EOS is the native cryptocurrency of eos.io, a blockchain- based platform that was established to build, host and operate business applications or decentralized applications.

The EOS blockchain claims to be a strong rival to Ethereum due to its enviable features. EOS blockchain was developed by blockchain technology firm Block.one with major contributions from Daniel Larimer and Brendan Blumer, who are reputed to have authored the whitepaper for EOS in 2017. Blumer has assumed the role of CEO of Block.one while Daniel Larimer was the Chief Technology Officer (CTO until his resignation in January 2021.

The Initial Coin Offering of the EOS token was conducted in 2017, making history as one of the most hyped ICOs of all time, arguably after Ethereum. EOS’ ICO lasted for a year- longer than many of the ICOs launched at the time. Block.one raised up to $4.1 billion from investors. While 90% of the tokens were distributed among investors, 10% went to the founders of the company with allocations spread over a 10-year period. Since its inception year, EOS has attracted investments from millions of investors around the world. The token’s utility and particularly its blockchain’s use case has given it more momentum to attain the relevance it boasts today. EOS blockchain is a powerhouse in itself. Apart from allowing the development of decentralized applications, the blockchain also operates as a decentralized operating system parading scalability, flexibility and extensive usability. The most interesting feature of the EOS blockchain is what they call horizontal scalability- a feature that allows transactions and smart contracts to be executed simultaneously. This is one of the fronts on which it towers above Ethereum. The blockchain also runs on the Delegated Proof-of-Stake (DPoS) consensus developed by Daniel Larimer, a co-founder of EOS. The DPoS consensus protocol type not only ensures that transactions are confirmed at super-fast speed and zero costs, but hodlers of the EOS token can partake in key governance decisions such as appointing block producers, using EOS, native and governance token. Essentially, the blockchain claims to be highly decentralized with less involvement from Block.one. EOS is believed to have been named after the Greek female god ‘Eos. However, some still believe the EOS is an acronym for Eletro-Optical System. The EOS token forms a core feature of its blockchain’s ecosystem. EOS has a circulating supply of 957 million and a total supply cap of 1 billion tokens according to CoinMarketCap. On this Page:

Best Exchange to Sell Crypto in May 2025

[fin_table id=”14125″]

Compare Exchanges & Brokers to Sell Crypto

[side_by_side_comparison id=”14147″ type=”Crypto”]

When buying cryptocurrencies, EOS is most likely to form an investment choice for investors. Looking at the token’s portfolio, they are convinced that it is a good crypto asset to place a bet on. The crypto asset is easy to invest in because of its availability on the platforms of brokers. So with the aim of profiting from a great deal from the token, they purchase on any platform of their choice. After a while, they are likely to sell after a significant price increase on EOS. Drawing from this, this guide will teach us how to sell EOS.

Without resorting to a broker or an exchange, investors cannot sell their EOS. While EOS can be sold via the peer-to-peer method, most investors prefer selling their EOS or any other cryptocurrencies in their possession on an exchange. This is due to the perception that an exchange is more reliable and they could easily sell their EOS tokens there. In light of this, we have identified brokers or exchanges where you have the opportunity of exchanging your EOS tokens for either fiat or other crypto assets like Bitcoin. Plus these exchanges have been properly vetted by industry stakeholders to be reputable brokers with the necessary infrastructure in place to make trading cryptocurrencies easy peasy. Whether you are a newbie or an experienced trader, the features on these exchanges are designed to cater to every category.

The services that the above listed brokers feature on their platforms vary. A common feature on these platforms is the trading of crypto assets including EOS. Users have the opportunity to exchange EOS tokens for USDT or any other crypto or fiat pair available on their platforms. More often than not, traders enjoy trading their EOS tokens for Tether (USDT) since the coin is stable. These brokers are some of the best brokers you would ever find around the world. They have been identified as the best because they have fulfilled every standard that makes up a good exchange.

These standards are what investors and traders try to confirm before going ahead to start trading their EOS or other crypto coins and tokens. In their case, brokers or exchanges are always after giving the best to their users, one of which providing a user-friendly trading interface. Some other requirements include- numerous trading pairs, security, reliable customer support.

