Ripple (XRP) is one of the top cryptocurrencies according to market capitalization. The token has witnessed exponential growth since its inception in 2018. Although the parent company behind the token, Ripple Labs is currently embroiled in a legal controversy with the US Securities and Exchange Commission, the token has managed to maintain a stable price, even attaining an all-time high of $1 in May.

Due to how highly-placed it is, Ripple is regarded as an investment choice for investors. Despite knowing how to buy the crypto asset to hold for sometime as an investment strategy, most of them are normally at loss on how to sell after making gains as planned on it. More often than not, investors would normally want to sell their Ripple against USDT, a common stablecoin. Hence, the need for this guide to help investors maximize the gains on their Ripple investment.

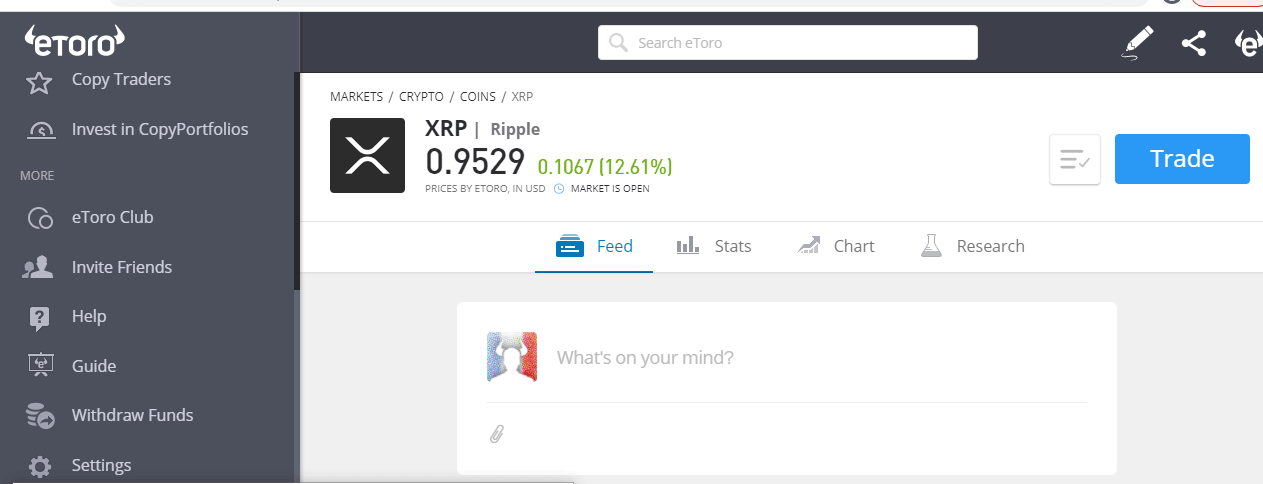

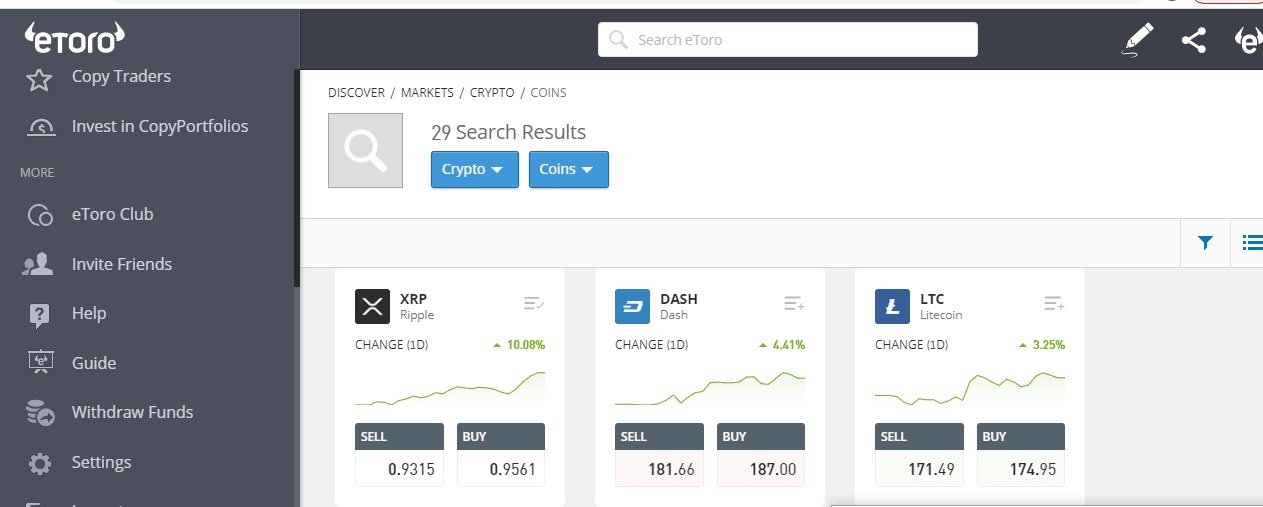

Selling Ripple cannot be done without using a broker. In a way, brokers provide liquidity for the crypto asset. As such, to ensure that you make the right decision on a broker, we highlighted some brokers that you can always resort to whenever you intend to sell Ripple. These brokers have been properly vetted by industry experts, and deemed to be suitable for both new and seasoned crypto investors. The aforementioned brokers have a common factor that binds them together- they allow users to exchange Ripple for USDT or any other pair you can find on their platforms. Beyond that, these brokers are industry-recognized brokers with markets in different parts of the world. Also, they comply with existing regulations from regulatory bodies while also improving the features on their platforms to ease trading processes for users. Before making a choice of brokers, it is necessary to look for certain benchmarks. If these benchmarks have not been met by any broker, it puts a question to the broker’s reputation. Some of these benchmarks include a simple and friendly user interface, quick-response customer support, compliance with regulations, security, numerous trading pairs, etc. The brokers listed above have passed the litmus test and are considered safe by experts. Also, some of these brokers boast of other impressive features like staking, borrowing or even allowing users to pay for services using their accounts on the brokers’ platforms. These brokers record massive daily trading volume which means that it is really easy to find liquidity for that asset you are holding. In some cases, users are able to engage in futures trading. In fact, all these brokers have become household names among investors and traders as they are dedicated to providing seamless transactions on cryptocurrency. They have been able to build trust over the years as brokers you can buy and sell Ripple on. Selling Ripple is just as easy as it is to buy Ripple. However, trading the asset or any other crypto asset is always reliant on whether there is liquidity for it. This determines if the asset will be bought. Ripple has much liquidity, due to its position among cryptocurrencies. While trying to sell your Ripple asset, ensure that there is an acceptable withdrawal channel. Of all of the brokers listed above, it is possible to sell Ripple on their platforms, but for this post, our focus in this guide will be on eToro which is at the top of our list. eToro has always featured in all of our guides including the ‘How to Sell Bitcoin guide’ as a broker you can count on whenever you want to buy or sell any crypto asset. You will not fail to find eToro as a broker among the top 10 crypto brokers in the globe. The eToro platform was created with new and seasoned experienced traders in mind. Every feature on the platform is aimed at simplifying the crypto trading process. Drawing from this, it will be very easy for new investors to use eToro to trade Ripple or any other crypto asset such that there is no room for errors. Below, we look at the five steps to sell Ripple (XRP) on eToro. If these steps are dutifully followed, selling on the platform will be as easy as a piece of cake. Since it is not possible to sell an asset that you don’t have in your possession, buying Ripple is the first step before any selling transaction can take place. eToro allows users to buy Ripple or you can buy from another broker, then send it to eToro to sell. eToro only allows verified users to purchase Ripple. Thus, after signing up, you’ll need to satisfy verification requirements. Following complete verification, you can go ahead to deposit funds into your account. Most people prefer to deposit