Ethereum (ETH) is the second-largest digital asset in the crypto market. This crypto has become a favorite to millions of investors and hasn’t failed to keep up to expectations. There are a whole lot of activities across the Ethereum ecosystem because it hosts DeFi (Decentralized Finance) projects and programs. Also, Ethereum is consistently developing its network to accommodate more features, become more scalable, and reduce gas fees. The use case of this cryptocurrency is evident and as you might know, it is a large contributor to the global crypto market cap.

Just like Bitcoin, Ethereum is a tradable asset. You can find it listed on several brokers or exchanges. If you don’t know Ethereum, you can purchase them from great brokers and trade them as well. You might likely have some of it in your crypto wallet too. However, considering that not everyone knows how to sell their Ethereum, a guide such as this would help you simplify the process.

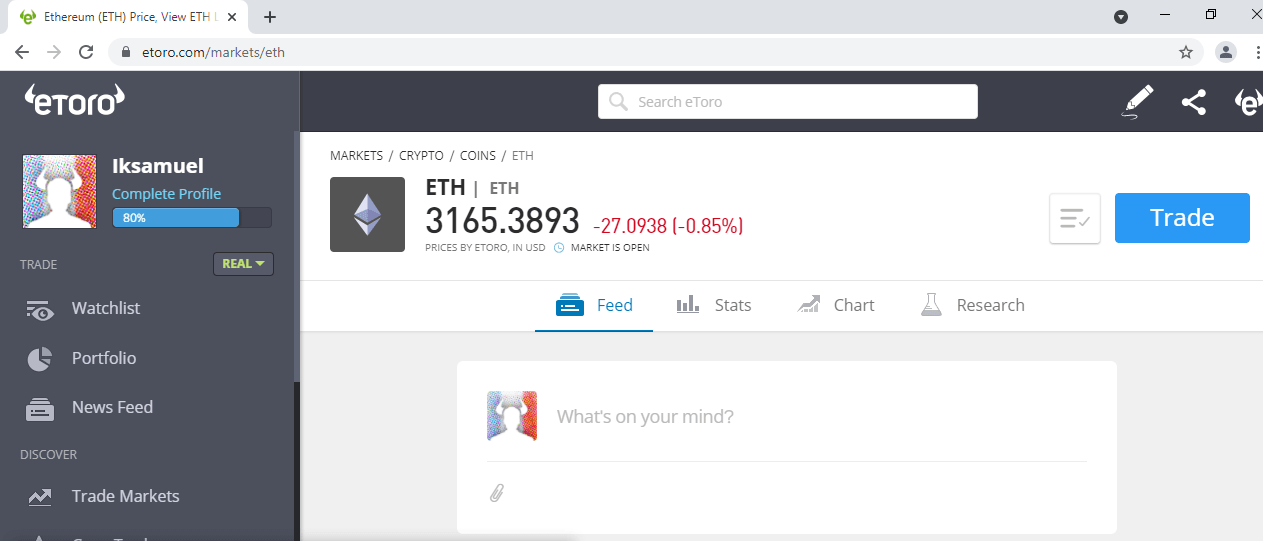

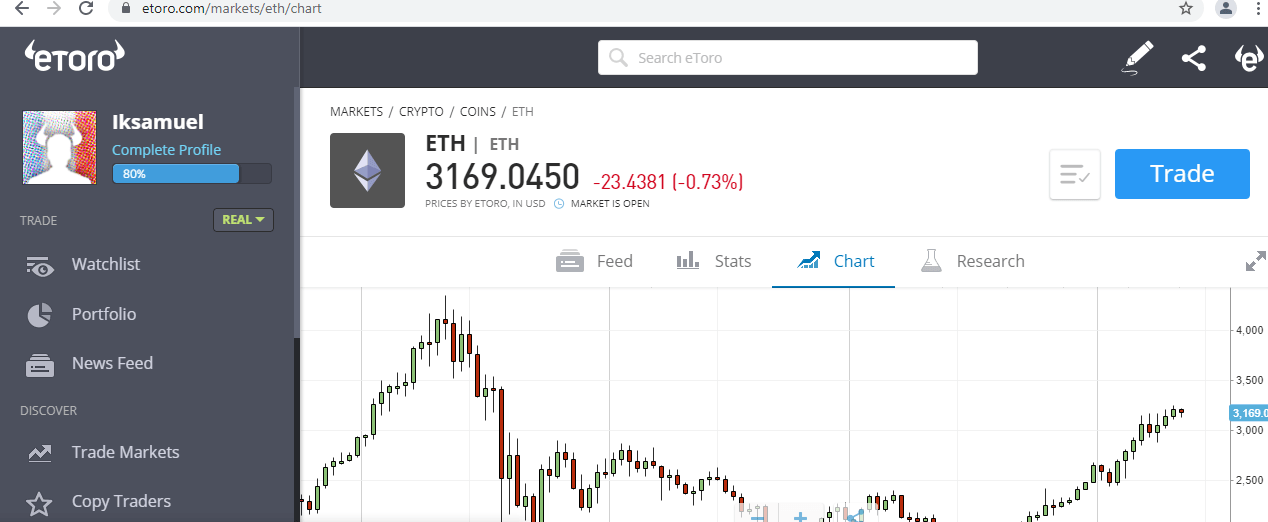

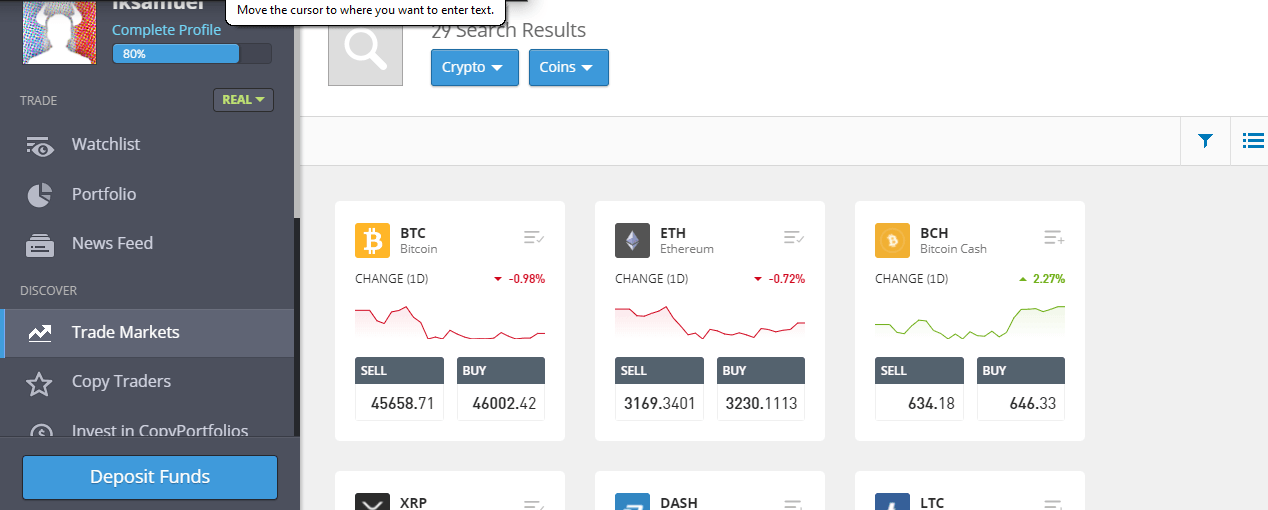

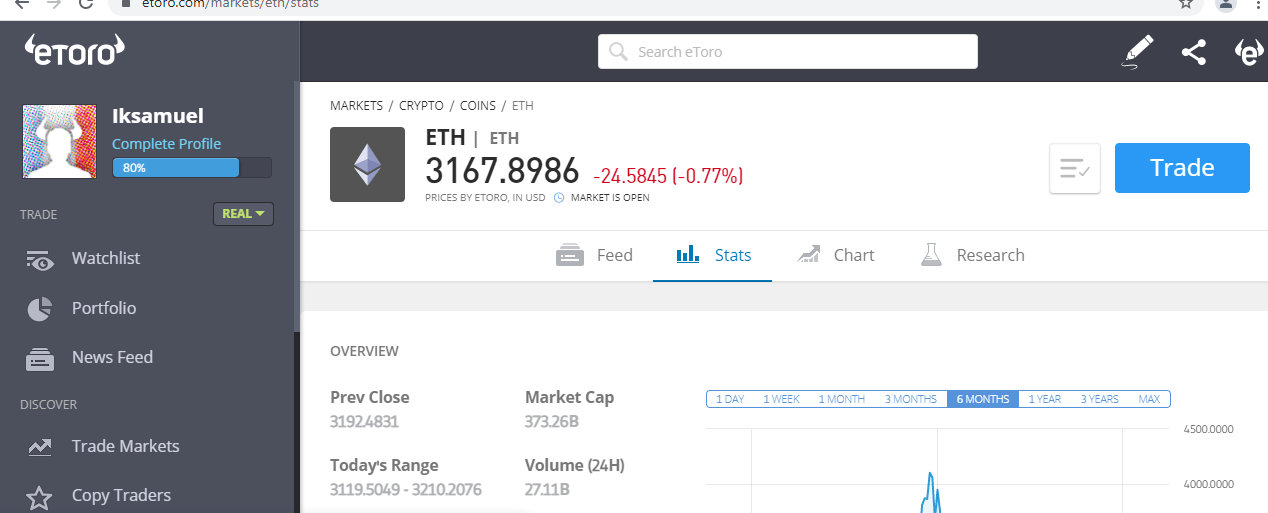

One important fact you must note is that selling Ethereum isn’t difficult. You can sell it if you’ve got a few tools handy. Paramount amongst them is a good broker that affords efficient liquidity. These brokers function as the needed support to begin the process of converting your Ethereum or any other cryptocurrency to fiat. To make the process easier for you, below are a few brokers that are the favorites of respected crypto experts and analysts. They are also superb platforms to begin your trading journey. The above brokers make the top rankings when it comes to selecting the most suitable options for any trader, notwithstanding the level of experience. Just as you know, there are hundreds of cryptocurrency brokers and exchanges newer platforms that enter the list regularly. Although most of these brokers perform the basic functions required, others might not be up to speed with the needed operations and flexibilities. The basic requirements for a crypto broker are efficiency, good customer service, security, crypto custody, and a trading desk. The above exchanges feature these requirements and even go much further to provide additional services. Their native features vary depending on the trading strategy and experience of the user. Another great way the validity of these brokers was evaluated is by analyzing their attention to user comfort. Aside from offering sleek trading views and an array of cryptocurrencies, most of them offer basic steps to maximize the platform. Some go as far as offering tutorials for novice traders. Security is also another important feature which these brokers hardly ignore. They are renowned for constantly updating their secure servers and employing newer mechanisms to keep things running more smoothly. You can check any of them and determine if it suits your trading style. If you have some Ethereum and you’re wondering the best way to sell it, this brief tutorial would give you the perfect head start. To be honest, the process isn’t as complex as you speculated it would. Nevertheless, we are aware that one of the most evident challenges with crypto liquidity is withdrawals. This guide would also cover that aspect as well. If you don’t own Ethereum yet, you can buy some from the brokers listed above. Just like we emphasized, they are easy to use and you can get your account up and running in minutes. For this tutorial, we are going to be learning about our favorite broker – eToro. This particular platform is structured to make trading a lot easier for everyone. eToro comes with a great trading view, a demo option to hone your trading skill, and a wide array of digital currencies to pick from. An added advantage is that traders can easily exchange them as eToro