We identified these exchanges due to their leading positions amongst. More importantly, there is high liquidity and trading volume for the EOS token on their platforms. Liquidity is highly significant to traders because, without it, traders cannot sell their EOS at their preferred prices. Aside from just buying and selling EOS, traders also engage in other profit-making activities they find interesting on these platforms.

How To Sell EOS in 2025

Selling EOS is not any different from buying. It has proven to be a good asset to invest in. The capabilities of the EOS blockchain confers value on the native cryptocurrency. A decentralized blockchain that is aimed at improving on the deficiencies of other blockchain is a welcome idea. It is this that has contributed to EOS growth over the last few years. Just like Ethereum, EOS allows developers to build on its software. However, EOS is more scalable and flexible than the former.

For selling EOS, we will look at a leading cryptocurrency broker, eToro. eToro has featured in all of our ‘how to’ cryptocurrency guides. eToro platform boasts millions of users and offers a wide range of cryptocurrencies and their trading pairs. The cryptocurrency exchange is US-based and has limited jurisdiction. Thus, if you are in Africa or in some parts of the Middle East, you cannot access the platform except by masking your IP or switching location.

eToro has a simple trading interface that ensures that traders do not find it difficult to sell EOS and other cryptocurrencies. Even if you are a newbie, you can navigate your way around the platform to sell your EOS tokens.

Here are five steps you are required to follow in case you prefer to sell your EOS on eToro.

