On this Page:

All signs are bullish, which means right now there’s a prime opportunity for investors to buy tokens. The majority of investors entering the crypto market will turn to Binance, the world’s largest crypto exchange and the dominant platform for global crypto trading. Binance offers low fees, an enormous selection of tokens, and powerful tools for traders and investors.

Bitcoin Ethereum XRP BNB Solana USDC Dogecoin TRON Cardano Wrapped Bitcoin Sui Chainlink Avalanche Stellar Bitcoin Cash Toncoin Shiba Inu Litecoin Polkadot NEAR Protocol Arbitrum WorldCoin

#

Coin

Price

24h %

Market Cap

Volume

24h Range

1

Bitcoin

BTC

$106,009.00

1.51%

$2,106,409,848,597

$27,041,036,912

2

Ethereum

ETH

$2,633.49

4.29%

$317,823,661,450

$15,292,342,610

3

XRP

XRP

$2.23

3.64%

$130,651,386,634

$2,048,608,812

4

BNB

BNB

$664.51

0.61%

$96,942,103,171

$732,837,678

5

Solana

SOL

$161.49

5.24%

$84,280,985,221

$3,752,694,066

6

USDC

USDC

$1.00

0.00%

$61,112,989,178

$3,596,138,349

7

Dogecoin

DOGE

$0.20

2.17%

$29,265,987,703

$1,065,946,157

8

TRON

TRX

$0.27

1.19%

$25,668,662,389

$427,880,744

9

Cardano

ADA

$0.69

3.02%

$24,960,585,982

$485,723,120

10

Wrapped Bitcoin

WBTC

$105,904.00

1.37%

$13,639,472,719

$218,526,689

11

Sui

SUI

$3.29

-0.42%

$11,161,086,360

$770,110,723

12

Chainlink

LINK

$14.28

3.71%

$9,380,758,679

$371,401,278

13

Avalanche

AVAX

$21.40

3.40%

$9,020,937,430

$372,160,647

14

Stellar

XLM

$0.27

3.34%

$8,571,848,951

$189,753,335

15

Bitcoin Cash

BCH

$405.30

1.15%

$8,055,518,441

$140,480,388

16

Toncoin

TON

$3.19

0.92%

$7,871,069,403

$223,310,488

17

Shiba Inu

SHIB

$0.0(4)13

1.98%

$7,771,556,583

$141,107,863

18

Litecoin

LTC

$90.08

1.40%

$6,835,679,304

$298,870,596

19

Polkadot

DOT

$4.18

3.41%

$6,364,896,944

$176,227,049

20

NEAR Protocol

NEAR

$2.56

5.80%

$3,122,878,808

$183,181,133

21

Arbitrum

ARB

$0.37

7.01%

$1,791,146,862

$191,230,121

22

WorldCoin

WDC

$0.0026

-0.87%

$368,621

-

In this guide, we’ll zero in on Binance and highlight the best crypto to buy on Binance in June 2025.

Top Binance Coins

Top Crypto to Buy on Binance

Let’s dive straight into the best crypto to buy on Binance today.

