

- High-speed transactions that can handle up to 100,000 transactions per second.

- Up to 100x leverage.

- Supports a number of advanced trading options, up to 100x leverage.

- User-Friendly Platform.

- Educational resources available for even absolute beginners.

Cons

- Risk associated with leveraged trading.

- Complexity can make inexperienced traders struggle.

- Geographical restrictions.

How Does A Bitcoin Transaction Work?

For someone to understand how Bitcoin works, they should know how Bitcoin transactions take place.

What counts as a Bitcoin transaction? It is when there is a transfer of Bitcoin from one address to another. The transaction has to be signed by the sender.

For every Bitcoin transaction to take place, Bitcoin makes use of public-key cryptography technology to keep the transactions integrated on the network. For transferring Bitcoins, each participant has a pair of public keys and private keys, and other factors as well.

Public Keys vs Private Key

A public key is something similar to an email address or a username. A public key, as the name suggests, is public in nature and can be used to receive Bitcoins from someone. Being public in nature, it’s quite safe to share it with others.

A private key is another randomly generated sequence of letters. It is similar to your ATM PIN or your passwords. The private key authorises any spending that should take place to conduct a Bitcoin transaction.

Now that we’re clear with what the keys are, there are other components involved in fulfilling a Bitcoin transaction. Let us illustrate this with an example. Say, Oliver sent 1 BTC to Emily. Previously though, Oliver had received 0.6 BTC from Alex and 0.5 BTC from John.

- Inputs: An input consists of information about any of the previous transactions that have taken place. Taking the example into the consideration, an input will contain the details of the previously received BTC from John and Alex, that Oliver had received.

- Amount: This is the amount that Oliver wants to send to Emily, i.e. 1 BTC

- Outputs: There will be two outputs in this entire scenario. The first is (0.6 + 0.5 BTC from John and Alex) to Emily’s public address. The second output will be 0.1 BTC returned to Oliver as ‘change’.

While a few steps above might seem a bit useless, this is what ensures transparency in the entire system. Moreover, knowing the intricacies of every transaction isn’t necessary for you to conduct these transactions. The wallet that you select takes care of this. Moving on, once you’ve got the input, output and the amount sorted, then comes in the process of confirmations and broadcasts.

Once Oliver decides to transfer the amount to Emily, he will send a signal of sorts to the Bitcoin network. The miners verify that the keys of Oliver’s are able to access the inputs. This process involves checking whether Oliver’s public and private keys match each other or not. Simultaneously, the miners also collect the other transactions that take place at the same time as Oliver’s and combine them into a single block.

Other Miners, meanwhile, are permitted to propose a new block that will be added to the existing chain. After this takes place, the new block is transmitted to the network. The other participants (nodes) look into it and decide if it’s a valid node or not. In case, it passes through that, it is added to the blocks.

Now, some other transaction, involving other blocks will be added to the chain on top of it, referencing the one above as the previous block. Any transaction which is in the previous block will be termed as ‘confirmed’ by the next miner.

As and when more transactions are added to the chain, Oliver’s transactions are confirmed simultaneously.

Transaction Fees

The transaction fees on every Bitcoin transaction is quite variable and can be decided by the customers themselves. The higher the fees rate, the faster the transaction will be processed.

Each block in a blockchain can contain a limited amount of information. Due to a space crunch, only a limited number of transactions can be included in each block. Hence, only a limited number of transactions can be included in each block. This is where higher incentives play a role.

A miner will prioritize a transaction that has a higher transaction fee attached to it.

During times, when there’s a higher number of transactions wanting to take place together, the ones which have the highest fees attached will be prioritized.

How To Store Bitcoin With A Crypto Wallet?

Just as you might be storing your physical cash and cards in a wallet, Bitcoins have a designated wallet as well – digital wallets.

A digital wallet can be either hardware-based or web-based as well. Apart from this one can store their Bitcoins on these wallets or add money and buy cryptocurrencies out of them.

Say, you want to buy Bitcoin for yourself. The first thing you need to do is use a cryptocurrency wallet to do so. Once you’ve downloaded the mobile application for the same on your device, you start setting up your account.

After this is done, you are now eligible to buy and sell cryptocurrencies. Selecting the best digital wallet varies a lot from one person to another.

At the end of the day, it’s your personal preference and your usage that defines the most suitable wallet for you. Any good Bitcoin wallet is also a crypto wallet – the exchange wallets we review on this site support both BTC and hundreds of other crypto coins and tokens.

In order to get access to cryptocurrencies, you can add your preferred payment method and buy Bitcoins against the same on your preferred application.

How To Buy Bitcoin in the UK?