USDT. However, eToro has provided many channels through which funds can be deposited into your account. Sending fiat to your eToro account may be done through your credit/debit card, local bank account or via third party payments service like PayPal, Skrill or Neteller. When the funds have reflected in your account, then you can go ahead to buy Ripple directly in the fiat currency deposited or instead buy USDT and then buy XRP. It all depends on your preference. Buy Ripple: Source eToro The aim of buying a tradeable asset is to make profits. As much as it is important to know when to buy an asset, it is also necessary to know when to sell, unless you plan to make a loss. Even investors who buy crypto assets to hold for long term always know when they are in profits so they can sell. Nobody wants to make losses. Besides, the prices of cryptocurrencies can be highly volatile. Also, nobody controls the prices of these assets. It is always advisable to have a selling price you intend to sell. Not doing so could be a dangerous move and you might eventually lose your funds. For this, eToro, in a bid to help traders make wise trading decisions, provided trading charts for every crypto asset including Ripple. These charts consist of candlesticks and patterns that help you study both the past and present price movements on different timeframes. You can also study these charts to know when to make a buying decision on Ripple or other cryptocurrencies. Clicking on Ripple takes you directly to where the chart for the asset is. Ripple Chart on eToro Apart from Ripple, there may be other assets you are holding in your portfolio because eToro offers numerous digital currencies and trading pairs. In this guide, our focus is on the asset, Ripple. Thus, knowing the total value of your portfolio will help you determine if the amount of XRP you wish to sell is up to the required amount. eToro has a minimum withdrawable amount which is $30. So you should have at least that amount of Ripple before you can sell. eToro Overview To know the value your portfolio holds, click top left where you have ‘Portfolio’ on the platform. After clicking on the icon, you get to see all your crypto holdings and their individual value. There you can click on any other asset apart from Ripple that you wish to sell. Note that you must have the required withdrawable amount before you can actually sell the asset. Closing active positions is necessary to sell cryptocurrency, if you are currently in a long or short, or have a stop-limit or stop-market order in place, you’ll need to cancel all orders first. Cryptocurrencies are volatile. Leaving your XRP holdings without going ahead to sell into USDT or any other currency pair could make you lose the gains made. There is a high likelihood of the price retracing within a few minutes or hours after increasing. So, to protect your gains, you need to take action. As earlier mentioned, closing your position requires trading the XRP against USDT or some other cryptocurrency. Upon conversion, the equivalent balance reflects in your portfolio. Sometimes, it could be less due to what is referred to as ‘Slippage.’ Slippage occurs when an asset settles for a price different from the initial price target. This could either occur positively or negatively. When a negative slippage happens, the asset settles for a lower price than initially agreed; while positive slippage results from an asset selling off at a higher price. Closing a trade on eToro If you want to close an active position on Ripple via your eToro account, you click on the portfolio icon where you are shown all the assets you hold. There, you can click on Ripple and then you are taken to the trade section. In this section, you can choose if you want to sell all your Ripple (XRP) or just a part of it. Alternatively, you can use the search icon to look for a Ripple pair of your choice and you’ll still find yourself at the trade section. After closing the position on the asset, the equivalent value from the conversion becomes withdrawable. You can withdraw the balance to your local bank account or credit card. Funds withdrawal on eToro is a hassle-free process as long as the necessary requirements have been met. Reviews from other users on eToro’s withdrawal process are mostly positive. Most of the reviewers commended the simple withdrawal process. There are instances when withdrawal challenges could arise, but these rarely happen. It could either be that a user is operating an account from a country blacklisted by the platform. Other instances include incomplete verification, errors while initiating withdrawals or missing withdrawal