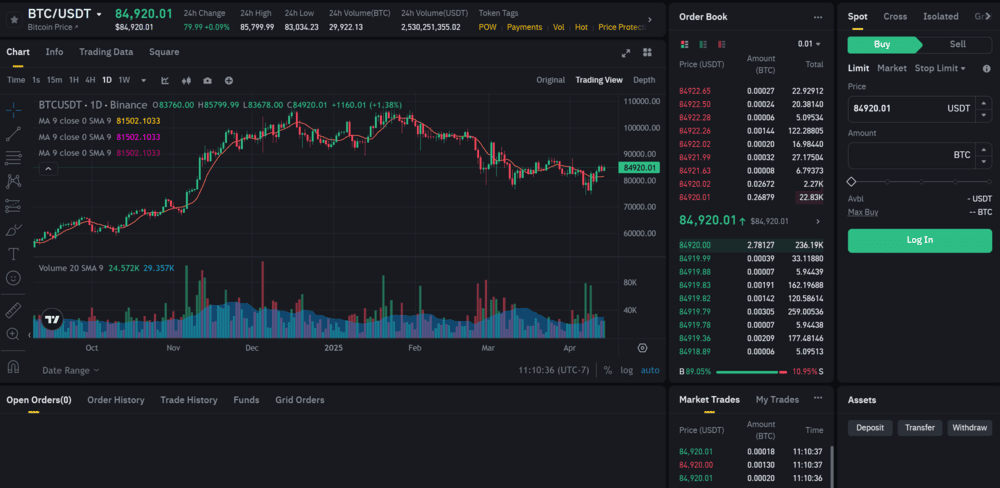

1. Bitcoin ($BTC)

Bitcoin Price Chart

(BTC)HarryPotterObamaSonic10Inu (ETH) (BITCOIN)

Bitcoin ($BTC) is the world’s oldest and largest cryptocurrency by market capitalization, and it shows no signs of giving up its mantle anytime soon. Quite the opposite—$BTC is gaining worldwide adoption as a global reserve currency and an alternative to the dollar in times of economic turbulence. Many analysts have called it ‘digital gold,’ referencing how Bitcoin can also act as a hedge against inflation.

Bitcoin has a lot of tailwinds behind it, including the establishment of a US Strategic Bitcoin Reserve and moves by companies like Strategy (formerly MicroStrategy) to stockpile as much $BTC as possible. Bitcoin miners also hold onto the token and wait for its price to go up, creating even more demand.

$BTC could be on the verge of explosive growth, with respected Wall Street analysts like Cathie Wood predicting the token could jump to $1.5 million by the end of the decade. That would represent a more than 10x price jump from Bitcoin’s all-time high and signals that the largest crypto’s journey to the mainstream has only just begun.

Find out more about Bitcoin

2. Ethereum ($ETH)

Ethereum Price Chart

(ETH)Ethereum (ETH)

Ethereum ($ETH) is the second-largest cryptocurrency and the dominant decentralized platform in Web3. It pioneered the concept of smart contracts when it launched in 2015 and recently demonstrated that it can still be nimble by switching from a Proof of Work blockchain to a Proof of Stake blockchain. That cut Ethereum’s environmental footprint by more than 99% and introduced staking rewards for $ETH token holders.

Ethereum has lagged gains in the broader crypto market over the past year, but analysts don’t expect the slow performance to last. This network is the most popular for developers building decentralized apps (dApps) and maintains a sizable lead over competitors like BNB Chain and Solana. While Ethereum has struggled with high gas fees and scalability challenges, the introduction of Layer-2 scaling solutions has charted a clear path forward.

$ETH is especially popular on Binance because it can be used for a wide range of functions, including staking, DeFi, and investing in new crypto projects. The launch of Ethereum ETFs in 2024 further boosted demand for $ETH and cemented its place as a critical token, so many analysts expect further growth through the remainder of the decade.

Find out more about Ethereum

3. BNB ($BNB)

BNB Price Chart

(BNB)BNB (BNB)

BNB ($BNB) is a must-have token for any traders and investors using Binance as their primary crypto exchange. Simply holding the token earns you significant discounts on every buy and sell at Binance. The more you hold, the more discounts you earn. In addition, BNB token holders get exclusive early access to upcoming Binance listings and token airdrops.

$BNB is also the native gas token of BNB Chain, the smart contract blockchain launched by Binance. BNB Chain is a close competitor to Ethereum, and it’s recently experienced massive growth in popularity as a hub for meme coin trading. While BNB Chain has faced competition from newer networks like Solana, it has managed to maintain its market position—a testament to the blockchain’s strength and user base.

The $BNB token’s price is a good barometer for the fortunes of the crypto market at large. $BNB tends to grow in value when trading volumes rise since that benefits Binance. So, with a bull market on the horizon, BNB could be one of the best buys today.