Buying Bitcoin in the United Kingdom isn’t a tough task if you have got the right wallet.

We recommend the eToro wallet to our readers to buy and sell Bitcoin and other cryptocurrencies. eToro’s features such as the virtual portfolio function allow you to test your trades in a virtual market with a $100k demo amount. Here’s how you can buy Bitcoin using eToro in a few steps.

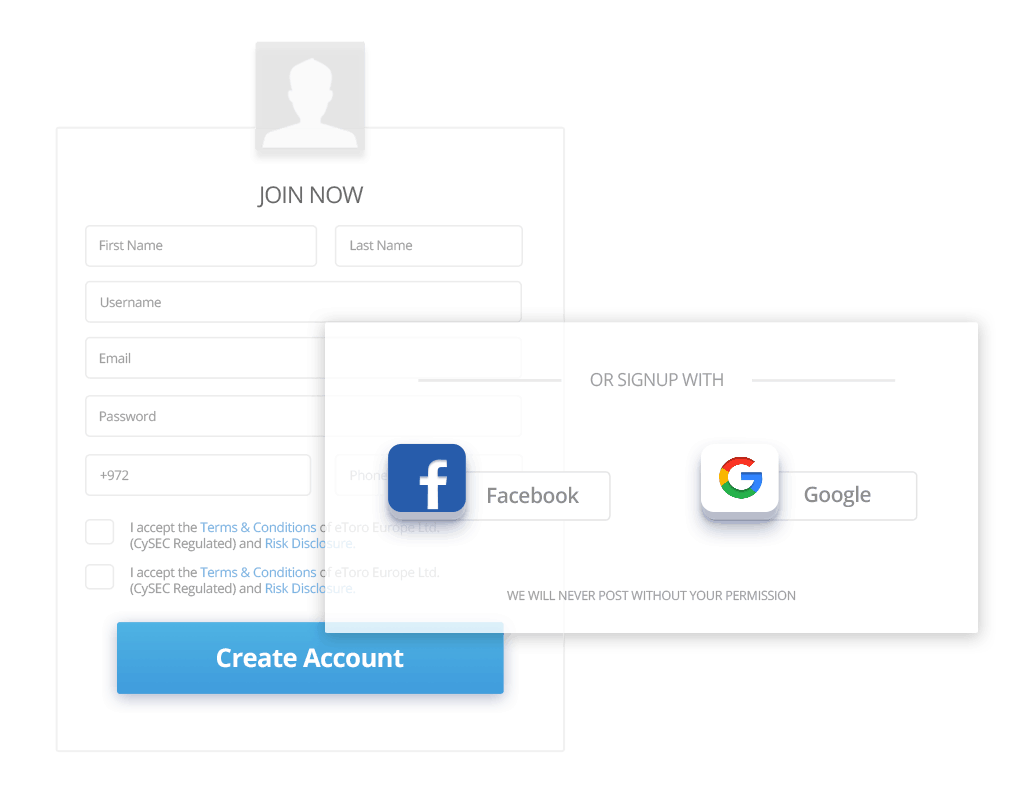

Step 1: Visit the eToro page and click on the ‘Trade Now’ or ‘Join Now’ button.

Step 2: Fill up the electronic form with the details mentioned, such as name, email, password etc. You can also log in using Google or Facebook. After filling up the form, go through eToro’s terms and conditions as mentioned.