channels. eToro is committed to making withdrawals on its platform as smooth as possible. This makes it easy for you as an end-user to sell your Ripple without troubles. eToro makes sure that every cryptocurrency listed on its platform can be liquidated. At any time, you can convert your Ripple to fiat. While some other exchanges peg their minimum withdrawable amount at a higher limit, eToro brought the threshold low without reducing the quality of its services. Minimum limit for XRP withdrawals is 17.7 XRP with a percentage fee of 0.5. eToro’s min withdrawal fee is $1 while max is $50. This goes to show that eToro is actually user-friendly not only in terms of user interface but also in fees for every activity carried out on the exchange. Update 2025 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum. Crypto taxes exist in the US. In fact, a new Infrastructure bill is being proposed by the US that will impose tax reporting obligations on crypto businesses operating within the US. However, the bill may signal the end to the legal controversy between the US SEC and the Ripple Labs. As suggested, the law would exempt the XRP token from being regarded as an unregistered securities as claimed by the Securities and Exchange Commission. It is known if investors and holders of the XRP token are required to pay taxes on the asset since the issue is still sub judice (still in court). But Bitcoin investors have to pay taxes on both short term and long term gains according to the new crypto tax guidelines by the US Internal Revenue Service. As regards the taxes on short and long term gains, short term means gains made on taxes within the space of a year, while long term represents gains made for more than a year. These taxes extend to a bunch of crypto-related activities including airdrops, DeFi yields, mining and transaction fees. Due to the evasive nature of cryptocurrencies, enforcing tax obligations on their owners might be a difficult thing to pull off. US authorities have continually expressed concerns over cryptocurrencies being used for illegal activities. Thus, they are looking to enact regulations that will encapsulate and safeguard against such acts. There are over 100 exchanges around the globe situated in different countries globally. Usually, crypto exchanges are meant to make cryptocurrencies accessible to investors and crypto enthusiasts. They also provide platforms for such asset classes to be traded by crypto traders. Despite being bound by one aim, you may actually find different services on these platforms. This means that apart from buying and selling crypto, these exchanges may have services peculiar to them. So your needs dictate which exchange will suit you. Of all the crypto exchanges that exist, some have been able to stand out and resonate with thousands of people around the globe. This is not because the services they offer are entirely different from those of others but because they go extra miles in securing their users’ interest. There are some identifiable parameters used to mark out the best crypto exchanges. These parameters include security, friendly UI, efficient customer support, a guide on how to use the exchange, and a growing community. In light of the above, some exchanges have been able to pass these parameters with a view to offering the best to their users. Other exchanges have fallen short of these parameters and do not enjoy so much signups or daily trading volume as the former. Giving their users nothing less than premium services, a handful of exchanges allow their customers to use copy trading or trading bots services. Traders who are not cut out for manual trading can actually copy trades from other experienced traders or automate the trading process via bot trading. Below, we have a list of high-ranking and industry-recognized crypto exchanges; Since Ripple is a digital asset, it requires proper storage. Cryptocurrencies like Ripple are stored in digital wallets. Crypto investors and holders have different ways of storing their digital assets. Some store theirs in hot and software wallets while others transfer the asset to hardware wallets, also known as cold wallets. Each of these wallet types have their pros and cons. For instance, software wallets are created with private keys. These keys can be used to access the wallet from which they were copied on any device. However, it is very easy to forget the private keys to such a wallet, especially when they are written down. Private keys are normally phrases of different numbers ( usually, 12 – 24). If the private keys go missing, then it becomes impossible to recover your Ripple asset. On