5 Popular FCA Regulated Brokers UK – Compare Licensed Brokers

Did you know that FCA regulated brokers offer a secure and safe trading environment for beginners? Safety and trust are two of the main concerns when choosing a stock broker. You want to be absolutely sure that the funds you send to your broker will be available when you need them, and then your broker is executing your trades faithfully every time.

In this article, we’ll review 5 FCA brokers in the UK today.

Key Points on FCA Brokers

- FCA regulated brokers are fully authorised and licensed by the UK’s Financial Conduct Authority.

- The UK’s FCA is responsible for overlooking the brokerage and trading activity in the United Kingdom. For example, it ensures that trading platforms are complying with all trading regulations that have been put in place to keep traders and their funds as safe as possible.

- The FCA also introduces new requirements – such as, the recent ruling that banned brokers from offering cryptocurrency derivatives to retail traders in the UK.

- FCA regulated brokers provide cover from the Financial Services Protection Scheme that insures retail brokerage accounts for up to £85,000.

Popular FCA Brokers in the UK for 2022

While a lot of UK brokers are regulated in the UK, many are regulated by financial watchdogs in other countries instead.

- XTB

- Fineco Bank

- Plus500

Popular FCA Regulated Brokers UK Reviewed

1. XTB Broker

XTB Broker is one of the largest stock exchange-listed brokers in the world offering a variety of financial instruments to trade. The platform can also be used to trade forex, commodities and indicies. Furthermore, the broker is listed on the stock-exchange and is regulated by the Financial Conduct Authority- meaning that trading with this platform is very secure.

XTB Broker regularly updates it’s interface to be one of the best on the market. The platform provides a number of tools to help with research and analysis as well as helpful educational resources for those who want to leanr more about trading.

One of the best features of this platform is that users can trade CFDs with zero commissions. This makes it ideal for traders who want to keep costs low and maximize their profits. XTB offers a leverage of 5:1 and it is possible to trade with just a 20% deposit.

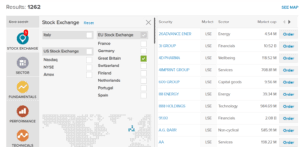

As well as market-leading tools, XTB makes trading simple by providing users with an advanced stock-scanner that is built into the platform. Traders can use XTB to take both long and short trading positions.

XTB has over 20 years of experience and has been given numerous awards for its platform. If you’re looking for a CFD trading platform that you can trust, XTB is definitely worth considering.

Your capital is at risk.

2. Fineco Bank

Fineco Bank

Fineco Bank has a lot to offer, but what really stands out to us about this broker is its approach to share dealing. You can buy UK shares for just £2.95 per trade, US shares for $3.95 per trade, and European shares for €3.95 per trade. There are no spreads to worry about and no inactivity or other account fees.

This broker offers more than 10,000 shares to choose from, so you certainly won’t find the selection lacking. You can also choose from nearly 1,000 ETFs, more than 5,500 bonds, and thousands of stock options. Fineco Bank also offers commission-free share CFD trading, although this is only available for a limited selection of around 850 stocks.

Fineco Bank offers a very robust trading platform called PowerDesk. You can thoroughly customise the charting interface, apply any of dozens of technical indicators, and keep up with the market thanks to a real-time news feed. Fineco Bank also has an online stock screener, which we thought was really nice for discovering new shares to trade from around the world.

Fineco Bank is regulated by the Bank of Italy in addition to the FCA. It’s also a publicly-traded company on the Milan Stock Exchange, so this broker is carefully watched by investors and releases routine financial reports. Customer support is available by phone, email, and live chat from 8 am to 9 pm, Monday to Friday.

Your capital is at risk.

3. Plus500

Plus500

Plus500 has nearly 2,000 stock CFDs, 70 currency pairs, 25 commodities, and 26 indices.

Plus500 has a web and mobile trading platform. It’s packed with technical indicators and drawing tools and features a built-in news feed and economic calendar so you can stay in the loop regarding the events that are driving the market

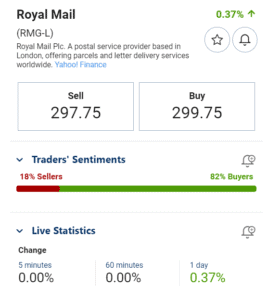

We also like that the trading platform offers a market sentiment score, enabling you to monitor how momentum around an asset is changing throughout the trading day. However, we found that price alerts aren’t integrated between the desktop, web, and mobile versions of Plus500’s platform, which is a notable drawback.