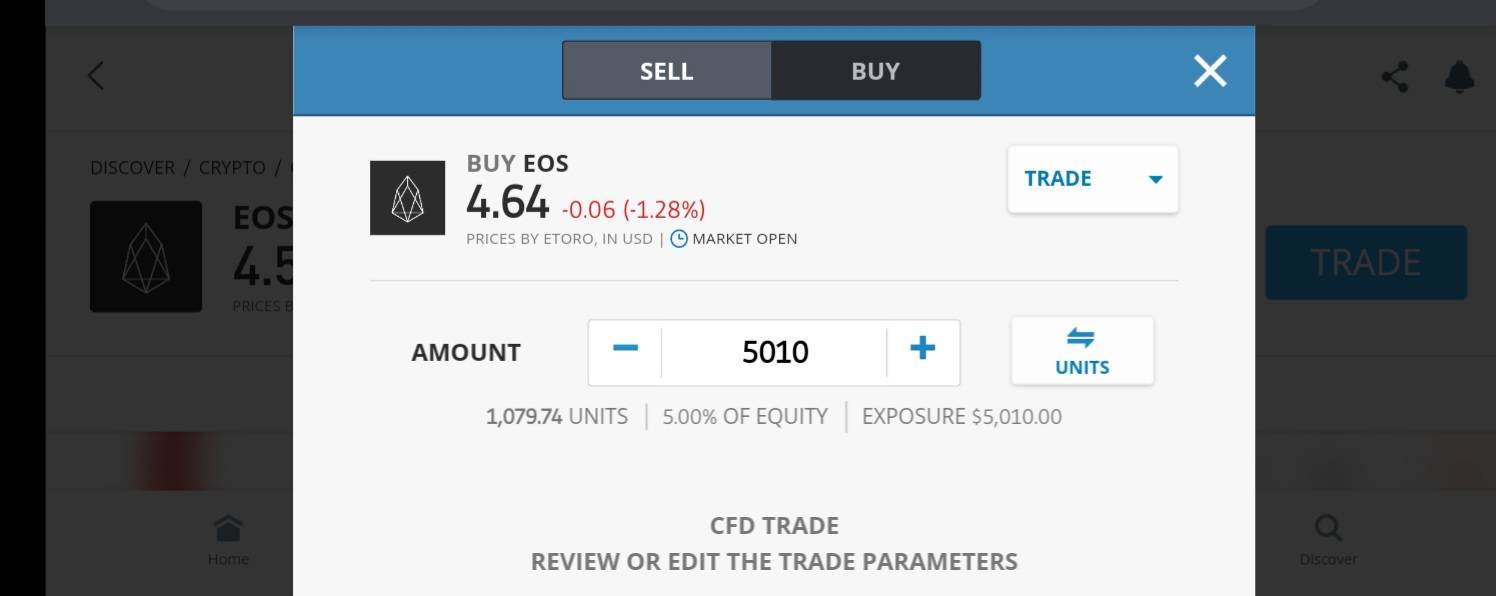

Step 1: Buy EOS

As an investor or a trader, you cannot sell EOS without owning it first. Buying a token early is crucial so that later you can sell cryptocurrency at a profit. eToro permits users to buy EOS or you can buy from another broker, then transfer it to eToro to sell.

eToro only allows verified accounts to buy EOS. Thus, after opening an account, you’ll need to fulfill verification requirements. As soon as you’ve verified your account and the details you submitted, eToro permits you to deposit funds into your account. Most traders opt for funding their accounts with stablecoin USDT. Many channels have been provided via which you can transfer funds into your account on the platform. Depending on your preference, you can send fiat to your eToro account and this may be done through your credit/debit card, local bank account or via third party payments services like PayPal, Skrill or Neteller.

After the funds have shown in your account, then you can go ahead to buy EOS directly in the fiat currency deposited or instead buy USDT and then buy EOS. Also, you can use the demo account on the platform. eToro preloads a demo account with $100,000 for every user to test if it satisfies their needs.

Buy EOS

Step 2: Always Know When to Sell

Investors buy a crypto asset for the sake of making profits. Knowing when to sell is a proper thing to do. No trader or investor buys cryptocurrencies with a preconceived notion of losing. When investors buy crypto assets to hold for the long term, they also know when they are in profits so they can sell. Cryptocurrencies are volatile assets such that their prices are subject to regular fluctuations. As such, it is always advisable to have a sell target. Without this, you are more likely to lose your money when the market moves in the opposite direction.