Find out more about BNB

4. Arbitrum ($ARB)

Arbitrum Price Chart

(ARB)Arbitrum (ARB)

Arbitrum ($ARB) is a Layer-2 scaling solution built for Ethereum—effectively, a blockchain that runs on Ethereum and is designed to combine transactions for processing. It offers faster transaction speeds and lower gas fees compared to the Ethereum mainnet while benefiting from Ethereum’s security architecture, which makes it a very popular choice for developers.

Arbitrum only launched in 2021, but it’s quickly grown to become one of the most important blockchains and cryptocurrencies. The network has more than $10 billion in total value locked and controls more than 33% of the total Layer-2 market. Analysts have predicted that Layer-2 networks in aggregate could become more valuable than Ethereum itself by 2030, and Arbitrum is likely to be at the front of this growth path.

The $ARB token is primarily a governance token for Arbitrum and isn’t required to pay gas fees on the network. However, its value is closely tied to Arbitrum’s use since there’s a chance that $ARB token holders could receive a share of the network’s revenue in the future. Regardless of how that plays out, $ARB appears set to continue growing in value at a market-beating pace.

Find out more about Arbitrum

5. Render ($RENDER)

Render Price Chart

(RENDER)Render (RENDER)

Render ($RENDER) is a Layer-1 blockchain and decentralized marketplace for buying and selling GPU processing power. It was originally built for artists, engineers, and other creators to access 3D rendering capabilities, but has since seen significant growth thanks to the demand for AI model training and generative video creation.

Render is fast, affordable, and highly scalable, making it a very attractive solution for individuals and businesses around the world who need on-demand access to graphics processors for 3D rendering. The marketplace requires the project’s native $RENDER token, which means the token’s value is closely tied to network use.

That’s exciting because demand for GPU power is only expected to increase. Generative AI video could be a huge source of demand, as could AI-powered video game engines and metaverse development. A growing number of crypto projects are also incorporating AI and graphics rendering, and many of them are likely to turn to Render because of its decentralized nature. So, the $RENDER token could see significant value growth.

Find out more about Render

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- 250,000+ Monthly Active Users

What Are the Benefits of Buying Crypto on Binance?

Binance is the world’s largest crypto exchange for a reason—it offers a lot of advantages over competitors. Let’s take a look at some of the key benefits of buying crypto on Binance.

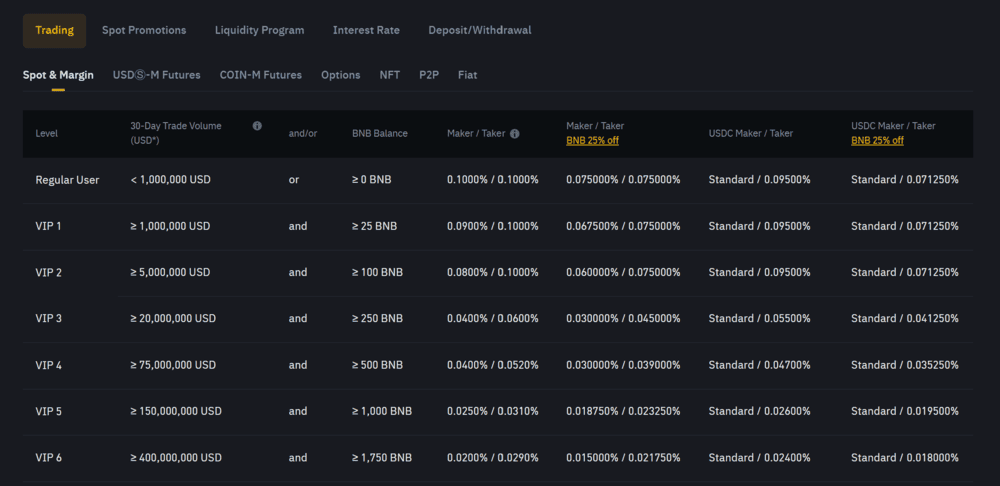

Low Fees

Binance leverages its scale to offer a very competitive fee structure for crypto traders and investors. Rates for spot trading start at only 0.10%, much lower than the industry average, and traders don’t have to worry about different rates for different tokens or for making or taking liquidity from the exchange.