boasts of high liquidity due to large trading volume. eToro also features other quality services accessible to traders. From easy deposits methods to safe wallets for storing your digital assets, and a withdrawal channel that sees payments go straight to your local bank. Ethereum is a digital asset that runs on the blockchain. You can transfer from one wallet to another if it is located in another wallet or exchange. If you do not have a crypto wallet, you can buy Ethereum on eToro. Purchasing Ethereum on eToro is an easy process. However, you can not buy Ethereum from this broker if you are not a verified user. To become one, you have to get your account up and running, fulfill the necessary KYC procedures, and integrate acceptable payment channels for your deposits. Impressively, eToro accepts deposits from local banks, credit cards, or third-party payment gateways like PayPal, Neteller, or Skrill. Ethereum price on eToro If you have completed your deposit to your eToro trading account, then you can purchase Ethereum straightaway. You can also find a comprehensive guide on how to buy crypto on this platform from eToro. If you are trading Ethereum, the motive is often to generate some profit. The same applies to other digital currencies which are naturally volatile. You have to evaluate your position to determine your profit margin before disposing of the crypto. Thankfully, the price momentum of cryptocurrencies can be tracked using the trading chart. One can easily access historical information from the period of entry to the speculated exit zone. Ethereum chart on eToro eToro has a great trading view to track the history of any digital assets. The time frame can be adjusted to view the price momentum that took place in weeks, days, hours, or even minutes. To evaluate Ethereum’s movement in a particular time frame, you have to click on Ethereum in eToro’s crypto window. For advanced crypto traders, there might be other digital assets in your portfolio. In eToro, you can trade multiple cryptocurrencies at the same time. If you want to sell one of your holdings, like Ethereum in this context, it is necessary that after tracking its performance, you also overview your crypto portfolio. The platform allows you to sell any amount of Ethereum. However, withdrawals require at least $30 in your available balance. Withdrawals might also be susceptible to limits depending on your channel. eToro overview To take a look at your crypto portfolio on eToro, simply click “portfolio” at the top left as seen above. This would bring you to a list of active positions, click on Ethereum and close the trade. The approximate value of Ethereum you have on eToro can be accessed once you take a look at your portfolio. Since cryptocurrencies are naturally volatile, the value might continually change until the position is closed. The broker eToro does not charge withdrawals from the crypto itself, no broker does. You have to close the position yourself and see it reflect on your available balance. Of course, you can decide to partially or close your position, it’s entirely up to you. Closing a trade on eToro First of all, after clicking on the portfolio and viewing your total holdings. Click on Ethereum, this would prompt you with a box that would detail your trade volume on Ethereum. Specify the amount you wish to sell and click “close position”. The value naturally reflects instantly on your available balance, after then, you can proceed with a withdrawal using the acceptable channels. A key consideration when you want to sell cryptocurrency is to understand the withdrawal procedure required by the broker you’re using. The major requirement across the majority of brokers and exchanges is being verified, some provide the option to go for a 2-factor authentication while some allow access once they have a few details about