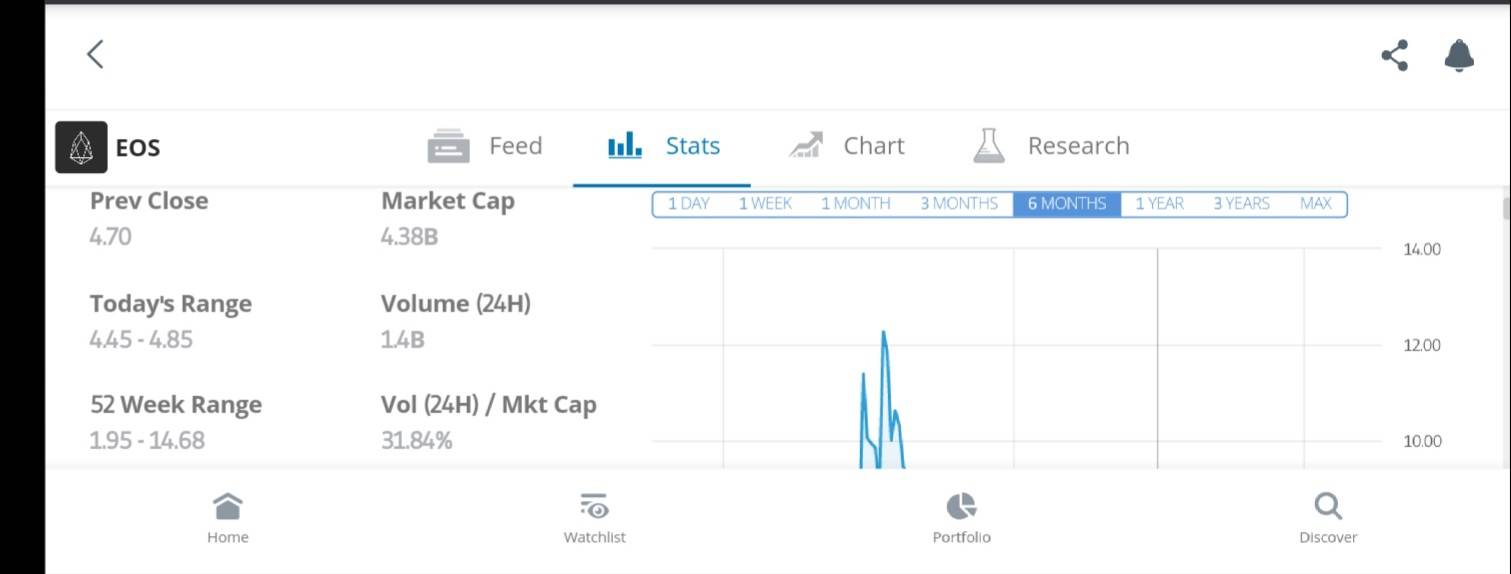

eToro helps traders to make proper trading decisions by providing trading tools including real-time charts for every crypto asset such as EOS. These charts consist of candlesticks and patterns that help you study the historical data of an asset on different timeframes. You can also study these charts to know when to make a buying decision on EOS or other cryptocurrencies. Tapping on EOS takes you to the trade section for the asset.

EOS Chart on eToro

Update 2025 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Step 3: Know the Total Value of Your Portfolio

Aside from EOS, an investor could be holding other valuable crypto assets in his portfolio since eToro parades over 100 crypto assets including their trading pairs. In this guide, our focus is on the asset, EOS. Thus, estimating the value of your portfolio will help you ascertain if the amount of EOS you wish to sell is up to the minimum limit for selling. eToro has a minimum withdrawable amount which is $30. So you can have exactly that amount of EOS or above before selling.

eToro Overview

To access the total value of EOS in your portfolio, locate the icon ‘Portfolio’ at the bottom right corner of the platform’s interface. After clicking on the icon, you get to see all your crypto holdings and their value. There you can click on any other asset apart from EOS that you wish to sell. However, whatever asset you are selling should be up to the permitted amount, otherwise you won’t be able to sell it.