$BNB token holders who use their coins to pay fees receive a whopping 25% discount, bringing the fee down to just 0.075%. In addition, Binance offers volume discounts for traders who buy and sell at least $1 million worth of cryptocurrencies every 30 days.

Even more impressive, Binance.US, Binance’s US exchange, offers fee-free Bitcoin trading. It’s one of the only exchanges in the US to do so. While Binance may not have the lowest fees for every type of trade or crypto pair, in general its fees are lower than competitors.

High Liquidity

Another way Binance leverages its scale is by offering impressive liquidity across a very wide range of tokens and digital assets. The sheer number of traders, investors, and institutions using Binance means that trading volume is very high around the clock. So, there’s never a shortage of liquidity in popular tokens and liquidity is usually higher for low-volume tokens than at other exchanges.

This is important for traders and investors because more liquidity is crucial for fast order execution and avoiding price slippage. It’s also good for investors who want to place large orders since Binance can handle these without partial fills.

Varied Portfolio Access

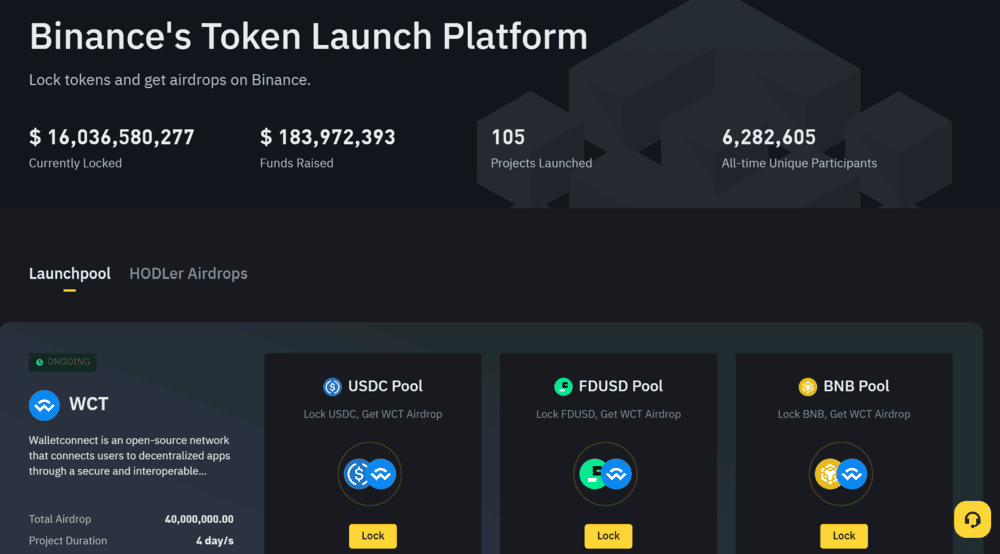

Binance has a very wide range of cryptocurrencies and digital assets to choose from, including hundreds of altcoins, crypto futures, and options. That’s a benefit for investors and traders looking to build a diversified crypto portfolio complete with hedges against price drops. Importantly, Binance also thoroughly vets tokens before listing them, so investors can feel confident that altcoins on the exchange are legitimate.

On top of that, some crypto projects list exclusively on Binance, meaning investors can only buy them there. Other projects join Binance Launchpad, an incubator platform for new tokens that haven’t yet been listed on the main exchange. Following projects on Binance Launchpad is a good way to get access to new cryptocurrencies.