the other hand, cold storage wallets are physical wallets like flash drives and do not require any private keys, but passwords only. The cons of a physical crypto wallet is that it can be destroyed by fire or any other destructive element. Notwithstanding, you can decide to store your Ripple in any wallet of your choice as long as you will take precautionary measures to protect your assets. You must also be ready to bear the losses in case anything happens. Here, in another guide, we have compiled some of the best crypto wallets you can store your XRP holdings in. If you are taking the invest-and-sit-back approach, it is very likely that you will have to actively monitor the price of Ripple, especially if you don’t have a target price. Monitoring the price of an asset can be really tasking since you have to keep yourself abreast of goings-on around the crypto market to know whether to sell off your Ripple holdings or keep maintaining the same position. Investors normally adopt different approaches in their investments. Some take the short-term path where they only have to wait within the range of a day to a week before deciding on a selling stance. Others in their own right, could buy Ripple and keep it for a mid-term timeframe, meaning in some weeks or months, they’ll come back to check if they have made any profits on their investments. A long-term investment strategy spans years before selling off. Essentially, the right to sell your Ripple holdings is determined by the investment strategy you adopted. If you adopt a short-term strategy, then you have to wait until that time is right before exchanging your Ripple. So there is no specific right time to sell. The time is right when your investment strategy says so. In between that period when your investment is yet to attain the target you set, a lot of things might happen given that the crypto market is volatile. A bearish news could affect your open position or holdings. Which is why it is advisable to always do analysis whenever you want to invest. The analysis keeps your actions in check even when the trade is going the wrong way. Sometimes, you might have to wait longer than necessary before hitting your target. If your analysis is right, a little deviation from that pattern you expected in the charts shouldn’t instil fear in you. An early discovery of an impending bearish movement might save from losing your funds if you invested in Ripple or other crypto assets. There are numerous to stay informed of events that may likely happen in the market. The crypto market is driven by relevant information. You can access them via reliable updates and reports. As an investor, you can also take advantage of the market opinions of industry experts. However, don’t rely solely on it or follow these opinions blindly, without doing diligent research. These experts are humans and they are fallible as well. You can access the updates released by professionals on this site. Ripple (XRP) has witnessed a series of fluctuations since creation. Given that the market is volatile, the price of the asset is not stable. Where the market fluctuates, it means that prices will go up at certain times, then experience a downtrend following a bearish report or when investors start selling off. The price movements are normally noticed on the chart via candlesticks and other patterns created. Back in April, Ripple reached the heights of $1 in the wake of a bull run that generally affected prices in an upward direction. Ripple is set to attain more price growth in the coming months. Ripple has been in the throes of a lawsuit since December 2020 after US regulators charged executives with fraud. They claimed that top executives had sold unregistered securities to investors to the tune of $1.3 billion. Ripple may likely emerge victorious in view of the proposed infrastructure bill, which defines digital assets and digital asset securities. Crypto trading requires maximum input and dedication from traders themselves, apart from the financial efforts they have to make. If traders are not actively monitoring charts, they are reading market-related reports in order to stay updated. All these activities can be time-consuming. It becomes worse if a trader is working at a 9 to 5 job. Splitting his attention between his job and the charts could make either of them suffer. When this happens, he makes costly trading mistakes that may incur losses hard to recover from, or he might get queries from superiors at his workplace. As a last resort, an automated form of trading was created to assist traders who hardly have the time to monitor their trades. A lack of attention