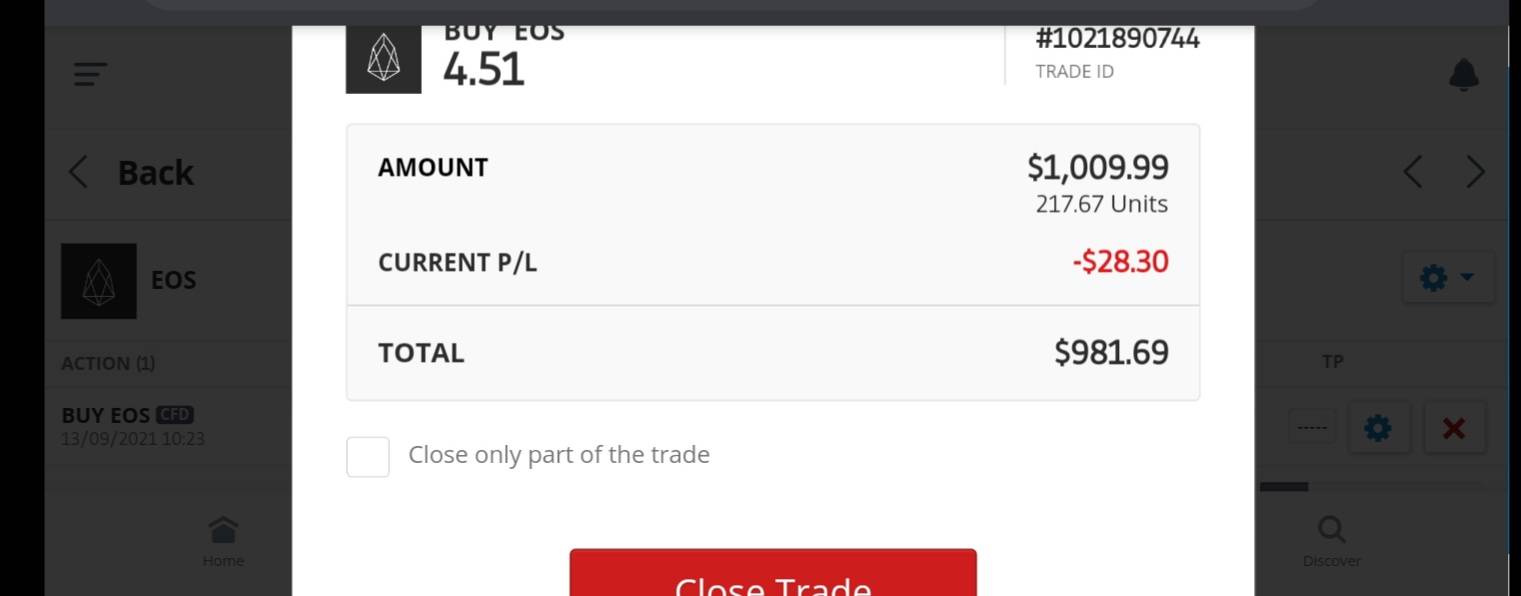

Step 4: Close All Active Positions

Closing all active positions means cancelling every open order you have on the EOS token or Bitcoin if that is what you intend to sell. Otherwise, you may not be able to sell unless there is a significant amount of the token in your wallet that is not part of any open orders. If you keep looking at the profits you have made on an asset, it is possible that you’ll lose the profits and in the worst case scenario, lose your capital.

After liquidating your tokens into fiat or stablecoin, the liquidated mount reflects in your portfolio. On certain occasions, it could be less due to what is referred to as ‘Slippage.’ Slippage occurs when an asset settles for a less different price than the initial price target. This often occurs when an asset lacks enough liquidity. However, with eToro, you can worry less about this since there is more than enough liquidity for every listed cryptocurrency.

Closing Trade on eToro

When you want to close an active position on EOS via your eToro account, you click on the portfolio icon where you are shown all the assets in your possession. After identifying the asset you want to close position on, click on it. In the next interface, you can choose if you want to sell all your EOS or just a portion of it.

Similarly, the liquidated amount becomes withdrawable. You can withdraw the balance to your local bank account or credit card.

Step 5: Withdrawal Requirements and Exchange Rates

Withdrawing funds on eToro is done via a hassle-free process, as long as you’ve completed account verification. There could be occasions when a user experiences difficulty in withdrawing his funds. Factors that could make this happen are many. A user can always decide to contact eToro’s customer’s support for assistance. eToro is willing to make withdrawals on its platform as easy as possible. It makes sure that users’ assets are easily liquidated. At any time, you can convert your EOS to fiat.

Although other exchanges stipulate their minimum withdrawable amount at a higher limit, eToro made the minimum limit considerable, especially for retail traders. The minimum limit for EOS withdrawals is $30 worth with a fee of 0.5%. eToro’s min withdrawal fee is $1 while the max is $50. This goes to show that eToro is user-friendly not only in relation to user interface but also in fees for every transaction carried out on the platform.

Crypto Taxation in the US

Currently, there are no taxes for cryptocurrencies in the US. However, the upcoming infrastructure bill, which has already been passed by the senate, is set to introduce taxes for capital gains within the country, with varying tax percentages on short and long term gains.

With respect to the taxes on short and long term gains, short term means gains made on taxes within the space of a year or months, while long term represents gains made for more than a year. These taxes will also include a bunch of crypto-related activities including airdrops, DeFi yields, mining and transaction fees.

Due to the decentralized nature of cryptocurrencies, enforcing tax obligations on their owners might be a difficult thing to pull off. US authorities have continually expressed concerns over cryptocurrencies being used for illegal activities like scams, money laundering and terrorism financing. Thus, they are looking to enact regulations that will protect the populace from bad actors in the crypto industry. The infrastructure bill is likely to address these issues.

Best Crypto Exchanges

Crypto exchanges globally are more than 200 exchanges and they all have varying jurisdictions. Some offer global services with few exceptions while others are native to a country or region, which means they only serve a particular region. Crypto exchanges are meant to make cryptocurrencies accessible to investors and crypto enthusiasts. Despite being bound by one aim, you may find different services on these platforms. This means that apart from buying and selling crypto, you can enjoy other services like staking, lending or even automated trading depending on your need.