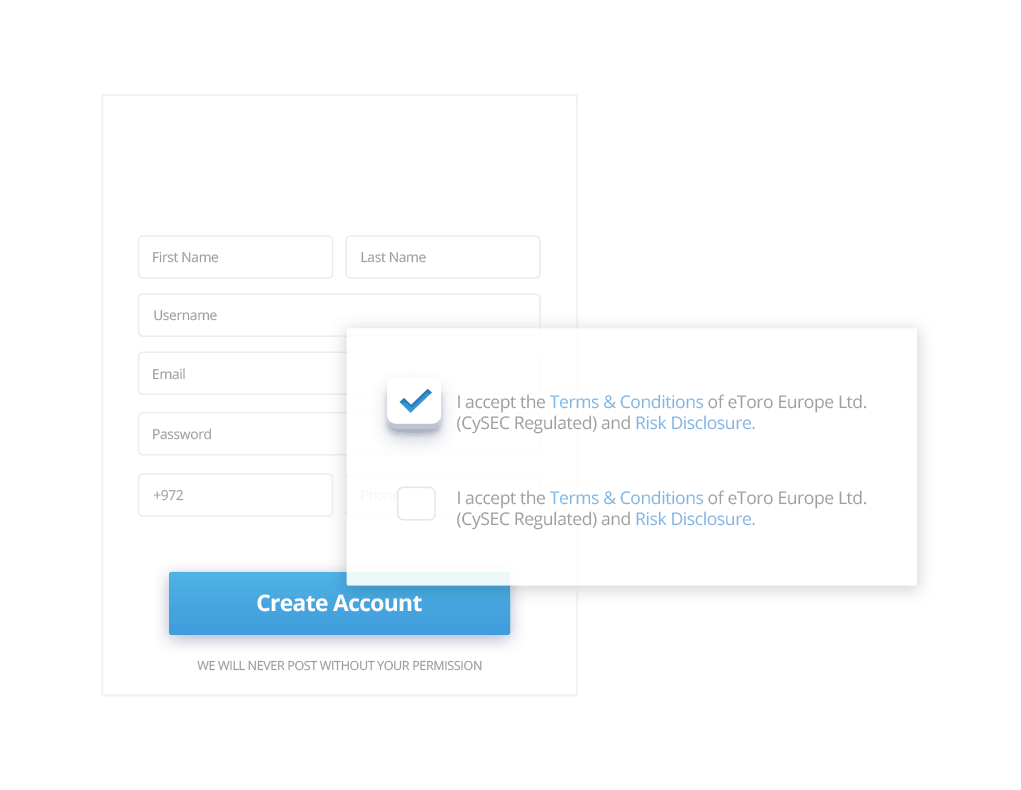

Step 3: After filling up the form, check the box that asks for your acknowledgment regarding eToro’s services.

Step 4: Submit your form by clicking on the ‘Sign up’ button.

Step 5: After submitting your form, there is a KYC process that takes place, which requires any customer to provide a confirmation of residence and a valid photo ID. There’s an additional eToro questionnaire which is part of the entire process, to help customise your services according to your requirements.

After you’re done setting your account up, you can deposit your preferred amount in your eToro wallet. For depositing money into your wallet, there are four steps involved.

- Login to your eToro account

- Click on “Deposit Funds”

- Enter the amount and select the currency

- Select your preferred mode of currency, such as PayPal, debit card, credit card etc.

You can buy cryptocurrencies using your added funds straight from your eToro wallet.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

What is Bitcoin Mining?

This being a ‘Bitcoin for beginners’ page, it makes more sense to help you understand what Bitcoin mining is.

In many ways, Bitcoin mining can be quite similar to gold mining. Both the processes are quite energy-intensive, both of them produce a new asset and both of them provide handsome monetary gains.

Hence, Bitcoin mining can be termed to be a process of producing new Bitcoins and validating the existing ones.

The miners, race towards competing, as they solve complex mathematical problems that are called hashes. A miner’s hash rate is the speed at which their device is able to solve the mathematical equations.

This mining process is called proof of work, as this works as proof for a miner to prove that they have done the “work” first and are eligible to mine the rest of the block for the Bitcoin transactions.

Bitcoin mining is a highly complex process that involves using highly complex mathematical problems. In order to execute a Bitcoin mining process, the miners need to have highly sophisticated and functional devices.

The number of Bitcoins that a miner can mine in a specific time period depends on the computational power and efficiency of their devices.

How To Sell Bitcoin in The UK?

If you’ve already opened your eToro account, as explained above, follow these steps:

Step 1: Select the amount you want to withdraw from your eToro wallet. You can withdraw the entire amount from your eToro wallet if required (minus the margins).

Step 2: Once you execute the sell transaction, the amount is reflected in your eToro account dashboard.

Step 3: You can withdraw the desired amount and the same will be transferred to your bank account, which was previously used for your purchase.

Your capital is at risk

Who Accepts Bitcoin in The UK?

While Bitcoin has penetrated and entered the mainstream financial system, in a small but noticeable manner, it’ll be quite some time before you are able to use it as a day-to-day currency for your run to the grocery store.

So, being a Bitcoin beginner, you might end up asking yourself- what can I do with Bitcoin exactly? Well, we have got an answer to that as well. Within the United Kingdom itself, there are a bunch of retailers and shops where you might be able to splurge on some necessities through Bitcoin. Let us look at some of them.

Amazon: While you still can’t directly pay through cryptocurrencies on Amazon itself, you can buy gift cards and coupons through a website called Bitrefill for Amazon.co.uk. This makes Amazon join the leagues of big tech giants like Facebook, paving its way to accept cryptocurrencies.

Shopify: Yes, Shopify accepts cryptocurrencies as a mode of payment. This means that any merchant that has a Shopify store can accept Bitcoin.

Whole Foods: Whole Foods was one of the early adopters of cryptocurrencies when it started accepting cryptocurrencies as a mode of payment, back in 2019.