could lead to losses which in turn may cause emotional instability. As part of trading rules, a trader is meant to be in the right frame of mind to maximize opportunities in the market. This is why apart from risk management, a trader is supposed to have a strong trading psychology as well as emotional stability. Trading bots automate the trading process such that traders can have time for other engagements. Trading bots utilize algorithms to trade cryptocurrencies. Nonetheless, they require a bit of human involvement to function effectively. They cannot function on their own, a trader has to activate a trading range based on his personal strategy, which these bots rely on. One reason trading bots are important is because they are designed to respond to opportunities in the market faster than humans. The main reason for the creation of automated trading is to ensure that price surges are capitalized on. Sometimes, there are opportunities that traders may be blind to due to their busy schedules. With the help of trading bots, every market activity is observed and this assists trading in making more profits than they would have made if they were trading themselves. The disadvantage of trading bots is that when the market is going the wrong way and the trader is not there to observe, it could result in massive losses. As such, trading bots are not 100% reliable. Trading bot software is unregulated – only deposit funds into bots that you can afford to lose. Our review team has a vetting system to help filter out genuine trading software from blacklisted bots. Some of the bots that we’ve reviewed include: Lately, every Dick and Harry, claims to have invested in cryptocurrency. Who would not? I mean, many people have made great fortunes from investing in cryptocurrencies. Of course, you might be feeling the pressure to do the same thing, but you are afraid of how it will turn out. The thing is crypto is not something to jump into without first acquiring expertise. It is beyond having capital to invest. The volatile market should be a red flag to a new investor. There are a whole lot of other qualities a crypto investor is expected to possess. Patience, risk management, strong trading psychology, emotional stability, technical and fundamental analysis expertise all combine to make an expert trader before capital. One must understand that the market is not controlled by anybody. Hence, it must be skillfully manoeuvred. Greed is a major challenge most traders battle with. Once a trader is able to overcome the lure to be greedy, he is one step closer to becoming an expert. Another thing to understand is that not trading is a trading strategy itself. There are times when the market is very volatile and highly unpredictable- a trader should learn to avoid the market during those periods. Also, as a trader, never revenge trade. This means trying to recover from loss after suffering one. While trying to revenge-trade, it could lead to more losses. The best thing to do at such a point is to sit back and restrategize, and head back to the market not with a mindset to recover from that loss. Note: As a trader, you must never trade the crypto market without a tested and proven strategy. Ripple (XRP) has prospects, but its parent company’s controversy with the US SEC has kept it from attaining greater heights. During the April bull run, XRP reached an ATH of $1. Here are some key things to note before you sell XRP: Ripple (XRP) is undoubtedly one of the top cryptocurrencies with a market capitalization of $41 billion. It is a digital asset, so it can be bought, stored and sold with ease. Ripple can be found on most exchanges apart from the brokers listed above To sell XRP on eToro and other brokers’ platforms, you need to close positions. You can trade the asset against USDT or the fiat currency of your residing country and then withdraw to your local bank account. Ripple can be stored in a wallet, whether hardware or software. It is safe to the extent of the owner’s diligence and security consciousness. If you have the intention of buying any cryptocurrency, you should do so from an informed standpoint and not because the asset looks profitable. As they say, invest what you can afford to lose. The crypto market is a volatile one and cannot be traded on from the viewpoint of hope and mere speculations. This guide can suffice as a handbook you can revert to whenever you want to make investments in XRP. Our recommended best exchange to sell Ripple in 2025 is eToro as they are regulated internationally and support withdrawals by bank wire, VISA, Skrill, Neteller and a range of other methods. FAQs