Amongst all crypto exchanges, some have been able to stand out and appeal to millions of people around the globe. There are certain benchmarks used to identify the best crypto exchanges. These benchmarks include security, friendly UI, efficient customer support, a guide on how to use the exchange, and a growing community. Only a few exchanges have been able to meet these benchmarks as they attempt to satisfy their teeming users.

Below, we have a list of leading and notable crypto exchanges:

Storing EOS in the Best Wallets

Since EOS is a digital asset, it is stored safely out of the reach of hackers or scammers. Cryptocurrencies like EOS are stored in digital wallets. Crypto holders have different ways of storing their digital assets. Some store theirs in digital wallets while others transfer the assets to hardware wallets, also known as cold wallets. Each of these wallets has its pros and cons.

Depending on what you like, you can decide to store your EOS in any wallet of your choice as long as you take precautionary measures to protect your assets from getting hacked and stolen. Here, in another guide, we have compiled some of the best crypto wallets you can store your EOS tokens in.

When is the Best Time to Sell my EOS?

Investors are exposed to different methods when investing. Some do short-term investment that is likely to take days or weeks based on their strategy before deciding to sell. This method is known as swing trading. Another notable strategy is scalping where traders try to make little profits on many trades within a day. Others could buy EOS and keep it for a medium-term spanning months. A long-term investment strategy means holding for years before selling off. In essence, you only sell if the price of the token has hit your target. This method is otherwise known as position trading.

As an investor, you can also consider the opinions of industry experts. However, do not follow these opinions blindly, without doing research to confirm their assertions. You can access the updates released by professionals on eToro, too. This process is known as copy trading, almost similar to automated trading.

Price of EOS

EOS’s price action has not performed well over the last few years. Since the market is volatile, the price of the native token has not been stable. Where the market fluctuates, it means that prices will go up at certain times, then experience a downtrend following a bearish report or when investors start selling off. The price movements are normally noticed on the chart via candlesticks and other patterns created.

Because of the utility of the EOS token, it is bound to perform well. Being a native token to the decentralized blockchain protocol, it is likely to outperform other altcoins. However, EOS is currently trading at the $4 range and has only had an all-time high of $22 in 2018. To date, EOS has not surpassed its 2018 ATH.

Guide to Automated Trading

Automated trading assists traders who hardly have the time to supervise their trades. As part of trading rules, a trader ought to be in the right frame of mind to maximize opportunities in the market. This is why apart from risk management, a trader is supposed to have strong trading psychology.

Trading bots allows traders to have time for other engagements. Trading bots utilize algorithms to trade cryptocurrencies. Nonetheless, they require a bit of human involvement to function effectively. They cannot function on their own, a trader has to activate a trading range based on his strategy, which these bots rely on. One reason trading bots are important is that they are designed to respond to opportunities in the market faster than humans.

The main reason for the creation of automated trading is to ensure that little price surges are capitalized on. Sometimes, there are opportunities that traders may be blind to due to their busy schedules. With the help of trading bots, every market activity is observed and this assists trading in making more profits than they would have made if they were trading themselves. The disadvantage of trading bots is that when the market is going the wrong way and the trader is not there to observe, it could result in massive losses. As such, trading bots are not 100% reliable. Automated trading is also known as robot trading.

Bot programs can involve risk – those interested should only deposit a small amount at first to test them out. These are some bots we’ve reviewed:

How to Invest Responsibly in Crypto

Everyone is interested in investing in cryptocurrencies to reap maximum benefits. It has always been said that crypto is not a get-rich-quick scheme and beyond just having the capital to invest. The volatile market should be a red flag to a new investor. There are a whole lot of other qualities a crypto investor is expected to possess.

Qualities like patience, risk management, strong trading psychology, emotional stability, technical and fundamental analysis expertise all combine to make an expert trader before capital. One must understand that the market is not controlled by anybody. Hence, it must be skillfully manoeuvred. Greed is a major challenge most traders battle with. Once a trader can overcome the lure to be greedy, he is one step closer to becoming an expert.

There are times when the market is very volatile and highly unpredictable- a trader should learn to avoid the market during those periods. Also, as a trader, never revenge trade. This means trying to recover from loss after suffering one. While trying to revenge-trade, it could lead to more losses. The best thing to do at such a point is to sit back and restrategize and head back to the market not with a mindset to recover from that loss.