Etsy: Etsy is a unique place to support artisans, small businesses and talented artistic individuals, selling unique and bespoke products. What has made it better is the fact that some sellers have started accepting Bitcoin as a form of payment on Etsy. While the majority of the sellers haven’t adopted Bitcoin as a form of payment yet, but some of them have.

Royal National Lifeboat Institution: In case you feel a little philanthropic, you can even donate Bitcoins. According to the RNLI, around 94% of their income comes from donations. While many charities still don’t accept cryptocurrency as a form of donation, you can actually be a good samaritan and donate to the one that does. What do you think?

Lush: Lush as a brand has been able to attract a lot of people due to all the ‘goodness’ they have. While their products are 100% vegetarian and handmade, they also promote ethical buying and are against animal testing. The cherry on top of the cake is the fact that they accept Bitcoin as a mode of payment since July 2017. However, the cryptocurrency mode of payment is only available on their online store.

Air Baltic: airBaltic became the first aviation company in the world to accept Bitcoin as a mode of payment way back in 2014. This was before Bitcoin had entered the mainstream news actively. As per the company, they have processed more than 1,000 Bitcoin transactions, since they launched their service way back. Their decision to introduce Bitcoin as a payment option made a Polish airline follow suit the very next year.

Tesla: Tesla has had quite a bittersweet relationship with cryptocurrencies. While the company’s CEO Elon Musk said that they will be accepting Bitcoin as a mode of payment, the decision turned out to be short-lived.

After some deliberation, the company decided that it won’t accept cryptocurrency as a mode of payment till at least 50% per cent of the cryptocurrencies are mined using renewable energy.

AXA Insurance: Yes, you can use Bitcoin to pay your insurance bills. The insurance company AXA insurance, recently announced, that its customers in Switzerland can now pay their insurance bills using Bitcoin.

The decision to do so came after research conducted by the company suggested that a big chunk of their 18-55 age group of the audience had either already invested in cryptocurrency or were interested in doing so.

What Are The Bitcoin Regulations And Taxes in the United Kingdom?

First things first. Your crypto gains aren’t tax-free.

The HMRC or Her Majesty’s Revenue and Customs have issued guidance on filing taxes on your Bitcoin gains. According to the HMRC, cryptocurrencies have been divided into four main categories.

- Exchange Tokens: These are supposed to be used as a means of payment.

- Utility Tokens: These provide the holder, access to particular goods or services on a platform.

- Security Tokens: These are the tokens that have a specific right or interest in a business, like ownership, repayment of a specific sum of money, or entitlement to shares in that company.

- Stablecoins: Cryptocurrencies, which are pegged to the value of fiat money.

Important Guidelines You Should Know

- Any person who holds Bitcoin or any other crypto assets, as a personal investment, will be taxed on the basis of the profits made on these assets. It says that you only have to pay capital gains tax on overall gains above the annual exempt amount.

- An individual has to pay taxes for cryptocurrencies received from mining, as a salary from the employer, airdrop or as confirmation rewards. Cryptocurrencies donated to the charity are exempted from capital gains tax unless the donated amount exceeds the acquisition cost.

- As per the HMRC, the losses incurred from cryptocurrency can be considered for the tax liability. In case, you end up selling a Bitcoin for loss, the loss can be deducted to reduce the overall capital gain.

This somewhat tells that most of your crypto assets are liable for taxes in the same manner that your stock portfolio might be.

Key Events in Bitcoin’s History

For you to understand Bitcoin completely, you should realize the ups, downs and everything else that Bitcoin has observed in its years of existence. Let’s look at some of the key events that shaped up how we look at Bitcoin today.

- The Genesis Block: On 31st October 2008, Satoshi Nakamoto authored and released a research paper titled Bitcoin: A Peer To Peer Electronic Cash System. This turned out to be the first step in the creation of decentralized money or Bitcoin.

Finally, after that, the Bitcoin network came into existence on 3rd January 2009, when Satoshi Nakamoto created block zero of the blockchain or also known as the genesis block. - The First Transaction: On January 11, 2009, Satoshi Nakamoto sent around 10 BTC to Hal Finney. Hal Finney also tweeted about the same on his, now immortalized, Twitter feed. Hal is credited with the conceptualization of the Reusable Proof of Work process. Unfortunately, Hal passed away in 2014 after being diagnosed with ALS in 2009.

- Pizza Day!: On 22nd May 2010, a man named Laszlo Hanyecz decided to order two Papa John’s pizzas and paid 10,000 Bitcoins for the same. The story has since then, achieved cult status. To give you a context, the amount he paid with respect to Bitcoin’s current value is $376 million. These are undoubtedly the most expensive Pizzas ever sold in human history.