In this guide, we recommend selling Ripple via an exchange as you are guaranteed safety and received your fiat. There are other means through which you can sell. P2P is an alternative, but this is somewhat risky.

When you use a broker like eToro, selling your Ripple can be concluded in minutes after a few clicks. The exchange features withdrawal options as well.

Several brokers can be used to sell Ripple. However, the following are considered the best by expert traders that have explored other options. They are eToro, Capital, Libertex, Plus500, Coinbase, Binance, AvaTrade, Revolut, Cryptorocket, and Changelly.

We do not know if holding Ripple incurs taxes.

To sell your Ripple for USD, you need an exchange that permits payment to your local bank or third-party payment service. Some of the best choices are eToro, Coinbase, AvaTrade, and Binance.

Some of the exchanges where Ripple can be sold include eToro, Capital, Libertex, Plus500, Coinbase, Binance, AvaTrade, Revolut, Cryptorocket, and Changelly.

To quickly sell your Ripple, you need an account with eToro or any other exchange-listed above. To set up your account doesn't take a lot of time. If you have your Ripple already, you can transfer them to the wallet on the exchange and sell them there instantly.

To sell Ripple for cash, you should integrate a withdrawal channel on eToro or any other exchange-listed above. Ensure that you've set your desired currency. When you withdraw, the exchange helps you convert the funds to cash and pays into the proper channel.

PayPal only supports four cryptocurrencies, which include Bitcoin, Bitcoin Cash (BCH), Ethereum (ETH) and Litecoin (LTC).

Some wallets help you sell your Ripple natively. To sell them on the wallets, you need to integrate a payment method and follow the necessary procedures to sell Ripple.

Often, you can swap your XRP for other cryptocurrencies on brokers like eToro or Coinbase. Once you complete a swap, the actual value of Ripple sold reflects on the crypto you choose. On this Page:

How to Sell Ripple in 2025 Step by Step

Step 1: Buy Ripple

Step 2: Always Know When to Sell

Step 3: Know the Total Value of Your Portfolio

Step 4: Close All Active Positions

Step 5: Withdrawal Requirements and Exchange Rates

Crypto Taxation in the US

Best Crypto Exchanges to Sell Ripple

Storing Ripple in the Best Wallets

When is the Best Time to Sell my Ripple?

Price of Ripple

Guide to Automated Trading

How to Invest Responsibly in Crypto

Should I Sell Ripple in 2025?

Summary

Where to Sell Ripple

How Easy it is to Sell Ripple

What are the Best Brokers for Selling Ripple?

What are the Taxes for Selling Ripple?

Where to Sell Ripple for USD?

What Exchanges Sell Ripple?

How to Quickly Sell Ripple

How to Sell Ripple for Cash

How to Sell Ripple for PayPal

How to Sell Ripple from Wallet

How to Sell Ripple for Other Cryptocurrencies