you. Other withdrawal criteria include being located in areas that the exchange offers services. The option to integrate a suitable payment channel is often necessary as well. For eToro, the withdrawal process and requirements are quite simplified. For one thing, this broker is determined to offer useful services to any trader notwithstanding the level of experience and trading capital. This reflects in the starting withdrawal fee of $30. The broker also wants to be sure that your funds are withdrawable, therefore, you have to ensure that the funds you wish to withdraw are available. Finally, eToro demands that your account be verified. You can detect if your account is verified once you observe a green tick at the top of your profile. You can also enjoy great exchange rates for multiple fiat pairs on eToro including EUR/USD. There is a dedicated page to access the live exchange rates of these currencies. eToro does not charge fees for USD deposits, but deposits that require an exchange to USD are susceptible to conversion fees. The average withdrawal fee on eToro is $5, which is very feasible. Just like gold and stocks, the United States Internal Revenue Service (IRS) considers cryptocurrencies as ‘assets’ or ‘properties’. In essence, reporting your tax returns is expected of you to avoid compliance violations. The IRS taxes the profits you make on cryptocurrencies based on the period they have been in your possession. However, this does not mean that you are liable to pay taxes the moment you use USD to buy cryptocurrency. Judging from your Form 1040 tax return guidance, crypto-only becomes taxable when you profit from it. For instance, if you use crypto to pay for goods and services, exchange them for another, or sell them for USD, these events are taxable. The IRS divides taxable events into two categories, short-term capital gain taxes, and long-term capital gain taxes. If you hold cryptocurrencies for less than a year, you are entitled to pay taxes under short-term capital gain. On the other hand, if they exceed a year, you file in the taxes as a long-term capital gain. You also get taxed for other profiting crypto events like staking, DeFi rewards, airdrops, and mining. To reconcile your capital gains and losses, you can use Form 8949 to report them on your Form 1040 using Scheduled. If you want to learn more about your tax liability, you can find relevant information on the IRS site. Cryptocurrency exchanges are the platforms that investors leverage to effectively trade digital currencies. These exchanges perform other functions like storing digital assets, offering a peek into the current action of the crypto market so traders can make good decisions. Cryptocurrency exchanges are indispensable to any crypto investor. There are so many crypto exchanges out there, a lot of them are quite similar which makes it a little difficult to determine the perfect one for you. The major features that make a crypto exchange stand out are if the exchange is secure, convenient, and does not cost so much. Security and customer support are paramount as well as efficiency, it is also a welcome addition if the exchange is not so demanding. Judging from the average needs of crypto traders, notwithstanding the level, experts uphold the exchanges below as the industry standard. You can navigate any of them and see why it is so. Ethereum is stored in a wallet just like Bitcoin or other cryptocurrencies. Wallets can either be digital or physical. Digital wallets are also referred to as hot wallets while physical wallets are otherwise called cold wallets. Both perform similar functions, however accessing your crypto in a digital wallet is often swifter than on a cold wallet. Emphasis should be paid to the security of a digital wallet before choosing it. Good digital wallets should encourage efficiency and ease to transact