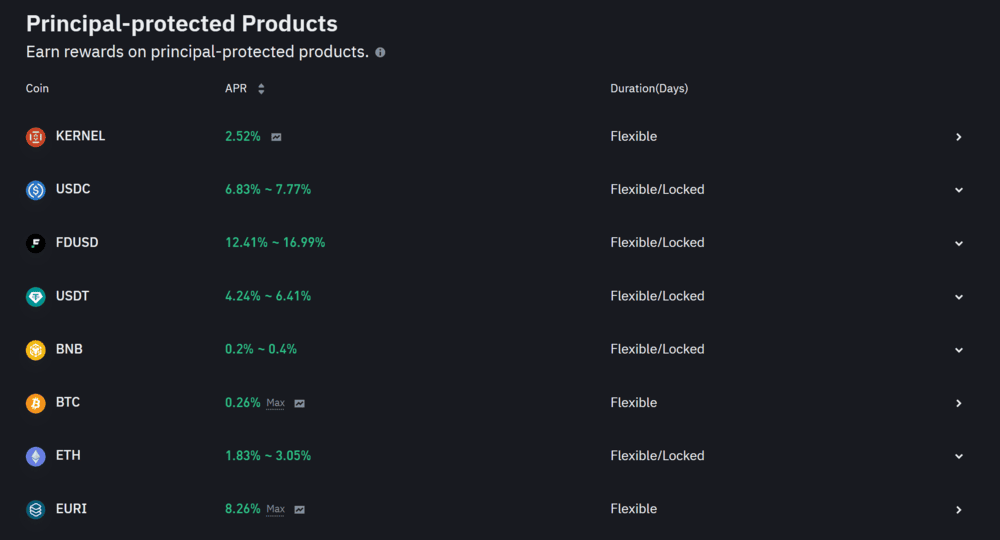

Passive Income Options

Finally, Binance offers a wide variety of options to generate passive income from the tokens you hold on the exchange. For example, Simple Earn offers flexible and locked token staking with APYs up to 30% or more. It’s available for 300+ tokens.

Advanced Earn uses high-yield strategies like Dual Investment and Smart Arbitrage to generate APYs up to 120% or more. Note that these strategies may involve trading and are higher risk than Simple Earn.

While many other exchanges offer staking, they typically don’t have staking available for as wide a range of tokens as Binance. They also lack more complex earning options like those available through Advanced Earn.

How to Find The Best Crypto to Invest in on Binance

Binance plays an active role in helping you find the top cryptos to invest in on the exchange. We’ll cover a few different strategies you can use and highlight the tools Binance offers for each.

Trading Strategy

Binance supports a variety of different trading and investing approaches. Short-term traders can use the exchange to day trade cryptos or make momentum plays that last a few hours to a few days. Investors can use Binance to actively buy low and sell high or pick up tokens and HODL them for the long-term.

Depending on your approach, you might use one or more of Binance’s trading platforms. The spot trading platform is designed for day traders and investors alike. It allows you to buy and sell tokens directly through the exchange using market or limit orders, with basic risk management controls like stop losses. Traders can buy and sell repeatedly, while investors can buy and then hold tokens without selling until they’re ready.

Binance offers futures and options trading for traders and investors who want to hedge their risk and build more complex strategies for different market conditions. For example, you can design straddle strategies that turn a profit when the price of a cryptocurrency moves sideways instead of up. Binance futures contracts can be settled in stablecoins like Tether ($USDT) and USD Coin ($USDC), or in the underlying cryptocurrency. $USDT perpetual futures contracts are available for hundreds of different altcoins.

Finally, Binance offers margin trading, which enables users to borrow money to trade or invest. Users can leverage their purchases by 5x for most cryptocurrencies on Binance, with the option to use up to 10x leverage for select tokens like $BTC. Using margin enables traders to deploy their capital more efficiently, so they can trade across more tokens with the same funds.

Fundamental Analysis

You can also invest in cryptocurrencies for the long-term on Binance using fundamental analysis. Fundamental analysis takes into account a cryptocurrency’s technological utility, product-market fit, audience, project team, partnerships, tokenomics, and more in order to estimate its potential future value. Armed with this analysis, investors can look for tokens that appear undervalued and buy them with the expectation that they will rise in price.

Binance offers helpful research tools to aid investors in conducting fundamental analysis. The exchange provides basic information about every token it lists, giving you a starting point to dig deeper. In addition, Binance has its own research arm where you can find reports on the overall market or specific cryptocurrencies. Reports explain what a token is, highlight its unique features, provide insights into the token supply dynamics, and discuss potential catalysts or development efforts.