Should I Sell EOS in 2025?

EOS (EOS) has prospects, owing to its utility in the industry. Thus, it is a crypto asset to watch out for. Its price is likely to cross its 2018 ATH in another bull run, perhaps to $30.

Here are some relevant things to note if you do sell EOS:

- Make sure that you are not in loss if you want to sell.

- Do not invest all of your money in cryptocurrency. The market is volatile and there is a high tendency to lose your funds.

- If you have attained your target on EOS, do not hesitate to sell off. Being greedy is not advised.

- In situations where you are yet to meet your target, remember to hold. Patience is key when investing in cryptocurrencies.

Summary

EOS (EOS) is one of the top cryptocurrencies with a market capitalization of $4 billion. It is a digital asset, so it can be bought, stored and sold without hassles. EOS can be found on most exchanges including on the platforms of the brokers listed above. The token ranks 33rd amongst all cryptocurrencies on CoinMarketCap.

To sell EOS on eToro and other brokers’ platforms, you need to close positions. You can trade the asset against USDT or the fiat currency of your residing country and then withdraw to your local bank account. EOS can be stored in a wallet, whether hardware or software. It is safe to the extent of the owner’s diligence and security consciousness.

If you intend to trade cryptocurrency, you should do so from an informed standpoint and not based on mere speculations. As they say, invest what you can afford to lose. You can always revert to this guide whenever you want to make investments in EOS.

Our recommended best exchange to sell Bitcoin in 2025 is eToro as they are regulated internationally and support withdrawals by bank wire, VISA, Skrill, Neteller and a range of other methods.

FAQs

Where to Sell EOS?

We recommend selling EOS via an exchange as you are guaranteed the safety of the transaction. There are other means through which you can sell. P2P is an alternative, but this is somewhat risky.

How Easy is it to Sell EOS?

Using a broker like eToro to sell your EOS can be concluded in minutes after a few clicks. The exchange features withdrawal options as well.

What are the Best Brokers for Selling EOS?

Most brokers can be used to sell EOS. However, the following are considered the best by expert traders that have explored other options. They are eToro, Capital, Libertex, Plus500, Coinbase, Binance, AvaTrade, Revolut, Cryptorocket, and Changelly.

What are the Taxes for Selling EOS?

There are different regulations on crypto globally. So if you are willing to know if selling EOS incurs any tax, you may have to resort to the financial regulations in your country.

Where to Sell EOS for USD?

If you need to sell your EOS for US Dollar, you need an exchange that permits payment to your local bank or third-party payment service. Some of the best choices are eToro, Coinbase, AvaTrade, and Binance.

What Exchanges Sell EOS?

Some of the exchanges where EOS can be sold include eToro, Capital, Libertex, Plus500, Coinbase, Binance, AvaTrade, Revolut, Cryptorocket, and Changelly.

How to Quickly Sell EOS

To quickly sell your EOS, you need an account with eToro or any of the exchanges listed above. Setting up your account doesn't take a lot of time. If you have your EOS already, you can transfer them to the wallet on the exchange and sell them there instantly.

How to Sell EOS for Cash

To sell EOS for fiat, you should integrate a withdrawal channel on eToro or any other exchange. Ensure that you've chosen your desired currency. When you withdraw, the exchange helps you convert the funds to cash and pays into the proper channel.

How to Sell EOS on PayPal

PayPal only supports four cryptocurrencies, which include Bitcoin, Bitcoin Cash (BCH), Ethereum (ETH) and Litecoin (LTC). However, you can buy EOS with any of the supported cryptocurrencies.

How to Sell EOS from Wallet

Some wallets help you sell your EOS directly. To sell them on the wallets, you need to integrate a payment method and follow the necessary procedures to sell EOS.

How to Sell EOS for Other Cryptocurrencies

Often, you can swap your EOS for other cryptocurrencies on brokers like eToro or Coinbase. Once you complete a swap, the actual value of EOS sold reflects in your portfolio.