any amount of Ethereum whenever possible without backlogs. We perceived that picking out the best wallets to store your Ethereum might be tasking, so we documented a helpful guide to aid you in selecting the perfect wallet here. Trading cryptocurrencies is profitable if you determine the proper time to get into a trade or exit. We earlier reiterated that cryptocurrencies are naturally volatile and Ethereum is not an exception. To benefit from it, you must develop a good trading strategy and implement an effective approach. Before investing in any digital asset, an important step is to carry out analyses on it. Useful analytical techniques are linked with fundamental or technical approaches. Both would help you determine your entry and exit points. You can decide to exit a trade depending on your overall expectations. Trade can go short-term, mid-term, or long-term. If you have attained your expectations, you can go ahead to let go of your hold. You can also decide to let go of a trade if you no longer appreciate the asset in your possession. For instance, if a technical indicator points out that Ethereum is diving down in its value which you perceive the turn would largely affect your portfolio, you can decide to let go. In another scenario, you can choose to close down on a trade if the funds allocated to it are all you have. Primarily, you should understand the asset you are investing in and how blockchain technology functions. It is an additional advantage to consistently stay informed. The cryptocurrency space is never devoid of new developments principally because it is a new development with a revolutionary agenda. Accurate information would sharpen your understanding of the industry and reflect in your trading decisions. Besides, you could catch the wind of bullish predictions and maximize them. A wonderful way to stay ahead of the crowd is to leverage this site for professional trading analysis. We understand that making accurate trading analyses might be complex if you are not an expert, due to this you can enjoy steady crypto predictions from industry experts. Simply by navigating this website regularly, you would access this information to reinforce your knowledge and trading strategies. Ethereum is a trending asset that experiences price fluctuations from time to time. This is because of the enormous amount of activity ongoing in the blockchain regularly. A massive input of funds would see Ethereum boost up in value. This is referred to as a ‘bull run’ in trading terms. On the other hand, a massive pullback could shrink the value of the crypto, in trading terms, it is called a ‘bear’. Like most cryptocurrencies, Ethereum has seen major changes in price since it made its advent into the crypto industry in 2015. At one time in 2021, the crypto soared past $4,000. To keep track of the price momentum of Ethereum, you can explore this site to note the previous and current prices of the asset. Trading cryptocurrencies successfully demands several essential requirements. Primarily, expertise and knowledge are key to maximize the industry. However, other requirements like funds and time are super relevant. Timing is a great requirement and a useful tool as well. If you are not adherent to set schedules, you might miss the chance to get in on out of a trade at the perfect time. The aftermath would be a reduction in your profits or a chance to get in at all. However, not every investor can afford the time nor possess the expertise to trade cryptocurrencies successfully. To counter this challenge and to make crypto trading applicable to all, automated trading has become an option. Automated trading involves the use of trading bots to execute trade orders just as a conventional trader would. Trading bots are smart computer programs that are capable of functioning autonomously to achieve a trading