Plus500 is regulated by several financial watchdogs in addition to the FCA. This broker comes under the purview of CySEC and the Australian Securities and Investments Commission (ASIC), plus regulators in New Zealand, Israel, Singapore, and Seychelles. Customer service is available 24/7 by live chat and email.

What is an FCA Broker?

An FCA broker is a stock, forex, or CFD broker that is regulated by the UK’s Financial Conduct Authority (FCA).

The FCA is the UK’s foremost financial regulatory agency. It was formed in 2013 when its predecessor, the Financial Services Authority (FSA), was eliminated as part of a financial restructuring in the UK.

The FCA is responsible for overseeing brokerage and trading activity within the UK. For one thing, it ensures that brokers are following all trading requirements that have been put in place to keep traders and their funds safe. The FCA also issues new rules – for example, the recent ruling that banned the trading of cryptocurrency derivatives in the UK came from the FCA.

Since its formation, the FCA has been viewed as one of the foremost financial watchdogs in the world.

What Features do FCA Brokers Include

While some brokers are more trustworthy than others, the financial industry has a sordid history of taking advantage of individual traders when there aren’t strong regulations in place. One of the key roles of the FCA is to put rules in place that ensure retail traders are being treated fairly and to penalize brokers that run afoul of these rules.

That means that when you use an FCA broker in the UK, you have the UK government behind you to ensure that your trading proceeds smoothly. FCA-regulated brokers are less likely to engage in shady practices like mixing their own funds with client funds.

They’re also more likely to treat your trades fairly. That means you shouldn’t experience slippage as a penalty for trading profitably or arbitrary execution delays that could prevent you from winning trades.

Another key element of trading with an FCA broker is that, in the event that you run into problems with your broker, there’s a route for mediation available. If your broker does something that they shouldn’t do, you can complain to the FCA and the agency will step in to investigate. This holds brokers accountable to their clients.

Importantly, trading with an FCA broker also gives you a measure of protection in case your broker goes out of business. The Financial Services Protection Scheme, which is managed by the FCA, insures retail trading accounts for up to £85,000. So, if your FCA broker suddenly declares bankruptcy and can’t repay the money you’ve deposited, the UK government will step in and reimburse you for the money you would otherwise have lost.

FCA Regulated Brokers Fees Comparison

FCA brokers aren’t necessarily more expensive than brokers that are regulated in other countries or brokers that aren’t regulated at all. That’s because the FCA doesn’t put strict limits on how much brokers can charge for trading as long as the fees follow all UK financial rules.

Most FCA-regulated brokers make money in a few different ways. They can charge commissions, which are fixed fees of a few pounds that are assessed every time you place a trade. They can also charge spreads, which are variable fees baked into the difference between the buy and sell prices for an individual financial instrument. Spread fees are especially common in forex and CFD trading.

Brokers can also charge non-trading fees. For example, some brokers have monthly account charges, while others charge fees for things like deposits and withdrawals. Inactivity fees are common, too – these fees are typically charged when you don’t place a trade with your broker for a specific amount of time.

Make sure to check what fees you will be responsible for before signing up with a broker. Also, look for clear fee reports when placing a trade.

How to Open a FCA Broker Account

Ready to start trading with an FCA broker? We’ll show you how to get started with a broker of your choice.

Step 1: Open an Account

To begin, head to your preferred trading platform’s website and click ‘Join Now’ to open a new account. You can create an account with your email, or use your Google or Facebook login. The FCA requires that new users verify their identity before they can start depositing and withdrawing funds. So, you’ll need to verify your identity in order to get started. Just upload a copy of your driver’s license or passport and a copy of a recent bill that shows your address to complete this step online.

Step 2: Fund Your Account

Next, fund your new account. There are often minimum deposit requirements, which can be paid by debit or credit card, bank transfer, PayPal, Neteller, or Skrill. Card and e-wallet transfers are available for trading immediately.

Step 3: Browse the markets

From your account dashboard, enter the name of a stock, forex pair, commodity, or another financial instrument that your preferred broker offers.

In the order form, enter how much money you want to trade. Depending on whether you’re buying an asset outright or trading CFDs, you can choose to apply leverage to your trade. Then select a stop loss price and take profit price, if desired, and click ‘Open Position’ to execute your trade.

Conclusion

Choosing a FCA regulated broker in the UK is important to ensure you get a safe and reliable trading experience. FCA-regulated brokers follow all UK government regulations around trading and are required to follow rules designed to protect retail traders. The FCA is one of the leading financial watchdogs in the world and its regulations and standards are designed to keep the online trading environment as safe as possible.