- The Biggest Heist: On 24th February 2014, the then-largest Bitcoin exchange collapsed and went offline. The users of the exchange weren’t able to access their wallets and coins. Mt Gox was launched in the summer of 2010. It was handling around 70% of the Bitcoin transactions taking place in the world. However, by the end of 2013, the company started having cash-flow issues. It was finally in the year 2018, that Mt Gox filed for bankruptcy protection in Tokyo. It was after the filing that it came into the picture that the exchange was hacked and had lost around 850,000 Bitcoins belonging to its customers. Those 850,000 Bitcoins were valued at $850 million at that time. Since then, only 200,000 of them have been able to be recovered.

The Future of Bitcoin

The Bitcoin enthusiasts and experts alike have been quite optimistic about the cryptocurrency in its near future. However, seeing its volatility in recent years, there are certain reasons to be a little cautious.

The coming decade for Bitcoin can be detrimental for its long term future. There can be certain things that can be cleared out for Bitcoin and its investors in the coming years. Firstly, it’s been seen that there is a uniform confusion across the countries regarding Bitcoin either being a store of value or a currency for daily transactions.

However, what becomes a matter of concern is security. Due to the hacks that took place in the last few years, the confidence around Bitcoin as a legal tender isn’t the same as say for government-issued currencies.

To ensure that Bitcoin is able to cement its place in the mainstream ecosystem and financial structure, it has to scale up its levels of operations and has to process millions of transactions at once.

Moreover, the coming few years might see regulations by countries all over the world on Bitcoin and other cryptocurrencies as they run to keep pace with the crypto technology. However, no matter what the future holds, till the time Bitcoin is able to provide decent returns and promises even a glimmer of hope, people might want to hold onto that.

Conclusion

Bitcoin for beginners can be quite overwhelming at times. There are many predictions for Bitcoin in the near future.

Hence, if you are someone who has been seeing, reading, watching and hearing a lot about Bitcoin, you might even look at it out of curiosity.

Although, when it comes to looking at Bitcoin, or any other cryptocurrencies, you might as well look at the numbers with a pinch of salt. In fact, many financial experts even call it a “Vegas account” due to the instability attached to cryptocurrencies at times.

While the numbers might give you a FOMO of sorts, it is always recommended to conduct your due diligence before you begin to invest. Bitcoin, while coming into the mainstream is still sparsely regulated.

Therefore, we recommend educating yourself and ensuring that any investments you make initially are the ones that you can do without, in case of an unforeseen loss. No expert or advisor would recommend you to put all your eggs into one basket. The recommended amount can be around not more than 1% to 10% of your portfolio.

If done correctly, and strategically Bitcoin investing can turn out to be beneficial for you as well. So, being a beginner we’d recommend you to look into as many free resources as available on the internet. Doing this will allow you to educate yourself before you decide to enter the ecosystem, unlearned and unsupervised.

FAQs

Who created Bitcoin?

It is largely believed that a person named Satoshi Nakamoto is the man behind inventing Bitcoin. However, there’s another faction of people who believe that it is a pseudonym used by the person or the people who invented Bitcoin.

How Many Bitcoins Are Out There?

As of now, the supply of Bitcoin has been capped at 21 million. As of now, there are around 18 million coins that are currently in circulation. Hence, almost 2 million Bitcoins are yet to be mined.

What was Bitcoin worth when it was first launched?

When the founder of Bitcoin first launched Bitcoins, he released 50 BTCs into circulation. These 50 Bitcoins entered the markets at a valuation of $0.00 on the Bitcoin Genesis Block

How long does it take to mine 1 Bitcoin?

In the most suitable atmosphere, with the aptest equipment, it takes around 10 minutes to mine one Bitcoin. However, the time to mine a Bitcoin can also depend on the specifications of the device it is being mined on and the expertise of the Bitcoin miner as well.

When will Bitcoin run out?

Bitcoin has a halving event that takes place after every four years. Keeping this in mind, and the current cap at 21 million BTCs, it can be assumed that the final Bitcoin won’t be mined before 2140.

Who owns and controls Bitcoin?

Bitcoin is supposed to be a decentralised entity and no one owns it per se. Bitcoin is owned by all the users around the world. However, in recent years, the rise of institutional investors and whales has given rise to a few power centres in the crypto world.

How much energy does Bitcoin use?

To give you a context, according to an article published in the New York Times, the entire Bitcoin network uses the same amount of energy as the Washington state. At the current levels, Bitcoin uses about 81.51 terawatt-hours (TWh) annually.