objective. They can be used by all kinds of cryptocurrency investors including amateur traders, busy investors, and professional traders. The paramount need for leveraging the technology of trading bots is connected to the need for trading efficiency. There are different types of trading bots. The most popular ones are arbitrage bots, trend trading bots, market-making bots, coin lending bots, and others. You can also find trading bots for high-risk trades like derivatives and margin trading. Trading bots perform based on predetermined instructions which they execute after careful analysis of the market. This implies that since the crypto market never sleeps, trading bots are capable of performing in irregular hours or even when you’re off for a vacation. Through automated trading, the game of crypto trading has taken a more innovative and accommodating approach. Since they are trading bots available for newbies and experts, it is easier for everyone to participate in the financial market. Now instead of hiring an individual to trade for you or putting your money into a hedge fund, you can trade passively by leveraging trading bots. These trading bots can be integrated into trading platforms where they analyze the trending market based on your strategy and execute the preset orders as API requests. The exchanges interpret these requests and permit the simulation of the process in real-time. However, trading bot software is unregulated, so you should only deposit funds into bots that you can afford to lose. Our review team has a vetting system to help filter out genuine trading software from the rest. Some of the notable trading robots that we’ve reviewed include: There is no need to sweet talk the reality, cryptocurrencies are speculative and never devoid of uncertainties. When it comes to making a trading decision, no one is too sure. A good trade with numerous green candles could turn negative in the next minute. According to the opinions of several analysts, the crypto market is still influenced largely by sentiment. The emotions of investors could trigger a bearish scenario or a bullish break. So, if you’re wondering how to invest safely and responsibly, the methods documented below would help you decipher the strategy to invest better in such a high-risk industry. If you are holding Ethereum, you might be wondering if you should sell it in 2025. Ethereum just like many digital currencies took on a downturn earlier in 2021. From May 2021, some cryptocurrencies lost as much as 70 percent in value, Bitcoin itself lost over $50 percent. While this might be disheartening, numerous investors chose to weather the bearish storm as the market gradually recovers. Here are some factors to consider to determine if you should sell Ethereum: Ethereum is a reputable crypto asset, with the second-largest market cap. This cryptocurrency never ceases to develop in value and structure, making it one of the favorites in the cryptocurrency market. Some analysts are predicting that Ethereum could overtake Bitcoin to hold the largest market cap. To sell Ethereum, you need to have some of it within the confines of a broker that offers evident high-end liquidity. Ensure that you have closed your active positions and designated the amount you wish to sell. Selling crypto is executed instantly on platforms like eToro, once the funds reflect on your available balance, you can begin a withdrawal process. Your investments in cryptocurrency should only be limited to what you can afford to lose. Develop a personal trading strategy and stick to it to minimize your risks. In addition, ensure that you keep track of your profits for tax purposes. Our recommended best exchange to sell Ethereum in 2025 is eToro as they are regulated internationally and support withdrawals by bank wire, VISA, Skrill, Neteller and a range of other methods.