Binance Launchpad is an especially good source of information about new projects that are accepting investment. Each token listed on Launchpad comes with a detailed research report, links to the whitepaper and project site, and detailed rules for investing in the new token launch.

Technical Analysis Tools on Binance

Traders on Binance will love the exchange’s technical analysis tools, which are designed to help you track price action in specific cryptocurrencies and identify potential entry and exit points.

Binance has a feature-rich trading interface that includes charts from TradingView, one of the most popular charting platforms for cryptocurrencies. The charts include drawing tools and dozens of technical indicators such as moving averages, moving average convergence-divergence (MACD), relative strength index (RSI), and more. You can enter buy and sell orders directly from the chart window or use alerts to be notified instantly about important price movements.

Binance also plots market depth and offers a transparent look at the exchange’s order book, which is helpful for identifying potential support and resistance levels. Volume signals keep you apprised of liquidity and momentum, and an order panel makes it easy to track all of your open crypto positions.

What to Watch Out for When Trading on Binance

While Binance does a lot to make crypto trading as seamless as possible, traders and investors on the exchange still need to be aware of the risks and potential pitfalls. Here are a few things to watch out for when trading cryptos on Binance.

Market Volatility

The cryptocurrency market is notoriously volatile, and Binance doesn’t have any control over price movements on specific tokens. Traders and investors always need to be aware that the market could move suddenly. You need to be prepared, or else you could lose money.

One of the best ways to manage your risk in a volatile market is to use stop losses. These are sell orders that execute only when a crypto’s price falls to a certain level. You can use stop losses to lock in profits on a trade or limit your losses from growing out of control. Binance makes it easy to add stop losses and trailing stops, which automatically adjust to lock in profits.

It’s also important to avoid overly leveraging your positions. Binance helps with this by limiting the maximum leverage for margin trades and offering spot trades without margin. New traders must also be careful to manage their emotions, since emotional trading can lead to significant losses in volatile markets.

Regulatory and Regional Restrictions

While Binance is available in most countries around the world, there are some differences in what the exchange offers in different countries or US states. This is to comply with different financial and crypto regulations.

For example, Binance.US, which is only available in the US, is significantly different from Binance.com, the exchange available to the rest of the world. Binance.US has a slightly different fee structure and a much more limited range of assets.

In nearly all cases, Binance requires new customers to go through Know Your Customer (KYC) checks, which include sharing your personal details, uploading a copy of your ID, and providing proof of address. Accounts must also be verified, which involves taking a live photo of your face, in order to access some features. Unverified accounts are subject to withdrawal limits.

Security and Asset Safety

Binance prides itself on being a leader in crypto exchange security and having a strong track record of protecting users’ funds. The exchange offers security mechanisms like two-factor authentication (2FA) and a Secure Asset Fund for Users (SAFU), which is an emergency fund that can be used to repay losses from a hack or other covered disruption.

That said, it’s still up to users to keep their accounts secure. Be sure to create a secure password that’s hard to guess, and never share your password with anyone. Binance will never ask for your password.

Alternatives to Binance

While Binance is the largest exchange and a great choice for many traders and investors, it’s far from the only option for buying and selling cryptocurrencies. Popular alternatives include:

- Coinbase: Largest US crypto exchange with learning rewards, staking, and hundreds of tokens.

- Bybit: The second-largest global crypto exchange, with platform tokens, crypto futures, margins, and more.

- OKX: Trading-focused exchange with trading bots, crypto futures, and deep liquidity.

- MEXC: Low-fee exchange for crypto futures and margin trading.

- Gate.io: Up-and-coming exchange that’s first to list many new crypto projects.

Conclusion

The best cryptos to buy on Binance today include Bitcoin, Ethereum, BNB, Arbitrum, and Render. These tokens are current market leaders with high growth potential ahead, and they could be among the biggest winners of a crypto bull market.

Binance makes it easy to buy and sell top cryptocurrencies while managing your risk and building a diversified portfolio. Check out Binance today to explore all of the exchange’s features and buy your first tokens.