To sell Ethereum, you need to own an account with a broker that offers liquidity. Buy some Ethereum or transfer them to your wallet on the broker. After then, proceed to close your position on Ethereum, select the amount you want to sell, and finally withdraw them via the acceptable channels.

There are several methods to sell your Ethereum. You can do that at an exchange or a broker. You can also sell your Ethereum if your broker offers a P2P feature or an OTC desk.

If you are a verified user in platforms like eToro, you can close your positions and sell your Ethereum in minutes. The process is relatively easy.

There are a lot of them but we consider these the most suitable for any trader. They are eToro, Capital, Libertex, Plus500, Coinbase, Binance, AvaTrade, Revolut, Cryptorocket, and Changelly.

Your Ethereum sales are susceptible to taxing in two ways - as a short-term capital gain which is less than a year and between 0% to 15% and a long-term capital gain which is more than a year and between 10% to 37%.

There are several options if you want to sell your Ethereum in exchange for USD. Brokers like eToro or Binance offer instant payment services to your USD bank account.

Exchanges like eToro, Capital, Libertex, Plus500, Coinbase, Binance, AvaTrade, Revolut, Cryptorocket, and Changelly are some of the best options.

Verifying your identity in eToro or any other broker of your choice as well as integrating a withdrawal channel would fast track your selling process. However, you should note that withdrawals to local banks can take about one to three business days.

eToro permits third-party withdrawals and you can integrate your PayPal account to facilitate the payment of the sale proceeds to your PayPal account.

Some wallets allow the sale of Ethereum natively. Ensure that you have satisfied the criteria and integrated a withdrawal channel.

This is done through a process known as swapping. You can decide to convert your Ethereum to another cryptocurrency in an exchange instead of selling it totally to pick another asset. On this Page:

How to Sell Ethereum in 2025 Step by Step

Step 1: Buy Ethereum

Step 2: Sell at the Right Time

Step 3: Evaluate Your Crypto Portfolio

Step 4: Close Your Ethereum Position

Withdrawal Requirements and Exchange Rates

Crypto Taxation in the US

Best Crypto Exchanges to Sell Ethereum

Storing Ethereum with the Best Wallets

When is the Best Time to Sell My Ethereum

Price of Ethereum

Guide to Automated Trading

How to Invest Responsibly in Crypto

Should I Sell Ethereum in 2025?

Summary

FAQs

How to Sell Ethereum?

Where to Sell Ethereum?

How Easy is it to Sell Ethereum?

What are the Best Brokers to Sell Ethereum?

What are the Taxes for Selling Ethereum?

Where to Sell Ethereum for USD?

What Exchanges Sell Ethereum?

How to Quickly Sell Ethereum?

How to Sell Ethereum for PayPal?

How to Sell Ethereum to my Wallet?

How to Sell Ethereum for Other Cryptocurrencies?